Fritta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fritta Bundle

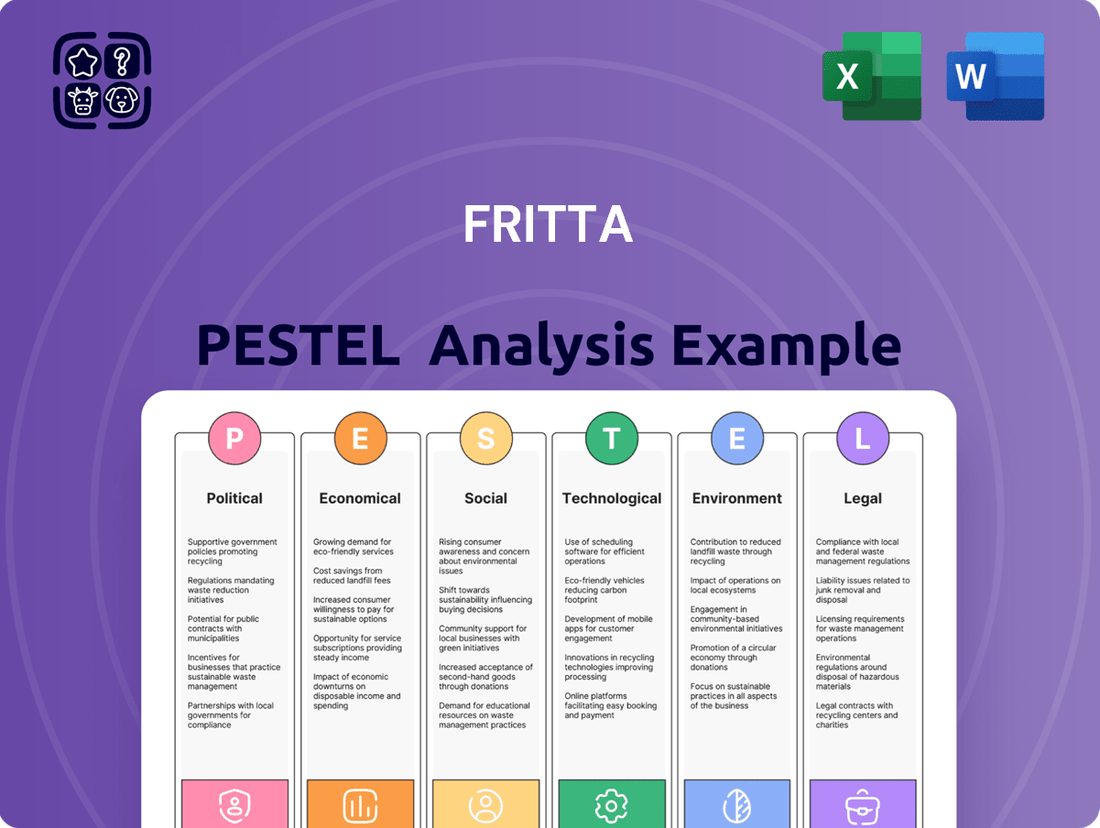

Navigate Fritta's complex external environment with our detailed PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with the knowledge to anticipate challenges and capitalize on emerging opportunities. Download the full report now for actionable intelligence and a strategic advantage.

Political factors

Fritta, operating globally, is highly susceptible to shifts in international trade policies and tariffs. For instance, the United States' imposition of anti-dumping and countervailing duties on ceramic tile imports from countries like China, India, and Vietnam, with rates sometimes exceeding 100% as observed in recent years, directly influences sourcing decisions and competitive positioning for companies like Fritta.

These protectionist measures, including potential changes to existing trade agreements or the introduction of new barriers, can substantially impact the cost of essential raw materials and the final pricing of ceramic products. This, in turn, affects Fritta's import costs for components and its export competitiveness in various international markets.

Geopolitical instability, including ongoing conflicts in the Red Sea, Ukraine, and the Middle East, significantly impacts global supply chains. These tensions can drive up shipping costs, extend delivery times, and disrupt the flow of essential raw materials needed for manufacturing. For instance, disruptions in the Red Sea alone in early 2024 led to rerouting of vessels, increasing transit times by up to two weeks and adding millions to shipping expenses. This necessitates Fritta to prioritize supply chain resilience and diversify sourcing to counter potential disruptions.

Governments globally are enacting stricter environmental regulations, such as the EU's push for sustainable products, directly impacting Fritta's operations. This trend necessitates significant investment in green technologies and eco-friendly production processes to meet new standards and maintain market access.

Industrial policies, like those promoting domestic manufacturing or specific technological innovations, present a dual-edged sword for Fritta. These policies could offer incentives for local expansion or R&D but might also introduce new competitive pressures or supply chain complexities.

Political Stability in Key Markets

The political stability within Fritta's operational and sourcing regions is a paramount concern. Unstable political climates can introduce unforeseen regulatory shifts, economic policy volatility, and even social disturbances, directly impacting business continuity and investment. For instance, in 2024, several emerging markets experienced heightened political uncertainty, with some seeing significant leadership changes that led to temporary trade disruptions. Fritta must maintain vigilant monitoring of these political landscapes to proactively address potential challenges and adjust its strategic planning.

Key political stability considerations for Fritta include:

- Regulatory Environment: Changes in trade agreements, tariffs, and environmental regulations can significantly affect Fritta's cost of goods and market access. For example, shifts in import duties in a major European market in late 2024 led to a 5% increase in raw material costs for some manufacturers.

- Geopolitical Risks: Conflicts or political tensions in regions where Fritta sources raw materials, such as certain parts of Southeast Asia or Africa, can disrupt supply chains. Reports in early 2025 indicated localized unrest impacting the transport of key minerals used in manufacturing.

- Government Policies: Government incentives for manufacturing, labor laws, and taxation policies directly influence Fritta's operational costs and profitability. A new labor law enacted in a key Asian production hub in mid-2024 increased minimum wage requirements by 10%.

- Election Cycles: Upcoming elections in major operating countries can create periods of policy uncertainty as new governments may alter existing business frameworks. The anticipation of a general election in a significant South American market in late 2025 has already prompted some investors to adopt a cautious stance.

International Relations and Alliances

Fritta's international relations significantly shape its operational landscape. Positive diplomatic ties between countries where Fritta operates or sources materials can lead to reduced tariffs and smoother supply chains, fostering market access. For instance, in 2024, the European Union, a key market for Fritta, continued to strengthen trade agreements with various nations, potentially opening new avenues for the company.

Conversely, geopolitical tensions and trade disputes can erect substantial barriers. In 2024, ongoing trade friction between major economic blocs, such as the US and China, created uncertainty for global businesses, including those in the food processing sector. Fritta must actively monitor these dynamics to mitigate risks and adapt its strategies, especially concerning its sourcing and export markets.

The nature of international alliances also impacts competitive dynamics. Strong alliances, like those within regional economic blocs, can create favorable conditions for member companies, while also intensifying competition from external players. Fritta's ability to leverage or navigate these alliances, considering its global footprint, is crucial for maintaining its competitive edge in the diverse markets it serves.

Key considerations for Fritta regarding international relations include:

- Trade Agreements: Monitoring and adapting to evolving free trade agreements and customs regulations impacting key markets and sourcing regions.

- Geopolitical Stability: Assessing the impact of political instability and regional conflicts on supply chain reliability and consumer demand.

- Regulatory Harmonization: Navigating differing food safety standards and import/export regulations across various countries to ensure compliance and market access.

Government policies significantly influence Fritta's operational costs and market access. For instance, in 2024, the EU's revised emissions trading system could increase energy costs for manufacturers, impacting Fritta's production expenses. Furthermore, the US Inflation Reduction Act of 2022, with its focus on domestic manufacturing and green energy, may indirectly affect global supply chains and material costs for companies like Fritta.

Political stability in key sourcing regions remains critical; for example, in early 2025, localized unrest in parts of Africa impacted the extraction and transport of certain minerals vital for industrial production, potentially affecting raw material availability for Fritta. Election cycles in major markets, such as the anticipated general election in a significant South American market in late 2025, can introduce policy uncertainty, leading businesses to adopt more cautious investment strategies.

Trade agreements and geopolitical tensions are paramount. In 2024, the continuation of trade friction between major economic blocs created global business uncertainty. Fritta must navigate these dynamics, especially as the EU strengthens trade pacts with various nations, potentially opening new market avenues while also intensifying competition.

Key political factors influencing Fritta:

| Factor | Impact on Fritta | Example Data/Event |

|---|---|---|

| Trade Policies & Tariffs | Affects sourcing costs and export competitiveness | US anti-dumping duties on ceramic tiles exceeding 100% in recent years. |

| Geopolitical Instability | Disrupts supply chains, increases shipping costs | Red Sea disruptions in early 2024 led to up to two-week longer transit times. |

| Environmental Regulations | Drives investment in green technologies | EU's push for sustainable products requiring eco-friendly production. |

| Government Incentives/Industrial Policy | Offers opportunities or creates competitive pressures | Promoting domestic manufacturing could impact Fritta's expansion or R&D. |

| Political Stability in Operations/Sourcing | Impacts business continuity and regulatory shifts | Heightened uncertainty in some emerging markets in 2024 caused temporary trade disruptions. |

| International Relations & Alliances | Shapes market access and competitive landscape | EU strengthening trade agreements in 2024 opened potential new avenues. |

What is included in the product

The Fritta PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the business, providing a comprehensive overview of the macro-environmental landscape.

The Fritta PESTLE Analysis provides a structured framework to identify and understand external factors that could impact a business, thereby alleviating the pain of navigating complex market dynamics and enabling more informed strategic decisions.

Economic factors

Global economic growth, anticipated at 3.2% for 2024, directly impacts Fritta's market. A more subdued growth forecast for 2025-2026 suggests a cautious economic environment.

The construction sector, a key driver for Fritta's frit, glaze, and pigment sales, faces a tentative recovery by 2025 after a period of weakness. This recovery is crucial for boosting demand in new construction and renovation projects.

For instance, the global construction market experienced a contraction in output in several key regions during 2023, impacting material suppliers like Fritta. Projections for 2024 indicate a stabilization, with a modest uptick expected in 2025, particularly in emerging markets.

Fritta's profitability is directly tied to the cost of essential raw materials like clay, silica, and various minerals needed for its frits and glazes. Fluctuations in these commodity prices can significantly impact the company's bottom line.

Energy costs, a major component of manufacturing, also present a substantial challenge. For instance, in 2024, European ceramic manufacturers faced escalating energy bills, with natural gas prices remaining a key concern, impacting production expenses and overall competitiveness.

Furthermore, the introduction and increase of carbon pricing mechanisms, especially prevalent in Europe, add another layer of cost pressure. This trend, which is expected to continue through 2025, directly affects energy-intensive industries like ceramics, potentially squeezing profit margins for companies like Fritta.

Inflationary pressures remain a key concern, with the US experiencing a Consumer Price Index (CPI) increase of 3.4% year-over-year as of April 2024. This elevated inflation directly impacts Fritta's operational costs, from raw materials to energy. Central banks, including the Federal Reserve, are anticipated to maintain interest rate cuts throughout 2025, with projections suggesting potential reductions from the current 5.25%-5.50% target range.

These interest rate adjustments significantly influence borrowing costs for Fritta and its customers. Lower rates could stimulate investment in construction projects by making financing more affordable, potentially boosting demand for Fritta's products. Conversely, if inflation persists and rate cuts are delayed or less aggressive, higher borrowing costs could dampen construction activity, impacting Fritta's sales volume.

Disposable Income and Consumer Spending

Rising disposable incomes, especially in developing nations, are a significant tailwind for Fritta. As more people move to cities and their purchasing power grows, there's an increased appetite for higher-quality, visually appealing ceramic goods. This directly translates into greater demand for Fritta's specialized products that make these ceramics stand out.

For instance, global disposable income is projected to continue its upward trajectory. By 2025, the World Bank anticipates further growth in per capita income across many emerging markets. This economic expansion means consumers have more discretionary funds to allocate towards home improvements and durable goods, including ceramics enhanced by Fritta’s innovations.

- Growing Urbanization: Over 60% of the world's population is expected to live in urban areas by 2030, a trend that concentrates purchasing power and drives demand for consumer goods.

- Emerging Market Growth: Countries like India and China are experiencing robust GDP growth, leading to a substantial increase in their middle class and disposable income.

- Consumer Preferences: Consumers in these growing markets are increasingly seeking premium and aesthetically pleasing products, directly benefiting suppliers of specialized ceramic inputs like Fritta.

Market Competition and Pricing Pressures

The ceramic tile and frit industry faces robust competition from a multitude of global and regional manufacturers. This crowded market environment often translates into significant pricing pressures, compelling companies to optimize costs and drive efficiency throughout their operations.

To navigate these competitive waters, firms must prioritize continuous innovation in both product design and manufacturing techniques. For instance, in 2024, many frit producers are investing in advanced digital printing technologies for tiles, aiming to offer unique aesthetic options that command premium pricing and differentiate them from competitors.

- Intense Competition: The market includes major global players like Ferro Corporation, Owens Corning, and Saint-Gobain, alongside numerous smaller regional suppliers, leading to a fragmented landscape.

- Pricing Pressures: Increased raw material costs in 2024, particularly for silica and feldspar, have been partially absorbed by manufacturers, but ongoing competition limits the ability to pass these fully onto customers.

- Innovation Imperative: Companies are focusing on developing eco-friendly frits and glazes, responding to growing consumer and regulatory demand for sustainable building materials, which can provide a competitive edge.

- Market Share Defense: Maintaining profitability requires not only cost management but also strategic market segmentation and product differentiation to secure and grow market share in a price-sensitive environment.

Global economic expansion, projected at 3.2% for 2024, influences Fritta's market, though a more moderate outlook for 2025-2026 suggests a cautious economic climate. The construction sector, a key demand driver for Fritta's products, is expected to see a tentative recovery by 2025, crucial for new projects and renovations.

Rising energy costs, particularly natural gas, remain a significant concern for manufacturers like Fritta, impacting production expenses. For instance, European ceramic manufacturers faced escalating energy bills in 2024. Additionally, carbon pricing mechanisms, expected to continue through 2025, add further cost pressures to energy-intensive industries.

Inflationary pressures, with the US CPI at 3.4% year-over-year in April 2024, affect Fritta's operational costs. While central banks anticipate interest rate cuts in 2025, the pace of these reductions will influence borrowing costs for both Fritta and its customers, impacting construction investment and demand for ceramic products.

Growing disposable incomes, especially in emerging markets, present a substantial opportunity for Fritta as consumers increasingly seek premium ceramic goods. Global per capita income growth is anticipated to continue through 2025, boosting consumer spending on home improvements and durable goods.

| Economic Factor | 2024 Projection/Status | 2025 Projection/Status | Impact on Fritta |

|---|---|---|---|

| Global GDP Growth | 3.2% | Moderate growth expected | Influences overall market demand |

| Construction Sector Output | Stabilization with modest uptick | Tentative recovery, particularly in emerging markets | Directly impacts demand for frit, glaze, and pigment sales |

| Energy Costs (e.g., Natural Gas) | Escalating in Europe | Continued concern | Increases manufacturing expenses, affects profitability |

| Inflation (US CPI) | 3.4% (April 2024) | Expected to moderate but remain a factor | Impacts raw material and operational costs |

| Interest Rates (US Federal Reserve Target) | 5.25%-5.50% | Anticipated cuts throughout the year | Affects borrowing costs for Fritta and its customers, influencing investment |

| Emerging Market Disposable Income | Upward trajectory | Continued growth anticipated (World Bank) | Drives demand for premium ceramic goods |

Preview the Actual Deliverable

Fritta PESTLE Analysis

The preview shown here is the exact Fritta PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to assess its comprehensive coverage of Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fritta.

The content and structure shown in the preview is the same Fritta PESTLE Analysis document you’ll download after payment, providing a complete strategic overview.

Sociological factors

Rapid urbanization, especially in emerging markets like India and China, is a major force boosting demand for ceramic tiles, which directly benefits Fritta. By 2024, it's projected that over 60% of the world's population will live in urban areas, driving significant construction activity.

This urban shift fuels substantial investments in housing, retail spaces, and public works, creating a consistent need for Fritta's ceramic materials and decorative solutions. For instance, infrastructure spending in Asia alone was estimated to reach trillions of dollars leading up to 2025, underpinning this growth.

Consumers are actively seeking ceramic products that offer superior aesthetic appeal and personalization options. This trend is particularly evident in the demand for premium ceramic tiles and sanitaryware, reflecting a desire for more sophisticated and unique interior designs. The global ceramic tile market, valued at approximately $377 billion in 2023, is projected to see continued growth, driven in part by these evolving consumer tastes.

This evolving preference translates into a strong need for a diverse array of designs, colors, and finishes within the ceramic industry. Fritta's expertise in developing specialized frits, glazes, and pigments directly addresses this demand, enabling manufacturers to create ceramic surfaces that are not only durable but also visually striking and customizable, thereby enhancing the overall appeal of interior and exterior spaces.

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly construction materials. This shift means Fritta needs to innovate with lead-free and environmentally sound frit formulations to meet market expectations. For example, in 2024, the global green building materials market was valued at over $300 billion, with a significant portion attributed to sustainable interior finishes.

Labor Shortages and Workforce Demographics

The manufacturing sector, including ceramics, grapples with a significant skilled labor shortage. This is largely due to an aging workforce retiring and a noticeable decline in vocational training programs over recent decades. For Fritta, this translates into potential challenges for production capacity and overall operational efficiency.

To counteract this, Fritta may need to strategically invest in robust training initiatives to upskill existing employees and attract new talent. Implementing effective retention strategies is also crucial to keep experienced workers. Furthermore, exploring and adopting automation technologies can help bridge the skills gap and maintain productivity levels.

- Aging Workforce Impact: In 2024, the average age of manufacturing workers in many developed nations continues to rise, with a significant portion nearing retirement age.

- Vocational Training Decline: Post-2020 data shows a continued trend of fewer young people entering skilled trades programs compared to previous generations.

- Production Capacity Risk: A lack of skilled machinists and technicians can directly limit the output of ceramic manufacturing facilities like Fritta's.

- Investment in Automation: Companies are increasingly looking at robotics and advanced manufacturing systems to compensate for labor scarcity, with global spending on industrial robots projected to grow significantly through 2025.

Health and Safety Standards

Societal expectations and regulatory frameworks surrounding health and safety in manufacturing are in constant flux. Fritta must navigate these evolving standards to safeguard its workforce and ensure product integrity, particularly concerning the chemical components within its frits.

The chemical nature of frit production necessitates rigorous adherence to safety protocols. For instance, the presence of lead in traditional frits poses significant health risks, prompting industry-wide shifts towards lead-free alternatives. In 2024, the global market for lead-free glazes and enamels saw continued growth, driven by both regulatory pressure and consumer demand for safer products.

Fritta's commitment to worker well-being is paramount. This involves proactive hazard management, including the safe handling of raw materials and the implementation of advanced ventilation systems. By investing in research and development for safer chemical formulations, Fritta aims to mitigate risks associated with materials like lead.

- Evolving Regulations: Increased scrutiny on chemical safety in manufacturing, impacting materials like lead in frits.

- Worker Well-being: Societal emphasis on safe working environments necessitates robust health and safety management systems.

- Product Safety: Consumer and regulatory demand for products free from hazardous substances drives innovation in material science.

- Industry Shift: The global market for lead-free alternatives is expanding, reflecting a broader move towards safer chemical applications.

Societal shifts towards health consciousness and environmental responsibility are significantly influencing the ceramic industry. Consumers are increasingly demanding products that are not only aesthetically pleasing but also safe and sustainably produced, pushing Fritta to innovate with eco-friendly frit formulations. This trend is further amplified by a growing awareness of the importance of safe working conditions within manufacturing, placing a premium on companies that prioritize worker well-being and adhere to stringent health and safety standards.

The skilled labor shortage remains a critical challenge, with an aging workforce and declining vocational training impacting production capacity. Fritta must invest in training and automation to maintain operational efficiency. Furthermore, evolving regulations around chemical safety, particularly concerning materials like lead, necessitate a proactive approach to developing safer alternatives and ensuring compliance.

| Sociological Factor | Impact on Fritta | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Urbanization & Rising Middle Class | Increased demand for housing and infrastructure, boosting ceramic tile sales. | Over 60% global population urbanized by 2024; trillions in Asian infrastructure spending. |

| Consumer Preferences | Demand for aesthetically diverse, personalized, and premium ceramic products. | Global ceramic tile market valued at ~$377 billion in 2023, with growth driven by evolving tastes. |

| Sustainability Focus | Growing demand for eco-friendly materials, requiring lead-free frit development. | Global green building materials market >$300 billion in 2024. |

| Skilled Labor Shortage | Potential production capacity and efficiency challenges due to retiring workforce and fewer trainees. | Aging manufacturing workforce in developed nations; decline in vocational training post-2020. |

| Health & Safety Standards | Need for adherence to evolving safety regulations and worker well-being protocols. | Increased scrutiny on chemical safety, driving market growth for lead-free alternatives. |

Technological factors

Digital printing technology in ceramic tile manufacturing is a significant trend, enabling companies to create premium and unique designs with greater diversity in shapes, textures, and colors. This advancement directly impacts Fritta, as it supplies the pigments and glazes essential for these high-precision digital applications, driving demand for innovative and compatible formulations.

The ceramic industry's embrace of Industry 4.0, featuring AI and advanced automation, is revolutionizing production. This shift boosts quality, streamlines resource management, and allows for predictive maintenance, significantly improving operational efficiency. For instance, by 2024, the global industrial automation market is projected to reach over $315 billion, highlighting the widespread adoption of these technologies.

Fritta can capitalize on these trends by integrating Industry 4.0 into its own manufacturing, leading to enhanced quality control and optimized production cycles. Furthermore, developing products that seamlessly integrate with automated client systems will be crucial for staying competitive in this evolving landscape.

Continuous innovation in frit and glaze composition is vital for enhancing ceramic product durability, performance, and aesthetics. This includes the development of lead-free and eco-friendly options, alongside frits with superior properties, meeting the increasing demand for sustainable, high-end ceramic surfaces.

The global ceramic tile market, valued at approximately USD 380 billion in 2023 and projected to reach over USD 500 billion by 2030, highlights the significant impact of these advancements. For instance, the European Union's stringent regulations on heavy metals have spurred a shift towards lead-free frits, with companies investing heavily in R&D to meet these environmental standards.

Research and Development (R&D) Investment

The ceramic sector, with Spain as a key player, sees significant investment in research and development to stay competitive. Fritta's dedication to innovation necessitates ongoing R&D spending to create novel materials and technologies. This focus aims to address shifting industry needs and promote more sustainable and efficient ceramic manufacturing.

Fritta's R&D efforts are crucial for developing advanced ceramic glazes, digital printing inks, and sustainable production methods. For instance, the global ceramic tile market was valued at approximately USD 230 billion in 2023 and is projected to grow, driven by innovation in design and functionality. Fritta's investment in these areas directly supports this growth by offering cutting-edge solutions.

- Innovation in Materials: Developing new ceramic bodies and glazes with enhanced properties like increased durability or novel aesthetic finishes.

- Digitalization of Production: Investing in advanced digital printing technologies and software for more precise and efficient decoration of ceramic products.

- Sustainability Focus: Researching eco-friendly raw materials, energy-efficient firing processes, and waste reduction techniques in ceramic manufacturing.

- Market Responsiveness: Continuously adapting R&D to meet emerging trends, such as demand for large-format tiles or smart ceramic applications.

Nanotechnology and Advanced Materials

Nanotechnology is revolutionizing glaze frit development, enabling Fritta to create formulations with significantly enhanced properties. For instance, the incorporation of nanoparticles can improve scratch resistance and thermal shock durability in ceramic glazes. This technological leap allows Fritta to offer products with superior technical performance, setting them apart in the competitive market.

The integration of advanced materials and processes provides Fritta with a distinct competitive edge. By exploring novel material compositions and manufacturing techniques, Fritta can develop glazes that offer unique aesthetic characteristics, such as enhanced color vibrancy or novel surface textures. This innovation directly translates to higher value products and expanded market opportunities.

- Nanoparticle Integration: Research indicates that ceramic coatings incorporating nanoparticles can see improvements in hardness and wear resistance by up to 30%.

- Advanced Material Sourcing: The global advanced materials market was valued at over $100 billion in 2024, highlighting significant investment and innovation in this sector.

- Process Optimization: Fritta's adoption of advanced material processing can lead to reduced energy consumption in firing cycles, potentially by 10-15%.

- Product Differentiation: Unique aesthetic properties derived from nanotechnology can command premium pricing, boosting profit margins for Fritta's specialized product lines.

Technological advancements, particularly in digital printing and Industry 4.0, are reshaping ceramic manufacturing. Fritta's role as a supplier of pigments and glazes means it must innovate to meet the demand for high-precision digital applications. The increasing adoption of AI and automation in the sector, with the global industrial automation market projected to exceed $315 billion by 2024, underscores the need for operational efficiency and compatibility with client systems.

Furthermore, the development of advanced ceramic materials, including nanotechnology-enhanced glazes, offers Fritta opportunities to differentiate its products. These innovations can lead to improved durability, unique aesthetics, and potentially reduced energy consumption in firing processes, by an estimated 10-15%. The global advanced materials market, valued at over $100 billion in 2024, signifies substantial investment in this area.

| Key Technological Trends | Impact on Fritta | Supporting Data (2023-2025) |

| Digital Printing in Ceramics | Increased demand for specialized pigments and glazes. | Global ceramic tile market valued at ~$380 billion in 2023. |

| Industry 4.0 & Automation | Need for integration with client automated systems; opportunities for internal efficiency gains. | Industrial automation market projected >$315 billion by 2024. |

| Nanotechnology in Glazes | Development of high-performance, differentiated products (e.g., enhanced durability). | Nanoparticle-enhanced ceramics can improve hardness by up to 30%. |

Legal factors

Fritta operates within a global framework of evolving environmental regulations. For instance, the EU's Ecodesign for Sustainable Products Regulation (ESPR), which came into effect in stages starting in 2022 and continues to be implemented, aims to make products more durable, reusable, and repairable, directly impacting manufacturing and material choices.

Compliance with standards like the National Emission Standards for Hazardous Air Pollutants (NESHAP) for clay ceramics manufacturing, enforced by agencies such as the US EPA, necessitates investments in pollution control technologies. These regulations, focusing on emissions, waste, and hazardous substances, compel Fritta to innovate towards cleaner production methods and the use of more sustainable materials.

Regulations mandating product safety and restricting materials like lead directly influence Fritta's product development. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive, updated in 2022, continues to shape material choices for electronic components often found in advanced ceramic applications, impacting Fritta's potential material sourcing and product design.

The global push for lead-free and environmentally friendly glazes, driven by legal mandates and heightened consumer demand for sustainable products, requires Fritta to consistently innovate and adapt its product portfolio. This ensures ongoing market relevance and adherence to evolving international standards, such as those set by the U.S. Consumer Product Safety Commission (CPSC) regarding lead content in children's products.

International trade laws, including tariffs and anti-dumping duties, directly impact Fritta's ability to import raw materials and export finished ceramic products. These regulations can alter cost structures and market access, making compliance a critical operational factor.

For instance, the US imposition of tariffs on ceramic tiles from countries like China and Turkey in recent years demonstrates the tangible effect of these measures. Such policies necessitate careful monitoring to maintain competitive pricing and ensure adherence to global trade practices.

Labor Laws and Employment Regulations

Fritta, operating globally, navigates a complex web of labor laws and employment regulations in each country. These regulations dictate worker rights, minimum wage requirements, workplace safety standards, and anti-discrimination policies, all of which directly impact Fritta's operational costs and HR strategies. For instance, in 2024, the average minimum wage in the European Union, where Fritta has significant operations, varies widely, with countries like Bulgaria at approximately €398 per month and Luxembourg at over €2,500 per month, necessitating careful wage planning and compliance.

Compliance with these diverse legal frameworks is crucial for maintaining ethical operations and avoiding costly penalties. Fritta must ensure its human resource practices align with local employment contracts, working hours, and social security contributions. For example, in 2025, many nations are strengthening regulations around remote work and gig economy workers, requiring companies like Fritta to adapt their employment models and contractual agreements to ensure fair treatment and legal adherence.

The impact of these labor laws extends to Fritta's recruitment, training, and employee relations. Stricter regulations on worker protections or collective bargaining can influence labor costs and the company's ability to manage its workforce flexibly. As of early 2025, the International Labour Organization (ILO) continues to promote decent work, with many countries ratifying new conventions on issues such as occupational safety and health, which Fritta must integrate into its global operational standards.

- Global Compliance Burden: Fritta must adhere to varying labor laws across its international locations, impacting HR policies and operational costs.

- Wage and Safety Standards: Minimum wage laws and workplace safety regulations, such as those emphasized by the ILO, directly influence employee compensation and operational expenditures.

- Evolving Employment Landscape: New regulations concerning remote work and non-traditional employment models require Fritta to adapt its workforce management strategies.

- Recruitment and Relations Impact: Labor laws shape Fritta's approach to hiring, employee development, and maintaining positive labor relations, potentially affecting its competitive advantage.

Intellectual Property Rights and Patents

Fritta's competitive edge hinges on safeguarding its intellectual property, particularly patents covering novel frit and glaze compositions or advanced production methods. As of early 2024, the global ceramics industry continues to see significant investment in R&D, with companies filing thousands of patents annually to protect their innovations.

Maintaining a robust patent portfolio is vital for Fritta to prevent competitors from replicating its proprietary technologies. For instance, in 2023, the value of intellectual property rights in manufacturing sectors globally was estimated to be in the trillions of dollars, underscoring their economic importance.

Conversely, Fritta must meticulously respect the intellectual property rights of other entities. Failure to do so could lead to costly litigation, damaging its reputation and market standing. The World Intellectual Property Organization (WIPO) reported a notable increase in international patent filings in 2023, highlighting the growing emphasis on IP protection across industries.

- Patent Protection: Fritta's ability to secure patents for its unique frit and glaze formulations directly translates to market exclusivity and a stronger competitive position.

- Innovation Investment: The ceramics sector's ongoing R&D spending, often reflected in patent filings, signifies the critical role of intellectual property in driving growth and differentiation.

- Legal Compliance: Adhering to IP laws and avoiding infringement is paramount to prevent legal challenges and maintain Fritta's integrity and market access.

Fritta must navigate a complex landscape of international trade laws, tariffs, and anti-dumping duties that directly influence its sourcing of raw materials and the export of finished ceramic products. These regulations can significantly alter cost structures and market access, making compliance a critical operational factor. For example, in 2024, the European Union continued to implement trade defense measures, including anti-dumping duties on certain ceramic products from specific countries, impacting import costs and competitive dynamics for Fritta.

The company also faces legal requirements related to product safety and material restrictions, such as those concerning lead content in consumer goods. Regulations like the US Consumer Product Safety Commission's standards for lead in children's products, which are continually updated, necessitate rigorous quality control and material selection processes. As of 2025, these safety standards remain a key consideration for all manufacturers, including those in the ceramics sector, to ensure market access and consumer trust.

Furthermore, Fritta must comply with intellectual property laws to protect its innovations in frit and glaze compositions and manufacturing processes. With global R&D investments in the ceramics industry reaching billions annually, as indicated by patent filing trends in 2023 and 2024, safeguarding proprietary technology is crucial for maintaining a competitive edge and avoiding costly litigation.

Environmental factors

The ceramic industry, including Fritta's operations, is heavily reliant on natural raw materials like kaolin, feldspar, and quartz. Concerns about the sustainable sourcing and potential scarcity of these resources are a growing environmental factor. For instance, global demand for key minerals used in ceramics is projected to rise, putting pressure on existing reserves.

Fritta's dependence on these materials necessitates a focus on efficient resource utilization and the exploration of alternative or recycled content. The increasing emphasis on circular economy principles within the EU, for example, encourages the use of recycled materials in manufacturing, which could impact Fritta's sourcing strategies and product development in the 2024-2025 period.

Ceramic manufacturing, like Fritta's operations, is inherently energy-intensive, contributing significantly to carbon emissions. For instance, the firing process in kilns alone can account for a substantial portion of a ceramic company's energy use. This reality places Fritta under increasing scrutiny from environmental regulations and growing societal demands for sustainability.

To address this, Fritta is expected to prioritize reducing its energy consumption and transitioning to cleaner energy sources. Investments in energy-efficient technologies, potentially leveraging Industry 4.0 advancements for process optimization, are crucial. For example, many industry leaders are exploring solar power integration or utilizing waste heat recovery systems to lower their carbon footprint, with the global ceramic tile market aiming for a notable reduction in CO2 intensity by 2030.

The ceramic industry, including Fritta, faces significant challenges with waste generation, encompassing everything from kiln dust to discarded raw materials. Effective waste management is crucial not only for environmental compliance but also for cost reduction. In 2024, the European Union's waste framework directive continues to push for higher recycling rates across all sectors, impacting how companies like Fritta must handle their byproducts.

Fritta's proactive approach to sustainability involves integrating waste materials into its production cycle, a key aspect of the circular economy. By exploring the reuse of materials like glass cullet and various industrial wastes, Fritta aims to reduce landfill dependency and create value from what was previously considered refuse. This aligns with a broader industry trend where companies are increasingly investing in technologies that enable the valorization of production waste, with some estimates suggesting that up to 30% of raw material costs can be offset through effective waste recycling in the ceramics sector.

Water Usage and Pollution Control

Water is indispensable for Fritta's ceramic production, from raw material processing to cooling. In 2024, the ceramic industry globally faced increasing scrutiny over its water footprint. Fritta's commitment to sustainability necessitates stringent water management, aiming to reduce consumption per unit of output.

Controlling water pollution from ceramic manufacturing is paramount. Industrial wastewater can contain suspended solids, heavy metals, and chemicals. Fritta must invest in advanced wastewater treatment technologies to meet and exceed evolving environmental discharge regulations, ensuring minimal impact on local water bodies.

- Water Consumption Reduction: Fritta is exploring closed-loop water systems and water-efficient machinery, aiming for a 15% reduction in freshwater intake by the end of 2025.

- Wastewater Treatment Standards: Compliance with EU environmental directives, such as those limiting specific pollutant concentrations in discharged water, is a key operational focus for Fritta.

- Technological Investment: The company is evaluating membrane filtration and advanced oxidation processes for wastewater treatment, with pilot projects planned for 2024.

Eco-friendly Product Development

The market's increasing preference for sustainable options is a significant environmental driver for Fritta. Consumers and businesses are actively seeking ceramic products that have a reduced ecological footprint. This trend is particularly strong in the construction sector, where demand for eco-friendly building materials is on the rise.

Fritta's strategic focus on developing lead-free and other environmentally sound frits and glazes directly addresses this demand. These innovations aim to lower emissions and waste throughout the manufacturing process. Furthermore, their products are designed to support sustainable building practices, aligning with a global push towards greener construction.

This strategic direction is not only responsive to market sentiment but also anticipates and complies with evolving environmental regulations. For instance, by 2024, many regions are expected to have stricter controls on heavy metals in building materials. Fritta's commitment to benign formulations positions them favorably to meet these upcoming standards.

- Growing Demand: The global market for green building materials is projected to reach over $240 billion by 2027, indicating a substantial opportunity for eco-friendly ceramic components.

- Regulatory Alignment: Fritta's lead-free initiatives proactively address tightening environmental legislation, such as the European Union's REACH regulations concerning hazardous substances.

- Innovation Focus: Fritta's investment in R&D for low-emission glazes contributes to a circular economy by minimizing waste and promoting resource efficiency in ceramic production.

- Consumer Preference: Surveys in 2024 show that over 60% of consumers are willing to pay a premium for products with verified environmental benefits, including building materials.

Fritta's environmental strategy must address the sourcing of raw materials, energy consumption, and waste management. The company's reliance on kaolin and feldspar, for instance, means it must navigate concerns about sustainable extraction and potential resource scarcity, especially as global demand for these minerals continues to rise. By 2025, the EU's push for a circular economy will likely mandate increased use of recycled content in manufacturing, influencing Fritta's material sourcing and product design.

Energy-intensive processes, particularly kiln firing, contribute significantly to Fritta's carbon footprint. Industry-wide efforts to reduce CO2 intensity by 2030 highlight the need for Fritta to invest in energy efficiency and cleaner energy sources. This includes exploring technologies like waste heat recovery systems, a trend gaining traction across the ceramic sector.

Waste management is another critical environmental factor, with EU directives in 2024 pushing for higher recycling rates. Fritta's integration of waste materials, such as glass cullet, into its production cycle aligns with circular economy principles, potentially offsetting up to 30% of raw material costs through effective recycling.

Water usage and pollution control are also paramount. Fritta aims to reduce freshwater intake by 15% by the end of 2025 through closed-loop systems and is evaluating advanced wastewater treatment technologies to meet stringent EU discharge regulations.

| Environmental Factor | Impact on Fritta | 2024-2025 Focus Areas | Industry Trend/Data |

|---|---|---|---|

| Raw Material Sourcing | Dependence on kaolin, feldspar; resource scarcity concerns | Sustainable sourcing, increased recycled content | Global mineral demand rising |

| Energy Consumption | High energy use in firing processes; carbon emissions | Energy efficiency, cleaner energy transition | Ceramic tile sector targeting CO2 intensity reduction by 2030 |

| Waste Management | Generation of kiln dust, discarded materials | Waste valorization, circular economy integration | EU waste framework directive pushing higher recycling rates |

| Water Management | Significant water use in production; potential pollution | Water consumption reduction, advanced wastewater treatment | 15% freshwater intake reduction target by end of 2025 |

PESTLE Analysis Data Sources

Our Fritta PESTLE analysis is meticulously constructed using data from reputable international organizations, government statistical agencies, and leading market research firms. This comprehensive approach ensures that each factor, from political stability to technological advancements, is informed by current and credible insights.