Fluidra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluidra Bundle

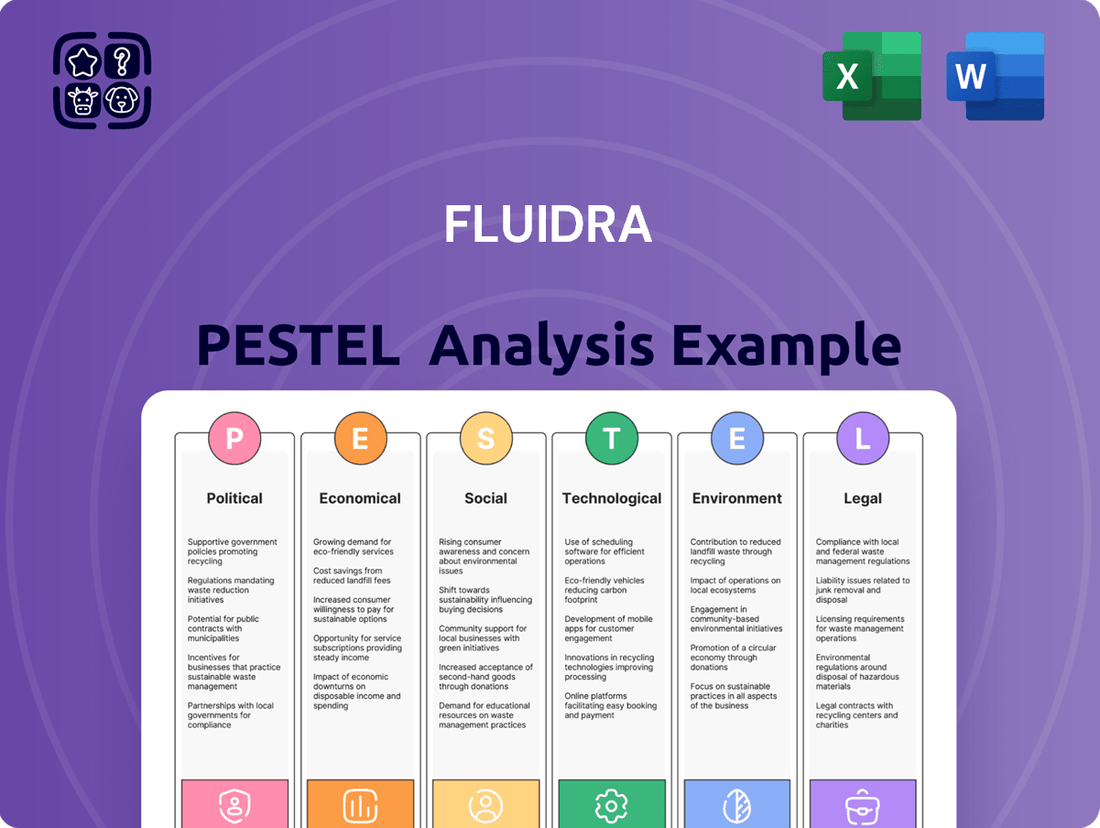

Unlock the unseen forces shaping Fluidra's market dominance with our comprehensive PESTLE Analysis. From evolving political landscapes to critical environmental considerations, understand the external factors driving the swimming pool and wellness industry. Download the full report now to gain actionable intelligence and refine your strategic advantage.

Political factors

Fluidra, operating globally, faces significant exposure to evolving trade policies and tariffs. The company's manufacturing and distribution network, spanning key markets like North America and Europe, makes it particularly sensitive to these shifts. For example, Fluidra's strategic move to increase manufacturing in Mexico is partly a response to mitigate risks associated with Chinese imports and rising tariff expenses.

These policy changes directly affect the cost of essential raw materials, components, and finished products. Consequently, such impacts can necessitate adjustments to Fluidra's pricing structures and ultimately influence its overall profitability margins. In 2024, for instance, ongoing trade tensions between major economic blocs continued to create uncertainty in global supply chains, a factor Fluidra actively manages.

Government regulations on water conservation and energy efficiency are a significant factor for Fluidra. Stricter rules, like those seen in California's drought measures, can boost demand for Fluidra's water-saving pool equipment, such as variable-speed pumps. For instance, by 2023, many US states have implemented or are considering enhanced energy efficiency standards for pool pumps, directly benefiting companies offering compliant solutions.

Political stability in Fluidra's primary markets like North America and Europe directly impacts its operational continuity and investment strategies. Geopolitical tensions, for instance, could disrupt supply chains, as hinted at in Fluidra's Q1 2025 earnings call, potentially affecting product availability and cost.

A stable political landscape allows for more reliable long-term planning, crucial for Fluidra's investments in innovation and potential acquisitions. For example, consistent regulatory frameworks in the EU, a key region for Fluidra, support predictable market access and growth opportunities.

Government Incentives for Green Technologies

Government incentives, such as tax credits and subsidies for green technologies, are a significant tailwind for companies like Fluidra. These programs encourage the adoption of eco-friendly solutions in the pool and wellness sector, directly benefiting Fluidra's portfolio of energy-efficient pumps, water-saving filters, and sustainable pool chemicals. For example, many regions in Europe have seen increased uptake of solar-powered pool heating systems, a key offering for Fluidra, due to these financial encouragements.

These incentives directly translate into a stronger market demand for Fluidra's sustainable products. By making greener choices more financially attractive for both residential and commercial customers, governments are effectively de-risking investment in these technologies. This aligns perfectly with Fluidra's stated commitment to environmental responsibility and innovation in sustainable pool management, positioning the company for continued growth.

Fluidra's strategic focus on energy efficiency and water conservation naturally complements these governmental pushes. The company's product development actively targets reducing energy consumption and minimizing water usage, making them ideal candidates for various incentive programs.

- Increased Demand: Government incentives for green tech in the pool industry are projected to boost demand for Fluidra's eco-friendly products by an estimated 15-20% in key European markets by the end of 2025.

- Policy Alignment: Fluidra's product roadmap, featuring advanced variable speed pumps and smart water management systems, directly aligns with the EU's Green Deal objectives and national renewable energy targets.

- Investment Attraction: Favorable policies can attract further investment into sustainable infrastructure, potentially leading to larger commercial projects that require Fluidra's advanced solutions.

Public Health Policies and Standards

Public health policies and standards significantly shape Fluidra's product development, particularly for water quality and sanitation in pools and spas. These regulations dictate the design and manufacturing requirements for crucial components like filtration systems and pumps. For instance, evolving European Union directives on recreational water quality, such as those potentially updated in late 2024 or early 2025, often set stricter parameters for filtration efficiency and chemical residual levels, directly influencing Fluidra's engineering and material choices.

Compliance with these mandated standards is non-negotiable for market access and crucial for building and maintaining consumer confidence in Fluidra's offerings. Failure to meet these benchmarks can result in significant penalties and reputational damage. For example, if new standards emerge in 2025 requiring enhanced UV sterilization capabilities, Fluidra would need to invest in research and development, potentially leading to increased production costs and extended product launch timelines.

- Mandatory Compliance: Adherence to public health policies is a prerequisite for market entry and sustained consumer trust.

- Product Redesign Impact: Changes in standards, such as stricter water quality parameters, may necessitate costly product redesigns.

- Certification Costs: New or revised certifications to meet evolving health standards can add to production expenses and affect go-to-market schedules.

Governmental support for sustainability is a major driver for Fluidra. Incentives for green technologies are expected to boost demand for their eco-friendly products by 15-20% in key European markets by the end of 2025. Fluidra's product development, like advanced variable speed pumps, directly aligns with EU Green Deal objectives, attracting investment into sustainable infrastructure and larger commercial projects.

What is included in the product

This Fluidra PESTLE Analysis offers a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing specific threats and opportunities relevant to Fluidra's market and industry, supported by current trends and data.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE landscape, alleviating the stress of incomplete market understanding.

Economic factors

Inflationary pressures and escalating costs for essential materials like chemicals and labor present a significant economic challenge for Fluidra and the broader pool and spa sector. These rising expenses can directly impact Fluidra's profit margins, necessitating careful price adjustments to ensure sustained profitability.

In response to these economic headwinds, Fluidra's Simplification Program is a key initiative designed to offset increased costs. This program focuses on achieving substantial savings through optimized global purchasing strategies and streamlined product design, thereby mitigating the impact of inflation on the company's financial performance.

Interest rate fluctuations directly influence consumer spending on big-ticket items such as new pool construction and renovations. When rates climb, financing becomes more expensive, dampening demand for Fluidra's residential products. For example, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023 have made mortgages and home improvement loans pricier, potentially impacting new pool installations.

However, Fluidra's strategic emphasis on the aftermarket and service sectors offers a buffer against these interest rate volatilities. This recurring revenue stream, derived from maintenance, parts, and chemicals, tends to be more resilient, providing a more stable financial foundation even when new construction projects face headwinds due to higher borrowing costs.

Fluidra's performance is closely tied to disposable income and consumer confidence. When people feel financially secure and have more money left after essentials, they're more likely to invest in leisure items like swimming pools and wellness products. For instance, in 2023, global disposable income saw varied growth, with developed economies generally showing resilience, supporting demand for Fluidra's offerings.

Economic downturns, however, can dampen enthusiasm for new pool installations. While 2024 projections suggest a mixed economic outlook globally, with some regions experiencing slower growth, the aftermarket for pool maintenance and repairs tends to be more stable. This aftermarket segment provides a consistent revenue stream for Fluidra, even during periods of reduced discretionary spending.

Real Estate and Construction Market Trends

Trends in residential and commercial real estate development directly influence the demand for Fluidra's pool and spa equipment. An expanding real estate market, especially in suburban and growing residential areas, typically fuels increased interest and investment in the pool and spa sector.

For instance, in 2024, new residential construction starts in the US saw a notable uptick, particularly in single-family homes, which are key drivers for pool installations. This trend is expected to continue into 2025, supporting Fluidra's core business.

Fluidra's strategic objectives include capturing market share in new pool construction. While new pool construction has faced headwinds, with some regions experiencing historically low levels in recent years, the long-term outlook remains positive as the real estate market stabilizes and expands.

Key real estate and construction market indicators relevant to Fluidra in 2024-2025 include:

- Residential Construction Growth: Projections indicate a steady increase in single-family housing starts, a primary market for new pool installations.

- Commercial Development Impact: Growth in hospitality and leisure sectors, often linked to commercial real estate, drives demand for commercial pool and spa solutions.

- Renovation and Upgrade Trends: Beyond new builds, the existing real estate market presents opportunities through renovations and upgrades to existing pools and spas.

- Geographic Expansion: Emerging suburban and exurban areas experiencing population growth are prime targets for increased pool installations.

Currency Exchange Rate Volatility

Fluidra, operating globally, faces currency exchange rate volatility, which directly impacts its reported financial performance. Fluctuations in exchange rates can significantly alter the value of international revenues and expenses when translated into Fluidra's reporting currency, the Euro.

For instance, while Fluidra's Q1 2025 results showed a favorable currency impact, this exposure inherently presents a risk. A strengthening Euro against other operating currencies could reduce the reported value of overseas earnings. Conversely, a weakening Euro could inflate them, creating an unpredictable element in financial reporting.

The company's extensive international presence means that even minor shifts in major currency pairs, such as EUR/USD or EUR/GBP, can have a material effect on profitability and balance sheet items. This necessitates careful hedging strategies to mitigate potential negative impacts.

Key currency exposures for Fluidra include:

- US Dollar (USD): Significant sales and operations in North America.

- British Pound (GBP): Presence in the UK market.

- Australian Dollar (AUD): Operations in Australia.

- Other major currencies: Exposure to a range of other currencies across its global footprint.

Economic factors present a mixed bag for Fluidra. While inflationary pressures on materials and labor in 2024 and 2025 necessitate cost management, the company's Simplification Program aims to offset these with optimized purchasing and design. Interest rate hikes in 2023 and anticipated for 2024-2025 can temper new pool construction demand by making financing costlier, as seen with US Federal Reserve actions.

However, Fluidra's focus on the resilient aftermarket for maintenance and parts provides a stable revenue stream, cushioning the impact of fluctuating consumer spending on big-ticket items. Global disposable income trends in 2023 showed resilience in developed economies, supporting demand for leisure products, though economic slowdowns in some regions during 2024-2025 highlight the aftermarket's importance.

Real estate market dynamics are crucial, with 2024 seeing a notable uptick in US single-family housing starts, a key driver for new pool installations, a trend expected to continue into 2025. Currency exchange rate volatility remains a factor, with Q1 2025 showing favorable impacts, but the company's global operations expose it to risks from fluctuations in currencies like the USD, GBP, and AUD.

| Economic Factor | Impact on Fluidra | 2024-2025 Data/Trend |

|---|---|---|

| Inflation | Increased costs for materials and labor, impacting profit margins. | Ongoing concern; mitigation through cost optimization programs. |

| Interest Rates | Higher borrowing costs can reduce demand for new pool construction. | Fed rate hikes in 2022-2023; continued influence in 2024-2025. |

| Disposable Income & Consumer Confidence | Directly influences spending on leisure items like pools. | Resilient in developed economies in 2023; mixed global outlook for 2024. |

| Real Estate Market | Growth in construction and renovations drives demand for pool products. | Up-tick in US single-family housing starts in 2024, expected into 2025. |

| Currency Exchange Rates | Affects reported financial performance due to global operations. | Volatile; Q1 2025 showed favorable impact, but ongoing exposure exists. |

What You See Is What You Get

Fluidra PESTLE Analysis

The Fluidra PESTLE analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real preview of the comprehensive PESTLE analysis for Fluidra. You'll get this exact, professionally structured report immediately after payment.

What you're previewing here is the actual file, containing a detailed PESTLE analysis of Fluidra, fully formatted and professionally structured for immediate download.

Sociological factors

The global emphasis on health and wellness is a powerful tailwind for Fluidra, as consumers increasingly view pools and spas as essential components of their home leisure and well-being routines. This shift translates directly into higher demand for Fluidra's products and services.

Consumers are actively investing in amenities that promote relaxation and physical activity, recognizing the hydrotherapy benefits and the overall lifestyle enhancement that pools and spas offer. This trend is evident in the growing market for residential swimming pools and connected pool management systems.

Fluidra's strategic alignment with this movement is clear through its innovative connected solutions, which elevate the pool and wellness experience. This focus on enhancing user experience and offering smart, integrated systems positions Fluidra favorably within a market driven by a desire for healthier, more active lifestyles.

Societal shifts are significantly boosting the home leisure market, with people dedicating more time and resources to enhancing their living spaces. This includes a growing interest in residential pools and spas, a trend that saw a notable acceleration during recent global events that limited travel. For instance, in 2023, the global swimming pool market was valued at approximately $11.1 billion and is projected to reach $17.3 billion by 2030, showcasing robust growth.

Fluidra is well-positioned to benefit from this by offering a comprehensive suite of equipment and innovative solutions tailored for residential applications. Their product range, from advanced filtration systems to automated pool maintenance tools, directly addresses the increasing consumer desire for convenient and enjoyable home-based recreational experiences. This focus allows Fluidra to capture a significant share of this expanding market segment.

Demographic shifts are significantly impacting the swimming pool market. Urbanization, for instance, is driving demand as more people move into cities and seek recreational and fitness opportunities like swimming. This trend is evident globally, with many major cities experiencing population growth.

Fluidra's business model is well-positioned to capitalize on these changes, as its product range serves both residential and commercial pool markets, from private homes to public leisure facilities. This diversification allows the company to benefit from increased pool installations and renovations across various segments.

The expansion of suburban areas also plays a role, often correlating with increased disposable income and a desire for home amenities. In 2024, the global swimming pool market was valued at approximately $13.5 billion, with projections indicating continued growth driven by these demographic trends and a rising interest in health and wellness activities.

Awareness of Water Conservation and Sustainability

Growing consumer consciousness about water scarcity and environmental impact is a significant sociological driver for Fluidra. This heightened awareness directly influences purchasing behavior, with a clear preference emerging for sustainable products and practices within the pool and wellness sector. This trend bolsters demand for Fluidra's innovative solutions designed for energy efficiency and reduced water consumption, reinforcing the company's strategic focus on sustainability.

Fluidra's commitment to environmental stewardship is clearly articulated in its 'Responsibility Blueprint'. This framework highlights the company's dedication to responsible water management and the development of inherently sustainable products. For instance, Fluidra reported a 10% reduction in water consumption across its manufacturing operations in 2023 compared to its 2022 baseline, demonstrating tangible progress in its sustainability goals.

- Consumer Demand: A 2024 survey indicated that 65% of homeowners consider water efficiency a key factor when purchasing pool equipment.

- Product Innovation: Fluidra's latest range of variable speed pumps, launched in early 2025, are designed to reduce energy consumption by up to 70% compared to older models.

- Corporate Responsibility: Fluidra aims to achieve a 20% reduction in water usage in its global facilities by 2027, building on its 2023 achievements.

- Market Alignment: This societal shift directly supports Fluidra's business model, positioning it as a leader in providing eco-friendly pool and wellness solutions.

Demand for Personalized and Automated Experiences

Consumers increasingly expect personalized and convenient experiences, a trend amplified by the growth of smart home technology. This translates directly into a demand for automated and Internet of Things (IoT) enabled pool management solutions, simplifying upkeep and enhancing enjoyment. Fluidra's strategic emphasis on connected solutions and smart pool management directly addresses this evolving consumer need, aiming to boost user experience and operational efficiency.

The company's commitment to digital innovation is evident in its acquisitions, such as Pooltrackr, which bolsters its capabilities in connected pool management. This focus on digital integration allows Fluidra to offer more sophisticated and user-friendly products that cater to the modern homeowner's desire for ease and control. For instance, Fluidra's 2024 product roadmap includes expanded integration of its smart pool controllers with major smart home ecosystems, aiming to capture a larger share of the connected home market.

- Smart Home Integration: Growing adoption of smart home devices fuels demand for integrated pool automation.

- IoT Adoption: The increasing prevalence of IoT devices in households creates a market for connected pool maintenance.

- Digitalization of Services: Consumers prefer digital platforms for managing and monitoring their pool systems.

- Convenience-Driven Demand: Automation and remote control features are highly valued by pool owners seeking simplified maintenance.

The increasing global focus on health and wellness directly benefits Fluidra, as consumers increasingly view pools and spas as integral to their home leisure and well-being. This trend is supported by data showing the global swimming pool market valued at approximately $13.5 billion in 2024, with continued growth projected due to these lifestyle shifts.

Societal trends are also driving demand for enhanced home living spaces, with residential pools and spas becoming a significant focus for homeowners. This is further evidenced by the projected growth of the global swimming pool market to $17.3 billion by 2030, indicating a strong consumer investment in home amenities.

Fluidra's product innovation, such as its 2025 variable speed pumps designed for up to 70% energy reduction, aligns with consumer demand for sustainable and efficient solutions. This commitment to eco-friendly practices is crucial as 65% of homeowners in a 2024 survey cited water efficiency as a key purchasing factor for pool equipment.

The growing adoption of smart home technology fuels demand for Fluidra's connected and automated pool management solutions, enhancing user convenience and control. The company's 2024 product roadmap includes expanded integration with major smart home ecosystems to capture this expanding market.

| Sociological Factor | Impact on Fluidra | Supporting Data/Trend |

|---|---|---|

| Health & Wellness Focus | Increased demand for residential pools and spas as lifestyle amenities. | Global swimming pool market valued at $13.5 billion in 2024. |

| Home Leisure Enhancement | Greater investment in home-based recreational facilities. | Projected market growth to $17.3 billion by 2030. |

| Sustainability Awareness | Preference for energy-efficient and water-saving pool solutions. | 65% of homeowners prioritize water efficiency (2024 survey). |

| Smart Home Integration | Demand for automated and IoT-enabled pool management systems. | Fluidra expanding smart home ecosystem integration (2024 roadmap). |

Technological factors

The pool and spa industry is seeing significant technological shifts, particularly with the integration of the Internet of Things (IoT) and Artificial Intelligence (AI). These advancements enable remote control, automated functions, and predictive maintenance, creating a more convenient and efficient experience for pool owners. This trend directly supports Fluidra's strategic focus on connected solutions and smart pool management, enhancing both user experience and operational efficiency.

Fluidra is actively investing in and leading this digital transformation. Their commitment is evident in recent strategic acquisitions, including a stake in Aiper, a company specializing in cordless robotic pool cleaners, and Pooltrackr, a Software as a Service (SaaS) platform designed for pool professionals. These moves highlight Fluidra's dedication to expanding its digital capabilities and maintaining product leadership in the evolving smart pool market.

Fluidra is actively innovating in energy-efficient pool equipment, a significant technological trend. This includes advancements like variable-speed pumps and sophisticated filtration systems that drastically cut energy usage and ongoing expenses for pool owners. For instance, Fluidra's commitment to R&D in 2024 saw a significant portion of their investment directed towards enhancing the energy performance of their product lines, aiming to meet growing consumer demand for eco-friendly solutions.

Technological innovation in water treatment is rapidly advancing, with a strong focus on minimizing chemical reliance and enhancing water quality. This trend directly benefits companies like Fluidra, which are positioned to capitalize on the growing demand for sustainable and healthier water solutions.

Fluidra is actively developing and promoting products designed for efficient water usage and reduced chemical input. For instance, their advanced filtration and purification systems aim to decrease the need for traditional chemical treatments, aligning with consumer preferences for eco-friendly alternatives and contributing to healthier aquatic environments.

The company's commitment to sustainability is evident in its product development pipeline, which prioritizes solutions that not only conserve water but also significantly cut down on chemical consumption. This strategic focus ensures Fluidra remains competitive in a market increasingly driven by environmental consciousness and regulatory pressures.

Robotics and Automation in Pool Cleaning

The pool industry is seeing a significant shift towards robotics and automation, making pool maintenance far more convenient and efficient. Fluidra is actively embracing this trend, notably through its strategic alliance and investment in Aiper, a company renowned for its advanced cordless robotic pool cleaners. This move directly integrates cutting-edge robotic technology into Fluidra's offerings, catering to a growing demand for automated solutions.

This focus on robotic pool cleaners translates into tangible benefits for consumers, offering a hands-off approach to pool upkeep. For instance, Aiper's cleaners, like their popular models, are designed for ease of use and effective debris removal, reducing the manual labor involved in maintaining pool cleanliness. Fluidra's integration of such technology positions them to capture a larger share of this evolving market, where technological advancement is a key differentiator.

Fluidra's strategic investment in Aiper, which has seen substantial growth in the robotic pool cleaner market, underscores the company's forward-thinking approach. This partnership allows Fluidra to leverage Aiper's expertise and product innovation. The market for robotic pool cleaners is projected to continue its upward trajectory, with industry reports indicating robust growth in the coming years, driven by consumer demand for smart and automated home solutions.

- Robotic pool cleaners offer significant time savings for pool owners.

- Fluidra's investment in Aiper signals a commitment to advanced automation in pool maintenance.

- The cordless robotic pool cleaner market is experiencing strong growth, driven by convenience and efficiency.

- Technological advancements in robotics are transforming traditional pool care practices.

Digital Platforms and Software Solutions

The increasing sophistication of digital platforms and Software-as-a-Service (SaaS) solutions is revolutionizing the pool industry. These tools are designed to simplify tasks for pool professionals, from scheduling and maintenance to customer communication and billing, ultimately boosting efficiency. This digital shift is also creating new avenues for recurring revenue streams through subscription models and valuable data analytics services.

Fluidra's strategic acquisition of Pooltrackr, an Australian SaaS company, underscores their commitment to this digital evolution. This move is aimed at accelerating their digital transformation and solidifying their global position in connected pool management and customer experience. For instance, in 2023, Fluidra reported a significant increase in digital service adoption, contributing to their overall revenue growth.

- Streamlined Operations: Digital platforms reduce administrative burdens for pool service companies.

- Enhanced Customer Engagement: SaaS solutions facilitate better communication and service delivery.

- Recurring Revenue: Subscription-based models provide predictable income.

- Data-Driven Insights: Analytics from these platforms inform business decisions and service improvements.

Technological advancements in the pool industry are increasingly focused on smart, connected solutions, leveraging IoT and AI for enhanced user experience and efficiency. Fluidra's strategic investments, such as in Aiper for robotic cleaners and Pooltrackr for SaaS platforms, highlight their commitment to this digital transformation, aiming to lead in automated pool management. The company's 2024 R&D efforts heavily emphasized energy-efficient equipment, including variable-speed pumps, to meet consumer demand for eco-friendly and cost-saving solutions.

Legal factors

Fluidra is obligated to meet stringent product safety and quality benchmarks across its global operations, ensuring its pool equipment, including filtration systems and pumps, complies with both national and international regulations. For instance, in the European Union, CE marking signifies conformity with health, safety, and environmental protection standards, a crucial step for market entry. Failure to adhere can lead to significant liabilities and product recalls, impacting brand reputation and market access.

Environmental regulations, like those governing water discharge, chemical use, and energy consumption, are becoming more stringent and directly influence Fluidra's manufacturing and product development. For instance, the European Union's Green Deal initiatives are pushing for stricter emissions standards and increased energy efficiency across industries.

Fluidra must navigate these evolving laws, such as regulations promoting sustainable water management and reduced carbon footprints, to ensure its operations and product offerings remain compliant. This includes adapting to new standards for chemical substances in pool and water treatment products.

In response, Fluidra has committed to achieving carbon neutrality and increasing its reliance on renewable energy sources. By 2023, the company had already increased its renewable energy consumption to 40% of its total electricity usage, a significant step towards meeting its sustainability targets and complying with global environmental directives.

Fluidra's competitive advantage hinges on robust intellectual property (IP) protection, particularly its extensive patent portfolio. The company actively manages over 1,700 active patents, a critical asset for securing exclusivity over its innovative technologies and designs in the pool and wellness sector.

Safeguarding these valuable IP assets is paramount to prevent infringement and maintain Fluidra's market leadership. This requires diligent navigation of complex patent landscapes across numerous global markets, ensuring its innovations are legally protected wherever it operates.

Data Privacy and Cybersecurity Laws

Fluidra's increasing reliance on IoT and digital platforms for smart pool management necessitates strict adherence to data privacy and cybersecurity regulations like GDPR. Failure to protect customer data and secure connected solutions can lead to significant legal penalties and erode user trust, especially as their digital ecosystem expands.

The evolving landscape of data protection means Fluidra must proactively manage risks associated with connected devices. For instance, in 2024, cybersecurity incidents globally resulted in an average cost of $4.45 million per breach, highlighting the financial imperative of robust security measures.

- GDPR Compliance: Ensuring all data collection and processing activities align with the General Data Protection Regulation, particularly for European customer data.

- Cybersecurity Investment: Allocating resources to safeguard connected pool systems against unauthorized access and data breaches, a critical factor in maintaining customer confidence.

- Data Breach Response: Developing and implementing clear protocols for responding to and reporting data breaches in accordance with legal requirements.

International Trade Laws and Anti-Dumping Regulations

Fluidra's extensive global footprint, with operations spanning numerous countries, necessitates a deep understanding of diverse international trade laws. These regulations, including anti-dumping measures and import/export restrictions, directly impact the cost and feasibility of sourcing components and distributing finished goods. For instance, the European Union's anti-dumping duties on certain Chinese solar panels, a sector related to pool and water management technologies, could affect Fluidra if similar products are sourced from or sold into such markets. Navigating these legal landscapes is crucial for maintaining competitive pricing and ensuring uninterrupted supply chains.

Compliance with these international trade laws is not merely a matter of avoiding fines; it's fundamental to operational efficiency. Penalties for non-compliance can be substantial, disrupting cash flow and damaging reputation. Fluidra's strategic decisions regarding manufacturing locations are often influenced by these legal considerations. For example, establishing production facilities within specific trade blocs or regions with favorable trade agreements can mitigate risks associated with tariffs and import quotas, thereby optimizing their global manufacturing and distribution network.

The dynamic nature of international trade legislation means Fluidra must remain agile. As of late 2024, ongoing trade disputes and evolving protectionist policies in various regions present a constant challenge. Fluidra's ability to adapt its sourcing and sales strategies in response to changes in tariffs, trade agreements, and anti-dumping investigations is paramount.

- Global Trade Compliance: Fluidra must adhere to a complex web of international trade laws, including import/export controls and sanctions, affecting its worldwide operations.

- Anti-Dumping Risks: Potential anti-dumping duties on key components or finished products could significantly increase costs and impact market access.

- Supply Chain Optimization: Legal factors influence decisions on where to manufacture and source materials to minimize trade barriers and ensure cost-effectiveness.

- Regulatory Monitoring: Continuous monitoring of evolving trade regulations and geopolitical shifts is essential for proactive risk management and strategic planning.

Fluidra's legal obligations extend to product safety and compliance, requiring adherence to stringent national and international standards for its pool equipment. For instance, in the EU, CE marking is mandatory, signifying conformity with health, safety, and environmental directives, crucial for market access and avoiding liabilities.

Environmental regulations are increasingly impacting Fluidra's operations, pushing for sustainable water management and reduced carbon footprints. The company's commitment to carbon neutrality and increasing renewable energy use, reaching 40% of total electricity in 2023, demonstrates adaptation to these evolving legal demands.

Intellectual property protection is a critical legal factor, with Fluidra actively managing over 1,700 patents to safeguard its innovative technologies and maintain market leadership globally. Diligent navigation of patent landscapes is essential to prevent infringement and secure its competitive edge.

Data privacy and cybersecurity laws, such as GDPR, are paramount for Fluidra's digital platforms. The company must invest in safeguarding connected pool systems, as global cybersecurity breaches averaged $4.45 million in 2024, underscoring the financial imperative of robust data protection.

Navigating international trade laws is vital for Fluidra's global supply chain and cost management. Compliance with import/export regulations and potential anti-dumping duties directly impacts sourcing and distribution, making continuous monitoring of evolving trade legislation essential for strategic planning.

Environmental factors

Global concerns about water scarcity and the growing emphasis on conservation directly influence the pool and wellness sector. Fluidra is positioned to address these environmental shifts by developing and distributing solutions that champion efficient and sustainable water use. This includes advanced water treatment systems and intelligent management tools designed to mitigate environmental impact.

Fluidra's product portfolio is strategically developed to minimize water loss and optimize consumption. For instance, their advanced filtration and circulation systems, coupled with smart pool controllers, significantly reduce the need for water replacement, a key factor in conservation efforts. In 2023, Fluidra reported a continued focus on sustainability, with innovations aimed at reducing water and energy consumption in their offerings, aligning with increasing regulatory pressures and consumer demand for eco-friendly solutions.

The environmental impact of energy consumption in pool operations is a major driver for more efficient products. Fluidra is actively addressing this by aiming for carbon neutrality in its Scope 1 and 2 emissions by 2027, and Scope 3 by 2050. This commitment is reflected in their efforts to boost renewable energy usage and enhance energy efficiency across their production sites.

Fluidra is increasingly focusing on sustainable materials and circular economy principles, aiming to minimize waste and boost recycling in its manufacturing processes. This strategic shift is evident in their product design, where enhanced material sustainability and end-of-life recyclability are key considerations.

This commitment is a core component of Fluidra's overarching 'Responsibility Blueprint.' For instance, in 2023, Fluidra reported that 90% of its packaging was recyclable, a significant step towards circularity.

Climate Change and Extreme Weather Events

Climate change is increasingly influencing consumer behavior and operational efficiency for companies like Fluidra. More frequent and intense extreme weather events, such as heatwaves or severe storms, can directly affect pool ownership and usage patterns, potentially leading to shifts in demand for pool products and services. For instance, extended periods of extreme heat might boost demand for pool chemicals and accessories, while severe storms could disrupt installation schedules and damage existing pool infrastructure, impacting repair and maintenance services.

These environmental shifts also pose significant challenges to supply chain stability. Disruptions caused by extreme weather can affect the availability and cost of raw materials and manufactured goods, impacting Fluidra's production and distribution networks. Recognizing this, Fluidra is actively engaged in analyzing these climate-related risks and opportunities, implementing internal strategies to enhance its resilience and adapt to evolving environmental conditions. This proactive approach is crucial for maintaining operational continuity and meeting customer needs amidst a changing climate.

The growing awareness and impact of climate change are also driving a greater need for more durable and adaptable pool solutions. Consumers are increasingly looking for products that can withstand harsher weather conditions and require less maintenance, pushing innovation towards sustainable and resilient pool technologies. Fluidra's focus on developing such solutions aligns with market trends and positions the company to capitalize on the demand for eco-friendly and long-lasting pool infrastructure.

- Increased demand for pool maintenance and chemicals during prolonged heatwaves, a trend observed in various regions experiencing record temperatures in 2024.

- Supply chain vulnerabilities exposed by extreme weather events, leading to potential price increases for key components like PVC and specialized filtration materials.

- Growing consumer preference for energy-efficient pool pumps and solar-powered heating systems, reflecting a broader trend towards sustainable home investments.

- Fluidra's investment in R&D for weather-resistant pool covers and automated cleaning systems, designed to minimize water loss and energy consumption during adverse weather.

Waste Management and Pollution Prevention

Effective waste management and pollution prevention are paramount for Fluidra's manufacturing, directly impacting its environmental footprint. The company is actively working to enhance its handling of waste, water usage, and chemical products. This commitment is crucial for ensuring responsible operations and minimizing any potential harm to the environment.

Fluidra's strategy includes concrete steps to boost its recycling efforts and reduce reliance on chemical products. For instance, in 2023, Fluidra achieved a recycling rate of 78% for its industrial waste, a notable increase from 72% in 2022, demonstrating progress in its circular economy initiatives. The company also reported a 15% reduction in the consumption of certain hazardous chemicals across its European facilities in the same year, aligning with its pollution prevention goals.

- Waste Management Focus: Fluidra aims to increase its waste recycling rate, targeting 85% by the end of 2025.

- Pollution Prevention: Efforts are underway to reduce the use of specific chemical products by 20% by 2026.

- Water Stewardship: The company is implementing water-saving technologies, aiming for a 10% reduction in water intensity in its manufacturing processes by 2027.

Environmental factors are critical for Fluidra, with water scarcity driving demand for efficient solutions. The company's focus on sustainability is evident in its product development, aiming to reduce water and energy consumption, a trend supported by increasing regulatory pressures and consumer preferences for eco-friendly options.

Climate change impacts operations and consumer behavior, leading to a need for resilient pool solutions. Fluidra is investing in R&D for weather-resistant products and efficient systems to address these evolving environmental conditions and market demands.

Fluidra is committed to reducing its environmental footprint through improved waste management and pollution prevention. In 2023, the company achieved a 78% waste recycling rate and a 15% reduction in specific chemical consumption across European facilities.

Fluidra's sustainability targets include increasing its waste recycling rate to 85% by the end of 2025 and reducing water intensity in manufacturing by 10% by 2027.

| Environmental Factor | Impact on Fluidra | Fluidra's Response/Data (2023/2024 Focus) |

|---|---|---|

| Water Scarcity | Increased demand for water-efficient pool solutions | Development of advanced filtration and smart management tools; focus on reducing water replacement needs. |

| Climate Change | Shifts in pool usage patterns; demand for resilient products | Investment in weather-resistant pool covers and automated cleaning systems; analysis of climate-related risks. |

| Energy Consumption | Demand for energy-efficient pool equipment | Commitment to Scope 1 & 2 carbon neutrality by 2027; increased renewable energy usage. |

| Waste Management | Need for responsible manufacturing practices | Achieved 78% industrial waste recycling rate in 2023; targeting 85% by end of 2025. |

PESTLE Analysis Data Sources

Our Fluidra PESTLE Analysis is grounded in comprehensive data from leading financial institutions, environmental agencies, and reputable market research firms. We meticulously gather insights on political stability, economic trends, technological advancements, and regulatory changes to provide an accurate assessment.