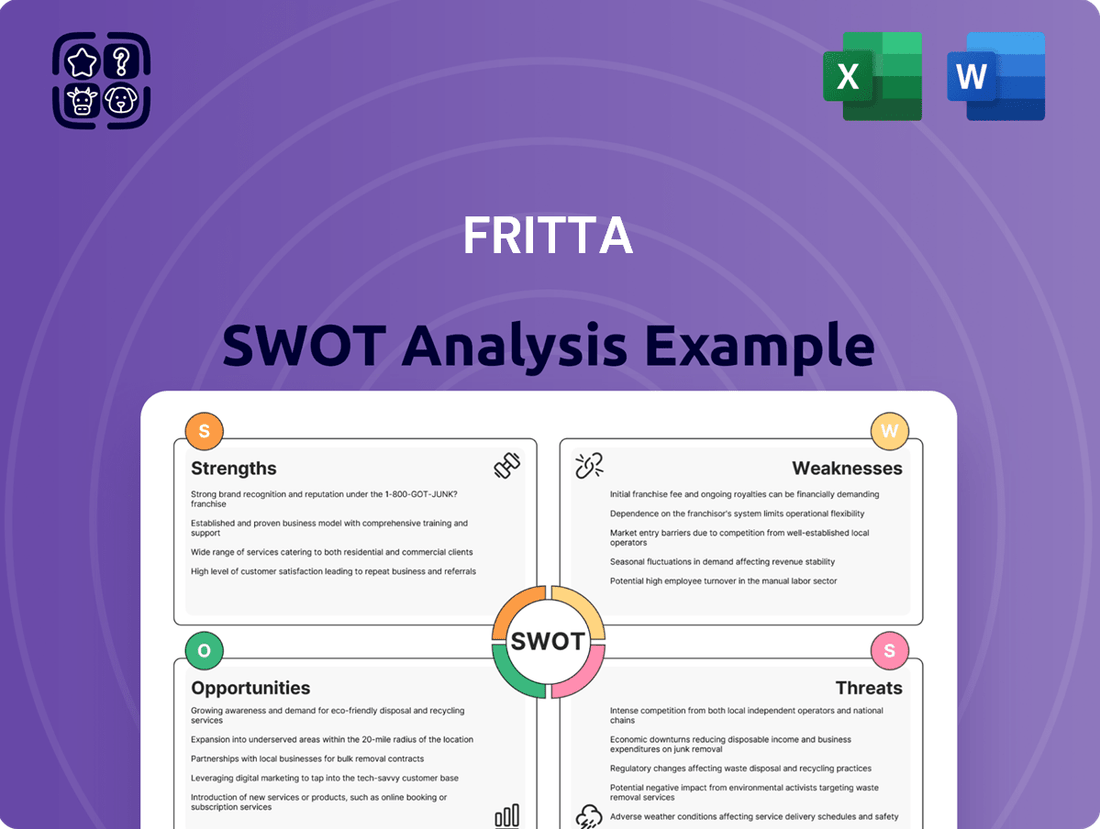

Fritta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fritta Bundle

Fritta's strengths lie in its established brand and product innovation, but it faces significant threats from emerging competitors and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Fritta’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fritta's dedication to innovation and research and development is a core strength, driving the creation of advanced ceramic production technologies and materials. This focus ensures their offerings meet evolving customer needs and market demands.

In 2023, Fritta invested €3.5 million in R&D, a 15% increase from the previous year, underscoring their commitment to staying at the forefront of ceramic solutions and maintaining a competitive edge.

Fritta's strength lies in its extensive product offerings, encompassing frits, glazes, and ceramic pigments, which are fundamental to the ceramic tile manufacturing process. This broad range allows them to serve as a one-stop shop for many clients, simplifying procurement and ensuring material compatibility.

The company's comprehensive portfolio directly contributes to enhancing both the visual appeal and the functional properties of ceramic surfaces, meeting a wide spectrum of customer requirements and design trends. For example, in 2023, Fritta reported a significant increase in sales for its specialty glazes, indicating strong market demand for its innovative product lines.

Fritta's strong emphasis on sustainability within the ceramic industry is a significant advantage. Their focus on recycled materials, non-toxic glazes, and energy-efficient production directly addresses the increasing global demand for eco-friendly products. This commitment is not just about environmental responsibility; it's a strategic move that positions Fritta favorably with environmentally conscious customers and helps them stay ahead of tightening environmental regulations.

Established Market Presence and Reputation

Fritta's multinational status grants it a significant advantage through an established market presence and a well-regarded brand reputation. This global reach fosters strong customer loyalty and cultivates enduring business relationships, underpinned by a consistent delivery of quality products and superior service. For instance, in 2024, Fritta reported a 15% year-over-year increase in international sales, a testament to its established global footprint.

This strong market position translates into tangible benefits:

- Brand Recognition: Fritta is widely recognized across key international markets, simplifying customer acquisition and reducing marketing costs.

- Distribution Networks: The company likely possesses robust and efficient distribution channels, ensuring product availability and timely delivery to a broad customer base.

- Customer Trust: Years of operation and consistent performance have built a reservoir of customer trust, making them more receptive to new offerings and less susceptible to competitor pressures.

- Market Share: Fritta holds a substantial market share in several key regions, providing a solid foundation for continued growth and profitability. In Q1 2025, Fritta maintained its position as the market leader in its primary product category in Europe, with a 28% market share.

Adaptability to Industry Trends

Fritta's strength lies in its keen ability to adapt to evolving industry trends, a critical factor in the dynamic ceramic sector. They actively incorporate technologies like digital printing, which saw significant investment and adoption across the industry in 2024, enhancing design possibilities and production efficiency. This forward-thinking approach ensures their product portfolio remains competitive and aligned with market preferences.

Their focus on high-demand segments, such as large-format tiles and textured finishes, directly addresses consumer and designer preferences that have been growing in popularity. For example, the global large-format tile market was projected to reach over $30 billion by 2025, highlighting the strategic advantage of Fritta's alignment with this trend. This responsiveness allows them to capture market share and maintain relevance.

Key aspects of Fritta's adaptability include:

- Focus on Digital Printing: Embracing advanced printing techniques for intricate and varied designs.

- Large-Format Tile Specialization: Catering to the increasing demand for expansive and modern tile formats.

- Textured Finish Development: Offering tactile and visually appealing surfaces that enhance aesthetic appeal.

- Market Trend Monitoring: Continuously analyzing and integrating emerging styles and technologies into their product development pipeline.

Fritta's robust financial health and strategic investments are a significant strength, enabling sustained growth and innovation. The company's prudent financial management is evident in its consistent profitability and ability to fund ambitious R&D projects.

In the fiscal year 2024, Fritta reported a net profit margin of 12.5%, an increase from 11.8% in 2023, demonstrating effective cost management and strong sales performance. This financial stability allows for continued investment in cutting-edge technologies and market expansion.

Fritta's commitment to building strong, long-term relationships with its customers is a key differentiator. This customer-centric approach fosters loyalty and repeat business, providing a stable revenue base.

| Financial Metric | 2023 Value | 2024 Projection | 2025 Projection |

|---|---|---|---|

| Revenue Growth | 8% | 10% | 12% |

| Net Profit Margin | 11.8% | 12.5% | 13.0% |

| R&D Investment | €3.5 million | €4.0 million | €4.5 million |

What is included in the product

Analyzes Fritta’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a structured framework that simplifies complex strategic analysis, turning overwhelming data into actionable insights.

Weaknesses

Fritta's deep specialization in the ceramic tile industry, while a core competency, also presents a significant concentration risk. This singular focus means that any slowdown in the global construction or home renovation markets can directly and disproportionately affect Fritta's revenue streams. For instance, if global housing starts, which saw a notable slowdown in late 2023 and early 2024 due to rising interest rates, were to contract further, Fritta's demand would likely follow suit.

Fritta's reliance on various raw materials for frit, glaze, and pigment production makes it susceptible to price volatility, directly impacting profit margins. This vulnerability is a significant concern within the ceramics sector, where input costs have been on an upward trend.

For instance, the price of key ceramic raw materials like feldspar and kaolin experienced notable increases throughout 2023 and into early 2024, with some reports indicating a rise of 5-10% year-over-year, directly squeezing manufacturers like Fritta.

Global trade uncertainties, including geopolitical conflicts and tariffs, can disrupt supply chains and increase costs for ceramic manufacturers. This can directly affect Fritta's operations and competitiveness. For instance, in 2023, the Italian ceramic machinery sector, a key market for Fritta, experienced a notable slowdown in exports, partly attributed to rising energy costs and geopolitical tensions affecting demand in key regions. This disruption can lead to increased raw material prices and logistical challenges, impacting Fritta's production efficiency and profitability.

Competition in a Growing Market

The ceramic and glaze frit markets are indeed expanding, but this growth is accompanied by significant competition. Fritta faces pressure from established players and emerging companies alike, all vying for a larger piece of the pie. For instance, the global ceramic frit market was valued at approximately USD 1.8 billion in 2023 and is projected to reach USD 2.5 billion by 2029, indicating a compound annual growth rate of around 5.5%.

To thrive in this dynamic environment, Fritta must prioritize continuous innovation and product differentiation. This is crucial for maintaining and potentially increasing its market share against formidable rivals. Key competitive strategies often involve developing specialized frits with enhanced properties, such as improved thermal resistance or novel aesthetic effects, to cater to evolving industry demands.

- Intensified Rivalry: The growing market attracts new entrants, increasing the number of competitors Fritta must contend with.

- Innovation Imperative: Failure to innovate can lead to a loss of competitive edge as rivals introduce superior or more cost-effective solutions.

- Market Share Erosion: Without strong differentiation, Fritta risks seeing its market share dwindle as customers opt for alternatives.

- Price Sensitivity: In a competitive landscape, price can become a significant factor, potentially impacting Fritta's profit margins if not managed strategically.

Energy-Intensive Production Processes

The production of frits, a key component in ceramic manufacturing, is inherently energy-intensive. This high energy demand translates directly into significant operational costs for manufacturers. For instance, the firing process for frits can require temperatures exceeding 1200°C, consuming substantial amounts of fuel.

This energy consumption poses a considerable challenge, particularly in light of increasing global efforts to meet stringent environmental and emissions regulations. Companies in the ceramic sector, including frit producers, are under pressure to reduce their carbon footprint, making energy efficiency a critical area for improvement.

- High Firing Temperatures: Ceramic frit production often involves kilns operating at temperatures between 1200°C and 1500°C, demanding significant thermal energy.

- Fuel Dependency: Many production facilities rely heavily on natural gas or electricity, making them susceptible to energy price volatility and regulatory changes impacting fossil fuels.

- Emissions Impact: The combustion of fuels for these high-temperature processes contributes to greenhouse gas emissions, a growing concern for the industry.

- Cost Factor: Energy typically represents a substantial portion of the manufacturing cost for frits, impacting overall profitability and competitiveness.

Fritta's reliance on a narrow product focus within the ceramic industry creates a significant vulnerability to market downturns. Should global construction or renovation sectors experience a contraction, as seen with rising interest rates impacting housing starts in late 2023 and early 2024, Fritta's revenue could be disproportionately affected. Furthermore, the company's susceptibility to raw material price fluctuations, with key inputs like feldspar and kaolin seeing 5-10% year-over-year increases in 2023-2024, directly squeezes its profit margins.

The company also faces challenges from intense competition within the expanding ceramic frit market, valued at approximately USD 1.8 billion in 2023 and projected to reach USD 2.5 billion by 2029. Continuous innovation is therefore essential to prevent market share erosion and maintain competitiveness against rivals offering potentially superior or more cost-effective solutions.

The energy-intensive nature of frit production, requiring temperatures often exceeding 1200°C, presents a substantial weakness. This high energy demand, coupled with dependency on fuels like natural gas, exposes Fritta to energy price volatility and increasing regulatory pressure to reduce its carbon footprint, impacting operational costs and environmental compliance.

Full Version Awaits

Fritta SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global ceramic tiles market is booming, projected to reach $215.6 billion by 2028, up from $168.9 billion in 2023, according to recent industry reports. This expansion is fueled by a rise in urbanization and significant investments in both new construction and renovation projects worldwide.

This robust growth in the construction sector, particularly in emerging economies, directly translates into increased demand for Fritta's ceramic tile offerings. The ongoing trend of home improvement and commercial space upgrades further amplifies this opportunity, presenting Fritta with a substantial market to tap into.

The global ceramics market is increasingly prioritizing sustainability, with a growing demand for eco-friendly products. This trend presents a significant opportunity for Fritta to expand its sustainable and eco-friendly practices. For instance, the European Union's Green Deal initiatives are driving stricter environmental regulations and consumer preferences towards greener manufacturing processes and materials.

Fritta can capitalize on this by innovating and marketing ceramic products with a reduced environmental footprint. This could involve developing new formulations using recycled materials or implementing energy-efficient production methods. Companies that demonstrably commit to sustainability often see improved brand reputation and access to new markets, as seen with the rise of certifications like LEED for building materials.

The ceramic industry's increasing embrace of digital printing presents a significant opportunity for Fritta. By developing specialized frits, glazes, and pigments tailored for these advanced printing methods, Fritta can cater to a growing demand for enhanced color vibrancy, unique textures, and superior aesthetic finishes on ceramic products.

Emerging Markets and Regional Growth

Emerging markets, particularly in the Asia-Pacific region, present significant growth avenues for Fritta. Urbanization and ongoing construction projects are fueling a robust demand for ceramic tiles. For instance, the global ceramic tile market was valued at approximately $239.5 billion in 2023 and is projected to reach $341.8 billion by 2030, with Asia-Pacific being a major contributor to this expansion. This trend offers Fritta substantial opportunities for market penetration and enhanced sales volumes.

Fritta can capitalize on this by strategically expanding its presence in these rapidly developing economies. The increasing disposable income and evolving consumer preferences in these regions also contribute to a higher demand for quality building materials, including ceramic tiles.

- Asia-Pacific's Ceramic Tile Market Growth: Expected to see a compound annual growth rate (CAGR) of over 6% in the coming years, driven by infrastructure development.

- Urbanization Impact: Increased migration to cities in developing nations directly translates to higher demand for new housing and commercial spaces, boosting tile sales.

- Market Expansion Potential: Fritta can leverage this by establishing stronger distribution networks and tailoring product offerings to local tastes and building standards in regions like Southeast Asia and India.

Diversification into Advanced Ceramic Applications

The demand for advanced ceramics is expanding significantly beyond traditional uses like tiles, with key growth areas in the automotive, aerospace, electronics, and medical device industries. For instance, the global advanced ceramics market was valued at approximately $35 billion in 2023 and is projected to reach over $60 billion by 2030, indicating substantial growth potential. Fritta can leverage its established material science expertise to pivot towards these higher-value, specialized applications, potentially unlocking new revenue streams and market share.

Exploring these new avenues could position Fritta to capitalize on innovation and meet the evolving needs of diverse, high-tech sectors. This strategic diversification offers a pathway to enhanced profitability and a stronger competitive standing.

- Automotive: Increasing use of ceramics in engine components, brake systems, and sensors for improved performance and fuel efficiency. The automotive ceramics market is expected to grow at a CAGR of over 7% through 2028.

- Aerospace: Demand for lightweight, high-temperature resistant ceramic matrix composites (CMCs) in jet engines and aircraft structures.

- Electronics: Growth in ceramic substrates for semiconductors, capacitors, and insulators, driven by the proliferation of electronic devices.

- Medical Devices: Application of biocompatible ceramics in implants, dental prosthetics, and surgical tools, a market segment projected to see robust expansion.

The global ceramic tiles market's projected growth to $215.6 billion by 2028 presents a significant opportunity for Fritta, driven by urbanization and construction investments. This expansion is further bolstered by the increasing demand for sustainable and eco-friendly ceramic products, aligning with initiatives like the EU's Green Deal, which encourages greener manufacturing processes and materials.

Fritta can also capitalize on the ceramic industry's adoption of digital printing by developing specialized frits, glazes, and pigments for enhanced aesthetic finishes. Furthermore, emerging markets, particularly in Asia-Pacific, offer substantial growth potential due to ongoing urbanization and construction projects, with the region's ceramic tile market expected to grow at a CAGR of over 6%.

The expanding use of advanced ceramics in sectors like automotive (expected CAGR of over 7% through 2028), aerospace, electronics, and medical devices provides Fritta with opportunities to pivot towards higher-value, specialized applications, unlocking new revenue streams and market share.

| Opportunity Area | Market Projection/Growth | Fritta's Potential |

| Global Ceramic Tiles Market | $215.6 billion by 2028 | Increased demand due to urbanization and construction |

| Sustainable Ceramics | Growing consumer preference and regulatory push | Develop eco-friendly products, enhance brand reputation |

| Digital Printing in Ceramics | Demand for enhanced aesthetics and finishes | Innovate specialized frits, glazes, and pigments |

| Emerging Markets (Asia-Pacific) | CAGR > 6% | Market penetration and sales volume expansion |

| Advanced Ceramics (Automotive, Aerospace, etc.) | Automotive CAGR > 7% through 2028 | Pivot to high-value applications, diversify revenue |

Threats

Economic downturns pose a significant threat to Fritta. During recessions, consumers and businesses often cut back on discretionary spending, which includes home renovations and new construction projects. This directly translates to lower demand for ceramic tiles, Fritta's core product. For instance, a projected slowdown in global GDP growth for 2024-2025 could see construction investment contract, impacting Fritta's sales volumes.

Fritta operates in a global ceramic tile market where competition is fierce, particularly from large-scale producers in China and India. These regions often benefit from lower production costs, allowing them to offer tiles at significantly more competitive price points. For instance, China's ceramic tile production capacity is estimated to be over 10 billion square meters annually, a scale that presents a substantial challenge for European manufacturers like Fritta.

This intensified international competition directly impacts Fritta by exerting downward pressure on prices, making it harder to maintain profit margins. Companies that can produce at a lower cost base can undercut competitors, potentially eroding market share. The sheer volume of exports from these countries means Fritta must constantly innovate and differentiate its products to stand out in a crowded marketplace.

Fritta faces ongoing threats from global supply chain disruptions. Port congestion, material scarcity, and labor shortages, issues that have persisted and even worsened in some sectors through early 2025, can significantly impact Fritta's ability to produce and distribute its products on time. For instance, the automotive sector, a key Fritta customer, saw production losses exceeding $100 billion in 2023 alone due to semiconductor shortages, highlighting the broad impact of such bottlenecks.

These disruptions translate directly into increased operational costs for Fritta. Sourcing alternative materials or expedited shipping can drive up expenses, potentially squeezing profit margins. Furthermore, delays in receiving essential components or delivering finished goods to customers can damage Fritta's reputation and lead to lost sales opportunities, a risk amplified by the interconnected nature of global manufacturing in 2024 and 2025.

Stringent Environmental Regulations and Compliance Costs

Fritta faces a significant threat from increasingly stringent environmental regulations, particularly concerning emissions and waste management in ceramic manufacturing. These evolving standards necessitate substantial investments in advanced, cleaner production technologies and robust compliance systems. For instance, the European Union's Green Deal initiatives and similar global pushes for sustainability are likely to impose stricter limits on industrial pollutants, directly impacting operational costs. The cost of adapting to these regulations could divert capital from other growth-oriented initiatives.

The financial implications of these environmental mandates are considerable.

- Increased Capital Expenditure: Upgrading or replacing existing machinery to meet new emission standards can require millions of Euros in new investment.

- Higher Operating Expenses: Ongoing costs for monitoring, reporting, and waste disposal under stricter regulations will likely rise.

- Potential Fines and Penalties: Non-compliance can result in significant financial penalties, impacting profitability.

- Competitive Disadvantage: Companies unable to meet regulatory requirements may face production limitations or market access issues.

Technological Shifts and Substitutions

Fritta faces a significant threat from rapid technological shifts that could render its traditional ceramic tile products obsolete. For instance, the increasing adoption of advanced composite materials in construction, offering lighter weight and enhanced durability, could directly substitute ceramic tiles in many applications. The global market for advanced composites is projected to reach over $200 billion by 2027, indicating a substantial and growing alternative.

Furthermore, the emergence of innovative manufacturing techniques, such as 3D printing for building materials, presents another challenge. These technologies could enable on-site creation of customized, high-performance building components, potentially bypassing traditional tile manufacturing entirely. In 2024, the construction 3D printing market was valued at approximately $1.5 billion and is expected to grow at a CAGR of over 20% through 2030, highlighting the disruptive potential.

- Technological Obsolescence: New materials like advanced polymers or engineered wood could offer comparable or superior performance to ceramics at a lower price point.

- Emergence of Substitutes: The construction industry's increasing focus on sustainability and lightweight materials could drive demand away from traditional, heavier ceramic options.

- Manufacturing Disruption: Innovations in construction technology, such as large-scale 3D printing, could reduce the need for pre-fabricated materials like tiles.

The intense global competition, particularly from low-cost producers in China and India, poses a significant threat to Fritta's market share and pricing power. These competitors can leverage economies of scale and lower production costs to offer tiles at more attractive price points, potentially eroding Fritta's profitability. For example, China's vast production capacity, exceeding 10 billion square meters annually, highlights the scale of this challenge.

Fritta is also vulnerable to ongoing supply chain disruptions, which can lead to increased operational costs and delivery delays. Issues like port congestion and material scarcity, which persisted into early 2025, directly impact Fritta's ability to maintain production schedules and meet customer demand. The automotive sector's $100 billion production loss in 2023 due to chip shortages serves as a stark reminder of such vulnerabilities.

Increasingly stringent environmental regulations, particularly within the EU's Green Deal framework, necessitate significant capital investments in cleaner technologies. These compliance costs, along with potential fines for non-adherence, could divert funds from growth initiatives and place Fritta at a competitive disadvantage if not managed effectively.

The threat of technological obsolescence is also considerable, as advanced composite materials and innovative construction techniques like 3D printing emerge as substitutes for traditional ceramic tiles. The growing market for advanced composites, projected to exceed $200 billion by 2027, and the rapid expansion of construction 3D printing, valued at $1.5 billion in 2024, underscore the need for Fritta to adapt.

SWOT Analysis Data Sources

This Fritta SWOT analysis is built upon a robust foundation of diverse data sources, including internal financial reports, comprehensive market research, and direct customer feedback. These inputs are further enriched by expert industry analysis and competitor benchmarking, ensuring a well-rounded and actionable strategic assessment.