Fortive PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortive Bundle

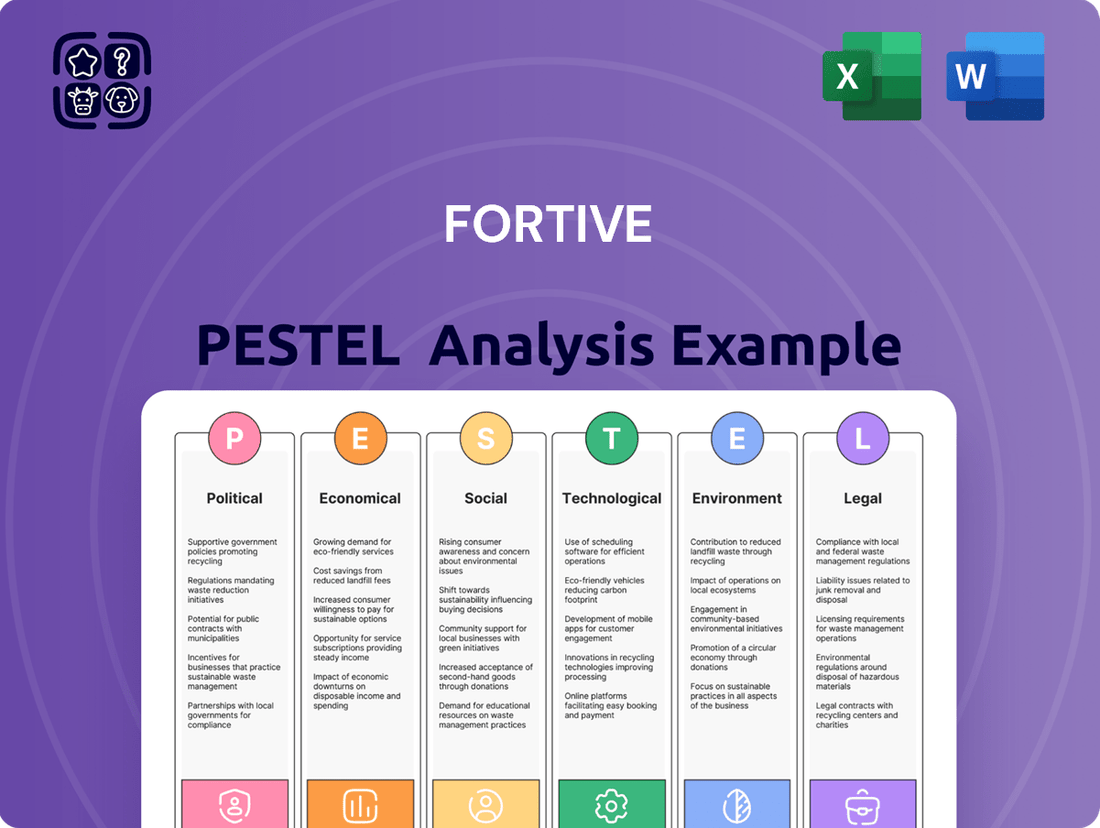

Fortive operates within a dynamic global landscape, and understanding the political, economic, social, technological, environmental, and legal forces at play is crucial for strategic success. Our comprehensive PESTLE analysis dives deep into these external factors, revealing how they are shaping Fortive's current operations and future trajectory. Don't get left behind; gain a competitive edge by understanding the complete picture. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government regulations heavily influence Fortive's Advanced Healthcare Solutions. New rules for medical device approvals, such as those from the FDA, can extend product launch timelines and increase R&D expenses. For instance, the FDA's 2024 guidance on artificial intelligence in medical devices necessitates rigorous validation, impacting development cycles.

Data privacy laws like HIPAA are crucial, requiring substantial investment in cybersecurity and data management to protect patient information. Failure to comply can result in significant fines, as seen with past healthcare data breaches costing millions. Fortive must continually adapt its systems to meet these evolving compliance standards.

Global trade policies, including tariffs and trade agreements, directly impact Fortive's supply chain and manufacturing costs, particularly for its industrial technologies and instrumentation segments. For instance, the ongoing trade tensions between major economies can lead to increased import duties on components or finished goods, affecting profitability.

Recent tariffs, especially those impacting U.S.-China trade, have presented challenges by potentially raising production expenses and squeezing profit margins. Fortive's strategy to counter these effects includes implementing pricing adjustments and strategically shifting its supply chain to more favorable locations.

Geopolitical instability presents a significant challenge for Fortive. For instance, ongoing conflicts in Eastern Europe and the Middle East can disrupt global supply chains, impacting the availability and cost of components essential for Fortive's manufacturing processes. These uncertainties also dampen international market demand and can delay crucial investment decisions in affected regions.

Fortive's extensive global presence, operating in over 50 countries, inherently exposes it to a wide array of political risks. Fluctuations in trade policies, the imposition of sanctions, or sudden changes in regulatory environments in any of these operating regions can directly affect the company's revenue streams and operational efficiency. For example, a trade dispute between major economic blocs could increase tariffs on imported goods, raising costs for Fortive.

Government Spending and Infrastructure Projects

Government spending on infrastructure, transportation, and advanced manufacturing directly impacts Fortive's Intelligent Operating Solutions and Precision Technologies segments. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1 trillion allocated, continues to drive demand for the types of professional instrumentation and industrial technologies Fortive provides, particularly in areas like smart grid development and transportation upgrades through 2024 and beyond. Fluctuations in government budget allocations and the speed of project deployment can create variability in demand, but long-term commitments, such as those seen in national manufacturing modernization initiatives, offer a more stable outlook for companies like Fortive.

Key impacts include:

- Increased Demand: Government investment in infrastructure projects directly boosts demand for Fortive's sensing, measurement, and diagnostic tools.

- Budgetary Sensitivity: Changes in government spending priorities or budget shortfalls can lead to project delays or cancellations, affecting revenue.

- Long-Term Stability: Sustained government focus on sectors like smart manufacturing and transportation ensures a consistent, albeit potentially variable, revenue stream.

- Regulatory Alignment: Government initiatives promoting efficiency and sustainability in industrial operations often align with Fortive's product offerings.

Political Stability in Key Markets

Political stability in countries where Fortive operates, such as the United States and Germany, is paramount for its global operations. For instance, in 2024, the US election cycle could introduce policy shifts impacting manufacturing and technology sectors, which are core to Fortive's businesses. Uncertainty stemming from geopolitical tensions, like those in Eastern Europe impacting supply chains, can directly affect operational costs and market access.

Fortive's strategic move to spin off its Precision Technologies segment into Ralliant in 2024 reflects a response to these dynamic market conditions, allowing for more focused management of diverse political and economic landscapes. This separation aims to enhance agility in navigating varying regulatory environments and trade policies across its operating regions, which is critical for maintaining consistent performance and investment planning.

- Geopolitical Risks: Ongoing conflicts and trade disputes can disrupt supply chains and increase operational expenses for companies like Fortive.

- Regulatory Environments: Shifting government regulations in key markets, such as environmental standards or data privacy laws, require continuous adaptation.

- Economic Policies: Government fiscal and monetary policies directly influence consumer spending and business investment, impacting demand for Fortive's products.

- Political Stability Index: Countries with higher political stability generally offer a more predictable business environment, reducing investment risk.

Government investment in infrastructure, such as the U.S. Infrastructure Investment and Jobs Act, continues to drive demand for Fortive's instrumentation and sensing technologies through 2024 and into 2025. Regulatory changes, particularly concerning data privacy and cybersecurity in healthcare, necessitate ongoing compliance investments for its Advanced Healthcare Solutions segment. Trade policies and geopolitical stability remain critical, with companies like Fortive actively managing supply chain risks and adapting to evolving international trade agreements.

What is included in the product

This PESTLE analysis delves into how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, specifically impact Fortive's operations and strategic decision-making.

Fortive's PESTLE analysis offers a structured framework to proactively identify and address external challenges, thereby alleviating the pain of unexpected market shifts and regulatory hurdles.

Economic factors

Fortive's business is inherently linked to the health of the global economy and the pace of industrial activity. When manufacturing, transportation, and other industrial sectors are booming, demand for Fortive's diverse product and service portfolio tends to rise. Conversely, a slowdown in these areas can present challenges.

The economic landscape in late 2023 and early 2024 has presented a mixed picture. While some industrial segments have shown resilience, others have experienced softer demand, leading to slower core revenue growth for Fortive in certain divisions. This reflects broader macroeconomic trends, including inflationary pressures and shifting consumer spending patterns.

Despite these headwinds, Fortive has continued to exhibit robust operating performance. The company's ability to generate strong cash flow remains a key strength, even amidst a more challenging growth environment. For instance, in the fourth quarter of 2023, Fortive reported a 5% increase in revenue to $1.7 billion, with particular strength in its Intelligent Vehicle solutions segment.

Rising inflation and the associated increases in raw material and component costs present a significant challenge for Fortive, potentially squeezing its profitability. For instance, global supply chain disruptions in 2024 continued to exert upward pressure on input prices across various industries.

Fortive has strategically responded by emphasizing operational efficiency improvements and implementing targeted pricing adjustments to counteract these escalating costs. This proactive approach is crucial for mitigating the impact of inflationary headwinds.

The company's commitment to cost management is evidenced by its consistent gross profit margins, which have remained robust, hovering around the 60% mark. This stability in margins, even amidst challenging economic conditions in 2024 and early 2025, suggests successful navigation of supply chain and inflationary pressures.

Currency exchange rate fluctuations present a significant challenge for Fortive, a global enterprise operating in over 50 countries. These shifts can negatively impact the company's reported revenue growth. For instance, during the first quarter of 2024, Fortive noted that foreign currency headwinds reduced its revenue by approximately 0.5% compared to the prior year's period.

Managing the financial implications of these currency movements is a continuous and critical task for Fortive. The company actively employs hedging strategies and operational adjustments to mitigate the volatility associated with foreign exchange. This proactive approach is essential for maintaining financial stability and predictable performance in its diverse international markets.

Interest Rates and Access to Capital

Changes in interest rates directly impact Fortive's borrowing costs and its capacity to finance strategic moves like acquisitions or expansion projects. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and into early 2025, as widely anticipated, Fortive's cost of new debt will remain elevated compared to periods of lower rates.

Fortive's financial strategy, characterized by a moderate debt-to-equity ratio, currently around 0.40 as of Q1 2024, indicates a cautious stance on leverage. This approach offers Fortive a degree of insulation from significant fluctuations in borrowing costs, allowing for more predictable financial planning even amidst potential interest rate shifts.

- Interest Rate Environment: The Federal Reserve's benchmark interest rate remained at 5.25%-5.50% through mid-2024, influencing borrowing costs for companies like Fortive.

- Cost of Debt: Higher interest rates increase the expense of servicing existing variable-rate debt and the cost of issuing new debt for capital expenditures or acquisitions.

- Acquisition Funding: Elevated interest rates can make debt-financed acquisitions more expensive, potentially impacting Fortive's M&A strategy and deal valuations.

- Debt-to-Equity Ratio: Fortive's conservative leverage, with a debt-to-equity ratio around 0.40 in early 2024, provides a buffer against interest rate volatility.

Market Demand and Customer Spending

Customer spending is a major driver for Fortive, particularly in its core sectors like healthcare, manufacturing, and utilities. When these industries invest, demand for Fortive's workflow solutions, which are crucial for their operations, naturally rises.

For instance, the healthcare sector, a significant market for Fortive, saw robust growth in medical device spending in 2024, driven by increased demand for diagnostics and treatment technologies. Conversely, certain manufacturing segments experienced more subdued investment in 2024 due to global economic uncertainties, impacting capital expenditure.

Fortive's strategic emphasis on essential, mission-critical technologies provides a degree of resilience. These are not discretionary purchases; they are fundamental to the functioning of vital services, ensuring demand remains relatively stable even when broader economic conditions are less favorable.

- Healthcare spending in 2024 was projected to increase by 5-7% globally, benefiting companies providing essential medical workflow tools.

- Industrial automation investments, key for manufacturing clients, showed a mixed picture in 2024, with some sub-sectors like semiconductors seeing strong demand while others faced headwinds.

- Fortive's recurring revenue model, often tied to service and maintenance of critical equipment, helps buffer against fluctuations in new capital spending by customers.

Economic factors significantly influence Fortive's performance, with global industrial activity and customer spending being key drivers. While inflation and currency fluctuations presented challenges in 2024, Fortive's focus on operational efficiency and essential technologies has maintained its financial stability.

The company's robust cash flow generation, exemplified by a 5% revenue increase to $1.7 billion in Q4 2023, and stable gross profit margins around 60% highlight its resilience. Fortive's conservative debt-to-equity ratio of approximately 0.40 in early 2024 also provides a buffer against interest rate volatility.

Looking ahead to 2024 and early 2025, continued vigilance regarding economic shifts, particularly in customer spending within healthcare and manufacturing, will be crucial. Fortive's strategic positioning in mission-critical solutions is expected to support consistent demand.

| Economic Factor | Impact on Fortive | 2024/2025 Data/Trend |

|---|---|---|

| Global Industrial Activity | Drives demand for Fortive's products and services. | Mixed resilience in industrial segments, with some softer demand observed in early 2024. |

| Inflationary Pressures | Increases raw material and component costs, potentially impacting profitability. | Continued upward pressure on input prices due to global supply chain disruptions in 2024. |

| Currency Exchange Rates | Affects reported revenue growth for a global enterprise. | Foreign currency headwinds reduced revenue by ~0.5% in Q1 2024. |

| Interest Rates | Impacts borrowing costs and acquisition funding. | Federal Reserve target rate maintained at 5.25%-5.50% through mid-2024, increasing debt servicing costs. |

| Customer Spending | Key driver, particularly in healthcare and manufacturing. | Robust growth in healthcare medical device spending in 2024; mixed industrial automation investments. |

Preview Before You Purchase

Fortive PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fortive provides actionable insights into the political, economic, social, technological, legal, and environmental factors impacting the company's strategic decisions. You'll gain a deep understanding of the external forces shaping Fortive's business landscape.

Sociological factors

Fortive, employing over 18,000 individuals worldwide, navigates the sociological landscape by focusing on attracting and retaining talent in demanding industrial and healthcare technology sectors. This involves addressing the complexities of a global, diverse workforce and ensuring a pipeline of skilled professionals.

The company's commitment to cultivating an inclusive environment and prioritizing employee development is paramount. For instance, in 2023, Fortive reported a significant investment in employee training and development programs, aiming to upskill its workforce to meet evolving industry demands and foster internal career progression.

Fortive's commitment to workplace safety and health is a core tenet, directly influencing its product development and operational standards. The company actively promotes robust safety protocols for its own workforce, recognizing that exemplary internal practices enhance the credibility and effectiveness of its safety solutions for customers. This focus is integral to its sustainability strategy and its mission to foster a safer global environment.

Societal expectations are increasingly pushing companies like Fortive to prioritize environmental, social, and governance (ESG) factors. This means a greater focus on how businesses impact the planet, their employees, and how they are managed. For instance, in 2023, Fortive reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating a tangible response to these evolving demands.

These heightened expectations directly influence Fortive's operational strategies and public reporting. The company is committed to transparency, regularly publishing sustainability reports that detail their progress and future targets. Their 2024-2025 sustainability roadmap includes ambitious goals for water conservation and waste diversion, reflecting a proactive approach to meeting societal calls for responsible corporate citizenship.

Impact on Healthcare and Public Well-being

Fortive's Advanced Healthcare Solutions directly bolsters public well-being by supplying essential products and services for critical healthcare functions like sterilization and enhancing clinical efficiency. The growing societal imperative for more effective and safer healthcare systems fuels the demand for these advanced solutions. For instance, in 2023, the global medical sterilization market was valued at approximately $10.5 billion, with a projected compound annual growth rate (CAGR) of 7.2% through 2030, indicating a strong and expanding need for Fortive's offerings.

Societal trends such as an aging global population and increased awareness of healthcare-associated infections are significant drivers for Fortive's healthcare segment. These demographic shifts and public health concerns translate into a greater demand for reliable sterilization technologies and improved patient care workflows, areas where Fortive specializes. The company's focus on clinical productivity solutions also addresses the societal pressure to optimize healthcare resource utilization and improve patient outcomes.

- Aging Population: Globally, the proportion of people aged 65 and over is projected to reach 16% by 2050, increasing demand for healthcare services and associated technologies.

- Infection Control: Healthcare-associated infections remain a significant public health concern, driving investment in advanced sterilization and disinfection solutions.

- Healthcare Efficiency: Societies are increasingly focused on improving the efficiency and cost-effectiveness of healthcare delivery, creating opportunities for solutions that streamline clinical workflows.

- Technological Adoption: Growing acceptance and demand for advanced medical technologies by both healthcare providers and patients further support Fortive's market position.

Changing Consumer and Industrial Needs

Consumer and industrial needs are constantly shifting, pushing companies like Fortive to adapt. Trends such as increased automation, a greater focus on digitalization, and the growing importance of sustainability are directly influencing what customers want and need from industrial technology and connected workflow solutions. For instance, the global industrial automation market was valued at approximately $174.4 billion in 2023 and is projected to reach $303.6 billion by 2030, demonstrating a clear demand for these advanced solutions.

Fortive's success hinges on its capacity to not only recognize but also proactively address these evolving demands through continuous innovation. By developing and launching new products that align with these emerging trends, Fortive can maintain its competitive edge and ensure its offerings remain relevant in a dynamic marketplace. This adaptability is crucial for capturing market share and driving future growth.

Key areas of evolving demand include:

- Increased demand for smart, connected devices: Businesses are seeking integrated systems that offer real-time data and remote monitoring capabilities.

- Focus on efficiency and productivity gains: Solutions that automate processes and optimize workflows are highly sought after to reduce operational costs.

- Growing emphasis on sustainability: Customers are prioritizing technologies that help them reduce their environmental impact, such as energy-efficient equipment and waste reduction solutions.

- Digital transformation initiatives: Companies are investing in digital tools to improve data management, customer engagement, and overall operational agility.

Societal shifts significantly impact Fortive's strategic direction, particularly concerning workforce expectations and corporate responsibility. The company's focus on attracting and retaining a skilled global workforce, evidenced by its 2023 investments in training, directly addresses the need for specialized talent in its core sectors. Furthermore, Fortive's proactive stance on ESG, including a 10% reduction in Scope 1 and 2 emissions by 2023 from a 2019 baseline, aligns with growing public and investor demands for sustainable business practices.

The aging global population and heightened awareness of infection control are critical sociological factors driving demand for Fortive's Advanced Healthcare Solutions. These trends underscore the need for effective sterilization and improved clinical workflows, markets where Fortive holds a strong position. The global medical sterilization market's estimated $10.5 billion valuation in 2023, with a projected 7.2% CAGR, highlights the substantial societal imperative for these technologies.

Evolving consumer and industrial needs, such as the demand for automation and digitalization, necessitate continuous innovation from Fortive. The industrial automation market's significant growth, valued at $174.4 billion in 2023 and projected to reach $303.6 billion by 2030, demonstrates a clear societal push towards more efficient and connected industrial processes. Fortive's ability to adapt its product offerings to these shifting preferences is key to maintaining its market relevance.

| Sociological Factor | Impact on Fortive | Supporting Data/Trend |

| Workforce Expectations & Development | Attracting and retaining skilled talent; fostering internal growth | 2023 investment in employee training programs; global workforce of 18,000+ |

| Corporate Social Responsibility (CSR) & ESG | Meeting societal demands for sustainability and ethical operations | 10% reduction in Scope 1 & 2 emissions (2023 vs. 2019 baseline); 2024-2025 sustainability roadmap |

| Healthcare Needs (Aging Population, Infection Control) | Increased demand for sterilization and clinical efficiency solutions | Global medical sterilization market: $10.5B (2023), 7.2% CAGR projection |

| Industrial Automation & Digitalization | Demand for smart, connected devices and process optimization | Industrial automation market: $174.4B (2023), projected to reach $303.6B by 2030 |

Technological factors

Fortive's commitment to intelligent operating and connected workflow solutions places technological advancements, particularly in automation and AI, at the forefront of its strategy. By embedding AI into its product offerings, Fortive aims to deliver significant boosts in efficiency and productivity for its manufacturing and industrial clients.

These AI integrations are designed to provide predictive maintenance, optimize production processes, and offer real-time data analytics, thereby enhancing customer operational performance. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the substantial investment and growth in this area, which Fortive is poised to leverage.

The increasing prevalence of the Internet of Things (IoT) and the demand for interconnected solutions offer substantial growth avenues for Fortive. The company's portfolio, particularly in professional instrumentation and industrial technologies, is increasingly integrating connectivity to deliver real-time data and actionable insights, thereby enhancing operational efficiency for its clientele.

For instance, Fortive's Fluke brand, a leader in test and measurement equipment, is actively developing connected diagnostic tools. These tools allow for remote monitoring and data analysis, which is crucial for industries aiming to optimize maintenance schedules and reduce downtime. As of early 2024, the global IoT market was projected to reach over $1.1 trillion, underscoring the immense potential for companies like Fortive that are capitalizing on this trend.

Fortive's Precision Technologies segment, which now operates largely under the Ralliant name following its spin-off, thrives on advancements in electronic test and measurement. These innovations are crucial for maintaining its edge in a rapidly evolving market.

For instance, the demand for faster, more accurate diagnostic tools in sectors like automotive and aerospace directly fuels the need for new precision technologies. In 2023, the global electronic test and measurement market was valued at approximately $30 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, highlighting the significant opportunities driven by technological progress.

Cybersecurity and Data Protection

As Fortive expands its connected workflow solutions, cybersecurity and data protection are critical. Protecting sensitive customer and operational data is essential for maintaining trust and operational integrity. The increasing sophistication of cyber threats necessitates continuous investment in advanced security protocols and threat detection capabilities.

Adherence to evolving data privacy regulations, such as GDPR and CCPA, presents a significant technological and legal challenge. Fortive must ensure its data handling practices align with these stringent requirements to avoid penalties and reputational damage. By 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the immense financial and operational risks associated with inadequate data protection.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, highlighting the financial impact of security failures.

- Regulatory Fines: Non-compliance with data privacy laws can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue.

- Customer Trust: Robust data protection is directly linked to customer confidence; a breach can erode trust and lead to significant customer attrition.

- Technological Investment: Companies are increasing spending on cybersecurity solutions, with global cybersecurity spending expected to exceed $200 billion in 2024.

Research and Development Investment

Fortive consistently prioritizes research and development (R&D) to fuel innovation and maintain its market leadership. This commitment is evident in its strategic allocation of resources across its diverse business segments, aiming to introduce cutting-edge products and solutions. For instance, in fiscal year 2023, Fortive reported R&D expenses of $657 million, representing approximately 5.6% of its net revenue. This sustained investment underscores the company's dedication to developing new technologies that drive growth and enhance customer value.

The company's R&D efforts are strategically focused on areas that promise significant market impact and competitive advantage. This includes developing advanced software solutions, improving product performance, and exploring new applications for its existing technologies. Fortive’s approach to innovation is not just about incremental improvements but also about creating disruptive technologies that can reshape industries. This forward-looking strategy is crucial for its long-term success in a rapidly evolving technological landscape.

- R&D Investment: Fortive invested $657 million in R&D in fiscal year 2023.

- Percentage of Revenue: R&D spending represented approximately 5.6% of Fortive's net revenue in 2023.

- Strategic Focus: Investment is directed towards new product introductions and technological advancements across all business segments.

- Competitive Edge: Sustained R&D is critical for maintaining Fortive's competitive position and driving top-line growth.

Fortive's strategic focus on intelligent operating and connected workflow solutions is heavily reliant on technological advancements, particularly in automation and artificial intelligence (AI). The company aims to embed AI into its product offerings to significantly boost efficiency and productivity for its manufacturing and industrial clients, with AI integrations designed for predictive maintenance and real-time data analytics.

The increasing prevalence of the Internet of Things (IoT) and the demand for interconnected solutions present substantial growth avenues for Fortive, especially within its professional instrumentation and industrial technologies segments. These segments are increasingly integrating connectivity to provide real-time data and actionable insights, enhancing operational efficiency for customers.

Fortive's Precision Technologies segment, now largely operating under the Ralliant name, thrives on innovations in electronic test and measurement, which are crucial for maintaining its market edge. The demand for faster, more accurate diagnostic tools in sectors like automotive and aerospace directly fuels the need for new precision technologies.

As Fortive expands its connected workflow solutions, cybersecurity and data protection are paramount. Protecting sensitive customer and operational data is essential for maintaining trust and operational integrity, requiring continuous investment in advanced security protocols and threat detection capabilities to counter increasingly sophisticated cyber threats.

| Technology Area | 2023/2024 Data Point | Fortive Relevance |

|---|---|---|

| AI Market Growth | Projected over $200 billion in 2024 | Fortive leverages AI for product enhancement, boosting client efficiency. |

| IoT Market Size | Projected over $1.1 trillion in early 2024 | Fortive integrates IoT for connected diagnostic tools and real-time data. |

| Electronic Test & Measurement Market | Valued at approx. $30 billion in 2023, 6%+ CAGR projected | Fortive's Precision Technologies segment benefits from this market's growth. |

| Cybersecurity Spending | Expected to exceed $200 billion globally in 2024 | Fortive invests to protect customer data and maintain operational integrity. |

Legal factors

Fortive's commitment to product liability and safety is crucial, especially given its presence in high-stakes sectors like healthcare and advanced manufacturing. For instance, in the medical device industry, regulations such as the FDA's Quality System Regulation (21 CFR Part 820) mandate stringent design, manufacturing, and post-market surveillance processes. Failure to comply can result in severe penalties, including product recalls and substantial fines, impacting financial performance and brand reputation.

The company must navigate a complex web of international safety standards, such as those set by the International Electrotechnical Commission (IEC) for electrical safety or ISO standards for quality management. In 2024, regulatory bodies globally continued to emphasize cybersecurity for connected devices, adding another layer of compliance for Fortive's technologically advanced products. Non-compliance with these evolving safety mandates can lead to costly litigation and a loss of market access.

Fortive's ability to protect its intellectual property, encompassing patents for its advanced instrumentation and proprietary software, is fundamental to maintaining its competitive edge. These legal protections are not merely a formality but a cornerstone of its business model, enabling innovation and market differentiation.

The global landscape of intellectual property law, including patent validity and enforcement, directly impacts Fortive's revenue streams and market share. For instance, in 2023, companies in the industrial technology sector, where Fortive operates, saw significant investment in R&D, highlighting the importance of safeguarding these innovations through robust legal frameworks.

Fortive's businesses, particularly in Advanced Healthcare Solutions, must navigate stringent data privacy laws such as HIPAA in the United States and GDPR in Europe. These regulations are critical for managing sensitive health and customer information, with non-compliance carrying significant financial penalties, as seen in cases where companies have faced millions in fines for data breaches.

International Trade Laws and Sanctions

Fortive's global operations mean it must contend with a labyrinth of international trade laws, export controls, and economic sanctions. These legal frameworks, enacted by nations like the United States and the European Union, directly impact market access and supply chain resilience. For instance, sanctions against countries like Russia or Iran can severely restrict business activities, forcing companies to re-evaluate market strategies and sourcing.

Navigating these complex regulations is crucial for maintaining compliance and avoiding significant penalties. The U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, affecting companies' ability to export U.S.-origin technology. As of early 2024, the number of entities on this list continues to grow, highlighting the dynamic nature of export controls.

- Export Controls: Fortive must adhere to regulations like the Export Administration Regulations (EAR) in the U.S., which govern the export of dual-use items.

- Sanctions Programs: Compliance with sanctions imposed by bodies such as the Office of Foreign Assets Control (OFAC) is mandatory for operating in or with sanctioned countries.

- Trade Agreements: Fortive's ability to leverage favorable trade agreements, like the USMCA, can influence sourcing and manufacturing location decisions.

- Customs Regulations: Understanding and complying with import and export customs procedures in each operating country is essential for smooth international trade.

Antitrust and Competition Laws

Fortive's aggressive growth strategy, heavily reliant on acquisitions, necessitates a keen understanding of antitrust and competition laws across its diverse operating regions. Navigating these regulations is crucial to prevent market dominance issues and potential governmental scrutiny. For instance, in 2023, Fortive completed several acquisitions, each requiring thorough review by competition authorities in relevant jurisdictions, such as the United States and the European Union, to ensure fair market practices.

Compliance with these laws is paramount for Fortive to avoid significant legal hurdles, hefty fines, and disruptions to its business operations. Regulatory bodies like the Federal Trade Commission (FTC) and the European Commission actively monitor mergers and acquisitions to safeguard consumer interests and prevent anti-competitive behavior. Fortive's commitment to adhering to these frameworks supports its long-term sustainability and reputation.

- Antitrust Review: Acquisitions are subject to review by antitrust agencies to prevent undue market concentration.

- Regulatory Compliance: Fortive must ensure its business practices align with competition laws in all markets.

- Merger Scrutiny: The scale of Fortive's M&A activity means ongoing engagement with regulatory bodies regarding market impact.

Fortive must navigate a complex regulatory environment, including product safety standards like those from the FDA and IEC, with cybersecurity for connected devices being a growing focus in 2024. Protecting its intellectual property through patents is vital for maintaining its competitive edge, especially as R&D investment in its sectors remained strong in 2023. Adherence to data privacy laws such as HIPAA and GDPR is critical for its healthcare solutions, with non-compliance risking substantial fines.

Environmental factors

Fortive is actively addressing climate change by setting aggressive targets for reducing its environmental impact. The company has committed to a 50% reduction in absolute Scope 1 and 2 greenhouse gas (GHG) emissions by 2029, using 2019 as its baseline year.

This significant undertaking aligns Fortive with globally recognized frameworks like the Science Based Targets initiative (SBTi) and the broader goals of the Paris Agreement. Such commitments are increasingly crucial as regulatory scrutiny and investor expectations around environmental performance continue to rise.

Fortive is actively pursuing water stewardship, aiming to cut water usage by 10% globally across its key sites by 2029, benchmarked against 2022 figures. This commitment to efficient resource management is integrated throughout its entire operational footprint.

Fortive's commitment to environmental stewardship is evident in its waste management strategies, aiming to minimize landfill contributions and maximize material recovery. This aligns with growing industry adoption of circular economy principles, where products and materials are designed for longevity and reuse.

In 2023, Fortive reported a continued focus on reducing operational waste, with specific targets for increasing recycling rates across its facilities. The company's efforts are geared towards integrating these principles into its product design and supply chain, reflecting a broader trend in manufacturing towards resource efficiency and reduced environmental impact.

Supply Chain Environmental Impact

Fortive's extensive global supply chain presents a considerable environmental challenge, necessitating proactive management. The company is committed to minimizing its ecological impact by collaborating with suppliers to reduce their environmental footprint throughout the value chain.

This commitment is underscored by initiatives aimed at resource conservation and pollution prevention. For instance, in 2023, Fortive reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress in its environmental stewardship efforts.

- Supplier Engagement: Fortive actively engages with its suppliers to promote sustainable practices, encouraging them to adopt environmental management systems and set their own emission reduction targets.

- Resource Efficiency: The company focuses on improving resource efficiency within its operations and supply chain, including water usage and waste generation, aiming for a circular economy approach.

- Climate Risk Mitigation: Fortive assesses and addresses climate-related risks within its supply chain, ensuring resilience against potential disruptions and investing in climate-friendly logistics solutions.

- Transparency and Reporting: The company maintains transparency regarding its environmental performance, with detailed reporting on its sustainability progress and targets, aligning with global reporting standards.

Sustainability-Enabling Products and Services

Fortive's strategic focus on sustainability-enabling products is a significant environmental factor. In 2022, the company reported that over 60% of its revenue stemmed from offerings that help customers achieve sustainability goals, such as enhancing efficiency and cutting energy use. This positions Fortive favorably within the growing market for environmentally conscious solutions.

This strong alignment with sustainability trends is crucial for Fortive's long-term growth and resilience. As global regulations and consumer preferences increasingly favor eco-friendly practices, companies providing such solutions are better positioned to thrive. Fortive's portfolio, which includes advanced process control and sensing technologies, directly addresses these market demands.

- Revenue from Sustainability: Over 60% of Fortive's 2022 revenue was linked to sustainability-enabling products and services.

- Customer Benefits: These offerings help customers improve operational efficiency and reduce energy consumption.

- Market Alignment: Fortive's strategy directly taps into the growing global demand for sustainable business practices.

Fortive is making significant strides in environmental stewardship, aiming for a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2029, using a 2019 baseline. The company also targets a 10% global reduction in water usage across key sites by 2029, referencing 2022 figures.

These commitments reflect a broader strategy to integrate sustainability into operations and supply chains, focusing on waste reduction and resource efficiency. In 2023, Fortive reported a 10% decrease in Scope 1 and 2 emissions compared to its 2019 baseline.

A key environmental driver for Fortive is its product portfolio, with over 60% of its 2022 revenue generated from offerings that enable customer sustainability goals, such as improved efficiency and reduced energy consumption.

| Environmental Target | Baseline Year | Target Year | Progress (as of 2023) |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 2019 | 2029 | 10% reduction achieved |

| Global Water Usage Reduction | 2022 | 2029 | Ongoing focus, specific progress TBD |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fortive is constructed using a blend of publicly available government data, reports from reputable financial institutions, and insights from leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscapes impacting Fortive.