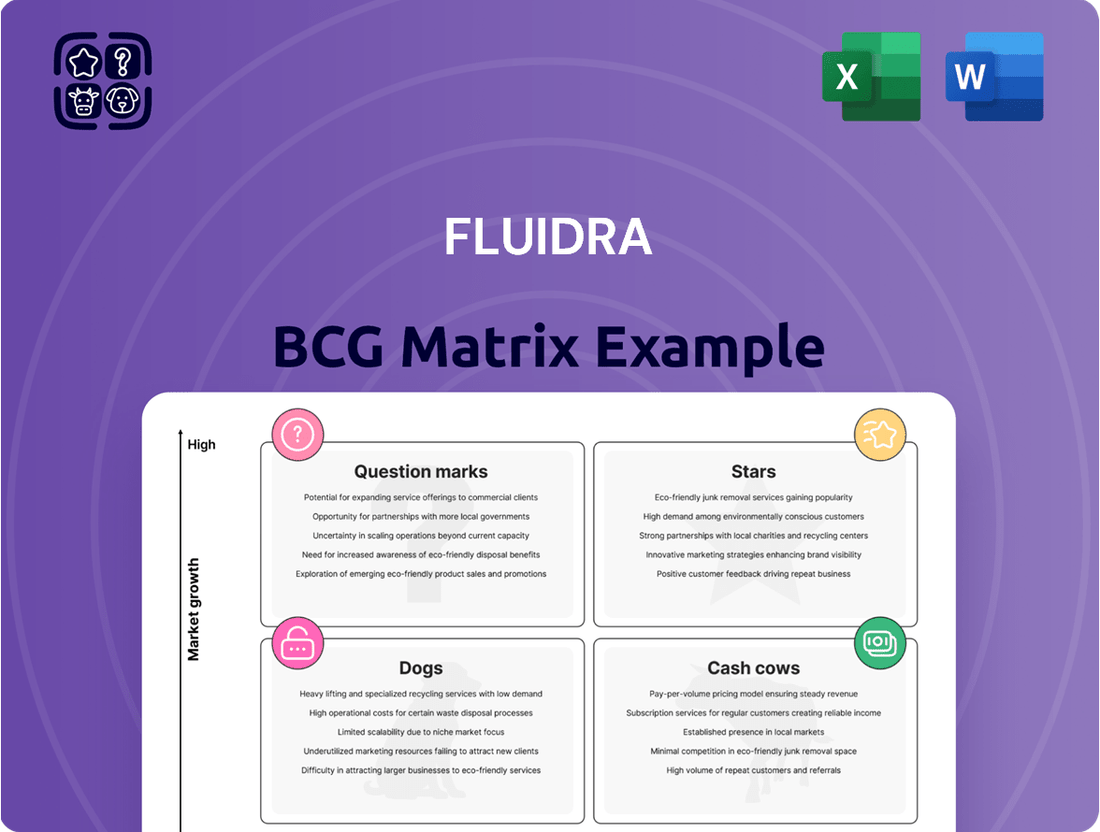

Fluidra Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluidra Bundle

Curious about Fluidra's product portfolio? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential growth areas and areas needing attention. Don't miss out on the complete picture; purchase the full BCG Matrix for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed strategic decisions.

Stars

Fluidra's smart pool and connected solutions, featuring IoT-enabled devices, are a significant growth driver. This segment benefits from rising consumer interest in automated and efficient pool management, solidifying Fluidra's position as an innovator in smart home technology for pools.

The company's strategic acquisition of Pooltrackr in 2023, an Australian SaaS platform for pool professionals, underscores its commitment to digital advancement. This move enhances Fluidra's capabilities in connectivity and customer experience, further cementing its leadership in the connected pool solutions market.

Fluidra's energy-efficient and sustainable products are a clear star in its portfolio. With growing global demand for eco-friendly solutions, the company is well-positioned. Their commitment to sustainability is highlighted by their 'Responsibility Blueprint 2020-2026' plan, which includes a goal of sourcing 100% renewable electricity by 2027.

Products such as variable-speed pumps and advanced filtration systems exemplify this focus. These innovations not only reduce environmental impact but also offer significant cost savings for consumers through lower energy consumption. This strategic emphasis on sustainability is a key differentiator and a strong growth engine for Fluidra.

Fluidra's investment in Aiper, a key player in cordless robotic pool cleaners, positions them in a rapidly expanding market. In 2023, the global robotic pool cleaner market was valued at approximately $1.3 billion and is projected to reach $2.2 billion by 2028, growing at a CAGR of over 11%. This strategic move leverages Aiper's innovation in a segment driven by consumer desire for effortless pool upkeep.

Commercial Pool Market Solutions

While the residential pool market might be seeing a bit of a slowdown, the commercial side is really picking up steam. Think hotels, spas, and places focused on health and fun – these are all driving demand for new and upgraded commercial pools. Fluidra is in a prime spot here as a major global player, ready to meet this growing need.

Fluidra's strategy involves leveraging its full range of products and its deep experience with big, complex projects. This positions them well to capture significant growth in the commercial sector. The company's ability to offer comprehensive solutions, from filtration to heating and automation, makes them a go-to partner for these specialized, large-scale installations.

- Commercial Pool Market Growth: The hospitality, wellness, and recreation sectors are fueling increased demand for commercial pool solutions.

- Fluidra's Market Position: Fluidra is a global leader in providing comprehensive product portfolios and expertise for large-scale commercial pool projects.

- Expansion Potential: The company aims to unlock substantial growth by focusing on the specialized needs of the rising commercial pool segment.

- Market Drivers: Factors like increased travel, a focus on wellness, and growing recreational activities are key contributors to commercial pool market expansion.

Fluidra Ventures and Innovation Initiatives

Fluidra Ventures, with its €20 million corporate venture capital fund, actively seeks out and invests in startups driving innovation within the pool and wellness industry. This strategic investment arm focuses on disruptive technologies like IoT, computer vision, and robotics. For instance, in 2024, the fund continued its commitment to cutting-edge solutions, with notable investments in companies like Coral Smart Pool, which leverages AI for enhanced pool safety, and Ecotropy, specializing in digital twin technology for improved energy management.

The open innovation program, Fluidra Lab, complements Fluidra Ventures by fostering a collaborative environment for startups. This initiative is crucial for identifying and integrating revolutionary solutions, ensuring Fluidra stays ahead of technological advancements and capitalizes on high-growth market segments. The program’s success is evident in its ability to connect Fluidra with promising ventures that can shape the future of pool and wellness experiences.

- Fluidra Ventures Fund Size: €20 million dedicated to corporate venturing.

- Innovation Focus Areas: IoT, computer vision, and robotics in the pool and wellness sector.

- Key Investments: Coral Smart Pool (AI for safety) and Ecotropy (digital twin for energy management).

- Program Objective: To foster startups and maintain Fluidra's position at the forefront of emerging technologies.

Fluidra's smart pool and connected solutions represent a significant star in its BCG matrix. These offerings, enhanced by IoT capabilities, cater to a growing consumer demand for automated and efficient pool management, positioning Fluidra as a leader in smart home pool technology.

The company's strategic acquisitions, such as Pooltrackr in 2023, bolster its digital capabilities and customer experience, reinforcing its leadership in the connected pool solutions market. Furthermore, Fluidra's focus on energy-efficient and sustainable products, like variable-speed pumps, aligns with global eco-friendly trends, with a target of 100% renewable electricity sourcing by 2027.

Fluidra's investment in Aiper, a key player in cordless robotic pool cleaners, highlights its strategic focus on high-growth segments. The global robotic pool cleaner market, valued at approximately $1.3 billion in 2023 and projected to reach $2.2 billion by 2028, demonstrates the significant potential in this area.

The commercial pool market is another strong star for Fluidra, driven by demand from hospitality, wellness, and recreation sectors. As a global leader, Fluidra leverages its comprehensive product range and expertise to serve these large-scale projects, aiming for substantial growth in this expanding segment.

| Category | Product/Service | Market Attractiveness | Business Strength | BCG Classification |

| Smart Pool & Connected Solutions | IoT-enabled devices, automated pool management | High | High | Star |

| Sustainable Products | Variable-speed pumps, advanced filtration | High | High | Star |

| Robotic Pool Cleaners | Cordless robotic cleaners (via Aiper investment) | High | High | Star |

| Commercial Pool Solutions | Comprehensive offerings for hospitality, wellness | High | High | Star |

What is included in the product

This BCG Matrix analysis offers strategic insights into Fluidra's product portfolio, guiding investment decisions across Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual representation of Fluidra's portfolio, simplifying strategic decision-making for busy executives.

Cash Cows

Fluidra's traditional residential pool equipment, encompassing filtration systems, pumps, and heaters, is a cornerstone of its business, likely generating substantial cash flow. This segment thrives on the aftermarket, where demand for maintenance, repairs, and upgrades of existing pools offers remarkable resilience and predictability.

The aftermarket for pool equipment is a consistent revenue stream, driven by the large installed base of pools. In 2023, Fluidra reported a significant portion of its sales coming from spare parts and accessories, underscoring the importance of this segment. This consistent demand for replacement parts and services provides a stable financial foundation.

Fluidra's established brands, including Jandy, AstralPool, Polaris, and Zodiac, are cornerstones of its Cash Cows. These brands boast significant market recognition and are supported by an extensive global distribution network, ensuring consistent sales and a strong market share.

The robust brand equity and widespread availability translate into reliable revenue streams, allowing Fluidra to maintain profitability with comparatively lower marketing expenditures. This established market position solidifies these product lines as dependable cash generators for the company.

Fluidra's chemical dosing and water treatment systems are undoubtedly a cash cow. These products are fundamental for pool hygiene and water quality, representing a stable, high-margin segment for the company. The recurring nature of these purchases, essential for pool maintenance, guarantees a consistent revenue stream within a mature market.

The market is seeing a noticeable shift towards salt chlorination systems. This trend is significant as it reduces reliance on traditional chlorine-based products, offering a more sustainable and efficient water treatment solution. For instance, Fluidra reported strong growth in its pool and wellness division in 2023, with sales increasing by 10.5% to €2,168 million, indicating healthy demand for these types of solutions.

Pool Covers and Safety Equipment

Pool covers and safety equipment are vital components for pool owners. They significantly reduce water evaporation, helping to conserve a precious resource, and also play a key role in maintaining water temperature, which can lead to energy savings. Safety equipment, such as fences and alarms, is often a regulatory requirement, ensuring responsible pool ownership.

These products operate within a mature market, meaning demand is steady and predictable rather than experiencing rapid growth. This stability translates into reliable sales for Fluidra. Because they are essential for pool maintenance and safety, and offer long-term cost benefits like reduced chemical and heating expenses, they generate consistent positive cash flow.

- Stable Demand: Pool covers and safety equipment cater to a consistent, ongoing need among pool owners.

- Cost Savings for Owners: These products offer tangible benefits like reduced water loss and energy consumption, enhancing their value proposition.

- Cash Flow Generation: Their essential nature and predictable sales contribute positively to Fluidra's overall cash flow.

- Mature Market Characteristics: Operating in a mature market implies less volatility and more predictable revenue streams.

Basic Pool Cleaning and Maintenance Tools

Basic pool cleaning and maintenance tools, such as brushes, nets, and manual vacuums, represent a stable segment within the pool industry. These essential items, while not flashy, are perpetually in demand by virtually all pool owners, ensuring a consistent revenue stream.

This consistent demand translates into a significant market share for these products. For instance, the global pool and spa market was valued at approximately $10.5 billion in 2023 and is projected to reach $14.2 billion by 2028, with basic maintenance tools forming a foundational part of this market.

- Consistent Demand: Pool owners regularly need brushes, nets, and basic cleaning equipment, regardless of economic fluctuations.

- High Market Share: These fundamental tools capture a substantial portion of the overall pool supply market due to their universal necessity.

- Steady Cash Generation: The predictable sales volume of these items provides a reliable source of income for companies.

- Low Growth Prospects: While essential, the market for basic tools is mature, with limited potential for rapid expansion.

Fluidra's established residential pool equipment, including filtration systems, pumps, and heaters, forms a significant cash cow. These products benefit from a robust aftermarket driven by maintenance, repairs, and upgrades, ensuring predictable revenue. The company's strong brand portfolio, featuring names like Jandy and Polaris, further solidifies their market position and reliable sales generation, allowing for consistent profitability with lower marketing investment.

Chemical dosing and water treatment systems are also key cash cows for Fluidra, essential for pool hygiene and offering high-margin, recurring revenue. The market's shift towards sustainable solutions like salt chlorination systems is evident, with Fluidra's pool and wellness division showing strong growth. In 2023, this division's sales increased by 10.5% to €2,168 million, reflecting healthy demand for these fundamental pool maintenance products.

Pool covers and safety equipment contribute to Fluidra's cash cow status due to their essential nature and mature market characteristics. These products offer owners cost savings through reduced evaporation and energy consumption, ensuring steady demand. Basic cleaning tools like brushes and nets also represent a stable segment, with the global pool and spa market valued at approximately $10.5 billion in 2023, underscoring the consistent need for these fundamental items.

| Product Category | BCG Classification | Key Characteristics | 2023 Sales Contribution (Estimated) | Market Trend Relevance |

|---|---|---|---|---|

| Residential Pool Equipment (Filters, Pumps, Heaters) | Cash Cow | Mature market, strong aftermarket, established brands | High | Stable demand, resilience |

| Chemical Dosing & Water Treatment | Cash Cow | Recurring revenue, high margins, essential for hygiene | Significant | Growth in sustainable solutions (e.g., salt chlorination) |

| Pool Covers & Safety Equipment | Cash Cow | Essential, mature market, cost-saving benefits for owners | Moderate | Consistent demand, regulatory influence |

| Basic Cleaning & Maintenance Tools | Cash Cow | Universal necessity, stable demand, foundational market segment | Moderate | Consistent sales, low growth potential |

What You’re Viewing Is Included

Fluidra BCG Matrix

The preview you are currently viewing is the identical, fully formatted Fluidra BCG Matrix report you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections – just the complete, professionally designed analysis ready for your strategic decision-making. You can trust that what you see is precisely what you will download, enabling you to seamlessly integrate this valuable market insight into your business planning without any further editing or revisions.

Dogs

Traditional manual pool cleaning tools, like basic skimmer nets and brushes, are increasingly becoming dogs in Fluidra's portfolio. Their market share is diminishing as consumers opt for automated cleaners. For instance, while the global pool cleaning market is projected to reach $5.7 billion by 2028, the segment for manual tools is experiencing a decline.

Older pool equipment, like inefficient pumps and heaters that consume more electricity, are prime examples of legacy products that would likely be classified as dogs in Fluidra's BCG Matrix. These items struggle to compete as consumers and regulations increasingly favor energy-saving alternatives. For instance, by 2024, many regions have stricter energy efficiency mandates for new appliance sales, directly impacting the market for older, less efficient models.

The declining demand for these legacy, energy-inefficient items means they hold a low market share within Fluidra's broader product portfolio. As the market prioritizes sustainability, the growth potential for such equipment is minimal, leading to a stagnant or shrinking revenue stream for these specific offerings.

Products demanding significant upkeep or intricate, expensive setups for consumers can face shrinking demand and a weak market position. In today's environment, where ease of use is paramount, such offerings are likely to falter, becoming financial drains rather than profit generators.

For instance, advanced pool automation systems, while offering sophisticated control, often require professional installation and ongoing technical support. If the cost and complexity of this maintenance outweigh the perceived benefits for the average homeowner, sales could stagnate. In 2023, the global pool and spa market saw growth, but products with high barriers to entry or ownership might lag behind simpler, more accessible alternatives.

Highly Commoditized Basic Pool Chemicals

Within Fluidra's portfolio, highly commoditized basic pool chemicals, such as chlorine tablets or basic algaecides, often fall into the 'Dogs' category of the BCG Matrix. These products face significant price pressure due to the large number of competitors and minimal product differentiation. In 2023, the global pool and spa chemicals market, while growing, saw increased competition in the basic chemical segments, leading to thinner profit margins for many suppliers.

- Low Market Share: Basic chemicals often have a smaller individual market share compared to more specialized or innovative products.

- Low Growth Rate: The market for these fundamental chemicals is mature and saturated, limiting significant expansion opportunities.

- Intense Price Competition: The commoditized nature means profitability is heavily reliant on cost efficiency and volume, rather than premium pricing.

- Limited Differentiation: Products are largely interchangeable, making it difficult to command higher prices or build strong brand loyalty.

Geographic Markets with Stagnant Pool Construction and Low Aftermarket Demand

Certain mature markets, particularly in parts of Eastern Europe and some older regions within North America, exhibit consistently low new pool construction rates. These areas often feature an aging pool base with limited investment in upgrades or aftermarket services, creating a challenging environment for Fluidra's growth.

For instance, countries like Poland or specific states in the US Midwest might fall into this category, where the pool market is saturated and new installations are minimal. This stagnant demand directly impacts Fluidra's ability to gain market share or drive sales for its innovative pool solutions.

In such geographies, Fluidra's product lines catering to new installations or extensive renovations would likely be classified as dogs. The limited pool construction pipeline and low aftermarket demand mean these segments offer little potential for expansion, suggesting a strategic review for divestment or a significant reduction in resource allocation.

- Stagnant Pool Construction: Markets with less than 1% annual growth in new pool installations.

- Aging Pool Infrastructure: Over 60% of existing pools are more than 15 years old, with low replacement rates.

- Low Aftermarket Demand: Limited consumer spending on pool maintenance, upgrades, or accessories.

- Geographic Examples: Specific regions in Eastern Europe and older, established suburban areas in North America.

Products with declining sales and a small market share, like older manual pool cleaning tools, are considered dogs in Fluidra's BCG Matrix. These items struggle against newer, automated alternatives, contributing little to overall growth. For example, while the broader pool cleaning market is expanding, the segment for basic manual tools is shrinking.

Legacy pool equipment, such as inefficient pumps, also falls into the dog category. These products face challenges due to increasing energy efficiency regulations and consumer demand for sustainable options. By 2024, stricter energy mandates are impacting the market for older, less efficient models, further diminishing their appeal and market position.

Commoditized pool chemicals represent another segment often classified as dogs. Intense price competition and a lack of product differentiation limit their profitability and growth potential. In 2023, the basic pool chemicals market saw increased competition, leading to thinner profit margins for suppliers.

Mature markets with low new pool construction and aging infrastructure also create dog segments for Fluidra. These regions, such as parts of Eastern Europe, have limited demand for new installations or upgrades, hindering sales of innovative solutions.

| Product Category | BCG Classification | Market Share | Market Growth | Key Challenges |

| Manual Pool Cleaners | Dog | Declining | Low | Competition from automated cleaners |

| Inefficient Pool Pumps | Dog | Low | Low | Energy efficiency regulations, consumer preference for sustainable options |

| Basic Pool Chemicals | Dog | Low | Mature | Price competition, low differentiation |

| Products for Mature Markets | Dog | Low | Stagnant | Low new pool construction, aging infrastructure |

Question Marks

Fluidra's strategic investment in advanced AI and robotics, exemplified by its stake in Coral Smart Pool, positions it in a high-growth potential segment of the pool management market. These technologies, focusing on AI-enhanced pool safety and predictive maintenance, are still in their early stages, reflected in a currently low market share.

The development and widespread adoption of these sophisticated AI and robotics solutions necessitate substantial capital investment. Fluidra is channeling resources into these areas to unlock their transformative capabilities in improving pool safety and operational efficiency, aiming to capture future market leadership.

Fluidra's investment in Aiper, a direct-to-consumer (DTC) robotics company, marks a strategic pivot towards a high-growth sales channel for pool cleaning robots. This move allows Fluidra to directly engage with end-users, potentially capturing higher margins and valuable customer data.

While the global robotic pool cleaner market is projected to reach approximately $2.5 billion by 2027, with a CAGR of around 8%, Fluidra's DTC infrastructure is still nascent. This necessitates significant investment in digital marketing, e-commerce platforms, and customer service to effectively compete and gain market share in this evolving landscape.

Fluidra's strategic investment in Ecotropy positions it squarely in the high-potential but nascent digital twin market for commercial pool optimization. This technology, focused on energy efficiency, represents a significant opportunity for growth, though widespread adoption still requires considerable market development and education.

The digital twin approach allows for granular monitoring and predictive maintenance, directly impacting operational costs and sustainability. As of early 2024, the market for smart pool management systems, including digital twins, is still emerging, with early adopters demonstrating substantial savings, often exceeding 20% in energy consumption.

New Smart Home Integration Systems for Pools

Developing and integrating pool systems with broader smart home ecosystems represents a significant growth avenue, yet Fluidra's current market share in this rapidly evolving and competitive sector might be relatively small. This segment demands ongoing innovation and substantial marketing investment to secure a leading position and encourage widespread consumer adoption.

Fluidra's new smart home integration systems for pools, while promising, likely fall into the question mark category of the BCG matrix. This is due to the high growth potential of the smart home market, estimated to reach over $150 billion globally by 2025, combined with the intense competition from established tech giants and specialized smart home providers. Fluidra needs to invest heavily in R&D and marketing to capture market share.

- High Growth Potential: The smart home market is expanding rapidly, with smart pool features being a growing niche.

- Competitive Landscape: Established smart home brands and other pool equipment manufacturers are also innovating in this space.

- Investment Needs: Significant investment in technology development, integration, and marketing is required for Fluidra to gain traction.

- Market Share Uncertainty: Fluidra's current market share in integrated smart pool systems is likely nascent, necessitating strategic efforts to build brand awareness and product adoption.

Innovative Water Recycling and Advanced Purification Systems

Innovative water recycling and advanced purification systems represent a classic 'question mark' in the Fluidra BCG Matrix. These cutting-edge solutions, designed to tackle growing water scarcity and environmental pressures, hold substantial promise for future expansion. For instance, the global water and wastewater treatment market was valued at approximately $673 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating a strong growth trajectory for advanced purification technologies.

Despite this potential, these advanced systems may currently possess a relatively low market share. This can be attributed to factors such as higher initial capital expenditure compared to conventional methods and a need for greater consumer and industrial adoption. Companies investing in this segment, like Fluidra, must therefore allocate significant resources towards research and development to enhance efficiency and reduce costs, alongside robust marketing efforts to build awareness and drive market penetration.

- High Growth Potential: Driven by global water scarcity and stricter environmental regulations, the demand for advanced water recycling and purification is set to surge.

- Current Low Market Share: Higher upfront costs and limited widespread adoption are typical challenges for these nascent technologies.

- Strategic Investment Needed: Significant R&D funding and market education are crucial for these 'question mark' products to transition into market leaders.

- Market Opportunity: The global market for advanced water treatment technologies is expanding rapidly, presenting a significant opportunity for innovation and growth.

Fluidra's ventures into emerging smart pool technologies, such as AI-driven maintenance and integrated smart home systems, represent key 'question marks' within its product portfolio. These areas exhibit high growth potential, driven by increasing consumer demand for convenience and efficiency, but currently hold a relatively low market share. For instance, the global smart home market is expected to exceed $150 billion by 2025, highlighting the significant opportunity for smart pool integration.

The challenge for Fluidra lies in navigating these nascent markets, which require substantial investment in research and development, marketing, and strategic partnerships to gain traction against established players. By investing in companies like Aiper and Ecotropy, Fluidra is positioning itself to capture future market share in these rapidly evolving segments.

These 'question mark' initiatives are characterized by their high investment requirements and uncertain returns, but they also offer the potential for significant market disruption and leadership. Fluidra's strategic allocation of capital to these areas underscores its commitment to innovation and long-term growth in the evolving pool and wellness industry.

| Initiative | Market Potential | Current Market Share | Investment Needs | Strategic Focus |

| AI & Robotics (e.g., Coral Smart Pool) | High (growing demand for automation & efficiency) | Low (nascent technology adoption) | High (R&D, infrastructure) | Enhance pool safety & predictive maintenance |

| Direct-to-Consumer (DTC) Robotics (e.g., Aiper) | High (expanding online retail channel) | Emerging (building brand presence) | High (digital marketing, logistics) | Capture higher margins, direct customer data |

| Digital Twins for Commercial Pools (e.g., Ecotropy) | High (energy efficiency & optimization) | Low (early adoption phase) | High (technology development, market education) | Reduce operational costs, improve sustainability |

| Smart Home Integration | Very High (broad smart home market growth) | Low (competitive landscape) | High (R&D, marketing, partnerships) | Seamless pool control within smart ecosystems |

| Water Recycling & Advanced Purification | High (water scarcity, environmental regulations) | Low (higher initial costs, adoption barriers) | High (R&D, cost reduction, market education) | Address environmental concerns, drive efficiency |

BCG Matrix Data Sources

Our Fluidra BCG Matrix leverages a robust blend of internal financial disclosures, market intelligence reports, and competitor analysis to accurately position each business unit.