Fritta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fritta Bundle

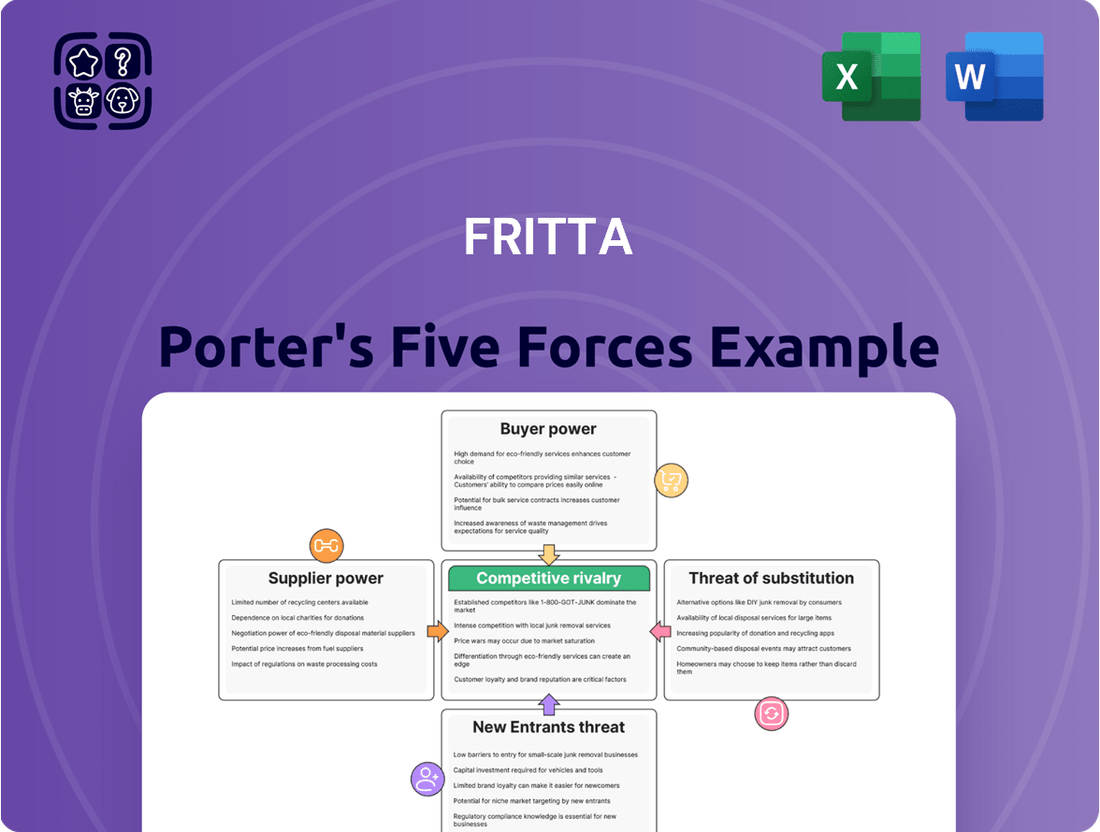

Understanding Fritta's competitive landscape is crucial, and a Porter's Five Forces analysis reveals the intricate web of industry pressures. From the power of buyers to the threat of new entrants, each force significantly shapes Fritta's strategic options.

The complete report reveals the real forces shaping Fritta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for essential raw materials like specialized clays, silica, feldspar, and various minerals, which are fundamental for frits, glazes, and ceramic pigments, can be highly concentrated. This concentration of suppliers grants them significant leverage in dictating prices and contractual terms. For instance, a report from early 2024 indicated a 15% year-over-year increase in the cost of certain high-purity silica grades due to limited extraction sites and rising energy costs for processing.

The availability of substitute raw materials significantly influences supplier bargaining power. If Fritta Porter can readily source similar inputs from multiple vendors, the power of any single supplier is reduced. For example, in 2024, the global market for specialty chemicals, a key input for Fritta's performance coatings, saw a 4% increase in the number of new market entrants, suggesting a more competitive supply landscape.

Growing environmental regulations worldwide are pushing raw material suppliers to adopt greener practices. For instance, by 2024, many industries are expected to see a significant increase in compliance costs related to emissions and waste management, potentially adding 5-10% to operational expenses for suppliers. This increased investment in sustainable extraction and processing methods can directly translate into higher input costs for companies like Fritta.

These rising costs for suppliers, driven by the need to meet stricter environmental standards and consumer demand for eco-friendly products, can be passed on to Fritta. This dynamic enhances the bargaining power of suppliers, as Fritta may have fewer alternatives for sustainably sourced materials, forcing them to accept higher prices to maintain their own product's green credentials.

Switching Costs for Fritta

Switching suppliers for critical components like frits, glazes, and pigments presents substantial hurdles for Fritta. These include the costs associated with re-tooling manufacturing equipment, recalibrating intricate production lines, and the rigorous process of re-validating the performance and quality of their finished ceramic products. This inherent difficulty in changing suppliers can significantly diminish Fritta's operational flexibility and, consequently, bolster the bargaining power of its existing suppliers.

The ceramic frit market is dynamic, with ongoing technological advancements directly impacting production processes and material specifications. For instance, innovations in raw material sourcing and processing efficiency by major suppliers can create new standards that are costly for Fritta to adapt to if they switch. In 2024, the global ceramic frit market was valued at approximately $12 billion, with specialized frits for high-performance applications seeing particular demand, indicating that suppliers with cutting-edge technology can command higher prices and exert greater influence.

- High Re-tooling Expenses: Upgrading or modifying production machinery to accommodate new frit formulations can cost Fritta hundreds of thousands of dollars.

- Production Line Calibration: Adjusting firing temperatures, application methods, and quality control parameters for new glazes requires extensive technical expertise and time.

- Product Performance Re-validation: Ensuring new materials meet stringent quality standards for durability, color consistency, and safety can involve lengthy testing cycles, potentially delaying product launches.

- Supplier Technology Leadership: Leading suppliers in 2024 invested heavily in R&D, offering advanced frit compositions that are difficult for competitors to replicate, thereby strengthening their negotiating position.

Supplier's Product Differentiation

When suppliers offer highly specialized or proprietary raw materials, their bargaining power significantly increases. For Fritta, this is evident if suppliers possess unique intellectual property in advanced ceramic compounds. These specialized materials are crucial for Fritta to achieve the specific aesthetic qualities and technical performance enhancements demanded in the ceramic tile market, leaving Fritta with limited viable alternatives.

The differentiation of a supplier's product directly impacts Fritta's reliance on them. For instance, a supplier of a unique glaze formulation that provides exceptional durability and a sought-after finish would command greater leverage. Fritta's inability to easily replicate or substitute such a component means the supplier can dictate terms more effectively, potentially impacting Fritta's cost structure and product development timelines.

- Supplier Specialization: Suppliers with unique intellectual property in advanced ceramic compounds, like specialized glazes or pigments, hold significant sway.

- Limited Substitutes: Fritta's reliance on these differentiated materials means finding comparable alternatives is difficult and costly.

- Performance Impact: These unique materials are essential for Fritta to achieve desired aesthetic and technical performance in its ceramic tiles.

- Increased Supplier Power: This reliance grants suppliers greater ability to negotiate prices and terms, impacting Fritta's profitability.

Suppliers of critical raw materials for the ceramic industry, such as specialized clays and minerals, wield significant bargaining power when the market is concentrated. This power is amplified by factors like high switching costs for manufacturers, the uniqueness of their offerings, and increasing environmental compliance expenses. For example, in 2024, the cost of high-purity silica grades rose by 15% due to limited supply and higher processing energy demands.

| Factor | Impact on Supplier Bargaining Power | Example/Data (2024) |

|---|---|---|

| Market Concentration | High power for few suppliers | Limited extraction sites for specialized clays |

| Switching Costs | High reliance on existing suppliers | Hundreds of thousands of dollars for re-tooling |

| Product Differentiation | Leverage for unique formulations | Specialized glazes for enhanced durability |

| Environmental Regulations | Increased supplier costs passed on | 5-10% rise in operational expenses for greener practices |

What is included in the product

Fritta's Five Forces analysis meticulously examines the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting Fritta's market position and profitability.

Effortlessly identify and mitigate competitive threats with a pre-built framework, eliminating the guesswork in strategic planning.

Customers Bargaining Power

The ceramic frit and glaze market is quite crowded, with many companies all trying to win over ceramic tile makers. This intense competition means that ceramic tile manufacturers, as customers, have a lot of choices. They can readily switch to a different supplier if they find better quality products, more attractive pricing, or more favorable terms from Fritta's rivals.

Fritta's customers, primarily ceramic tile manufacturers, are notably price-sensitive. This sensitivity stems from operating in a competitive market where input costs directly impact their own product pricing and profitability. The global ceramic tiles market is expected to reach $176.86 billion by 2029, indicating substantial demand, but this growth is accompanied by a strong customer drive for cost-effective solutions.

Customers in the ceramic tile market are increasingly vocal about their desire for cutting-edge products. This includes tiles designed for digital printing, a technology that allows for greater design flexibility and customization. For instance, in 2024, the global digital ceramic printing market was valued at approximately USD 4.8 billion and is projected to grow significantly, indicating a strong customer pull for these innovations.

Beyond aesthetics, a powerful trend is the demand for sustainability. Consumers and businesses are actively seeking out eco-friendly options, such as ceramic tiles made with lead-free glazes or produced using energy-efficient methods. This focus on environmental responsibility means companies like Fritta must continuously invest in greener manufacturing processes and materials to meet customer expectations.

Fritta's proactive stance on innovation and sustainability, while a key strength, also inherently elevates customer expectations. When a company consistently delivers advanced and eco-conscious products, customers come to anticipate these offerings, thereby strengthening their bargaining power. They can more readily switch to competitors who also meet these evolving demands if a company falters.

Customer Concentration and Purchasing Volume

Fritta's bargaining power of customers is significantly influenced by customer concentration and purchasing volume. If Fritta primarily serves a few large ceramic tile manufacturers, these key clients, due to their substantial purchase volumes, can exert considerable leverage over pricing and favorable contract terms. This concentration means a disruption with one major customer could have a disproportionate impact on Fritta's revenue.

The demand for ceramic frit spandrel glass is closely tied to large-scale construction projects. For instance, in 2024, global construction spending was projected to reach approximately $15.5 trillion, with significant portions allocated to commercial and residential buildings that utilize ceramic tiles. A slowdown in these major projects directly translates to reduced demand for Fritta's products, giving larger developers and builders more sway in negotiations.

- Customer Concentration: A small number of large ceramic tile manufacturers can dictate terms due to their significant purchasing power.

- Purchasing Volume: High-volume buyers can negotiate lower prices and more favorable payment or delivery schedules.

- Market Dependence: Fritta's reliance on a few key customers makes them vulnerable to price pressures and demands.

- Project Influence: Large construction projects, driving demand for ceramic frit, give buyers in these sectors increased bargaining leverage.

Customer's Threat of Backward Integration

The threat of backward integration by customers, particularly large ceramic tile manufacturers, can significantly impact Fritta's bargaining power. If these manufacturers find it economically feasible to produce their own frits, glazes, or pigments, especially for more standardized products, they could reduce their dependence on Fritta. For example, a major tile producer might invest in R&D and production facilities for common glaze formulations if the cost savings and control over supply chain outweigh the initial investment. This is a tangible risk, as seen in other manufacturing sectors where vertical integration is a common strategy to capture more value.

However, Fritta's specialization in complex and high-performance frits, glazes, and ceramic pigments acts as a strong countermeasure to this threat. The technical expertise and proprietary knowledge required to develop and manufacture these specialized materials are substantial barriers to entry for most tile manufacturers. For instance, developing advanced digital glazes or specific color pigments with unique properties demands significant scientific and engineering capabilities that are Fritta's core competency. This specialization means that while a large customer might consider in-house production for basic components, they are far less likely to replicate Fritta's most advanced offerings, thereby preserving Fritta's market position.

- Customer Integration Risk: Large ceramic tile manufacturers may explore producing standard frits and glazes internally if cost-effective.

- Fritta's Specialization Advantage: Fritta's expertise in complex frits, glazes, and pigments creates a high barrier to customer backward integration.

- Market Dynamics: The economic viability of backward integration depends on the scale of production and the complexity of the materials required.

Customers in the ceramic frit and glaze market, primarily ceramic tile manufacturers, wield significant bargaining power. This stems from their ability to switch suppliers easily due to market fragmentation and their price sensitivity, especially given the global ceramic tile market's projected $176.86 billion valuation by 2029. Their demand for innovation, such as digital printing technologies valued at approximately USD 4.8 billion in 2024, and sustainability further amplifies their leverage, pushing suppliers like Fritta to continuously adapt.

| Factor | Impact on Fritta | Evidence/Data |

| Customer Concentration & Volume | High leverage for large buyers | Major tile manufacturers can dictate terms due to substantial purchase volumes. |

| Price Sensitivity | Pressure on Fritta's margins | Ceramic tile market's competitive nature drives demand for cost-effective solutions. |

| Demand for Innovation | Need for continuous R&D investment | Digital ceramic printing market valued at USD 4.8 billion in 2024, indicating customer pull. |

| Backward Integration Threat | Potential loss of business for standard products | Large manufacturers may produce basic frits if economically viable. |

Same Document Delivered

Fritta Porter's Five Forces Analysis

The document displayed here is the exact Fritta Porter's Five Forces Analysis you’ll receive, providing a comprehensive breakdown of competitive forces within the industry. You're looking at the actual, fully formatted analysis that will be available to you instantly after purchase, ensuring no surprises and immediate usability. This preview showcases the complete, ready-to-use document, allowing you to assess its quality and relevance before making your investment.

Rivalry Among Competitors

The ceramic frit, glaze, and pigment market is quite crowded, with several major companies like Ferro Corporation and Smalticeram holding significant positions. This means there are many established players vying for market share, making it a diverse competitive environment.

Adding to this, the global pottery glaze market includes a mix of large multinational corporations and smaller, niche companies. This variety in competitor size and focus further intensifies the rivalry, as each type of company brings different strengths and strategies to the table.

The ceramic tile market's strong growth is a positive sign for Fritta, as it directly fuels demand for its frit and glaze products. This expansion, however, also means that the frit and glaze segments themselves are seeing steady growth. This might temper aggressive price wars as companies are more focused on securing their share of this expanding pie rather than solely undercutting competitors.

The overall ceramic frit market is anticipated to reach a substantial $2.53 billion by 2033. This upward trajectory suggests ample opportunity for players like Fritta to grow without resorting to cutthroat pricing, fostering a more collaborative competitive environment focused on innovation and market penetration.

Fritta Porter's dedication to pioneering new frits, glazes, and pigments, especially those enhancing aesthetic appeal and technical functionality, sets its products apart. This focus on differentiation is crucial in a market where visual and performance qualities are paramount for ceramic manufacturers.

However, the competitive landscape is dynamic. Rivals are also channeling resources into advanced areas like digital printing technologies, nanotechnology for improved material properties, and the development of environmentally sustainable formulations. This means Fritta Porter faces constant pressure to innovate just to maintain its competitive edge, as competitors are actively pursuing similar advancements.

High Fixed Costs and Exit Barriers

The ceramic materials industry, including frit, glaze, and pigment production, demands substantial upfront capital for specialized manufacturing equipment and ongoing research and development. This inherently leads to high fixed costs for any player in this market.

These considerable fixed costs create significant barriers to exiting the industry. Companies are often incentivized to continue operating and competing, even when market conditions are unfavorable, simply to cover their fixed expenses and avoid even larger losses associated with shutting down operations.

For example, a typical advanced frit production line can cost upwards of $10 million to $20 million, with R&D for new formulations potentially adding millions more annually. In 2024, many established manufacturers reported operating at reduced capacity but maintained production to spread these costs, intensifying competitive pressure.

- High Capital Investment: Specialized machinery for frit, glaze, and pigment production requires millions in initial outlay.

- Ongoing R&D Costs: Continuous innovation in ceramic materials necessitates significant investment in research and development.

- Exit Barriers: High fixed costs compel companies to remain in the market, even during economic downturns, to avoid substantial shutdown losses.

- Intensified Competition: The need to cover fixed expenses fuels aggressive pricing and market share battles among existing players.

Sustainability as a Competitive Factor

The ceramic sector is seeing intensified competition as sustainability becomes a key differentiator. Companies are actively vying to offer eco-friendly products and processes, such as the development and adoption of lead-free frits and glazes. This push for greener solutions fuels innovation and raises the stakes for market leadership in environmentally conscious offerings.

For instance, in 2024, several major ceramic tile manufacturers announced significant investments in reducing their carbon footprint, with some targeting a 30% reduction in emissions by 2030. This competitive pressure encourages firms to explore sustainable raw material sourcing and energy-efficient production methods.

- Innovation in Lead-Free Glazes: Companies are investing heavily in R&D to develop high-performance, lead-free glazes that meet aesthetic and durability standards.

- Eco-Certifications: Achieving recognized sustainability certifications, like LEED or Cradle to Cradle, is becoming a crucial competitive advantage, influencing purchasing decisions for environmentally aware clients.

- Supply Chain Transparency: Demonstrating transparency in sourcing sustainable materials and ethical labor practices is increasingly important for brand reputation and market share.

Competitive rivalry in the ceramic frit, glaze, and pigment market is robust, driven by established players like Ferro Corporation and Smalticeram, alongside a mix of large corporations and niche specialists. This diverse competitive landscape means companies must continuously innovate to maintain their edge.

The market's growth, projected to reach $2.53 billion by 2033, encourages expansion rather than aggressive price wars, though rivals are investing in advanced areas like digital printing and nanotechnology. High fixed costs, often exceeding $10-20 million for production lines, create significant exit barriers, compelling firms to compete intensely to cover expenses.

Sustainability is a growing battleground, with companies investing in lead-free glazes and eco-certifications to attract environmentally conscious customers. For example, in 2024, many ceramic tile manufacturers aimed for substantial emission reductions, pushing suppliers to adopt greener practices.

| Key Competitor | Market Focus | 2024 Strategic Emphasis |

|---|---|---|

| Ferro Corporation | Frit, Glaze, Pigment | Advanced materials, sustainability |

| Smalticeram | Glaze, Pigment | Product innovation, customer solutions |

| Unnamed Niche Players | Specialty Glazes/Pigments | Customization, unique formulations |

SSubstitutes Threaten

Fritta Porter faces a significant threat from substitute surface materials available to end-users. Options like luxury vinyl tile (LVT), wood-look products, natural stone, concrete, and advanced polymers and metals offer compelling alternatives to traditional ceramic tiles.

The U.S. ceramic tile market experienced a downturn in the first quarter of 2025, with sales declining. This dip is partly attributed to the increasing adoption of substitutes, particularly LVT, which has seen a surge in popularity due to its durability and aesthetic versatility.

Shifting consumer tastes in interior design and construction present a significant threat. If trends move away from ceramic tiles towards alternative materials, perhaps due to new aesthetic appeal or perceived superior performance, demand for Fritta Porter's products could decline. For instance, while digital printing and large-format tiles are current innovations within the ceramic tile industry, a broader market shift to materials like engineered stone or advanced composites could bypass these advancements.

The threat of substitutes is heightened when alternative materials offer compelling cost advantages. For instance, porcelain tiles, a substitute in many construction and design applications, are increasingly favored over traditional ceramics due to their durability and often lower long-term cost. This trend is significant, as the global porcelain tile market was projected to reach $120 billion by 2027, indicating a substantial customer preference for these alternatives.

Technological Advancements in Other Materials

Innovations in alternative material industries are a significant threat of substitutes for ceramic surfaces. For instance, advancements in high-performance coatings and novel composite materials are increasingly offering comparable or even superior aesthetic appeal and technical capabilities, challenging ceramics in various applications. The global advanced materials market, which includes composites and specialized coatings, was valued at approximately $230 billion in 2023 and is projected to grow substantially, indicating a strong competitive landscape.

Furthermore, advanced ceramics themselves are emerging as viable replacements for traditional materials like polymers and metals, particularly in high-demand sectors. This trend is driven by ceramics' inherent properties such as high strength, thermal resistance, and chemical inertness. For example, the automotive sector is exploring advanced ceramics for components like brake systems and engine parts, where they offer weight reduction and enhanced durability compared to metal alternatives. The market for technical ceramics, a segment of advanced ceramics, was estimated to be around $60 billion in 2023, with robust growth expected.

- Technological breakthroughs in coatings and composites offer competitive aesthetic and functional alternatives to ceramic surfaces.

- The global advanced materials market, including these substitutes, was valued at approximately $230 billion in 2023.

- Advanced ceramics are increasingly displacing polymers and metals in demanding applications due to superior properties.

- The technical ceramics market alone reached an estimated $60 billion in 2023, highlighting the growing threat from within the advanced materials sector.

Shift to Non-Ceramic Decorative or Functional Elements

The threat of substitutes for fritta, particularly in decorative and functional applications, is a growing concern. As design trends evolve, there's a noticeable shift towards non-ceramic materials that can achieve similar aesthetic or functional outcomes without relying on frits, glazes, or ceramic pigments. This means alternative decorative finishes or functional components in construction might bypass the need for traditional ceramic inputs altogether.

While the broader ceramic market is projected for growth, certain segments face substitution risks. For instance, the global ceramic tiles market was valued at approximately USD 135 billion in 2023 and is anticipated to reach around USD 200 billion by 2030, showing overall expansion. However, within this, specific decorative applications might see a decline due to the adoption of these non-ceramic alternatives.

- Material Substitution: Emerging composite materials and advanced polymers offer durability and aesthetic appeal, directly competing with ceramic surfaces in sectors like interior design and façade cladding.

- Functional Alternatives: In functional areas, such as heat-resistant coatings or durable surfaces, new material science innovations might provide comparable or superior performance without ceramic components.

- Cost and Sustainability Factors: The perceived cost-effectiveness and environmental footprint of non-ceramic substitutes can also drive their adoption, potentially impacting demand for fritta-dependent ceramic products.

The threat of substitutes for Fritta Porter's ceramic products is significant, driven by advancements in alternative materials that offer comparable or superior aesthetics and functionality. Luxury vinyl tile (LVT) and engineered stone are gaining traction, with the U.S. ceramic tile market seeing a sales decline in early 2025 partly due to this shift. Innovative coatings and composites, part of a global advanced materials market valued at approximately $230 billion in 2023, also present a competitive challenge.

| Threat of Substitutes | Description | Market Data (2023/2025) |

| Alternative Surface Materials | LVT, wood-look products, natural stone, concrete, polymers, metals | U.S. ceramic tile market sales declined Q1 2025 |

| Advanced Materials | High-performance coatings, novel composite materials | Global advanced materials market valued at ~$230 billion (2023) |

| Advanced Ceramics | Technical ceramics for automotive, industrial applications | Technical ceramics market estimated at ~$60 billion (2023) |

Entrants Threaten

Entering the frit production market demands significant upfront capital for specialized plants, research, and distribution. For instance, the global ceramic frit market reached an estimated $4.33 billion in 2024, indicating the scale of investment required.

Established companies, such as Fritta, leverage economies of scale, which allows them to produce at a lower cost per unit. This cost advantage presents a formidable barrier for newcomers trying to gain a foothold and compete effectively on price.

Established players like Fritta possess proprietary technology and deep expertise in formulating specialized frits, glazes, and pigments. This intellectual property, including advanced manufacturing processes, acts as a significant barrier to entry. For instance, the ceramic materials sector saw continued innovation in 2024, with companies investing heavily in R&D to differentiate their offerings and maintain a competitive edge.

Fritta has cultivated deep, long-term relationships with ceramic tile manufacturers, a testament to their consistent product quality and robust technical support. These established partnerships create a significant barrier for newcomers looking to gain market traction. Building comparable trust and loyalty in the competitive ceramic materials sector, where Fritta operates as a multinational entity, requires substantial investment and time, making it difficult for new entrants to quickly disrupt the status quo.

Regulatory Hurdles and Environmental Standards

The production of ceramic materials, such as frits and glazes, faces considerable regulatory scrutiny, especially regarding hazardous substances like lead and evolving sustainability mandates. New companies entering this market must invest heavily in compliance, navigating complex environmental standards that can significantly increase initial operating costs and slow market entry.

For instance, in 2024, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to impact the industry, requiring extensive data submission and potentially restricting the use of certain chemicals common in traditional glaze formulations. This creates a substantial barrier for newcomers who lack the established processes and financial resources to meet these demanding requirements.

- Environmental Compliance Costs: New entrants must budget for significant capital expenditure to implement pollution control technologies and ensure adherence to emissions standards.

- Substance Restrictions: Regulations limiting or banning specific hazardous materials, like lead and cadmium in glazes, necessitate investment in alternative, often more expensive, raw materials and reformulated production processes.

- Certification and Permitting: Obtaining necessary environmental permits and certifications can be a lengthy and costly process, adding further complexity for new market participants.

- Sustainability Reporting: Increasing demand for transparency and adherence to sustainability goals requires new entrants to establish robust tracking and reporting mechanisms from the outset.

Access to Distribution Channels

New entrants face a significant hurdle in gaining access to established distribution channels for ceramic frit. Building out the necessary logistics and supply chain infrastructure to serve ceramic tile manufacturers worldwide is a substantial undertaking, often requiring considerable capital investment and time. Existing players have already cultivated these relationships and networks, creating a formidable barrier.

The global ceramic frit market, valued at approximately $16.5 billion in 2023, highlights the scale of operations required. For instance, the Asia-Pacific region, a major manufacturing and export hub for ceramic tiles, accounts for a substantial portion of this market. New entrants must therefore devise strategies to penetrate these well-established Asian distribution networks, which are often dominated by incumbents with long-standing partnerships.

- Distribution Channel Barrier: Newcomers must invest heavily in building or acquiring extensive distribution networks to reach global ceramic tile manufacturers, a task made difficult by existing players' well-entrenched supply chains.

- Logistical Costs: Establishing robust logistics and supply chains comparable to those of established companies in the ceramic frit industry involves significant upfront and ongoing costs, deterring potential entrants.

- Regional Market Access: Penetrating key markets like Asia-Pacific, which dominates ceramic production and export, requires navigating complex and often exclusive distribution channels already secured by incumbents.

The threat of new entrants in the ceramic frit market is moderate, primarily due to high capital requirements for specialized production facilities and research and development. The global ceramic frit market was valued at approximately $16.5 billion in 2023, indicating the substantial investment needed to establish a competitive presence.

Existing players benefit from strong brand loyalty and established relationships with ceramic tile manufacturers, built on years of consistent quality and technical support. For example, Fritta's multinational presence and long-standing partnerships create a significant hurdle for newcomers attempting to gain market traction and trust.

Proprietary technology and deep industry expertise further solidify barriers. The sector saw continued innovation in 2024, with companies investing heavily in R&D to differentiate offerings, making it challenging for new entrants to match the technological advancements of incumbents.

Regulatory compliance, particularly concerning environmental standards and substance restrictions, adds another layer of difficulty. New entrants must invest significantly to meet evolving mandates, such as the EU's REACH regulations, which impact chemical usage in glaze formulations.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a foundation of diverse data, including extensive market research reports, company annual filings, and industry-specific trade publications. This comprehensive approach ensures a robust understanding of competitive dynamics.