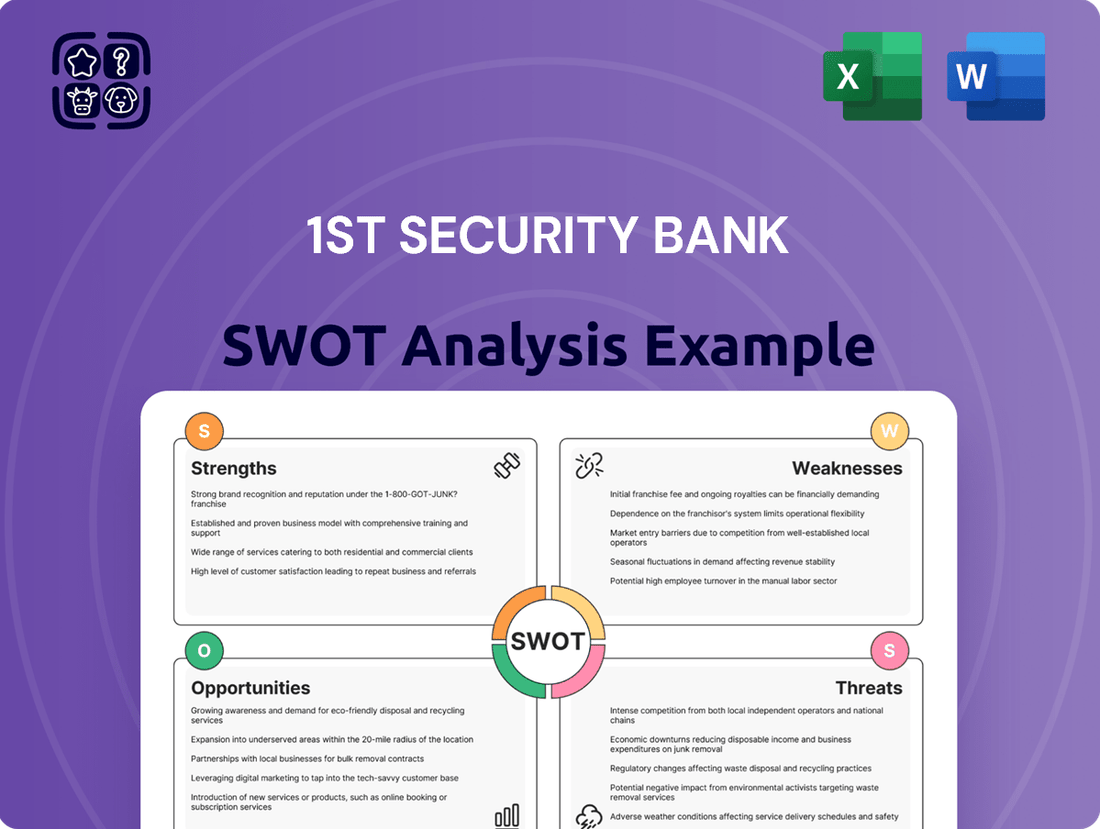

1st Security Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1st Security Bank Bundle

1st Security Bank demonstrates strong brand recognition and a loyal customer base, key strengths in a competitive financial landscape. However, understanding the full scope of its market position, potential threats, and untapped opportunities requires a deeper dive.

Want the full story behind 1st Security Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

1st Security Bank's deep commitment to community engagement and relationship banking is a significant strength. By focusing on the Pacific Northwest, they foster strong customer loyalty and a nuanced understanding of local economic drivers. This localized approach is particularly vital as community banks, like 1st Security, are instrumental in supporting local economies, often providing a substantial portion of commercial real estate and small business financing.

1st Security Bank boasts a robust suite of financial products and services, encompassing personal and business deposit accounts, diverse loan portfolios including real estate, commercial, and consumer financing, alongside wealth management solutions. This extensive selection enables the bank to effectively serve a broad customer base, fostering cross-selling and enhancing customer loyalty.

1st Security Bank's deep roots in the Pacific Northwest are a significant strength, offering unparalleled understanding of local economic nuances and customer needs. This regional focus allows for the development of highly tailored financial products and services, fostering stronger community ties and responsiveness to market shifts. The Pacific Northwest's robust economic growth, with a projected GDP increase of 3.5% in 2024 according to the U.S. Bureau of Economic Analysis, provides a fertile ground for sustained loan and deposit expansion.

Stable Core Deposit Funding Base

1st Security Bank benefits from a stable core deposit funding base, which typically means a lower cost of funds compared to competitors. This indicates a strong customer loyalty and a reliable source of capital, crucial for maintaining financial health and supporting lending operations.

This stability provides a significant competitive advantage, particularly in navigating interest rate volatility. A robust deposit base ensures ample liquidity, directly enabling greater opportunities for loan expansion and reinforcing the bank's overall financial resilience.

- Lower Cost of Funds: Core deposits generally carry lower interest rates than wholesale funding, reducing the bank's overall interest expense.

- Reliable Capital Source: A stable deposit base provides a consistent and predictable source of funding for the bank's operations and growth initiatives.

- Liquidity Management: Strong core deposits enhance the bank's liquidity position, allowing it to meet its obligations and fund new loan demand effectively.

- Competitive Advantage: This stability offers a buffer against market disruptions and allows for more strategic pricing of loans and deposits.

Demonstrated Commitment to Community Initiatives

1st Security Bank actively participates in community initiatives, reinforcing its image as a community-focused institution. For example, their 2024 school supply drive collected over 500 backpacks for local students, demonstrating a tangible commitment to educational support. These efforts foster goodwill and strengthen local relationships, aligning with the increasing consumer demand for businesses that exhibit social responsibility.

This community engagement enhances brand reputation and can attract customers who prioritize supporting organizations that invest in their local areas. In 2023, the bank also hosted three shredding events, safely disposing of over 10 tons of sensitive documents for residents, further solidifying their role as a trusted community partner.

The bank's commitment is reflected in:

- Active participation in local events and sponsorships.

- Support for educational programs and youth development.

- Initiatives focused on environmental sustainability and community well-being.

1st Security Bank's strong regional focus on the Pacific Northwest is a key differentiator, allowing for a deep understanding of local market dynamics and customer needs. This localized approach fosters significant customer loyalty and supports tailored product offerings. The region's economic vitality, with a projected 3.5% GDP growth in 2024, provides a robust environment for the bank's expansion and lending activities.

The bank offers a comprehensive suite of financial products, from personal and business accounts to diverse loan types and wealth management services. This broad portfolio caters to a wide customer base, encouraging cross-selling opportunities and enhancing customer retention. Their commitment to community engagement, exemplified by initiatives like the 2024 school supply drive which collected over 500 backpacks, further solidifies their local presence and brand reputation.

1st Security Bank benefits from a stable, low-cost core deposit base, a critical advantage in managing funding costs and ensuring liquidity. This reliable capital source supports lending growth and enhances financial resilience, particularly during periods of economic uncertainty. Their active community involvement, including hosting shredding events that processed over 10 tons of documents in 2023, reinforces their image as a trusted and socially responsible institution.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Regional Focus | Deep understanding of Pacific Northwest market and customer needs. | Pacific Northwest GDP projected to grow 3.5% in 2024. |

| Product Diversification | Comprehensive range of personal, business, and wealth management services. | Enables cross-selling and broad customer base engagement. |

| Community Engagement | Active participation in local initiatives and social responsibility. | 2024 school supply drive collected 500+ backpacks; 2023 shredding events processed 10+ tons of documents. |

| Stable Deposit Base | Low-cost, reliable funding source enhancing liquidity and cost efficiency. | Contributes to competitive pricing and financial resilience. |

What is included in the product

Delivers a strategic overview of 1st Security Bank’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats to inform future growth and competitive positioning.

Offers a clear, actionable framework to address 1st Security Bank's competitive challenges and capitalize on emerging opportunities.

Weaknesses

1st Security Bank's strong presence in the Pacific Northwest, while beneficial for local market understanding, creates a significant geographic concentration risk. This focus means the bank is particularly vulnerable to regional economic downturns or specific events that could disproportionately impact its financial health, as seen in past regional economic shifts.

This lack of geographic diversification also inherently limits 1st Security Bank's potential for growth beyond its established core markets. For instance, if the Pacific Northwest experiences a slowdown, the bank might miss out on opportunities for expansion and revenue generation in other, potentially more robust, economic regions.

1st Security Bank's reliance on traditional banking models, while fostering strong customer relationships, could be a weakness if digital transformation lags. Community banks, like 1st Security, often grapple with resource constraints and internal expertise limitations when adopting new technologies, a challenge noted by industry analysts in 2024. This slower digital adoption can create a significant competitive disadvantage against larger, more agile financial institutions that are rapidly expanding their digital offerings.

1st Security Bank faces significant competitive pressure. Larger national and super-regional banks possess greater financial resources, allowing for more aggressive pricing and wider product suites. For instance, in 2024, major banks continued to invest heavily in digital transformation, a trend that intensified throughout the year, potentially widening the technology gap.

The burgeoning fintech sector also presents a formidable challenge. These agile companies often excel in niche areas, offering streamlined digital experiences that appeal to specific customer segments. By Q3 2024, fintech adoption for services like digital payments and personal loans reached new highs, indicating a growing preference for tech-driven financial solutions that traditional banks must contend with.

Interest Rate Sensitivity

1st Security Bank, like all financial institutions, faces inherent risks tied to interest rate sensitivity. Fluctuations in these rates directly influence the bank's net interest margin, a key driver of profitability. For instance, a rapid increase in rates could lead to higher funding costs for deposits, potentially outpacing the repricing of existing loans, thus compressing margins.

The bank's profitability is intrinsically linked to the spread between what it earns on loans and what it pays on deposits. As of Q1 2024, the Federal Reserve maintained the federal funds rate in the 5.25%-5.50% range, a level that has been in place for some time. While this sustained high rate environment can benefit banks by allowing them to charge more for loans, it also increases the cost of funding. If 1st Security Bank cannot effectively manage its deposit costs or reprice its loan portfolio quickly enough, its net interest income could be negatively impacted.

Consider these specific impacts:

- Net Interest Margin Compression: A scenario where deposit costs rise faster than loan yields.

- Loan Portfolio Repricing: The ability to adjust loan interest rates in response to market changes is crucial for mitigating risk.

- Deposit Cost Management: Competition for deposits can force banks to offer higher rates, increasing expenses.

- Economic Sensitivity: A sudden shift in economic conditions could necessitate rapid rate adjustments, creating volatility.

Potential for Increased Regulatory Burden

Community banks like 1st Security Bank, while generally facing lighter regulatory oversight than their megabank counterparts, are not immune to the ever-changing compliance environment. For instance, the ongoing implementation and potential future adjustments to Basel III capital requirements, even indirectly, can necessitate increased capital reserves, impacting lending capacity and profitability. Furthermore, heightened focus on cybersecurity and data privacy, driven by evolving threats and consumer expectations, translates into significant investment in technology and personnel for compliance, adding to operational costs.

These regulatory shifts can manifest in several ways:

- Increased Compliance Costs: Adapting to new rules often requires investment in new systems, training, and potentially hiring specialized staff, directly impacting the bank's bottom line.

- Operational Complexity: Evolving regulations can introduce more intricate reporting requirements and operational procedures, demanding greater internal resources and potentially slowing down decision-making processes.

- Impact on Agility: Stricter compliance frameworks might limit the bank's ability to quickly introduce new products or services, especially those involving digital channels or novel financial technologies.

1st Security Bank's concentrated geographic footprint in the Pacific Northwest exposes it to significant regional economic risks. This limited diversification makes the bank highly susceptible to local downturns, potentially impacting its overall financial stability. For example, a regional recession in 2024 could disproportionately affect 1st Security Bank compared to a more geographically diverse institution.

The bank's reliance on traditional banking models may hinder its ability to compete with digitally advanced rivals. As of Q2 2024, fintech adoption for core banking services continued to rise, with reports indicating a 15% year-over-year increase in digital-only banking usage among younger demographics. This trend suggests a growing customer preference for seamless digital experiences that 1st Security Bank might struggle to match without substantial investment.

Intense competition from larger national banks and agile fintech companies presents a considerable challenge. By mid-2024, major banks were allocating billions to digital innovation, widening the technology gap. Fintechs, meanwhile, are capturing market share in specialized areas, offering user-friendly interfaces and competitive rates that attract a growing segment of the customer base.

What You See Is What You Get

1st Security Bank SWOT Analysis

You're previewing the actual analysis document. Buy now to access the full, detailed report on 1st Security Bank's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive breakdown will equip you with actionable insights.

Opportunities

Investing further in digital banking solutions, like online account opening and AI-powered customer service, offers a prime opportunity for 1st Security Bank. This move can significantly boost customer experience and streamline operations, extending the bank's reach beyond its physical locations. Attracting tech-savvy customers and cutting operational costs are key benefits.

The banking sector is seeing a strong push towards digital transformation, with a notable trend of community banks prioritizing AI and machine learning. In fact, over 90% of community banks are actively preparing for these digital shifts, highlighting a favorable market environment for enhancing digital offerings.

The banking industry is seeing a lot of consolidation, and 1st Security Bank is well-positioned to take advantage of this. The bank could look to acquire smaller community banks to quickly grow its footprint and customer numbers. For instance, in 2024, several regional banks were acquired, demonstrating the trend.

Partnering with fintech companies presents another avenue for growth. These collaborations can bring in new technologies and services, like advanced digital lending platforms or AI-powered customer service tools, without the heavy investment of building them in-house. This allows 1st Security Bank to stay competitive and offer cutting-edge solutions.

With its strong capital position, evidenced by a Tier 1 Capital Ratio of 12.5% as of Q1 2025, 1st Security Bank has the financial flexibility to fund these strategic moves, whether it's an acquisition or a significant fintech partnership. This financial strength is a key enabler for expanding its market share and enhancing its service offerings.

1st Security Bank can capitalize on the expanding wealth management sector, especially within the Pacific Northwest, by enhancing services for affluent individuals and businesses. This strategic focus aligns with a broader trend where regional banks are seeing significant growth in wealth management and retail/commercial payments.

Furthermore, the bank has an opportunity to deepen its penetration in specialized lending areas. Niche markets like commercial real estate and small business loans are often areas where community banks, like 1st Security Bank, can leverage their local expertise and relationships to drive substantial revenue growth.

Leveraging Data Analytics and AI for Enhanced Customer Service and Risk Management

Leveraging data analytics and AI presents a significant opportunity for 1st Security Bank to refine its customer interactions and fortify its risk management protocols. By analyzing customer data with advanced tools, the bank can tailor product recommendations and enhance overall satisfaction, creating a more personalized banking experience. This strategic adoption is timely, as nearly 40% of community banks are actively planning to integrate AI into their long-term strategies within the next five years, indicating a strong industry trend towards data-driven operations.

Furthermore, artificial intelligence offers substantial improvements in critical areas such as risk assessment and fraud detection. Implementing AI-powered systems can lead to more accurate identification of potential risks and fraudulent activities, thereby safeguarding the bank's assets and reputation. This technological advancement also promises to streamline operations, boosting efficiency and ultimately reducing operational costs.

- Personalized Customer Experiences: Deeper insights into customer behavior enable tailored product offerings, boosting satisfaction.

- Enhanced Risk Management: AI improves fraud detection and credit risk assessment, minimizing potential losses.

- Operational Efficiency: Automation of tasks through AI can reduce costs and improve processing times.

- Industry Alignment: Nearly 40% of community banks are prioritizing AI integration, signaling a competitive imperative.

Responding to Evolving Consumer Preferences for Local Banking

A growing number of consumers are prioritizing personalized service and local community engagement, areas where 1st Security Bank excels. This trend presents a significant opportunity to attract customers who feel underserved by larger financial institutions.

By highlighting its commitment to community and offering a high-touch customer experience, 1st Security Bank can differentiate itself. This strategy resonates particularly with individuals seeking tailored financial advice and a deeper connection to their local banking partner.

- Customer Loyalty: Research indicates that community banks often experience higher customer retention rates due to stronger personal relationships. For instance, a 2024 study showed community banks retaining an average of 91% of their customers compared to 85% for larger national banks.

- Niche Market Appeal: The demand for localized banking solutions is on the rise, especially among younger demographics who value authenticity and community impact. A significant portion of Gen Z and Millennials express a preference for supporting businesses that demonstrate strong local ties.

- Brand Differentiation: Emphasizing community involvement, such as sponsoring local events or participating in community development projects, can build a powerful brand image that attracts like-minded customers.

Expanding digital banking capabilities, including AI-driven customer service and seamless online account opening, presents a significant growth avenue for 1st Security Bank. This focus on digital transformation aligns with industry trends, as over 90% of community banks are actively preparing for shifts towards AI and machine learning in 2024-2025.

The bank can also leverage its strong capital position, with a Tier 1 Capital Ratio of 12.5% as of Q1 2025, to pursue strategic acquisitions of smaller community banks. This consolidation trend in the banking sector, evidenced by several regional bank acquisitions in 2024, offers a pathway to rapidly expand market share and customer base.

Furthermore, 1st Security Bank has an opportunity to enhance its wealth management services, particularly in the Pacific Northwest, and deepen its penetration in specialized lending, such as commercial real estate and small business loans. These areas show strong growth potential for regional banks.

By emphasizing its commitment to community and offering personalized, high-touch customer experiences, 1st Security Bank can attract customers who value local engagement. This strategy is supported by data showing community banks often achieve higher customer retention, with an average of 91% in 2024 compared to 85% for national banks.

Threats

A general economic downturn, especially impacting the Pacific Northwest, could increase loan defaults for 1st Security Bank, negatively affecting its asset quality and overall profitability. For instance, a projected slowdown in regional GDP growth for 2024 could translate to higher non-performing assets.

While credit quality has remained relatively stable for many regional banks, a significant economic slowdown in 2025 could lead to a noticeable uptick in loan losses. This would likely span across various loan portfolios, including commercial real estate and consumer credit segments.

The banking landscape in 2024 and 2025 is marked by a fierce battle for customer deposits. As interest rates fluctuate, this competition can significantly drive up funding costs for institutions like 1st Security Bank. This isn't just about rising rates; even when rates fall, depositors may resist lower yields, creating a persistent 'war for deposits' that squeezes net interest margins.

Larger, more diversified financial institutions often possess a distinct advantage in navigating these deposit rate pressures. Their broader customer base and varied product offerings allow them greater flexibility in adjusting deposit rates without alienating a significant portion of their clientele, a challenge smaller banks may find more difficult to manage.

Financial institutions like 1st Security Bank face significant cybersecurity risks as they increasingly operate on digital platforms and manage sensitive customer information. A major breach could result in substantial financial losses, severe reputational damage, and legal penalties, all of which would erode customer confidence. Indeed, cybersecurity and data privacy are recognized as paramount concerns for bankers heading into 2025, highlighting the critical need for robust defenses.

Regulatory Changes and Compliance Costs

1st Security Bank, like all financial institutions, faces the persistent threat of evolving regulatory landscapes. New or ongoing changes, particularly in areas like consumer protection, data privacy (e.g., CCPA, GDPR implications), and stricter capital requirements, can lead to substantial compliance costs and operational hurdles. For instance, the Federal Reserve's ongoing review of bank capital rules, potentially impacting community banks, could increase operational burdens for institutions like 1st Security Bank.

These regulatory shifts can also stifle business activities. Overly prescriptive rules might make lending more challenging, potentially slowing growth or impacting profitability. Furthermore, such stringent requirements can accelerate industry consolidation, as smaller banks may struggle to absorb the associated costs, potentially leading to fewer community banking options in the market.

- Increased Compliance Burden: Banks must invest heavily in technology and personnel to adhere to new regulations, impacting operational efficiency.

- Potential for Stifled Lending: Stringent capital or risk-management rules could limit the bank's ability to extend credit, affecting revenue growth.

- Competitive Disadvantage: Smaller banks may find it harder to absorb compliance costs compared to larger, more diversified competitors.

Talent Recruitment and Retention Challenges

Community banks like 1st Security Bank often struggle to attract and keep skilled employees, especially in tech and cybersecurity. This is because bigger banks and tech firms can offer better pay and perks, making it tough to compete. For instance, a 2024 report indicated that the average salary for cybersecurity professionals in the financial sector saw a significant increase, a benchmark smaller institutions find challenging to match.

This talent gap can slow down innovation and impact how smoothly the bank operates. In 2025, many community banks are reporting that their technology upgrades are delayed due to a lack of specialized IT staff. This directly affects their ability to offer cutting-edge digital services and maintain robust cybersecurity defenses.

- Competition for Tech Talent: Larger financial institutions and tech companies often outbid community banks for skilled tech and cybersecurity professionals.

- Salary and Benefits Gap: A 2024 industry survey revealed a notable disparity in compensation packages between community banks and their larger counterparts.

- Impact on Innovation: Difficulty in hiring specialized talent can hinder the development and implementation of new technologies and digital services.

- Operational Efficiency Concerns: Understaffing in critical areas like IT and cybersecurity can lead to operational bottlenecks and increased security risks.

Intensifying competition for deposits in 2024 and 2025, driven by fluctuating interest rates, poses a significant threat by increasing funding costs and squeezing net interest margins for 1st Security Bank. Larger, more diversified institutions often have an advantage in managing these pressures due to their broader customer bases and product offerings. The ongoing 'war for deposits' means even when rates fall, customers may resist lower yields, creating persistent margin challenges.

SWOT Analysis Data Sources

This 1st Security Bank SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and insightful assessment.