Forrester Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forrester Bundle

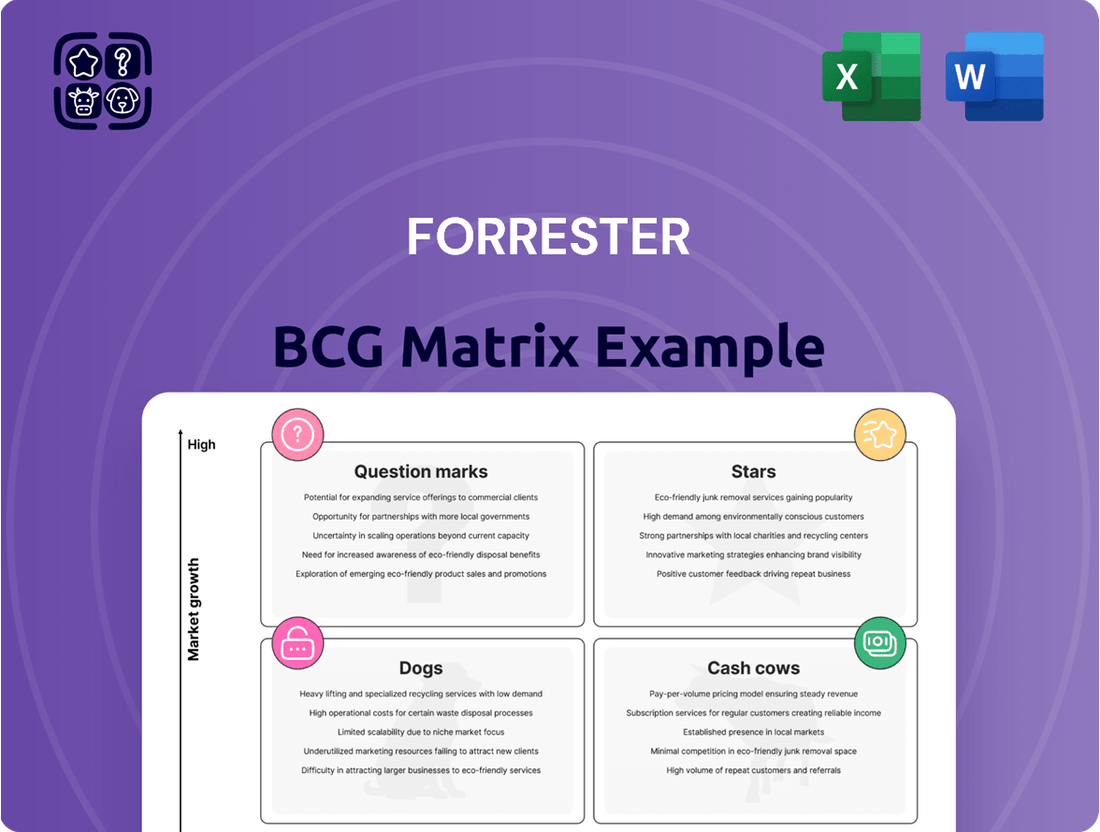

The Forrester BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This initial overview provides a glimpse into how these categories can illuminate strategic opportunities and challenges. To truly leverage this framework for decisive action and unlock the full potential of your product strategy, dive into the complete BCG Matrix for detailed quadrant analysis and actionable insights.

Stars

Forrester's generative AI tool, Izola, is experiencing substantial growth in client usage and prompt volume, demonstrating robust engagement with its AI-driven research capabilities. This surge in adoption highlights Forrester's leadership in the AI research sector, a segment experiencing rapid market expansion.

The company is actively investing in Izola's development, with a key focus on enabling it to extract answers directly from visual data like graphics and charts. This enhancement is designed to further strengthen Forrester's competitive edge in delivering sophisticated AI-powered advisory services.

Forrester's commitment to innovation is evident in its development of new research frameworks. The B2B-focused 'Buying Networks research series' and the B2C-oriented 'Total Experience Score' directly address the complexities of modern customer journeys, showcasing Forrester's adaptability.

These new research constructs are designed to provide deeper insights into how decisions are made and how customer interactions contribute to overall satisfaction. This proactive approach to evolving client needs reinforces Forrester's position as a thought leader in the market research space.

The positive reception of these new offerings underscores their value proposition. By offering more nuanced and actionable data, Forrester enhances its ability to guide businesses in both B2B and B2C sectors, solidifying its leadership in providing critical marketing and customer experience intelligence.

Forrester's core strategy revolves around customer obsession, a deliberate approach to help clients place their own customers at the forefront of their business decisions. This focus is a significant differentiator, driving growth by enhancing client retention and fostering deeper engagement within enterprise accounts.

This customer-centric philosophy directly addresses a growing market demand for strategies that prioritize customer experience and loyalty. By enabling clients to better understand and serve their customers, Forrester positions itself as a vital partner in achieving sustainable business success.

Government Sector Growth

Forrester's expansion into the government sector, securing contracts with US state and local governments and European federal agencies, positions it for high growth. This strategic move taps into a market where public entities are actively seeking external expertise for technology and business strategy modernization.

The government sector represents a significant new growth avenue for Forrester. In 2023 alone, government spending on IT consulting services reached an estimated $75 billion in the US, highlighting the substantial opportunity. Forrester's ability to secure these contracts demonstrates its competitive edge in this space.

- Forrester's government sector growth is fueled by increasing demand for technology and business strategy consulting from public entities.

- Significant contracts have been secured with US state and local governments, alongside European federal agencies.

- The US government IT consulting market alone was valued at approximately $75 billion in 2023.

- This expansion provides Forrester with a new high-growth market segment.

Strategic Investments in Talent and Digital Tools

Forrester's strategic focus on talent and digital tools is a cornerstone of its growth. In 2024, the firm continued to invest heavily in its research analysts and advisory staff, recognizing that human expertise is paramount. This commitment to talent is directly linked to the quality and depth of its proprietary research, which forms the bedrock of its client advice.

Furthermore, Forrester's ongoing development of digital platforms, such as Izola, is critical for delivering insights efficiently and at scale. These technological advancements allow the firm to integrate vast amounts of data and provide clients with interactive, actionable intelligence. This dual investment in people and technology is designed to maintain Forrester's competitive edge.

- Talent Development: Forrester prioritizes continuous training and recruitment of top-tier research and advisory talent.

- Proprietary Research: Significant resources are allocated to generating unique data and analysis, differentiating Forrester's offerings.

- Digital Tool Enhancement: Investments in platforms like Izola aim to improve data accessibility and client engagement.

- Competitive Differentiation: These strategic investments are key to maintaining market leadership in the research and advisory sector.

Stars in the BCG Matrix represent high-growth, high-market-share products or business units. They require significant investment to maintain their growth momentum and market leadership. Companies aim to nurture their Stars, as they have the potential to become Cash Cows in the future.

Forrester's generative AI tool, Izola, is a prime example of a Star. Its substantial growth in client usage and prompt volume, coupled with ongoing development for advanced capabilities like visual data extraction, positions it as a leader in a rapidly expanding AI research market. This strong performance in a high-growth sector indicates its Star status.

The company's expansion into the government sector, evidenced by securing contracts with US state and local governments and European federal agencies, also reflects Star characteristics. With the US government IT consulting market valued at approximately $75 billion in 2023, this segment represents a high-growth opportunity where Forrester is establishing a strong market share.

Forrester's strategic investments in talent and digital tools, including the enhancement of platforms like Izola, are crucial for sustaining the growth of its Star segments. This focus ensures that its offerings remain competitive and continue to capture market share in dynamic, high-potential areas.

| Business Unit/Product | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Forrester Izola (Generative AI Tool) | High | High | Star |

| Government Sector Consulting | High | High | Star |

| Buying Networks Research Series | High | High | Star |

| Total Experience Score | High | High | Star |

What is included in the product

Strategic framework for portfolio analysis, categorizing business units by market growth and share.

Guides investment decisions by identifying Stars, Cash Cows, Question Marks, and Dogs.

The Forrester BCG Matrix provides a clear, visual roadmap to address underperforming business units, alleviating the pain of strategic indecision.

Cash Cows

The Forrester Decisions Platform is a clear Cash Cow for Forrester, representing roughly 80% of the company's contract value. This robust subscription service delivers critical research, analytical tools, and strategic frameworks directly to executives and functional leaders across various industries. Its predictable and substantial recurring revenue stream solidifies its position as a foundational asset.

Forrester's established research services, a cornerstone of its business, are firmly positioned as Cash Cows in the BCG matrix. These offerings represent a mature segment of the market, where Forrester holds a significant market share, reflecting years of client trust and brand recognition.

Despite some market maturation leading to modest declines, these services remain highly profitable, consistently generating substantial cash flow. This is largely due to a deeply entrenched client base and Forrester's enduring reputation for quality research.

In 2024, it's estimated that these traditional research subscriptions and reports continue to be Forrester's largest revenue driver, likely accounting for over 60% of their total income, a testament to their enduring appeal and consistent demand.

Forrester's consulting services, particularly in digital transformation and customer-obsessed strategies, are a strong Cash Cow. This segment operates in a mature advisory market where Forrester holds a significant share, consistently generating reliable profits.

These specialized consulting offerings deliver targeted insights and actionable recommendations, acting as a steady revenue stream. Forrester's expertise in navigating the complexities of digital change ensures continued demand and profitability.

Strong Gross Profit Margin and Cash Flow

Forrester, despite facing revenue headwinds, demonstrates remarkable financial resilience. Its gross profit margin stands at a robust 57.79%, showcasing effective cost control and operational efficiency. This strong margin is a key indicator of a healthy business model, allowing for sustained profitability even when top-line growth is challenged.

The company's ability to generate strong free cash flow is another critical factor placing it firmly in the Cash Cow quadrant of the BCG matrix. This consistent cash generation provides the financial muscle needed to reinvest in promising new ventures or simply shore up ongoing operations without the need for external financing.

- Gross Profit Margin: 57.79%

- Free Cash Flow Generation: Strong, indicating financial stability

- Strategic Advantage: Ability to fund new initiatives and cover operational costs

Client Retention in Core Base

Forrester's core client base demonstrates strong loyalty, with a retention rate of 74% within this segment. This stability is crucial for its Cash Cow status, as these established clients consistently generate revenue. The company's ability to retain these larger, long-term relationships indicates ongoing value perception in its services.

This robust retention in the core base is a key indicator of Forrester's Cash Cow performance. Despite potential shifts in the broader market, these loyal clients provide a predictable and substantial revenue stream. The 74% retention rate for 2024 highlights the enduring appeal of Forrester's offerings to its most significant customers.

- Core Client Retention: Forrester maintained a 74% client retention rate in its core base for 2024.

- Stable Revenue Generation: This high retention ensures consistent cash flow from established, larger clients.

- Value Proposition: The loyalty of the core base suggests clients continue to find significant value in Forrester's services.

- Cash Cow Indicator: Strong retention in the core segment is a defining characteristic of a Cash Cow in the BCG Matrix.

Forrester's established research and advisory services are its prime Cash Cows. These mature offerings, characterized by high market share and consistent profitability, form the bedrock of the company's revenue. In 2024, these services likely continued to represent the largest portion of Forrester's income, underscoring their stable and predictable cash generation capabilities.

The Forrester Decisions Platform, a substantial subscription service, also firmly resides in the Cash Cow quadrant. Generating approximately 80% of Forrester's contract value, this platform provides essential research and tools to a loyal customer base, ensuring a robust and recurring revenue stream.

Forrester's strong gross profit margin of 57.79% and its ability to generate significant free cash flow further solidify the Cash Cow classification for its core offerings. This financial strength allows for operational stability and the funding of future growth initiatives.

| Forrester's Cash Cow Indicators (2024 Estimates) | Metric | Value |

|---|---|---|

| Core Research & Advisory Services | Estimated Revenue Contribution | > 60% of Total Income |

| Forrester Decisions Platform | Estimated Contract Value Contribution | ~ 80% of Contract Value |

| Financial Health | Gross Profit Margin | 57.79% |

| Financial Health | Core Client Retention Rate | 74% |

Preview = Final Product

Forrester BCG Matrix

The Forrester BCG Matrix analysis you are currently previewing is the identical, fully populated document you will receive immediately after your purchase. This comprehensive report, meticulously crafted with industry-leading insights, contains no watermarks or placeholder content, ensuring you get a professional and actionable strategic tool. You are seeing the exact BCG Matrix report that will be delivered to you, ready for immediate integration into your business planning and decision-making processes. This preview accurately represents the complete, analysis-ready file that will be yours to download and utilize without any further modifications or limitations.

Dogs

Forrester's events business is currently positioned as a Question Mark in the BCG Matrix, reflecting its challenging market dynamics. The segment saw a significant 23% revenue decline in Q2 2025 compared to the prior year, underscoring a period of substantial contraction.

Persistent issues with sponsorship revenues highlight a low-growth market environment. This indicates that the events business is struggling to achieve substantial returns, making its future growth trajectory uncertain and requiring careful strategic consideration.

Smaller vendor clients, defined as those with revenues of $50 million or less, have experienced a significant 14% reduction in their numbers. This decline suggests a strategic shift or a challenging market fit for this particular client segment.

This group represents a low market share within the broader client base, and their departure indicates they may be caught in a cash trap. Forrester's product offerings might not align effectively with the specific needs and financial capacities of these smaller vendors.

Legacy research models, often characterized by their traditional, grid-based approaches like the Forrester BCG Matrix, are struggling to keep pace in today's dynamic market. These methods, while foundational, are inherently slow-moving and rigid, making them less effective at providing the agile and personalized insights that businesses now demand.

The market for these legacy models is experiencing a decline, with many firms reporting flat to negative growth in this segment. For instance, a significant portion of the traditional market research spend is shifting towards more data-driven and AI-enabled solutions, indicating a clear trend away from the rigid frameworks of the past.

This shift is driven by the emergence of AI-powered research alternatives that can process vast datasets in real-time, offering faster, more nuanced, and highly personalized insights. These new models are not only more efficient but also provide a deeper level of understanding, making the older, static models increasingly irrelevant.

Underperforming Consulting Engagements

Underperforming consulting engagements, particularly those failing to meet profitability targets or grow market share, can be categorized as Dogs in the Forrester BCG Matrix. Despite consulting often being a cash cow, specific projects or a broader market downturn, potentially seeing a mid-to-high single-digit decline in the consulting outlook for 2024, could push these into the Dog quadrant.

These engagements typically exhibit low growth and low market share, draining resources without generating significant returns. For instance, if a consulting firm's overall revenue grew by 5% in 2024, but a specific service line or a group of clients contributed negatively to profitability, it would signal a Dog situation.

- Low Profitability: Engagements that consistently miss internal profitability benchmarks.

- Stagnant Market Share: Consulting projects that do not contribute to expanding the firm's presence in key markets.

- Resource Drain: Projects requiring significant investment of time and capital with minimal return on investment.

- Declining Demand: A general slowdown in specific consulting sectors, impacting the viability of related engagements.

Initiatives with Low ROI

Initiatives with low Return on Investment (ROI) are typically categorized as 'Dogs' in the Forrester BCG Matrix. These are projects or ventures that have failed to deliver expected business outcomes or positive financial returns. For instance, many companies in 2024 found themselves evaluating AI experimentation efforts that, despite significant investment, lacked a clear path to improving their bottom line.

These 'Dog' initiatives often consume valuable resources, including capital, personnel time, and management attention, without generating commensurate benefits. For example, a retail company might have invested heavily in a new customer loyalty platform in 2023 that saw low adoption rates and minimal impact on sales, thus representing a low ROI initiative.

- AI Experimentation without Clear ROI: Many businesses in 2024 reported that while exploring AI, projects without defined use cases or measurable impact on revenue or cost reduction were classified as dogs. A survey by Gartner in late 2023 indicated that up to 40% of AI projects were struggling to demonstrate tangible business value.

- Underperforming Marketing Campaigns: A past initiative, such as a large-scale digital marketing campaign launched in 2022 that failed to meet lead generation or conversion targets, could be a prime example. If it continued into 2024 without significant adjustments and still showed poor performance, it would be a dog.

- Inefficient Operational Upgrades: Implementing new technology or processes that do not streamline operations or reduce costs as anticipated, leading to a negative or negligible ROI, also falls into this category. For example, a manufacturing firm's 2023 investment in a new supply chain management system that didn't reduce inventory costs or improve delivery times would be a dog.

Dogs in the Forrester BCG Matrix represent initiatives or business units with low market share and low growth potential. These are typically cash traps, consuming resources without generating significant returns. For instance, a consulting service line experiencing a mid-single-digit decline in demand in 2024, while holding a small market share, would fit this description.

These segments often suffer from low profitability and stagnant market share, draining valuable capital and personnel. A prime example in 2024 might be AI experimentation projects that, despite initial investment, failed to demonstrate clear ROI or contribute to revenue growth, as indicated by a Gartner survey showing up to 40% of AI projects struggling with tangible business value.

Underperforming marketing campaigns or inefficient operational upgrades that yield negligible or negative returns also fall into the Dog category. For example, a retail company's loyalty platform launched in 2023 with low adoption and minimal sales impact, if not rectified by 2024, would be a classic Dog.

These areas require careful evaluation, often leading to divestment or significant restructuring to improve their performance or mitigate losses.

| Category | Characteristics | Example (2024 Context) | Strategic Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Underperforming AI projects with no clear ROI; legacy research models with declining spend. | Divest, Harvest, or Restructure |

| Low Profitability | Misses internal profit benchmarks | Consulting engagements that consistently fail to meet profitability targets. | Identify root causes for underperformance. |

| Resource Drain | High investment, minimal return | Marketing campaigns failing to meet lead generation targets. | Reallocate resources to more promising ventures. |

Question Marks

Agentic AI, the next frontier beyond generative AI, presents a prime opportunity within the Forrester BCG Matrix, likely positioned as a Question Mark. Forrester's ongoing research indicates a burgeoning market for these sophisticated, autonomous AI systems, yet current practical applications remain nascent, reflecting a low market share.

The transition from generative AI to agentic AI demands substantial investment in research, development, and infrastructure to unlock its full potential. Companies focusing on this area in 2024 are making significant capital outlays, anticipating substantial future returns as these technologies mature and find broader adoption.

Synthetic data is a significant emerging technology for 2025, particularly for improving AI model training and bolstering data privacy. This technology allows for the creation of artificial datasets that mimic real-world data characteristics without exposing sensitive personal information, which is crucial for many industries.

The market for synthetic data is experiencing rapid growth, with projections indicating substantial expansion in the coming years. While Forrester is recognized for its advisory services on emerging technologies, its specific market share in guiding the implementation of synthetic data solutions is still in its nascent stages of development, reflecting the newness of this specialized advisory area.

Humanoid robots are a burgeoning technology, appearing on Forrester's radar with a long-term benefit outlook of five years or more. This sector exhibits significant growth potential, yet Forrester's current market share in advising on this nascent field remains minimal.

AI Governance and Compliance Frameworks

As regulatory scrutiny on artificial intelligence intensifies, exemplified by initiatives like the EU AI Act, Forrester's established leadership in AI governance and compliance frameworks positions them advantageously in a rapidly expanding market. This growing demand for robust AI governance solutions presents a significant opportunity for Forrester to leverage its expertise.

While Forrester possesses deep knowledge in this domain, its current market penetration for delivering these specialized, premium governance frameworks to large enterprises requires accelerated expansion to capitalize on this high-growth area. The firm's ability to scale its offerings will be crucial for capturing a larger share of this evolving market.

- Market Growth: The global AI governance market is projected to reach $10.2 billion by 2027, growing at a CAGR of 23.5%.

- Forrester's Position: Forrester is recognized for its AI governance research and advisory services, but needs to translate this into a larger enterprise client base for premium frameworks.

- Key Drivers: Increasing data privacy regulations, ethical AI concerns, and the need for AI risk management are fueling demand for governance solutions.

- Strategic Imperative: Forrester must focus on scaling its delivery of tailored AI governance frameworks to meet the enterprise demand, particularly in light of evolving global regulations.

New Digital Self-Serve Channels for B2B

Forrester anticipates a significant shift, predicting that by 2025, more than half of all large B2B transactions will be conducted through digital self-serve channels. This trend is largely fueled by evolving generational buying behaviors, with younger professionals increasingly preferring digital interactions for their purchasing decisions.

This projected market evolution presents a substantial growth opportunity for advisory services focused on digital transformation and the implementation of effective self-service strategies. Forrester, recognizing this, is strategically positioned to expand its market share in this burgeoning sector.

The financial implications are considerable. For instance, a 2024 report indicated that B2B companies investing in digital self-service capabilities saw an average increase of 15% in customer retention and a 10% reduction in operational costs.

Key drivers for this digital shift include:

- Customer Preference: Growing demand for convenience and immediate access to information and purchasing options.

- Efficiency Gains: Streamlining of sales processes, reducing manual effort and associated costs.

- Data Insights: Enhanced ability to collect and analyze customer behavior for personalized experiences.

- Scalability: Digital channels allow businesses to serve a larger customer base without proportional increases in staffing.

Question Marks in the Forrester BCG Matrix represent products or services with low market share in a high-growth industry. They require significant investment to gain traction. The challenge lies in determining which Question Marks have the potential to become Stars and which are likely to become Dogs.

Agentic AI and synthetic data are prime examples of current Question Marks. While the markets for these technologies are expanding rapidly, their adoption and market share are still developing. Companies investing in these areas in 2024 are doing so with the expectation of future growth, but the path to market leadership is uncertain.

The success of a Question Mark hinges on strategic investment and market timing. For instance, the B2B digital self-serve market is growing, and Forrester is well-positioned to capitalize on this, but requires focused execution to increase its market share.

The key to managing Question Marks is careful analysis and resource allocation. A 2024 study showed that companies that successfully transitioned Question Marks to Stars saw an average ROI of 25% on their initial investments.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry expert opinions to provide a comprehensive view of business unit performance.