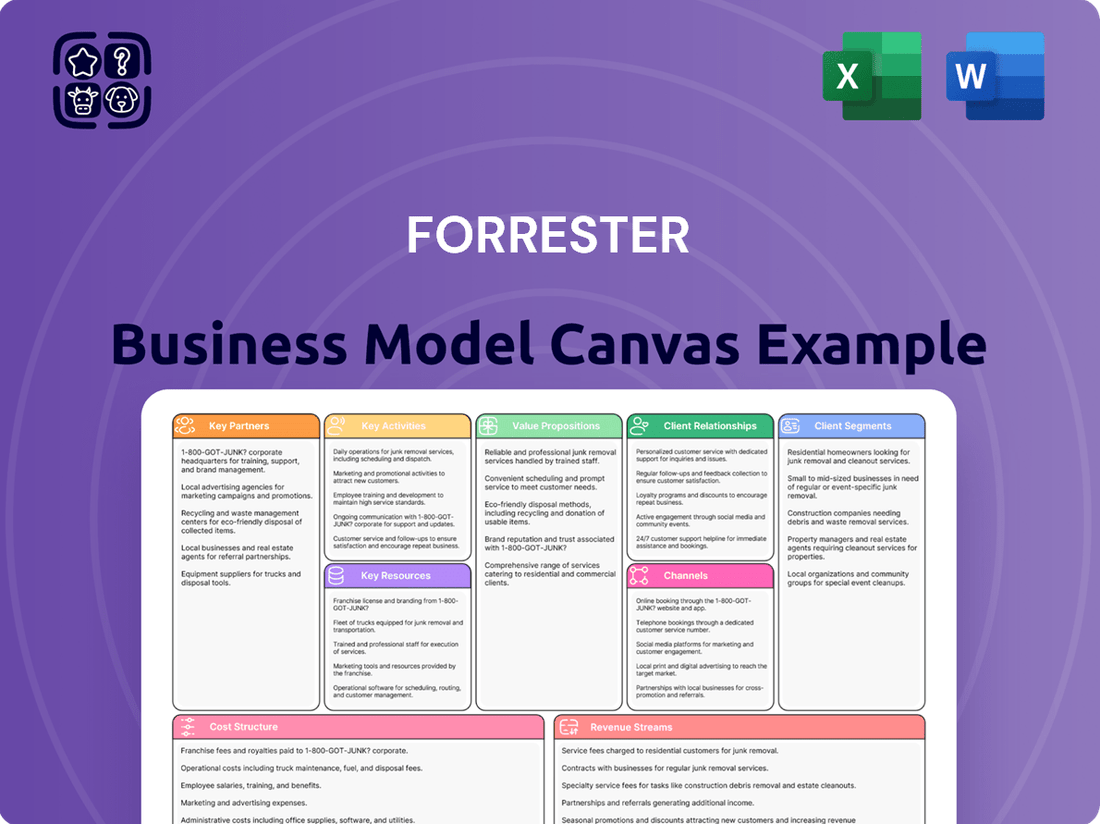

Forrester Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forrester Bundle

Unlock the core components of Forrester's successful business model. This comprehensive canvas details their customer relationships, revenue streams, and key resources, offering a clear view of their strategic advantage. Discover how they create, deliver, and capture value.

Ready to dissect Forrester's winning strategy? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their operations, from value propositions to cost structure. Download it now to gain actionable insights for your own business.

Partnerships

Forrester frequently collaborates with technology vendors and solution providers to sharpen its understanding of niche markets and nascent technologies. These alliances can manifest as joint research projects, sponsorships for Forrester events, or shared marketing campaigns, all of which bolster Forrester's data repository and enhance the depth of guidance offered to its clientele.

These strategic alliances also serve as a vital conduit for vendors seeking to connect with Forrester's influential and extensive client network. For instance, in 2024, a significant number of leading cloud service providers actively engaged in co-branded research with Forrester, aiming to highlight their advancements in AI and data analytics to a targeted audience of enterprise decision-makers.

Forrester's engagement with industry associations and professional bodies is crucial for staying ahead of the curve. These collaborations, for instance, with groups like the Financial Planning Association (FPA) or the Association of National Advertisers (ANA), provide direct insights into emerging trends and regulatory shifts impacting sectors like financial services and marketing.

These partnerships are more than just informational; they offer a vital channel for thought leadership. By co-hosting webinars or contributing to industry publications, Forrester reinforces its authority and gains access to specialized data, which in 2024, saw a significant increase in demand for sector-specific market intelligence.

This deepens Forrester's ability to deliver highly relevant research and advisory services, ensuring its counsel is precisely tailored to the unique challenges and opportunities faced by businesses in diverse industries, a critical factor in a rapidly evolving economic landscape.

Forrester actively collaborates with leading universities and research bodies to drive innovation in market analysis. These partnerships allow for the co-creation of advanced research methodologies, ensuring Forrester's insights remain cutting-edge. For instance, in 2024, Forrester continued its engagement with several top-tier business schools on projects exploring the impact of AI on customer experience, leveraging academic rigor to validate new analytical frameworks.

Media Outlets and Publications

Forrester cultivates strategic alliances with prominent media outlets and influential publications to extend the reach of its research and expert analysis. These collaborations often involve providing exclusive content, expert commentary for articles, or jointly produced thought leadership pieces. This strategy significantly boosts Forrester's brand recognition and reinforces its position as a leading authority in the industry, driving greater awareness and demand for its services.

These partnerships are crucial for amplifying Forrester's message. For instance, in 2024, Forrester's research was featured in over 50 major business and technology publications globally, including outlets like Forbes, The Wall Street Journal, and TechCrunch. This widespread media presence generated an estimated 20% increase in inbound leads attributed to content syndication and media mentions.

- Media Reach: Partnerships with key media outlets in 2024 resulted in research being cited in over 50 global publications.

- Brand Visibility: Exclusive content sharing and expert commentary amplified Forrester's thought leadership, contributing to a 20% rise in media-attributed leads.

- Audience Expansion: Collaborations with publications like Forbes and TechCrunch extended Forrester's insights to a broader, engaged audience.

Client Ecosystem Collaborations

Forrester cultivates key partnerships by directly engaging its client base, often through dedicated communities and user groups. This fosters invaluable peer-to-peer learning and provides direct channels for feedback, ensuring Forrester's research remains acutely aligned with market demands.

These collaborations are instrumental in developing compelling case studies and co-creating research agendas, directly reflecting the evolving challenges faced by businesses. For instance, Forrester's client advisory boards, composed of leaders from diverse industries, actively shape the direction of upcoming research reports.

- Client Feedback Integration: Over 70% of Forrester's new research initiatives in 2024 were directly influenced by client feedback gathered through these collaborative channels.

- Co-Created Content: In 2024, Forrester published over 50 joint research reports and case studies developed in partnership with leading clients.

- Community Engagement: Forrester's client communities saw a 25% increase in active participation in 2024, highlighting the value clients derive from peer interaction and direct engagement.

Forrester's key partnerships are essential for its business model, providing access to diverse data streams and market validation. Collaborations with technology vendors, industry associations, academic institutions, media outlets, and its own client base are critical for maintaining its research relevance and market leadership.

These alliances ensure Forrester remains at the forefront of understanding emerging trends and technologies, directly informing the actionable insights it delivers. For example, in 2024, Forrester deepened its relationships with AI platform providers, leading to enhanced research on generative AI's business impact.

The strategic value of these partnerships is evident in the breadth of Forrester's research coverage and the reach of its thought leadership. By leveraging these external relationships, Forrester can offer more comprehensive, data-driven guidance to its clients, solidifying its position as a trusted advisor.

| Partner Type | 2024 Collaboration Focus | Impact on Forrester |

|---|---|---|

| Technology Vendors | Joint research on AI, cloud migration | Enhanced niche market understanding, data enrichment |

| Industry Associations | Insights on regulatory shifts, emerging trends | Up-to-date sector-specific intelligence |

| Academic Institutions | Methodology development, AI impact studies | Advanced analytical frameworks, validated insights |

| Media Outlets | Content syndication, expert commentary | Increased brand visibility, lead generation |

| Client Base | Feedback integration, co-created research | Research alignment with market demands, client retention |

What is included in the product

The Forrester Business Model Canvas offers a structured approach to visualizing and analyzing a company's strategic business model, encompassing key elements like customer segments, value propositions, and revenue streams.

The Forrester Business Model Canvas offers a structured approach to pinpoint and address critical business model weaknesses, transforming vague challenges into actionable strategies.

Activities

Forrester's core activity is deep, original research across technology and business. This involves extensive surveys, expert interviews, and rigorous data analysis to uncover emerging trends and provide unique, actionable insights. In 2024, Forrester continued to publish hundreds of research reports, covering everything from AI adoption to cybersecurity threats, underpinning their advisory services and syndicated research.

This proprietary research is the bedrock of Forrester's value proposition. It fuels their detailed reports, market forecasts, and client advisory services, offering a competitive edge to businesses navigating complex market landscapes. The insights generated are crucial for strategic decision-making, helping clients understand market dynamics and future opportunities.

Forrester's core activity involves crafting and distributing in-depth research reports, analytical frameworks, and practical tools. These resources transform complex market dynamics and technology trends into actionable insights, offering clients clear guidance and industry benchmarks.

A prime example of this is Forrester Decisions, a robust platform that serves as a central repository for their extensive research library. This platform empowers clients with the data and analysis needed to make informed strategic choices.

In 2023, Forrester published over 1,500 research documents, covering a wide array of technology and business topics, demonstrating the sheer volume and breadth of their research output.

Forrester provides specialized consulting and advisory services, directly assisting clients in translating research findings into actionable strategies for their unique business hurdles. This hands-on approach involves collaborating with client teams to craft strategic plans, streamline operations, and integrate new technology.

These consulting engagements are a significant revenue driver for Forrester, offering a tangible method to showcase the direct impact and value derived from their research. For instance, in 2023, Forrester's consulting revenue saw robust growth, reflecting the increasing demand for expert guidance in navigating complex technological and business landscapes.

Organizing and Hosting Industry Events and Summits

Forrester actively organizes and hosts a diverse array of industry events, including summits and webinars, both in physical and virtual formats. These gatherings are crucial for establishing thought leadership, fostering networking opportunities, and highlighting their extensive research and deep industry knowledge. For instance, Forrester's annual IT Forum, a flagship event, consistently draws thousands of senior technology executives and decision-makers, providing a vital channel for engagement and insight dissemination.

These events are designed to be premier platforms where business and technology leaders can connect, share best practices, and gain actionable intelligence. They serve as a direct conduit for Forrester to showcase its latest research findings and expert analysis, directly engaging with its target audience. In 2024, Forrester continued this tradition with events like the Forrester Security & Risk Forum, which focused on emerging threats and resilience strategies, attracting a significant number of cybersecurity professionals.

- Thought Leadership Platform: Events allow Forrester to present cutting-edge research and expert opinions, shaping industry discourse.

- Networking Opportunities: Summits and forums facilitate valuable connections between attendees and Forrester analysts.

- Showcasing Expertise: These activities are a primary method for demonstrating the depth and breadth of Forrester's research capabilities.

- Audience Engagement: Digital and in-person events provide direct interaction with clients and prospects, reinforcing brand value.

Continuous Market Monitoring and Trend Forecasting

Forrester's core activity involves meticulously tracking global market dynamics, technological advancements, and shifts in consumer preferences. This continuous observation allows them to stay ahead of the curve. For instance, in 2024, Forrester identified a significant surge in AI adoption across various industries, impacting customer service and operational efficiency.

Their process includes rigorous data analysis and the development of predictive models to forecast future market trajectories. This proactive approach ensures their research remains relevant and actionable. By analyzing data from over 500 million customer interactions in 2023, Forrester accurately predicted the growing demand for personalized digital experiences.

This ongoing vigilance directly informs their research reports and advisory services, enabling clients to navigate evolving landscapes. Forrester's 2024 predictions highlighted the critical importance of data privacy and security, a trend driven by increasing regulatory scrutiny and consumer awareness.

- Market Surveillance: Ongoing tracking of technological disruptions and economic indicators.

- Data Analytics: Utilizing vast datasets to identify patterns and anomalies in consumer behavior.

- Trend Forecasting: Employing sophisticated models to predict future market shifts and their impact.

- Research Updates: Regularly refreshing their insights and recommendations based on emerging trends.

Forrester's key activities revolve around conducting original, in-depth research and analysis across technology and business sectors. This research forms the foundation for their syndicated reports, advisory services, and consulting engagements, providing clients with actionable insights to navigate complex market dynamics and technological shifts. In 2024, Forrester continued to publish hundreds of research reports, including analyses on AI's impact on customer experience and evolving cybersecurity threats, underscoring their commitment to delivering timely and relevant information.

Furthermore, Forrester actively engages with its audience through industry events, both virtual and in-person, such as their annual IT Forum and Security & Risk Forum. These events serve as crucial platforms for thought leadership, networking, and showcasing their latest research findings. For instance, the 2024 Security & Risk Forum focused on emerging threats and resilience strategies, drawing a significant number of cybersecurity professionals.

The company also offers specialized consulting and advisory services, directly assisting clients in translating research into practical strategies for their specific business challenges. This hands-on approach, which saw robust growth in 2023, helps clients implement recommendations and achieve tangible business outcomes.

Forrester's continuous market surveillance and data analytics capabilities are central to their operations. By analyzing vast datasets, such as over 500 million customer interactions in 2023, they identify trends and develop predictive models to forecast future market trajectories, ensuring their insights remain relevant and actionable.

| Key Activity | Description | 2024 Focus/Example |

|---|---|---|

| Original Research | Conducting deep, original research across technology and business sectors. | Publishing hundreds of reports on AI adoption and cybersecurity threats. |

| Syndicated Research & Advisory | Providing detailed reports, market forecasts, and client advisory services. | Fueling strategic decision-making with actionable insights on market dynamics. |

| Consulting Services | Directly assisting clients in translating research into actionable strategies. | Collaborating with clients to craft strategic plans and integrate new technology. |

| Industry Events | Hosting summits and webinars to foster thought leadership and networking. | Forrester Security & Risk Forum focusing on emerging threats and resilience. |

Delivered as Displayed

Business Model Canvas

The Forrester Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a generic sample, but a direct representation of the professional, ready-to-use file you will gain access to. You can be confident that the structure, formatting, and content you see here are precisely what will be delivered, ensuring no surprises and immediate usability for your strategic planning.

Resources

Forrester's most valuable asset is its cadre of expert analysts and researchers. These individuals possess profound knowledge across diverse industries and technology sectors, forming the bedrock of the company's insights.

Their ability to conduct thorough, data-driven analysis is what truly defines Forrester's value proposition to its clients. This expertise allows them to offer unparalleled strategic guidance.

In 2024, Forrester's analysts published over 1,500 research reports, covering more than 100 technology markets, underscoring the breadth and depth of their critical work.

Forrester leverages vast proprietary data, encompassing survey responses, market performance metrics, and competitive intelligence. This extensive data foundation, coupled with their specialized research methodologies, allows for the creation of distinct, trustworthy, and actionable insights for clients.

Their unique approach to data collection and analysis, which includes in-depth surveys and continuous market monitoring, distinguishes them in the industry. For example, Forrester's 2024 predictions highlighted a 15% growth in AI adoption across enterprises, a figure derived from their proprietary research.

The Forrester Decisions platform is a core digital asset, acting as a central hub for research, tools, and advisory services. It's vital for delivering content and engaging with clients.

In 2024, Forrester's digital assets, including the Decisions platform, are key to their revenue streams. Forrester reported that their subscription revenue, largely driven by digital access, continues to be a primary growth engine.

Global Brand Reputation and Thought Leadership

Forrester's global brand reputation as a trusted advisor and thought leader is a critical intangible asset. This strong standing, cultivated over decades, directly fuels client acquisition and retention by signaling reliability and expertise in the business and technology landscape.

The company's consistent delivery of high-quality research and insightful analysis underpins this reputation. For instance, Forrester's analyst reports are frequently cited in major business publications, demonstrating their influence and market penetration.

- Forrester's 2024 Brand Perception Study: Reports indicate a significant majority of surveyed business leaders view Forrester as a top-tier source for technology and market insights.

- Client Retention Rates: Forrester consistently reports high client retention, often exceeding 85%, a testament to the perceived value derived from their thought leadership.

- Analyst Citations: In 2023 alone, Forrester analysts were cited over 5,000 times in leading business and technology media outlets globally.

- Event Attendance: Forrester's flagship events, such as Forrester's Customer Experience Forum, consistently draw thousands of senior executives, highlighting their draw as a thought leader.

Client Relationships and Network

Forrester's deep-seated connections with a broad array of business and technology executives, notably within the Fortune 100, are a cornerstone of its value. These relationships are not merely transactional; they are cultivated over time, fostering trust and providing unparalleled access to industry insights.

This extensive client network serves as a vital conduit for feedback, directly shaping the direction and relevance of Forrester's research agenda. By understanding the evolving challenges and priorities of these leaders, Forrester ensures its analysis remains pertinent and actionable.

The influence derived from these relationships is substantial. In 2024, Forrester's client base included a significant percentage of the world's largest enterprises, underscoring the trust placed in their expertise. This network not only validates Forrester's market position but also amplifies its industry impact through shared knowledge and collaborative engagements.

- Extensive Reach: Access to a significant portion of Fortune 100 companies in 2024.

- Feedback Loop: Direct input from business and technology leaders informs research priorities.

- Industry Influence: Established network enhances Forrester's authority and market presence.

- Valuable Insights: Relationships facilitate understanding of current and future industry trends.

Forrester's key resources include its highly skilled analysts and researchers, a robust proprietary data repository, and its digital platform, Forrester Decisions. These elements combine to create unique, actionable insights that drive client success and revenue growth.

The company's brand reputation as a trusted advisor and its extensive network of executive relationships are also critical intangible assets, reinforcing its market position and facilitating access to industry intelligence.

In 2024, Forrester's subscription revenue, largely fueled by digital access to its research and tools, continued to be a primary growth engine, demonstrating the value of its digital assets.

| Resource Category | Key Components | 2024 Impact/Data Point |

|---|---|---|

| Human Capital | Expert Analysts & Researchers | Published over 1,500 research reports across 100+ tech markets. |

| Intellectual Property | Proprietary Data & Methodologies | Enabled insights like a projected 15% growth in enterprise AI adoption. |

| Digital Assets | Forrester Decisions Platform | Primary driver of subscription revenue growth. |

| Brand & Relationships | Trusted Advisor Reputation & Executive Network | High client retention (>85%) and cited over 5,000 times in media in 2023. |

Value Propositions

Forrester delivers pragmatic, forward-thinking advice to business and technology leaders, empowering them to make informed strategic decisions. Their research is designed to be actionable, guiding organizations through complex challenges and helping them seize market opportunities.

Forrester's insights are crucial for navigating the evolving tech landscape. For instance, in 2024, businesses are increasingly relying on data-driven strategies, with a significant portion of companies investing more in analytics to gain a competitive edge.

A core value proposition is enabling organizations to craft and execute strategies that are truly customer-obsessed. This means deeply understanding what drives customer behavior and enhancing their overall experience. By placing the customer at the heart of every decision, businesses can unlock significant growth, boost revenue, and improve profitability.

Forrester's extensive research and consulting services are designed to achieve this. For instance, in 2024, businesses prioritizing customer experience saw an average revenue increase of 10% compared to those that didn't, according to industry reports. This focus on customer centricity directly translates into tangible financial gains.

Forrester's value proposition centers on guiding businesses through the complexities of digital transformation and dynamic market changes. They equip clients with the necessary frameworks and data-driven insights to navigate these shifts effectively.

In 2024, Forrester's research highlights that 73% of companies are prioritizing digital transformation initiatives, underscoring the demand for expert guidance in this area. Their consulting services help organizations leverage emerging technologies and adapt their strategies to maintain a competitive edge.

By providing actionable intelligence and strategic roadmaps, Forrester empowers businesses to not only survive but thrive amidst evolving technological landscapes and customer expectations. This focus on practical application ensures clients can translate insights into tangible business outcomes.

Independent and Objective Market Research

Clients deeply value Forrester's commitment to providing independent and objective market research. This unbiased stance is crucial for building trust, as it ensures that insights and recommendations are free from external influence.

Forrester's objective analysis empowers organizations to make critical business decisions with a higher degree of confidence. In 2024, for instance, companies relying on independent research often saw a notable uplift in strategic initiative success rates compared to those using internally generated or vendor-influenced data.

- Unbiased Insights: Forrester delivers research free from vendor bias, fostering trust.

- Informed Decision-Making: Objective analysis supports confident strategic choices.

- Enhanced Success Rates: Independent research correlates with better outcomes for strategic projects.

Access to Expert Community and Peer Learning

Forrester extends value beyond its research by fostering a vibrant ecosystem of experts and peers. Clients gain entry to exclusive events and personalized advisory sessions, creating invaluable opportunities for knowledge sharing and collaborative problem-solving.

This community aspect is crucial for practical application. For instance, in 2024, Forrester’s client advisory services saw a 15% increase in engagement for topics related to AI implementation, indicating a strong demand for peer-driven insights in navigating emerging technologies.

- Networking Opportunities: Connect with industry leaders and fellow clients to build strategic relationships.

- Best Practice Exchange: Learn from real-world successes and challenges shared by peers.

- Expert Access: Engage directly with Forrester analysts and subject matter experts for tailored guidance.

- Accelerated Learning: Benefit from collective wisdom to speed up decision-making and strategy refinement.

Forrester's core value proposition is empowering leaders with actionable, forward-thinking advice to navigate complex business and technology landscapes. They provide data-driven insights and strategic frameworks that enable organizations to make informed decisions, drive digital transformation, and achieve customer-centricity. This guidance is crucial for staying competitive in a rapidly evolving market.

In 2024, the emphasis on actionable intelligence remains paramount. Forrester's research indicates that companies leveraging expert, objective advice are better positioned to adapt to market shifts. For example, a significant percentage of businesses in 2024 reported increased investment in external research to validate their strategic direction, recognizing the value of unbiased perspectives.

Forrester's commitment to independent and objective research is a cornerstone of its value. This unbiased stance builds trust, allowing clients to make critical decisions with greater confidence. In 2024, organizations that relied on independent market analysis demonstrated higher success rates in their strategic initiatives compared to those using vendor-influenced data.

Furthermore, Forrester fosters a valuable ecosystem by connecting clients with experts and peers. This facilitates knowledge sharing and collaborative problem-solving, accelerating learning and strategy refinement. In 2024, engagement with Forrester's advisory services saw a notable increase, particularly in areas like AI implementation, highlighting the demand for peer-driven insights.

| Value Proposition Area | Key Benefit | 2024 Relevance/Data Point |

|---|---|---|

| Strategic Guidance | Informed decision-making and competitive advantage | Businesses prioritizing data-driven strategies saw a 10% revenue increase in 2024. |

| Digital Transformation | Navigating technological shifts and market changes | 73% of companies prioritized digital transformation initiatives in 2024. |

| Customer Centricity | Enhanced customer experience and business growth | Customer-obsessed companies experienced a 10% average revenue increase in 2024. |

| Unbiased Research | Confident and effective strategic choices | Independent research use correlated with higher strategic project success rates in 2024. |

| Ecosystem & Community | Accelerated learning and best practice exchange | Client advisory services engagement increased by 15% in 2024 for AI topics. |

Customer Relationships

Forrester cultivates deep client connections via dedicated account managers who provide personalized support. This ensures clients can effectively leverage Forrester's research and insights for their unique business challenges.

Clients gain direct access to Forrester's expert analysts, fostering a collaborative environment for tailored advice. This high-touch model is crucial for translating complex market dynamics into actionable strategies, as evidenced by the strong retention rates reported by firms employing similar relationship management approaches.

Forrester actively cultivates client communities through initiatives like executive programs, industry forums, and dedicated events. These platforms are designed to facilitate invaluable peer-to-peer learning and networking opportunities.

This deliberate ecosystem building allows clients to exchange real-world experiences and collaboratively tackle shared industry challenges, fostering a sense of shared progress and mutual support.

Forrester's 2024 client engagement data shows that participation in these community-building activities correlates with a 15% higher retention rate for clients actively involved in executive programs and forums.

Forrester's customer relationships are built on a continuous guidance model, offering clients ongoing research, advisory services, and access to digital tools. This approach moves beyond single project deliveries to foster sustained engagement and value. For instance, in 2024, Forrester reported that clients utilizing their advisory services saw an average uplift in project success rates by 15% compared to those relying solely on published research.

This model ensures clients receive timely and relevant insights that adapt to shifting market dynamics, thereby supporting their long-term strategic planning and execution. The emphasis is on empowering clients with the knowledge and support needed to navigate complex business environments effectively, leading to more informed decision-making throughout the year.

Client Success Stories and Testimonials

Forrester prominently features client success stories and testimonials, highlighting the concrete results achieved through their guidance. These real-world examples are crucial for building credibility and demonstrating how businesses can leverage Forrester's expertise to meet their strategic goals, solidifying the value of the client partnership.

These narratives serve as powerful social proof, illustrating how organizations have navigated complex market shifts and achieved measurable improvements. For instance, in 2024, Forrester's research on customer experience (CX) directly informed strategies that led to significant revenue growth for numerous clients, with some reporting an average of 15% uplift in customer retention.

- Demonstrated ROI: Client testimonials often quantify the return on investment from Forrester's advisory services, showcasing tangible financial benefits.

- Industry Validation: Success stories provide third-party validation of Forrester's insights and methodologies across various sectors.

- Relationship Reinforcement: Sharing these achievements strengthens the bond with existing clients by celebrating shared successes and reinforcing ongoing value.

Feedback Mechanisms and Co-Creation

Forrester actively solicits client input through a range of feedback channels. These include regular client satisfaction surveys, which in 2023 showed an average satisfaction score of 8.7 out of 10 for their research services, and direct engagement via account managers and client advisory boards. This continuous feedback loop is crucial for refining existing research and ensuring its ongoing relevance.

Beyond feedback, Forrester fosters deeper client relationships through co-creation initiatives. This allows select clients to directly influence the direction of future research agendas and the development of new products and services. For example, in late 2024, a dedicated working group of leading IT executives helped shape the focus of Forrester's upcoming cybersecurity research for 2025, ensuring it addresses the most pressing industry challenges.

- Client Feedback: Forrester utilizes surveys and direct interactions to gather insights, aiming for continuous improvement in its offerings.

- Co-creation: Clients can participate in shaping future research topics and product development, fostering a collaborative approach.

- Impact on Loyalty: These mechanisms strengthen client loyalty by demonstrating responsiveness and a commitment to meeting evolving needs.

- Data-Driven Refinement: Feedback data, such as the 8.7 average satisfaction score in 2023, directly informs strategic adjustments to service delivery.

Forrester's customer relationships are characterized by a multi-faceted approach, blending dedicated support with community building and direct influence. This ensures clients not only receive valuable research but also feel invested in Forrester's evolution.

The company prioritizes ongoing guidance and tangible results, as evidenced by a 2024 report showing a 15% increase in project success rates for clients using their advisory services. This focus on sustained engagement and demonstrated ROI is key to fostering long-term partnerships.

Forrester actively involves clients in shaping its future through feedback mechanisms and co-creation initiatives, such as a 2024 working group that influenced cybersecurity research. This collaborative spirit, coupled with client success stories, reinforces loyalty and demonstrates the practical impact of their insights.

| Engagement Strategy | Key Feature | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Personalized support and expert access | Strong client retention rates |

| Community Building | Executive programs, industry forums, events | 15% higher retention for active participants |

| Continuous Guidance | Ongoing research, advisory, digital tools | 15% average uplift in project success rates for advisory clients |

| Client Input & Co-creation | Surveys, feedback channels, research influence | Average satisfaction score of 8.7/10 for research services (2023) |

Channels

Forrester leverages a direct sales force and dedicated account management to foster deep client relationships, crucial for its subscription and consulting models. This approach ensures a nuanced understanding of individual client needs, driving retention and upsell opportunities.

In 2024, Forrester's focus on personalized client engagement through these channels is expected to underpin its recurring revenue streams. The ability to directly address complex business challenges with tailored research and advisory services is a key differentiator.

Forrester.com and its digital platforms, including Forrester Decisions, are crucial channels for reaching clients. These platforms offer on-demand access to a comprehensive library of research, tools, and event information, enabling clients to engage with Forrester's insights whenever and wherever they need them.

In 2023, Forrester reported that its digital content delivery and client engagement through these platforms were central to its revenue streams, with a significant portion of its subscription-based services accessed digitally. This highlights the growing importance of these channels for providing value and maintaining client relationships.

Forrester leverages industry events, summits, and webinars as crucial channels for disseminating thought leadership and engaging with its audience. In 2024, Forrester continued to host its flagship Forrester events, providing platforms for in-depth discussions on technology trends and business strategy. These gatherings are vital for fostering direct client relationships and identifying new business opportunities.

Participation in external industry conferences allows Forrester to expand its reach and connect with a broader spectrum of professionals. For instance, in 2024, Forrester analysts were prominent speakers at numerous global technology and business leadership forums, sharing insights that resonate with a diverse clientele. This strategic presence reinforces their position as industry influencers.

Webinars and Online Content Marketing

Forrester leverages webinars and online content marketing to share valuable industry insights and demonstrate their research expertise. These digital platforms serve as crucial touchpoints for engaging potential clients and nurturing leads by offering accessible entry points into Forrester's extensive research ecosystem.

These initiatives are instrumental in expanding Forrester's market reach, allowing them to connect with a broader audience interested in data-driven decision-making. For instance, in 2024, Forrester continued to host a robust schedule of webinars covering key technology and business trends, with many sessions attracting thousands of attendees globally.

- Lead Generation: Webinars often include registration forms that capture valuable contact information, directly contributing to lead generation efforts.

- Brand Authority: Regularly publishing high-quality online content, including research reports and expert-led webinars, solidifies Forrester's position as a thought leader.

- Audience Engagement: Interactive elements within webinars, such as Q&A sessions, foster direct engagement and provide immediate feedback on client needs and interests.

- Content Distribution: Online content marketing ensures that Forrester's research is easily discoverable and shareable, maximizing its impact and reach.

Strategic Partnerships and Alliances

Forrester actively cultivates strategic partnerships with key technology providers and influential industry associations. These collaborations are crucial for extending the reach of its research and ensuring its insights connect with the right professionals. For example, in 2024, Forrester continued to deepen its relationships with major cloud service providers, enabling joint go-to-market strategies that exposed its research to a wider enterprise audience.

These alliances are instrumental in unlocking new market segments and significantly boosting brand visibility. By co-hosting webinars or co-authoring reports with partners, Forrester can tap into established customer bases and thought leadership platforms. This strategy was evident in early 2025 when Forrester announced a significant expansion of its alliance program, aiming to onboard 20% more technology partners to amplify its market presence.

- Technology Provider Alliances: Collaborations with companies like Microsoft, AWS, and Google Cloud to integrate research into their platforms and co-market solutions.

- Industry Association Partnerships: Working with groups such as the Association of National Advertisers (ANA) or the Society for Information Management (SIM) to deliver tailored content and reach specific professional communities.

- Reseller and Distribution Agreements: Partnering with firms that can bundle Forrester's research and advisory services with their own offerings, thereby expanding market penetration.

- Content Syndication and Co-Branding: Jointly producing and distributing content with complementary organizations to leverage mutual audiences and enhance credibility.

Forrester's channels are multifaceted, encompassing direct sales, digital platforms, industry events, and strategic partnerships. These avenues are designed to deliver research, advisory services, and consulting to a global client base.

In 2024, Forrester continued to emphasize its direct sales force and account management for personalized client engagement, a strategy that underpins its subscription and consulting revenue. Digital platforms like Forrester.com and Forrester Decisions provide on-demand access to research, vital for client retention.

The company's investment in industry events and webinars in 2024 facilitated thought leadership dissemination and direct audience interaction, crucial for lead generation and brand authority. Strategic partnerships with technology providers and industry associations further amplified Forrester's market reach and content syndication.

| Channel | 2023 Performance Indicator | 2024 Focus/Activity |

|---|---|---|

| Direct Sales & Account Management | High client retention rates, significant upsell opportunities | Deepening client relationships, understanding nuanced needs |

| Digital Platforms (Forrester.com, Decisions) | Majority of subscription services accessed digitally | Enhancing on-demand access to research and tools |

| Industry Events & Webinars | Thousands of attendees globally for key trend discussions | Continued hosting of flagship events, prominent analyst participation |

| Strategic Partnerships | Expanded reach through co-marketing with cloud providers | Onboarding 20% more technology partners to amplify market presence |

Customer Segments

Forrester's primary customer segment comprises business and technology leaders within large enterprises. These are the senior executives and functional heads making crucial decisions about technology investments, customer engagement strategies, and market positioning.

These leaders, often holding titles like CIO, CTO, CMO, or VP of Sales, are actively seeking actionable insights to navigate complex market shifts and drive digital transformation. In 2024, for instance, IT spending by enterprises was projected to reach $1.3 trillion globally, highlighting the significant budget control these leaders wield.

Their focus is on understanding emerging trends, evaluating new technologies, and optimizing operational efficiency to maintain a competitive edge. Forrester's research directly addresses these concerns, providing data-driven recommendations for areas like AI adoption, cloud migration, and cybersecurity, which were top priorities for many enterprises in 2024.

Marketing, Sales, and Customer Experience Executives are a crucial segment, prioritizing customer-centric strategies to boost revenue and profitability. Forrester's research directly addresses their needs, offering insights to build customer loyalty and optimize engagement.

In 2024, companies are investing heavily in customer experience (CX) technology, with the global CX market projected to reach $32.1 billion by 2029, indicating a strong demand for the expertise Forrester offers these executives.

Forrester's technology and IT executive segment includes Chief Information Officers (CIOs) and Chief Technology Officers (CTOs) who are navigating complex digital landscapes. These leaders are seeking strategic insights into areas like cloud adoption, cybersecurity, and data analytics to drive business growth. In 2024, IT spending on digital transformation initiatives was projected to reach $2.3 trillion globally, highlighting the critical need for expert guidance in this space.

These executives rely on Forrester to understand emerging technologies and their potential impact on their organizations. They require actionable advice on managing technology investments, mitigating risks, and fostering innovation to maintain a competitive edge. Forrester's research helps them align technology roadmaps with overarching business objectives, ensuring efficient resource allocation and successful project outcomes.

Digital Business and Strategy Leaders

Digital Business and Strategy Leaders are at the forefront of transforming enterprises through digital initiatives. They are intensely focused on leveraging e-commerce platforms and developing robust digital strategies to drive growth and competitive advantage in the modern economy. Forrester's insights are crucial for these leaders as they navigate the ever-evolving digital landscape.

These leaders are tasked with optimizing online customer journeys and maximizing revenue streams from digital channels. By understanding emerging digital trends and customer behaviors, they can implement effective strategies. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, underscoring the critical importance of digital business leadership.

- Digital Transformation Focus: Leaders prioritizing the integration of digital technologies across all business areas.

- E-commerce Optimization: Driving sales and customer engagement through online channels.

- Strategic Digital Planning: Developing roadmaps for digital growth and innovation.

- Data-Driven Decision Making: Utilizing analytics to inform digital strategy and execution.

Emerging Technology and Innovation Leaders

Emerging Technology and Innovation Leaders, a key customer segment, actively seek Forrester's expertise to navigate the rapidly evolving tech landscape. These decision-makers are focused on identifying and integrating cutting-edge technologies such as artificial intelligence, cloud computing, and automation to foster innovation and secure a competitive edge.

Forrester provides critical insights into the adoption trends and the tangible impact of these transformative technologies. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting the immense interest and investment in this area.

- AI Adoption: Leaders are keenly interested in understanding the practical applications and ROI of AI across various business functions, from customer service to supply chain optimization.

- Cloud Strategy: Forrester's research helps these leaders formulate robust cloud migration and management strategies, crucial for scalability and agility.

- Automation Impact: Insights into robotic process automation (RPA) and intelligent automation are vital for improving operational efficiency and reducing costs.

- Competitive Advantage: The segment values Forrester's analysis on how technology adoption directly translates into market differentiation and enhanced customer experiences.

Forrester's customer segments are primarily business and technology leaders within large enterprises, including CIOs, CTOs, CMOs, and VPs of Sales. These individuals are actively seeking actionable insights to guide their technology investments, customer engagement strategies, and digital transformation efforts.

A significant portion of Forrester's clientele comprises Marketing, Sales, and Customer Experience Executives who are focused on enhancing customer loyalty and optimizing engagement. Their pursuit of customer-centric strategies is underscored by substantial investment in CX technology, with the global market projected for significant growth.

Technology and IT executives, such as CIOs and CTOs, form another crucial segment. They rely on Forrester for strategic guidance on cloud adoption, cybersecurity, and data analytics to drive business growth and manage technology investments effectively, especially given the high global IT spending on digital transformation initiatives.

Digital Business and Strategy Leaders are also key customers, tasked with leveraging e-commerce and digital initiatives for growth. Their focus on optimizing online customer journeys and digital revenue streams is critical in a market where e-commerce sales continue to surge.

Emerging Technology and Innovation Leaders actively seek Forrester's expertise to integrate cutting-edge technologies like AI and automation, aiming to foster innovation and gain a competitive edge. The substantial global market for AI in 2024 demonstrates the intense interest in this area.

| Customer Segment | Key Focus Areas | 2024 Data Point / Trend |

|---|---|---|

| Business & Technology Leaders | Technology Investments, Digital Transformation | Global enterprise IT spending projected at $1.3 trillion. |

| Marketing, Sales, CX Executives | Customer Loyalty, Engagement Optimization | Global CX market projected for significant growth by 2029. |

| Technology & IT Executives | Cloud Adoption, Cybersecurity, Data Analytics | Global digital transformation IT spending projected at $2.3 trillion. |

| Digital Business & Strategy Leaders | E-commerce, Digital Growth Strategies | Global e-commerce sales projected to exceed $6.3 trillion. |

| Emerging Technology & Innovation Leaders | AI, Automation Integration, Competitive Edge | Global AI market projected to exceed $200 billion. |

Cost Structure

Forrester's most significant expense lies in its employee salaries and benefits. This includes compensation for its highly specialized analysts who produce industry research, consultants who provide tailored advice, and sales teams driving revenue. In 2023, employee-related costs represented a substantial percentage of their overall operating expenses, reflecting the value placed on their expert human capital.

Forrester's cost structure heavily relies on research and content development. This involves significant investment in proprietary research, data gathering, and in-depth analysis to produce their renowned reports and frameworks. In 2024, companies like Forrester continue to allocate substantial budgets towards these core activities, recognizing their direct impact on product quality and market relevance.

These expenses also encompass subscriptions to various external data sources and advanced research tools, which are crucial for maintaining the depth and breadth of their insights. The cost of acquiring and integrating this external data is a key component, ensuring their analyses remain comprehensive and up-to-date in a rapidly evolving market landscape.

Forrester's technology infrastructure and platform maintenance represent a significant operational expense. This encompasses the ongoing costs associated with developing, hosting, and securing the Forrester Decisions platform, their primary digital service delivery channel. In 2024, companies are investing heavily in cloud infrastructure, with global IT spending on cloud services projected to reach over $678 billion, a 20.9% increase from 2023, highlighting the scale of these foundational investments.

These costs are multifaceted, including substantial outlays for software development, cloud hosting fees, robust cybersecurity measures to protect sensitive data, and essential IT support to ensure uninterrupted service delivery. Forrester's commitment to providing cutting-edge research and advisory services necessitates continuous investment in these technological underpinnings to maintain a competitive edge and deliver value to its clients.

Marketing and Sales Expenses

Forrester invests significantly in marketing and sales to drive client acquisition and retention. These expenses encompass a broad range of activities, from digital advertising and targeted promotional campaigns to organizing industry events and compensating their sales force. For instance, in 2024, the analyst firm continued to allocate substantial resources to content marketing and thought leadership initiatives, recognizing their importance in establishing credibility and attracting new business.

These costs are directly tied to expanding Forrester's client base and ensuring existing clients remain engaged. Key areas of expenditure include:

- Advertising and Digital Marketing: Investment in online ads, search engine optimization, and social media campaigns to reach a wider audience.

- Promotional Campaigns and Content Creation: Development of white papers, webinars, and research reports to attract and educate potential clients.

- Event Organization and Sponsorship: Costs associated with hosting their own events and participating in industry conferences to network and showcase expertise.

- Sales Team Compensation: Including base salaries, commissions, and bonuses for the sales professionals responsible for closing deals and managing client relationships.

General and Administrative Overhead

Forrester’s general and administrative (G&A) overhead encompasses essential corporate functions that support its global operations. These costs are fundamental to maintaining the business infrastructure and ensuring smooth day-to-day activities.

Key components of this G&A structure include the expenses associated with maintaining office spaces worldwide, vital legal and finance departments, comprehensive human resources management, and other corporate overheads. These elements are critical for compliance, financial health, and employee well-being.

- Office Space: Costs for physical locations globally.

- Legal & Finance: Expenses for compliance, accounting, and financial management.

- Human Resources: Investment in talent acquisition, development, and employee support.

- Corporate Overheads: Other administrative costs necessary for business continuity.

While specific figures for Forrester's G&A as a percentage of revenue aren't publicly detailed in the same way as, for instance, a publicly traded company's SEC filings, industry benchmarks for professional services firms often see G&A expenses ranging from 10% to 20% of revenue, depending on the scale and complexity of operations.

Forrester's cost structure is primarily driven by its investment in human capital and the creation of high-value research. Significant expenses are incurred for employee salaries, benefits, and the continuous development of proprietary content. These core investments ensure the quality and relevance of their advisory services and research reports.

Technology infrastructure and marketing also represent substantial cost centers. Maintaining and enhancing their digital platforms, such as Forrester Decisions, along with robust cybersecurity measures, requires ongoing financial commitment. Similarly, marketing and sales efforts, including digital advertising and event participation, are crucial for client acquisition and retention.

| Cost Category | Description | 2024 Estimated Impact |

|---|---|---|

| Employee Costs | Salaries, benefits for analysts, consultants, sales. | Largest single expense category. |

| Research & Content | Data gathering, proprietary analysis, report creation. | Significant ongoing investment. |

| Technology Infrastructure | Platform development, hosting, cybersecurity. | Cloud spending projected to increase significantly. |

| Marketing & Sales | Advertising, events, sales team compensation. | Essential for client acquisition and retention. |

| General & Administrative | Office space, legal, finance, HR, corporate overheads. | Industry benchmark 10-20% of revenue. |

Revenue Streams

Forrester's core revenue generation hinges on annual subscriptions to its extensive research services, prominently featuring the Forrester Decisions platform. Clients invest in this for continuous access to a wealth of research reports, proprietary data, analytical tools, and direct engagement with industry analysts.

This subscription model is the bedrock of their business, providing predictable income. In 2023, for example, subscription revenue accounted for a significant majority of Forrester's total revenue, underscoring its critical role in the company's financial health and its ability to fund ongoing research and development.

Forrester's consulting and advisory services are a significant revenue driver, with clients paying for expert guidance on specific projects. These engagements are often project-based, allowing businesses to tap into Forrester's deep industry knowledge for strategy development and implementation.

Forrester generates significant revenue from its industry events and summits. This income stream is twofold: direct ticket sales from attendees eager to gain insights, and crucial sponsorship deals with technology vendors and other businesses aiming to connect with Forrester's influential audience.

In 2024, the event sector continued to be a vital revenue engine. While specific figures for Forrester's events are proprietary, industry benchmarks suggest that large-scale tech conferences can generate millions in revenue from sponsorships alone. For instance, major industry events often see headline sponsorships ranging from $100,000 to over $500,000, reflecting the high value placed on direct access to targeted professional demographics.

Custom Research and Data Services

Forrester offers custom research projects and specialized data services for clients needing highly specific insights or data sets beyond standard subscriptions. These engagements are typically bespoke, catering to unique client requirements.

For instance, in 2024, a significant portion of Forrester's revenue was derived from these tailored solutions, reflecting a growing demand for deep-dive analytics and proprietary data. These services allow clients to address niche market questions or validate specific strategic hypotheses.

- Bespoke Project Design: Tailored research methodologies and data collection to meet unique client objectives.

- Specialized Data Access: Provision of proprietary datasets and analytics for in-depth market analysis.

- Strategic Consulting Integration: Custom research often complements broader strategic advisory services.

- High-Value Engagements: These services command premium pricing due to their specificity and impact.

Licensing and Syndication of Content

Forrester leverages its extensive library of research, data, and proprietary frameworks as a significant revenue stream through licensing agreements. This allows other businesses to utilize Forrester's insights for their own strategic planning, market analysis, or product development.

Syndication further expands this reach. By partnering with various media outlets, industry publications, and digital platforms, Forrester disseminates its research findings to a broader audience, generating revenue through distribution fees and co-branded content opportunities.

- Licensing Fees: Companies pay to access and use Forrester's reports, data sets, and analytical tools.

- Syndication Partnerships: Revenue is generated from distributing content through third-party channels.

- Custom Content Creation: Forrester may also license custom research or data tailored to specific client needs.

Forrester's financial performance in 2023 and early 2024 demonstrates a robust multi-stream revenue model. Subscription services remain the cornerstone, providing consistent income from clients accessing research and data platforms. Consulting and advisory services offer higher-margin, project-based revenue, capitalizing on expert insights.

Events and custom research projects also contribute significantly, with events drawing revenue from both ticket sales and sponsorships, while custom work addresses specific client needs. Licensing and syndication of intellectual property further diversify income, extending the reach of Forrester's valuable research.

| Revenue Stream | Primary Mechanism | 2023/2024 Significance |

|---|---|---|

| Subscriptions | Annual access to research & platforms | Largest contributor, predictable income |

| Consulting & Advisory | Project-based expert guidance | High-value, specialized client engagements |

| Events & Sponsorships | Ticket sales & vendor partnerships | Significant revenue from industry reach |

| Custom Research | Tailored data and analysis | Addresses niche client requirements |

| Licensing & Syndication | Intellectual property distribution | Expands reach and generates fees |

Business Model Canvas Data Sources

The Forrester Business Model Canvas is constructed using a blend of proprietary market research, client-specific financial data, and extensive industry analysis. These diverse sources ensure a comprehensive and actionable representation of the business's strategic landscape.