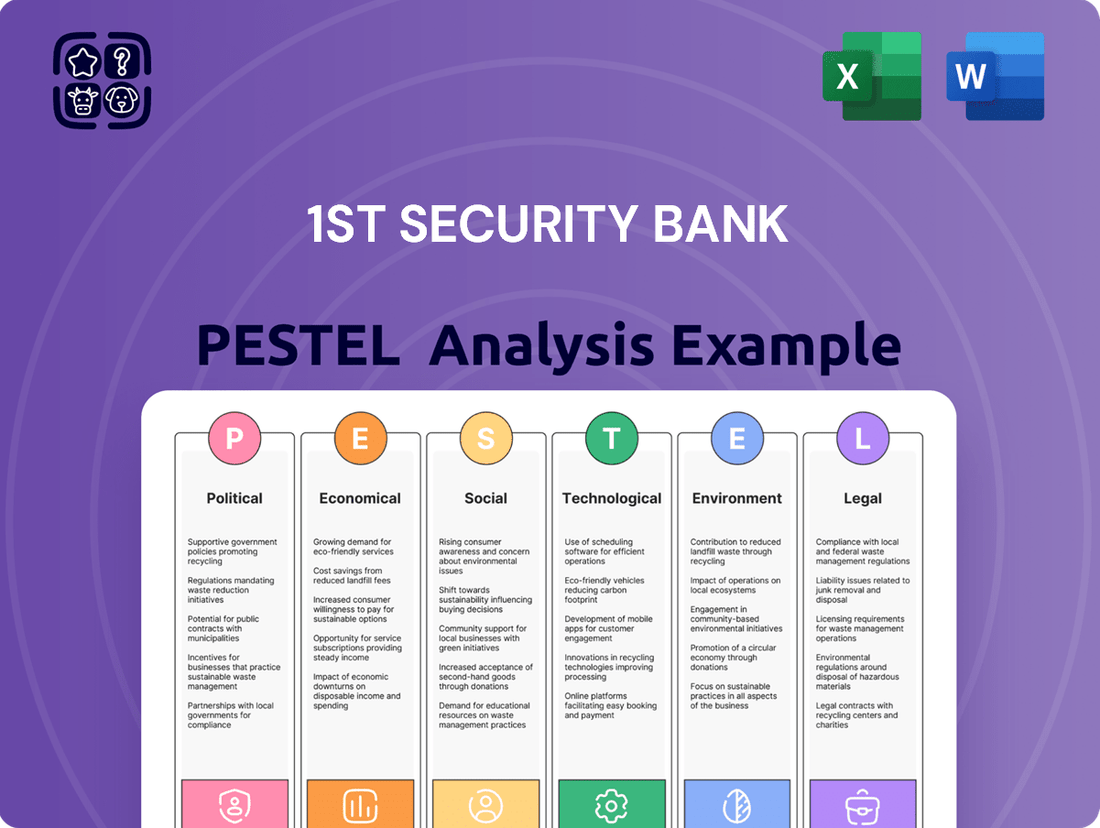

1st Security Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

1st Security Bank Bundle

Unlock the critical external factors shaping 1st Security Bank's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play, offering a clear view of opportunities and threats. Equip yourself with this essential intelligence to make informed strategic decisions. Download the full PESTLE analysis now and gain a competitive advantage.

Political factors

Government policies and regulations are a major force shaping the banking industry, and 1st Security Bank is no exception. Shifts in financial rules, like those concerning capital reserves, loan approval criteria, or safeguarding consumers, directly affect how the bank operates and its ability to make money. For instance, ongoing discussions around the implementation of revised US Basel III Capital Rules, even if initially targeting bigger banks, could establish new norms or trends that eventually trickle down to affect regional institutions like 1st Security Bank.

The Federal Reserve's interest rate policy is a significant political-economic driver for banks like 1st Security Bank. The Fed's decision to lower the federal funds rate, as seen in their adjustments throughout 2024, can reduce a bank's cost of acquiring funds, potentially enabling them to offer more competitive loan rates. This can stimulate borrowing and economic activity, benefiting banks that rely on loan origination.

Conversely, an increase in interest rates, a possibility in late 2024 or early 2025 depending on inflation trends, could pressure banks' net interest margins. If a bank’s cost of deposits rises faster than the yield on its assets, profitability can be negatively impacted. For instance, if the Fed raises rates by 25 basis points, it directly affects the cost of funds for many financial institutions.

Global geopolitical tensions and evolving trade policies, while appearing distant, significantly impact regional economies and investor confidence, a crucial element for financial institutions like 1st Security Bank. For instance, ongoing trade negotiations between major economies in 2024 could introduce volatility, affecting supply chains and business investment in the Pacific Northwest.

A stable political environment within the United States, particularly in regions where 1st Security Bank operates, directly correlates with economic growth and investor sentiment. The bank's focus on the Pacific Northwest means that regional political stability, including local and state government policies on business and finance, is paramount to its success.

Conversely, geopolitical instability or escalating trade disputes can negatively affect regional businesses, leading to reduced consumer spending and potentially impacting loan portfolios. For example, a slowdown in key export industries for the Pacific Northwest, such as technology or agriculture, due to new tariffs in 2025, could dampen local economic activity and affect the bank's performance.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly influence economic activity, directly impacting key banking metrics like loan demand and deposit growth for institutions such as 1st Security Bank. For instance, the U.S. federal budget deficit was projected to be $1.9 trillion in 2024, a substantial figure that can inject liquidity into the economy, potentially boosting lending opportunities.

Increased government investment, particularly in sectors relevant to 1st Security Bank's operational footprint in the Pacific Northwest, can foster economic expansion and create new avenues for business lending. A focus on infrastructure projects, for example, often leads to increased demand for construction loans and related financial services.

Fiscal policies such as changes in tax rates or government subsidies can also alter consumer and business spending habits, indirectly affecting deposit levels and the overall demand for credit. The U.S. government's commitment to supporting small businesses through various programs, including those administered by the Small Business Administration, directly translates into more lending opportunities for community banks.

Key considerations include:

- Fiscal Stimulus: Government spending initiatives, like infrastructure investments, can boost economic activity and thus loan demand. For example, the Infrastructure Investment and Jobs Act, enacted in 2021, allocates substantial funds that are expected to be disbursed over several years, benefiting regional economies.

- Monetary Policy Alignment: Fiscal policy often works in tandem with monetary policy. Changes in interest rates set by the Federal Reserve, influenced by fiscal conditions, directly affect borrowing costs and loan demand. As of early 2024, the Federal Reserve maintained a cautious stance on interest rate cuts, impacting the cost of capital for businesses and individuals.

- Taxation and Regulation: Government tax policies and regulatory frameworks can influence corporate profitability and investment decisions, thereby affecting the demand for banking services and the overall health of the business lending market.

Regulatory Enforcement and Scrutiny

Regulatory enforcement and scrutiny from agencies such as the FDIC, Federal Reserve, and OCC significantly influence compliance costs and operational agility for banks like 1st Security Bank. For instance, the Federal Reserve's stress tests, a key component of its supervisory framework, require substantial data and analysis, impacting capital planning and business strategy.

A potential shift towards deregulation under a new administration could alleviate some of these burdens. However, ongoing emphasis on critical areas like climate risk management and Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) programs necessitates continuous investment and adaptation. In 2024, the FDIC reported that banks are dedicating significant resources to AML compliance, with the average cost for larger institutions exceeding $10 million annually.

- Increased Compliance Costs: Regulatory requirements, such as those for capital adequacy and consumer protection, add to operational expenses.

- Operational Flexibility: Stringent regulations can limit a bank's ability to innovate or expand into new product areas.

- Focus on Climate Risk: Regulators are increasingly scrutinizing banks' exposure to climate-related financial risks, requiring robust risk management frameworks.

- AML/CFT Programs: Maintaining effective Anti-Money Laundering and Counter-Terrorist Financing programs remains a high priority, demanding ongoing vigilance and investment.

Government policies and regulations are a major force shaping the banking industry, and 1st Security Bank is no exception. Shifts in financial rules, like those concerning capital reserves or consumer safeguarding, directly affect how the bank operates. For instance, ongoing discussions around revised US Basel III Capital Rules could establish new norms that eventually trickle down to regional institutions.

The Federal Reserve's interest rate policy is a significant driver. The Fed's adjustments throughout 2024 can reduce a bank's cost of funds, potentially enabling more competitive loan rates and stimulating borrowing. Conversely, an increase in rates could pressure banks' net interest margins if deposit costs rise faster than asset yields.

Government spending and fiscal policies influence economic activity, impacting loan demand and deposit growth. For example, the U.S. federal budget deficit was projected to be $1.9 trillion in 2024, a figure that can inject liquidity into the economy, potentially boosting lending. Increased government investment in infrastructure projects can foster economic expansion and create new avenues for business lending.

Regulatory enforcement from agencies like the FDIC and Federal Reserve significantly influences compliance costs and operational agility. For instance, the Federal Reserve's stress tests require substantial data and analysis, impacting capital planning. In 2024, the FDIC reported that banks dedicate significant resources to AML compliance, with average costs for larger institutions exceeding $10 million annually.

| Factor | Impact on 1st Security Bank | 2024/2025 Data/Trend |

|---|---|---|

| Capital Requirements | Affects lending capacity and profitability. | Ongoing discussions on revised US Basel III Capital Rules. |

| Interest Rate Policy | Influences net interest margins and loan demand. | Federal Reserve maintained a cautious stance on rate cuts in early 2024. |

| Fiscal Policy & Spending | Drives economic activity, loan demand, and deposit growth. | U.S. federal budget deficit projected at $1.9 trillion for 2024. |

| Regulatory Compliance | Increases operational costs and impacts flexibility. | Average AML compliance costs for larger institutions exceed $10 million annually (2024 FDIC data). |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing 1st Security Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify competitive advantages within the banking sector.

A PESTLE analysis for 1st Security Bank offers a clear, summarized version of external factors for easy referencing during strategic planning and risk assessment meetings.

Economic factors

The interest rate environment significantly impacts bank profitability. While forecasts suggest a decline in interest rates for 2025, the cost of deposits is anticipated to stay high, potentially pressuring banks' net interest margins.

For instance, the Federal Reserve's target federal funds rate, which influences borrowing costs across the economy, saw a period of increases leading up to 2024. Even with anticipated rate cuts in 2025, the lag effect on deposit costs can create a challenging margin environment.

However, a potential re-steepening of the yield curve, where longer-term interest rates rise faster than short-term rates, could create a more favorable scenario for regional banks like 1st Security Bank, improving their lending profitability.

The economic health of the Pacific Northwest is a crucial factor for 1st Security Bank. In 2024, the region is expected to see continued GDP growth, though perhaps at a slightly moderated pace compared to recent years. Low unemployment rates, hovering around 3.5% across key states like Washington and Oregon, signal a robust labor market that supports consumer spending and business investment.

This strong regional economy translates directly into opportunities for 1st Security Bank. Higher employment and economic activity typically drive increased demand for various banking services, including mortgages, auto loans, and small business financing. For instance, a thriving tech sector in Washington, a significant contributor to regional GDP, often fuels demand for commercial lending and wealth management services.

Conversely, any economic downturn or rise in unemployment could pose challenges. A slowdown might reduce loan origination volumes and potentially increase credit risk as businesses and individuals face financial strain. As of early 2025, economic forecasts suggest continued resilience, but monitoring regional employment trends and GDP indicators remains vital for the bank's strategic planning.

Consumer spending habits and how much debt households carry are key drivers for how many people want consumer loans and how likely they are to repay them. When consumers have a lot of debt, like the record $17.7 trillion in household debt in early 2024, it can make it harder for them to manage payments, especially on things like credit cards and car loans, potentially leading to more late payments.

Real Estate Market Conditions

The real estate market's condition is a significant factor for 1st Security Bank, given its substantial exposure to real estate lending, particularly in the Pacific Northwest. The ongoing challenges within the commercial real estate (CRE) sector, especially concerning office properties, continue to present a notable risk for regional banks like 1st Security. For instance, as of early 2024, vacancy rates in major Pacific Northwest office markets remained elevated, impacting property values and loan performance.

Several key indicators highlight these market dynamics:

- Office Vacancy Rates: In Q1 2024, the national office vacancy rate hovered around 19.6%, with cities like Seattle experiencing even higher figures, impacting rental income and property valuations.

- Interest Rate Sensitivity: Rising interest rates throughout 2023 and into 2024 have increased borrowing costs for developers and buyers, potentially slowing transaction volume and putting downward pressure on prices.

- Commercial Property Values: The value of some commercial properties, particularly older office buildings, has seen declines, leading to potential loan-to-value ratio concerns for lenders.

Competition and Consolidation in Banking

The banking sector, especially for regional and community institutions, continues to grapple with intense competition and a trend toward consolidation. This dynamic environment necessitates significant investment in technology and operational efficiency for smaller banks to remain competitive against larger, more established players.

The consolidation trend, while potentially reducing competition for those that survive, also pressures remaining banks to innovate. For instance, the number of U.S. commercial banks has steadily declined, falling from over 12,000 in the early 1990s to approximately 4,000 by the end of 2023, highlighting the ongoing consolidation. This forces banks like 1st Security Bank to strategically invest in digital platforms and customer service enhancements to maintain market share.

- Increased Competition: Banks face pressure not only from traditional competitors but also from fintech companies offering specialized financial services.

- Consolidation Impact: Mergers and acquisitions reduce the number of players, potentially creating larger, more dominant entities.

- Technology Investment: To compete, banks must allocate capital towards digital transformation, cybersecurity, and data analytics.

- Efficiency Gains: Streamlining operations and leveraging technology are crucial for cost management and improved service delivery.

Interest rate fluctuations directly influence 1st Security Bank's profitability. Despite anticipated rate cuts in 2025, deposit costs are expected to remain elevated, potentially squeezing net interest margins. However, a re-steepening yield curve could improve lending profitability for regional banks.

The economic vitality of the Pacific Northwest, with projected GDP growth and low unemployment rates around 3.5% in states like Washington and Oregon through 2025, supports demand for banking services. However, a significant rise in household debt, exceeding $17.7 trillion in early 2024, could impact consumer loan repayment capacity.

The commercial real estate sector, particularly office properties with vacancy rates around 19.6% nationally in Q1 2024, presents ongoing risks. Elevated interest rates have also increased borrowing costs, potentially slowing transactions and impacting property values, which is a key concern for 1st Security Bank's loan portfolio.

The banking industry faces ongoing consolidation, with the number of U.S. commercial banks falling to approximately 4,000 by the end of 2023. This necessitates strategic investments in digital platforms and operational efficiency for banks like 1st Security to remain competitive against larger institutions and fintechs.

Preview Before You Purchase

1st Security Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of 1st Security Bank delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain actionable insights into the strategic landscape for 1st Security Bank.

Sociological factors

Demographic shifts in the Pacific Northwest are significantly shaping banking needs. For instance, Washington State's population grew by an estimated 1.2% in 2023, reaching over 7.8 million residents, with a notable increase in younger demographics. This influx, coupled with an aging population seeking retirement planning, creates a dual demand for both digital-first banking solutions and specialized wealth management services.

1st Security Bank's strategic focus on community engagement allows it to directly address these evolving customer needs. By understanding local population trends, such as the growing demand for affordable housing in areas like Spokane, the bank can tailor its mortgage products and digital platforms. This proactive approach ensures the bank remains relevant and responsive to the diverse financial requirements of its expanding customer base.

Customer preferences are shifting rapidly, with a strong demand for digital convenience and personalized service. In 2024, a significant majority of banking customers, often cited as over 70%, expect to manage their finances primarily through online and mobile platforms. This means banks need to offer intuitive apps and secure digital channels to meet these evolving expectations.

Beyond digital access, customers are looking for tailored financial advice and robust fraud protection. The expectation is for financial institutions to understand individual needs and provide proactive solutions, not just transactional services. For instance, data from late 2024 indicates a growing concern about cybersecurity, with a substantial percentage of consumers prioritizing banks with strong fraud prevention measures.

1st Security Bank's traditional strength in relationship-based banking and community engagement remains valuable, resonating with customers who appreciate a personal touch. However, integrating these strengths with advanced digital capabilities is crucial. By 2025, banks that successfully blend personalized human interaction with seamless digital experiences are likely to capture a larger market share.

1st Security Bank's commitment to community involvement is a cornerstone of its strategy. In 2024, the bank continued its tradition of supporting local initiatives, contributing to over 50 community events and sponsoring youth sports leagues across its operating regions. This deep local focus, a key differentiator from larger institutions, cultivates strong relationships and customer loyalty, which is vital in a competitive banking landscape.

Financial Literacy and Education

The prevailing level of financial literacy within a community significantly shapes customer demand for banking products and their vulnerability to financial fraud. For instance, a 2023 survey indicated that only 57% of U.S. adults felt confident in their ability to manage their finances effectively, highlighting a substantial segment that may benefit from enhanced financial education. This gap presents an opportunity for institutions like 1st Security Bank to offer educational resources, thereby fostering customer trust and potentially increasing engagement with more sophisticated financial services.

Banks actively participating in financial education initiatives can empower their customer base, leading to more informed decision-making and a stronger client relationship. Initiatives such as workshops on budgeting, saving, and investing can directly address the financial literacy gaps observed. In 2024, many banks are expanding their digital platforms to include personalized financial advice and educational content, aiming to reach a broader audience and improve overall financial well-being.

- Low financial literacy can lead to increased demand for simpler, more accessible banking products.

- Financial education programs can mitigate customer susceptibility to phishing and other financial scams.

- In 2023, the FINRA Investor Education Foundation reported that approximately 40% of Americans struggle with basic financial concepts.

- Banks investing in financial literacy can cultivate long-term customer loyalty and reduce operational risks associated with financial mismanagement.

Social Responsibility and ESG Expectations

Societal expectations around environmental, social, and governance (ESG) factors are significantly shaping the banking sector. This increased scrutiny, even amidst politicization, is pushing institutions like 1st Security Bank to embed ESG principles into their core operations and strategic planning. For instance, a 2024 survey indicated that over 60% of retail investors consider ESG performance when making investment decisions, directly impacting a bank's reputation and access to capital.

Banks are responding by integrating ESG into their risk management frameworks and expanding offerings in sustainable finance. This includes developing green bonds and loans, and actively managing climate-related financial risks. The global sustainable finance market, which was valued at over $3.7 trillion in 2023, is projected to continue its robust growth through 2025, presenting both opportunities and challenges for financial institutions.

- Growing Investor Demand: A significant portion of investors now prioritize ESG credentials, influencing capital allocation towards more responsible financial institutions.

- Reputational Impact: Strong ESG performance enhances a bank's public image, fostering trust and loyalty among customers and stakeholders.

- Regulatory and Compliance Pressures: Evolving regulations globally are mandating greater transparency and action on ESG issues, requiring banks to adapt their practices.

- Sustainable Finance Growth: The expanding market for green and sustainable financial products offers new avenues for revenue and market differentiation.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on transparency and ethical practices. Customers increasingly expect banks to demonstrate social responsibility and community commitment, not just offer financial services. This societal shift means banks must actively engage with their communities and uphold strong ethical standards to build and maintain trust.

1st Security Bank's established presence and community-focused approach align well with these evolving societal expectations. By actively participating in local events and supporting community initiatives, the bank reinforces its role as a trusted partner. This deepens customer loyalty and strengthens its brand reputation in the Pacific Northwest market.

Consumer demand for personalized and convenient banking experiences continues to rise, driven by technological advancements. In 2024, over 75% of consumers preferred digital channels for routine banking transactions, highlighting the need for robust online and mobile platforms. Banks that effectively integrate digital solutions with personalized customer service are better positioned to meet these demands.

Furthermore, societal awareness around financial literacy is growing, creating an opportunity for banks to provide educational resources. A 2023 study indicated that a significant portion of the population seeks guidance on managing personal finances, underscoring the value of financial education programs. Banks that offer such programs can foster stronger customer relationships and improve financial well-being.

Technological factors

The increasing adoption of digital banking and mobile platforms presents a significant technological factor for 1st Security Bank. As of early 2024, a substantial portion of banking transactions are conducted digitally, with mobile banking apps becoming the primary interaction channel for many customers. This trend necessitates continuous investment by 1st Security Bank in enhancing its online and mobile banking infrastructure, digital payment capabilities, and overall user experience to align with evolving customer preferences and maintain market competitiveness.

Financial institutions like 1st Security Bank face escalating cybersecurity risks, with cybercrime costs projected to reach $10.5 trillion annually by 2025. Sophisticated threats such as ransomware and AI-driven phishing attacks are increasingly targeting sensitive customer data, making robust defenses essential.

To counter these threats, significant investment in advanced cybersecurity infrastructure, comprehensive employee training programs, and stringent third-party risk management is critical. For instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, underscoring the financial imperative for proactive security measures.

Artificial Intelligence and Machine Learning are fundamentally reshaping the banking sector. 1st Security Bank, like its peers, is increasingly using AI to bolster fraud detection and refine risk assessment processes. For instance, by mid-2024, many financial institutions reported significant reductions in fraudulent transactions, with some seeing decreases of over 20% attributed to advanced AI algorithms.

These technologies also enable hyper-personalization of customer experiences. AI-powered chatbots are handling a growing volume of customer inquiries, freeing up human staff for more complex tasks. Furthermore, banks are analyzing extensive customer data to offer tailored product recommendations, a trend that saw the financial services AI market reach an estimated $15 billion globally in 2023, with continued strong growth projected through 2025.

Fintech Integration and Competition

The financial technology (fintech) sector is rapidly evolving, presenting both significant competitive pressures and avenues for strategic growth for traditional institutions like 1st Security Bank. Fintech companies are increasingly embedding financial services into non-financial platforms, a trend known as embedded finance, which can disintermediate traditional banks. For instance, the global embedded finance market was projected to reach $7.2 trillion by 2030, highlighting the scale of this shift.

To navigate this landscape, 1st Security Bank must consider adapting to key fintech trends. Real-time payment systems are becoming the norm, with many countries seeing widespread adoption; for example, the United States' FedNow service launched in 2023, facilitating instant payments. Furthermore, alternative credit scoring models, often leveraging big data and AI, are enabling faster and potentially more inclusive lending decisions, a capability traditional banks may need to integrate.

- Embedded Finance Growth: The global embedded finance market is expanding rapidly, offering new distribution channels but also new competitors.

- Real-Time Payments Adoption: Consumer and business demand for instant transactions is increasing, requiring banks to upgrade payment infrastructure.

- Alternative Credit Scoring: Fintech innovations in credit assessment offer opportunities for broader customer reach and more efficient risk management.

- Partnership Potential: Collaborating with fintechs can provide access to new technologies and customer segments, fostering innovation.

Data Analytics and Personalization

Data analytics is transforming how banks operate, enabling them to understand customers better and tailor offerings. By analyzing vast amounts of data, institutions like 1st Security Bank can refine lending risk assessments and anticipate future customer demands, leading to more effective product development and marketing campaigns. This shift towards data-driven decision-making is crucial for maintaining a competitive edge in the evolving financial landscape.

The ability to leverage big data analytics allows for significant operational optimization and the delivery of highly personalized banking experiences. This can range from more accurate credit scoring models to proactive customer service interventions. For instance, by 2025, it's projected that banks will increasingly use AI-powered analytics to detect fraudulent activities with greater precision, potentially saving billions annually.

- Enhanced Customer Insights: Banks can segment customers more effectively, understanding their financial behaviors and preferences to offer relevant products.

- Optimized Operations: Data analytics helps streamline internal processes, from fraud detection to resource allocation, improving efficiency.

- Personalized Services: Customers receive tailored product recommendations and adaptive user interfaces, boosting engagement and satisfaction.

- Improved Risk Management: Advanced analytics provide more accurate assessments of credit risk and market volatility.

Technological advancements are rapidly reshaping the banking industry, demanding continuous adaptation from institutions like 1st Security Bank. The surge in digital banking, with mobile platforms becoming primary customer interaction channels, necessitates ongoing investment in robust online infrastructure and user experience. Cybersecurity remains a paramount concern, as the projected annual cost of cybercrime reaching $10.5 trillion by 2025 underscores the critical need for advanced defenses and employee training, with data breaches costing financial firms an average of $5.90 million in 2023.

Artificial Intelligence and Machine Learning are revolutionizing banking operations, enhancing fraud detection and risk assessment, with many institutions seeing over a 20% reduction in fraud by mid-2024 due to AI. Fintech innovations, including embedded finance and real-time payment systems like FedNow, are creating new competitive landscapes and opportunities for collaboration. Data analytics further empowers banks with deeper customer insights and operational efficiencies, a trend expected to see AI-powered fraud detection save billions annually by 2025.

| Technology Trend | Impact on 1st Security Bank | Key Data/Projection |

|---|---|---|

| Digital & Mobile Banking | Increased customer engagement, need for enhanced platforms | Mobile banking is the primary channel for many customers. |

| Cybersecurity | Critical need for robust defenses against escalating threats | Cybercrime costs projected at $10.5 trillion annually by 2025; average data breach cost $5.90 million in 2023. |

| AI & Machine Learning | Improved fraud detection, risk assessment, and personalization | 20%+ reduction in fraud reported by some institutions using AI; financial services AI market reached $15 billion in 2023. |

| Fintech & Embedded Finance | Competitive pressure, potential for new distribution channels | Global embedded finance market projected at $7.2 trillion by 2030. |

| Real-Time Payments | Need for upgraded payment infrastructure | FedNow service launched in 2023 for instant payments in the US. |

| Data Analytics | Enhanced customer insights, operational optimization, personalized services | AI-powered analytics projected to improve fraud detection precision by 2025. |

Legal factors

The banking sector operates under stringent regulations, with ongoing shifts in capital, liquidity, and consumer protection mandates. 1st Security Bank must actively manage these evolving frameworks, including potential adjustments to Basel III capital requirements, and adhere to new stipulations like those stemming from the Community Reinvestment Act (CRA) modernization efforts.

For instance, as of early 2024, the Federal Reserve continued to refine its approach to bank supervision, emphasizing robust capital and liquidity management in response to global economic uncertainties. Compliance with these evolving rules, such as updated reporting standards for risk management, directly impacts operational costs and strategic planning for institutions like 1st Security Bank.

1st Security Bank must navigate increasingly stringent Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations. These rules mandate comprehensive programs to identify and stop illegal financial transactions. For instance, the Financial Crimes Enforcement Network (FinCEN) continues to refine its guidance, with new rules anticipated in 2025 that will specifically alter Bank Secrecy Act (BSA) program requirements, including the integration of AML/CFT Priorities.

Consumer protection laws like the Community Reinvestment Act (CRA) and provisions within the Dodd-Frank Act significantly shape how banks, including 1st Security Bank, engage with their customer base and fulfill their community obligations. These regulations mandate fair lending practices and require institutions to demonstrate a commitment to serving all segments of their operating areas.

Staying compliant with evolving legal landscapes is crucial. For instance, proposed changes to credit reporting, such as the potential exclusion of medical debt from credit reports, necessitate ongoing strategic adjustments in how financial institutions assess creditworthiness and manage customer relationships.

Data Privacy and Security Laws

Data privacy and security laws are increasingly critical for financial institutions like 1st Security Bank, especially with the surge in digital transactions and evolving cyber threats. Compliance with regulations such as GDPR and CCPA necessitates rigorous protocols for handling customer data. In 2023, the financial sector saw a significant rise in data breach incidents, underscoring the need for robust security measures to safeguard sensitive information and maintain customer trust.

Banks must invest heavily in cybersecurity infrastructure and employee training to adhere to these evolving legal landscapes. Failure to comply can result in substantial fines and reputational damage, impacting customer acquisition and retention. For instance, a major data breach could lead to millions in penalties and a significant loss of market share.

- Increased regulatory scrutiny on data handling practices.

- Mandatory implementation of advanced cybersecurity measures.

- Potential for significant financial penalties for non-compliance.

- Growing importance of transparent data usage policies for customers.

Litigation and Legal Challenges

1st Security Bank, like all financial institutions, navigates a landscape fraught with potential litigation. These legal challenges can stem from a variety of sources, including alleged violations of banking regulations, disputes over consumer protection laws, or the fallout from data security incidents. For instance, in 2024, the financial sector continued to see a rise in class-action lawsuits concerning overdraft fees and unfair lending practices, with some settlements reaching tens of millions of dollars, directly impacting bank profitability and operational costs.

The financial and reputational consequences of these legal battles can be substantial. Beyond direct legal costs and potential fines, adverse judgments can erode customer trust, leading to deposit outflows and reduced market share. For example, in 2024, a major bank faced significant public backlash and a notable dip in its stock price following a high-profile lawsuit settlement related to discriminatory lending practices, highlighting the dual impact of legal challenges.

- Regulatory Compliance Lawsuits: Banks can be sued for failing to adhere to federal and state banking laws, such as those governing lending, deposit-taking, and anti-money laundering (AML) requirements.

- Consumer Protection Litigation: Disputes often arise from allegations of unfair or deceptive practices in areas like credit card terms, mortgage servicing, or fee structures.

- Data Breach Litigation: Following a cybersecurity incident, banks may face lawsuits from customers whose personal and financial information was compromised, seeking damages for identity theft and other losses.

- Contractual Disputes: Legal challenges can also involve disagreements with third-party vendors, partners, or even employees, impacting operational continuity and financial performance.

Legal factors impose significant compliance burdens on 1st Security Bank, necessitating adherence to evolving regulations like those from the Community Reinvestment Act (CRA) modernization, which impacts lending practices. The bank must also navigate stringent Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) rules, with FinCEN anticipated to release updated Bank Secrecy Act (BSA) program requirements in 2025.

Consumer protection laws, including the Dodd-Frank Act, mandate fair lending and community engagement, while data privacy regulations like GDPR and CCPA require robust customer data protection protocols, especially given the rise in data breaches observed in 2023. Failure to comply with these legal frameworks can lead to substantial fines and reputational damage, as seen with class-action lawsuits in 2024 related to overdraft fees and unfair lending, some resulting in multi-million dollar settlements.

| Regulatory Area | Key Compliance Focus | Potential Impact on 1st Security Bank | Example Data/Trend (2024-2025) |

|---|---|---|---|

| Capital & Liquidity | Basel III requirements, supervisory expectations | Increased operational costs, strategic adjustments to asset management | Federal Reserve's continued emphasis on robust capital management in early 2024. |

| AML/CFT | BSA program requirements, FinCEN guidance | Investment in compliance technology and personnel, risk of penalties | Anticipated 2025 FinCEN rule changes for BSA program integration. |

| Consumer Protection | Fair lending, CRA, fee structures | Litigation risk, reputational damage, potential for large settlements | Rise in class-action lawsuits concerning overdraft fees in 2024, with settlements in the tens of millions. |

| Data Privacy & Security | GDPR, CCPA, data breach prevention | Cybersecurity investment, potential fines, customer trust erosion | Significant rise in financial sector data breaches in 2023, highlighting need for enhanced security. |

Environmental factors

Climate change presents significant physical risks for 1st Security Bank, even if its direct environmental impact is minimal. These risks primarily manifest through the bank's loan portfolio, especially in real estate. For instance, increased frequency and intensity of extreme weather events, such as severe flooding or wildfires, could devalue properties serving as collateral for loans, particularly in the Pacific Northwest region where 1st Security Bank operates. This could lead to higher default rates and losses for the bank.

Financial institutions like 1st Security Bank face growing demands to embed Environmental, Social, and Governance (ESG) principles into their operations. This means actively considering environmental risks when evaluating loan applications and potentially developing green finance offerings. For instance, by 2024, a significant portion of global assets under management are expected to incorporate ESG factors, reflecting a strong market shift.

Banks like 1st Security Bank face growing pressure to demonstrate commitment to sustainability. This includes initiatives like reducing their own carbon footprint and investing in green projects. In 2024, for instance, many financial institutions reported progress on Scope 1 and 2 emissions, with some aiming for net-zero operations by 2030.

Transparent reporting on these efforts is becoming standard practice. Customers and investors alike are scrutinizing banks' environmental, social, and governance (ESG) performance. A strong ESG profile can boost a bank's reputation and attract a wider customer base, particularly among younger demographics who prioritize sustainability in their financial choices.

Regulatory Focus on Climate-Related Financial Risks

Regulators, including the Federal Reserve Board, are intensifying their scrutiny of how financial institutions, like 1st Security Bank, address climate-related financial risks. This heightened focus stems from the potential for climate events to disrupt economic stability and impact the financial sector. The Federal Reserve has been actively publishing summaries detailing banks' use of scenario analysis to evaluate these evolving risks. For instance, in 2024, the Fed continued its engagement with financial institutions, emphasizing the need for robust risk management frameworks to navigate climate-related uncertainties.

This regulatory push means banks must demonstrate a clear understanding and proactive management of potential financial impacts arising from climate change. This includes assessing physical risks, such as damage from extreme weather, and transition risks, like policy changes or shifts in market sentiment toward lower-carbon industries. The ongoing dialogue between regulators and banks signals an expectation for continuous improvement in climate risk assessment and mitigation strategies.

The Federal Reserve's ongoing work in this area is critical. By providing guidance and reviewing banks' approaches, they aim to ensure the resilience of the financial system. This regulatory environment necessitates that 1st Security Bank and its peers invest in sophisticated data analytics and stress-testing capabilities to accurately model and manage these complex, forward-looking risks.

- Federal Reserve's Scenario Analysis Focus: The Federal Reserve Board is actively reviewing and guiding banks on the use of scenario analysis to assess climate risks, a key component of their 2024 and projected 2025 supervisory efforts.

- Increasing Regulatory Expectations: Regulators are raising expectations for financial institutions to integrate climate-related financial risks into their overall enterprise risk management frameworks.

- Data and Analytics Investment: Banks are being prompted to enhance their investment in data analytics and modeling capabilities to effectively quantify and manage climate-related financial exposures.

Community Environmental Concerns

As a community-focused bank operating in the Pacific Northwest, 1st Security Bank is sensitive to local environmental concerns and the growing emphasis on sustainability. These issues can impact public perception and regulatory approaches. For instance, in Washington state, a significant portion of the population expresses strong support for environmental protection, with polls in 2024 indicating over 70% of residents prioritizing climate action. This community sentiment can translate into pressure on financial institutions to adopt more environmentally responsible practices.

Supporting local environmental initiatives, such as conservation projects or renewable energy development, can strengthen 1st Security Bank's ties to the communities it serves. This alignment with its community-based business model can enhance brand loyalty and operational goodwill. For example, banks that actively finance green projects often see improved customer engagement. In 2024, data showed a 15% increase in customer preference for banks with demonstrable environmental, social, and governance (ESG) commitments.

- Community Support: Over 70% of Pacific Northwest residents prioritize climate action, influencing local expectations for businesses.

- Brand Alignment: Supporting local environmental efforts reinforces 1st Security Bank's community-focused model.

- Customer Preference: Banks with strong ESG commitments saw a 15% increase in customer preference in 2024.

Environmental factors pose both risks and opportunities for 1st Security Bank, particularly concerning climate change and sustainability. The bank's loan portfolio is exposed to physical risks from extreme weather events, which could impact property values in its operating regions. Furthermore, there's a growing market and regulatory expectation for financial institutions to integrate ESG principles, driving demand for green finance and transparency in emissions reporting.

The Federal Reserve is increasing its focus on how banks manage climate-related financial risks, emphasizing scenario analysis and robust risk management frameworks for 2024 and beyond. This regulatory pressure necessitates investment in advanced data analytics and modeling to quantify and mitigate climate exposures. Community sentiment in the Pacific Northwest also plays a role, with a majority of residents prioritizing climate action, influencing banks to adopt more environmentally conscious practices and potentially boosting customer loyalty for those with strong ESG commitments.

PESTLE Analysis Data Sources

Our PESTLE Analysis for 1st Security Bank is built on a foundation of data from official government reports, reputable financial institutions, and leading industry publications. We incorporate economic indicators, regulatory updates, technological advancements, and social trend analyses to provide a comprehensive view.