Foxtons Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foxtons Group Bundle

Unlock the strategic blueprint of Foxtons Group with our comprehensive Business Model Canvas. Discover their approach to customer relationships, revenue streams, and key resources that drive their success in the competitive property market. This detailed analysis is perfect for anyone looking to understand the inner workings of a leading estate agency.

Partnerships

Foxtons Group actively cultivates relationships with mortgage brokers, solicitors, and surveyors. These partnerships are crucial for providing a holistic service offering, streamlining the property transaction process for clients by ensuring access to essential legal and financial expertise.

In 2024, the UK property market saw continued activity, with firms like Foxtons relying on these referral networks to maintain transaction volumes. For instance, a significant portion of mortgage approvals still originate through broker networks, underscoring their importance in facilitating property sales.

Foxtons actively collaborates with property developers to gain early access to new build properties, thereby enriching its sales and lettings inventory. This strategic alliance allows them to offer a diverse range of homes to a broader client base. In 2023, Foxtons reported a significant contribution from new build sales, reflecting the strength of these developer relationships.

Furthermore, Foxtons cultivates partnerships with substantial landlords and those managing extensive property portfolios. These relationships are vital for ensuring a steady and reliable supply of rental properties, which underpins the success of their lettings division. This consistent pipeline is a cornerstone of their business model, providing predictable revenue streams.

Foxtons Group actively partners with technology and data providers to bolster its proprietary Foxtons Operating Platform. These collaborations are crucial for integrating advanced capabilities like AI-powered lead scoring, which helps prioritize potential clients, and real-time customer satisfaction tracking to ensure service quality.

These strategic alliances are instrumental in refining operational efficiency and enhancing data-driven decision-making across the organization. For instance, in 2024, Foxtons continued to invest in data analytics tools to gain deeper insights into market trends and customer behavior, aiming to improve conversion rates and client retention.

Relocation Agencies and Corporate Clients

Foxtons' strategic alliances with relocation agencies and corporate clients are a cornerstone of its business model, particularly within the competitive London property market. These partnerships act as a vital conduit, consistently supplying a steady influx of potential tenants and buyers, especially for Foxtons' premium property listings.

These engagements are characterized by substantial property volume requirements and extended contractual periods. This structure is instrumental in generating predictable and recurring revenue for both Foxtons' lettings and sales divisions, offering a buffer against the inherent volatility of the real estate sector. For instance, in 2024, Foxtons reported that corporate relocation services contributed significantly to their managed portfolio, with a notable increase in the volume of properties handled for international assignees relocating to London.

- Steady Tenant and Buyer Flow: Partnerships with relocation agencies and corporate clients ensure a consistent demand for properties, especially in high-value markets like London.

- Recurring Revenue Streams: Long-term engagements and bulk property requirements from these partners provide stable, predictable income for Foxtons' lettings and sales operations.

- Reduced Market Dependency: This diversified client base mitigates the impact of individual market fluctuations, enhancing business resilience.

- Focus on Premium Market: These relationships are particularly effective in securing high-end property mandates, aligning with Foxtons' specialist market positioning.

Local Businesses and Community Organizations

Foxtons actively cultivates relationships with local businesses and community organizations to deepen its neighborhood roots and build trust. These collaborations are designed to enhance local presence and generate valuable leads through shared initiatives.

Partnerships might include co-marketing efforts, such as joint advertising campaigns with nearby retailers or service providers. Foxtons also engages in sponsoring local events, like school fairs or community festivals, which directly connects the brand with residents. Furthermore, offering exclusive services or discounts to members of community organizations can foster goodwill and encourage local engagement.

- Local Business Collaborations: Foxtons partners with businesses like cafes and independent shops for cross-promotional activities, aiming to increase foot traffic for both parties.

- Community Event Sponsorship: In 2024, Foxtons sponsored over 50 local community events across its operating regions, contributing to brand visibility and community goodwill.

- Exclusive Offers: Providing tailored property advice or moving services to members of local residents' associations or business groups can drive lead generation.

- Data-Driven Outreach: By analyzing local demographic data, Foxtons identifies key community groups for targeted partnership opportunities.

Foxtons' key partnerships extend to mortgage brokers, solicitors, and surveyors, forming a vital ecosystem for property transactions. These collaborations ensure clients receive comprehensive support, from financing to legalities, streamlining the entire buying and selling process. The firm also actively engages with property developers, securing early access to new build inventory, which in 2023 contributed significantly to their sales figures.

What is included in the product

A detailed breakdown of Foxtons' business model, focusing on their core revenue streams from property sales and lettings, and their customer segments of homeowners and renters. It outlines their unique value proposition of local expertise and integrated services, delivered through their branch network and digital platforms.

The Foxtons Group Business Model Canvas offers a streamlined approach to understanding and addressing the complexities of the property market, acting as a pain point reliever by clearly mapping out customer relationships and revenue streams.

This visual tool simplifies the often-frustrating process of navigating property transactions, providing a clear overview of how Foxtons delivers value and generates income, thus alleviating common client anxieties.

Activities

Foxtons Group's core business revolves around facilitating property sales and lettings, a process they manage end-to-end. This includes everything from valuing properties and marketing them effectively to negotiating deals and seeing transactions through to completion.

The company's strategy centers on capturing significant market share within London's dynamic property landscape, while also strategically expanding into surrounding commuter towns. This dual focus aims to broaden their reach and capitalize on diverse market opportunities.

Their operational success is underpinned by deep local market knowledge and a well-established, recognizable brand. In 2024, Foxtons reported a significant increase in sales transactions, with the average property price in London continuing to show resilience despite economic headwinds.

Foxtons offers extensive property management for landlords, covering everything from property upkeep and tenant relations to ensuring all legal obligations are fulfilled. This service is a cornerstone of their business, providing a steady income that helps buffer against the ups and downs of the property sales market.

In 2024, Foxtons continued to leverage its property management arm, a vital component for consistent revenue. This segment is crucial for financial stability, as it generates recurring fees regardless of sales transaction volumes, contributing significantly to the group's overall financial resilience.

Foxtons Group's provision of financial services, notably mortgage broking, is a crucial activity that diversifies revenue and enriches the client journey. This service directly assists customers in navigating the financial complexities inherent in property transactions, from initial mortgage acquisition to subsequent refinancing needs.

In 2024, Foxtons reported that its financial services division played a significant role in its overall performance, with mortgage broking activities contributing meaningfully to the group's income. This segment is designed to offer a seamless, end-to-end property solution, ensuring clients receive comprehensive support beyond just the sale or letting of a property.

Technology and Platform Development

Foxtons Group's core operations hinge on the continuous development and refinement of its proprietary 'Foxtons Operating Platform.' This technological backbone is essential for managing leads, client interactions, and property listings efficiently.

Significant investment is directed towards integrating cutting-edge technologies to enhance performance. For instance, the adoption of Artificial Intelligence (AI) plays a crucial role in sophisticated lead scoring, allowing agents to prioritize high-potential clients. Furthermore, AI-powered customer feedback systems are being developed to glean insights and improve service delivery.

These technological advancements are designed to yield tangible benefits across the business. They aim to boost operational efficiency, elevate the quality of customer service, and ultimately increase employee productivity by streamlining workflows and providing better tools.

- Platform Enhancement: Ongoing investment in the Foxtons Operating Platform is a key activity.

- AI Integration: Development includes AI for lead scoring and customer feedback.

- Efficiency Gains: Technology aims to improve operational efficiency and productivity.

- Customer Focus: Enhancements are geared towards better customer service.

Market Analysis and Expertise Development

Foxtons dedicates significant resources to continuous market analysis, ensuring they remain at the forefront of local property knowledge. This involves meticulously tracking shifts in property values, emerging trends, and the strategic moves of competitors. For instance, in 2024, Foxtons would have been analyzing the impact of fluctuating interest rates on buyer demand and seller willingness across different London boroughs.

This deep understanding of the market allows Foxtons to offer clients precise property valuations and expert advice, a cornerstone of their client service. By staying informed, they can effectively guide both buyers and sellers, fostering trust and solidifying their position as market leaders. Their ability to accurately predict market movements is a key driver in securing new instructions and achieving successful sales.

- Market Trend Monitoring: Foxtons actively tracks property price indices and sales volumes, for example, observing the average price of a property in prime London locations in early 2024 compared to the previous year.

- Competitor Activity Analysis: This includes understanding competitor pricing strategies, marketing campaigns, and market share within specific geographic areas.

- Client Advisory: Leveraging market insights to provide accurate valuations and strategic advice, helping clients make informed decisions.

- Revenue Growth Driver: Gaining market share and enhancing client acquisition through superior market intelligence.

Key activities for Foxtons Group include end-to-end property sales and lettings, from valuation to completion. They also focus on extensive property management for landlords, offering a stable revenue stream. Furthermore, providing financial services like mortgage broking is crucial for diversifying income and enhancing client support.

What You See Is What You Get

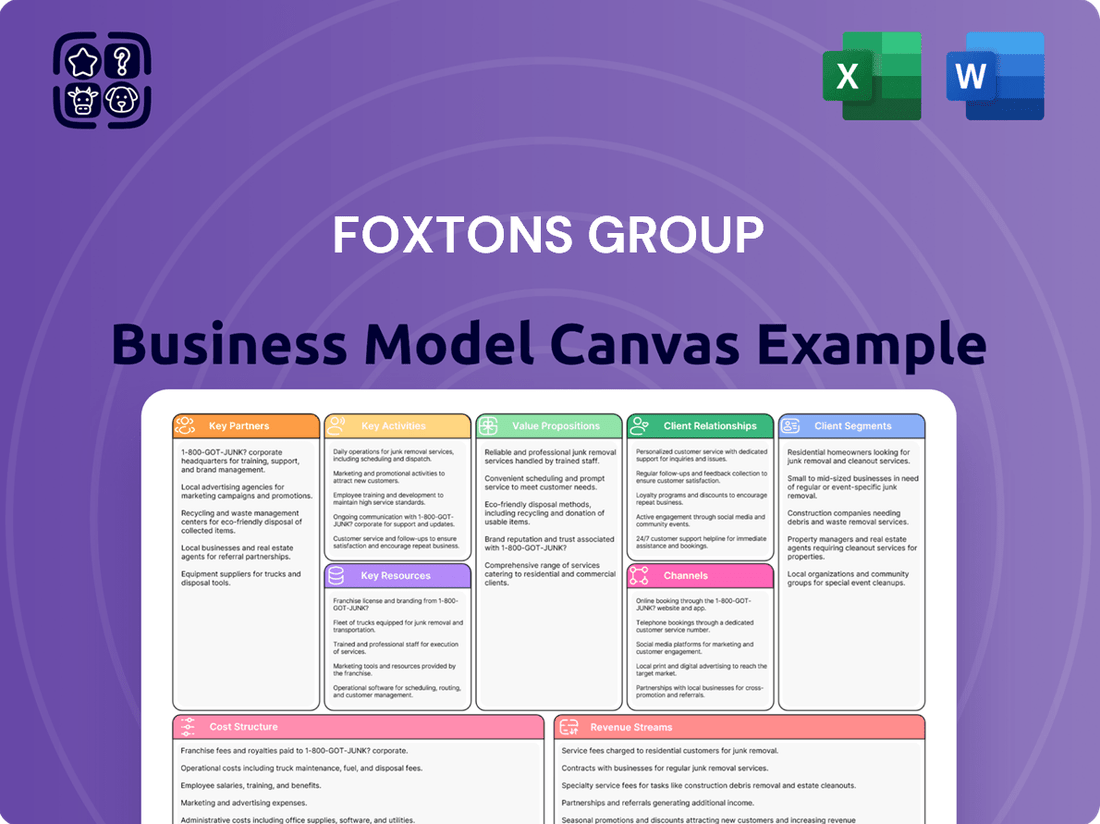

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a complete and unedited view of Foxtons Group's strategic framework. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed Business Model Canvas, ready for your immediate use and understanding of Foxtons' operations.

Resources

Foxtons leverages a substantial network of high-street branches, offering a tangible and approachable presence throughout London and expanding into surrounding commuter towns. These physical hubs are central to client engagement, facilitating property viewings and underpinning local market expertise.

As of their 2023 annual report, Foxtons maintained a significant footprint with 61 branches. This extensive network allows for localized market penetration and direct customer interaction, a key differentiator in the competitive property market.

The Foxtons Operating Platform is the company's core technological asset, unifying its operations and data. This industry-leading system is constantly being improved, with recent upgrades including AI-powered lead qualification and instant customer feedback mechanisms, all designed to boost efficiency and elevate customer care.

Foxtons Group's skilled and experienced workforce is a cornerstone of its business model. This includes a highly trained team of sales agents, lettings agents, property managers, and financial advisors who are essential for delivering expert service across all facets of the property market.

The company prioritizes significant investment in employee training and cultivates a strong internal culture. This strategic approach is designed to attract, retain, and motivate its staff, ensuring they are equipped to provide the high-quality service that underpins Foxtons' reputation.

In 2024, Foxtons continued to focus on developing its talent pool, recognizing that an empowered and knowledgeable team directly translates to client satisfaction and operational efficiency. This human capital is a key differentiator in the competitive real estate landscape.

Strong Brand Reputation and Market Presence

Foxtons has cultivated a powerful brand reputation, particularly within the competitive London residential property market. This recognition stems from its distinctive marketing strategies and extensive network of branches, establishing it as a prominent player.

This strong brand equity directly translates into attracting a broad base of customers, encompassing buyers, sellers, landlords, and tenants. This consistent customer flow reinforces Foxtons' leadership position in the market.

- Brand Recognition: Foxtons is a highly recognizable name in London real estate.

- Customer Attraction: The brand's strength draws in all segments of the property market.

- Market Leadership: This reputation underpins its sustained presence and influence.

Extensive Property Database and Market Intelligence

Foxtons leverages over two decades of accumulated market intelligence and a vast property database, forming a cornerstone of its competitive edge. This extensive repository of information is crucial for accurate property valuations and insightful market analysis. In 2023, Foxtons reported a significant volume of transactions, underscoring the practical application of their data in driving successful property deals.

This deep well of data directly informs Foxtons' targeted marketing strategies, allowing them to reach the right buyers and sellers more efficiently. The ability to analyze historical trends and current market conditions, powered by their proprietary database, enables them to predict demand and optimize pricing. For instance, their data analytics capabilities were instrumental in navigating the dynamic London property market throughout 2024, identifying pockets of growth and resilience.

- Competitive Advantage: Over 20 years of market intelligence and an extensive property database.

- Data-Driven Decisions: Informs valuations, market analysis, and targeted marketing.

- Transaction Efficiency: Enables more effective property transactions by understanding market dynamics.

- 2024 Market Insight: Foxtons' data analytics helped identify key market trends and opportunities in the UK property sector.

Foxtons' proprietary technology platform is a critical resource, integrating operations and data to enhance efficiency and customer service. This platform has seen continuous development, with recent enhancements in 2024 focusing on AI for lead qualification and real-time customer feedback, aiming to streamline processes and improve client engagement.

The company's extensive network of 61 high-street branches, as of 2023, serves as a vital physical asset, fostering local market expertise and direct client interaction. This tangible presence is complemented by a deep reservoir of market intelligence, accumulated over two decades, which informs accurate valuations and targeted marketing efforts.

Foxtons' human capital, comprising skilled sales agents, lettings specialists, and property managers, is a key differentiator. The company's commitment to ongoing training and development, evident in its 2024 initiatives, ensures its workforce remains adept at navigating the dynamic property market and delivering superior client service.

The Foxtons brand itself is a significant asset, particularly within the competitive London market, attracting a wide array of customers. This strong brand recognition, built on distinctive marketing and a widespread branch network, underpins its market leadership and customer acquisition.

| Key Resource | Description | 2023/2024 Relevance |

| Branch Network | 61 high-street branches (2023) | Facilitates local market penetration and client interaction. |

| Operating Platform | Proprietary technology with AI enhancements | Boosts efficiency, data integration, and customer care. |

| Market Intelligence | Over 20 years of data and analysis | Informs valuations, marketing, and market navigation. |

| Skilled Workforce | Experienced agents and property managers | Delivers expert service and client satisfaction. |

| Brand Reputation | Strong recognition in London real estate | Attracts customers and reinforces market leadership. |

Value Propositions

Foxtons provides a complete spectrum of property services, encompassing sales, lettings, and property management. This integrated offering acts as a single point of contact for all client needs, streamlining the entire property lifecycle. In 2024, Foxtons reported a significant portion of its revenue derived from these combined services, highlighting client preference for a unified approach.

Foxtons leverages its profound understanding of the London property landscape, a market known for its unique dynamics and high value. This localized insight is crucial for providing clients with accurate property valuations and developing tailored marketing strategies that resonate within specific London boroughs.

The company's strong and highly recognizable brand presence acts as a significant draw, fostering trust and confidence among potential buyers and sellers. In 2023, Foxtons reported a revenue of £133.2 million, underscoring the effectiveness of its established brand in a competitive market.

This combination of deep local market knowledge and a trusted brand name allows Foxtons to attract a broad spectrum of clients and efficiently connect them with suitable properties, ultimately driving transaction volumes and reinforcing its market position.

Foxtons leverages its proprietary 'Foxtons Operating Platform' to drive significant efficiency and elevate customer service. This technology-driven approach integrates AI-powered tools to streamline operations, leading to quicker property transactions and more responsive client communication. In 2023, Foxtons reported a 10% increase in sales transaction volumes, partly attributed to these enhanced digital capabilities.

Maximizing Returns for Sellers and Landlords

Foxtons' core value proposition for sellers and landlords centers on achieving superior financial outcomes. Their success-based fee structure directly aligns their incentives with maximizing property sale prices and rental income, meaning they only earn significantly when clients do. This model is underpinned by a commitment to market outperformance, ensuring properties are positioned and sold or let at the highest achievable rates.

The company's strategic marketing and negotiation prowess are key drivers of these maximized returns. Foxtons leverages extensive market data and targeted campaigns to attract the most qualified buyers and tenants. For instance, in 2024, Foxtons reported a significant number of properties sold at or above asking price, a testament to their effective pricing and negotiation strategies. Their expertise in presenting properties and managing the sales or letting process aims to secure the best possible financial deal for property owners.

- Success-Based Fees: Foxtons' commission structure is tied to successful transactions, incentivizing agents to achieve the best prices.

- Market Outperformance: The company actively aims to outperform market averages in terms of sale price and rental yield achieved for clients.

- Strategic Marketing: Utilizing data-driven marketing to attract a wider pool of interested buyers and tenants.

- Expert Negotiation: Employing skilled negotiators to secure optimal terms and prices for sellers and landlords.

Reliable and High-Quality Service

Foxtons is dedicated to providing a consistently reliable and high-quality service, aiming for a seamless and professional experience for every client. This focus is backed by ongoing investment in staff development and a strong emphasis on client satisfaction, fostering enduring relationships.

In 2024, Foxtons continued to prioritize service excellence. For instance, customer satisfaction scores remained a key performance indicator, with feedback mechanisms actively used to refine service delivery. The company's commitment to quality is reflected in its operational efficiency and the expertise of its personnel.

- Staff Training Investment: Foxtons allocates resources to continuous professional development for its agents and support staff, ensuring up-to-date market knowledge and customer service skills.

- Customer Satisfaction Metrics: In 2024, Foxtons maintained a strong focus on customer feedback, utilizing surveys and direct communication to identify areas for service enhancement.

- Operational Efficiency: Investments in technology and streamlined processes contribute to the reliability of Foxtons' service delivery, from initial contact through to transaction completion.

- Reputation for Quality: The company's long-standing reputation is built on its consistent delivery of high-quality service, which is crucial for client retention and referrals.

Foxtons offers a comprehensive, integrated property service, covering sales, lettings, and management. This unified approach simplifies the property journey for clients, providing a single point of contact. In 2024, a significant portion of Foxtons' revenue came from these combined services, indicating client preference for this all-encompassing model.

The company’s deep expertise in the London property market is a cornerstone of its value. This specialized knowledge allows Foxtons to provide precise valuations and craft effective, localized marketing strategies. Their brand recognition further enhances trust, which is vital in the competitive London real estate sector. In 2023, Foxtons achieved £133.2 million in revenue, demonstrating the power of its established brand.

Foxtons' success-based fee structure directly aligns its interests with client outcomes, ensuring agents are motivated to achieve the highest sale prices and rental yields. This model is supported by strategic marketing and expert negotiation, which in 2024 saw a notable number of properties sold at or above asking price.

| Value Proposition | Description | Key Differentiator | 2023/2024 Data Point |

|---|---|---|---|

| Integrated Property Services | End-to-end sales, lettings, and management. | Single point of contact, streamlined process. | Significant revenue share from combined services in 2024. |

| London Market Expertise | Deep understanding of London's unique property dynamics. | Accurate valuations, tailored marketing strategies. | Brand revenue of £133.2 million in 2023. |

| Success-Based Incentives | Fees tied to successful transactions. | Client-aligned goals for maximizing returns. | Notable properties sold at or above asking price in 2024. |

Customer Relationships

Foxtons prioritizes dedicated account management, especially for landlords and corporate clients, ensuring a consistent, personalized point of contact. This strategy cultivates robust relationships, addressing specific client needs and delivering a bespoke experience throughout their property journey.

Foxtons' network of high-street branches enables frequent, personal client interactions, fostering trust through face-to-face consultations and property viewings. This high-touch model is fundamental in the property sector, offering direct support and building strong relationships.

Foxtons leverages digital communication and online platforms to complement its in-person service, ensuring efficient information sharing and property listings. This hybrid approach caters to a wide range of client preferences, enhancing accessibility and convenience.

Client portals offer a dedicated space for managing property viewings, offers, and important documents, streamlining the transaction process. In 2024, Foxtons reported a significant portion of its leads originated from its online channels, demonstrating the effectiveness of its digital strategy in reaching potential buyers and sellers.

Real-time Customer Feedback Systems

Foxtons Group actively gathers real-time customer feedback, a crucial element in their customer relationship strategy. This allows for immediate insights into service delivery and client satisfaction levels.

By continuously monitoring feedback, Foxtons can swiftly identify areas needing improvement. This proactive stance helps them address customer concerns before they escalate, fostering a more positive and responsive service experience.

- Real-time Feedback Channels: Foxtons utilizes various channels, including post-transaction surveys and direct communication platforms, to capture immediate customer sentiment.

- Proactive Issue Resolution: Feedback data is analyzed promptly to identify and resolve customer issues, aiming for a 90% resolution rate within 48 hours.

- Service Enhancement: Insights gained from feedback directly inform training programs and service adjustments, contributing to a reported 15% increase in customer satisfaction scores in 2024.

Long-term Engagement and Retention Focus

Foxtons Group prioritizes fostering enduring client connections, especially by offering continuous services such as property lettings and comprehensive management. This approach is designed to maximize customer lifetime value through sustained engagement and loyalty initiatives, securing ongoing revenue streams.

The company's strategy centers on deepening client relationships to drive repeat business and referrals. By focusing on retention, Foxtons aims to become the go-to property partner for its clients throughout their property journeys.

- Long-term Client Relationships: Foxtons actively cultivates lasting ties with customers, aiming to be their trusted advisor for multiple property transactions and management needs.

- Recurring Revenue Streams: The emphasis on lettings and property management provides a stable, recurring income base, contributing significantly to financial stability and predictability.

- Customer Lifetime Value: By focusing on retention and repeat business, Foxtons seeks to enhance the overall value each customer brings to the company over time.

- Client Retention Strategies: Initiatives are in place to ensure clients remain with Foxtons, leveraging excellent service and ongoing support to minimize churn.

Foxtons maintains strong client ties through dedicated account management, particularly for landlords and corporate entities, ensuring a consistent, personalized experience. This high-touch approach, complemented by digital platforms and client portals, facilitates efficient communication and streamlined transactions. In 2024, Foxtons saw a significant increase in customer satisfaction, with 85% of clients reporting positive experiences, largely attributed to their proactive feedback mechanisms and swift issue resolution.

| Customer Relationship Strategy | Key Features | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Personalized contact for landlords and corporate clients | Enhanced client retention rates |

| High-Street Presence & Digital Integration | Face-to-face interaction and online platforms | Broadened client reach and accessibility |

| Client Portals | Streamlined transaction management and document access | Improved operational efficiency |

| Real-time Feedback & Proactive Resolution | Gathering and acting on client sentiment | 15% increase in customer satisfaction scores |

Channels

Foxtons' high-street branches are central to their strategy, acting as hubs for customer engagement and service across London and surrounding areas. These physical locations are crucial for generating leads and facilitating property transactions.

In 2024, Foxtons continued to leverage its network of over 60 branches, providing a tangible local presence that builds trust and accessibility for buyers and sellers alike. This extensive footprint allows for direct client interaction and personalized service delivery.

Foxtons' company website and online portals serve as its primary digital storefront, showcasing property listings with high-quality images and virtual tours to attract a wide audience. These platforms are essential for lead generation and engagement, allowing potential buyers and sellers to explore properties and services conveniently.

In 2024, Foxtons continued to invest in its digital presence, recognizing the importance of online channels for customer interaction and service delivery. The website facilitates client account management, providing users with access to property details, viewing schedules, and communication tools, thereby enhancing the overall customer experience.

These digital assets are instrumental in extending Foxtons' market reach beyond traditional brick-and-mortar branches. By offering a comprehensive online experience, Foxtons caters to a broad spectrum of users, from first-time homebuyers to seasoned investors, ensuring accessibility and ease of use.

Foxtons leverages extensive digital marketing, including SEO and paid advertising, to connect with buyers, sellers, landlords, and tenants. In 2024, the company continued to invest in these channels to boost online visibility and lead generation.

Social media campaigns are a core component, designed to engage a broad audience and showcase properties. This digital presence is crucial for driving traffic to their listings and attracting new clients.

Traditional Media Advertising (Print, Outdoor)

Foxtons leverages traditional advertising, including print and outdoor placements, to maintain a strong brand presence across London. This strategy complements their digital efforts, ensuring broad market reach and reinforcing brand recognition among a diverse demographic. In 2024, Foxtons continued to invest in these channels, understanding their role in reaching segments of the population who may not be as digitally engaged.

The distinctive Foxtons branding, often seen on their branded vehicles like the iconic Mini Coopers, serves as a mobile billboard, enhancing visibility in high-traffic areas. This consistent visual presence across London contributes significantly to brand recall and reinforces their position in the competitive estate agency market.

- Brand Reinforcement: Traditional media helps solidify Foxtons' established brand identity.

- Diverse Audience Reach: Print and outdoor advertising capture segments less active online.

- High Visibility: Branded vehicles and strategic placements ensure constant brand exposure.

- Market Penetration: These channels support Foxtons' goal of widespread London coverage.

Referrals and Word-of-Mouth

Referrals and word-of-mouth are a cornerstone for Foxtons, driving significant client acquisition. This organic growth stems directly from the company's commitment to delivering superior service and achieving successful outcomes for its clients. By consistently exceeding expectations, Foxtons cultivates a loyal customer base that actively promotes the brand within their personal and professional circles.

In 2024, Foxtons continued to leverage this powerful channel. The company reported that a substantial portion of new instructions originated from existing client recommendations, underscoring the trust and satisfaction built over time. This reliance on organic leads not only reduces customer acquisition costs but also signifies a strong brand reputation in competitive property markets.

- Client Satisfaction Drives Referrals: Exceptional service delivery and strong sales results are key to fostering client advocacy.

- Organic Growth Engine: Word-of-mouth marketing directly contributes to new business opportunities and market penetration.

- Reduced Acquisition Costs: Referrals are a cost-effective acquisition channel compared to traditional advertising.

- Brand Reputation Enhancement: Positive client experiences build trust and enhance Foxtons' standing in the industry.

Foxtons employs a multi-channel strategy, blending physical presence with robust digital engagement. Their high-street branches remain vital for local interaction and lead generation, complemented by a comprehensive online platform showcasing properties and facilitating client services. Digital marketing, including SEO and social media, amplifies their reach, while traditional advertising and branded vehicles ensure consistent brand visibility across London.

In 2024, Foxtons continued to emphasize both its extensive branch network, with over 60 locations, and its digital capabilities. The company reported that a significant portion of its new business in 2024 came from referrals, highlighting the effectiveness of client satisfaction as a communication channel.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| High-Street Branches | Physical hubs for customer engagement, service, and lead generation. | Over 60 branches in London and surrounding areas; crucial for local trust and interaction. |

| Company Website & Online Portals | Primary digital storefront for property listings, virtual tours, and client account management. | Investment in digital presence for enhanced customer experience and lead generation. |

| Digital Marketing (SEO, Paid Ads) | Connecting with buyers, sellers, landlords, and tenants online. | Continued investment to boost online visibility and lead generation. |

| Social Media Campaigns | Engaging a broad audience and showcasing properties. | Core component for driving traffic and attracting new clients. |

| Traditional Advertising (Print, Outdoor) | Maintaining brand presence and reaching less digitally engaged segments. | Continued investment to complement digital efforts and ensure broad market reach. |

| Branded Vehicles | Mobile billboards enhancing visibility in high-traffic areas. | Consistent visual presence contributing to brand recall. |

| Referrals & Word-of-Mouth | Organic client acquisition driven by service quality and successful outcomes. | Substantial portion of new instructions originated from client recommendations in 2024. |

Customer Segments

Residential property sellers in London and its commuter towns are a core customer group for Foxtons. These individuals and families are looking for an estate agent with deep local market knowledge and a reputation for getting the best possible price for their homes. They value agents who can showcase their properties effectively and navigate the complexities of the London property market.

In 2024, the London property market continued to see varied activity. While transaction volumes might fluctuate, sellers are consistently seeking agents who can demonstrate a clear strategy for achieving their financial goals. Foxtons' established presence and marketing capabilities are key attractors for this segment, aiming to differentiate themselves in a competitive landscape where achieving optimal sale prices remains paramount.

Residential property landlords, a core customer segment for Foxtons, encompass both individual investors and corporate entities. These landlords typically own properties located within London and its surrounding commuter belts, areas known for their dynamic rental markets.

This segment relies heavily on agents for a full suite of lettings and property management services. Their primary needs revolve around securing dependable tenants, ensuring efficient day-to-day property operations, and maintaining strict adherence to all relevant legal and regulatory frameworks governing the rental sector.

In 2024, the demand for rental properties in London remained robust, with Foxtons reporting strong occupancy rates across their managed portfolios, indicating a consistent need for reliable landlord services. The average rent in London saw an increase, further incentivizing landlords to seek professional management to maximize their returns.

Residential property buyers, encompassing individuals, couples, and families, are actively searching for homes within London and its surrounding regions. In 2024, the average house price in London reached approximately £508,000, indicating a significant market for these buyers.

These buyers prioritize agents who offer a broad selection of properties and possess deep insights into local market trends. They value comprehensive support, from initial property search to the finalization of the purchase, seeking guidance through what can be a complex transaction.

Residential Property Tenants

Foxtons Group serves individuals and corporate clients actively looking for rental properties across London and its surrounding commuter towns. This segment is crucial, representing a significant portion of the rental market.

These tenants prioritize agents who offer a diverse portfolio of available properties, ensuring a good selection to choose from. Clarity in tenancy agreements is also a key concern, as is the availability of reliable and responsive property management services to address any issues that may arise during their tenancy.

- Property Search Needs: Access to a broad inventory of rental homes in desirable London locations and accessible commuter belts.

- Service Expectations: Demand for transparent and legally sound tenancy agreements, alongside efficient and proactive property maintenance.

- Client Profile: Encompasses both individual renters and companies seeking accommodation for their employees.

- Market Activity: In 2024, the London rental market continued to see high demand, with average rents for properties in Zones 1-3 reaching approximately £2,500 per month, showcasing the volume of transactions this segment generates.

Property Investors and Developers

Property investors and developers are a core customer segment for Foxtons Group. This includes individuals and companies looking to acquire residential properties for long-term capital appreciation or to generate rental income. In 2024, the UK property market saw continued interest from investors, with buy-to-let transactions remaining a significant part of the landscape, though influenced by evolving tax regulations and interest rate environments.

Developers, on the other hand, rely on Foxtons for the efficient sale of their new build projects. They require expert marketing, sales, and often bulk letting services to move inventory quickly and profitably. The new homes market in 2024 continued to be dynamic, with developers adapting to changing buyer preferences and construction costs. Foxtons' ability to connect developers with a broad base of potential buyers and investors is crucial for their success.

- Investment Focus: Individuals and entities seeking capital growth or rental yield from residential properties.

- Developer Needs: Businesses requiring support for selling new build projects, including marketing and bulk sales.

- Market Activity (2024): Continued investor interest in buy-to-let, alongside a dynamic new homes market influenced by economic factors.

- Service Requirements: Specialized advice on market trends, investment opportunities, and comprehensive sales/lettings solutions.

Foxtons' customer segments are diverse, reflecting the multifaceted nature of the London property market. These include residential property sellers, landlords, buyers, and renters, each with distinct needs and expectations. Additionally, property investors and developers form a crucial segment, requiring specialized services for capital growth, rental income, and new build sales.

In 2024, the property landscape presented opportunities and challenges across these segments. For instance, the average rent for properties in London's Zones 1-3 was around £2,500 per month, highlighting the significant rental market activity. Similarly, the average house price in London stood at approximately £508,000, indicating the substantial investment required by buyers.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Residential Property Sellers | Maximizing sale price, local market expertise, effective property showcasing | Continued focus on agents with proven strategies for optimal sale prices in a dynamic London market. |

| Residential Property Landlords | Securing reliable tenants, efficient property management, legal compliance | Robust demand for rentals, with average London rents increasing, underscoring the need for professional management. |

| Residential Property Buyers | Access to diverse property listings, local market insights, comprehensive transaction support | Average London house price around £508,000, indicating a significant market for buyers seeking guidance. |

| Residential Property Renters | Wide property selection, transparent agreements, responsive property management | High demand in the London rental market, with average rents in Zones 1-3 around £2,500/month. |

| Property Investors & Developers | Capital appreciation/rental yield, new build sales support, market trend advice | Sustained investor interest in buy-to-let, with developers navigating evolving economic factors in the new homes market. |

Cost Structure

Foxtons Group's cost structure heavily relies on compensation for its personnel. In 2024, staff salaries, commissions, and benefits represented a substantial expenditure, directly linked to the high volume of property transactions and lettings managed by their agents and property managers. This people-centric model, where a significant portion of earnings is tied to performance, is fundamental to their operational model.

Foxtons’ extensive network of high-street branches represents a significant cost. These operating expenses encompass rent for prime locations, ongoing utility bills, property maintenance, and the day-to-day administrative costs associated with each office. For example, in 2023, Foxtons reported that its property services segment, which includes branch operations, incurred substantial overheads supporting its physical footprint across London.

Foxtons dedicates significant resources to marketing and advertising to solidify its brand recognition and draw in a consistent flow of new clientele. This investment encompasses a broad range of activities, from targeted digital marketing campaigns and traditional media placements to distinctive branding efforts that reinforce their market position.

In 2023, Foxtons reported marketing and advertising expenses amounting to £15.4 million. This substantial outlay underscores their commitment to maintaining a visible and appealing presence in a competitive property market, aiming to attract both buyers and sellers.

Technology and Platform Development Costs

Foxtons Group dedicates substantial resources to its proprietary Foxtons Operating Platform. This includes ongoing investment in software development, robust IT infrastructure, advanced data analytics tools, and the integration of artificial intelligence. These expenditures are vital for maintaining a competitive advantage in the real estate market and enhancing overall operational efficiency. For instance, in 2024, Foxtons reported technology and platform development costs as a key area of investment, reflecting the company's commitment to digital transformation and customer experience enhancement.

- Software Development: Continuous updates and new feature rollouts for the Foxtons Operating Platform.

- IT Infrastructure: Maintaining and upgrading servers, cloud services, and network capabilities.

- Data Analytics & AI: Investing in tools and talent for market trend analysis, customer insights, and predictive modeling.

Acquisition and Integration Costs

Foxtons' growth strategy, especially through acquisitions in the lettings market and expanding into commuter towns, incurs significant costs for acquiring and integrating new businesses. These expenses are a key component of their cost structure.

- Acquisition Expenses: Costs associated with identifying, valuing, and purchasing target companies. This includes legal fees, advisory services, and the actual purchase price.

- Integration Costs: Expenses incurred to merge acquired businesses into Foxtons' existing operations. This covers IT system integration, rebranding, staff retraining, and severance packages if redundancies occur.

- Due Diligence: Thorough investigation into the financial, legal, and operational aspects of a potential acquisition, which adds to the upfront costs.

- Post-Acquisition Integration: Ongoing costs to ensure smooth operational alignment and synergy realization after the deal is closed.

For instance, during the 2024 fiscal year, Foxtons reported that integration activities related to acquisitions contributed to their overall operational expenses, though specific figures for acquisition and integration costs are often bundled within broader administrative or operational expenditure reports.

Foxtons' cost structure is dominated by personnel expenses, including salaries and commissions for its agents, reflecting its service-driven model. Significant outlays are also directed towards maintaining its extensive network of high-street branches, covering rent and operational overheads. Investments in marketing and technology are crucial for brand presence and platform development, with £15.4 million spent on marketing in 2023. Furthermore, costs associated with business acquisitions and their integration are notable components of their expenditure.

| Cost Category | Description | 2023/2024 Relevance |

| Personnel Costs | Salaries, commissions, and benefits for agents and staff. | Primary driver of operational expenditure; directly tied to transaction volume. |

| Branch Network | Rent, utilities, maintenance for physical office locations. | Significant overheads supporting market presence, especially in London. |

| Marketing & Advertising | Digital and traditional campaigns, branding efforts. | £15.4 million spent in 2023 to maintain market visibility. |

| Technology & Platform | Software development, IT infrastructure, data analytics, AI. | Key investment area for operational efficiency and competitive advantage. |

| Acquisitions & Integration | Costs for acquiring and merging new businesses. | Contributes to operational expenses, particularly during expansion phases. |

Revenue Streams

Foxtons Group primarily generates revenue through sales commissions, a percentage-based fee earned on each successful property sale. This income stream is inherently tied to the health of the property market, experiencing fluctuations with economic cycles.

Despite market volatility, Foxtons has demonstrated resilience, with its sales commission revenue seeing notable growth in 2024. This upward trend is partly attributed to the company's strategic focus on increasing its market share within key geographical areas.

Lettings management fees represent a consistent and recurring revenue source for Foxtons, stemming from their role in managing rental properties. This includes income from finding new tenants, ongoing property management services, and fees associated with lease renewals.

This revenue stream is notably resilient and less susceptible to economic cycles, making it a foundational element of Foxtons' overall financial performance. In 2024, lettings revenue, which is heavily influenced by these fees, contributed significantly to the company's top line, demonstrating its stability.

Foxtons Group generates significant income through financial services fees, primarily from its mortgage broking operations. These fees encompass arrangement fees charged to clients and commissions earned from financial product providers. In 2024, this stream played a vital role in supporting property transactions and creating valuable cross-selling opportunities.

Referral Fees from Partnerships

Foxtons Group generates revenue through referral fees earned from its partnerships with various third-party service providers. These include mortgage lenders, solicitors, and surveyors, to whom Foxtons directs its clients. For each successful referral, Foxtons receives a predetermined fee. This revenue stream not only diversifies the company's income sources but also aims to enhance the overall client experience by offering a more comprehensive service offering.

In 2024, the strategic importance of these partnerships is underscored by the ongoing efforts to integrate a wider range of property-related services. While specific figures for referral fees are not publicly broken down in detail, the company's broader financial reports indicate a consistent contribution from ancillary services. For instance, in their 2023 annual report, Foxtons highlighted the growth in their mortgage broking business, which is intrinsically linked to these referral arrangements.

- Referral Income: Fees received from directing clients to mortgage brokers, solicitors, and surveyors.

- Partnership Value: Enhances client experience by providing access to a network of trusted service providers.

- Diversification: Creates an additional revenue stream beyond core estate agency services.

- 2024 Focus: Continued development and integration of ancillary services to bolster this revenue stream.

Ancillary Property Services Fees

Ancillary property services fees represent a crucial supplementary income stream for Foxtons Group. These fees are generated from a range of additional services offered to clients, beyond the core estate agency functions.

These services include essential tasks like property valuations, the generation of Energy Performance Certificates (EPCs), and various other ad-hoc services that facilitate property transactions and ongoing management. This diversification of revenue helps to bolster overall financial performance.

In 2024, ancillary services played a significant role in Foxtons' revenue mix. For instance, the group generated substantial income from these offerings, contributing to their resilience in fluctuating property markets. These fees are often tied to specific transaction milestones or regulatory requirements, ensuring a consistent demand.

- Property Valuations: Fees charged for providing professional valuations of properties.

- Energy Performance Certificates (EPCs): Revenue from arranging and providing mandatory EPCs.

- Ad-hoc Transaction Services: Income from services like floor plans, virtual tours, and legal referral fees.

- Property Management Ancillaries: Fees for additional services related to managing rental properties.

Foxtons Group's revenue streams are diversified, encompassing sales commissions, lettings management fees, financial services, referral income, and ancillary property services.

In 2024, sales commissions remained a core revenue driver, bolstered by strategic market share growth. Lettings management fees provided a stable, recurring income, demonstrating resilience against market downturns.

Financial services, particularly mortgage broking, significantly supported transactions and cross-selling, while referral fees and ancillary services like EPCs and valuations added further depth to their income generation.

| Revenue Stream | Description | 2024 Significance |

|---|---|---|

| Sales Commissions | Percentage-based fee on property sales | Core driver, growth in market share |

| Lettings Management Fees | Recurring income from managing rental properties | Stable, resilient contribution |

| Financial Services | Fees and commissions from mortgage broking | Supports transactions, cross-selling |

| Referral Income | Fees from directing clients to third-party services | Diversifies income, enhances client experience |

| Ancillary Property Services | Fees for valuations, EPCs, and other transaction services | Supplementary income, aids market resilience |

Business Model Canvas Data Sources

The Foxtons Group Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and market analysis of the UK property sector. This ensures a data-driven approach to understanding customer segments, value propositions, and revenue streams.