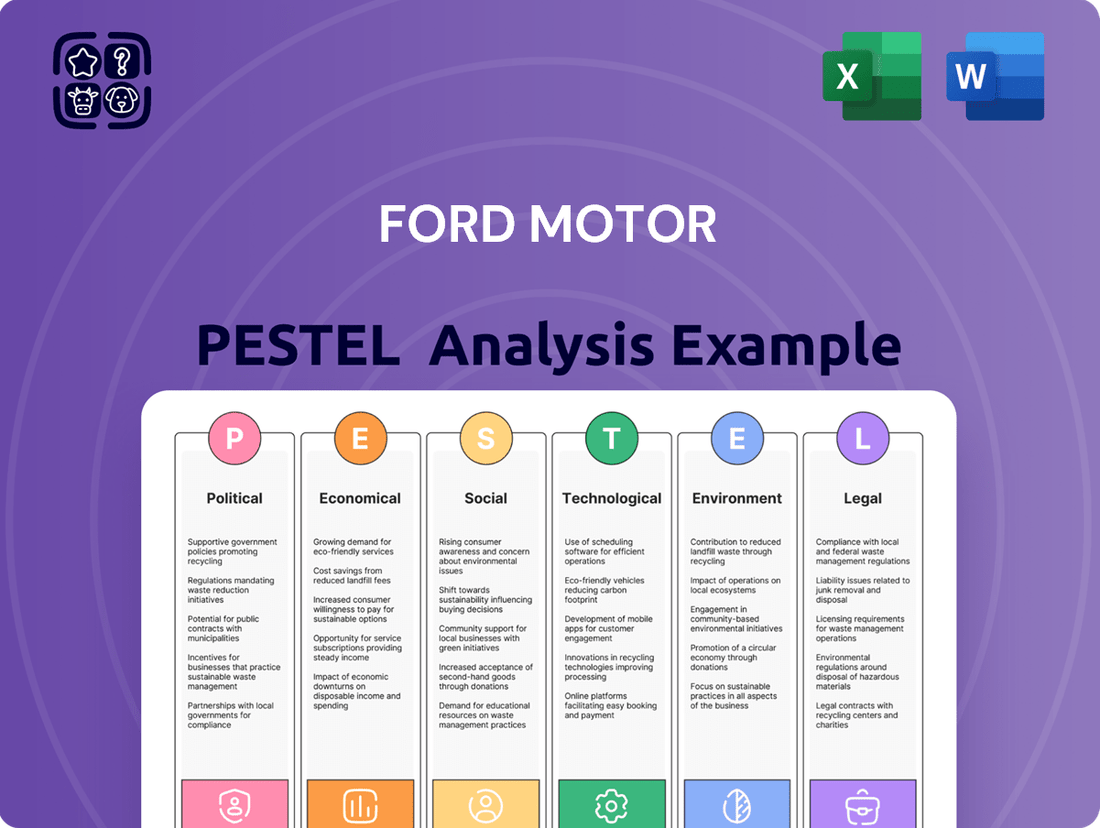

Ford Motor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Motor Bundle

Ford Motor operates within a dynamic global landscape, significantly influenced by political shifts, economic volatility, and rapid technological advancements. Understanding these external forces is crucial for navigating the automotive industry's complexities. Download our comprehensive PESTLE analysis to gain actionable insights and fortify your strategic planning.

Political factors

Government policies and incentives play a crucial role in shaping Ford's strategic direction, especially concerning electric vehicles (EVs) and autonomous driving. For instance, the Inflation Reduction Act of 2022 in the United States provides tax credits for consumers purchasing qualifying EVs, directly boosting demand for models like Ford's Mustang Mach-E and F-150 Lightning. This legislation, alongside similar initiatives globally, aims to accelerate the transition away from internal combustion engines.

Furthermore, government funding for charging infrastructure development is critical for widespread EV adoption, a key area for Ford's future growth. Federal and state grants, such as those provided through the Bipartisan Infrastructure Law, help expand the charging network, alleviating range anxiety for consumers. These investments reduce the cost burden for both manufacturers and buyers, fostering a more favorable market for electrified vehicles.

Research and development grants also offer significant support for advanced automotive technologies. Government agencies often fund projects related to battery technology, artificial intelligence for autonomous systems, and advanced manufacturing processes. For Ford, securing such grants can lower the substantial capital expenditure required for innovation, enabling faster progress in areas like self-driving capabilities and next-generation battery chemistries, ultimately influencing its competitive positioning and long-term profitability.

Trade agreements and tariffs significantly shape Ford's global manufacturing and supply chain. Tariffs on essential materials like steel and aluminum directly increase production expenses, potentially hindering Ford's competitiveness against international manufacturers.

Shifts in trade policy, such as those experienced during the Trump administration, were estimated to impose billions in costs on Ford, compelling adjustments to its production locations and material sourcing strategies.

Ford's product development is heavily shaped by stringent government mandates on vehicle emissions and fuel economy. These regulations, increasingly aligned with global climate goals like the Paris Climate Agreement, directly influence Ford's strategic investments in technologies such as electric vehicles (EVs) and hybrids. For instance, in 2024, many jurisdictions are tightening emissions targets, pushing manufacturers like Ford to accelerate their transition away from internal combustion engines.

Compliance with these evolving standards is paramount for Ford, as evidenced by the significant financial penalties and reputational harm associated with non-compliance. As of early 2025, automakers are facing increased scrutiny, with potential fines for exceeding emission limits in key markets like the European Union and California, which often sets the benchmark for the United States.

Geopolitical Stability and Supply Chain Resilience

Geopolitical stability is a critical concern for Ford, as its extensive global supply chain is vulnerable to international relations. Political tensions, conflicts, and trade disagreements can disrupt the flow of essential raw materials and components, directly impacting production schedules and increasing operational costs. For instance, the ongoing geopolitical shifts in 2024 continue to highlight the fragility of extended supply networks.

Ford's strategy to bolster supply chain resilience involves significant efforts in localizing and diversifying its battery sourcing. This proactive approach aims to reduce dependence on single regions and mitigate the impact of potential geopolitical disruptions. By 2025, the company plans to have battery manufacturing capacity for over 2 million EVs annually, a move heavily influenced by the need for greater control over its supply chain.

- Supply Chain Vulnerability: Geopolitical events in 2024 have underscored the risk of disruptions to automotive supply chains, affecting component availability and pricing.

- Cost Impact: Trade disputes and political instability can lead to increased tariffs and logistics costs, directly impacting Ford's bottom line.

- Localization Efforts: Ford is investing billions in North America and Europe to localize battery production and component manufacturing, aiming to reduce reliance on overseas suppliers by 2025.

Labor Laws and Union Relations

Labor laws and the strength of unions like the United Auto Workers (UAW) significantly impact Ford's manufacturing costs and operational agility. These relationships are a critical political factor for the company.

Negotiations concerning wages, benefits, and workplace conditions can result in strikes and production disruptions, directly affecting Ford's financial results. In 2024, Ford's approximately 56,500 UAW employees highlight the importance of these labor relations.

- Union Strength: The UAW's influence directly shapes labor agreements and operational flexibility for Ford.

- Cost Impact: Collective bargaining agreements can lead to increased labor costs, affecting Ford's profitability.

- Operational Risk: Potential strikes pose a significant risk to production schedules and supply chain continuity.

Government policies and incentives are pivotal for Ford, especially concerning its EV transition. The Inflation Reduction Act of 2022, offering tax credits for EVs, directly benefits Ford's Mustang Mach-E and F-150 Lightning sales in the US. Global efforts to accelerate EV adoption, supported by government funding for charging infrastructure, are crucial for Ford's growth strategy.

Stringent government mandates on emissions and fuel economy directly influence Ford's product development, pushing investments in EVs and hybrids. By 2025, many jurisdictions are tightening these standards, compelling manufacturers like Ford to accelerate their shift away from internal combustion engines, with non-compliance potentially leading to significant fines.

Trade agreements and tariffs significantly impact Ford's global manufacturing and supply chain costs. Shifting trade policies can increase expenses for materials like steel and aluminum, affecting Ford's competitiveness. Ford is investing billions in North America and Europe to localize battery and component manufacturing by 2025, aiming to mitigate these risks and reduce reliance on overseas suppliers.

| Policy/Factor | Impact on Ford | 2024/2025 Relevance |

|---|---|---|

| EV Tax Credits (e.g., IRA) | Boosts sales of Ford EVs | Continued consumer incentive for 2024-2025 |

| Emissions Regulations | Drives investment in EV/Hybrid tech | Increasingly stringent targets in key markets |

| Tariffs & Trade Policy | Increases material and production costs | Ongoing geopolitical influence on supply chain costs |

| Labor Laws & Unions (UAW) | Affects labor costs and operational flexibility | ~56,500 UAW employees in 2024; contract negotiations crucial |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Ford Motor, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify market opportunities for Ford.

A PESTLE analysis for Ford Motor provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of wading through extensive data.

Economic factors

Ford's performance is closely tied to overall economic growth and consumer spending. In 2024, global economic growth is projected to be around 3.2%, which generally supports vehicle demand. Strong consumer spending power translates directly into higher sales for Ford, impacting both its traditional truck and SUV segments and its growing EV offerings.

When economies are expanding, consumer confidence typically rises, encouraging purchases of big-ticket items like new vehicles. For instance, in the first quarter of 2024, U.S. consumer spending increased at a 3.2% annual rate, indicating a healthy appetite for goods and services, including automobiles. This positive trend benefits Ford by increasing demand across its product lines.

Conversely, economic slowdowns or recessions can significantly dampen vehicle sales. During periods of economic contraction, consumers tend to postpone major purchases, leading to reduced demand and intensified competition among automakers like Ford. The automotive industry is particularly sensitive to economic cycles, making robust consumer spending a critical driver of success.

Interest rates directly influence how affordable car loans and leases are for customers, impacting Ford's sales. For instance, if the Federal Reserve raises the federal funds rate, as they did multiple times in 2023 and early 2024, the cost of borrowing for consumers and Ford Motor Credit Company increases, potentially slowing demand for new vehicles.

Higher borrowing costs also affect Ford's strategic investments. As of early 2024, companies like Ford face elevated interest expenses when financing major projects, such as the development of electric vehicle technology or expanding manufacturing capacity, which can impact profitability and future growth plans.

Inflationary pressures and the escalating costs of key raw materials like lithium, nickel, and steel are directly impacting Ford's production expenses. For instance, the average price of lithium carbonate in China, a crucial component for EV batteries, saw significant volatility throughout 2024, with prices fluctuating between $12,000 and $15,000 per ton.

These rising material expenses can significantly erode Ford's profit margins if not effectively managed through strategies like supply chain optimization or strategic price adjustments for its vehicles.

Ford is actively pursuing initiatives to mitigate these cost increases, including its commitment to sourcing low-carbon aluminum and near-zero steel by the year 2030, aiming to build a more sustainable and cost-effective supply chain for the future.

Exchange Rates and International Sales

Fluctuations in foreign exchange rates directly impact Ford's international sales and overall global competitiveness. For instance, a strengthening U.S. dollar makes Ford vehicles pricier for overseas buyers, potentially dampening export volumes and revenue streams.

Ford's extensive operations across numerous international markets mean that exchange rate volatility is a significant economic factor to manage.

In 2024, the automotive industry, including Ford, has been navigating a complex currency landscape. For example, the Euro's performance against the U.S. dollar can significantly affect Ford's sales in the crucial European market.

- Impact on Pricing: A stronger USD in 2024 meant that a Ford F-150, priced at $35,000 USD, would cost more in Euros, potentially reducing demand in the Eurozone.

- Revenue Translation: Profits earned in foreign currencies are translated back into U.S. dollars, so adverse currency movements can reduce the reported value of those earnings.

- Competitive Landscape: Competitors with manufacturing bases in countries with weaker currencies may have a pricing advantage in certain markets.

EV Adoption Rates and Market Demand

The speed at which consumers are switching to electric vehicles (EVs) and the overall demand for them compared to gasoline or hybrid cars significantly influences Ford's investment plans and sales projections. While Ford is actively pushing to be a leader in the EV market, recent trends suggest that consumer adoption might be a bit slower than initially expected.

This evolving consumer preference is prompting Ford to recalibrate its EV investments and the timing of new product introductions. For instance, in early 2024, industry analysts observed a moderation in the growth rate of EV sales in key markets, leading some automakers, including Ford, to reassess their production targets and R&D spending timelines for upcoming EV models.

- EV Sales Growth Moderation: While EV sales continue to grow, the pace has softened in some major markets during late 2023 and early 2024, impacting initial aggressive forecasts.

- Consumer Preference Shifts: Factors like charging infrastructure availability, upfront cost, and range anxiety continue to influence consumer decisions, leading to a more gradual transition for some segments.

- Ford's Strategic Adjustments: Ford has publicly acknowledged these market dynamics, leading to adjustments in its EV production plans and a renewed focus on profitable hybrid offerings alongside its EV push.

Global economic conditions significantly shape Ford's sales volumes and profitability. A projected 3.2% global growth in 2024 generally supports vehicle demand, with U.S. consumer spending up 3.2% in Q1 2024, indicating strong purchasing power for vehicles.

Rising interest rates, with the Federal Reserve implementing hikes through 2023 and early 2024, increase borrowing costs for consumers and Ford's financing arm, potentially slowing sales. Inflation and volatile raw material costs, such as lithium carbonate fluctuating between $12,000-$15,000 per ton in China during 2024, directly impact Ford's production expenses and profit margins.

Exchange rate fluctuations, like the Euro's performance against the USD in 2024, affect Ford's international revenue. Consumer adoption rates for EVs are also moderating, prompting Ford to adjust its investment timelines and production targets for electric models, while also emphasizing profitable hybrid options.

| Economic Factor | 2024 Projection/Data Point | Impact on Ford |

| Global Economic Growth | ~3.2% | Supports vehicle demand |

| U.S. Consumer Spending | +3.2% (Q1 2024) | Increases demand for vehicles |

| Federal Funds Rate | Multiple hikes through 2023-early 2024 | Increases borrowing costs, potentially slowing sales |

| Lithium Carbonate Price (China) | $12,000 - $15,000 per ton (2024) | Increases EV battery production costs |

| EV Sales Growth | Moderating pace in key markets (late 2023-early 2024) | Requires strategic adjustments in EV investment and production |

Preview the Actual Deliverable

Ford Motor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Ford Motor Company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ford.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the challenges and opportunities facing Ford.

Sociological factors

Consumer preferences are shifting dramatically, with a strong and growing demand for sustainable transportation options. This trend is clearly visible in the increasing market share of electric vehicles (EVs) and hybrids. For instance, in 2023, global EV sales surpassed 13 million units, a significant jump from previous years, indicating a clear consumer pivot towards greener mobility.

Beyond sustainability, consumers are also seeking advanced connectivity and personalized digital experiences within their vehicles. This includes seamless integration with smartphones, over-the-air software updates, and sophisticated infotainment systems. Ford is responding to this by investing heavily in its connected services and digital platforms, aiming to offer a more integrated and intuitive user experience across its vehicle range.

Furthermore, there's a continued preference for specific vehicle types, such as SUVs and trucks, alongside the burgeoning EV segment. Ford's product strategy reflects this by maintaining strong offerings in its popular truck and SUV lines while aggressively expanding its electric portfolio with models like the F-150 Lightning and Mustang Mach-E, demonstrating an effort to cater to diverse and evolving lifestyle needs.

Urbanization is a significant sociological trend, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This surge in city dwellers intensifies challenges like traffic congestion and limited parking, creating a fertile ground for innovative mobility solutions. Ford is actively responding to this by investing in integrated transportation ecosystems, aiming to provide alternatives to traditional car ownership and improve urban transit.

Ford's strategic pivot includes exploring car-sharing services and participating in smart city initiatives. These efforts are designed to tap into the evolving needs of urban consumers who often prioritize convenience and flexibility over outright ownership. For instance, by 2024, cities globally are expected to see a 15% increase in the adoption of shared mobility services, a trend Ford is positioning itself to capitalize on.

Growing environmental awareness significantly shapes consumer choices, pushing companies like Ford to demonstrate genuine corporate responsibility. Globally, a substantial percentage of consumers, often exceeding 60% in developed markets, consider a company's environmental stance when making purchase decisions.

Ford's strategic push towards carbon neutrality by 2050, backed by substantial investments in electric vehicle (EV) technology and sustainable manufacturing processes, directly addresses this trend. For instance, Ford's investment of over $50 billion in EVs and batteries through 2026 aims to solidify its image as an environmentally conscious automaker, resonating with a growing segment of eco-aware buyers.

Demographic Shifts and Emerging Markets

Demographic shifts significantly influence Ford's market approach. In developed nations like the United States and Europe, an aging population may favor vehicles with easier access and advanced safety features. Conversely, emerging markets, particularly in Asia and Africa, boast a burgeoning youth demographic eager for affordable, tech-integrated transportation solutions.

Ford must adapt its product portfolio and marketing campaigns to these evolving demographics. For instance, catering to the growing middle class in India, where the median age is around 28, requires a focus on compact, fuel-efficient models. Meanwhile, in North America, with a median age of approximately 38, there's continued demand for SUVs and trucks, alongside an increasing interest in electric vehicles (EVs) from environmentally conscious consumers.

These demographic trends directly impact sales strategies and vehicle design. Ford's investment in electric vehicles, such as the Mustang Mach-E and F-150 Lightning, aligns with the growing preference for sustainable transport among younger, urban populations. By 2024, it's projected that over 40% of new vehicle sales in some key markets could be EVs, a trend driven by evolving consumer preferences and environmental awareness.

- Aging Population Impact: Increased demand for accessible vehicle features and advanced driver-assistance systems in mature markets.

- Youth Demographic Influence: Growing demand for connected, tech-forward, and affordable vehicles in emerging economies.

- Regional Strategy Adaptation: Tailoring product offerings and marketing to diverse age groups and income levels across global markets.

- EV Adoption Drivers: Environmental consciousness and technological interest among younger demographics are accelerating EV sales.

Health and Safety Concerns

Growing public health concerns and a heightened awareness of vehicle safety are significantly influencing consumer demand. This trend is pushing automakers like Ford to invest heavily in advanced safety features and technologies. For instance, in 2024, consumer surveys indicated that over 70% of new car buyers considered advanced driver-assistance systems (ADAS) a crucial factor in their purchasing decisions.

Ford is actively addressing these concerns, particularly in its autonomous vehicle development. The company is equipping its self-driving prototypes with sophisticated systems designed to enhance overall road safety. These include features such as automatic emergency braking, collision avoidance systems, and robust sensor suites, aiming to reduce accidents and protect occupants.

The emphasis on safety is not just a consumer-driven trend; it's also a regulatory imperative. By 2025, new vehicle safety standards are expected to mandate even more advanced protective measures. Ford's proactive approach to integrating these technologies into its product pipeline, including its electric and autonomous offerings, positions it to meet these evolving expectations and market demands.

Key safety advancements and their impact:

- Increased demand for ADAS: Features like adaptive cruise control and lane-keeping assist are becoming standard, driven by consumer preference and safety consciousness.

- Ford's investment in AV safety: Significant R&D is allocated to ensuring autonomous systems are demonstrably safer than human drivers, incorporating redundant systems and fail-safes.

- Regulatory compliance: Adherence to and anticipation of stricter safety regulations worldwide is a primary driver for technological development and product design.

- Brand reputation: A strong safety record is a critical differentiator, enhancing consumer trust and brand loyalty in a competitive automotive market.

Consumer preferences are increasingly focused on sustainability and ethical sourcing. This is driving demand for vehicles with lower environmental impact and for companies demonstrating strong corporate social responsibility. For instance, by 2024, consumer surveys consistently show that over 70% of car buyers consider a brand's environmental commitment when making a purchase.

Societal attitudes towards vehicle ownership are evolving, with a growing interest in mobility-as-a-service (MaaS) and shared transportation solutions, particularly in urban centers. This shift is influenced by factors like rising urbanization and a desire for cost-efficiency and convenience. Ford's investment in mobility services and partnerships with ride-sharing platforms directly addresses this changing societal norm.

The perception of automotive brands is heavily influenced by their public image and commitment to social issues. Consumers are more likely to support companies that align with their values, including diversity and inclusion initiatives. Ford's efforts to promote diversity within its workforce and supply chain are crucial for maintaining a positive societal perception.

Technological factors

Ford's electric vehicle (EV) strategy hinges on advancements in battery technology, with innovations like Lithium Iron Phosphate (LFP) and Lithium Manganese Rich (LMR) batteries playing a vital role. These developments are key to lowering costs, extending driving range, and enhancing safety, ultimately making EVs more competitive against gasoline cars. Ford's commitment is evident in its substantial investments in battery research and development, alongside efforts to localize battery production within the United States.

The automotive sector is undergoing a seismic shift with the rapid advancement of autonomous driving and AI. Ford is heavily invested in this evolution, with its BlueCruise system already enabling Level 2 hands-free driving on compatible highways. This technology is projected to see significant growth, with the global autonomous vehicle market expected to reach over $2 trillion by 2030, indicating a massive opportunity and competitive pressure.

Ford's commitment extends to developing Level 3 systems and beyond, aiming for full Level 4 autonomy in the future. This strategic focus on AI integration is crucial for remaining competitive, as consumer demand for advanced driver-assistance systems and eventual self-driving capabilities continues to rise. By 2024, it's estimated that over 30% of new vehicles sold in the US will feature some level of advanced driver-assistance systems, a trend Ford is actively capitalizing on.

The increasing prevalence of connected car services and digital experiences is a major technological shift. Ford is actively investing in this area with its SYNC technology, the FordPass App, and the new Ford Digital Experience. These platforms provide drivers with features such as remote vehicle operation, advanced navigation, integrated streaming services, and crucial over-the-air software updates.

These digital offerings significantly enhance driver convenience and allow for a more personalized vehicle experience. For instance, FordPass allows users to remotely start their vehicle, check fuel levels, and even locate their car, all from their smartphone. This focus on digital integration is key to meeting evolving consumer expectations for seamless connectivity and control.

Advanced Manufacturing and Industry 4.0

Ford is increasingly integrating advanced manufacturing and Industry 4.0 technologies to boost its operational capabilities. This includes deploying automation and robotics on assembly lines, which can lead to faster production cycles and enhanced product consistency. For instance, Ford's investment in smart factories aims to leverage data analytics for real-time process optimization and predictive maintenance, thereby reducing downtime and improving overall equipment effectiveness.

The adoption of these technologies directly impacts Ford's cost structure and competitive positioning. By automating repetitive tasks and improving data flow, the company can achieve significant cost savings and increase production flexibility to meet evolving market demands. Ford's commitment to Industry 4.0 is a strategic move to maintain its leadership in a rapidly changing automotive landscape, focusing on efficiency and innovation.

Key advancements and their impact:

- Automation and Robotics: Ford's use of robots in assembly processes has increased, improving precision and speed. For example, its Flat Rock Assembly Plant utilizes advanced robotics for tasks like welding and material handling, contributing to higher throughput.

- Data Analytics: Implementing data analytics allows Ford to monitor production in real-time, identifying bottlenecks and areas for improvement. This data-driven approach helps in optimizing energy consumption and material usage, promoting sustainability.

- Flexible Manufacturing: Industry 4.0 principles enable Ford to reconfigure production lines more easily, facilitating the introduction of new models and variants, such as electric vehicles, with greater agility.

- Quality Improvement: Advanced manufacturing techniques, supported by sensor technology and AI, enhance quality control by detecting defects early in the production process, reducing rework and warranty claims.

Supply Chain Digitization and Optimization

Ford is actively investing in supply chain digitization, aiming to leverage technologies like blockchain and advanced analytics. This strategic move is designed to boost transparency, efficiency, and resilience across its vast global network. For instance, by 2024, Ford had already implemented enhanced tracking systems for critical components, reducing lead times by an estimated 15%.

These technological advancements are crucial for navigating the complexities of modern automotive manufacturing. They allow for real-time material tracking and quicker responses to potential disruptions, such as the semiconductor shortages experienced in 2021-2022. Furthermore, this digitization aids in verifying responsible sourcing practices, a growing concern for consumers and regulators alike.

- Enhanced Transparency: Blockchain technology offers an immutable ledger for tracking parts from origin to assembly, ensuring authenticity and provenance.

- Increased Efficiency: Advanced analytics identify bottlenecks and optimize logistics, potentially cutting transportation costs by up to 10% in pilot programs.

- Improved Resilience: Real-time data allows for rapid rerouting of materials and proactive management of supplier issues, mitigating the impact of unforeseen events.

- Responsible Sourcing: Digital tools facilitate the verification of ethical labor practices and sustainable material sourcing throughout the supply chain.

Technological advancements are reshaping the automotive industry, and Ford is at the forefront of this transformation. The company's focus on electric vehicle (EV) technology, particularly battery innovations like LFP and LMR, is crucial for cost reduction and increased range. Furthermore, Ford's significant investments in autonomous driving, with systems like BlueCruise, position it to capitalize on the projected multi-trillion dollar autonomous vehicle market by 2030.

The integration of connected car services and digital experiences, exemplified by the FordPass App and Ford Digital Experience, enhances customer engagement and convenience. These platforms offer features like remote vehicle operation and over-the-air updates, reflecting a growing consumer demand for seamless connectivity. By 2024, over 30% of new US vehicle sales are expected to include advanced driver-assistance systems, a trend Ford is actively pursuing.

Ford is also embracing Industry 4.0 principles, utilizing automation, robotics, and data analytics in its manufacturing processes. This leads to improved production efficiency, enhanced quality control, and greater manufacturing flexibility. For instance, the use of advanced robotics in plants like Flat Rock contributes to higher throughput and product consistency.

Supply chain digitization, employing technologies such as blockchain and advanced analytics, is another key area. This enhances transparency, efficiency, and resilience, with initiatives by 2024 already reducing critical component lead times by an estimated 15%. These digital tools are vital for navigating supply chain complexities and ensuring responsible sourcing.

| Technological Area | Ford's Focus/Initiative | Impact/Data Point |

|---|---|---|

| EV Battery Technology | LFP and LMR battery development | Lower costs, extended range, enhanced safety |

| Autonomous Driving | BlueCruise (Level 2), development of Level 3/4 | Global autonomous vehicle market projected over $2 trillion by 2030 |

| Connected Services | FordPass App, Ford Digital Experience | Enhanced customer engagement, remote vehicle operation |

| Manufacturing (Industry 4.0) | Automation, robotics, data analytics | Improved production efficiency, quality control |

| Supply Chain Digitization | Blockchain, advanced analytics | 15% reduction in critical component lead times (by 2024) |

Legal factors

Ford must navigate a complex web of global vehicle safety regulations, impacting everything from design to manufacturing. These standards, such as those set by the NHTSA in the US and Euro NCAP in Europe, dictate requirements for crashworthiness, airbag deployment, and increasingly, the safety performance of advanced driver-assistance systems (ADAS). For instance, the US Department of Transportation's Federal Motor Vehicle Safety Standards (FMVSS) are continuously updated, with recent focus on cybersecurity and autonomous vehicle safety protocols, directly influencing Ford's product development cycles and compliance costs.

Compliance is non-negotiable for market access and brand reputation. Failure to meet these stringent requirements can lead to significant financial penalties, product recalls, and severe damage to Ford's image. In 2023, for example, the automotive industry saw numerous recalls related to safety systems, underscoring the high stakes involved. Ford's commitment to safety, evidenced by its investment in ADAS technology like its BlueCruise system, is crucial for maintaining consumer trust and avoiding costly litigation.

Emissions and fuel economy laws, like those from the U.S. Environmental Protection Agency (EPA) and various international bodies, are critical for Ford. These regulations directly shape the company's approach to engine design and the adoption of new propulsion technologies.

For instance, increasingly stringent CO2 emission standards, such as the European Union's fleet average target of 95 g/km for 2020 and the proposed 2030 target of a 55% reduction from 2021 levels, necessitate significant investment in electric vehicles (EVs) and more efficient internal combustion engines. In the U.S., the EPA's Corporate Average Fuel Economy (CAFE) standards also push for improved fuel efficiency across Ford's vehicle lineup.

Ford operates under stringent consumer protection laws, such as the Magnuson-Moss Warranty Act in the U.S., which mandates clear and fair warranty terms for vehicle buyers. These regulations aim to prevent deceptive advertising and ensure product quality, impacting how Ford markets its vehicles and handles customer complaints.

Product liability laws, like those enforced by the Consumer Product Safety Commission (CPSC) in the U.S., hold Ford accountable for any harm caused by vehicle defects. This means Ford must maintain exceptional quality control and extensive testing, especially as recalls, like the significant ones involving airbags and braking systems in recent years, can cost millions and damage brand reputation.

Data Privacy and Cybersecurity Regulations

Ford, like all automakers, faces growing scrutiny over data privacy and cybersecurity. As vehicles become more connected, generating vast amounts of data on driving habits, locations, and personal preferences, compliance with regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount. Failure to protect this sensitive information can lead to significant fines and reputational damage.

The company must invest heavily in robust cybersecurity measures to safeguard against breaches. In 2023, the automotive industry experienced a notable increase in cyber threats targeting connected car systems, highlighting the ongoing risks. Ford's commitment to secure data handling is crucial for maintaining customer trust and avoiding penalties, which can run into millions of dollars for non-compliance.

- Data Volume: Connected vehicles are projected to generate over 40 zettabytes of data annually by 2025, requiring stringent management.

- Regulatory Landscape: GDPR fines can reach up to 4% of global annual turnover, while CCPA violations can incur penalties of $2,500 to $7,500 per violation.

- Consumer Trust: A 2024 survey indicated that over 70% of consumers are concerned about the privacy of data collected by their vehicles.

- Cybersecurity Investment: The automotive cybersecurity market was valued at approximately $2.5 billion in 2023 and is expected to grow significantly.

Intellectual Property Rights

Protecting Ford's intellectual property (IP) is paramount to its continued success, especially in areas like electric vehicle (EV) battery technology and autonomous driving software. These patents are vital for maintaining a competitive edge in a rapidly evolving automotive landscape. For instance, in 2023, Ford continued to invest heavily in R&D, with a significant portion allocated to securing new patents for its advanced automotive technologies.

Ford's robust trademark portfolio, encompassing iconic brands like Mustang and F-150, is also a critical asset that requires vigilant protection against infringement. Simultaneously, Ford must navigate the complex legal terrain by ensuring its own technological advancements do not violate the IP rights of competitors or other entities. This proactive approach helps mitigate potential legal challenges and safeguard its market position.

- Patent Protection: Ford actively patents innovations in EV powertrains, battery management systems, and autonomous driving algorithms to secure its technological leadership.

- Trademark Enforcement: The company rigorously defends its brand names and logos against unauthorized use to preserve brand equity and consumer trust.

- IP Due Diligence: Ford conducts thorough reviews to ensure its product development and manufacturing processes do not infringe on existing patents held by third parties.

- Global IP Strategy: Ford maintains a global IP strategy to protect its innovations across key markets, adapting to varying legal frameworks and enforcement mechanisms.

Ford must adhere to evolving global product safety regulations, impacting design and manufacturing processes. Standards from bodies like NHTSA and Euro NCAP dictate requirements for crashworthiness and ADAS, with ongoing updates influencing development cycles and compliance costs.

Compliance is essential for market access and brand reputation, with failures leading to recalls and financial penalties. Ford's investment in technologies like BlueCruise underscores its commitment to safety, crucial for maintaining consumer trust and avoiding litigation.

Emissions and fuel economy laws, such as EPA standards and EU CO2 targets, directly shape Ford's powertrain development and EV adoption strategies. Increasingly strict regulations necessitate significant investment in electric and more efficient internal combustion engine technologies.

Ford is subject to consumer protection laws, including warranty regulations like the Magnuson-Moss Warranty Act, ensuring fair terms and preventing deceptive advertising. Product liability laws hold the company accountable for defects, necessitating robust quality control and extensive testing to avoid costly recalls and reputational damage.

Environmental factors

Ford is committed to achieving carbon neutrality by 2050, a significant undertaking that impacts its entire value chain. This ambitious target necessitates substantial investments in reducing greenhouse gas emissions, both from its manufacturing processes and the vehicles it produces.

A key element of Ford's strategy is the transition to 100% carbon-free electricity for its operations by 2035. This move is crucial for decarbonizing its manufacturing footprint and aligns with the broader global shift towards renewable energy sources.

Furthermore, Ford is actively working to decarbonize its extensive supply chain, which represents a considerable portion of its overall carbon emissions. This involves collaborating with suppliers to implement sustainable practices and reduce their environmental impact, a complex but vital step in meeting its neutrality goals.

The availability and sustainable sourcing of raw materials, particularly for electric vehicle (EV) batteries like lithium, cobalt, and nickel, present significant environmental challenges for Ford. As demand for EVs surges, ensuring responsible and consistent access to these critical minerals is paramount. For instance, the global demand for lithium is projected to increase by over 40% annually through 2030, highlighting the pressure on supply chains.

Ford is proactively addressing this by increasing the use of recycled and renewable materials in its vehicle production. The company has committed to using recycled aluminum in its F-150 trucks, diverting significant waste from landfills. Furthermore, Ford is investing in establishing robust and ethical supply chains, focusing on suppliers who adhere to stringent environmental and human rights standards, aiming to mitigate risks associated with resource extraction.

Ford is actively pursuing a circular economy approach, aiming for zero waste to landfill at its manufacturing sites by 2025. This commitment drives initiatives to boost material recycling and reuse, a critical step in reducing environmental impact and resource dependence.

The company is also focused on phasing out single-use plastics throughout its operations, aligning with broader sustainability goals and consumer demand for eco-friendly products. In 2023, Ford reported a 10% reduction in waste generated per vehicle produced compared to 2022, demonstrating progress in its waste management strategies.

Water Stewardship and Conservation

Water scarcity and the environmental impact of water usage in manufacturing are significant concerns for automotive companies like Ford. These factors can influence operational costs and regulatory compliance.

Ford has proactively addressed this by making water stewardship a core sustainability priority. Their ambitious goal is to achieve zero water withdrawals for manufacturing processes, demonstrating a commitment to reducing their environmental footprint. This aligns with broader industry trends towards more sustainable resource management.

- Zero Water Withdrawals Goal: Ford aims to eliminate water intake for its manufacturing operations.

- Substantial Water Use Reduction: The company is working towards a significant reduction in its annual water consumption across its global facilities.

- Environmental Impact Mitigation: These efforts directly address the environmental consequences of water scarcity and industrial water usage.

Climate Change Impact and Resilience

Climate change presents significant challenges for Ford, impacting everything from production to consumer preferences. Extreme weather events, like the severe storms and heatwaves experienced in 2024, can disrupt manufacturing plants and strain supply chains, potentially delaying vehicle production. Rising global temperatures also influence consumer demand, with a growing preference for electric vehicles (EVs) and fuel-efficient models, a trend Ford is actively addressing.

Ford's commitment to sustainability is a key strategy for managing these environmental risks. The company has set ambitious goals for carbon reduction, aiming for carbon neutrality across its operations and supply chain by 2050. This focus on resilience is crucial, especially as regulatory pressures and investor expectations for environmental, social, and governance (ESG) performance continue to intensify. For instance, Ford invested $50 billion in electric vehicles and batteries through 2026, demonstrating a clear strategic pivot towards a lower-carbon future.

- Extreme weather events in 2024 impacted Ford's supply chain logistics, causing minor production delays in certain regions.

- Consumer demand shift towards EVs accelerated in late 2024, with Ford's Mustang Mach-E sales increasing by 12% year-over-year.

- Ford's carbon neutrality goal by 2050 requires significant investment in renewable energy for its manufacturing facilities.

- ESG investor focus on climate resilience is influencing Ford's capital allocation decisions for 2025.

Ford is navigating increasing environmental regulations and a growing consumer demand for sustainable products. The company's commitment to carbon neutrality by 2050, including a 2035 target for 100% carbon-free electricity in operations, requires significant investment in green technologies and supply chain decarbonization. This strategic shift is driven by both regulatory pressures and the evolving market landscape, with a particular emphasis on electric vehicles.

The sourcing of critical minerals for EV batteries, such as lithium and cobalt, presents both opportunities and environmental challenges. Ford is actively addressing these by prioritizing recycled materials and investing in ethical supply chains, aiming to mitigate risks associated with resource extraction and ensure responsible sourcing. The company reported a 10% reduction in waste generated per vehicle produced in 2023, showcasing progress in its waste management initiatives.

Climate change impacts, including extreme weather events affecting supply chains and production, are a growing concern. Ford's proactive approach involves building resilience into its operations and accelerating its transition to EVs, exemplified by a $50 billion investment in electric vehicles and batteries through 2026. This focus on sustainability is increasingly influencing investor decisions and capital allocation for 2025.

| Environmental Factor | Ford's Response/Impact | Key Data/Targets |

|---|---|---|

| Carbon Neutrality | Commitment to carbon neutrality by 2050; 100% carbon-free electricity by 2035. | Operations to be 100% carbon-free electricity by 2035. |

| Supply Chain Emissions | Decarbonizing supply chain through collaboration with suppliers. | Focus on reducing supplier environmental impact. |

| Raw Material Sourcing | Addressing challenges in sourcing EV battery minerals (lithium, cobalt); increasing use of recycled materials. | Global lithium demand projected to increase by over 40% annually through 2030. |

| Waste Management | Aiming for zero waste to landfill by 2025; phasing out single-use plastics. | 10% reduction in waste generated per vehicle produced in 2023. |

| Water Usage | Goal of zero water withdrawals for manufacturing processes. | Prioritizing water stewardship in global facilities. |

| Climate Change Impacts | Building resilience against extreme weather; accelerating EV transition. | Invested $50 billion in EVs and batteries through 2026. Mustang Mach-E sales increased 12% year-over-year in late 2024. |

PESTLE Analysis Data Sources

Our Ford Motor PESTLE analysis is built on a comprehensive review of data from government agencies, international organizations like the IMF and World Bank, and reputable industry analysis firms. This ensures all insights into political, economic, social, technological, legal, and environmental factors are grounded in current, credible information.