Frontier Airlines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frontier Airlines Bundle

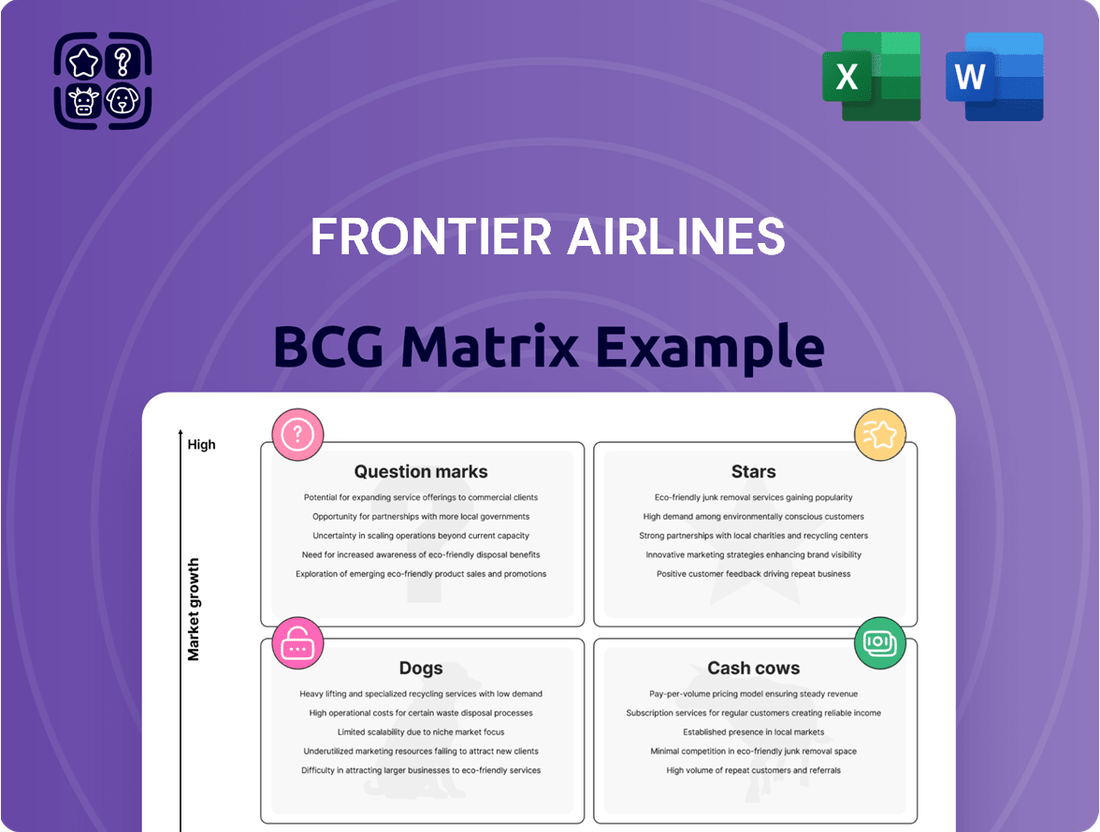

Frontier Airlines, known for its ultra-low-cost model, likely has a fascinating BCG Matrix. Imagine understanding which of their routes are booming "Stars," which are reliably generating cash like "Cash Cows," and which might be "Dogs" needing a strategic rethink. This preview only scratches the surface of their market positioning.

Dive deeper into Frontier Airlines' BCG Matrix and gain a clear view of where its routes and services stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Frontier Airlines is aggressively pursuing growth by launching numerous new routes in 2025, targeting markets across the United States, Mexico, and the Caribbean. This expansion strategy is designed to tap into new customer bases and bolster its market presence. For instance, the airline unveiled plans for 16 new routes in February and March 2025, re-establishing service in cities like Tucson and Reno, and venturing into new territories such as Antigua and Barbuda.

Frontier Airlines' strategic focus on modernizing its fleet with the Airbus A320neo family is a significant strength. As of March 31, 2025, a remarkable 82% of their operational fleet consists of these fuel-efficient aircraft. This commitment is further underscored by an extensive order book of 183 new Airbus planes, positioning Frontier ahead of many major U.S. carriers in terms of fuel efficiency.

This investment in the A320neo family directly translates into lower operating expenses due to reduced fuel consumption. It also provides a distinct competitive edge in an increasingly environmentally aware travel market. Furthermore, this modern fleet is crucial for supporting Frontier's planned capacity expansion.

Frontier Airlines launched 'The New Frontier' initiative in late 2024, with a full rollout planned for 2025. This strategic pivot introduces first-class seating and complimentary upgrades for Elite Status members, alongside unlimited companion travel. This move signals a departure from its purely ultra-low-cost model, aiming to capture a more diverse customer segment willing to pay for enhanced comfort and benefits.

Focus on High-Demand 'Trunk Routes'

Frontier Airlines is strategically concentrating on high-demand 'trunk routes' connecting major cities and previously underserved markets. This focus involves a reduction in less profitable midweek flights, aiming to boost revenue and load factors.

This network optimization is clearly demonstrated by the significant growth in Atlanta, which saw a 40% year-over-year increase in departures by summer 2025, making it Frontier's fastest-growing hub. This targeted approach is designed to enhance profitability on these key travel corridors.

- Focus on High-Demand Routes: Frontier is prioritizing routes with consistent passenger demand, often between major metropolitan areas.

- Underserved Market Expansion: Simultaneously, they are targeting routes to markets that have less competition and a clear need for affordable air travel.

- Network Optimization: This strategy includes cutting back on flights that historically have lower occupancy, such as certain midweek services.

- Atlanta Hub Growth: By summer 2025, Atlanta is projected to be Frontier's fastest-growing hub with a 40% increase in departures, highlighting the success of this route strategy.

Ancillary Revenue Growth Potential

Frontier Airlines' ancillary revenue, a cornerstone of its ultra-low-cost model, offers substantial growth potential. These revenues, derived from unbundled services such as baggage fees and seat selection, historically represented over 60% of the airline's total operating revenue.

While Q1 2025 saw a minor dip in ancillary revenue per passenger, the core strategy remains robust. Frontier's ability to cater to a highly customizable travel experience, with numerous add-on fees, positions it well for future expansion.

- Ancillary Revenue Dominance: Ancillary revenue historically exceeds 60% of Frontier's total operating revenue, highlighting its critical role.

- Customization as a Driver: The airline's model thrives on offering passengers choices for additional services, creating revenue streams beyond the base fare.

- Growth Through Optimization: Refining bundling strategies and dynamic pricing for ancillary services presents a clear avenue for future revenue expansion.

- Resilience in the Model: Despite minor fluctuations, the fundamental reliance on ancillary fees provides a strong foundation for continued growth.

Frontier Airlines' expansion into new markets and its focus on high-demand routes position its growth initiatives as potential Stars in the BCG matrix. The airline's aggressive route launches in 2025, including 16 new routes in early 2025, demonstrate a clear strategy to capture market share. This expansion, particularly into hubs like Atlanta which saw a 40% increase in departures by summer 2025, indicates strong potential for high growth and market leadership in these segments.

| Initiative | Market Share | Growth Rate | BCG Category |

| New Route Expansion (2025) | Growing | High | Star |

| Atlanta Hub Growth (2025) | Growing | High | Star |

What is included in the product

Frontier Airlines' BCG Matrix analysis would focus on its route network and aircraft fleet, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Frontier Airlines BCG Matrix provides a clear, actionable overview of its business units, simplifying complex strategic decisions for executives.

Cash Cows

Frontier Airlines thrives on an ultra-low-cost carrier (ULCC) model, where rock-bottom base fares are complemented by charges for every add-on, from checked bags to seat selection. This strategy is designed to attract price-sensitive leisure travelers, effectively maximizing passenger volume.

This approach has historically been a cash-generating machine for Frontier. By keeping operating costs incredibly lean and focusing on filling every seat, the airline has been able to generate substantial cash flow, even with minimal revenue per passenger on the base fare alone.

For instance, in 2024, Frontier continued to emphasize its ULCC strategy, aiming to capture market share through aggressive pricing. While specific cash flow figures are dynamic, the model's inherent efficiency in managing costs per available seat mile (CASM) remains its core strength in generating cash.

Frontier Airlines' dedication to maximizing aircraft usage and operating the most fuel-efficient fleet in the U.S. is a cornerstone of its competitive edge. This focus directly translates into a significant cost advantage.

The airline's operational prowess is evident in its Q1 2025 achievement of a record 107 Available Seat Miles (ASMs) per gallon. This remarkable fuel efficiency is crucial for maintaining a low Cost per Available Seat Mile (CASM) and, consequently, robust profit margins within the highly competitive airline industry.

Frontier Airlines' established network of leisure destinations, particularly across the U.S., Mexico, and the Caribbean, functions as a classic Cash Cow within its BCG Matrix. This segment benefits from consistent demand, meaning it generates reliable cash flow without requiring substantial new investment.

The airline's focus on popular leisure routes ensures a steady stream of passengers, allowing for efficient operations and profitability. In 2024, Frontier continued to leverage this strength, with leisure travel remaining a significant driver of its revenue.

Cost Management and Operational Efficiency Programs

Frontier Airlines' commitment to cost management is a cornerstone of its operational strategy, directly impacting its position as a cash cow. The airline has actively pursued programs aimed at streamlining operations and reducing expenses. For instance, network simplification efforts have been a key focus, allowing for more efficient utilization of aircraft and resources.

These initiatives are not just theoretical; they translate into tangible financial benefits. Frontier reported significant annual savings through its disciplined capacity deployment and other cost-cutting measures. In 2023, for example, the airline continued to emphasize operational efficiency, which directly contributes to its ability to generate substantial cash flow, reinforcing its status as a cash cow.

- Network Simplification: Frontier has focused on optimizing its route network to reduce complexity and associated costs.

- Disciplined Capacity Deployment: The airline carefully manages the number of flights and seats offered to align with demand and cost structures.

- Annual Savings: These programs have consistently delivered significant annual savings, bolstering cash generation.

- Low-Cost Leadership: The ongoing pursuit of efficiency ensures Frontier maintains its position as a low-cost carrier, converting more revenue into cash.

Brand Recognition as 'America's Greenest Airline'

Frontier Airlines' positioning as "America's Greenest Airline" is a significant brand asset. This focus on fuel efficiency, a key component of their operational strategy, appeals to an environmentally aware customer segment. This niche appeal fosters loyalty and provides a reliable passenger base, generating consistent revenue without demanding substantial new marketing outlays, fitting the profile of a cash cow.

- Fuel Efficiency Advantage: Frontier's fleet of Airbus A320neo family aircraft boasts a 15% reduction in fuel burn compared to previous generations, a critical factor in their green branding.

- Niche Market Appeal: This branding strategy targets travelers prioritizing sustainability, contributing to a stable demand.

- Consistent Revenue Stream: The loyalty generated by this niche appeal translates into predictable passenger numbers and revenue.

- Low Investment Requirement: Maintaining this brand perception requires less incremental investment compared to acquiring new markets, characteristic of a cash cow.

Frontier's established leisure routes are its cash cows, generating consistent profits with minimal new investment. These routes benefit from steady demand, allowing for efficient operations and reliable cash flow. In 2024, the airline continued to capitalize on this strength, with leisure travel remaining a primary revenue driver.

The airline's focus on popular leisure destinations ensures a predictable passenger base, contributing to its cash cow status. This segment doesn't require significant capital infusions to maintain its market position, unlike potential growth areas.

Frontier's operational efficiency, particularly its low CASM, directly supports the cash-generating capabilities of these established routes. By keeping costs down, more of the revenue from these consistent demand segments converts into profit.

The airline's commitment to optimizing its network and capacity deployment in 2023 further solidified these routes as reliable cash generators. These strategic moves enhance efficiency and bolster the cash flow from its core operations.

| Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

| Established Leisure Routes (US, Mexico, Caribbean) | Cash Cow | Consistent demand, low investment required, reliable cash flow | Continued strong passenger volume on popular leisure routes |

| Operational Efficiency | Supporting Factor | Low CASM, fuel efficiency, network simplification | Record 107 ASMs per gallon in Q1 2025 |

| Brand Positioning (America's Greenest Airline) | Supporting Factor | Niche market appeal, customer loyalty, stable demand | Continued appeal to environmentally conscious travelers |

What You’re Viewing Is Included

Frontier Airlines BCG Matrix

The Frontier Airlines BCG Matrix you are currently previewing is the complete and final document you will receive immediately after purchase. This means the strategic analysis, including the categorization of Frontier's services and routes into Stars, Cash Cows, Question Marks, and Dogs, is precisely as it will be delivered to you, ready for immediate application. You will not encounter any watermarks, demo content, or missing sections; what you see is the fully formatted, actionable report designed for in-depth strategic planning.

Dogs

Frontier Airlines has strategically pared down its operations by reducing midweek flights, especially on Tuesdays and Wednesdays, and has exited 43 routes. This move acknowledges that these specific days and routes often experience lower demand, impacting overall profitability. For instance, in early 2024, Frontier reported a load factor of around 80% on average, but the midweek segments likely fell below this average, making them less efficient.

These underperforming routes and flight days are classic examples of 'dogs' in the BCG matrix. They tie up valuable resources like aircraft and crew time but fail to generate adequate revenue, leading to operational inefficiencies and a drag on the company's financial performance. The decision to cut these areas reflects a focused effort to optimize resource allocation.

Frontier Airlines might find certain routes classified as dogs if they encounter significant competition or an oversupply of available seats. This intense market pressure often forces fare discounting and promotional pricing, directly impacting revenue. For instance, if a particular route sees a surge in new entrants or capacity increases beyond demand, Frontier's revenue per available seat mile (RASM) could decline significantly, potentially turning profitable routes into underperformers.

Frontier Airlines' legacy IT systems, while not explicitly labeled as 'dogs' in a BCG matrix context, represent a potential area of concern. These older systems might require significant investment in maintenance and personnel, diverting resources that could be better utilized elsewhere. For instance, if these systems contribute to operational bottlenecks, they could indirectly inflate station costs, a factor that has been a point of discussion, with Q1 2025 reporting higher operational expenses in certain areas.

Certain Less Profitable Ancillary Products

While Frontier Airlines generally excels in ancillary revenue, certain less profitable ancillary products could be categorized as 'dogs' within the BCG Matrix. These are offerings that, despite being part of a strong overall revenue stream, have low customer uptake or high associated costs, dragging down overall profitability.

Frontier's Q1 2025 performance, which saw a 7% decrease in ancillary revenue per passenger, hints that some of these less successful ancillary products might be contributing to this decline. Identifying and addressing these underperforming offerings is crucial for optimizing the airline's financial strategy.

- Low Adoption Rates: Specific add-on services or premium amenities that few passengers choose to purchase.

- High Operational Costs: Ancillary products that require significant investment in technology, staffing, or maintenance without generating commensurate revenue.

- Market Saturation/Competition: Offerings that are easily replicated by competitors or are no longer perceived as valuable by consumers.

- Declining Ancillary Revenue: A reported 7% drop in ancillary revenue per passenger in Q1 2025 suggests some offerings are not meeting expectations.

Older Aircraft Models (if any remain)

While Frontier Airlines is known for its relatively young fleet, any older aircraft models that may still be in operation could be classified as dogs in their BCG Matrix. These older planes are typically less fuel-efficient than their newer counterparts, leading to higher operating costs per flight hour. For instance, older Boeing 737 variants, if still part of the fleet, would likely fall into this category when compared to their highly efficient Airbus A320neo family aircraft.

The economic impact of retaining older aircraft is significant. Their lower fuel efficiency directly translates to higher variable costs, impacting Frontier's ability to offer its signature low fares on routes served by these older planes. Furthermore, these models often require more frequent and costly maintenance, further eroding profitability and return on investment compared to the streamlined maintenance schedules of newer aircraft.

- Lower Fuel Efficiency: Older aircraft can consume 15-20% more fuel per seat mile compared to the latest generation models.

- Increased Maintenance Costs: The average maintenance cost per flight hour for older aircraft can be substantially higher due to parts availability and aging systems.

- Reduced Passenger Appeal: Newer aircraft often offer enhanced passenger amenities and cabin comfort, making them more attractive to travelers.

Frontier Airlines' decision to exit 43 routes and reduce midweek flights directly addresses its 'dog' assets. These underperforming segments, often characterized by low demand on Tuesdays and Wednesdays, consume resources without generating sufficient returns, impacting the airline's overall efficiency. For example, a load factor below the 80% average on these specific days would classify them as dogs.

These 'dog' routes represent a strategic challenge, tying up aircraft and crew while failing to contribute meaningfully to profitability. By shedding these inefficient operations, Frontier aims to reallocate its valuable assets to more promising areas of its network, thereby improving resource utilization and financial performance.

Routes with intense competition or excess capacity can become 'dogs' if they force fare wars, significantly reducing revenue per available seat mile (RASM). This market pressure can turn otherwise viable routes into underperformers, necessitating strategic exits.

Frontier's older aircraft models, less fuel-efficient and requiring more maintenance than newer planes, also function as 'dogs'. For instance, older Boeing 737s, compared to the efficient Airbus A320neo family, incur higher operating costs, impacting the airline's ability to maintain low fares and profitability on routes they serve.

| Category | Description | Frontier Airlines Example | Financial Implication |

| Dogs | Low market share, low growth potential | Underperforming routes (e.g., low-demand midweek flights) | Resource drain, low profitability |

| Dogs | Low market share, low growth potential | Older, less fuel-efficient aircraft | Higher operating costs, reduced competitiveness |

| Dogs | Low market share, low growth potential | Less popular ancillary products | Reduced ancillary revenue per passenger |

Question Marks

Frontier Airlines' 'The New Frontier' initiative, set to launch in late 2025, introduces first-class seating and premium bundles. This strategic move targets a high-growth market segment, a notable shift from its established ultra-low-cost carrier (ULCC) model.

While this premium offering represents a new venture for Frontier, its market share is currently minimal due to its recent introduction. The airline is investing in this segment to capture a new customer base and increase revenue per passenger.

The airline's 2024 performance saw a continued focus on operational efficiency, with a load factor of 83.6% in the first quarter of 2024, indicating strong passenger demand for its core offerings. The success of the new premium seating in attracting and retaining higher-spending customers will be a key indicator for future revenue growth.

Frontier Airlines' expansion into new and returning cities like Tucson, Reno, Corpus Christi, Richmond, and Tulsa in 2025, alongside international routes to Antigua and Barbuda, signifies a strategic move into high-growth potential markets. These ventures, however, represent new territories for Frontier, meaning their initial market share is naturally low, placing them in the 'Question Marks' category of the BCG matrix.

The success of these new city entries and route re-establishments hinges on Frontier's ability to generate demand and secure market adoption rapidly. For instance, their 2024 schedule saw additions like service to Raleigh-Durham and San Juan, demonstrating a pattern of exploring new demand. The airline's ability to execute effective marketing campaigns and offer competitive pricing will be crucial in converting these potential growth areas into profitable ventures.

Frontier Airlines is exploring a strategic pivot towards the 'friends and relatives' (VFR) travel market, shifting focus from some traditional leisure routes to connections between major urban centers. This move acknowledges the consistent demand within the VFR segment, which often involves less price-sensitive travel for personal reasons.

While this VFR focus presents a growth avenue, Frontier's existing market share within this specific niche compared to established competitors remains a key consideration. Understanding how their ultra-low-cost model will resonate with VFR travelers, who may prioritize reliability and convenience alongside price, is crucial for success in 2024 and beyond.

Long-term Fleet Expansion with Deferred Deliveries

Frontier Airlines' substantial order of 183 Airbus aircraft, while a testament to future ambitions, presents a complex picture for its long-term fleet expansion. The strategic deferral of 54 deliveries, shifting them from 2025-2028 to 2029-2031, signals a measured approach to capacity growth. This adjustment, likely driven by evolving market dynamics and operational considerations, places a question mark on the immediate pace of expansion.

This deferral suggests Frontier is exercising caution in its growth trajectory, potentially due to factors like uncertain demand, economic headwinds, or the need to optimize existing fleet utilization. However, the underlying commitment to a significant fleet increase underscores a belief in substantial long-term growth potential. The airline is essentially pacing its investment to align with anticipated future market conditions and its own strategic objectives.

- Fleet Order: Frontier has a total order of 183 Airbus aircraft.

- Deferred Deliveries: 54 aircraft deliveries are being moved from 2025-2028 to 2029-2031.

- Growth Implications: This deferral indicates a cautious, phased approach to capacity expansion, acknowledging current market uncertainties.

- Long-Term Outlook: Despite the timing adjustments, the large order signifies a strong underlying commitment to significant future growth.

Potential for International Market Expansion

Frontier Airlines' potential for international market expansion beyond its current Mexico and Caribbean routes presents a classic question mark scenario within the BCG matrix framework. While these new territories offer substantial growth prospects, they also carry considerable risk due to their nascent market share and the significant capital investment required for successful penetration.

These emerging international markets are characterized by high potential but also by low initial market share for Frontier. This combination necessitates substantial investment in infrastructure, marketing, and operational adaptation, making them a key area of strategic consideration. For instance, expanding into South America or Europe would require a thorough analysis of competitive landscapes and regulatory environments, which could significantly impact initial returns.

- High Growth Potential: Emerging international markets offer opportunities for significant passenger volume growth, especially in regions with developing economies and increasing demand for low-cost travel.

- Low Initial Market Share: Frontier would be entering these markets as a new player, meaning its current market share would be negligible, requiring substantial effort to build brand recognition and customer loyalty.

- Significant Investment Required: Establishing new routes, potentially acquiring new aircraft suited for longer hauls, and navigating foreign regulatory frameworks demand considerable financial outlay.

- Risk and Uncertainty: Geopolitical factors, currency fluctuations, and varying consumer preferences in new international markets introduce a higher degree of risk compared to established domestic or near-international routes.

Frontier Airlines' new premium seating initiative, while targeting growth, currently holds a minimal market share due to its recent introduction. The airline's 2024 first-quarter load factor of 83.6% highlights strong demand for its core ultra-low-cost offerings, but the success of this premium segment remains a question mark for future revenue streams.

Expansion into new and returning cities for 2025, alongside international routes, places these ventures in the 'Question Marks' category due to their nascent market share. Similarly, the exploration of the VFR travel market presents a growth avenue, but Frontier's existing share within this niche is yet to be firmly established.

The deferral of 54 Airbus aircraft deliveries from 2025-2028 to 2029-2031 signals a cautious approach to capacity growth, creating a question mark on the immediate pace of expansion despite a strong long-term commitment. Potential international market expansion beyond current routes also represents a classic question mark, offering high growth but demanding significant investment and carrying considerable risk due to low initial market share.

| BCG Category | Frontier Airlines' Initiatives | Market Share | Growth Rate | Strategic Implication |

|---|---|---|---|---|

| Question Marks | New Premium Seating | Low (Recent Introduction) | High Potential | Requires investment to gain share; uncertain future success. |

| Question Marks | New/Returning City Routes (2025) | Low (New Markets) | High Potential | Needs rapid market adoption; success depends on marketing and pricing. |

| Question Marks | VFR Travel Market Focus | Low/Uncertain (Niche) | High Potential | Assessing model fit and competitor landscape is critical. |

| Question Marks | Deferred Aircraft Deliveries | N/A (Fleet Planning) | Moderate (Phased Growth) | Cautious capacity expansion; signals adaptation to market conditions. |

| Question Marks | Potential International Expansion | Low (New Territories) | High Potential | Significant investment and risk; requires thorough market analysis. |

BCG Matrix Data Sources

Our Frontier Airlines BCG Matrix is constructed using a blend of financial reports, industry growth data, and competitive analysis to accurately position their offerings.