Fortive Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortive Bundle

Unlock the strategic DNA of Fortive's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. It's an essential tool for anyone aiming to replicate or analyze such impactful business strategies.

Partnerships

Fortive actively collaborates with technology developers and startups to embed advanced software, AI, and IoT capabilities into its offerings. These partnerships are vital for enhancing workflow solutions across its diverse industrial and healthcare segments.

For instance, in 2024, Fortive continued to strategically invest in and partner with emerging tech firms, aiming to accelerate the integration of novel digital tools. These alliances are critical for maintaining a competitive edge in rapidly advancing markets.

These collaborations allow Fortive to leverage external expertise and innovation, thereby speeding up its product development cycles and broadening its technological reach. This approach ensures its solutions remain at the forefront of industry advancements.

Fortive relies on a vast global network of authorized distributors and value-added resellers to expand its market presence, particularly for its professional instrumentation and industrial technologies. These partners are crucial for reaching diverse geographic regions and specific industry customer bases.

These channel partners offer vital local sales, marketing, and technical support, ensuring efficient market penetration. Their presence is key to making Fortive's products widely available and providing excellent customer service worldwide.

Fortive strategically partners with key suppliers and contract manufacturers to secure a consistent flow of high-quality components for its diverse product portfolio. These relationships are vital for obtaining specialized materials, advanced electronic components, and precision-engineered parts essential for its instruments and integrated solutions.

In 2024, Fortive's emphasis on supply chain resilience meant deepening ties with manufacturers capable of meeting stringent quality and volume demands. For instance, its Fluke division relies on specialized electronics manufacturers for its testing and measurement equipment, where component reliability directly impacts performance and customer trust.

Academic and Research Institutions

Fortive actively collaborates with academic and research institutions to drive innovation and stay at the forefront of technological advancements. These partnerships are crucial for accessing specialized knowledge and exploring nascent technologies pertinent to Fortive's diverse business segments.

These collaborations often manifest as joint research initiatives, providing Fortive with early access to cutting-edge discoveries. For instance, in 2024, Fortive continued its engagement with leading universities on projects focused on advanced sensor technology and data analytics, areas critical to the performance of its intelligent operating solutions.

These academic ties also serve as a vital pipeline for talent acquisition, allowing Fortive to recruit top graduates with specialized skills. By fostering these relationships, Fortive ensures a continuous influx of fresh perspectives and expertise, bolstering its intellectual property portfolio and maintaining a significant technological advantage in competitive markets.

- Innovation Hubs: Fortive leverages university research to identify and integrate emerging technologies.

- Talent Pipeline: Partnerships facilitate the recruitment of highly skilled graduates in fields like engineering and data science.

- Intellectual Property: Joint research contributes to Fortive's robust IP portfolio and technological leadership.

- Market Insight: Academic collaborations provide early understanding of future market needs and technological trends.

Acquisition Targets and Integration Partners

Fortive's strategic growth is heavily fueled by acquiring complementary businesses, especially those offering high-value services and predictable recurring revenue within healthcare and intelligent operating solutions. For instance, in 2024, Fortive continued its active M&A strategy, aiming to bolster its existing segments.

To facilitate this, Fortive collaborates with investment banks and specialized consulting firms. These partners are crucial for identifying potential acquisition targets, conducting thorough due diligence, and ensuring seamless integration of new entities into Fortive's operational framework.

- Strategic Acquisitions: Fortive's approach focuses on businesses that enhance its service offerings and recurring revenue streams, particularly in healthcare and intelligent operations.

- Partnership Ecosystem: Investment banks and consulting firms are key allies in identifying, evaluating, and integrating acquisition targets effectively.

- Integration Success: Smooth integration of acquired companies is paramount for realizing anticipated synergies, expanding market share, and driving overall value creation.

Fortive's key partnerships extend to technology developers and startups, crucial for integrating advanced software, AI, and IoT into its products. In 2024, Fortive continued strategic investments in these firms to accelerate digital tool adoption.

Furthermore, Fortive relies on a broad network of distributors and resellers for market reach, particularly for its instrumentation and industrial technologies. These partners are vital for local sales, marketing, and technical support, ensuring widespread product availability and customer service.

Deepening ties with suppliers and contract manufacturers is also essential for securing high-quality components, with a focus on supply chain resilience in 2024. For instance, its Fluke division depends on specialized electronics manufacturers for reliable testing equipment.

Collaborations with academic and research institutions drive innovation, providing early access to cutting-edge discoveries like advanced sensor technology, as seen in 2024 university projects. These partnerships also serve as a talent pipeline for skilled graduates.

Fortive also partners with investment banks and consulting firms to facilitate strategic acquisitions, focusing on businesses that enhance services and recurring revenue, particularly in healthcare and intelligent operating solutions.

| Partnership Type | Focus Area | 2024 Impact/Example | Strategic Importance |

|---|---|---|---|

| Technology Developers & Startups | Software, AI, IoT Integration | Accelerated digital tool adoption | Enhances workflow solutions, maintains competitive edge |

| Distributors & Resellers | Market Reach & Support | Expanded presence for instrumentation | Ensures efficient market penetration, customer service |

| Suppliers & Manufacturers | Component Sourcing & Quality | Deepened ties for supply chain resilience | Secures high-quality materials, ensures product reliability |

| Academic & Research Institutions | Innovation & Talent | Joint projects on sensor technology | Drives innovation, provides talent pipeline |

| Investment Banks & Consultants | Mergers & Acquisitions | Facilitated identification of acquisition targets | Supports strategic growth through complementary businesses |

What is included in the product

A detailed Business Model Canvas for Fortive, outlining its diversified industrial technology portfolio, customer relationships, and revenue streams across its operating segments.

Fortive's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategic thinking.

It helps teams quickly identify and address potential roadblocks by offering a clear, one-page overview of all critical business elements.

Activities

Fortive’s commitment to Research and Development (R&D) is central to its strategy, driving innovation across its diverse segments. The company consistently allocates resources to develop new professional instrumentation, advanced industrial technologies, and integrated connected workflow solutions. This focus ensures Fortive remains at the forefront of technological advancement, catering to the dynamic demands of key sectors.

In 2023, Fortive reported R&D expenses of $773.2 million, a notable increase reflecting its dedication to product pipeline expansion and next-generation platform development. This investment fuels the enhancement of existing product lines and the creation of entirely new offerings designed to meet evolving customer requirements in critical industries such as healthcare, transportation, and manufacturing.

Fortive's product design and engineering activities are central to its mission-critical offerings. This involves the intricate development of both hardware and software, ensuring every solution meets exacting precision, reliability, and regulatory compliance standards. For instance, in 2023, Fortive's dedication to innovation led to significant investments in R&D, a key component of their engineering prowess.

The company focuses on creating high-performance, safe products tailored for demanding applications. This encompasses sophisticated hardware design and the development of connected software solutions, including intuitive user interfaces. Their rigorous design processes are designed to deliver dependable performance, crucial for sectors like healthcare and industrial automation.

Fortive's core activities revolve around the meticulous manufacturing and production of its extensive range of professional instrumentation and industrial technologies. This demands sophisticated production facilities and highly optimized operational workflows to ensure the consistent delivery of high-quality products. For instance, in 2023, Fortive reported net sales of $5.1 billion, a testament to the scale and efficiency of its manufacturing operations.

The company leverages its proprietary Fortive Business System (FBS) to drive manufacturing excellence across its diverse portfolio. This system focuses on continuous improvement, lean principles, and robust quality control, which are essential for meeting the significant global demand for its specialized equipment. This commitment to operational efficiency is a cornerstone of Fortive's strategy to maintain its competitive edge in various industrial sectors.

Sales, Marketing, and Distribution

Fortive's core activities revolve around effectively marketing and selling its specialized products and services to a diverse global customer base. This is often accomplished through dedicated direct sales teams and a robust network of distributors. The company focuses on developing targeted marketing campaigns to reach its specific customer segments and cultivates strong, lasting relationships with them.

Managing these extensive distribution channels efficiently is crucial for Fortive's success, directly impacting revenue generation and market penetration. In 2023, Fortive reported total revenue of $5.7 billion, showcasing the scale of its sales and distribution efforts. The company's strategy emphasizes understanding customer needs and delivering value through its specialized offerings.

- Direct Sales Force: Fortive employs specialized direct sales teams with deep product and industry knowledge to engage with key customers.

- Distributor Networks: The company leverages a global network of distributors to extend its reach and serve a broader market.

- Targeted Marketing: Marketing efforts are focused on creating awareness and demand for Fortive's high-value, specialized solutions.

- Customer Relationship Management: Building and maintaining strong customer relationships is a cornerstone of their sales strategy.

Post-Sales Service and Support

Fortive's commitment to post-sales service is a cornerstone of its business model, ensuring customers maximize the value of their sophisticated equipment. This includes offering comprehensive support such as installation, calibration, and ongoing technical assistance. For instance, in 2023, Fortive's service revenue represented a significant portion of its overall income, underscoring the importance of these offerings.

The company focuses on delivering high-value services and connected workflow solutions designed to optimize product performance and extend their operational lifespan. This proactive approach fosters customer loyalty and creates dependable recurring revenue streams.

- Installation & Calibration: Ensuring seamless integration and accurate operation from day one.

- Technical Support: Providing expert assistance to resolve issues quickly and efficiently.

- Maintenance Programs: Offering scheduled upkeep to prevent downtime and maintain peak performance.

- Connected Workflow Solutions: Leveraging data and technology to enhance customer operations and product utility.

Fortive's key activities are centered on innovation through R&D and meticulous product design and engineering. This is complemented by efficient manufacturing and production, supported by the Fortive Business System (FBS). Finally, robust sales, marketing, and post-sales service operations ensure customer satisfaction and revenue generation.

| Key Activity | Description | 2023 Data Point |

|---|---|---|

| Research & Development | Driving innovation in instrumentation and workflow solutions. | $773.2 million in R&D expenses. |

| Manufacturing & Production | High-quality production of specialized equipment. | $5.1 billion in net sales. |

| Sales & Marketing | Reaching global customers via direct sales and distributors. | $5.7 billion in total revenue. |

| Service & Support | Ensuring customer value through installation, calibration, and technical assistance. | Service revenue a significant portion of income. |

Delivered as Displayed

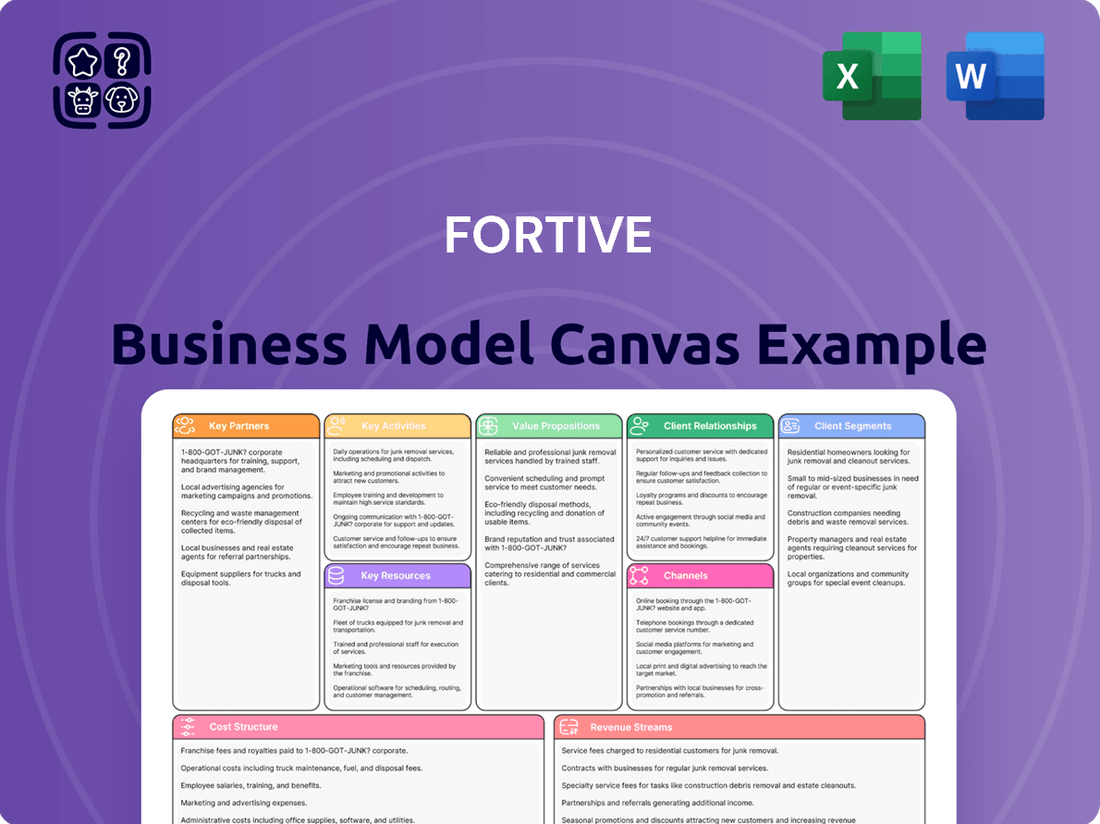

Business Model Canvas

The Fortive Business Model Canvas preview you are viewing is an authentic representation of the complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this exact, professionally prepared canvas, ready for your strategic analysis.

Resources

Fortive holds a robust portfolio of intellectual property, including patents and trademarks, which are crucial for its competitive edge in specialized markets. This IP protects its innovative product lines and solutions across its various business segments. For instance, as of the end of 2023, Fortive's ongoing commitment to R&D fuels the continuous expansion of this valuable asset base, reinforcing its market leadership.

Fortive's highly skilled workforce, encompassing engineers, scientists, software developers, sales professionals, and service technicians, is a cornerstone of its business model. This deep well of expertise is what fuels the company's innovation pipeline, guaranteeing the quality of its products and the seamless delivery of its intricate services.

This global team, numbering over 10,000 employees, is directly responsible for cultivating and maintaining robust customer relationships. In 2023, Fortive reported that its dedicated workforce was instrumental in achieving its financial goals, underscoring the direct link between human capital and operational success.

Fortive's advanced manufacturing facilities are the backbone of its operations, enabling the creation of high-precision instruments and sophisticated industrial technologies. These sites leverage cutting-edge machinery and streamlined production processes to ensure both efficiency and exceptional quality in complex hardware and integrated systems. For instance, in 2023, Fortive invested significantly in upgrading its manufacturing capabilities, contributing to a robust product pipeline and operational excellence across its segments.

Fortive Business System (FBS)

The Fortive Business System (FBS) is the bedrock of Fortive's operations, a comprehensive framework designed for relentless improvement and disciplined execution. It permeates every facet of the company, fostering a culture of innovation and driving tangible results.

FBS is instrumental in achieving operational excellence, boosting profit margins, and accelerating growth. This system is not merely a program; it's a deeply ingrained philosophy that provides Fortive with a significant competitive edge.

- Operational Efficiency: FBS focuses on lean principles and process optimization to streamline operations.

- Margin Expansion: Through cost control and value-added initiatives, FBS directly contributes to improved profitability.

- Accelerated Growth: The system empowers businesses to identify and capitalize on growth opportunities more effectively.

- Continuous Improvement: FBS embeds a culture where every employee is encouraged to identify and implement improvements.

Strong Financial Capital and Brand Portfolio

Fortive's robust financial capital is a cornerstone of its business model, allowing for significant investments in research and development. In 2023, Fortive reported total revenues of $5.7 billion, demonstrating its substantial financial capacity to fund innovation and strategic growth initiatives.

The company's strength lies in its diverse portfolio of market-leading brands, such as Fluke and Accruent. These brands command strong recognition and deep customer trust, providing a competitive advantage in their respective sectors. This established brand equity is crucial for driving sales and maintaining market leadership.

- Financial Strength: Fortive's substantial revenue base, exceeding $5.7 billion in 2023, underpins its ability to invest in R&D and pursue strategic acquisitions.

- Brand Equity: Market-leading brands like Fluke and Accruent foster significant customer loyalty and brand recognition, facilitating market penetration and pricing power.

- Strategic Investment: The combination of financial capital and brand strength enables Fortive to effectively manage global operations and support sustained growth.

Fortive's intellectual property, including patents and trademarks, safeguards its innovations across specialized markets. This IP is vital for maintaining its competitive edge and market leadership. As of year-end 2023, the company's ongoing investment in research and development continues to expand this valuable asset base.

Fortive's skilled workforce, comprising over 10,000 employees globally, is central to its operations. This team of engineers, scientists, and service professionals drives innovation and ensures high-quality product delivery and service. In 2023, this workforce was directly credited with achieving the company's financial objectives.

Advanced manufacturing facilities are key to Fortive's production of high-precision instruments and industrial technologies. These sites utilize modern machinery and efficient processes to guarantee quality and operational excellence. Significant investments were made in 2023 to enhance these manufacturing capabilities.

The Fortive Business System (FBS) is the core operational framework, driving continuous improvement and disciplined execution. It fosters innovation and delivers tangible results, enhancing profitability and growth. FBS is a fundamental element of Fortive's competitive advantage.

Fortive's substantial financial capital, evidenced by $5.7 billion in total revenues for 2023, enables significant investment in R&D and strategic growth. This financial strength supports its market-leading brands, such as Fluke and Accruent, which benefit from strong customer trust and recognition.

Value Propositions

Fortive’s solutions are designed to significantly boost efficiency and productivity for its clients. By offering advanced instrumentation and integrated workflow tools, the company empowers businesses across manufacturing, healthcare, and transportation sectors to streamline their operations.

These offerings help customers reduce inefficiencies and waste, leading to a tangible improvement in their overall output. For instance, in 2023, Fortive's focus on operational excellence contributed to its customers achieving better throughput and realizing substantial cost savings.

Fortive's value proposition of improved safety and compliance is crucial for its customers operating in high-stakes environments. Many of its products are engineered for critical applications, directly contributing to the maintenance of safety standards and adherence to regulatory mandates. This focus is particularly evident in sectors like healthcare and industrial manufacturing, where failure to comply can have severe consequences.

For instance, in the healthcare sector, Fortive's solutions assist in ensuring patient safety and meeting stringent medical device regulations. In industrial settings, their offerings help prevent accidents and maintain operational integrity, a vital aspect given that workplace injuries cost the U.S. economy an estimated $171 billion in 2022, according to the National Safety Council.

By providing reliable tools and technologies that mitigate risks and guarantee adherence to rigorous industry regulations, Fortive empowers its clients to operate more securely and avoid costly penalties or disruptions. This commitment to safety and compliance is a core element of their offering, building trust and long-term partnerships.

Fortive's mission-critical reliability is evident in its professional instrumentation and industrial technologies, designed for unwavering performance in tough conditions. For instance, Fluke's thermal imagers, essential for predictive maintenance, boast accuracy rates that minimize costly downtime for manufacturers. This consistent dependability is crucial for customers whose operations, like those in the semiconductor industry, cannot afford even brief interruptions.

Connected Workflow Solutions

Fortive's Connected Workflow Solutions offer a powerful combination of integrated hardware and software designed to link various operational processes. This integration facilitates a smooth flow of data, ultimately leading to better-informed decisions for customers.

These connected workflows are key to improving operational visibility, automating repetitive tasks, and delivering actionable insights. This digital transformation is helping businesses across many sectors become more efficient and responsive.

- Seamless Data Integration: Fortive's solutions connect disparate systems, ensuring data consistency and accessibility.

- Process Automation: Automating workflows reduces manual effort and minimizes errors, boosting productivity.

- Enhanced Decision-Making: Real-time data and analytics provide the insights needed for smarter, faster business decisions.

- Digital Transformation Catalyst: These offerings are designed to drive digital transformation, making operations more agile and intelligent.

High-Value Services and Recurring Revenue Models

Fortive's strategy extends beyond initial product sales by offering essential high-value services such as maintenance, calibration, and software subscriptions. These services ensure ongoing customer support and sustained value, fostering deeper client relationships.

The company's deliberate shift towards recurring revenue streams, generated through these service offerings, significantly boosts customer loyalty and creates a more predictable revenue base. For instance, in 2023, Fortive reported that its recurring revenue represented a substantial portion of its total sales, highlighting the success of this model.

- Service Offerings: Maintenance, calibration, and software subscriptions provide continuous value and support.

- Recurring Revenue Focus: Enhances customer stickiness and predictable income streams.

- Long-Term Partnerships: Emphasizes continuous value delivery and client retention.

Fortive's value proposition centers on driving operational efficiency and productivity for its clients. By providing advanced instrumentation and integrated workflow tools, the company enables businesses in sectors like manufacturing and healthcare to streamline operations, reduce waste, and improve output. This focus on operational excellence was a key driver for customers in 2023, leading to better throughput and cost savings.

The company also emphasizes improved safety and compliance, crucial in high-stakes industries. Fortive's products are engineered for critical applications, helping maintain safety standards and regulatory adherence. For example, in healthcare, their solutions aid in patient safety and meeting medical device regulations. In industrial settings, these offerings help prevent accidents, a significant benefit given that workplace injuries cost the U.S. economy an estimated $171 billion in 2022.

Fortive delivers mission-critical reliability through robust professional instrumentation and industrial technologies designed for demanding environments. Products like Fluke's thermal imagers, vital for predictive maintenance, offer high accuracy to minimize costly downtime. This reliability is essential for industries like semiconductors, where even brief interruptions are unacceptable.

Furthermore, Fortive's Connected Workflow Solutions integrate hardware and software to create a seamless data flow, enhancing operational visibility and decision-making. These solutions automate tasks, reduce errors, and accelerate digital transformation, making operations more agile and intelligent.

Beyond product sales, Fortive offers high-value services such as maintenance, calibration, and software subscriptions. These services ensure continuous customer support and foster long-term partnerships. The company's strategic shift towards recurring revenue streams from these services significantly boosts customer loyalty and creates a more predictable revenue base, a model that proved successful in 2023 with a substantial portion of total sales coming from recurring revenue.

| Value Proposition | Description | Key Benefit | Supporting Fact/Example |

| Operational Efficiency & Productivity | Streamlining operations with advanced instrumentation and workflow tools. | Reduced waste, improved output, cost savings. | Contributed to customers achieving better throughput in 2023. |

| Safety & Compliance | Engineering products for critical applications to maintain standards. | Mitigated risks, ensured adherence to regulations, avoided penalties. | Workplace injuries cost the U.S. economy $171 billion in 2022. |

| Mission-Critical Reliability | Providing dependable instrumentation for demanding environments. | Minimized costly downtime, ensured operational integrity. | Fluke thermal imagers essential for predictive maintenance. |

| Connected Workflow Solutions | Integrating hardware and software for seamless data flow. | Enhanced visibility, automated tasks, improved decision-making. | Driving digital transformation for agile operations. |

| Recurring Revenue Services | Offering maintenance, calibration, and software subscriptions. | Continuous support, customer loyalty, predictable income. | Substantial portion of 2023 sales from recurring revenue. |

Customer Relationships

Fortive cultivates enduring customer connections through specialized sales and technical support. These teams offer expert advice and swift solutions, ensuring clients receive precisely what they need. This focus on personalized service is key for customers adopting high-value products and maintaining satisfaction.

Fortive cultivates service-oriented partnerships through robust post-sales support, encompassing preventative maintenance, calibration, and essential software updates. This ensures their sophisticated solutions consistently perform at their peak, extending product lifecycles. For instance, in 2023, Fortive reported significant revenue from its service and other revenue segments, underscoring the importance of these ongoing customer engagements.

Fortive distinguishes itself through solution-based consulting, acting as a trusted advisor to clients. This involves offering expert guidance and implementation services, crucial for integrating sophisticated industrial technologies and connected workflow solutions into existing operational frameworks.

This consultative model is designed to ensure customers fully leverage the potential of Fortive's offerings, thereby maximizing the value they receive. For instance, Fortive's acquisition of EA Elektro-Automatik in 2020, a leader in high-power testing, likely enhanced their ability to offer specialized consulting for power electronics integration, a rapidly growing sector.

By adopting this approach, Fortive moves beyond a traditional vendor relationship to become a strategic partner. This positioning is vital in complex industrial environments where seamless integration and optimized performance are paramount for competitive advantage.

Digital Engagement and Online Support

Fortive leverages digital engagement through online platforms and customer portals, offering efficient access to product information, technical documentation, and software downloads. This digital infrastructure streamlines support and enhances customer convenience, particularly for its software-centric offerings. In 2023, Fortive reported significant digital interaction growth, with a 15% increase in customer portal usage for self-service support.

- Online Platforms: Fortive utilizes its website and dedicated customer portals for information dissemination and support.

- Digital Tools: Software downloads, knowledge bases, and troubleshooting guides are readily available online.

- Scalable Support: Digital channels provide a scalable solution for customer assistance, complementing direct interactions.

- Customer Convenience: Enhanced accessibility to resources improves the overall customer experience.

Strategic Account Management

Fortive's strategic account management is key for its large enterprise clients, focusing on understanding their long-term goals to build solutions together. This deep collaboration ensures Fortive's products and services align with evolving customer needs, securing substantial, ongoing revenue and driving innovation.

- Deep Collaboration: Fortive works closely with strategic accounts to align its offerings with customer roadmaps.

- Long-Term Focus: This approach prioritizes understanding and meeting the long-term business objectives of key clients.

- Solution Co-creation: Fortive actively partners with these clients to develop tailored solutions.

- Revenue Stability: Strategic account management is designed to generate significant and predictable long-term revenue streams.

Fortive fosters strong customer relationships through a multi-faceted approach, combining expert direct engagement with accessible digital tools. This ensures clients receive tailored support and can efficiently access necessary resources, driving satisfaction and long-term loyalty.

Their service-oriented partnerships, including preventative maintenance and software updates, are crucial for maximizing the performance of sophisticated solutions. This focus on ongoing support is reflected in Fortive's substantial service revenue, a key contributor to their overall financial performance.

By acting as a trusted advisor and co-creating solutions with strategic accounts, Fortive moves beyond transactional sales to build deep, collaborative partnerships. This strategy is vital for integrating complex industrial technologies and ensuring sustained value delivery.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Specialized Sales & Technical Support | Expert advice and rapid solutions for high-value products. | Ensures client satisfaction with complex industrial technologies. |

| Service-Oriented Partnerships | Post-sales support, maintenance, and updates. | Fortive's service and other revenue segments showed strong performance in 2023. |

| Solution-Based Consulting | Acting as a trusted advisor for integration and optimization. | Acquisition of EA Elektro-Automatik enhanced power electronics consulting. |

| Digital Engagement | Online platforms and portals for information and self-service. | 15% increase in customer portal usage for self-service support in 2023. |

| Strategic Account Management | Deep collaboration with large clients on long-term goals. | Secures ongoing revenue and drives co-created innovation. |

Channels

Fortive utilizes a robust global direct sales force to directly engage with significant clients, including large enterprises, government bodies, and critical accounts. This approach is particularly effective for selling intricate and interconnected solutions, enabling tailored approaches and in-depth technical discussions.

This direct channel is instrumental for facilitating high-value transactions and cultivating essential strategic partnerships. For instance, in 2023, Fortive reported approximately $7.2 billion in revenue, with a significant portion attributed to these direct sales efforts, underscoring its importance in driving growth and customer relationships.

Fortive leverages an extensive network of authorized distributors and value-added resellers to achieve broad market penetration. This strategy allows them to reach a diverse customer base, including smaller businesses and those in various geographic regions.

These partners are crucial for managing local sales, logistics, and initial customer support. For instance, in 2023, Fortive's Intelligent Vehicle Solutions segment, which relies heavily on channel partners, saw significant growth, indicating the effectiveness of this approach for reaching a wider audience.

The reseller channel is particularly advantageous for Fortive's more standardized product offerings. It ensures widespread market access and efficient distribution, allowing the company to focus its internal resources on innovation and higher-level strategic initiatives.

Fortive leverages its corporate website and dedicated e-commerce portals to offer detailed product information, facilitate software downloads, and enable direct sales for select offerings. This digital presence ensures customer convenience and provides a scalable avenue for product and service delivery, particularly for software subscriptions and digital solutions.

Service and Support Networks

Fortive's global network of service centers and dedicated field service teams are crucial channels for delivering essential post-sales support. These operations provide customers with vital maintenance, repair, and calibration services, directly impacting product longevity and operational efficiency.

These service networks are fundamental to Fortive's strategy, ensuring high levels of customer satisfaction and product uptime. For instance, in 2023, Fortive reported significant revenue from its service and other offerings, underscoring the financial importance of these customer-facing channels.

- Global Reach: Fortive operates service centers and employs field technicians across numerous countries to provide localized support.

- Expertise: These teams are trained to offer specialized technical assistance for Fortive's diverse product portfolio.

- Revenue Driver: Service contracts and ongoing support represent a substantial and recurring revenue stream for the company.

- Customer Retention: Effective service networks are key to building long-term customer loyalty and repeat business.

Industry Trade Shows and Conferences

Fortive actively participates in key industry trade shows and conferences, such as IFPE (International Fluid Power Exposition) and various automation and manufacturing events. These gatherings are crucial for showcasing their latest technological advancements and engaging directly with a broad customer base. For instance, in 2023, IFPE saw over 20,000 attendees, offering Fortive a significant opportunity for brand visibility and lead generation.

These events serve as vital platforms for networking with industry peers, potential partners, and key decision-makers. Fortive uses these opportunities to demonstrate the practical applications and benefits of its diverse product portfolio, reinforcing its market leadership and thought leadership within the sectors it serves. The ability to physically display and explain complex solutions at these events is invaluable for capturing interest and generating qualified leads.

The strategic presence at these industry gatherings directly supports Fortive's customer relationships and market intelligence gathering. By observing competitor activities and understanding emerging market trends firsthand, Fortive can refine its product development and go-to-market strategies. For example, insights gained from customer interactions at events like the 2024 Hannover Messe, a major industrial technology trade fair, can directly influence future product roadmaps.

- Showcasing Innovation: Fortive leverages trade shows to unveil new products and technologies, driving customer interest and market adoption.

- Customer Engagement: Direct interaction at conferences allows for in-depth discussions, feedback collection, and relationship building with potential and existing clients.

- Market Visibility: Consistent participation enhances Fortive's brand recognition and establishes its position as a leader in the industrial technology space.

- Lead Generation: These events provide a concentrated environment for identifying and qualifying new business opportunities, contributing to revenue growth.

Fortive employs a multi-faceted channel strategy, combining direct sales for key accounts with a broad network of distributors and resellers for wider market penetration. This hybrid approach ensures efficient reach across diverse customer segments, from large enterprises to smaller businesses.

The company also utilizes its corporate website and e-commerce platforms for direct sales of select offerings, particularly software and digital solutions. Complementing these sales channels are extensive service networks, crucial for post-sales support, maintenance, and driving customer retention.

Industry trade shows and conferences serve as vital platforms for showcasing innovation, engaging with customers, and gathering market intelligence, directly supporting Fortive's growth and strategic initiatives.

Customer Segments

Hospitals, clinics, and diagnostic labs are key customers for Fortive's Advanced Healthcare Solutions. These institutions depend on Fortive's technology to enhance patient safety and streamline operations, with a strong emphasis on precision and regulatory compliance. For instance, in 2023, the global medical devices market, which includes many of Fortive's offerings, was valued at over $500 billion, highlighting the significant demand for reliable healthcare instrumentation.

Industrial and manufacturing companies, encompassing discrete manufacturing, process industries, and critical infrastructure operators, represent a core customer segment for Fortive. These businesses leverage Fortive's Intelligent Operating Solutions to enhance efficiency, bolster safety, and boost productivity across their production lines and entire facilities. For instance, in 2024, the manufacturing sector continued its drive for operational excellence, with companies investing heavily in automation and data analytics to streamline workflows and reduce waste.

These customers are particularly drawn to solutions that are not only robust and reliable but also offer seamless connectivity. They seek integrated systems that can optimize everything from supply chain management to real-time production monitoring. The demand for such connected solutions is underscored by the growing adoption of Industry 4.0 technologies, with global spending on industrial IoT expected to reach hundreds of billions of dollars annually by 2024, reflecting the critical need for operational optimization.

Transportation and logistics operators, spanning rail, marine, and aviation, rely on Fortive's advanced technologies. These solutions are crucial for enhancing safety, optimizing asset management, and boosting operational efficiency within critical infrastructure and extensive fleet operations. For instance, in 2024, the global transportation and logistics market was projected to reach over $10 trillion, highlighting the immense scale and need for robust technological support.

This vital customer segment demands solutions that guarantee unwavering performance, even when subjected to the harshest and most demanding operational environments. Their core priorities revolve around ensuring maximum uptime, preventing costly disruptions, and implementing predictive maintenance strategies to extend asset life and reduce unforeseen failures.

Utilities and Energy Sectors

The Utilities and Energy Sectors, encompassing power generation, transmission, and distribution, along with oil and gas operations, represent a critical customer segment for Fortive. These entities leverage Fortive's advanced solutions to meticulously monitor, control, and ensure the safety of their intricate and often hazardous energy infrastructures. A significant driver for their adoption is the imperative to bolster operational safety, optimize asset performance, and rigorously adhere to evolving regulatory mandates.

These customers place a premium on unwavering reliability and consistent, long-term support, understanding that any disruption can have widespread consequences. For instance, the global energy sector's capital expenditure was projected to reach approximately $800 billion in 2024, highlighting the significant investment in maintaining and upgrading critical infrastructure where Fortive's solutions play a vital role.

- Operational Safety Enhancement: Utilities and energy firms prioritize solutions that minimize risks and prevent incidents in high-stakes environments.

- Asset Performance Optimization: Customers seek technologies to improve the efficiency, longevity, and output of their power generation and distribution assets.

- Regulatory Compliance: Adherence to stringent industry standards and environmental regulations is a non-negotiable requirement, driving demand for compliant solutions.

- Reliability and Support: The critical nature of energy services necessitates dependable technology and responsive, ongoing technical assistance.

Government and Public Sector Entities

Government and public sector entities, including defense and public safety agencies, represent a key customer segment for Fortive. These organizations rely on Fortive's specialized instrumentation and workflow solutions to manage critical infrastructure and ensure national security. For instance, in 2024, government spending on technology solutions for public safety and defense is projected to reach significant figures, highlighting the demand for reliable and compliant systems.

These customers typically operate under stringent procurement processes and demand solutions that meet rigorous security and compliance standards. Fortive's ability to provide robust, long-lasting, and compliant technologies directly addresses these needs, making them a preferred partner.

- Critical Infrastructure Management: Fortive's tools support the maintenance and operation of essential public services.

- Defense and Security Applications: Solutions cater to the unique requirements of national defense and public safety operations.

- Procurement and Compliance: Fortive navigates complex government purchasing protocols and ensures adherence to regulatory frameworks.

- Durability and Reliability: The emphasis is on technologies that offer extended lifecycles and dependable performance in demanding environments.

Fortive serves a diverse range of customers, each with unique needs and priorities. From healthcare providers focused on patient safety and operational efficiency to industrial manufacturers driving productivity through automation, Fortive's solutions are tailored to enhance performance across various sectors. Transportation and logistics firms rely on Fortive for safety and asset management, while utilities and energy companies depend on its technologies for infrastructure monitoring and regulatory compliance.

Government and public sector clients, including defense and public safety agencies, also form a significant customer base, requiring robust, secure, and compliant solutions for critical infrastructure and national security. The common thread across these segments is a demand for reliability, precision, and integrated systems that optimize operations and ensure safety, often within highly regulated and demanding environments. For instance, the global industrial automation market was projected to grow to over $200 billion by 2024, reflecting the broad need for the types of solutions Fortive provides.

| Customer Segment | Key Needs | Fortive's Value Proposition | Market Context (2024 Data) |

|---|---|---|---|

| Hospitals, Clinics, Diagnostic Labs | Patient safety, operational efficiency, precision, regulatory compliance | Advanced healthcare solutions, reliable instrumentation | Global medical devices market: >$500 billion (2023) |

| Industrial & Manufacturing | Efficiency, safety, productivity, automation, data analytics | Intelligent operating solutions, integrated systems | Manufacturing sector investment in automation and data analytics |

| Transportation & Logistics | Safety, asset management, operational efficiency | Advanced technologies for fleet and infrastructure | Global transportation & logistics market: >$10 trillion |

| Utilities & Energy | Infrastructure monitoring, safety, asset performance, regulatory compliance | Advanced monitoring and control solutions | Energy sector capital expenditure: ~$800 billion |

| Government & Public Sector | Critical infrastructure management, defense, public safety, security, compliance | Specialized instrumentation, workflow solutions | Government tech spending for public safety & defense significant |

Cost Structure

Fortive's commitment to innovation is reflected in its significant Research and Development (R&D) costs. These investments fuel the creation of new products and enhancements, a critical aspect of their business model. In 2024, Fortive allocated $414 million to R&D, covering essential elements like personnel, advanced laboratory equipment, and software development tools.

This substantial expenditure on R&D is not merely a cost but a strategic investment aimed at securing Fortive's position as an innovation leader in its markets. The company projects its R&D spending to remain robust, with an estimated $415 million planned for 2025, underscoring its ongoing dedication to developing cutting-edge solutions and intellectual property.

Manufacturing and production costs are a significant part of Fortive's operations, encompassing raw materials, components, direct labor, and factory overhead. For instance, the company's focus on professional instrumentation and industrial technologies means these inputs are critical. In 2024, Fortive continued to leverage its Fortive Business System to streamline these expenses, aiming for greater efficiency in its production processes.

Sales, General, and Administrative (SG&A) expenses for Fortive are a significant component, covering everything from sales team salaries and commissions to the costs of running corporate functions and managing general business operations. These costs are crucial for expanding market reach and ensuring smooth customer engagement.

In 2023, Fortive reported SG&A expenses of $2.1 billion. The company consistently aims to optimize these expenditures, ensuring they effectively support growth initiatives without becoming a drag on profitability. This balance is key to maintaining operational efficiency.

Acquisition and Integration Costs

Fortive's aggressive growth strategy heavily relies on acquisitions, making acquisition and integration costs a substantial component of its cost structure. These expenses encompass a wide range, from the initial identification and evaluation of potential targets to the complex process of merging them into the existing Fortive ecosystem. For instance, the company's acquisition of EA Elektro-Automatik in 2023, a significant move in the power electronics sector, would have incurred substantial due diligence, legal, and advisory fees.

These costs are not merely expenses but strategic investments aimed at expanding Fortive's market reach, technological capabilities, and overall portfolio diversification. The integration phase, which involves aligning IT systems, operational processes, and company cultures, also carries considerable financial weight.

- Due Diligence and Legal Fees: Costs associated with thoroughly vetting potential acquisition targets, including financial, operational, and legal reviews, as well as contract negotiations.

- Integration Expenses: Outlays for merging acquired entities' IT infrastructure, supply chains, human resources, and operational systems to achieve synergies.

- Transaction Costs: Fees paid to investment banks, lawyers, accountants, and other advisors involved in facilitating the acquisition process.

- Potential Restructuring Costs: Expenses related to optimizing the combined entity, which might include severance packages or asset write-downs.

Service and Support Infrastructure Costs

Fortive's commitment to exceptional post-sales support is a cornerstone of its business model, driving significant investment in its service and support infrastructure. This includes maintaining a robust global network of service centers, employing skilled field technicians, and staffing dedicated technical support teams. These operational necessities are critical for delivering high-value services that ensure customer satisfaction and loyalty.

The financial implications of this infrastructure are considerable. Costs encompass ongoing training for personnel to stay abreast of technological advancements, the procurement and maintenance of specialized equipment, and the complex logistics involved in supporting a worldwide customer base. For instance, in 2023, Fortive reported that its service and support segment contributed a substantial portion to its overall revenue, underscoring the economic importance of these investments. The company's strategic focus on generating recurring service revenue provides a strong justification for these ongoing expenditures, as they directly contribute to long-term customer relationships and predictable income streams.

- Global Service Network: Fortive operates numerous service centers worldwide to provide timely and efficient customer support.

- Field Technician Deployment: A significant portion of costs is allocated to the training, compensation, and travel expenses of field technicians who perform on-site repairs and maintenance.

- Technical Support Staffing: Investment in skilled technical support personnel is crucial for resolving customer inquiries and issues remotely, ensuring high levels of customer satisfaction.

- Logistics and Equipment: Maintaining an inventory of spare parts and specialized diagnostic equipment, along with the associated logistics, represents a substantial operational cost.

Fortive's cost structure is heavily influenced by its strategic acquisitions, with significant outlays for due diligence, legal fees, and integration processes. These expenses are vital for expanding its market presence and technological capabilities.

The company also invests heavily in Research and Development (R&D), allocating $414 million in 2024 to drive innovation and product development, with a projected $415 million for 2025. Manufacturing and production costs, including raw materials and direct labor, are managed through its Fortive Business System for efficiency.

Sales, General, and Administrative (SG&A) expenses, totaling $2.1 billion in 2023, are crucial for market reach and customer engagement, while service and support infrastructure represents a significant ongoing investment to ensure customer satisfaction and recurring revenue.

| Cost Category | 2023 (Actual) | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| R&D Expenses | N/A | $414 million | $415 million |

| SG&A Expenses | $2.1 billion | N/A | N/A |

| Acquisition & Integration Costs | Variable (e.g., EA Elektro-Automatik acquisition) | Variable | Variable |

| Manufacturing & Production | Variable | Variable | Variable |

| Service & Support Infrastructure | Substantial contribution to revenue | Substantial contribution to revenue | Substantial contribution to revenue |

Revenue Streams

Fortive generates substantial revenue through the direct sale of its professional instrumentation, industrial technologies, and hardware components. This is a core element across both its Intelligent Operating Solutions and Advanced Healthcare Solutions segments. These sales represent the initial acquisition of new equipment and systems by customers, forming a critical foundation for the company's financial performance.

In 2023, Fortive reported product sales as a significant driver of its revenue. For instance, the company's revenue from product sales in segments like professional instrumentation and industrial technologies directly contributed to its overall financial results, underscoring its importance to Fortive's business model.

Fortive generates a significant and expanding portion of its income from service and maintenance agreements tied to its existing product installations. These contracts are crucial for delivering consistent, predictable revenue and guaranteeing that customers receive continuous support and optimal product functionality.

This service segment boasts impressive customer loyalty, with high retention rates underscoring the value customers place on ongoing support and product upkeep. For instance, in 2023, Fortive reported strong performance in its recurring revenue segments, which are heavily influenced by these types of contracts, contributing to overall financial stability.

Fortive generates significant revenue from software subscriptions and licenses, a core component of its Intelligent Operating Solutions segment. This recurring revenue model, often measured in Annual Recurring Revenue (ARR), provides a predictable income stream and typically boasts high profit margins.

In 2023, Fortive reported that its software and service revenue, which is heavily influenced by these subscriptions and licenses, grew by 15% to $1.3 billion. This growth highlights the increasing importance of its connected workflow solutions and industrial software applications.

Calibration and Repair Services

Fortive's calibration and repair services are a vital revenue stream, ensuring the continued accuracy and operational integrity of their specialized equipment. These services, often provided through service contracts or on a per-incident basis, generate recurring income and reinforce customer loyalty.

This segment not only provides a direct financial benefit but also enhances the overall value proposition of Fortive's product offerings by supporting them throughout their lifecycle. For example, in 2023, Fortive reported that its service and other revenue, which includes calibration and repair, contributed significantly to its overall financial performance, demonstrating the importance of these offerings.

- Specialized Services: Instrument calibration, repairs, and upgrades are offered to maintain equipment performance.

- Revenue Model: Services are typically billed on a per-service or contract basis, providing predictable income.

- Value Proposition: These services extend the lifespan and ensure the reliability of critical assets.

- Financial Impact: In 2023, Fortive's service and other revenue streams played a key role in its financial results, underscoring the financial significance of these offerings.

Consulting and Professional Services

Fortive also generates revenue through consulting and professional services. This includes offering expert advice, system integration, and developing bespoke solutions for clients adopting their advanced technologies.

These services are crucial for customers looking to optimize the performance and efficiency of their Fortive technology investments, highlighting the company's position as a comprehensive solutions provider.

- Consulting: Providing expert guidance on technology implementation and business process optimization.

- System Integration: Seamlessly incorporating Fortive's solutions into existing customer infrastructure.

- Customized Solutions: Developing tailored applications and functionalities to meet specific client needs.

- Maximizing Utility: Ensuring clients derive the greatest possible value and efficiency from their technology investments.

Fortive's revenue streams are diverse, encompassing product sales, recurring service and maintenance agreements, software subscriptions, calibration and repair services, and specialized consulting. These various avenues contribute to a robust financial model, with a notable emphasis on recurring revenue sources that foster customer loyalty and predictable income.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Product Sales | Direct sale of instrumentation, industrial tech, and hardware. | Significant driver, forming the initial customer acquisition. |

| Service & Maintenance | Ongoing support contracts for product upkeep and functionality. | High retention, providing predictable and stable income. |

| Software Subscriptions | Recurring revenue from software licenses and connected solutions. | Grew by 15% to $1.3 billion in 2023, highlighting digital growth. |

| Calibration & Repair | Ensuring accuracy and operational integrity of specialized equipment. | Enhances product value and generates recurring income. |

| Consulting & Professional Services | Expert advice, system integration, and bespoke solution development. | Optimizes customer technology investments and provides comprehensive solutions. |

Business Model Canvas Data Sources

The Fortive Business Model Canvas is meticulously constructed using a blend of proprietary financial data, in-depth market analysis, and strategic operational insights. These diverse data sources ensure that each component of the canvas accurately reflects Fortive's current business realities and future strategic direction.