Ford Motor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Motor Bundle

Unlock the full strategic blueprint behind Ford Motor's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Ford Motor Company actively cultivates key partnerships with leading battery technology suppliers to fuel its electric vehicle (EV) expansion. This includes collaborations with innovators like Solid Power for the advancement of next-generation solid-state batteries.

Furthermore, Ford has secured substantial battery cell capacity from major global players such as CATL, LG Energy Solution, and SK On. These agreements are vital for meeting the growing demand for both lithium-ion and increasingly important lithium iron phosphate (LFP) battery cells, underpinning Ford's ability to scale its EV production effectively and drive down costs.

The company's strategic approach also involves significant joint ventures, such as BlueOvalSK. This partnership specifically targets the localization of battery manufacturing within North America, a critical step in building a robust and resilient EV supply chain and potentially creating thousands of jobs in the region.

Ford actively cultivates strategic alliances with technology and software developers to accelerate its innovation in connected vehicle services, advanced infotainment, and autonomous driving capabilities, such as the enhanced BlueCruise system. These collaborations are crucial for embedding state-of-the-art artificial intelligence, sophisticated data analytics, and seamless software integration across Ford's vehicle portfolio, thereby elevating the customer experience and unlocking novel digital revenue streams.

Ford Pro partners with commercial fleet solution providers to create a comprehensive ecosystem for its customers. This includes collaborations with charging infrastructure specialists and companies like Ecolab, Southern Company, and Vestas, focusing on fleet electrification and management services.

These strategic alliances allow Ford to offer a unified ‘one-stop shop’ experience. Customers can access work-ready vehicles, essential services, integrated software, charging solutions, and flexible financing options, all designed to meet a wide array of specific business requirements.

Automotive Component and Raw Material Suppliers

Ford relies on a sprawling global network of automotive component and raw material suppliers to build its vehicles. These partnerships are foundational to Ford's manufacturing operations, ensuring a steady flow of everything from steel and aluminum to intricate electronic systems and powertrain components. In 2024, Ford continued to emphasize strategic sourcing and supplier collaboration to navigate volatile material costs and geopolitical uncertainties.

Maintaining robust relationships with these suppliers is paramount for several reasons. It directly impacts production efficiency, the quality of the final product, and the overall resilience of Ford's supply chain. This is particularly important as the automotive industry grapples with the transition to electric vehicles, requiring new types of materials and components, and managing the complexities of global logistics.

- Supplier Diversity: Ford works with thousands of suppliers worldwide, ranging from large multinational corporations to specialized smaller firms, ensuring a broad base for critical inputs.

- Strategic Sourcing: The company actively manages its supplier base to secure favorable pricing, ensure quality standards, and mitigate risks associated with single-source dependencies.

- Innovation Collaboration: Ford partners with suppliers on research and development, particularly for advanced technologies like battery components and autonomous driving systems.

- Supply Chain Resilience: In 2024, efforts were intensified to build more resilient supply chains, including exploring near-shoring and dual-sourcing strategies for key materials and components.

Research and Development Institutions

Ford actively partners with universities and research institutes to drive innovation, focusing on areas like advanced materials and next-generation battery technology. These collaborations are crucial for staying ahead in the rapidly evolving automotive landscape.

In 2024, Ford continued its investment in R&D, with a significant portion of its capital expenditure allocated to future technologies. For instance, their work with institutions on hydrogen fuel cell technology aims to diversify their powertrain options beyond electric vehicles.

- Partnerships with universities like MIT and Stanford

- Exploration of advanced manufacturing processes, including 3D printing for automotive components

- Joint research into sustainable materials and circular economy principles for vehicle production

- Focus on developing AI and machine learning applications for autonomous driving systems

Ford's key partnerships are central to its EV strategy, securing crucial battery supply and manufacturing capabilities. Collaborations with battery tech leaders like Solid Power and major cell suppliers such as CATL, LG Energy Solution, and SK On are vital for scaling production and cost reduction. The BlueOvalSK joint venture specifically targets North American battery manufacturing, enhancing supply chain resilience.

Beyond batteries, Ford partners with technology firms to advance connected vehicle services and autonomous driving, integrating AI and data analytics. For its commercial division, Ford Pro collaborates with fleet solution providers, charging specialists, and companies like Ecolab and Southern Company to offer comprehensive electrification and management services.

Ford also relies on a vast network of component and raw material suppliers, with strategic sourcing and supplier collaboration intensified in 2024 to manage costs and geopolitical risks. These relationships are critical for production efficiency, product quality, and supply chain robustness, especially during the EV transition.

Further driving innovation, Ford partners with universities like MIT and Stanford on advanced materials and battery technology, and explores areas such as hydrogen fuel cells and AI for autonomous driving.

| Partnership Area | Key Partners | Strategic Importance | 2024 Focus/Data |

|---|---|---|---|

| Battery Supply & Technology | CATL, LG Energy Solution, SK On, Solid Power | Securing EV battery cells (LFP, NMC), next-gen battery R&D | Secured significant battery cell capacity; ongoing investment in solid-state research. |

| Battery Manufacturing | BlueOvalSK (JV with SK On) | Localized North American battery production | Construction of battery plants in Tennessee and Kentucky progressing. |

| Connected Services & Autonomy | Various tech & software developers | Enhancing infotainment, AI, and autonomous driving (e.g., BlueCruise) | Continued integration of advanced software and data analytics. |

| Commercial Fleet Solutions | Ecolab, Southern Company, charging infrastructure providers | Offering integrated electrification and management for commercial fleets | Expanding the Ford Pro ecosystem for a 'one-stop shop' experience. |

| Component & Raw Materials | Thousands of global suppliers | Ensuring production efficiency, quality, and supply chain resilience | Intensified strategic sourcing and supplier diversification to mitigate risks. |

| Research & Development | Universities (MIT, Stanford), research institutes | Innovation in advanced materials, battery tech, hydrogen fuel cells, AI | Significant capital expenditure on future technologies; joint research into sustainable materials. |

What is included in the product

This Ford Motor Business Model Canvas outlines a strategy focused on a diverse customer base, leveraging a multi-channel sales approach, and delivering value through a broad range of vehicles and mobility solutions.

Ford's Business Model Canvas effectively addresses the pain point of complex strategic planning by offering a clear, visual representation of their entire operation.

This one-page snapshot allows for rapid comprehension of Ford's core value propositions and customer segments, simplifying strategic discussions.

Activities

Ford's core activity revolves around the intricate design, engineering, and continuous development of its wide range of vehicles. This encompasses everything from their iconic trucks and versatile SUVs to practical vans and sleek cars, alongside the premium offerings under the Lincoln brand.

A significant portion of this effort is dedicated to robust research and development. In 2023, Ford invested approximately $10 billion in R&D, with a substantial focus on developing new powertrains, advanced vehicle architectures, and innovative features to maintain a competitive edge in the automotive market.

This commitment to innovation ensures Ford's product lineup remains appealing and technologically advanced. For instance, their ongoing work in electric vehicle technology, including battery development and charging infrastructure, is a key component of their future vehicle engineering.

Ford's global manufacturing and assembly operations are a cornerstone of its business, involving the production of millions of vehicles annually across numerous plants worldwide. In 2024, Ford continued to invest heavily in modernizing these facilities, aiming for greater efficiency and flexibility.

The company is actively integrating advanced technologies, often referred to as 'Smart Manufacturing.' This includes the use of robotics for precision assembly and AI for optimizing production flow and quality control, as evidenced by their ongoing efforts to enhance output at plants like the Oakville Assembly Plant in Canada, which is undergoing significant transformation for EV production.

Sustainability is also a key focus within these activities. Ford is committed to reducing its environmental footprint, with initiatives like increasing renewable energy usage in its manufacturing plants and exploring more sustainable materials in vehicle production, aligning with global trends and regulatory pressures.

Ford is significantly investing in research and development to spearhead the electric and connected vehicle movement. This includes pioneering advancements in battery technology, designing flexible EV platforms, and enhancing embedded software for a seamless user experience.

The company is also actively exploring future mobility solutions and cutting-edge commercial vehicle technologies. The goal is to establish a profitable and efficient electric vehicle business model that minimizes capital expenditure.

In 2023, Ford reported investing $7.5 billion in electric vehicles and autonomous driving, with plans to spend $50 billion through 2026. This commitment underscores their dedication to innovation in this rapidly evolving sector.

Marketing, Sales, and Distribution

Ford's marketing strategy is multifaceted, aiming to build a strong brand presence and connect with diverse customer bases. This includes significant investment in advertising across traditional and digital platforms to highlight vehicle features and innovations. In 2024, Ford continued to leverage its iconic brands like the F-Series and Mustang, with the F-Series remaining a top seller in the U.S. pickup truck market, demonstrating sustained marketing effectiveness.

The sales process at Ford is largely driven by its extensive dealership network, which provides a crucial touchpoint for customers. Alongside this, Ford is increasingly focusing on digital sales channels, offering online purchasing options and virtual showrooms to cater to evolving consumer preferences. This hybrid approach allows for broader market reach and enhanced customer convenience.

Distribution is managed through a complex global supply chain, ensuring vehicles reach dealerships worldwide. Ford's commitment to efficient logistics is paramount, especially as it navigates the production of both internal combustion engine vehicles and its growing lineup of electric vehicles, such as the Mustang Mach-E and F-150 Lightning. Their distribution network is designed to support a high volume of sales and maintain product availability.

- Brand Building: Ford invests heavily in advertising and sponsorships to maintain its brand image, focusing on themes of reliability, performance, and innovation.

- Sales Incentives: The company frequently offers promotional pricing, financing deals, and lease specials to stimulate demand and attract buyers.

- Dealership Network: Ford operates thousands of dealerships globally, serving as primary sales and service centers.

- Digital Sales: Expansion of online purchasing tools and virtual experiences is a key focus to complement physical dealerships.

Automotive Financing and Leasing Services

Ford Motor Credit Company, a wholly-owned subsidiary, is central to Ford's automotive financing and leasing operations. This segment is critical for facilitating vehicle sales by offering customers diverse purchasing and ownership solutions, thereby boosting overall vehicle demand.

In 2023, Ford Motor Credit Company reported total revenue of $7.5 billion, underscoring its significant contribution to Ford's financial performance. This revenue stream is vital, acting as a powerful enabler for both individual consumer vehicle purchases and large-scale fleet management solutions.

- Facilitating Sales: Provides crucial financing options that make purchasing Ford vehicles more accessible for a wider customer base.

- Flexible Ownership: Offers leasing programs that cater to customers seeking flexibility and potentially lower monthly payments.

- Revenue Generation: Generates substantial interest and fee income, contributing significantly to Ford's profitability.

- Fleet Management: Supports business customers with tailored financing for their vehicle fleets, a key segment for Ford.

Ford's key activities are centered around the design, manufacturing, and sale of vehicles, supported by robust research and development, particularly in electric and connected technologies. The company also leverages its financing arm, Ford Motor Credit, to facilitate sales and generate revenue.

| Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Vehicle Design & Engineering | Developing new vehicle models, powertrains, and technologies. | Invested $10 billion in R&D in 2023. |

| Global Manufacturing | Producing vehicles across numerous worldwide plants. | Continued investment in modernizing facilities for efficiency and EV production in 2024. |

| EV & Connected Vehicle Development | Pioneering advancements in battery tech, EV platforms, and software. | Committed $7.5 billion to EVs and autonomous driving in 2023, with $50 billion planned through 2026. |

| Sales & Marketing | Promoting vehicles through dealerships and digital channels. | F-Series remained a top seller in the U.S. pickup market in 2024. |

| Automotive Financing | Providing financing and leasing solutions through Ford Motor Credit. | Ford Motor Credit reported $7.5 billion in revenue in 2023. |

What You See Is What You Get

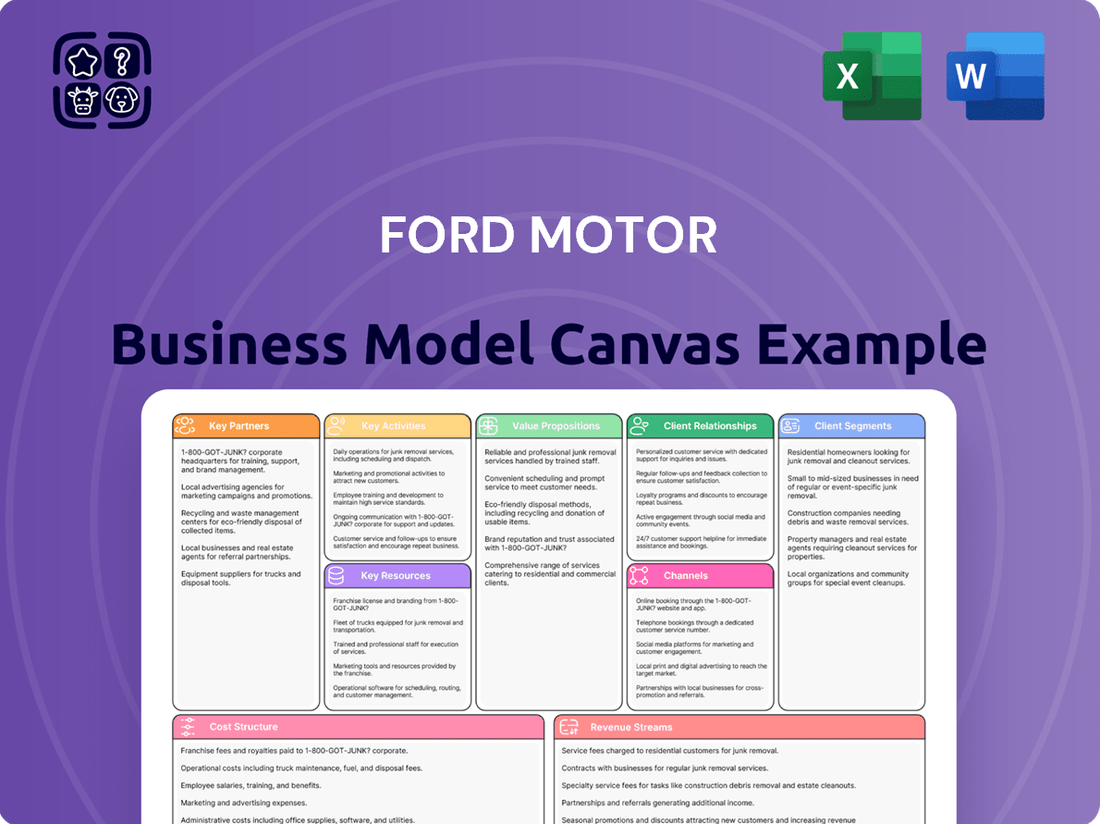

Business Model Canvas

The Ford Motor Company Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing a direct representation of the comprehensive analysis that details Ford's value propositions, customer segments, channels, revenue streams, key resources, activities, partnerships, and cost structure. Upon completing your purchase, you will gain full access to this exact, professionally formatted Business Model Canvas, ready for your immediate use and strategic planning.

Resources

Ford's global manufacturing and production infrastructure is a cornerstone of its business model, featuring a vast network of plants and assembly lines across the globe. This extensive physical asset base is crucial for the high-volume production of vehicles, encompassing specialized facilities dedicated to engines, transmissions, and the growing demand for battery manufacturing.

In 2024, Ford continued to invest heavily in modernizing its manufacturing footprint. For instance, the company announced plans to invest $3.7 billion in its Michigan facilities to retool for electric vehicle and battery production, underscoring the shift towards future mobility. This strategic allocation of resources highlights the importance of these physical assets in adapting to evolving market demands and technological advancements.

Ford's intellectual property is a cornerstone of its business model, encompassing a substantial portfolio of patents protecting innovations in vehicle design, powertrain technology, and driver-assist systems. In 2024, Ford continued to invest heavily in R&D, filing numerous new patents to secure its technological advancements.

Proprietary technologies like Blue Oval Intelligence and Ford Pro Intelligence are critical. These platforms manage vehicle data, enable over-the-air updates, and power advanced driver-assistance features, providing a significant competitive advantage in the evolving automotive landscape.

Ford's brand equity, encompassing both the Ford and Lincoln marques, is a cornerstone of its business model. This strong recognition, built over decades, translates into significant customer loyalty and a premium perception for its vehicles.

Iconic and best-selling models such as the F-Series trucks, Mustang, and Explorer are not just products; they are powerful intangible assets that drive demand and command market share. For instance, the F-Series has been the best-selling truck in America for over 40 consecutive years, a testament to its enduring appeal and brand strength.

This deep-seated brand loyalty and the diverse appeal of its product portfolio enable Ford to maintain a sustained market presence. In 2023, Ford reported global revenue of $176.0 billion, with its automotive segment being the primary driver, underscoring the commercial power of its established brands and popular models.

Skilled Workforce and Engineering Talent

Ford's skilled workforce, encompassing a global network of engineers, designers, manufacturing experts, and sales professionals, represents a critical asset. This human capital is the engine behind their product innovation, the guarantor of quality, and the backbone of their extensive international operations.

The company's commitment to talent is evident in its continuous investment in employee development and its focus on attracting top-tier engineering graduates. As of early 2024, Ford continued to emphasize its global engineering footprint, with a significant portion of its research and development activities centered in the United States and Europe.

- Global Engineering Teams: Ford employs tens of thousands of engineers worldwide, crucial for designing and developing new vehicle platforms and technologies.

- Manufacturing Expertise: Highly skilled production specialists are essential for maintaining efficiency and quality across Ford's numerous assembly plants.

- Innovation Hubs: The company's talent pool fuels its innovation centers, driving advancements in areas like electric vehicles and autonomous driving systems.

- Sales and Service Professionals: A knowledgeable sales and service force is vital for customer engagement and brand loyalty.

Financial Capital and Investment Capacity

Ford's financial capital is a cornerstone of its business model, providing the fuel for innovation and expansion. This includes significant cash on hand, robust access to credit, and continuous investment in its future. For instance, in the first quarter of 2024, Ford reported total cash and cash equivalents of approximately $25.9 billion, demonstrating substantial liquidity.

This financial muscle is essential for funding critical areas like research and development, particularly in the burgeoning electric vehicle (EV) sector. It also underpins the massive capital expenditures required to modernize manufacturing facilities and implement cutting-edge technologies. Ford's commitment to electrification, exemplified by its significant investments in EV production and battery technology, is directly supported by this strong financial foundation.

- Substantial Cash Reserves: Ford maintained approximately $25.9 billion in cash and cash equivalents as of Q1 2024, providing immediate operational flexibility.

- Access to Credit Markets: The company's ability to secure financing is crucial for large-scale projects, especially the multi-billion dollar investments in EV and autonomous vehicle development.

- Ongoing Investment Capacity: Ford's financial strength allows for consistent capital allocation towards R&D, new plant construction, and the integration of advanced manufacturing processes, such as those for its next-generation F-Series trucks.

- Funding Transformation: This financial capacity directly enables Ford's ambitious transformation strategy, particularly its aggressive push into the electric vehicle market and related software services.

Ford's key resources also include its extensive network of dealerships and service centers, which are vital for customer sales, support, and after-sales service. This widespread physical presence ensures accessibility for customers across diverse geographic markets.

The company's strategic partnerships and supplier relationships are also critical resources, enabling access to specialized components, technologies, and manufacturing capabilities. These collaborations are essential for managing complex supply chains and driving innovation.

Ford's data and software platforms, such as FordPass and its connected vehicle services, represent increasingly valuable intangible assets. These platforms facilitate customer engagement, enable new revenue streams through subscriptions, and provide insights for product development.

| Resource Category | Key Components | 2024 Relevance/Data Point |

| Physical Assets | Global Manufacturing Plants, Assembly Lines | Investment of $3.7 billion in Michigan facilities for EV/battery production (announced 2024). |

| Intellectual Property | Patents, Proprietary Technologies (Blue Oval Intelligence) | Continued heavy R&D investment and patent filings in 2024. |

| Brand Equity | Ford & Lincoln Marques, Iconic Models (F-Series) | F-Series: Best-selling truck in the U.S. for over 40 consecutive years. |

| Human Capital | Skilled Workforce (Engineers, Manufacturing Experts) | Tens of thousands of engineers globally; focus on talent development in 2024. |

| Financial Capital | Cash Reserves, Access to Credit | Approx. $25.9 billion in cash and cash equivalents (Q1 2024). |

| Distribution & Service | Dealership Network, Service Centers | Global network ensuring customer accessibility and support. |

| Partnerships & Suppliers | Strategic Alliances, Supply Chain Relationships | Essential for component access and technological collaboration. |

| Data & Software | Connected Vehicle Platforms (FordPass) | Enabling new revenue streams and customer engagement. |

Value Propositions

Ford's value proposition centers on a remarkably diverse vehicle range, encompassing everything from tough trucks and adaptable SUVs to practical vans and sedans. This breadth extends to its luxury Lincoln brand, ensuring a fit for nearly every customer requirement. In 2024, this extensive lineup is crucial as Ford continues to navigate evolving consumer demands, offering choices across traditional internal combustion engines, hybrids, and a rapidly expanding electric vehicle (EV) portfolio.

Ford vehicles are engineered for dependability and longevity, with the F-Series trucks consistently leading the pack in sales and demonstrating exceptional durability. This commitment to robust capability and an engaging driving experience is a cornerstone of their value proposition, cultivated over a century of automotive innovation.

Ford's value proposition heavily leans on advanced technology and seamless connectivity. This includes features like their SYNC infotainment system, which offers intuitive control over navigation, entertainment, and communication, and increasingly sophisticated driver-assist systems designed to improve safety and reduce driver fatigue.

The company is also pushing boundaries with its BlueCruise hands-free driving technology, available on select models, and the comprehensive Ford Pro telematics for commercial vehicles. These innovations provide customers with smarter, more connected experiences, offering valuable data-driven insights for both personal and business use.

For instance, in 2024, Ford reported significant adoption of its connected vehicle features, with millions of vehicles equipped with SYNC technology. This focus on advanced tech aims to differentiate Ford in a competitive market by enhancing the overall ownership experience and providing tangible benefits like improved efficiency and safety.

Affordability and Value for Money

Ford's commitment to affordability and value for money is a cornerstone of its business model, ensuring that reliable transportation is within reach for a wide customer base. This strategy focuses on delivering robust features and dependable performance without demanding a premium price.

The Ford Maverick is a prime example of this philosophy in action. Introduced in 2021, this compact pickup truck has resonated with consumers by offering significant utility and a comfortable driving experience at a highly competitive price point. Its success underscores Ford's ability to identify and cater to market segments seeking practical and economical vehicle solutions.

- Value Proposition: Ford vehicles are designed to offer a compelling balance of quality, features, and price, making them an attractive option for budget-conscious consumers.

- Market Accessibility: By focusing on affordability, Ford broadens its market reach, attracting first-time buyers and those prioritizing cost-effectiveness.

- Product Example: The Ford Maverick, launched with a starting MSRP well under $30,000 in its initial years, demonstrates this commitment by providing truck-like utility and fuel efficiency at an accessible price.

- Customer Appeal: This approach appeals to a diverse range of customers, from individuals needing a reliable daily driver to small businesses seeking cost-effective fleet options.

Tailored Commercial Solutions and Productivity (Ford Pro)

Ford Pro delivers a comprehensive ecosystem of vehicles and services, meticulously crafted for commercial clients. This integrated approach prioritizes boosting fleet productivity, minimizing downtime, and enhancing overall operational efficiency.

The value proposition centers on providing work-ready vehicles, specialized service, advanced telematics, charging infrastructure, and tailored financing. These offerings collectively aim to reduce the total cost of ownership for businesses.

- Integrated Solutions: Ford Pro combines vehicles, software, and services into a single offering.

- Productivity Focus: The suite is designed to keep commercial vehicles on the road and working efficiently.

- Cost Reduction: By optimizing uptime and maintenance, Ford Pro aims to lower operating expenses for fleet owners.

- Customization: Solutions are tailored to meet the specific needs of diverse commercial operations.

In 2024, Ford Pro reported significant growth, with revenue increasing by 20% year-over-year, driven by strong demand for its commercial vans and integrated software solutions. This segment is crucial to Ford's overall strategy, aiming to capture a larger share of the global commercial vehicle market.

Ford's diverse vehicle portfolio, from robust trucks to versatile SUVs and electric options, caters to a wide array of customer needs in 2024. This breadth, including the premium Lincoln brand, ensures broad market appeal and adaptability to evolving consumer preferences.

Ford emphasizes dependability and capability, with its F-Series trucks consistently demonstrating exceptional durability and sales leadership. This long-standing commitment to robust engineering and driving pleasure remains a core element of its customer value.

Advanced technology and connectivity, such as the SYNC infotainment system and BlueCruise hands-free driving, enhance the ownership experience. In 2024, millions of Ford vehicles are equipped with these features, improving safety, convenience, and efficiency.

Ford Pro offers integrated solutions for commercial clients, focusing on boosting fleet productivity and reducing total cost of ownership through vehicles, software, and services. In 2024, this segment saw a 20% year-over-year revenue increase, highlighting its strategic importance.

| Value Proposition Aspect | Description | 2024 Relevance/Data |

|---|---|---|

| Diverse Vehicle Range | Broad selection of trucks, SUVs, sedans, vans, and EVs, plus the Lincoln luxury brand. | Caters to varied consumer demands in a dynamic market. |

| Dependability & Capability | Engineered for longevity and robust performance, exemplified by F-Series truck sales. | Core brand attribute reinforcing customer trust and loyalty. |

| Technology & Connectivity | Features like SYNC and BlueCruise enhance safety, convenience, and driving experience. | Millions of connected vehicles in 2024 underscore adoption and differentiation. |

| Affordability & Value | Delivering quality and features at competitive price points, like the Ford Maverick. | Attracts a wide customer base prioritizing cost-effectiveness. |

| Ford Pro Ecosystem | Integrated vehicles, software, and services for commercial fleet optimization. | 20% revenue growth in 2024 highlights strong demand and strategic success. |

Customer Relationships

Ford cultivates strong customer bonds through its vast global dealership network, offering tailored sales guidance and expert maintenance. These local dealerships are vital for building lasting loyalty by providing consistent, personalized support.

Ford is cultivating lasting customer connections through its digital ecosystem, featuring apps like FordPass, Lincoln Way, and Ford Pro Intelligence. These platforms provide seamless remote vehicle management, appointment booking, navigation, and access to crucial vehicle data, enhancing the overall ownership journey and fostering stronger brand loyalty.

In 2024, Ford reported that over 3 million vehicles were connected, with a significant portion actively utilizing these digital engagement tools. This always-on connectivity allows Ford to deliver personalized experiences, proactive service reminders, and valuable insights, thereby deepening customer relationships beyond the initial purchase.

Ford generates recurring revenue and fosters lasting customer connections through a variety of post-sale services. These include extended warranties, comprehensive service plans, and increasingly, software-based subscriptions. For instance, telematics services and Ford's advanced driver-assist system, BlueCruise, offer ongoing value and enhanced vehicle functionality, ensuring continued customer engagement well after the initial purchase.

Community Building and Brand Loyalty Programs

Ford actively fosters a sense of community, particularly resonating with its loyal truck owners and performance vehicle enthusiasts. This connection is built through targeted marketing campaigns and events that highlight the brand's heritage and values, reinforcing customer identification.

Brand loyalty programs are central to Ford's strategy, encouraging repeat business and advocacy. These programs often offer exclusive benefits, early access to new models, and unique experiences, deepening the customer's bond with the Ford marque.

- Community Focus: Ford leverages its strong heritage, especially with the F-Series trucks, to build a community around shared experiences and brand pride.

- Loyalty Programs: Initiatives like FordPass Rewards offer points for vehicle service, purchases, and engagement, redeemable for discounts and exclusive perks.

- Event Engagement: Participation in and sponsorship of events like the Woodward Dream Cruise and specialized track days allow Ford to connect directly with enthusiasts.

- Brand Advocacy: By creating positive and memorable experiences, Ford encourages customers to become brand ambassadors, further strengthening its market position.

Dedicated Commercial Customer Support (Ford Pro)

Ford Pro offers dedicated commercial customer support, acting as a crucial element in their business model. This specialized support goes beyond typical customer service, focusing on the unique demands of businesses operating commercial fleets.

- Dedicated Account Management: Ford Pro assigns specific account managers to commercial clients, ensuring a direct point of contact for all their vehicle and service needs.

- Tailored Vehicle Solutions: They provide customized vehicle configurations and upfitting services to match the exact operational requirements of businesses, from specialized cargo vans to heavy-duty trucks.

- Fleet Management Services: Ford Pro offers solutions aimed at optimizing fleet efficiency, including telematics, maintenance scheduling, and driver management tools, helping businesses reduce downtime and operational costs.

- Business Needs Focus: The entire support structure is built around understanding and addressing the specific challenges and goals of commercial enterprises, fostering long-term partnerships.

Ford's customer relationships are built on a multi-faceted approach, blending a robust physical dealership network with an expanding digital presence. This dual strategy aims to provide both personalized local support and convenient, tech-enabled interactions. The company actively nurtures brand loyalty through community engagement and tailored programs, ensuring customers feel valued beyond the point of sale.

In 2024, Ford's commitment to digital engagement saw its connected vehicle services, like FordPass, actively used by over 3 million vehicles. This connectivity allows for proactive service alerts and personalized offers, enhancing the ownership experience and fostering deeper customer ties.

Ford Pro specifically caters to commercial clients, offering dedicated account management and tailored fleet solutions. This focus on business needs, including specialized upfitting and fleet management tools, helps drive efficiency and build long-term partnerships within the commercial sector.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Dealership Network | Personalized sales and service at local dealerships | Vast global network providing localized support |

| Digital Ecosystem | Apps like FordPass for remote management and services | Over 3 million connected vehicles actively using digital tools |

| Post-Sale Services | Recurring revenue through subscriptions and extended warranties | BlueCruise subscription services and extended service plans |

| Community & Loyalty | Building brand pride through events and loyalty programs | FordPass Rewards program offering points for engagement and service |

| Commercial Focus (Ford Pro) | Dedicated support for business fleet needs | Tailored vehicle solutions and fleet management services for commercial clients |

Channels

Ford Motor Company leverages an extensive global dealership network, comprising both independent franchises and company-owned outlets, to reach customers worldwide. This multi-faceted channel is crucial for showcasing vehicles, facilitating test drives, processing sales, and providing essential after-sales service and parts. In 2023, Ford reported approximately 11,000 dealerships globally, underscoring the breadth of its distribution capabilities.

Ford leverages its official websites, like Ford.com, for customers to configure vehicles, explore features, and even place reservations. This digital presence is key for generating leads and providing detailed product information, even if direct new vehicle sales online are still evolving across different markets.

In 2024, Ford continued to invest in its digital customer journey. For instance, the company reported significant growth in online vehicle inquiries and configurator usage, indicating a strong customer preference for digital research before visiting a dealership.

Ford Pro Direct Sales and Commercial Accounts are central to Ford's strategy for its business customers. This channel involves dedicated sales teams and account managers who engage directly with entities like businesses, government agencies, and rental car companies. This direct relationship facilitates tailored solutions, large-volume transactions, and specialized fleet management support, ensuring commercial clients receive precisely what they need to operate efficiently.

In 2024, Ford Pro continued to solidify its direct sales approach, reporting significant growth in its commercial vehicle segment. For instance, the F-Series Super Duty, a cornerstone of many commercial fleets, saw robust demand. This direct engagement model allows Ford to understand the unique operational challenges of its commercial clients, offering everything from vehicle customization to integrated telematics and charging solutions, thereby deepening customer loyalty and driving substantial revenue.

Mobile Applications (FordPass, Lincoln Way)

Ford leverages mobile applications like FordPass and Lincoln Way as a crucial digital channel, directly connecting with customers. These platforms offer a suite of services, from vehicle diagnostics and remote start to appointment scheduling and access to charging networks. By Q1 2024, FordPass had over 10 million registered users, demonstrating significant adoption.

These applications enhance the customer ownership experience by providing convenient access to vehicle management and support. They also serve as a gateway for Ford to introduce and manage new connected services, fostering ongoing engagement and potential revenue streams. In 2023, Ford reported that connected vehicle services contributed over $1 billion in revenue.

- Digital Channel: Direct customer interaction for services and support.

- Ownership Experience: Enhanced convenience through remote vehicle management.

- Connected Services: Gateway for new digital offerings and revenue generation.

- User Adoption: Over 10 million FordPass users by early 2024.

Marketing and Advertising Campaigns

Ford's marketing and advertising campaigns utilize a broad, multi-channel strategy. This includes traditional avenues like television commercials and print advertisements, alongside robust digital media efforts across websites and social platforms. They also leverage experiential events to connect with consumers directly.

These diverse campaigns are meticulously crafted to resonate with various customer demographics. The primary objectives are to cultivate strong brand awareness and to effectively direct potential buyers towards Ford dealerships and their online sales channels. For instance, in 2024, Ford continued its significant investment in digital marketing, with online advertising spend projected to reach billions globally.

- Multi-channel Approach Ford leverages television, digital media, social media, print, and experiential events.

- Targeted Reach Campaigns aim to connect with a wide array of customer segments.

- Brand Building Key focus on increasing and maintaining brand awareness.

- Sales Drive Efforts are directed at driving traffic to dealerships and online platforms.

Ford's channels are a blend of traditional and digital, ensuring broad customer reach. The extensive global dealership network remains vital for sales and service, complemented by a strong online presence for research and lead generation. Direct sales efforts for commercial clients through Ford Pro and engagement via mobile apps like FordPass further segment and cater to specific customer needs.

| Channel Type | Key Function | 2023/2024 Data Point |

|---|---|---|

| Dealership Network | Sales, Service, Test Drives | ~11,000 Global Dealerships (2023) |

| Official Websites (e.g., Ford.com) | Vehicle Configuration, Product Info, Lead Gen | Significant growth in online inquiries & configurator usage (2024) |

| Ford Pro Direct Sales | Commercial Vehicle Sales, Fleet Management | Robust demand for F-Series Super Duty (2024) |

| Mobile Applications (FordPass, Lincoln Way) | Vehicle Management, Diagnostics, Connected Services | Over 10 million FordPass users (Q1 2024) |

Customer Segments

Ford's mass market consumers represent a vast and diverse group, primarily seeking dependable and reasonably priced transportation for their daily lives. This includes individuals and families looking for everything from fuel-efficient sedans to versatile SUVs and robust pickup trucks. In 2024, Ford continued to cater to this segment with popular models like the Escape, a compact SUV known for its practicality, and the enduringly strong F-150 pickup truck, which consistently ranks as a top seller in the United States, often moving over 600,000 units annually.

Ford Pro is keenly focused on commercial and fleet businesses, including government entities and rental car companies. This segment relies on Ford for durable vehicles like vans and work trucks, prioritizing low operating expenses and comprehensive fleet management tools.

In 2024, Ford Pro's commercial vehicle sales continued to be a significant driver for Ford, with strong performance in segments like Transit vans and F-Series chassis cabs, catering to the demanding needs of these operational customers.

Ford targets luxury vehicle buyers through its Lincoln brand, offering vehicles that emphasize advanced technology, elegant styling, and plush interiors. This segment prioritizes a premium ownership experience, including superior comfort and a sense of prestige. In 2023, Lincoln's global sales reached approximately 110,000 units, reflecting continued demand for its upscale offerings.

Performance Enthusiasts and Lifestyle Buyers

Performance Enthusiasts and Lifestyle Buyers are a crucial segment for Ford, drawn to vehicles that offer exhilarating driving dynamics, distinctive styling, and a connection to automotive heritage. These customers often seek out iconic models that represent more than just transportation, but a statement of personal style and passion.

Ford caters to this group with vehicles like the Mustang, a perennial favorite known for its powerful engines and classic design. Performance variants of their popular trucks and SUVs, such as the F-150 Raptor and Bronco, also appeal to those who desire capability married with an adventurous spirit and robust performance.

In 2024, Ford continued to leverage the Mustang’s legacy, with sales data showing sustained interest in its performance-oriented trims. The brand's focus on heritage and driving pleasure resonates strongly, contributing significantly to Ford's image and sales in this enthusiast-driven market.

- Mustang Sales Momentum: In early 2024, the Mustang continued to be a strong performer, with Ford reporting robust demand for its latest generation, particularly the Dark Horse variant, highlighting the enduring appeal of performance-focused, heritage-rich models.

- Bronco and Raptor Demand: Ford's off-road and performance SUVs, like the Bronco and F-150 Raptor, saw continued high demand throughout 2024, with production often struggling to keep pace with customer orders, indicating a strong lifestyle buyer segment.

- Brand Heritage as a Differentiator: Ford actively promotes the historical significance and performance pedigree of models like the Mustang and Bronco, which is a key factor in attracting and retaining these lifestyle-oriented customers.

- Customization and Personalization: This segment often values the ability to personalize their vehicles, and Ford offers a wide range of factory-backed performance parts and accessories for models like the Mustang and F-150, enhancing their appeal to enthusiasts.

Environmentally Conscious and Early EV Adopters

Ford is actively targeting consumers and businesses keen on embracing sustainable transportation. This segment prioritizes environmental impact, seeking to reduce their carbon footprint through electric vehicles. Their purchasing decisions are often driven by a desire for advanced EV technology and improved fuel efficiency, making them early adopters of innovations like the Mustang Mach-E, F-150 Lightning, and the E-Transit van.

This environmentally conscious group is a significant growth area for Ford. In 2024, the demand for electric vehicles continued to surge, with global EV sales projected to reach over 16 million units. Ford's commitment to electrifying its popular models directly appeals to these buyers who want to transition to greener alternatives without compromising on performance or utility.

- Growing EV Market Share: In Q1 2024, Ford's EV sales in the US saw a notable increase, contributing to the overall expansion of the electric vehicle market.

- Model Appeal: The Mustang Mach-E and F-150 Lightning have garnered significant attention and positive reviews, attracting customers specifically looking for electric SUVs and trucks.

- Commercial Electrification: The E-Transit is a key offering for businesses aiming to electrify their fleets, aligning with corporate sustainability goals and operational cost savings.

- Consumer Motivation: Beyond environmental concerns, this segment is also motivated by potential long-term savings on fuel and maintenance, as well as access to the latest automotive technology.

Ford's customer segments are diverse, ranging from mass-market consumers seeking reliable transportation to specialized groups like performance enthusiasts and environmentally conscious buyers. The company also heavily targets commercial and fleet businesses with its Ford Pro division and luxury buyers through its Lincoln brand.

In 2024, Ford's core mass market continued to rely on dependable models like the F-150, which consistently outsells competitors in the truck segment. The Lincoln brand, meanwhile, saw continued demand for its premium offerings, with global sales in 2023 reaching approximately 110,000 units.

Ford's commitment to electrification is evident in its appeal to environmentally conscious consumers, with models like the Mustang Mach-E and F-150 Lightning experiencing strong demand. This segment is increasingly driven by a desire for advanced EV technology and sustainability, aligning with broader market trends.

Performance and lifestyle buyers remain a key demographic, drawn to iconic models such as the Mustang and the rugged Bronco. Ford's strategic focus on brand heritage and driving dynamics continues to resonate, as evidenced by sustained interest in these performance-oriented vehicles throughout 2024.

| Customer Segment | Key Characteristics | 2024 Focus/Data Points |

|---|---|---|

| Mass Market | Dependable, reasonably priced transportation | F-150 remains a top seller; Escape popular for families. |

| Commercial & Fleet (Ford Pro) | Durability, low operating expenses, fleet management | Strong sales of Transit vans and F-Series chassis cabs. |

| Luxury (Lincoln) | Advanced technology, elegant styling, premium experience | Global sales around 110,000 units in 2023. |

| Performance Enthusiasts & Lifestyle | Exhilarating driving, distinctive styling, heritage | Sustained demand for Mustang and Bronco; Raptor variants popular. |

| Sustainable Transportation | Environmental impact, EV technology, fuel efficiency | Growing EV sales; Mustang Mach-E and F-150 Lightning in high demand. |

Cost Structure

Ford's manufacturing and production expenses are substantial, encompassing raw materials like steel, aluminum, and lithium, along with essential component parts. In 2024, the automotive industry, including Ford, continued to navigate volatile commodity prices, impacting these material costs significantly. Energy consumption for its vast factory network and direct labor wages for its workforce also represent major outlays in this cost category.

Ford Motor Company dedicates significant resources to Research and Development, a cornerstone of its business model. In 2024, these investments are heavily focused on advancing electric vehicle (EV) and hybrid technologies, aiming to expand its lineup and improve battery efficiency. The company also pours funds into developing sophisticated driver-assistance systems and the software infrastructure for connected vehicles, essential for future mobility solutions.

Ford Motor Company continues to grapple with substantial expenses stemming from warranty claims and quality-related issues, including vehicle recalls and defects. For instance, in the first quarter of 2024, Ford reported that its recall costs, which are a significant component of its quality-related expenses, remained a notable factor impacting profitability. These costs are directly tied to ensuring vehicle reliability and addressing any manufacturing or design flaws that emerge post-sale.

The company actively invests in improving vehicle quality to mitigate these financial burdens and boost customer satisfaction. Despite these efforts, the financial impact of warranty claims and recall campaigns remains a critical area for cost optimization. For example, in 2023, Ford incurred significant expenses related to recalls, highlighting the ongoing challenge of managing these quality-related expenditures.

Marketing, Sales, and Distribution Costs

Ford's marketing, sales, and distribution costs are a substantial part of its overall expenses, crucial for reaching customers and generating revenue. These include significant outlays for advertising campaigns, which aim to build brand awareness and highlight new models.

Sales incentives, such as rebates and financing offers, are also key drivers of volume, though they directly impact profit margins. Dealership support, encompassing training, marketing co-ops, and inventory financing, represents another major cost category, ensuring a robust sales network.

Logistics and transportation expenses are considerable, as Ford needs to move vehicles efficiently from manufacturing plants to dealerships across the globe. For instance, in 2023, Ford reported selling approximately 1.8 million vehicles in the U.S. alone, underscoring the scale of its distribution network and associated costs.

- Advertising and Promotion: Costs associated with national and regional advertising campaigns, digital marketing, and public relations efforts.

- Sales Incentives and Discounts: Financial incentives offered to consumers and dealers to stimulate sales, including rebates and special financing rates.

- Dealer Network Support: Expenses related to maintaining and supporting the extensive Ford dealership infrastructure, including training and marketing assistance.

- Logistics and Transportation: Costs incurred in shipping vehicles from manufacturing facilities to dealerships worldwide, including freight and related services.

Capital Expenditures for New Facilities and Technologies

Ford's cost structure heavily features significant capital expenditures, particularly for building new manufacturing plants and upgrading existing ones. These investments are crucial for expanding production capacity, especially for their growing electric vehicle (EV) lineup, a cornerstone of their Ford+ transformation plan.

A substantial portion of these capital outlays is directed towards developing and scaling battery production capabilities. This includes investments in new battery plants and joint ventures to secure critical battery supply chains. For example, Ford announced plans to invest billions in its BlueOval City complex in Tennessee and Kentucky, a major hub for EV and battery manufacturing.

- Investment in EV and Battery Production: Ford is allocating significant capital towards its electric vehicle strategy, including the development of new battery technologies and manufacturing facilities.

- Plant Upgrades and New Construction: The company is investing in modernizing existing plants and building new ones to support increased production volumes, particularly for models like the F-150 Lightning and Mustang Mach-E.

- Technology Deployment: Capital is also spent on integrating advanced manufacturing technologies, automation, and digital solutions to improve efficiency and quality across its operations.

- Securing Supply Chains: Expenditures are made to establish and strengthen supply chains for essential EV components, such as batteries and semiconductors.

Ford's cost structure is heavily influenced by its extensive manufacturing operations, including raw materials, energy, and labor. In 2024, the company continued to manage fluctuating commodity prices, impacting the cost of steel, aluminum, and lithium, essential for vehicle production. Direct labor wages for its large workforce also represent a significant expenditure, alongside the energy required to power its global manufacturing facilities.

Research and Development (R&D) is another major cost driver for Ford, with substantial investments in 2024 directed towards electric vehicle (EV) technology, battery advancements, and autonomous driving systems. These R&D efforts are crucial for staying competitive in the rapidly evolving automotive landscape and developing future mobility solutions.

Warranty and quality-related expenses, including recall costs, remain a notable area of expenditure for Ford. The company actively works to improve vehicle reliability, but in early 2024, recall costs continued to be a factor affecting profitability, highlighting the ongoing challenge of managing quality-related expenditures.

Marketing, sales, and distribution costs are also significant, encompassing advertising, sales incentives, and dealer network support. The logistics of transporting millions of vehicles globally, as evidenced by the approximately 1.8 million vehicles sold in the U.S. in 2023, contribute substantially to these operational expenses.

Capital expenditures are a critical component of Ford's cost structure, with major investments in 2024 focused on expanding EV and battery production capacity. This includes significant outlays for new manufacturing plants like the BlueOval City complex, aimed at supporting the company's ambitious electric vehicle strategy and securing vital supply chains.

| Cost Category | Key Components | 2024 Focus Areas |

| Manufacturing & Production | Raw Materials (Steel, Lithium), Energy, Direct Labor | Managing volatile commodity prices, optimizing energy consumption |

| Research & Development | EV Technology, Battery Advancements, Autonomous Driving | Expanding EV lineup, improving battery efficiency, developing driver-assistance systems |

| Quality & Warranty | Recalls, Defect Rectification, Warranty Claims | Improving vehicle reliability, mitigating recall costs |

| Sales, Marketing & Distribution | Advertising, Sales Incentives, Dealer Support, Logistics | Brand building, driving sales volume, efficient vehicle delivery |

| Capital Expenditures | New Plants, Plant Upgrades, Battery Production, Technology Deployment | Scaling EV production, securing supply chains, automation investments |

Revenue Streams

Ford's main income comes from selling vehicles. This includes their popular trucks, SUVs, vans, and cars under the Ford brand, as well as the luxury Lincoln models. They sell these to individual buyers and businesses all over the world.

In 2024, Ford reported significant vehicle sales figures. For instance, their F-Series trucks continued to be a dominant force, with millions of units sold annually, contributing substantially to their overall revenue. The company also saw growing demand for its electric vehicles, like the Mustang Mach-E and F-150 Lightning, which are increasingly becoming key revenue drivers.

Ford Motor Credit Company is a significant revenue driver for Ford, offering financing for vehicle purchases and leasing options to both individual customers and dealerships. This financial services arm consistently contributes to the company's bottom line, providing a steady income stream.

In 2023, Ford Motor Credit reported a pre-tax profit of $2.1 billion, showcasing its robust performance and importance to Ford's overall financial health.

Ford Motor Company generates significant revenue from selling parts and accessories. This includes everything from essential replacement components for routine maintenance and repairs to a wide array of customization options for new and existing vehicles. This aftermarket business provides a consistent and valuable post-sale income stream.

In 2023, Ford's wholesale parts revenue was a substantial contributor to its overall financial performance. While specific figures for the accessories segment are often bundled, the company's commitment to its parts division underscores its importance in maintaining customer loyalty and capturing ongoing revenue beyond the initial vehicle sale.

Connected Services and Software Subscriptions

Ford is increasingly focusing on connected services and software subscriptions as a significant growth area. This includes paid offerings for telematics, fleet management solutions like Ford Pro Intelligence, and advanced driver-assistance features such as BlueCruise. The company's strategy is to boost revenue from these high-margin software-based services.

- Connected Services: Ford is expanding its portfolio of paid connected services, aiming to capture recurring revenue from vehicle owners and fleet operators.

- Software Subscriptions: The company is developing and marketing software subscriptions for features like advanced driver assistance and fleet management, targeting higher profit margins.

- Ford Pro Intelligence: This platform is a key enabler for fleet management subscriptions, offering telematics and operational insights to commercial customers.

- BlueCruise: This hands-free highway driving technology is offered as a subscription service, demonstrating Ford's push into feature-based recurring revenue.

Extended Warranties and Service Contracts

Ford offers customers the option to purchase extended warranties and service contracts, providing a valuable revenue stream. These plans protect buyers from unexpected repair expenses after the initial warranty expires. In 2023, Ford reported that its service and parts revenue, which includes these contracts, reached $15.6 billion.

These high-margin offerings not only generate additional income for Ford but also foster deeper, long-term relationships with customers. By offering peace of mind regarding future maintenance costs, Ford encourages customer loyalty and repeat business.

- Extended Warranties: Cover unforeseen repair costs beyond the standard factory warranty period.

- Service Contracts: Often include scheduled maintenance like oil changes and tire rotations.

- Revenue Contribution: These products are a significant contributor to Ford's aftermarket sales and overall profitability.

- Customer Retention: Enhance customer satisfaction and encourage continued service at Ford dealerships.

Ford's revenue streams are diverse, extending beyond vehicle sales to include financial services, parts and accessories, and increasingly, connected services and software subscriptions.

Ford Motor Credit Company plays a crucial role, generating revenue through vehicle financing and leasing, contributing significantly to overall profitability. In 2023, this segment reported a pre-tax profit of $2.1 billion.

The company also benefits from a robust aftermarket business, selling parts and accessories for maintenance and customization, which generated $15.6 billion in service and parts revenue in 2023.

Looking ahead, Ford is strategically investing in high-margin software-based services like BlueCruise and Ford Pro Intelligence, aiming for recurring revenue from connected vehicle features and fleet management solutions.

| Revenue Stream | Description | 2023 Data/Notes |

|---|---|---|

| Vehicle Sales | Sale of Ford and Lincoln vehicles (trucks, SUVs, cars, vans) | F-Series trucks remain a top seller; growing EV sales (Mach-E, F-150 Lightning) |

| Ford Motor Credit Company | Financing and leasing for vehicles | Pre-tax profit of $2.1 billion in 2023 |

| Parts & Accessories | Aftermarket sales for maintenance, repair, and customization | Service and parts revenue totaled $15.6 billion in 2023 |

| Connected Services & Software | Subscriptions for telematics, fleet management, advanced driver assistance | Focus on recurring revenue from services like BlueCruise and Ford Pro Intelligence |

| Extended Warranties & Service Contracts | Post-warranty protection and maintenance plans | Contributes to aftermarket sales and customer retention |

Business Model Canvas Data Sources

The Ford Motor Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer preferences and automotive trends, and competitive analysis of other major players in the industry.