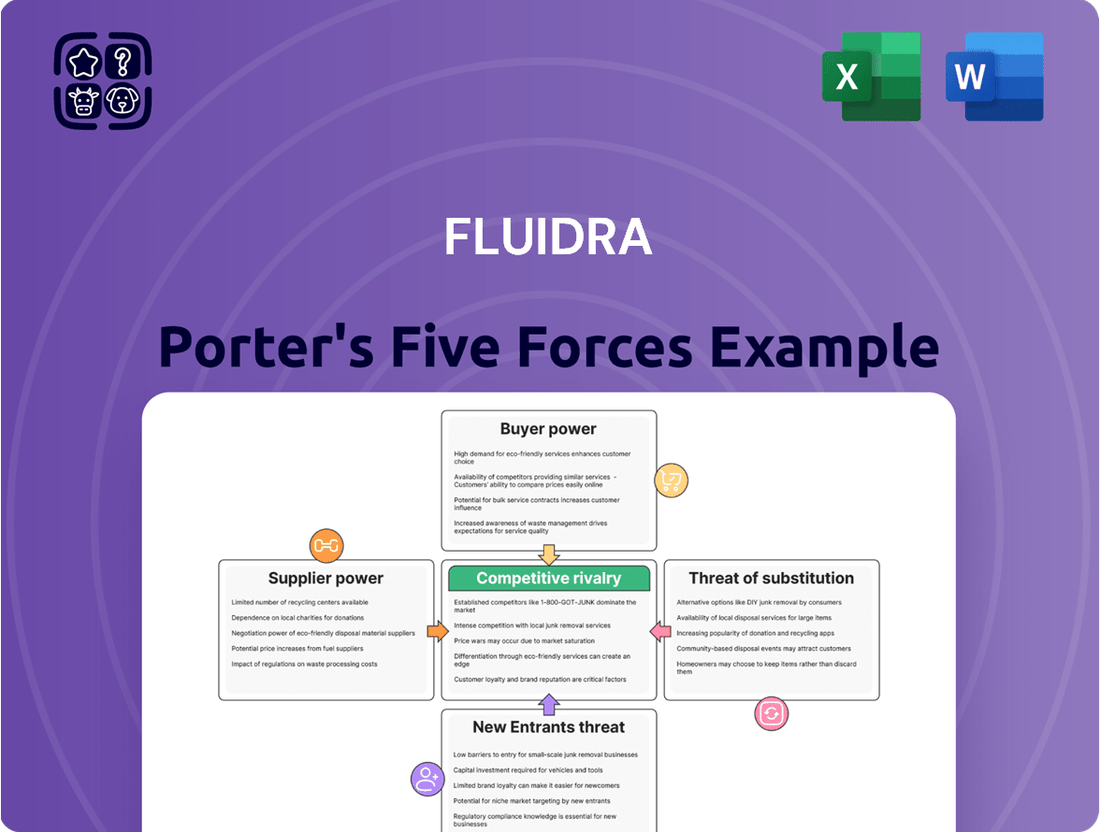

Fluidra Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluidra Bundle

Fluidra's competitive landscape is shaped by significant buyer power and a moderate threat of substitutes, influencing pricing and product differentiation. The industry also faces intense rivalry among existing players and a growing threat of new entrants, particularly in emerging markets. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Fluidra’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Fluidra is significantly influenced by the concentration of providers for specialized components. For instance, if only a handful of companies offer advanced filtration membranes or proprietary IoT sensors crucial for smart pool systems, these suppliers gain considerable leverage. This concentration means Fluidra has fewer alternatives, potentially leading to increased component costs and reduced negotiation flexibility. For example, in 2024, the global market for pool automation sensors, a key area for Fluidra, is dominated by a few innovative technology firms, giving them pricing power.

Suppliers hold significant bargaining power when they offer unique or highly differentiated inputs crucial for Fluidra's advanced products. For instance, if a supplier provides patented pump technology or specialized chemical compounds that are difficult to source elsewhere, Fluidra's negotiation leverage diminishes. This uniqueness makes it challenging for Fluidra to switch suppliers without incurring substantial costs or compromising product quality.

In 2024, the demand for energy-efficient pool pumps, a key component for Fluidra, saw a notable increase driven by environmental regulations and consumer preference for lower operating costs. Suppliers who could offer advanced, patented motor designs or proprietary filtration technologies for these pumps were in a strong position. This allowed them to command premium pricing, impacting Fluidra's cost of goods sold.

Fluidra faces significant supplier bargaining power due to high switching costs. For instance, integrating new suppliers for their advanced, connected pool systems often necessitates substantial investment in retooling manufacturing lines and re-certifying components, potentially impacting production timelines and costs.

These substantial upfront expenses and the potential disruption to operations make it challenging for Fluidra to easily switch suppliers. This dependency strengthens the suppliers' position, allowing them to potentially dictate terms and pricing, especially for specialized components crucial to Fluidra's smart pool technology offerings.

Supplier's Ability to Forward Integrate

Suppliers who can potentially move into Fluidra's pool equipment manufacturing or distribution business gain significant leverage. This threat means Fluidra must carefully consider how its supplier choices might create future competitors. For instance, a major pump component supplier could, in theory, begin assembling and selling complete pool pump systems, directly competing with Fluidra's own branded products.

This ability for suppliers to forward integrate directly impacts Fluidra's pricing power and ability to negotiate favorable terms. If a supplier can easily enter Fluidra's market, they have less incentive to offer competitive pricing or favorable contract conditions. This is particularly true for suppliers of more commoditized components where the barrier to entry for assembly and distribution is lower.

However, the risk of supplier forward integration is significantly reduced for highly specialized component manufacturers. These suppliers often lack the established brand recognition or existing distribution networks necessary to successfully enter Fluidra's established market. For example, a maker of a unique, patented filtration membrane might find it prohibitively difficult to establish the sales and marketing infrastructure needed to compete directly with Fluidra.

- Supplier Forward Integration Threat: Suppliers can increase their bargaining power by potentially entering Fluidra's manufacturing or distribution channels.

- Strategic Sourcing Implications: Fluidra must evaluate sourcing decisions considering the risk of future competition from its suppliers.

- Reduced Risk for Specialized Suppliers: Highly specialized component providers with limited brand or distribution typically pose a lower forward integration risk.

Importance of Fluidra to Suppliers

Fluidra's substantial global purchasing volume often positions it as a key customer for many specialized component manufacturers. This scale means that for a significant number of its suppliers, Fluidra represents a substantial portion of their revenue stream, thereby diminishing the supplier's bargaining leverage.

Conversely, if Fluidra were a minor client to a large, diversified supplier, that supplier would possess greater power to dictate terms. However, given Fluidra's expansive operational footprint, it's more common for its suppliers to be reliant on Fluidra's consistent demand.

For example, in 2024, Fluidra continued to emphasize strategic sourcing and supplier relationships to ensure competitive pricing and reliable supply chains. The company's commitment to innovation also means it often works closely with suppliers on developing new materials and components, further solidifying these relationships and potentially reducing supplier power.

- Supplier Dependence: Fluidra's considerable global demand makes it a crucial revenue source for many specialized suppliers, limiting their ability to exert strong bargaining power.

- Diversification Impact: If a supplier serves a broad market and Fluidra represents a small fraction of its sales, that supplier gains more influence over pricing and terms.

- Scale Advantage: Fluidra's large-scale operations generally translate into significant purchasing power, enabling it to negotiate more favorable terms with its supplier base.

Fluidra's bargaining power with suppliers is generally strong due to its significant purchasing volume. This scale makes Fluidra a vital customer for many specialized component manufacturers, thereby reducing the suppliers' leverage. For instance, in 2024, Fluidra's global procurement strategy focused on consolidating suppliers to maximize this purchasing power, aiming for better pricing and terms on essential pool equipment components.

However, suppliers who offer unique, patented technologies or highly differentiated inputs for Fluidra's advanced products, such as smart pool controllers or energy-efficient motors, can command higher prices. The high switching costs associated with retooling or re-certifying these specialized components further bolster these suppliers' negotiating positions.

The threat of supplier forward integration, where a supplier might begin manufacturing or distributing finished pool products, also influences bargaining dynamics. While this risk is lower for highly specialized component makers lacking brand recognition, it remains a factor for suppliers of more commoditized parts.

| Factor | Impact on Fluidra's Supplier Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration of suppliers for key components increases their power. | Dominance of a few tech firms in pool automation sensors in 2024. |

| Input Differentiation | Unique or patented inputs reduce Fluidra's negotiation flexibility. | Patented pump technology and specialized chemicals are examples. |

| Switching Costs | High costs to switch suppliers strengthen supplier leverage. | Retooling and re-certification for smart pool systems are significant. |

| Supplier Forward Integration Threat | Potential for suppliers to enter Fluidra's market increases their power. | Lower risk for specialized suppliers, higher for commoditized component makers. |

| Fluidra's Purchasing Volume | Large volume makes Fluidra a key customer, reducing supplier power. | Fluidra's global scale ensures reliance from many suppliers. |

What is included in the product

This analysis unpacks the competitive forces impacting Fluidra, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the pool and wellness industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on Fluidra's market landscape.

Customers Bargaining Power

Customer price sensitivity is a major force, especially for homeowners who view pool equipment as a discretionary purchase. For these residential buyers, the initial price tag often outweighs long-term value considerations when comparing options. This can make them more likely to switch to lower-cost alternatives if Fluidra's premium or smart solutions are perceived as too expensive, impacting sales volumes.

The pool equipment market is characterized by a substantial number of alternative brands and products, granting consumers significant leverage. This abundance of choice means customers can readily switch to competitors if they find better pricing, enhanced features, or superior service from another provider, forcing Fluidra to maintain a competitive edge.

Fluidra's strategy to counter this customer bargaining power involves offering a comprehensive suite of pool equipment and integrated solutions. By providing a more complete and seamless experience, Fluidra aims to diminish the appeal of customers assembling their pool systems from various, disparate suppliers, thereby increasing customer loyalty and reducing the ease of switching.

In 2023, the global pool and spa market was valued at approximately $12.5 billion, with projections indicating continued growth. This competitive landscape, filled with established players and emerging brands, underscores the critical importance of Fluidra’s product breadth and service integration in retaining its customer base and mitigating the impact of customer price sensitivity.

Customers today have unprecedented access to information about products and services, with online reviews and price comparison tools readily available. This heightened transparency significantly empowers them, allowing for more informed purchasing decisions and increasing their bargaining power. For instance, in 2024, consumer electronics saw a significant shift with online price comparisons becoming a standard practice, influencing purchasing behavior across the board.

This increased customer knowledge intensifies price competition, forcing companies like Fluidra to look beyond just brand name and focus on delivering superior quality, continuous innovation, and exceptional service. The ability to easily compare offerings means that price alone is often not enough to secure loyalty.

Fluidra's strategic investment in Internet of Things (IoT) solutions is a key differentiator in this environment. By offering unique data insights and enhanced convenience through connected products, Fluidra aims to create customer stickiness, making it harder for consumers to switch to competitors even if prices are slightly lower.

Low Switching Costs for Customers

Customers facing low switching costs in the pool equipment market possess significant bargaining power. This ease of transition between brands, particularly for standard replacement parts or basic equipment, allows them to readily seek out alternative manufacturers offering better prices or features. For instance, if a customer can easily find a comparable filter or pump from a competitor without incurring substantial costs or effort, they are more likely to negotiate harder or switch if their demands aren't met.

Fluidra, however, actively works to mitigate this by developing integrated systems and smart solutions. These offerings are designed to create higher switching costs by embedding customers within Fluidra's ecosystem. Once a customer invests in a connected pool management system or a suite of Fluidra products that work seamlessly together, the effort and expense of switching to a competitor's entirely different system can become prohibitive. This strategy aims to lock customers in, thereby reducing their bargaining power over time.

- Low Switching Costs: Customers can easily switch between pool equipment brands for standard parts, increasing their leverage.

- Fluidra's Ecosystem Strategy: Fluidra aims to increase switching costs through integrated smart pool solutions.

- Impact on Bargaining Power: Higher switching costs reduce customer bargaining power, enhancing Fluidra's pricing and retention capabilities.

Concentration of Key Customers

The concentration of key customers significantly impacts bargaining power. If a few large distributors or commercial pool operators represent a substantial portion of Fluidra's revenue, they can leverage this volume to negotiate more favorable pricing and terms. For instance, if the top 10 customers account for over 30% of sales, their influence would be considerable.

Fluidra's strategy of serving both residential and commercial markets, alongside a broad geographic spread, helps to dilute the impact of any single customer's concentration. This diversification means that the loss or negotiation pressure from one large client is less likely to cripple overall sales performance.

- Customer Concentration Risk: High dependence on a few major clients increases their leverage over Fluidra.

- Mitigation through Diversification: Fluidra's broad customer base across residential and commercial sectors reduces individual customer impact.

- Impact on Pricing and Terms: Concentrated customers can demand discounts or preferential treatment due to their purchasing volume.

Customers possess significant bargaining power due to the availability of numerous alternative brands and products in the pool equipment market. This ease of switching, especially for standard items, allows them to demand better pricing or features, directly impacting Fluidra's sales and margins.

Fluidra counters this by developing integrated smart pool solutions, creating higher switching costs and customer loyalty. The global pool and spa market, valued at around $12.5 billion in 2023, is highly competitive, making Fluidra's focus on product breadth and service crucial for retaining customers and mitigating their bargaining power.

| Factor | Description | Impact on Fluidra |

|---|---|---|

| Price Sensitivity | Homeowners often prioritize initial cost over long-term value. | Increases likelihood of switching to lower-cost alternatives. |

| Availability of Alternatives | Numerous brands offer comparable products. | Grants customers leverage to negotiate or switch easily. |

| Information Accessibility | Online reviews and price comparisons empower buyers. | Intensifies price competition and demands for value. |

| Switching Costs | Low costs for standard parts allow easy brand changes. | Enhances customer bargaining power. |

Preview Before You Purchase

Fluidra Porter's Five Forces Analysis

This preview showcases the comprehensive Fluidra Porter's Five Forces Analysis, detailing the competitive landscape of the swimming pool and wellness industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, offering actionable insights into industry profitability and strategic positioning.

Rivalry Among Competitors

The pool and wellness sector is characterized by a dynamic competitive landscape, featuring both large, globally recognized companies and a multitude of smaller, specialized regional players. This broad spectrum of participants, from comprehensive manufacturers to niche component suppliers, fuels intense rivalry as each entity strives to capture market share. Fluidra, operating as a significant global entity, encounters competition across its entire product and service portfolio.

The pool industry typically sees consistent growth, but regional saturation or slower economic periods can heat up competition. When demand is tighter, companies often compete more fiercely for the customers already in the market. For instance, in 2023, the global swimming pool market was valued at approximately $10.5 billion, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2030. This steady, albeit not explosive, growth means companies are always looking for an edge.

In contrast, rapidly expanding niches like smart pool technology, which saw significant investment and consumer interest in 2024, tend to foster competition centered on groundbreaking features and securing market share. Fluidra's strategic emphasis on developing innovative products, such as advanced automation and energy-efficient systems, directly targets these high-growth segments, aiming to lead rather than merely participate in the market's evolution.

Fluidra's competitive rivalry is significantly shaped by product differentiation and innovation. The company's investment in IoT solutions for pool management, for instance, allows for a degree of product uniqueness that can reduce direct price competition. This focus on advanced features and technology enables Fluidra to potentially command premium pricing, thereby mitigating some of the intense rivalry often seen in more commoditized segments of the pool and wellness industry.

High Fixed Costs and Exit Barriers

Industries characterized by substantial fixed costs and high exit barriers often foster intense competitive rivalry. Companies invest heavily in assets like manufacturing plants or research and development, making it difficult and costly to divest or exit the market. This can force players to remain competitive even in less profitable periods, driving down prices and margins.

Fluidra's global manufacturing operations and ongoing investments in product innovation represent significant fixed costs. For instance, the company's commitment to expanding its production capabilities, as seen in its strategic acquisitions and facility upgrades, locks in capital. These investments create a strong incentive for Fluidra to maintain and grow its market share rather than withdraw.

- High Fixed Costs: Fluidra's capital expenditures, including those for its extensive global manufacturing network and R&D initiatives, create a substantial fixed cost base.

- Exit Barriers: Specialized machinery, established supply chains, and brand reputation in the pool and water treatment industry present significant hurdles for companies looking to exit.

- Reluctance to Exit: The high sunk costs associated with these assets mean that Fluidra and its competitors are incentivized to continue operating and competing, even if market conditions are challenging.

- Intensified Rivalry: This dynamic contributes to a highly competitive landscape where companies fight aggressively for market share to justify their fixed cost investments.

Strategic Stakes and Aggressiveness

The pool and wellness sector is highly strategic for its major participants, often fueling aggressive tactics like price wars and aggressive marketing. Companies might focus on capturing market share, even if it means sacrificing immediate profits. For instance, in 2023, the global swimming pool market was valued at approximately USD 12.7 billion, with projections indicating continued growth, making it an attractive arena for intense competition.

Fluidra, as a global leader, frequently finds itself as a target for rivals aiming to expand their market presence. This dynamic intensifies rivalry, as competitors may launch new products or acquire smaller players to challenge Fluidra's dominance. The company's extensive product portfolio, ranging from pool equipment to water treatment solutions, makes it a benchmark that others strive to surpass.

- Strategic Importance: The pool and wellness market’s significant value, estimated to reach over USD 17 billion by 2028, drives intense competition.

- Aggressive Tactics: Competitors may engage in price undercutting and accelerated innovation to gain market share against leaders like Fluidra.

- Market Share Focus: Companies often prioritize long-term market position over short-term profitability in this sector.

- Fluidra as a Target: Fluidra's leading global position makes it a natural focal point for competitors seeking to disrupt the status quo.

Competitive rivalry within the pool and wellness sector is substantial, driven by a mix of large global players and numerous smaller, specialized firms. This competition is amplified by the sector's consistent growth, with the global swimming pool market valued at approximately $10.5 billion in 2023 and projected to grow. Companies like Fluidra face pressure to innovate and differentiate, particularly in high-growth areas such as smart pool technology, which saw significant investment and consumer interest in 2024.

| Key Metric | 2023 Value | Projected Growth (CAGR) | Key Driver |

| Global Swimming Pool Market Value | ~$10.5 Billion | ~4.5% (through 2030) | New installations, renovations, smart technology adoption |

| Smart Pool Technology Segment | Significant Investment & Interest | High Growth Potential | Consumer demand for automation, energy efficiency, remote management |

SSubstitutes Threaten

Consumers have a vast selection of leisure options outside of pools, from travel and dining to home entertainment like streaming services. For instance, global tourism expenditure was projected to reach $1.5 trillion in 2024, indicating a significant draw on discretionary income that could otherwise be spent on pool-related activities.

When alternatives like gym memberships or new gaming consoles become more attractive or cost-effective, they can easily pull consumer spending away from pool installation and upkeep. This competition for leisure dollars directly impacts the potential market size for Fluidra's offerings.

A significant threat of substitutes emerges when consumers increasingly favor public swimming facilities, community pools, or water parks over private pool and spa investments. This shift can be driven by factors such as escalating maintenance costs for private pools, limited residential space, and growing environmental consciousness regarding water usage. For instance, the global water park market was valued at approximately USD 12.5 billion in 2023 and is projected to grow, indicating a strong consumer appetite for communal aquatic experiences.

These trends can directly impact Fluidra's core business if a substantial portion of potential private pool buyers opt for public alternatives. While Fluidra's commercial division actively serves public pool operators, a widespread migration to public facilities could still represent a lost opportunity for its residential pool and spa segment. The ongoing development and enhancement of public aquatic centers, often supported by municipal budgets, present a compelling and potentially more cost-effective option for many consumers.

The growing accessibility of online tutorials and readily available pool parts presents a tangible threat of substitutes for Fluidra. Pool owners are increasingly empowered to handle routine maintenance and even minor repairs themselves, potentially bypassing the need for professional services or the purchase of Fluidra's more integrated, higher-margin offerings. For instance, a 2024 survey indicated that 35% of pool owners attempted at least one DIY repair in the past year, up from 28% in 2022.

While this DIY trend might reduce demand for complex, professionally installed systems, it's important to note that sophisticated IoT-enabled pool management solutions remain largely out of reach for the average DIY enthusiast. Fluidra's focus on smart, connected technologies offers a counter-argument to the pure DIY threat, as these advanced features still necessitate specialized knowledge and installation, thereby maintaining a competitive advantage.

Evolution of Water Treatment Technologies

Emerging water treatment technologies pose a potential long-term threat by offering alternatives to Fluidra's core offerings. Innovations in areas like advanced oxidation processes or bio-filtration could bypass the need for traditional pool filtration, sanitation, and heating equipment. For instance, research into UV-C LED sanitation systems is advancing, potentially reducing reliance on chemical treatments and associated hardware.

Breakthroughs in creating chemical-free or ultra-low maintenance aquatic environments could significantly diminish demand for conventional pool equipment. Consider the growing interest in natural swimming pools or bio-pools, which rely on aquatic plants and biological filtration, presenting a distinct substitute. While still niche, their appeal is growing among environmentally conscious consumers.

Fluidra's strategic focus on research and development in sustainable solutions, such as energy-efficient pumps and smart water management systems, is a proactive measure to mitigate this substitute threat. The company invested €70 million in R&D in 2023, aiming to integrate innovative technologies and maintain its market leadership.

- Emerging Technologies: Advanced oxidation, bio-filtration, and UV-C LED sanitation systems offer alternatives to traditional pool equipment.

- Market Trends: Growing consumer interest in chemical-free and low-maintenance aquatic environments like natural swimming pools.

- Fluidra's Response: Significant R&D investment, including €70 million in 2023, focusing on sustainable and innovative solutions.

Cost-Benefit Ratio of Substitutes

The cost-benefit ratio of substitutes is a key factor in assessing their threat to Fluidra. If alternative solutions, such as public pools or other recreational activities, offer comparable benefits for a lower price or less personal effort, they become more appealing. For instance, the ongoing costs associated with pool ownership, including chemicals, energy, and maintenance, can be substantial. In 2023, the average annual cost to maintain a residential pool in the US was estimated between $1,200 and $2,500, a figure that can deter potential pool owners or encourage existing ones to seek more economical alternatives.

Fluidra's strategy to mitigate this threat involves enhancing the value proposition of its pool solutions. By focusing on energy efficiency, automation, and smart management systems, Fluidra aims to reduce the long-term operational costs for pool owners. For example, their connected pool systems can optimize water filtration and heating, potentially leading to significant savings on energy bills. This focus on efficiency directly addresses the cost-benefit calculation for consumers, making Fluidra's offerings more competitive against simpler, albeit less advanced, alternatives.

- Cost Comparison: The upfront and ongoing expenses of maintaining a private pool with Fluidra's technology versus the cost of accessing public swimming facilities or engaging in other leisure activities.

- Benefit Analysis: Evaluating the convenience, privacy, and health benefits of a private pool against the benefits offered by substitutes.

- Technological Advantage: How Fluidra's smart pool solutions, designed for efficiency and reduced maintenance, improve the overall cost-benefit ratio compared to traditional pool upkeep or less sophisticated alternatives.

- Market Trends: Consumer willingness to invest in home amenities versus spending on external recreational services, influenced by economic conditions and lifestyle preferences.

The threat of substitutes for Fluidra is significant, encompassing a wide range of leisure activities and alternative aquatic experiences. Consumers can opt for travel, dining, or home entertainment, with global tourism expenditure projected to reach $1.5 trillion in 2024, diverting discretionary income. Public swimming facilities, water parks, and even DIY pool maintenance represent direct substitutes that challenge the demand for Fluidra's private pool and spa solutions. Emerging technologies like chemical-free water treatment and natural swimming pools also present long-term threats by offering lower-maintenance, environmentally friendly alternatives.

| Substitute Category | Examples | 2024/2023 Data Point | Impact on Fluidra |

|---|---|---|---|

| Leisure Activities | Travel, Dining, Home Entertainment | Global tourism expenditure projected at $1.5 trillion (2024) | Diversion of discretionary income from pool investments. |

| Public Aquatic Facilities | Water Parks, Community Pools | Global water park market valued at ~$12.5 billion (2023) | Reduced demand for private pool installations and upkeep. |

| DIY Maintenance | Online tutorials, self-repair parts | 35% of pool owners attempted DIY repair (2024) | Potential decrease in demand for professional services and integrated systems. |

| Emerging Technologies | UV-C LED sanitation, Natural Swimming Pools | Advancing research in UV-C LED sanitation | Long-term threat to traditional pool equipment and chemical usage. |

Entrants Threaten

Entering the pool and wellness equipment market demands significant upfront capital. Companies need to invest heavily in research and development, state-of-the-art manufacturing facilities, managing substantial inventory, and building robust distribution networks. This financial hurdle acts as a strong deterrent for many aspiring new players.

Fluidra's established global presence and extensive operational infrastructure further magnify this challenge for potential entrants. For instance, in 2023, Fluidra reported capital expenditures of €272 million, illustrating the scale of investment required to maintain and grow within the industry.

Fluidra's strong brand loyalty, built over years of delivering quality and innovation, presents a formidable barrier to new entrants. Customers often stick with Fluidra due to trust in its products and services, making it difficult for newcomers to gain market share. For instance, in 2023, Fluidra reported a revenue of €2.3 billion, underscoring its significant market presence and the substantial investment required for any new competitor to even approach this level of recognition and customer base.

New companies entering the pool and wellness industry face significant challenges in securing access to established distribution channels. Fluidra, for instance, benefits from decades of building strong relationships with wholesalers, retailers, pool builders, and service professionals. This extensive network is a formidable barrier, as replicating it requires substantial time, investment, and proven reliability.

For newcomers, achieving market penetration without these crucial distribution links is extremely difficult. Imagine trying to sell pool equipment when you can't easily get it into the hands of the people who actually build and maintain pools. In 2023, Fluidra's global presence and established distribution agreements were key to its €2.4 billion in revenue, highlighting the critical advantage of this access.

Proprietary Technology and Patents

Fluidra's substantial investment in research and development, particularly in smart pool management using IoT, advanced filtration, and energy-efficient pumps, leads to proprietary technologies and patents. This intellectual property acts as a significant barrier to entry, making it challenging for new companies to replicate their offerings without considerable R&D expenditure or securing licenses. For instance, Fluidra's focus on connected devices and data analytics in pool maintenance, a growing segment, provides a distinct competitive edge.

These patents and unique technological capabilities create a moat around Fluidra's business. New entrants would face the daunting task of either developing their own innovative solutions from scratch or acquiring the rights to existing technologies, both of which demand substantial capital and time. This situation directly impacts the threat of new entrants by raising the cost and complexity of entering the market with competitive products.

- Proprietary Technology: Fluidra's R&D investment fuels the creation of unique technologies in areas like IoT pool management and energy-efficient pumps.

- Patent Protection: Intellectual property rights, including patents, shield Fluidra's innovations from direct imitation by new market participants.

- High Barrier to Entry: The need for significant R&D investment or licensing agreements makes it difficult and costly for new entrants to compete effectively.

- Competitive Advantage: These technological barriers provide Fluidra with a sustained competitive advantage, deterring potential new competitors.

Economies of Scale and Experience Curve

Existing players like Fluidra leverage substantial economies of scale in manufacturing, procurement, and research and development, driven by their extensive production volumes and global presence. For instance, Fluidra's 2023 revenue reached €2.4 billion, demonstrating the scale of its operations. This allows them to achieve lower per-unit costs, creating a significant barrier for newcomers attempting to compete on price.

The industry's experience curve also plays a crucial role, with established companies possessing accumulated knowledge that enhances efficiency and problem-solving capabilities. This deep-seated expertise translates into optimized production processes and quicker adaptation to market changes, further disadvantaging new entrants who lack this historical learning.

- Economies of Scale: Fluidra's substantial revenue base supports large-scale production, lowering per-unit costs.

- Procurement Power: Bulk purchasing by established firms secures better terms with suppliers.

- R&D Investment: Larger companies can afford more significant investments in innovation, creating a technological edge.

- Experience Curve Benefits: Accumulated operational knowledge leads to greater efficiency and reduced errors.

The threat of new entrants in the pool and wellness industry is moderate, primarily due to high capital requirements and established brand loyalty. Fluidra’s significant investments, such as €272 million in capital expenditures in 2023, along with its global infrastructure and strong distribution networks, create substantial barriers. Newcomers must overcome these hurdles, which include replicating extensive supplier relationships and achieving economies of scale to compete on price.

| Barrier Type | Description | Impact on New Entrants | Fluidra's Position |

|---|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and distribution. | Significant deterrent due to substantial financial needs. | Fluidra's €272M 2023 CapEx highlights industry investment scale. |

| Brand Loyalty & Reputation | Customer trust in established brands like Fluidra. | Difficult for newcomers to gain market share without proven quality. | Fluidra's €2.3B 2023 revenue reflects strong market presence and customer base. |

| Distribution Channels | Access to established networks of wholesalers and retailers. | Replication requires considerable time, investment, and reliability. | Fluidra's global presence and established agreements contributed to €2.4B 2023 revenue. |

| Proprietary Technology | Patented innovations in areas like IoT pool management. | Requires significant R&D or licensing, increasing entry costs. | Fluidra's R&D focus provides a distinct competitive edge. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to compete on price against larger players. | Fluidra's €2.4B 2023 revenue indicates significant operational scale. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fluidra leverages data from financial reports, industry-specific market research, and competitor analysis platforms to provide a comprehensive view of the competitive landscape.