Forrester SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forrester Bundle

Forrester's strengths lie in its deep industry expertise and established reputation, but its reliance on subscription revenue presents a potential vulnerability. Unlock the complete picture behind Forrester's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Forrester Research stands as a preeminent global force in market research, delivering critical insights to technology and business executives. Its deep-seated expertise and widespread recognition translate into serving a substantial segment of Fortune 100 companies, a testament to its industry authority.

Forrester's core strength lies in its deep expertise in developing customer-obsessed strategies. This focus is paramount in the current market, where understanding and catering to customer needs directly fuels growth, revenue, and profitability. In 2024, companies prioritizing customer experience saw an average of 4% higher revenue growth compared to their peers.

The company's distinctive research and ongoing advisory services are tailored to help clients successfully manage intricate market changes and digital transformations. Forrester's clients consistently report improved customer retention rates, with many seeing a 10-15% uplift within the first year of implementing their guidance.

Forrester is making significant strides in AI research, investing heavily in AI capabilities. This commitment is evident in their generative AI tool, Izola, which is attracting considerable client interest.

This strategic focus on advanced AI and responsible AI practices sets Forrester apart in the market. Client engagement has seen a notable uptick due to these pioneering efforts in cutting-edge technology.

Comprehensive Service Offerings

Forrester's strengths lie in its comprehensive service offerings, extending well beyond its core research reports. They provide a diverse portfolio that includes data analytics, expert consulting, and industry-leading events, catering to a broad spectrum of client needs.

This multi-faceted approach allows Forrester to address complex client challenges, offering everything from foundational strategic frameworks to highly specific, actionable insights crucial for informed decision-making in the dynamic tech landscape. For instance, their 2024 advisory services revenue is projected to grow significantly, reflecting strong demand for their consulting capabilities.

Key aspects of their comprehensive service include:

- Research and Data: Providing in-depth market intelligence and proprietary data sets.

- Consulting Services: Offering tailored advice and strategic guidance to businesses.

- Events and Community: Facilitating knowledge sharing and networking through flagship conferences like Forrester's CX events.

- Digital Tools and Platforms: Delivering interactive resources and analytics for clients.

Strong Financial Liquidity and Cost Management

Forrester's financial health remains a significant strength, even with recent revenue headwinds. The company has consistently shown robust cash flow from operations, a testament to its effective cost management strategies. This financial discipline allows for a healthy liquidity position, crucial for navigating economic uncertainties and funding future growth opportunities.

In the first quarter of 2024, Forrester reported cash and cash equivalents of $164.2 million. Furthermore, the company generated $10.1 million in cash flow from operating activities during the same period, underscoring its ability to convert revenue into readily available funds. This strong liquidity serves as a vital cushion, enabling strategic investments and operational resilience.

- Solid Cash Generation: Forrester consistently produces strong cash flow from its operations, indicating efficient business processes and financial management.

- Ample Liquidity: The company maintains a substantial cash balance, providing a buffer against market fluctuations and enabling strategic flexibility.

- Cost Discipline: Effective cost management practices contribute to the company's ability to generate positive cash flow despite revenue challenges.

- Financial Resilience: The combination of strong liquidity and cash flow generation positions Forrester favorably to weather economic downturns and pursue growth initiatives.

Forrester's core strength is its deep expertise in customer-obsessed strategies, a critical differentiator in today's market. This focus directly impacts client growth and profitability, with companies prioritizing customer experience showing an average of 4% higher revenue growth in 2024.

The company's comprehensive service offerings, including data analytics, consulting, and events, allow it to address complex client needs effectively. Their advisory services revenue is projected for significant growth in 2024, reflecting strong demand.

Forrester's robust financial health is another key strength. In Q1 2024, the company reported $164.2 million in cash and cash equivalents and generated $10.1 million in operating cash flow, demonstrating financial resilience and liquidity.

| Strength | Description | Supporting Data (2024/2025) |

|---|---|---|

| Customer-Obsessed Strategy Expertise | Deep knowledge in developing strategies centered on customer needs, driving client growth. | Clients prioritizing CX saw 4% higher revenue growth in 2024. |

| Comprehensive Service Portfolio | Offers a wide range of services including research, consulting, events, and digital tools. | Projected significant growth in advisory services revenue for 2024. |

| Strong Financial Health and Liquidity | Maintains substantial cash reserves and consistent operating cash flow. | Q1 2024: $164.2M cash and cash equivalents; $10.1M operating cash flow. |

What is included in the product

Analyzes Forrester’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis into actionable insights for immediate decision-making.

Weaknesses

Forrester's financial health is facing headwinds, with consistent revenue declines impacting its core business segments. In the first two quarters of 2025, both research and consulting revenues saw year-over-year decreases, a trend that has persisted for some time.

The research division, in particular, has experienced a downturn for nine consecutive quarters. This sustained drop in research revenue is a significant concern, directly affecting Forrester's ability to invest in new capabilities and maintain its competitive edge.

Forrester has experienced a notable decline in its client base, with a reduction in the total number of clients compared to prior periods. This trend is further underscored by a decrease in the average contract value (CV), signaling a challenge in securing and retaining business, especially from smaller vendors.

While Forrester saw a slight uptick in client retention to 91.5% in Q2 2025, a more concerning trend emerged with a decrease in wallet retention. This indicates that while clients are staying, they are spending less with Forrester or not increasing their engagement levels.

This decline in wallet share is directly linked to persistent budgetary pressures faced by clients, a situation exacerbated by ongoing macroeconomic headwinds. These factors collectively limit clients' capacity and willingness to expand their spending on research and advisory services.

Impact of Goodwill Impairment Charges

Forrester experienced a substantial GAAP net loss in the first quarter of 2025, largely due to an $83.9 million non-cash goodwill impairment charge. This significant write-down negatively impacted reported earnings, even though the company's underlying business operations demonstrated strength.

Goodwill impairment charges, while non-cash, can create a negative perception among investors, potentially affecting stock valuation and confidence. This can overshadow the performance of Forrester's core services and future growth prospects.

- Goodwill Impairment: $83.9 million in Q1 2025.

- Impact on GAAP Net Loss: Directly contributed to a significant reported loss.

- Investor Perception: Can negatively influence market sentiment and stock price.

- Core Operations: The impairment does not reflect the underlying operational health of the business.

Underperformance in Events Business

Forrester's events business has faced significant headwinds, contributing to its overall weaknesses. The segment experienced a notable 23% drop in revenue during the second quarter of 2025 when compared to the same period in the previous year. This decline is largely attributed to difficulties in securing sponsorship revenues, highlighting an area where strategic adjustments are clearly necessary.

Key factors contributing to this underperformance include:

- Declining Sponsorship Revenue: A 23% year-over-year decrease in Q2 2025 revenue for the events segment directly points to challenges in attracting and retaining sponsors.

- Market Saturation or Shifting Preferences: The inability to maintain sponsorship levels may indicate a need to re-evaluate the value proposition offered to potential sponsors in the current market.

- Operational Inefficiencies: While not explicitly stated, a substantial revenue drop could also signal underlying issues in event execution or attendee engagement that impact sponsor satisfaction.

Forrester is grappling with a shrinking client base and reduced spending from existing clients, a trend that directly impacts revenue. The average contract value has decreased, particularly for smaller vendors, indicating a struggle to secure and expand business relationships.

Wallet retention, a measure of how much existing clients are spending, has declined, suggesting that while clients may stay, their engagement and expenditure with Forrester are diminishing. This is further compounded by clients facing budget constraints due to ongoing macroeconomic pressures.

The events segment has seen a significant revenue drop of 23% in Q2 2025 year-over-year, primarily due to difficulties in securing sponsorship revenue. This points to a potential need to reassess the value proposition for sponsors in the current market landscape.

| Metric | Q2 2025 vs Q2 2024 | Commentary |

|---|---|---|

| Events Revenue | -23% | Primarily due to challenges in sponsorship revenue. |

| Average Contract Value | Decreasing | Impacts ability to secure and retain business, especially from smaller vendors. |

| Wallet Retention | Decreasing | Existing clients are spending less or not increasing engagement. |

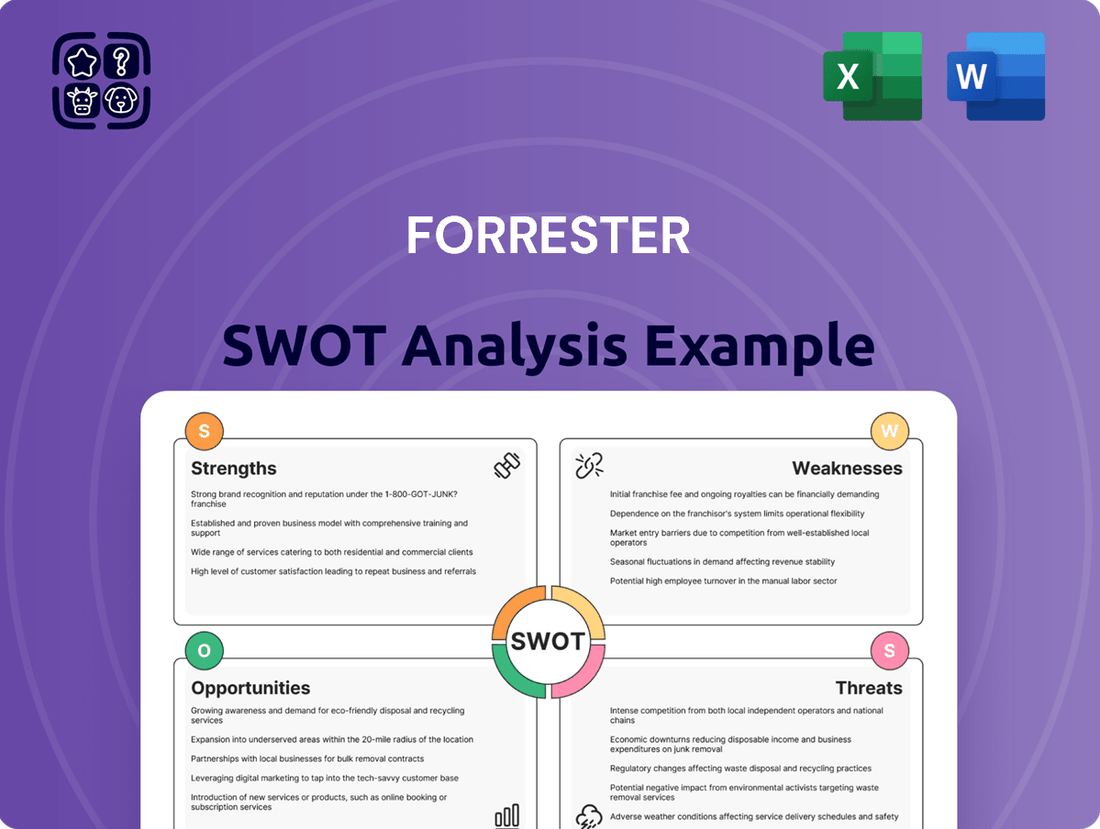

Preview Before You Purchase

Forrester SWOT Analysis

The preview you see is the same Forrester SWOT analysis document you'll receive upon purchase. This ensures transparency and guarantees you're getting the complete, professional-grade report.

Opportunities

Forrester is positioned to capitalize on the surging global technology market, which is projected to hit $4.9 trillion by 2025, according to Forrester's own forecasts. This massive expansion, especially within generative AI, software, and IT services, creates a fertile ground for Forrester to offer its insights.

By leveraging its deep expertise in AI and its comprehensive research capabilities, Forrester can develop and market new offerings that directly address the growing demand for guidance in these rapidly evolving technology sectors, thereby unlocking significant new revenue opportunities.

The growing need for AI governance and strategic implementation presents a significant opportunity. By 2025, Forrester anticipates that 40% of highly regulated enterprises will integrate data and AI governance, highlighting a critical market demand that Forrester is well-positioned to address.

Forrester's focus on AI governance and agentic AI directly taps into this burgeoning market. This strategic niche allows the firm to offer high-value advisory services as businesses grapple with the complexities of AI regulations and the practicalities of deploying AI systems effectively.

Forrester's development of novel research frameworks, like the Buying Networks series for B2B and the Total Experience Score for B2C, presents a significant opportunity. These new constructs have garnered positive client reception, indicating a strong market demand for such advanced analytical tools.

The successful introduction of these frameworks can substantially bolster Forrester's value proposition. By offering unique insights and methodologies, Forrester can attract a broader client base, particularly those looking for deeper, more actionable intelligence in their respective markets.

Improved Sales Pipeline and Client Engagement

Forrester's sales pipeline saw a significant 15% quarter-over-quarter increase in Q2 2025. This growth, coupled with a slight uptick in client retention, presents a clear opportunity to capitalize on expanding market interest.

This pipeline expansion translates into a stronger foundation for future revenue generation. The focus now shifts to effectively converting these leads into closed deals and nurturing existing client relationships for deeper engagement.

- Increased Lead Conversion: Leverage the 15% pipeline growth to implement targeted sales strategies for higher conversion rates.

- Enhanced Client Retention: Build on the improved client retention by offering tailored solutions and proactive support.

- Revenue Growth Potential: The expanding pipeline directly correlates with increased opportunities for revenue growth in the upcoming quarters.

- Strengthened Market Position: A robust sales pipeline and engaged client base solidify Forrester's competitive standing.

Leveraging Unique Research Model in Volatile Times

The current climate of economic and geopolitical instability actually creates a prime opportunity for Forrester. Their distinct approach to research, which emphasizes ongoing client support, becomes particularly valuable when businesses are navigating uncertainty. This allows Forrester to solidify its position as a crucial ally for organizations aiming to streamline expenses, mitigate risks, and respond effectively to swift market shifts.

Forrester can capitalize on this by highlighting how their continuous guidance helps clients make informed decisions amidst volatility. For instance, during periods of high inflation, like the projected 3.1% CPI increase for the US in 2024, Forrester's insights can guide businesses on cost-optimization strategies and risk management protocols.

- Cost Optimization: Providing actionable research on supply chain resilience and operational efficiency to combat rising input costs.

- Risk Management: Offering frameworks for assessing and mitigating geopolitical and economic risks, crucial in a landscape where global trade disruptions are frequent.

- Adaptability: Equipping clients with foresight into emerging technologies and market trends, enabling agile strategic adjustments.

- Essential Partnership: Demonstrating how continuous research guidance translates into tangible benefits, such as improved financial performance and market positioning, even in challenging economic conditions.

Forrester's expertise in AI, particularly in governance and agentic AI, positions it to capture a significant share of the growing market for AI implementation guidance. The firm's development of novel research frameworks, like Buying Networks and the Total Experience Score, has been met with positive client reception, indicating strong demand for its advanced analytical tools.

The company's robust sales pipeline, which saw a 15% quarter-over-quarter increase in Q2 2025, coupled with improved client retention, presents a clear opportunity for increased revenue conversion and deeper client engagement.

Economic and geopolitical instability actually enhances Forrester's value proposition, as businesses increasingly seek ongoing research and guidance to navigate uncertainty, optimize costs, and manage risks effectively.

Forrester's strategic focus on emerging technology trends and its ability to provide actionable insights during periods of economic volatility, such as the projected 3.1% US CPI increase for 2024, allows it to solidify its role as an essential partner for client success.

Threats

Ongoing macroeconomic and geopolitical instability presents a significant threat to Forrester. Clients, facing tightened budgets due to global economic uncertainty, are likely to reduce spending on research and advisory services, directly impacting Forrester's revenue streams and contract renewal rates. For example, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, a slight decrease from 3.0% in 2023, highlighting the challenging environment for discretionary spending.

The market research and advisory sector, especially concerning AI, is incredibly crowded. Forrester faces significant competition from established players like Gartner and IDC, both of whom are actively developing and promoting their own AI-driven analytics and predictive capabilities. This intense rivalry directly challenges Forrester's ability to maintain its market share and distinctiveness.

Forrester anticipates a significant challenge with declining brand loyalty. Their 2025 predictions suggest that as prices increase, consumers may become 25% less loyal to specific brands. This broader market shift could indirectly influence Forrester's clients, potentially making them hesitant to invest in customer experience (CX) strategies, which are core to Forrester's offerings.

This potential reduction in client investment in CX initiatives could directly impact the demand for Forrester's research and advisory services. If businesses are cutting back on CX spending due to economic pressures, they might also scale back their reliance on external insights and guidance in this area.

Potential for AI to Reduce Demand for Human-Led Services

Generative AI's rapid advancement presents a significant threat by automating tasks previously handled by humans. This could directly impact service-based industries, including consulting. For instance, a significant portion of frontline agents in contact centers are expected to be displaced by AI, as reported by various industry analyses for 2024 and 2025.

This automation trend may translate into a reduced demand for certain human-led consulting services, particularly those focused on customer experience optimization where AI can now perform many analytical and execution tasks. Forrester's consulting segment, which often advises on these areas, could see a shift in client needs and a potential decrease in project volume for traditional advisory roles.

- AI-driven automation is projected to impact millions of customer service jobs globally by 2025.

- The efficiency gains from AI could lead businesses to rely less on external human consultants for routine customer experience strategies.

- Forrester's revenue streams tied to human-centric advisory services may face pressure as AI solutions become more prevalent and cost-effective.

Risk of Continued Revenue and Contract Value Declines

Forrester's persistent struggle with declining revenue and contract value, evident over multiple quarters, presents a significant threat. This trend, if unchecked, could severely erode profitability and dampen investor sentiment. For instance, Forrester reported a 1.5% year-over-year revenue decline in Q1 2024, continuing a pattern from the previous fiscal year.

The continuation of these revenue and contract value declines poses a substantial risk to Forrester's financial health and its capacity for future investment. Such a trajectory could lead to a downward spiral, impacting its ability to innovate and maintain its competitive edge in the market.

- Revenue Decline: Continued year-over-year revenue decreases, as seen in Q1 2024's 1.5% drop, threaten profitability.

- Contract Value Erosion: A shrinking contract value base limits future recurring revenue streams.

- Impact on Investment: Reduced financial flexibility hinders essential investments in new research and technology.

- Investor Confidence: Sustained negative financial performance can significantly damage investor trust and market valuation.

Forrester faces intense competition from established research firms and emerging AI-native analytics providers, which could dilute its market share and pricing power. For example, Gartner and IDC are heavily investing in AI capabilities, directly challenging Forrester's AI research and advisory services. This crowded landscape necessitates continuous innovation to maintain differentiation and client engagement.

The increasing commoditization of data and analytics, particularly with advancements in generative AI, threatens to reduce the perceived value of traditional research reports and advisory services. As businesses gain easier access to AI-powered insights, they may become less reliant on external providers like Forrester for foundational analysis, impacting revenue from core offerings. This trend is underscored by projections that AI could automate a significant portion of data analysis tasks by 2025.

Forrester's financial performance, marked by a 1.5% year-over-year revenue decline in Q1 2024, presents a critical threat. This ongoing revenue erosion, coupled with a shrinking contract value, limits the company's ability to invest in R&D and adapt to market shifts, potentially impacting its long-term competitiveness and investor confidence.

| Threat Category | Specific Threat | Impact on Forrester | Supporting Data/Projection |

|---|---|---|---|

| Market Competition | Intensified competition from Gartner, IDC, and AI-native firms | Market share erosion, reduced pricing power | Gartner and IDC actively investing in AI capabilities |

| Technological Disruption | AI-driven automation and commoditization of data | Reduced demand for traditional research, lower perceived value of services | AI projected to automate data analysis tasks by 2025 |

| Financial Performance | Continued revenue decline and contract value erosion | Limited investment capacity, reduced competitiveness, damaged investor confidence | 1.5% year-over-year revenue decline in Q1 2024 |

SWOT Analysis Data Sources

This Forrester SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide actionable and data-driven strategic insights.