Foxtons Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foxtons Group Bundle

Navigate the dynamic real estate market with our comprehensive PESTLE analysis of Foxtons Group. Understand how political shifts, economic fluctuations, and social trends are influencing their operations and future growth. Gain the strategic advantage by downloading the full report for actionable insights.

Political factors

The UK government's ambition to boost housing supply, with a target of 1.5 million new homes this parliamentary term, directly influences the transaction volumes and development prospects for estate agents like Foxtons. This commitment is underscored by the reinstatement of mandatory local housing targets, raising the annual goal to 370,000 homes, a significant increase from the prior 300,000.

Changes to Stamp Duty Land Tax (SDLT) significantly impact the property market. For instance, from October 2024, the additional rate for second homes and landlords rose from 3% to 5% on properties between £40,000 and £250,000. This adjustment, alongside alterations to first-time buyer relief, directly influences buyer demand and investment decisions.

The Renters' Rights Bill, anticipated to be enacted by Spring 2025, introduces significant changes for Foxtons' lettings operations. By eliminating Section 21 'no-fault' evictions and capping rent hikes, the bill aims to bolster tenant security. This shift necessitates a recalibration of landlord relationships and rental income projections.

Landlords will soon require concrete grounds for eviction, a departure from the current 'no-fault' system. Furthermore, the establishment of a Private Rental Sector Ombudsman will introduce a new layer of dispute resolution, potentially impacting operational efficiency and client satisfaction for agencies like Foxtons.

Leasehold and Freehold Reform Act

The Leasehold and Freehold Reform Act 2024 is set to significantly alter the property landscape in the UK. By removing the previous two-year waiting period for lease extensions and freehold purchases, it empowers leaseholders with greater flexibility and reduces a common barrier to property ownership. This reform is anticipated to boost the number of leasehold properties being converted to freehold, potentially increasing transaction volumes for estate agents like Foxtons.

Furthermore, the Act's aim to transition towards a commonhold system, where leaseholders collectively own the freehold of their building, represents a fundamental shift in property tenure. This could reshape the types of properties Foxtons specializes in and the advice they offer clients. The legislation also extends the right to manage to more homeowners in mixed-use buildings, simplifying the process for collective property management.

- Reduced Leasehold Barriers: The elimination of the two-year waiting period for lease extensions and freehold purchases streamlines the process for leaseholders.

- Commonhold Transition: The Act promotes a move towards commonhold, potentially increasing the prevalence of this ownership model.

- Mixed-Use Property Rights: More homeowners in mixed-use buildings gain the right to manage their properties, impacting property management services.

- Market Impact: These changes are expected to influence the volume and type of property transactions, directly affecting estate agency business models.

Local Government Reorganisation and Devolution

Government initiatives like the English Devolution White Paper are reshaping regional planning and housing development. This means local authorities are being reorganised, potentially impacting how housing strategies are implemented across different areas. Foxtons will need to navigate these changes to ensure their regional plans remain aligned and effective.

These devolution strategies are designed to work with existing housing partnerships, offering a degree of continuity. This is crucial for Foxtons as it helps maintain consistency in their market approach during periods of structural change within local governance. The aim is to create a smoother transition for housing development priorities.

- Devolution Impact: Changes in local government structures can alter planning permissions and development incentives, directly affecting the property market.

- Partnership Alignment: Ensuring Foxtons' strategies align with new or evolving housing partnerships is key to navigating reorganisation smoothly.

- Regional Focus: Devolution often brings a stronger regional focus, requiring tailored approaches to property services in different areas.

Government housing targets, aiming for 370,000 new homes annually by 2025, signal increased development activity, benefiting Foxtons' sales and lettings. Changes to Stamp Duty Land Tax (SDLT), such as the 2024 increase in the additional rate for second homes to 5%, directly influence buyer affordability and transaction volumes.

The Renters' Rights Bill, expected by Spring 2025, will abolish Section 21 evictions and introduce rent control measures, impacting landlord confidence and Foxtons' lettings revenue streams. The Leasehold and Freehold Reform Act 2024 simplifies leasehold enfranchisement, potentially boosting transactions for Foxtons by making property ownership more accessible.

| Policy/Legislation | Key Change | Potential Impact on Foxtons |

|---|---|---|

| Housing Supply Target | 370,000 homes annually (by 2025) | Increased transaction volumes, development opportunities |

| SDLT (Additional Rate) | Increased to 5% (Oct 2024) | Potentially reduced demand from buy-to-let investors |

| Renters' Rights Bill | Abolition of Section 21 evictions | Shift in landlord-tenant dynamics, potential rental market adjustments |

| Leasehold Reform Act 2024 | Simplified leasehold enfranchisement | Increased property transactions, greater leaseholder empowerment |

What is included in the product

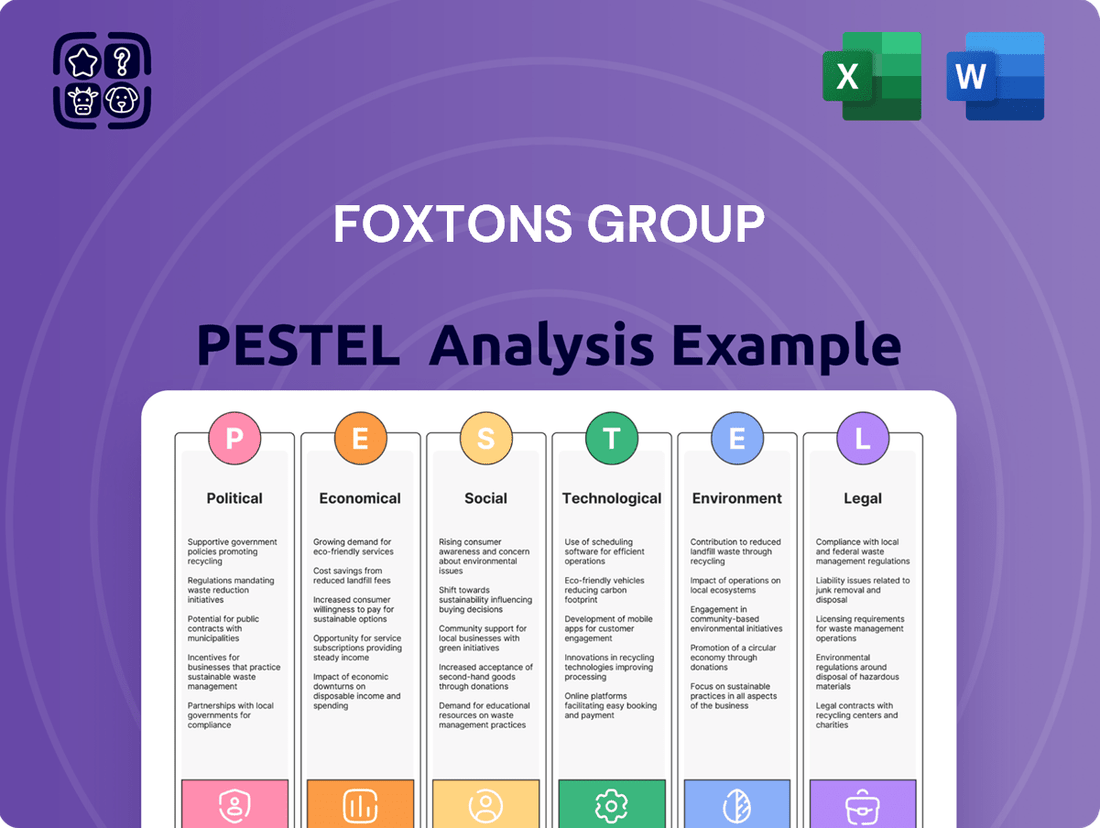

This PESTLE analysis of Foxtons Group examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing strategic insights into market dynamics and potential growth avenues.

Offers a streamlined PESTLE analysis of Foxtons Group, providing a concise overview of external factors impacting the business, perfect for quick strategic discussions and decision-making.

Economic factors

Interest rate fluctuations significantly influence how affordable mortgages are, which in turn directly impacts buyer demand and the number of property sales. Even with recent stabilization, affordability remains a hurdle for many potential buyers.

However, forecasts suggest that a projected decrease in mortgage rates during 2025 is anticipated to boost sales volumes and support a recovery in house prices, offering a more optimistic outlook for the market.

Inflationary pressures and consumer sentiment are key drivers for significant property purchases. While UK consumer confidence in the property market dipped in early 2025, a notable resilience persists in consumers' capacity to manage rent and mortgage obligations.

Property price growth significantly influences Foxtons' financial performance. The trajectory of property prices in London and across the UK directly impacts sales commission revenue and the valuation of properties under management. UK house prices saw a 3.5% increase in the year leading up to April 2025, a slowdown from the 7% growth recorded in March 2025.

Rental Market Dynamics and Affordability

The rental market for Foxtons is shaped by a persistent supply and demand imbalance. While demand for rental properties remains robust, exceeding historical averages, the pace of rent price growth is anticipated to moderate throughout 2025. This slowdown is particularly noticeable in key markets like London, where affordability ceilings are being tested, potentially impacting Foxtons' lettings revenue streams and necessitating strategic adjustments.

Several factors contribute to these dynamics:

- Sustained High Demand: Rental demand continues to outstrip supply, driven by various economic and social factors, keeping vacancy rates low for landlords.

- Moderating Rent Growth: Projections indicate a deceleration in rental price increases for 2025, a shift from the rapid growth seen previously. For instance, Zoopla reported average rents in the UK reached £1,278 per calendar month in Q1 2024, but the rate of annual growth has begun to ease.

- Affordability Constraints: In expensive regions like London, tenants are increasingly reaching their affordability limits, which can dampen further rent increases and potentially lead to higher tenant turnover.

- Impact on Foxtons: These trends directly influence Foxtons' lettings business, affecting commission income and the volume of properties managed, requiring a focus on tenant retention and efficient property management.

Economic Growth and Investment Returns

The broader UK economic outlook, particularly GDP growth, directly impacts the health of the property market and investor sentiment. For instance, the Office for Budget Responsibility (OBR) forecasts UK GDP growth to reach 1.7% in 2025, a significant uptick from previous projections. This economic expansion is a key driver for investment returns in the real estate sector.

Real estate capital values in the UK are anticipated to see a rebound in 2025. This positive outlook is underpinned by several factors, including the anticipated decline in inflation and a reduction in debt servicing costs for both individuals and businesses.

- UK GDP Growth Forecast: The OBR projects 1.7% GDP growth for the UK in 2025.

- Inflationary Environment: Falling inflation is expected to improve purchasing power and reduce borrowing costs.

- Interest Rate Expectations: Lower debt costs are anticipated to stimulate investment and property transactions.

- Real Estate Capital Values: Projections indicate a rebound in UK property capital values for 2025.

The UK property market's performance is closely tied to broader economic indicators like GDP growth and inflation. The Office for Budget Responsibility (OBR) forecasts UK GDP to grow by 1.7% in 2025, signaling economic expansion that typically supports property transactions. While inflation has been a concern, its projected moderation in 2025 is expected to ease borrowing costs, potentially stimulating buyer activity and bolstering real estate capital values.

| Economic Indicator | 2024 Projection | 2025 Projection |

|---|---|---|

| UK GDP Growth | 1.2% (OBR estimate) | 1.7% (OBR forecast) |

| UK Inflation Rate (CPI) | 2.5% (Bank of England estimate) | 2.0% (Bank of England forecast) |

| Average UK House Price Growth | 3.0% (Zoopla estimate) | 3.5% (Zoopla forecast) |

Same Document Delivered

Foxtons Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Foxtons Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed examination of the external forces shaping the real estate market and Foxtons' strategic landscape.

Sociological factors

London's demographic landscape is undergoing significant shifts, with a notable increase in urban population density. This trend directly impacts the property market, shaping demand for various housing types and influencing preferences between renting and buying. Evolving household compositions, such as smaller family units or single-person households, further diversify these demands.

The property market in London is poised for a substantial influx of new supply. Projections indicate that 2025 will witness an all-time high in new property deliveries, exceeding the anticipated market absorption or take-up. This imbalance between supply and demand could create interesting dynamics within the rental and sales sectors.

Shifting lifestyle choices are significantly impacting housing demand. A growing number of individuals, particularly younger generations, are prioritizing flexibility, often favoring shorter lease agreements or co-living arrangements over traditional homeownership. This trend is driven by evolving career paths and a desire for mobility.

Furthermore, there's a pronounced demand for properties that align with sustainability goals. For instance, a 2024 survey indicated that 65% of renters consider energy efficiency a key factor when choosing a property, with a significant portion willing to pay a premium for homes equipped with smart meters or solar panels. This indicates a clear market shift towards eco-conscious living spaces.

Consumer behaviour is increasingly shifting towards digital channels for property transactions. In 2024, a significant majority of property searches in the UK begin online, with portals like Rightmove and Zoopla dominating. This digital reliance means Foxtons must invest heavily in user-friendly websites, mobile apps, and targeted digital marketing to capture leads.

The adoption of virtual reality (VR) and augmented reality (AR) in property viewings is accelerating. By mid-2025, it's estimated that over 40% of major estate agents will offer VR tours as standard. This technological advancement necessitates that Foxtons enhances its capabilities in creating immersive digital property experiences to remain competitive and cater to evolving buyer preferences.

Affordability Crisis and Social Housing Needs

The persistent housing affordability crisis significantly shapes the property market, directly impacting Foxtons' operational landscape. Government initiatives aimed at boosting social and affordable housing supply are a key consideration for market dynamics and demand across various price segments.

The UK government has committed to delivering approximately 300,000 social and affordable homes throughout the current program's duration. A substantial portion, at least 60%, is designated for Social Rent, indicating a strong policy push towards more accessible housing options.

- Government Target: Aiming for around 300,000 social and affordable homes.

- Social Rent Focus: At least 60% of these homes are intended for Social Rent.

- Market Impact: Influences demand for different housing price points.

Public Perception and Brand Reputation

Public perception significantly impacts Foxtons' ability to attract and retain clients. Negative sentiment towards estate agents, often stemming from concerns about transparency and fees, can directly affect customer acquisition. Foxtons’ brand reputation, built on service quality and ethical conduct, is therefore a critical asset in the competitive London property market.

Foxtons actively works to cultivate a positive brand image. For instance, their commitment to an engaging, respectful, and inclusive workplace culture aims not only to retain employees but also to project an image of a responsible and forward-thinking company to the public. This focus on internal culture can translate into better customer interactions and a stronger brand reputation.

The company's performance in customer satisfaction surveys and online reviews directly reflects public perception. While specific 2024/2025 data is still emerging, past trends indicate that estate agents with strong ethical track records and demonstrable customer care often outperform competitors. Foxtons' efforts to highlight their commitment to these areas are vital for sustained success.

Key aspects influencing public perception include:

- Customer Service Quality: Positive client experiences are paramount for word-of-mouth referrals and repeat business.

- Ethical Practices: Adherence to industry regulations and transparent dealings build trust.

- Brand Values: Perceived corporate responsibility and community engagement can enhance reputation.

- Online Presence and Reviews: Digital feedback platforms heavily influence potential clients' initial impressions.

Sociological factors significantly shape London's housing market, influencing demand and preferences. Increasing urban density and evolving household structures, such as more single-person households, are altering the types of properties in demand. Furthermore, a growing emphasis on lifestyle flexibility, with younger generations favoring renting and co-living, is a key trend impacting traditional homeownership models.

Sustainability is increasingly a driver of consumer choice, with a notable 65% of renters in 2024 citing energy efficiency as a key factor. This highlights a market shift towards eco-conscious living spaces, pushing demand for properties with smart technology and renewable energy sources.

Public perception of estate agents, often influenced by transparency and fees, directly impacts Foxtons' client acquisition. Maintaining a strong brand reputation built on service quality and ethical conduct is crucial for navigating this sentiment and fostering trust in the competitive London market.

The government's commitment to delivering approximately 300,000 social and affordable homes, with at least 60% designated for Social Rent, will influence market dynamics across various price segments. This policy push towards more accessible housing options is a critical consideration for Foxtons.

Technological factors

The real estate sector is seeing a significant surge in PropTech adoption. This includes AI-driven property valuations and virtual reality tours, fundamentally altering how properties are assessed and experienced. For instance, a 2024 report indicated that over 60% of real estate firms are actively exploring or implementing AI in their operations, aiming for greater efficiency and accuracy in valuations.

These technological shifts, particularly the rise of automated valuation models (AVMs), are reshaping traditional appraisal methods. AVMs, powered by vast datasets and machine learning, can provide rapid property value estimates, impacting transaction speed and market transparency. Foxtons Group must therefore continue to invest in and integrate these advanced technological solutions to remain competitive and responsive to evolving market dynamics.

Foxtons Group is increasingly leveraging data analytics and predictive modeling to gain a competitive edge. By analyzing vast datasets, the company can uncover valuable market insights, refine customer relationship management strategies, and boost operational efficiency. This data-driven approach is crucial in the dynamic real estate landscape.

The integration of Artificial Intelligence (AI) and machine learning is poised to revolutionize the real estate sector, and Foxtons is at the forefront of this transformation. These technologies are expected to significantly enhance decision-making processes, from property valuation to identifying investment opportunities, ultimately leading to superior customer experiences and improved business outcomes.

A robust digital marketing strategy, encompassing search engine optimization (SEO), active social media engagement, and innovative virtual open houses, is paramount for Foxtons. This approach is essential for effectively reaching and engaging potential clients in the current market. For instance, in 2024, the UK property market saw a significant increase in online property searches, with platforms like Rightmove and Zoopla dominating initial buyer interest.

The ability to market properties online has become a cornerstone for real estate success. Foxtons' investment in digital channels allows them to showcase listings to a wider audience than traditional methods alone. Data from early 2025 indicates that over 85% of property viewings begin with an online search, highlighting the critical nature of a strong digital footprint.

Smart Home Technology and IoT Integration

The increasing adoption of smart home technology and Internet of Things (IoT) devices is significantly reshaping buyer and renter expectations in the UK residential market. This trend presents a clear opportunity for Foxtons to differentiate its services by catering to demand for connected living experiences. A significant portion of UK households are now embracing these technologies, driven by benefits like enhanced convenience and improved energy efficiency, with smart thermostats alone projected to save households an average of £200 annually on energy bills in 2024.

Foxtons can leverage this technological shift by offering specialized property listings that highlight smart home features and potentially partnering with smart home installation providers. This strategic alignment can attract a segment of the market actively seeking properties equipped with these modern amenities. The market for smart home devices in the UK is experiencing robust growth, with an estimated 15% year-on-year increase in consumer spending on these products during 2024, indicating a strong and growing demand.

- Smart Home Integration: Properties with integrated smart home systems are becoming increasingly desirable, influencing buyer preferences towards convenience and modern living.

- IoT Device Adoption: The widespread adoption of IoT devices, from smart thermostats to security systems, is creating a new standard for residential property features.

- Energy Efficiency Focus: Smart home technology plays a crucial role in enhancing a property's sustainability credentials by optimizing energy consumption, a key consideration for many UK buyers and renters.

- Value-Added Services: Foxtons can offer specialized marketing and advisory services for properties equipped with smart technology, tapping into a growing market segment.

Cybersecurity and Data Privacy

Foxtons Group, like all businesses handling sensitive client data, faces significant technological challenges related to cybersecurity and data privacy. The increasing volume of digital transactions and personal information processed necessitates robust defenses against cyber threats. Failure to protect this data can lead to severe financial penalties and irreparable damage to customer trust.

Adherence to evolving data privacy regulations is a critical operational requirement. For instance, the General Data Protection Regulation (GDPR) in the UK, which came into full effect in 2018, imposes strict rules on how personal data is collected, processed, and stored, with substantial fines for non-compliance. Foxtons must continuously invest in and update its systems to meet these stringent requirements.

Key considerations for Foxtons Group include:

- Implementing advanced threat detection and prevention systems to safeguard against data breaches.

- Ensuring all staff receive regular training on data security best practices and privacy protocols.

- Regularly auditing and updating data handling policies to align with current legal and regulatory frameworks, such as the upcoming Data Protection and Digital Information Bill in the UK, which aims to update post-Brexit data laws.

- Maintaining transparency with clients regarding data usage and protection measures.

The real estate sector is rapidly embracing technological advancements, with PropTech solutions like AI-driven property valuations and virtual reality tours becoming mainstream. In 2024, over 60% of real estate firms reported exploring or implementing AI to enhance efficiency and valuation accuracy.

Automated Valuation Models (AVMs), powered by machine learning, are transforming traditional appraisal methods by providing swift property value estimates, thus improving transaction speed and market transparency. Foxtons Group's continued investment in these technologies is crucial for maintaining its competitive edge.

Foxtons is increasingly utilizing data analytics and predictive modeling to gain market insights and refine customer relationship management, boosting overall operational efficiency in the dynamic real estate landscape.

The integration of AI and machine learning is set to revolutionize real estate decision-making, from property valuation to identifying investment opportunities, ultimately enhancing customer experiences and business outcomes.

A strong digital marketing strategy, including SEO and virtual open houses, is essential for reaching clients, especially as online property searches dominated UK property interest in 2024, with platforms like Rightmove and Zoopla leading initial buyer engagement.

Online property marketing is now a cornerstone of success, with over 85% of property viewings beginning with an online search in early 2025, underscoring the importance of a robust digital presence for Foxtons.

The growing demand for smart home technology and IoT devices is reshaping buyer expectations, presenting an opportunity for Foxtons to differentiate by catering to connected living experiences. Smart thermostats alone were projected to save UK households an average of £200 annually on energy bills in 2024.

Foxtons can capitalize on this trend by marketing properties with smart features and potentially partnering with smart home providers, tapping into a growing market segment where consumer spending on these products saw an estimated 15% year-on-year increase in the UK during 2024.

| Technology Trend | Impact on Real Estate | Foxtons' Opportunity/Challenge | 2024/2025 Data Point |

|---|---|---|---|

| PropTech Adoption (AI, VR) | Alters property assessment and experience | Need for investment and integration for competitiveness | 60% of firms exploring AI in 2024 |

| Automated Valuation Models (AVMs) | Speeds up transactions, increases transparency | Reshapes traditional appraisal methods | N/A (General trend) |

| Data Analytics & Predictive Modeling | Provides market insights, improves CRM and efficiency | Crucial for competitive edge | N/A (General trend) |

| Digital Marketing (SEO, Virtual Tours) | Expands reach and client engagement | Essential for market presence | 85% of viewings start online (early 2025) |

| Smart Home Technology & IoT | Enhances property desirability and buyer expectations | Opportunity for differentiation and specialized services | 15% YoY growth in UK smart home spending (2024) |

| Cybersecurity & Data Privacy | Risk of data breaches, financial penalties, trust erosion | Requires robust defenses and compliance | UK GDPR compliance essential; Data Protection and Digital Information Bill upcoming |

Legal factors

The Renters' Reform Bill, anticipated for full implementation in 2025, will reshape the UK's private rental market. Key provisions include the end of Section 21 'no-fault' evictions, which could impact landlord flexibility, and new regulations on rent increases, potentially affecting rental income predictability. Foxtons, as a major letting agent, will need to adapt its services and client advice to these new legal requirements.

The Leasehold and Freehold Reform Act 2024 is set to significantly alter property transactions by simplifying and reducing the cost for leaseholders to extend their leases or purchase the freehold. This reform is particularly relevant for companies like Foxtons Group, which operates within the UK property market, as it could streamline sales processes and impact property valuations.

Further changes are anticipated with the government's intention to introduce a draft Leasehold and Commonhold Reform Bill in late 2025. This bill aims to transition away from the leasehold system towards commonhold, a model that grants leaseholders full ownership of their property and a share in the management company. This fundamental shift could reshape how residential properties are owned and managed across the UK.

Changes to Stamp Duty Land Tax (SDLT) significantly affect property transaction costs. From April 2025, the stamp duty exemption for first-time buyers will be adjusted, with the threshold decreasing to £300,000. This change could make property ownership less accessible for some new entrants to the market.

Consumer Protection and Anti-Money Laundering Regulations

Foxtons must continually comply with consumer protection and anti-money laundering (AML) regulations to maintain its operating license. The UK's Financial Conduct Authority (FCA) and the Property Ombudsman Scheme set strict standards for transparency and client funds handling. Failure to adhere can result in significant fines and reputational damage, impacting their ability to conduct business. This regulatory environment, particularly concerning client money protection, is a critical operational factor.

The evolving landscape of these regulations can also create opportunities. For instance, the increasing complexity of AML checks and consumer protection requirements can drive demand for specialized property management services that handle these compliance burdens for landlords and tenants. This can enhance the value proposition of Foxtons' ancillary services, differentiating them in a competitive market.

- Regulatory Compliance: Foxtons operates under strict consumer protection laws, including the Consumer Rights Act 2015, and robust anti-money laundering (AML) regulations enforced by bodies like the FCA and HMRC.

- AML Enforcement: In 2023, the UK saw continued focus on AML compliance within the property sector, with penalties for non-compliance remaining a significant deterrent for firms.

- Value-Add Services: The growing complexity of regulations, such as Know Your Customer (KYC) requirements for new clients, increases the appeal of professional property management that ensures adherence.

- Industry Standards: Adherence to standards set by The Property Ombudsman (TPO) and Property Redress Scheme (PRS) is mandatory, ensuring client satisfaction and dispute resolution mechanisms are in place.

Planning Laws and Housing Targets

Government revisions to the National Planning Policy Framework (NPPF) and the mandatory reintroduction of housing targets are significantly impacting the property development landscape for firms like Foxtons. The standard method for assessing housing needs is now compulsory for all local planning authorities, aiming to accelerate housing delivery across the UK. This push for increased housing supply, with a national target of 300,000 homes per year, directly influences the pipeline of new properties available for sale and rent, affecting Foxtons' core business.

These legal changes create both opportunities and challenges. While increased development activity can lead to more listings and transactions, the stringent nature of planning laws and the pressure to meet targets can also introduce complexities and delays. For instance, the NPPF's focus on sustainable development and brownfield site utilization requires developers to navigate specific regulations, potentially impacting project timelines and costs. Foxtons, as a major estate agent, must adapt to this evolving regulatory environment to effectively serve its clients and capitalize on market shifts driven by these planning reforms.

- Mandatory Housing Targets: The UK government has reinforced its commitment to building 300,000 new homes annually, making local authorities legally obliged to plan for and meet these targets using the standard method.

- NPPF Revisions: Updates to the National Planning Policy Framework emphasize the importance of delivering sufficient housing, including provisions for increasing density and utilizing brownfield land, influencing where and how development can occur.

- Impact on Development Pipeline: These legal factors directly shape the volume and location of new properties entering the market, which is crucial for Foxtons' sales and lettings operations.

The Renters' Reform Bill, expected in 2025, will end Section 21 evictions and regulate rent increases, impacting landlords and requiring Foxtons to adapt its advice. The Leasehold and Freehold Reform Act 2024 simplifies lease extensions, potentially streamlining transactions for Foxtons. Further reforms in late 2025 may shift the market towards commonhold ownership. Changes to Stamp Duty Land Tax, with a reduced first-time buyer exemption threshold from April 2025, could affect market accessibility.

Foxtons must adhere to strict consumer protection and anti-money laundering (AML) rules, with penalties for non-compliance. In 2023, AML enforcement in property remained a key focus. The growing complexity of regulations, like KYC checks, highlights the value of professional property management services that ensure adherence. Compliance with industry standards from bodies like The Property Ombudsman is mandatory.

Government revisions to the National Planning Policy Framework and mandatory housing targets, aiming for 300,000 new homes annually, directly influence Foxtons' business by shaping the property development pipeline. These legal factors create opportunities through increased development but also introduce complexities in navigating planning laws and meeting targets.

| Legal Factor | Description | Impact on Foxtons | Relevant Data/Timeline |

|---|---|---|---|

| Renters' Reform Bill | Ends Section 21 evictions, regulates rent increases. | Requires adaptation of services and client advice. | Expected full implementation in 2025. |

| Leasehold and Freehold Reform Act 2024 | Simplifies lease extensions and freehold purchases. | Streamlines sales processes, may impact property valuations. | Enacted in 2024. |

| Stamp Duty Land Tax (SDLT) Changes | Reduced first-time buyer exemption threshold. | Could affect property market accessibility for new buyers. | Effective from April 2025; threshold reduced to £300,000. |

| AML & Consumer Protection | Strict regulations on transparency and client funds. | Mandatory compliance for operating license; penalties for non-adherence. | Continued focus on enforcement in 2023; FCA and HMRC oversight. |

| National Planning Policy Framework (NPPF) Revisions | Mandatory housing targets, focus on development. | Influences property development pipeline and market supply. | Target of 300,000 new homes annually; standard method for housing needs compulsory. |

Environmental factors

Increasing regulations, particularly around Net Zero targets, are pushing for greater energy efficiency in properties. This means that Foxtons' listed properties will increasingly need to meet specific Energy Performance Certificate (EPC) standards, impacting both sellers and the agency's marketing efforts. As of early 2024, the UK government has been consulting on raising minimum EPC standards for rental properties, aiming for a C rating by 2028, which will significantly affect the market.

Buyers and renters are also becoming more aware of and demanding more sustainable homes. This growing consumer preference for energy-efficient properties means that Foxtons needs to highlight these features effectively in its listings. Properties with higher EPC ratings, such as a B or A, are likely to attract more interest and potentially command higher prices or rental yields, a trend expected to intensify through 2025.

The property market is increasingly shaped by environmental concerns. Buyers are actively seeking homes that incorporate sustainable building practices, utilize eco-friendly materials, and hold green certifications. This trend is driving developers to prioritize energy efficiency and reduced environmental impact in new constructions, influencing the types of properties available and their market appeal.

In 2024, the UK government continued to push for higher energy efficiency standards in new builds, with regulations aiming to reduce carbon emissions. For instance, the Future Homes Standard, expected to be fully implemented by 2025, mandates that new homes will be future-proofed with low carbon heating and world-leading energy efficiency. This directly impacts developers like Foxtons Group, who must adapt their building strategies and material sourcing to meet these evolving environmental expectations and consumer demand for greener living spaces.

Foxtons, like all property firms, faces growing scrutiny over climate change's physical impacts. Rising awareness of risks like flooding and extreme weather directly affects property valuations and insurance premiums, potentially dampening buyer demand in vulnerable areas. For instance, the UK's Environment Agency reported in 2024 that over 5 million properties are at risk of flooding, a figure expected to grow.

This heightened awareness is pushing occupiers, investors, and lenders to actively assess their exposure to these physical climate risks. Foxtons will need to adapt its advice and potentially its portfolio focus as market participants increasingly factor in climate resilience when making decisions. The Association of British Insurers noted in early 2025 that climate-related claims costs are on an upward trend, signaling a significant shift in risk perception.

Biodiversity Net Gain and Nature Reporting

New environmental regulations are reshaping the property sector. Biodiversity Net Gain, a requirement in England since February 2024, mandates that new developments must enhance biodiversity by at least 10%. This means property firms like Foxtons Group must actively plan for and demonstrate positive impacts on local ecosystems.

The increasing emphasis on nature-related financial disclosures, such as those recommended by the Taskforce on Nature-related Financial Disclosures (TNFD), is also a significant factor. Companies are now expected to report on their dependencies and impacts on nature, moving beyond just carbon emissions to encompass broader ecological health. This shift necessitates a more integrated approach to environmental strategy and reporting within property businesses.

- Biodiversity Net Gain Mandate: Effective February 2024 in England, requiring a minimum 10% biodiversity increase for new developments.

- Nature-Related Financial Disclosures: Growing pressure for businesses to report on their impact and dependencies on nature, aligning with frameworks like TNFD.

- Ecosystem Impact Assessment: Property firms need to evaluate and mitigate their effects on local biodiversity and natural habitats.

- Nature-Positive Outcomes: The focus is shifting towards demonstrating tangible improvements in ecological value as part of development and operational activities.

Waste Management and Circular Economy Principles

The real estate sector is increasingly embracing circular economy principles, aiming to significantly reduce waste and boost material recycling. This shift involves designing buildings with longevity and adaptability in mind, which can lower the environmental footprint associated with construction and demolition. For instance, the UK government's commitment to a circular economy, outlined in its 2023 Net Zero Strategy, encourages such practices across industries, including property development.

Applying these principles to real estate means a focus on deconstruction rather than demolition, enabling the reuse of building components. This approach not only conserves resources but also creates new economic opportunities in material recovery and reprocessing. By 2025, the UK construction industry is targeting a 50% reduction in waste sent to landfill, a goal directly supported by circular economy initiatives.

- Material Reuse: Prioritizing salvaged and recycled materials in new builds and renovations.

- Design for Disassembly: Creating structures that can be easily taken apart at the end of their life cycle for component reuse.

- Waste Reduction Targets: Implementing strict waste management plans on construction sites, aiming for zero waste to landfill.

- Extended Producer Responsibility: Encouraging manufacturers to take responsibility for the end-of-life management of building products.

Environmental factors are increasingly shaping the property market, with a strong push towards energy efficiency and sustainability. New regulations, such as the Future Homes Standard by 2025, mandate lower carbon heating and high energy efficiency for new builds, directly impacting developers and the types of properties available.

Consumer demand for greener homes is rising, with buyers and renters prioritizing properties that use eco-friendly materials and have higher Energy Performance Certificate (EPC) ratings. The UK government's ongoing consultations to raise minimum EPC standards for rental properties, aiming for a C rating by 2028, will further influence market dynamics.

Climate change risks, like flooding, are also gaining prominence, affecting property valuations and insurance premiums, with over 5 million UK properties at risk of flooding in 2024. This necessitates greater focus on climate resilience in property decisions and advice.

Furthermore, initiatives like Biodiversity Net Gain, requiring a minimum 10% biodiversity increase for new developments since February 2024, and growing pressure for nature-related financial disclosures, are pushing property firms to adopt more holistic environmental strategies.

| Environmental Factor | Description | Impact on Foxtons | Relevant Data/Target |

| Energy Efficiency Regulations | Mandates for higher EPC ratings and energy-efficient building standards. | Influences property listings, marketing, and potential property values. | Future Homes Standard by 2025; UK rental EPC target: C rating by 2028. |

| Consumer Demand for Sustainability | Growing preference for eco-friendly materials and green certifications. | Requires highlighting sustainable features in property marketing. | Increasing buyer interest in properties with B or A EPC ratings. |

| Climate Change Risks | Physical impacts like flooding affecting property valuations and insurance. | Need to advise clients on climate resilience and potential risk areas. | Over 5 million UK properties at risk of flooding (2024); rising climate-related insurance claims (early 2025). |

| Biodiversity and Nature Reporting | Requirements for biodiversity enhancement and reporting on nature impact. | Necessitates integration of ecological considerations into development and operations. | Biodiversity Net Gain mandate (10% increase from Feb 2024); TNFD framework adoption. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Foxtons Group is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that all political, economic, social, technological, legal, and environmental insights are grounded in current and credible data.