Foxtons Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foxtons Group Bundle

Foxtons Group navigates a dynamic property market where buyer power can be significant, especially in fluctuating economic conditions. The threat of new entrants is moderate, influenced by regulatory hurdles and brand recognition, while the bargaining power of suppliers, like technology providers, presents a manageable challenge. The intensity of rivalry among estate agents is high, demanding constant innovation and service differentiation.

The complete report reveals the real forces shaping Foxtons Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Foxtons' reliance on key technology and portal providers is a significant factor in its operational landscape. The company heavily utilizes Customer Relationship Management (CRM) systems and relies on major property listing portals such as Rightmove and Zoopla to connect with potential clients. In 2023, Rightmove reported a revenue of £367.5 million, highlighting its dominant position in the market.

The UK property portal market is quite concentrated, with Rightmove and Zoopla holding substantial sway. This concentration means these portals possess considerable bargaining power over estate agents like Foxtons, as access to their vast user bases is crucial for reaching a broad audience of buyers and renters. For instance, Rightmove boasts over 190 million visits per month.

Furthermore, the costs associated with switching between major property portals or implementing entirely new, integrated technology systems can be quite high. This creates switching costs for Foxtons, potentially limiting its flexibility and bargaining leverage with these essential technology and listing partners.

The London property market's demand for skilled estate agents, property managers, and administrative staff highlights the critical role of human capital as a key supplier for Foxtons. In the competitive UK job market, particularly in London, the bargaining power of talented employees and specialized consultants, such as legal or financial experts, can be substantial. This can lead to increased wage demands or higher service fees, impacting Foxtons' operational costs.

Foxtons' success in attracting and retaining high-caliber talent is directly linked to its service quality and operational efficiency. For instance, in 2024, the average salary for an estate agent in London was reported to be around £45,000, with experienced agents earning significantly more, reflecting the specialized skills required and the competitive landscape for talent.

Foxtons' reliance on prime London high-street locations means landlords for these properties are significant suppliers. In 2024, London's commercial property market continued to see robust demand, particularly in sought-after areas, potentially giving landlords leverage in lease negotiations. For instance, average prime office rents in central London remained elevated, impacting Foxtons' operational costs.

Marketing and Advertising Services

Foxtons' substantial investment in marketing and advertising, crucial for its London market presence, means it relies on external agencies and media. The bargaining power of these suppliers is influenced by the specialization and reputation of certain marketing agencies and the cost of premium advertising placements. In 2024, the digital advertising market continued to see increased costs, particularly for highly targeted campaigns.

- Specialized Agencies: Highly reputable marketing and advertising firms can command higher fees due to their proven track record and expertise in the property sector.

- Media Costs: The cost of advertising slots on popular property portals and in high-circulation publications can be significant, giving media owners leverage.

- Digital Platform Fees: Fees for search engine marketing and social media advertising can fluctuate based on demand and platform algorithms, impacting Foxtons' advertising spend.

- Brand Impact: The effectiveness of Foxtons' branding can influence its negotiation power with suppliers, but the inherent need for high-quality creative and media reach remains.

Financial and Legal Services

Foxtons Group, a prominent estate agency, depends on specialized financial and legal service providers for critical functions like regulatory compliance, transaction execution, and strategic counsel. These suppliers, often highly reputable law firms and accounting practices, are indispensable for navigating complex property deals and corporate governance.

The specialized knowledge and high-value nature of these services grant significant bargaining power to these suppliers. For instance, specialized legal advice on property law or intricate financial structuring for large deals can command premium fees, reflecting the expertise and risk involved. In 2024, the demand for expert legal and financial advice in the UK property sector remained robust, driven by evolving regulations and market dynamics, further solidifying supplier leverage.

- High Switching Costs: Changing legal or financial advisors can be time-consuming and costly due to the need to transfer knowledge and establish new relationships.

- Concentration of Expertise: A limited number of firms possess the deep, specialized knowledge required for complex property transactions, reducing the pool of viable alternatives for Foxtons.

- Reputation and Trust: The established reputations of leading financial and legal service providers lend them considerable weight in negotiations, as trust and proven track records are paramount in these fields.

Foxtons faces significant supplier bargaining power from property listing portals like Rightmove and Zoopla, given their market dominance and the high costs associated with switching. The concentration of these platforms, with Rightmove attracting over 190 million monthly visits in 2023, means Foxtons' access to potential clients is heavily reliant on them, granting these portals considerable leverage.

The company also contends with the bargaining power of skilled human capital, particularly in the competitive London market where average estate agent salaries reached approximately £45,000 in 2024. Furthermore, landlords of prime London high-street locations can exert influence due to sustained demand for commercial property in 2024, potentially increasing Foxtons' rental costs.

Specialized financial and legal service providers also hold strong bargaining power due to their indispensable expertise and the high switching costs involved. A limited number of firms possess the necessary deep knowledge for complex property transactions, reinforcing their position in negotiations.

| Supplier Type | Key Dependence | Bargaining Power Factors | 2023/2024 Data Point |

|---|---|---|---|

| Property Portals | Client Acquisition | Market Concentration, High Switching Costs | Rightmove: £367.5M Revenue (2023) |

| Skilled Employees | Service Delivery | Competitive Job Market, Specialized Skills | London Estate Agent Avg. Salary: ~£45,000 (2024) |

| Landlords (Prime Locations) | Operational Presence | Sustained Demand for Commercial Property | Elevated Prime Office Rents in Central London (2024) |

| Financial/Legal Services | Regulatory Compliance, Deal Execution | Specialized Expertise, High Switching Costs | Robust Demand for Expert Advice in UK Property Sector (2024) |

What is included in the product

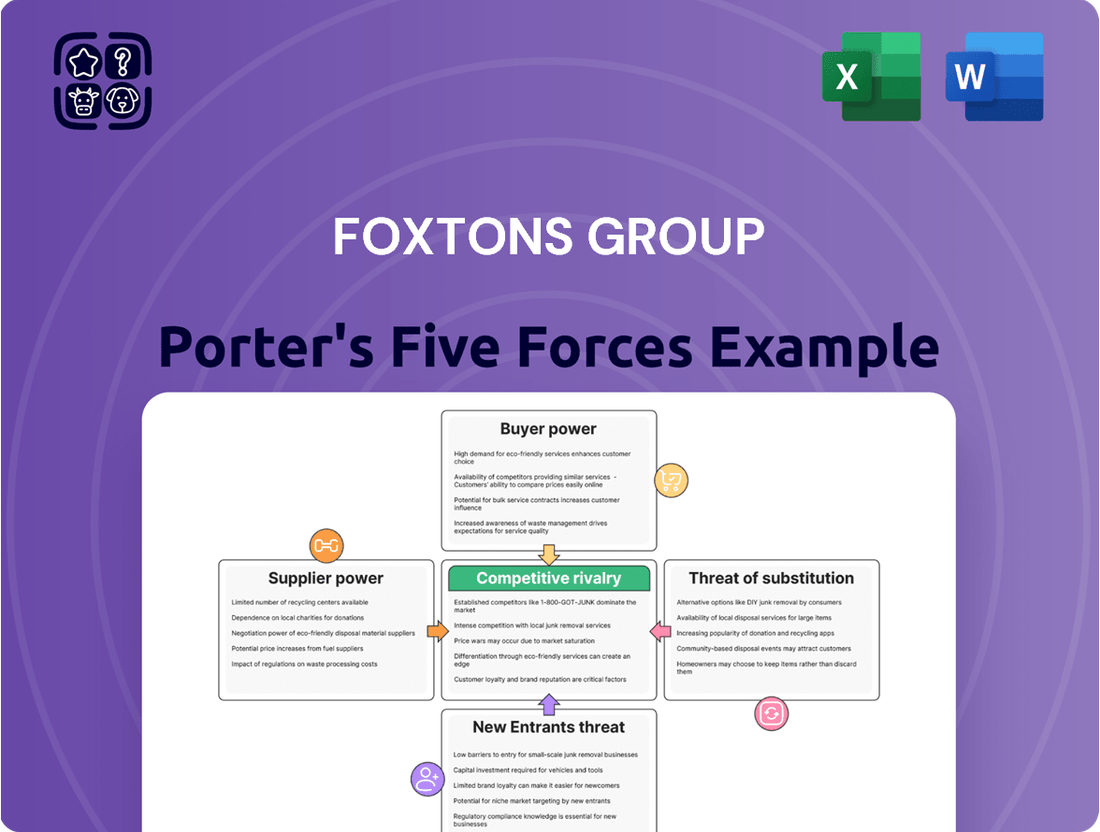

This analysis of Foxtons Group's Porter's Five Forces dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within the UK property market.

Instantly understand strategic pressure with a powerful spider/radar chart, allowing Foxtons to visualize and address competitive threats with clarity.

Customers Bargaining Power

Foxtons Group caters to a diverse and fragmented customer base, including individual property buyers, sellers, landlords, and tenants primarily within the London market. This broad distribution means no single customer or small group holds substantial sway over the company's revenue, thereby diminishing direct bargaining power for any one client.

While individual customer leverage is limited, the collective impact of customer sentiment, particularly through online reviews and social media, can indirectly shape Foxtons' reputation and influence overall business volume. For instance, in 2024, the UK property market saw continued interest from both domestic and international buyers, with London remaining a key hub, indicating a large pool of potential clients whose aggregated satisfaction is crucial.

Customers in London's property market are acutely aware of costs, especially regarding sales commissions and rental management fees. This price sensitivity is amplified by readily accessible online comparison platforms that allow easy evaluation of Foxtons' offerings against rivals.

The ease of accessing information about fees and services empowers buyers and sellers to negotiate more effectively, driving down prices. For instance, in 2024, average commission rates in the UK property market saw continued pressure, with some online agents offering significantly lower percentages, making Foxtons' pricing a key point of comparison for many potential clients.

For sellers and landlords, the cost of switching estate agents is generally low. This means they can easily list their property with several agencies simultaneously or switch to a different agent if they aren't satisfied with the service. This flexibility significantly boosts their bargaining power.

This ease of switching compels Foxtons to consistently prove its value and deliver strong results to keep clients. In 2024, the UK property market saw a dynamic shift, with many homeowners looking for agents who could navigate fluctuating market conditions effectively, highlighting the importance of demonstrable performance for customer retention.

Similarly, tenants have a wide array of choices when looking for rental properties. With numerous agencies and online platforms listing available homes, tenants can readily compare options and negotiate terms, further enhancing their leverage in the market.

Customer Choice and Alternatives

Customers looking to buy, sell, or rent property in the UK have a vast selection of estate agents to choose from, significantly increasing their bargaining power. Beyond traditional high-street firms like Foxtons, the market includes a growing number of online-only portals and hybrid agencies offering competitive fee structures. For instance, in 2024, the UK property market saw continued growth in the adoption of online estate agency services, with many consumers actively comparing fees and service offerings across dozens of providers.

The sheer volume of alternatives means Foxtons faces considerable pressure to justify its pricing and service levels. Customers can easily switch between agents based on commission rates, marketing strategies, and perceived local market knowledge. This competitive landscape necessitates that Foxtons continually refines its value proposition to stand out.

- Diverse Alternatives: Customers can opt for high-street agents, online platforms (e.g., Purplebricks, Strike), or hybrid models, all competing for market share.

- Price Sensitivity: The availability of lower-cost alternatives puts upward pressure on Foxtons' commission rates, forcing them to demonstrate superior value.

- Information Accessibility: Online reviews and comparison sites empower customers with information to make informed choices, further amplifying their bargaining position.

- Service Differentiation: Foxtons must highlight unique selling points such as its brand reputation, extensive local network, and specialized marketing capabilities to retain clients.

Impact of Market Conditions on Customer Power

In a buyer's or tenant's market, where the supply of properties outstrips demand, customers gain significant bargaining power. This is evident when there are more homes available than people looking to buy or rent, allowing them to negotiate better prices and terms. For instance, in early 2024, the UK property market saw a slight cooling, with average house prices experiencing modest fluctuations, giving potential buyers more room to negotiate than in previous years.

Conversely, in a seller's or landlord's market, where demand is high and supply is limited, customer bargaining power naturally diminishes. Foxtons, like other estate agents, operates within these market dynamics. The London property market, known for its volatility, sees customer power ebb and flow. For example, during periods of high rental demand in London, such as late 2023 and early 2024, tenants often faced limited choices and less leverage to negotiate rent increases.

- Buyer's Market Advantage: Increased options lead to greater negotiation leverage for customers.

- Seller's Market Shift: Limited supply reduces customer bargaining power.

- London Market Dynamics: Customer power fluctuates with economic and housing conditions.

- 2024 Trend: A cooling property market in early 2024 offered buyers more negotiation space.

Foxtons' customers, a broad group of buyers, sellers, landlords, and tenants, possess significant bargaining power due to the competitive nature of the UK property market. The proliferation of online agents and comparison platforms in 2024 has made it easy for consumers to scrutinize fees and services, driving down commission rates. This accessibility empowers individuals to negotiate more effectively, as switching costs between agents remain low, forcing Foxtons to consistently demonstrate value and strong performance to retain business.

| Factor | Impact on Foxtons | 2024 Context |

|---|---|---|

| Availability of Alternatives | High | Numerous online and traditional agents offer competitive pricing and services. |

| Price Sensitivity | High | Customers actively compare commission rates and service packages. |

| Switching Costs | Low | Clients can easily move to other agencies if dissatisfied. |

| Information Accessibility | High | Online platforms provide transparent fee structures and service comparisons. |

Preview the Actual Deliverable

Foxtons Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Foxtons Group, providing a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, offering a comprehensive understanding of the strategic landscape. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for immediate use.

Rivalry Among Competitors

The London estate agency market is a crowded space, being both mature and highly fragmented. This means there are a lot of companies trying to sell homes, and the market isn't really growing much anymore, making it tough to gain new ground.

Foxtons is up against a wide array of competitors. This includes well-known national and regional chains with a strong presence on the high street, as well as smaller, independent agencies that often have deep roots in specific local communities. The competition isn't just traditional; it also comes from online-only platforms and hybrid models that blend digital convenience with some in-person services.

This sheer number of businesses all vying for the same customers naturally fuels aggressive competition. For instance, in 2024, the UK property market saw a significant number of transactions, but the competition among agents to secure listings and buyers remained fierce, often leading to price wars on commission fees and increased marketing spend.

Foxtons operates with substantial fixed costs inherent in its high-street branch network, encompassing expenses like rent, employee wages, and essential technology. This financial structure necessitates a consistent flow of transactions to offset these ongoing overheads, naturally driving a more aggressive competitive stance.

The pressure to keep branches and agents productive intensifies rivalry within the real estate sector. For instance, Foxtons' 2023 annual report indicated a revenue of £110.6 million, but this was achieved with a significant cost base, highlighting the ongoing need for high sales volumes to ensure profitability and maintain market share against competitors vying for the same customer base.

Foxtons strives to stand out in a crowded market by emphasizing its strong brand, a reputation for superior service, deep knowledge of local areas, and a widespread branch presence. This differentiation is key to commanding higher fees in a sector where price wars are common, pushing competitors to either improve their offerings or reduce expenses.

Market Growth and Volatility

The London property market, a key battleground for Foxtons, is known for its cyclical nature. Periods of strong growth can see increased competition as more agents enter the fray, while downturns often lead to heightened rivalry for fewer deals, potentially squeezing agent fees. For instance, in early 2024, the market saw a cautious recovery following interest rate hikes in 2023, with transaction volumes still below pre-pandemic levels, indicating an environment where competitive pressures remain significant.

This inherent volatility means that agents like Foxtons must constantly adapt their strategies. In a rising market, the focus might be on market share acquisition and brand building. However, during slower phases, the emphasis shifts to operational efficiency and retaining existing client relationships to weather the storm. The ability to navigate these market swings effectively is crucial for sustained profitability.

- Market Volatility Impact: London property market cycles influence competitive intensity, with downturns often leading to fee compression as agents vie for limited transactions.

- 2024 Market Conditions: Early 2024 data indicated a cautious market recovery, with transaction volumes still lagging, suggesting ongoing competitive pressures for estate agents.

- Strategic Adaptation: Agents must adjust strategies from market share focus during booms to efficiency and client retention during contractions to maintain profitability.

Diverse Business Models and Strategies

Foxtons faces a competitive landscape shaped by a variety of business models. Traditional agencies operate on a commission basis, while newer entrants, particularly online agents, often adopt fixed-fee structures. This means Foxtons must continually evaluate its offerings against these differing pricing and service approaches to remain competitive.

This diversity in strategy compels Foxtons to adapt its value proposition. For instance, the rise of digital-first platforms means that customer acquisition costs and service delivery speed are critical differentiators. In 2023, the UK property market saw a significant shift, with online agents gaining traction, though traditional agencies still hold a substantial market share.

- Diverse Business Models: Foxtons competes with traditional commission-based agencies and fixed-fee online platforms.

- Value Proposition Assessment: The company must constantly benchmark its services against varied pricing and delivery methods.

- Niche Market Focus: Many rivals concentrate on specific segments, intensifying competition for particular client groups.

- Market Dynamics: The UK property market in 2023 highlighted the growing influence of digital-first estate agents.

The competitive rivalry for Foxtons is intense, stemming from a mature and fragmented London market populated by numerous national, regional, and independent agencies, alongside online and hybrid competitors. This crowded field necessitates aggressive strategies, including price competition on fees and increased marketing efforts, especially given Foxtons' significant fixed costs tied to its branch network.

| Competitor Type | Key Characteristics | Impact on Foxtons |

| National/Regional Chains | Established brand, high street presence | Pressure on market share and fees |

| Independent Agencies | Local expertise, community ties | Targeted competition in specific areas |

| Online/Hybrid Agents | Digital convenience, often fixed fees | Disruption of traditional models, fee pressure |

SSubstitutes Threaten

Property owners opting for private sales or lettings represent a significant threat. These owners bypass traditional estate agents like Foxtons, utilizing online platforms and social media. This approach, while saving on commission fees, demands considerable owner involvement in marketing, negotiation, and handling legalities.

Online platforms like Rightmove and Zoopla, while not directly facilitating transactions in the same way as peer-to-peer marketplaces, are increasingly offering tools that empower consumers to manage more of the process themselves. In 2024, these platforms continue to enhance their features, allowing for more direct communication between parties and providing extensive data for valuation, potentially reducing reliance on traditional agents for initial stages.

While legal and conveyancing firms are crucial for property transactions, they don't fully substitute estate agents like Foxtons. These firms handle the legal paperwork, but lack the marketing prowess and active buyer sourcing that Foxtons offers. For instance, in 2023, Foxtons reported a revenue of £139.4 million, highlighting their significant market presence and the value they add beyond legalities.

Hybrid Models Offering Limited Services

Hybrid estate agency models, blending online capabilities with reduced in-person support, present a form of substitution. These models often attract cost-conscious consumers seeking a balance between professional guidance and DIY involvement, typically at a lower fee structure than full-service agents.

These hybrid offerings blur the traditional distinctions between comprehensive agency services and purely self-service platforms. They cater to a segment of the market willing to manage more aspects of a property transaction in exchange for reduced costs.

- Hybrid models compete by offering lower commission rates, often in the range of 0.75% to 1.5% of the sale price, compared to traditional agents who might charge 1.5% to 2.5%.

- In 2024, the online estate agency sector, which includes many hybrid models, continued to gain market share, with some estimates suggesting they handle up to 20% of property sales in the UK.

- Customers utilizing these models may be responsible for tasks such as conducting viewings, negotiating offers, and managing paperwork, thereby reducing the service scope of the agent.

Perceived Value vs. Cost Savings

The threat of substitutes for Foxtons is significantly influenced by how customers perceive the value they receive compared to the cost savings of going it alone or using a discount competitor. If clients believe they can achieve similar results without paying Foxtons' commission, they might explore alternatives. For instance, in 2024, the rise of online property portals offering self-service listings and data analytics might appeal to tech-savvy sellers seeking to reduce agency fees, which can range from 1% to 2.5% of the sale price in the UK market.

Foxtons needs to consistently highlight its distinct advantages. This includes its established brand reputation, extensive network of buyers, and the expertise its agents bring to negotiations and property marketing. A strong value proposition is crucial to counter the allure of cost-saving substitutes. For example, Foxtons' market share in London, a key indicator of its perceived value, remained a significant factor in its performance throughout 2024.

- Perceived Value: Customers weigh Foxtons' service against potential savings from DIY or low-cost platforms.

- Cost Savings: Lower fees from alternative services can be a strong motivator for some clients.

- Expertise and Reach: Foxtons' established network and agent knowledge are key differentiators.

- Market Confidence: A client's belief in their own ability to manage a sale impacts their choice of substitute.

The threat of substitutes for Foxtons primarily stems from individuals choosing to sell or let their properties privately, bypassing traditional estate agents. This trend is amplified by the increasing sophistication of online platforms and social media, which empower owners to manage marketing, negotiations, and even legal aspects themselves, albeit with a greater time commitment.

Hybrid estate agency models also pose a significant substitute threat. These blend online convenience with reduced in-person support, attracting cost-conscious consumers. In 2024, these online and hybrid agencies continued to capture market share, with some estimates placing their involvement in up to 20% of UK property sales, often offering commission rates between 0.75% and 1.5%.

Foxtons must continuously reinforce its value proposition, emphasizing its brand reputation, extensive buyer networks, and agent expertise to justify its commission fees, which can range from 1.5% to 2.5% in the UK market. For instance, Foxtons' strong market share in London during 2024 underscores the perceived value it offers compared to alternatives.

| Substitute Type | Key Features | Typical Cost (Commission) | Foxtons' Counter |

| Private Sales/DIY | Owner handles all aspects; uses online portals for listings | None (owner's time) | Brand, network, negotiation expertise |

| Online Agencies | Digital-first, limited physical presence | 0.75% - 1.5% | Full-service support, local market knowledge |

| Hybrid Agencies | Online platform with some human support | 1% - 2% | Comprehensive marketing, dedicated agent |

Entrants Threaten

Establishing a traditional high-street estate agency, akin to Foxtons' established model in London, demands substantial capital. This includes securing prime retail spaces, which in London can command rents upwards of £50,000 per annum for a decent high-street location, extensive branch outfitting, and building a sizable team of sales and support personnel.

Furthermore, significant investment in robust technology infrastructure, encompassing CRM systems, property listing platforms, and marketing tools, is essential. These considerable upfront costs present a formidable barrier, deterring new entrants from easily replicating Foxtons' established physical footprint and operational scale.

Foxtons has cultivated a powerful brand presence in London over decades, fostering significant client trust and recognition. New competitors must invest heavily in marketing and consistent service to even begin to replicate this established reputation.

The significant time and financial resources required to build comparable brand equity present a substantial hurdle for potential new entrants. In the property sector, where trust is fundamental, this established brand recognition acts as a strong deterrent.

The London property market's intricate nature demands profound local expertise and established networks. Newcomers struggle to replicate the deep understanding of neighborhood nuances and relationships with developers and investors that incumbents like Foxtons possess. This accumulated localized experience forms a significant barrier, as evidenced by the high failure rate of new agencies attempting to break into established London postcodes.

Regulatory and Compliance Hurdles

New entrants to the Foxtons Group market face regulatory and compliance hurdles that, while not insurmountable, add significant cost and time to market entry. These include adhering to stringent anti-money laundering (AML) regulations, which are critical in the property sector to prevent financial crime. For instance, in 2024, the UK government continued to emphasize robust AML checks for estate agents, requiring thorough customer due diligence and record-keeping.

Furthermore, new firms must comply with various consumer protection laws designed to safeguard buyers and sellers. This involves transparent dealings, accurate property descriptions, and fair contract practices. Professional body memberships, such as those with The Property Ombudsman or Property Redress Scheme, are also often mandatory, requiring adherence to their codes of conduct and dispute resolution processes. These requirements can demand substantial investment in training and compliance systems.

- AML Compliance: Estate agents in the UK are subject to Money Laundering Regulations, requiring them to register with HMRC and implement robust internal controls.

- Consumer Protection: Adherence to the Consumer Rights Act 2015 and the Consumer Protection from Unfair Trading Regulations 2008 is essential.

- Professional Body Membership: Membership in schemes like The Property Ombudsman (TPO) or Property Redress Scheme (PRS) is a legal requirement for most estate agents in England.

- Data Protection: Compliance with GDPR (General Data Protection Regulation) for handling client data is a significant operational consideration.

Incumbent Advantages and Economies of Scale

Foxtons Group benefits significantly from established incumbent advantages, particularly economies of scale. Its substantial size allows for more efficient marketing spend, investment in advanced technology, and streamlined operational processes that smaller competitors cannot easily replicate. For instance, in 2023, Foxtons reported revenue of £110.2 million, demonstrating a scale that underpins its market presence.

These economies of scale translate into a competitive edge in pricing and service delivery. Foxtons can absorb costs more readily and invest in infrastructure that enhances customer experience. New entrants, often starting with limited capital, find it challenging to match the marketing reach and technological capabilities that Foxtons has built over time, creating a barrier to entry.

- Economies of Scale: Foxtons leverages its size for cost efficiencies in marketing, technology, and operations.

- Market Reach: A large property portfolio and extensive client database provide a significant advantage.

- Barriers for New Entrants: Smaller competitors struggle to achieve similar cost structures and market penetration.

- Competitive Disadvantage: New entrants face difficulties in matching Foxtons' pricing and service levels.

The threat of new entrants into the London estate agency market, particularly those aiming to replicate Foxtons' established model, is significantly mitigated by high capital requirements. These include the substantial costs associated with prime London real estate, which can see rents exceeding £50,000 annually for desirable high-street locations, alongside outfitting numerous branches and building a skilled workforce. Furthermore, substantial investment in advanced technology, such as sophisticated CRM systems and property listing platforms, is crucial for operational efficiency and market competitiveness.

Brand loyalty and the extensive time required to build trust in the property sector also act as formidable barriers. Foxtons has spent decades cultivating a strong brand presence and client confidence in London. New competitors would need to invest heavily in marketing and consistently deliver superior service to even approach this level of established reputation, a process that is both time-consuming and financially demanding.

Regulatory compliance, including stringent Anti-Money Laundering (AML) checks and adherence to consumer protection laws, adds another layer of complexity and cost for new entrants. For instance, in 2024, UK estate agents continued to face increased scrutiny on AML procedures, requiring robust due diligence and record-keeping. Membership in professional bodies like The Property Ombudsman is also often a legal necessity, necessitating investment in training and compliance systems.

Economies of scale enjoyed by established players like Foxtons present a significant challenge. With 2023 revenues reaching £110.2 million, Foxtons can leverage its size for more efficient marketing, technology investment, and streamlined operations, which smaller, newer firms struggle to match. This scale advantage allows for competitive pricing and service delivery, making it difficult for new entrants to gain traction and achieve similar market penetration.

| Barrier Category | Specific Example for Foxtons | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Prime London High-Street Rent | £50,000+ per annum |

| Brand Equity | Decades of building client trust | Significant marketing and service investment required |

| Regulatory Compliance | AML checks, Consumer Protection Laws | Investment in training and compliance systems |

| Economies of Scale | 2023 Revenue: £110.2 million | Cost efficiencies in marketing, technology, operations |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Foxtons Group is built upon a foundation of publicly available financial disclosures, including annual reports and investor presentations. This is supplemented by industry-specific market research reports and data from reputable property market analysis firms to provide a comprehensive view of the competitive landscape.