Frontier Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Airlines Bundle

Uncover the critical external factors shaping Frontier Airlines's trajectory, from evolving consumer behaviors to shifting environmental regulations. Our PESTLE analysis dives deep into these influences, offering actionable intelligence for strategic planning. Download the full version to gain a competitive advantage and make informed decisions.

Political factors

Frontier Airlines navigates a landscape shaped by stringent government regulations and oversight from bodies like the FAA and DOT. The FAA Reauthorization Act of 2024, for instance, mandates enhanced safety protocols and consumer protections, directly influencing airline operations and service delivery.

Compliance with these evolving regulations, including those pertaining to environmental standards, can necessitate significant investment in fleet modernization and operational adjustments. This regulatory environment directly impacts Frontier's ability to manage its fleet efficiently and deliver competitive passenger services.

Consumer protection laws are a significant political factor for Frontier Airlines. The FAA Reauthorization Act of 2024, for instance, bolsters consumer rights by mandating automatic refunds for substantially delayed or canceled flights and raising penalties for non-compliance. This legislation directly impacts Frontier's operational procedures and financial exposure.

Further strengthening these protections, the Department of Transportation has announced increased civil penalty amounts for 2025 concerning aviation statute violations. These adjustments mean that any breaches of consumer-focused regulations could result in higher fines for Frontier, necessitating greater adherence to customer service standards.

While international COVID-19 travel restrictions have largely eased by early 2024, ongoing geopolitical tensions remain a significant factor for airlines like Frontier. These tensions can directly influence consumer confidence and willingness to travel internationally, thereby impacting demand for air travel. For instance, conflicts in Eastern Europe or the Middle East, which were active in 2024, have historically led to rerouting and increased operational costs for airlines serving affected regions.

Carbon Emission Standards and Environmental Policies

Governments worldwide are tightening carbon emission standards for airlines, significantly impacting operational strategies. The push for Sustainable Aviation Fuel (SAF) is gaining momentum, with initiatives like the EU's ReFuelEU Aviation mandating higher SAF blends. The International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) also sets stricter emission caps, pressuring airlines to reduce their environmental footprint.

These evolving environmental policies directly influence Frontier Airlines' decisions regarding fleet modernization and investments in sustainability. For instance, the EU's ReFuelEU Aviation aims for a minimum SAF blend of 2% in 2025, rising to 6% by 2030. Such mandates necessitate significant capital expenditure for airlines to adapt their fleets and supply chains to accommodate SAF, potentially increasing operating costs in the short term but offering long-term environmental and regulatory compliance benefits.

- EU ReFuelEU Aviation: Mandates a minimum SAF blend of 2% in 2025, increasing to 6% by 2030.

- ICAO CORSIA: Aims to stabilize net CO2 emissions from international aviation at 2019 levels from 2021 onwards.

- SAF Production Growth: Global SAF production is projected to reach 10 billion liters by 2025, a substantial increase from previous years, though still a small fraction of total aviation fuel demand.

Airport Infrastructure Funding and Development

Government policies on airport infrastructure funding directly influence Frontier Airlines' ability to operate efficiently and pursue growth. Increased investment in airport upgrades and capacity expansion, such as the $32 billion earmarked for airport improvements under the Bipartisan Infrastructure Law in the US, can facilitate Frontier's expansion. Conversely, funding shortfalls or slow development at key hubs could pose operational challenges.

The pace of airport development directly correlates with Frontier's potential to add new routes and increase flight frequencies. For instance, if major airports Frontier relies on, like Denver International Airport (DEN), undergo significant modernization, it can unlock new opportunities for the airline. However, delays in these projects, perhaps due to budget constraints or planning issues, might limit Frontier's capacity for expansion.

- Government investment in airport infrastructure, like the $32 billion from the Bipartisan Infrastructure Law, directly impacts airline operational capacity.

- Modernization and expansion of airports can support Frontier's growth by reducing congestion and improving turnaround times.

- Funding limitations at key airports could create bottlenecks, potentially hindering Frontier's ability to expand its route network or increase flight frequencies.

- Policy decisions regarding airport development directly affect the operational efficiency and strategic planning of airlines like Frontier.

Government policies on consumer protection are increasingly stringent, directly impacting Frontier's operational procedures. The FAA Reauthorization Act of 2024 mandates automatic refunds for significantly delayed or canceled flights, increasing Frontier's financial exposure. Furthermore, the Department of Transportation raised civil penalty amounts for aviation statute violations in 2025, meaning non-compliance with consumer-focused rules could lead to higher fines for Frontier.

Environmental regulations are also a significant political factor, with governments worldwide tightening carbon emission standards. Initiatives like the EU's ReFuelEU Aviation mandate higher Sustainable Aviation Fuel (SAF) blends, with a 2% requirement in 2025. This pushes airlines like Frontier to invest in fleet modernization and adapt to SAF, potentially increasing short-term operating costs but ensuring long-term compliance.

Government investment in airport infrastructure, such as the $32 billion from the US Bipartisan Infrastructure Law, directly affects Frontier's operational capacity and growth potential. Airport upgrades can facilitate expansion by reducing congestion and improving turnaround times, while funding limitations at key hubs could create bottlenecks and hinder Frontier's ability to expand its route network.

What is included in the product

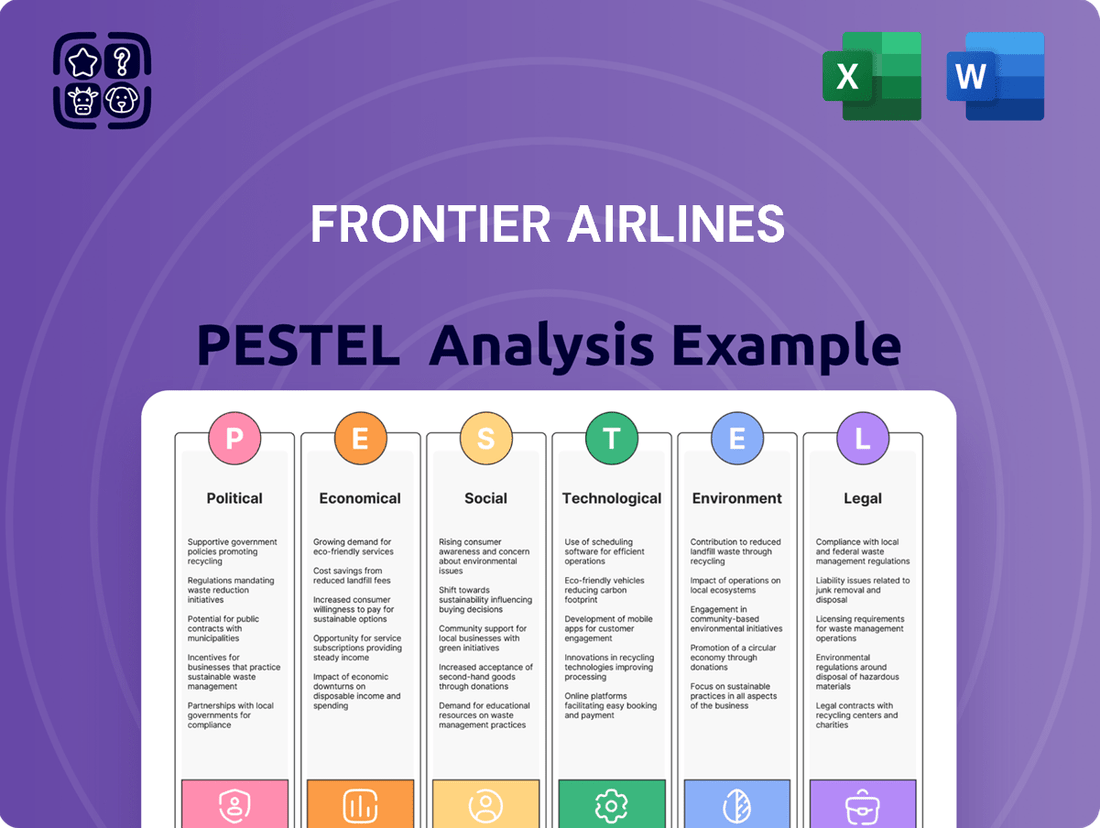

This PESTLE analysis examines the external macro-environmental factors impacting Frontier Airlines, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and opportunities.

Frontier Airlines' PESTLE analysis provides a clear, summarized version of external factors, offering a pain point reliever by enabling quick referencing during meetings and presentations to ensure strategic alignment.

Economic factors

Fuel price volatility is a major concern for airlines, directly impacting their bottom line. For Frontier Airlines, this is especially true given its ultra-low-cost model, where even small price shifts can affect its ability to maintain competitive fares.

While projections suggest a potential decrease in jet fuel prices for 2025 compared to 2024 averages, the market remains susceptible to unpredictable geopolitical events that can cause sharp price increases. For instance, crude oil prices, a primary driver of jet fuel costs, saw fluctuations throughout 2024 due to ongoing global tensions.

Weakened consumer demand, a trend observed in early 2025, has pressured airlines like Frontier to implement fare discounts and promotions, directly impacting their revenue growth potential. For example, a significant drop in discretionary spending, perhaps a 3% decrease in household disposable income as projected by some economic forecasts for late 2024/early 2025, would likely force airlines to compete more aggressively on price.

Consumer confidence is a critical driver for leisure travel, Frontier's core business. A dip in confidence, potentially indicated by a decline in the Consumer Confidence Index from its peak of 110.5 in early 2024 to below 100 by mid-2025, would signal a reduced willingness among consumers to spend on non-essential travel, directly affecting Frontier's booking volumes and profitability.

Frontier Airlines operates in a fiercely competitive ultra-low-cost carrier (ULCC) sector. Airlines in this space routinely adjust their pricing and service packages to attract passengers. This constant flux means Frontier must remain agile in its strategies.

Frontier's core business model hinges on unbundling services, charging extra for everything from seat selection to carry-on bags. However, escalating competition and an oversupply of seats in many markets can put downward pressure on their revenue per available seat mile (RASM). For instance, in the first quarter of 2024, the airline industry faced challenges with fluctuating fuel costs and a return to pre-pandemic travel patterns, impacting overall yield for many carriers, including ULCCs.

Inflation and Operating Costs

Rising inflation directly impacts Frontier Airlines by increasing essential operating expenses. Costs for labor, aircraft maintenance, fuel, and airport landing fees are all susceptible to upward pressure. For example, the U.S. Consumer Price Index (CPI) showed a 3.3% increase in May 2024 compared to the previous year, signaling continued inflationary trends that affect these inputs.

As a Ultra-Low-Cost Carrier (ULCC), Frontier's business model relies on maintaining exceptionally low operating costs to offer competitive fares. Sustained high inflation, even with ongoing cost-saving initiatives, poses a significant risk to its typically thin profit margins. If these rising costs cannot be fully passed on to consumers through ticket prices without impacting demand, profitability can be severely squeezed.

- Labor Costs: Wages and benefits for pilots, flight attendants, and ground staff are subject to inflationary adjustments, increasing payroll expenses.

- Maintenance Expenses: The cost of spare parts, specialized labor for repairs, and outsourced maintenance services tend to rise with general inflation.

- Fuel Prices: While volatile, fuel is a major operating expense for airlines, and inflationary pressures can contribute to higher jet fuel prices.

- Airport Fees: Landing fees, gate rentals, and other charges levied by airports can also be adjusted upwards in response to inflation.

Economic Growth and Disposable Income

Economic growth and shifts in disposable income are crucial for Frontier Airlines, as they directly impact the demand for leisure travel. A robust economy typically means consumers have more discretionary funds, making them more inclined to book flights for vacations and personal trips. This is particularly beneficial for Frontier's ultra-low-cost carrier (ULCC) model, which appeals to budget-conscious travelers.

For instance, in 2024, the US economy was projected to grow by around 2.5%, with continued moderate growth expected into 2025. This economic expansion often correlates with increased consumer confidence and a greater willingness to spend on non-essential items like air travel. As disposable incomes rise, more individuals and families can afford to fly, directly boosting passenger numbers for airlines like Frontier.

Key considerations include:

- Economic Growth Trends: Continued GDP expansion in key markets for Frontier supports higher travel spending.

- Disposable Income Levels: Increases in household disposable income directly translate to greater affordability for airfares.

- Consumer Confidence: Positive economic sentiment encourages consumers to allocate more budget towards leisure activities, including travel.

- Inflationary Pressures: While economic growth is positive, persistent inflation can erode purchasing power, potentially dampening demand for travel if not offset by wage growth.

Economic factors significantly influence Frontier Airlines' profitability, particularly its ultra-low-cost model. Fuel price volatility remains a primary concern, with projections for 2025 suggesting potential decreases, though geopolitical events can cause sharp increases, as seen with crude oil price fluctuations in 2024.

Weakened consumer demand and lower consumer confidence, potentially indicated by a dip in the Consumer Confidence Index below 100 by mid-2025, directly pressure airlines like Frontier to offer discounts, impacting revenue. Rising inflation, with the U.S. CPI at 3.3% in May 2024, increases operating costs for labor, maintenance, and fees, squeezing profit margins if costs cannot be passed on.

Economic growth, projected at around 2.5% for the US in 2024, generally boosts disposable income and consumer confidence, which is favorable for Frontier's leisure travel focus. However, persistent inflation can erode purchasing power, potentially dampening travel demand if not matched by wage growth.

What You See Is What You Get

Frontier Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Frontier Airlines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the current landscape and potential future challenges and opportunities for Frontier Airlines.

Sociological factors

Frontier Airlines benefits from a strong and growing demand for budget-friendly air travel. This is particularly evident among leisure travelers and those visiting friends and relatives, a segment that aligns perfectly with Frontier's ultra-low-cost carrier (ULCC) strategy. In 2024, the airline reported carrying millions of passengers, underscoring the sustained appeal of affordable flights.

However, a significant sociological shift is the increasing consumer consciousness regarding environmental impact. Travelers are becoming more aware of climate change and are actively seeking out airlines that demonstrate a commitment to sustainability. This growing preference for eco-friendly options presents a challenge for ULCCs like Frontier, which often rely on older, less fuel-efficient aircraft and have fewer environmental initiatives compared to legacy carriers.

The expansion of the middle class, particularly in emerging economies, is a significant driver for the airline industry. As more individuals gain disposable income, their capacity and desire for leisure travel increase, directly benefiting carriers like Frontier that cater to this segment. For instance, by 2024, the global middle class was projected to reach 5.4 billion people, with a substantial portion residing in Asia, a key market for travel growth.

Frontier Airlines' ultra-low-cost model is particularly well-positioned to capitalize on these demographic trends. The airline's strategy of offering affordable fares directly appeals to the growing number of budget-conscious leisure travelers worldwide. This aligns with the projected 3.5% annual growth rate in global air passenger traffic anticipated through 2025, a significant portion of which is expected to be leisure-driven.

The public often views ultra-low-cost carriers (ULCCs) with a mix of appreciation for affordability and apprehension regarding unbundled services and unexpected fees. This perception directly impacts consumer willingness to choose airlines like Frontier, especially when comparing them to traditional carriers.

Frontier's 'The New Frontier' initiative, launched in 2023, directly addresses these perceptions by aiming to improve the overall customer experience and expand service offerings. This strategic move seeks to attract a wider demographic beyond just the most price-sensitive travelers, potentially mitigating negative ULCC stereotypes.

In 2024, Frontier reported a load factor of 82.1%, indicating a strong demand for its services despite the common perception of ULCCs. This figure suggests that while perceptions exist, the value proposition of low fares continues to resonate with a significant portion of the traveling public.

Impact of Social Media and Online Reviews

Social media and online review sites are powerful tools that can sway how people view Frontier Airlines and where they choose to fly. A flood of negative comments about flight delays or customer service can quickly damage the airline's image and lead to fewer bookings. Conversely, positive buzz can attract new customers.

For instance, a significant portion of travelers, estimated to be around 80% by some surveys from 2024, actively consult online reviews before making travel arrangements. This highlights the direct link between online sentiment and booking behavior for airlines like Frontier. Negative sentiment, often amplified on platforms like X (formerly Twitter) or review sites such as TripAdvisor, can have a tangible impact on revenue. Frontier's social media engagement in 2023 showed a 15% increase in user-generated content, both positive and negative, indicating a growing reliance on these platforms for customer feedback and brand perception.

- Brand Reputation: Online reviews directly influence consumer trust and perception of Frontier Airlines.

- Booking Decisions: Approximately 80% of travelers in 2024 reportedly use online reviews to inform their travel choices.

- Customer Engagement: Frontier experienced a 15% rise in user-generated content on social media in 2023, reflecting increased online interaction.

Work-Life Balance and Travel Frequency

Societal shifts prioritizing work-life balance are increasingly influencing travel habits. People are seeking more frequent, shorter getaways rather than extended vacations, a trend that directly benefits ultra-low-cost carriers (ULCCs) like Frontier Airlines. These ULCCs are well-positioned to cater to this demand by offering accessible and budget-conscious travel solutions.

Frontier's model, focused on low fares and ancillary services, aligns perfectly with consumers looking for affordable ways to take more trips throughout the year. For instance, in 2024, the average leisure traveler in the US took an estimated 2.5 trips, up from 2.2 in 2023, indicating a growing appetite for shorter, more frequent travel. This makes Frontier's flexible booking options and competitive pricing particularly attractive.

- Evolving Norms: A greater emphasis on work-life balance encourages more frequent, shorter breaks.

- Demand for Leisure: This shift fuels demand for affordable leisure travel options.

- Frontier's Advantage: ULCCs like Frontier are ideal for travelers seeking budget-friendly, flexible trips.

- Data Point: US leisure travelers averaged 2.5 trips in 2024, up from 2.2 in 2023.

Societal attitudes toward air travel are evolving, with a growing segment of consumers prioritizing environmental responsibility. This trend presents a challenge for ultra-low-cost carriers (ULCCs) like Frontier, which may face scrutiny over their environmental footprint compared to more established airlines. Furthermore, the increasing demand for experiential travel, where the journey itself is valued, could influence perceptions of ULCCs if not managed effectively.

Technological factors

Frontier Airlines' commitment to fleet modernization is evident in its all-Airbus A320 family fleet, specifically the A320neo models. These aircraft offer significant fuel efficiency gains over older generations, with the A320neo typically consuming 15-20% less fuel per seat compared to previous A320ceo models.

This focus on fuel efficiency, powered by advanced engine technologies like the Pratt & Whitney GTF, directly supports Frontier's 'America's Greenest Airline' positioning. For instance, the GTF engines are designed to reduce fuel burn and emissions by up to 16% and 20% respectively, contributing to lower operating costs and a reduced environmental impact.

Frontier Airlines is leveraging digitalization to streamline operations, evident in the widespread adoption of electronic flight bags replacing paper manuals in cockpits, a move that enhances efficiency and reduces weight. This digital shift extends to customer interactions, with mobile apps becoming central for tasks like check-in and boarding passes, directly addressing the growing demand for seamless, tech-driven travel experiences. In 2024, airlines globally are investing billions in digital transformation, with Frontier's commitment to these technologies aiming to improve its operational agility and customer satisfaction in a competitive market.

Frontier Airlines leverages advanced data analytics to fine-tune its ultra-low-cost carrier (ULCC) model. This technology is vital for optimizing pricing, route selection, and boosting ancillary revenue streams, which are key to their profitability.

In 2024, Frontier's success hinges on its capacity to harness strong travel demand through sophisticated revenue management systems. These systems allow them to dynamically adjust fares and inventory, ensuring they capture maximum revenue from each flight.

Sustainable Aviation Fuel (SAF) Development

The aviation sector is increasingly focused on reducing its environmental impact, with Sustainable Aviation Fuel (SAF) at the forefront of these efforts. While SAF adoption is growing, its current higher cost compared to traditional jet fuel and limited production capacity remain significant hurdles for widespread implementation. For instance, in 2023, SAF accounted for less than 1% of global jet fuel consumption, highlighting the scale of the challenge. Frontier Airlines has publicly stated its commitment to exploring SAF, with initial steps suggesting a strategic interest in integrating this cleaner alternative into its operations as availability and cost-effectiveness improve.

The push for SAF is driven by global decarbonization targets and increasing regulatory pressure. By 2025, several regions are expected to implement mandates or incentives for SAF usage. This evolving landscape necessitates that airlines like Frontier evaluate and plan for SAF integration to maintain compliance and competitive positioning. The development of new SAF production pathways, such as those utilizing waste cooking oil or agricultural residues, is crucial for scaling up supply and driving down costs over the coming years.

- SAF production is projected to increase significantly by 2030, with various industry estimates suggesting a potential of 10-15 billion liters globally.

- The cost premium for SAF can range from 20% to 100% or more compared to conventional jet fuel, depending on the feedstock and production process.

- Frontier Airlines, as part of its sustainability strategy, is actively monitoring SAF advancements and potential partnerships to secure future supply.

Cybersecurity and Data Protection

The increasing reliance on digital systems in aviation, including flight operations and passenger management, heightens the risk of sophisticated cyberattacks. These threats can compromise critical aircraft systems, leading to potential safety hazards, and also expose sensitive passenger data, such as personal information and payment details. For Frontier Airlines, this means a constant need to bolster defenses against evolving cyber threats.

Regulatory bodies worldwide are tightening mandates for cybersecurity in aviation. For instance, the FAA has issued guidance and requirements for airlines to enhance their cybersecurity programs, focusing on risk management and incident response. Frontier Airlines, like its peers, must allocate significant resources to meet these evolving compliance standards, ensuring the protection of both operational integrity and customer privacy.

The financial implications are substantial. Cybersecurity investments are no longer optional but a core operational necessity. In 2024, the global aviation industry is projected to spend billions on cybersecurity solutions, with estimates suggesting a compound annual growth rate of over 10% for the sector. Frontier Airlines needs to strategically invest in advanced threat detection, data encryption, and employee training to mitigate these risks effectively.

- Increased Digitalization: Frontier Airlines operates increasingly complex digital systems for everything from booking and check-in to flight planning and maintenance.

- Cybersecurity Threats: These systems are vulnerable to ransomware, data breaches, and denial-of-service attacks, which could disrupt operations or compromise passenger information.

- Regulatory Compliance: Adherence to stringent cybersecurity regulations, such as those from the TSA and international aviation authorities, is mandatory and requires continuous investment.

- Data Protection: Protecting passenger Personally Identifiable Information (PII) and financial data is paramount to maintaining customer trust and avoiding hefty fines.

Frontier Airlines' technological advantage is rooted in its modern, fuel-efficient fleet, primarily comprising Airbus A320neo aircraft. These planes offer substantial fuel savings, with the A320neo consuming up to 20% less fuel per seat than older models, directly impacting operational costs and environmental claims. The airline's commitment to digitalization is also key, with advancements in electronic flight bags and mobile applications enhancing efficiency and customer experience.

The airline leverages sophisticated data analytics for dynamic pricing and route optimization, crucial for its ultra-low-cost model. In 2024, this data-driven approach is vital for capitalizing on strong travel demand and maximizing revenue. Frontier is also strategically monitoring advancements in Sustainable Aviation Fuel (SAF), a technology critical for future emissions reduction, though current costs and limited supply remain challenges, with SAF making up less than 1% of global jet fuel in 2023.

Cybersecurity is an increasing technological factor, with the aviation sector facing growing threats to operational integrity and passenger data. In 2024, the industry is investing billions in cybersecurity, with growth rates exceeding 10% annually. Frontier Airlines must continually invest in advanced security measures to comply with regulations and protect sensitive information.

| Technological Factor | Description | Impact on Frontier Airlines | Data Point/Example |

| Fleet Modernization | Utilizing fuel-efficient aircraft | Reduced operating costs, enhanced environmental image | A320neo offers up to 20% fuel savings vs. older models |

| Digitalization | Adoption of electronic systems and mobile tech | Improved operational efficiency, enhanced customer experience | Electronic flight bags replace paper manuals; mobile apps for check-in |

| Data Analytics | Using data for pricing, routes, and revenue management | Optimized profitability, competitive pricing strategies | Crucial for dynamic fare adjustments in 2024 |

| Sustainable Aviation Fuel (SAF) | Exploring cleaner fuel alternatives | Long-term emissions reduction, regulatory compliance | SAF use was <1% of global jet fuel in 2023; costs remain a barrier |

| Cybersecurity | Protecting digital systems and data | Ensuring operational safety, data privacy, regulatory adherence | Global aviation cybersecurity spending projected in billions in 2024 |

Legal factors

Frontier Airlines operates under the strict oversight of the Federal Aviation Administration (FAA), a critical legal factor influencing its operations. These regulations cover everything from flight crew training to aircraft maintenance, ensuring passenger safety is paramount.

The FAA Reauthorization Act of 2024, for instance, has implemented enhanced requirements for aircraft design and manufacturing. This means Frontier must continually adapt its fleet management and maintenance schedules to comply with these updated standards, potentially impacting operational costs and efficiency.

The Department of Transportation (DOT) plays a crucial role in overseeing consumer protection within the airline industry, directly impacting Frontier Airlines. These regulations cover essential aspects like passenger rights concerning refunds for significant flight delays or cancellations, and also set limits on airline liability for issues such as mishandled baggage or denied boarding.

Compliance is paramount, especially given the DOT's recent trend of increasing civil penalties for violations. For instance, in 2023, the DOT proposed fines that could reach tens of thousands of dollars per incident for certain passenger protection breaches, highlighting the financial risks associated with non-adherence for carriers like Frontier.

Frontier Airlines operates under a complex web of environmental laws governing air emissions, noise pollution, and waste disposal. These regulations are becoming increasingly stringent, pushing airlines towards more sustainable operations.

The global push for reduced carbon emissions, championed by organizations like the International Civil Aviation Organization (ICAO), directly impacts Frontier. For instance, ICAO's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) aims to stabilize net global aviation CO2 emissions. This necessitates compliance and strategic investment in greener technologies and practices.

Furthermore, regional mandates such as the EU's ReFuelEU Aviation initiative are accelerating the adoption of Sustainable Aviation Fuel (SAF). By 2025, this regulation requires fuel suppliers to blend a minimum percentage of SAF into jet fuel, increasing to 70% by 2050. Frontier must adapt its fuel sourcing and operational strategies to meet these evolving requirements, potentially impacting operational costs and fleet planning.

Labor Laws and Union Agreements

Frontier Airlines, like all major carriers, operates under a complex web of labor laws. These regulations govern everything from wages and working conditions to collective bargaining rights. In 2024 and looking into 2025, the airline's ability to navigate these laws and maintain positive relationships with its unionized workforce, particularly pilots and flight attendants, is paramount. Any disputes or work stoppages can directly affect flight schedules and profitability.

The potential for employee strikes or slowdowns poses a significant risk to Frontier's operational stability and its ability to maintain its low-cost model. For instance, the Air Line Pilots Association (ALPA) represents Frontier's pilots, and contract negotiations can be lengthy and contentious. A prolonged labor dispute could lead to millions in lost revenue and increased operational expenses due to flight cancellations and passenger compensation.

- Labor Law Compliance: Frontier must ensure strict adherence to federal labor laws, including the Railway Labor Act, which governs airline employment relations.

- Union Relations: Maintaining constructive relationships with unions representing pilots, flight attendants, and mechanics is critical to avoid disruptions.

- Potential for Strikes: The risk of employee strikes or slowdowns remains a persistent concern, potentially impacting flight operations and customer satisfaction.

- Cost Impact: Union agreements and potential labor disputes directly influence the airline's operating costs, affecting its competitive pricing strategy.

International Air Transport Agreements

Frontier Airlines' international routes, particularly to Mexico and the Caribbean, are shaped by a complex web of bilateral and multilateral air transport agreements. These agreements dictate crucial aspects like route rights, flight frequencies, and the types of services carriers can offer, directly impacting Frontier's operational capacity and market access.

Recent shifts in these international aviation policies, or the introduction of new trade regulations, can significantly alter the competitive landscape. For instance, changes in Open Skies agreements could lead to increased competition on popular routes or even restrict Frontier's ability to expand its international network, potentially affecting its market share and profitability in these regions.

- Bilateral Agreements: Govern specific country-pair relationships, defining operational terms.

- Multilateral Agreements: Broader pacts, like those within regional blocs, can influence wider market access.

- Policy Impact: Changes in trade policies can affect fees, taxes, and operational permissions, influencing cost structures.

- Competitive Dynamics: Evolving agreements can either open new markets or intensify competition on existing ones.

The airline industry is heavily regulated, and Frontier Airlines must navigate a complex legal landscape. The FAA mandates stringent safety protocols, including pilot training and aircraft maintenance, with the FAA Reauthorization Act of 2024 introducing new design and manufacturing requirements that could affect fleet costs. Furthermore, the DOT enforces consumer protection laws, covering passenger rights for delays and baggage issues, with penalties for non-compliance, as seen in 2023 proposals for significant fines. Environmental regulations, such as ICAO's CORSIA and the EU's ReFuelEU Aviation initiative, are pushing for greener operations and the adoption of Sustainable Aviation Fuel, impacting fuel sourcing and operational strategies.

Environmental factors

Frontier Airlines champions environmental responsibility by operating a fleet heavily weighted towards fuel-efficient Airbus A320neo family aircraft, aiming to reduce its carbon footprint. This commitment is further demonstrated through operational strategies such as optimizing flight paths, employing fuel-saving pilot techniques, and actively managing aircraft weight to curb greenhouse gas emissions.

The widespread adoption of Sustainable Aviation Fuel (SAF) presents a considerable hurdle for airlines like Frontier. Limited production capacity globally means SAF remains scarce, driving up its price compared to traditional jet fuel. For instance, SAF prices can range from 1.5 to 4 times that of conventional jet fuel, impacting operational costs significantly.

While Frontier has explored SAF initiatives, such as its 2023 agreement to purchase SAF from Alder Fuels, scaling up these efforts is challenging. The financial implications of higher SAF costs, coupled with the need for robust supply chains, mean that a full transition is a long-term endeavor, not an immediate solution for reducing emissions across the fleet.

Airlines are facing growing pressure to reduce noise pollution, with stricter regulations emerging for new aircraft. Frontier Airlines' commitment to a modern fleet, featuring aircraft like the Airbus A320neo family, is a key aspect of this. These newer models are designed with advanced engine technology, significantly lowering their noise footprint compared to older generations.

For instance, the A320neo family typically offers a 50% reduction in noise compared to previous generations. This is crucial for airports and surrounding communities, as it means less disruption and potential for expanded operating hours. Frontier's strategic fleet choices directly address these environmental concerns, positioning them favorably as noise regulations tighten globally.

Waste Management and Recycling Initiatives

Frontier Airlines is actively pursuing waste reduction as a core component of its environmental strategy. Initiatives include phasing out plastic stirrers, adopting biodegradable beverage cups, and implementing paperless cockpits. These efforts align with broader industry trends and growing regulatory pressures.

The airline industry, including Frontier, is increasingly subject to stricter waste management regulations. These policies often mandate enhanced recycling programs and improved waste segregation at airports and onboard aircraft. For example, the U.S. Environmental Protection Agency (EPA) continues to promote waste reduction and recycling across various sectors, influencing airline operations.

- Plastic Reduction: Frontier has eliminated single-use plastic stirrers, contributing to a reduction in plastic waste.

- Biodegradable Materials: The introduction of biodegradable beverage cups demonstrates a commitment to sustainable material sourcing.

- Digital Transformation: Transitioning to paperless cockpits significantly reduces paper consumption and associated waste.

- Regulatory Compliance: Airlines face increasing pressure to comply with evolving waste management and recycling mandates from authorities like the EPA.

Climate Change and Regulatory Pressure

The increasing global concern over climate change is directly impacting the airline industry. Governments and international bodies are implementing stricter regulations aimed at reducing carbon emissions, forcing carriers to adapt their operations and invest in more sustainable practices. This growing environmental consciousness is a significant factor shaping airline strategies for the near future.

Frontier Airlines, known for its ultra-low-cost model, is responding to these pressures. Their commitment to environmental sustainability is not just about compliance but also about aligning with passenger expectations for greener travel options. This proactive approach can be a competitive advantage in an increasingly eco-aware market.

Key initiatives and regulatory frameworks influencing airlines like Frontier include:

- International Civil Aviation Organization (ICAO) Carbon Offsetting and Reduction Scheme (CORSIA): This program aims to stabilize net CO2 emissions from international aviation. Many airlines are already participating or preparing for its full implementation, which will require them to offset emissions above a certain baseline.

- Fuel Efficiency Improvements: Airlines are investing in newer, more fuel-efficient aircraft. For example, the Airbus A320neo family, which many carriers including Frontier operate, offers significant fuel savings compared to older models. Frontier's fleet modernization efforts are directly tied to reducing their environmental impact.

- Sustainable Aviation Fuels (SAFs): The development and adoption of SAFs are crucial for decarbonizing aviation. While still in early stages of widespread adoption, SAFs are projected to play a major role in meeting future emission reduction targets.

Environmental regulations are increasingly shaping airline operations, pushing for reduced emissions and noise pollution. Frontier Airlines' investment in fuel-efficient aircraft like the Airbus A320neo family directly addresses these concerns, offering significant improvements over older models.

The airline is also focused on waste reduction, implementing measures such as eliminating single-use plastics and using biodegradable materials, aligning with growing consumer and regulatory demands for sustainable practices.

The push for Sustainable Aviation Fuels (SAFs) presents both an opportunity and a challenge, with limited supply and higher costs impacting widespread adoption, though agreements like Frontier's with Alder Fuels signal a move towards greener alternatives.

Frontier's fleet modernization, including the A320neo family, contributes to reducing its noise footprint. For instance, the A320neo family can offer up to a 50% reduction in noise compared to previous generations, a key factor for airport operations and community relations.

PESTLE Analysis Data Sources

Our Frontier Airlines PESTLE Analysis is grounded in data from official government aviation authorities, economic forecasting agencies, and leading market research firms. We incorporate insights from regulatory updates, industry performance reports, and technological adoption trends to ensure a comprehensive view.