Flowco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowco Bundle

Uncover the hidden forces shaping Flowco's future with our comprehensive PESTLE Analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to navigate this dynamic landscape and make informed strategic decisions. Download the full analysis now to gain a critical competitive advantage.

Political factors

Government policies and regulations are a major factor for Flowco, affecting everything from exploring for oil and gas to shutting down old wells. For instance, new rules on environmental impact assessments or stricter safety standards for drilling operations can add significant time and expense to projects. In 2024, the US Environmental Protection Agency continued to refine methane emission regulations, potentially requiring Flowco to invest in new leak detection and repair technologies, impacting operational budgets.

Geopolitical stability in major oil and gas producing regions, such as the Middle East and parts of Africa, directly influences global energy supply. For instance, in 2024, ongoing tensions in Eastern Europe continued to create volatility in oil markets, with Brent crude prices fluctuating significantly based on supply disruption fears. These dynamics directly impact Flowco's client base, as instability can lead to project delays or cancellations, affecting demand for Flowco's services.

Shifts in alliances or conflicts can reconfigure energy trade routes and investment attractiveness. For example, the strategic realignments following conflicts in 2023-2024 have prompted some nations to reassess their reliance on traditional energy suppliers, potentially opening new markets for Flowco but also introducing new competitive pressures. The strategic importance of domestic hydrocarbon production is heightened when international supply chains are perceived as vulnerable.

Energy security concerns are increasingly driving policy decisions. Many nations are accelerating investments in diverse energy sources, including renewables and advanced natural gas technologies, to reduce dependence on single suppliers. This trend, evident in policy announcements throughout 2024, could favor Flowco's involvement in projects utilizing cleaner or more diversified energy infrastructure, while potentially diminishing opportunities in purely traditional upstream exploration.

International trade agreements, tariffs on equipment, and export/import restrictions on oil and gas products directly impact Flowco's material costs and the accessibility of its services to clients globally. For instance, the United States imposed tariffs on steel imports in 2018, which could have increased the cost of specialized piping and equipment for Flowco's projects.

Protectionist policies or ongoing trade disputes, such as those between major economies in 2024, can escalate operational expenses or dampen global demand for hydrocarbon production. This directly affects Flowco's competitiveness and its ability to reach international markets, as seen in potential slowdowns in cross-border energy infrastructure projects.

Consequently, maintaining supply chain resilience by closely monitoring evolving trade policies and potential trade disputes is crucial for Flowco's sustained operational efficiency and market presence. For example, changes in tariffs can affect the landed cost of imported components, necessitating proactive sourcing strategies.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in shaping the energy sector, directly influencing companies like Flowco. For instance, the US Inflation Reduction Act of 2022, with its significant tax credits for clean energy and carbon capture, signals a strong governmental push towards decarbonization. This could reduce demand for traditional artificial lift services as the industry shifts away from fossil fuels. Conversely, continued subsidies for oil and gas production, while potentially decreasing in the long term, could offer short-term stability for Flowco’s existing business lines.

Flowco needs to monitor and adapt to these evolving governmental priorities. For example, if governments increase carbon taxes, the economic viability of carbon-intensive operations that rely on Flowco’s services will diminish. Conversely, policies that support the development and deployment of technologies like enhanced oil recovery (EOR) or carbon capture utilization and storage (CCUS) could create new avenues for Flowco’s expertise in fluid management and artificial lift systems. The International Energy Agency (IEA) projects that while fossil fuel demand will likely plateau in the coming years, the transition period will still require significant investment in existing infrastructure and new, cleaner technologies.

- Governmental support for renewable energy and carbon capture technologies can create new market opportunities for Flowco.

- Policies like carbon taxes directly impact the cost-effectiveness of fossil fuel extraction, potentially affecting demand for Flowco's services.

- The US Inflation Reduction Act of 2022 offers substantial tax credits for clean energy, incentivizing a shift away from traditional oil and gas operations.

- Flowco must strategically align its service offerings with national and international energy transition goals to maintain long-term relevance.

International Climate Agreements

International climate agreements, like the Paris Agreement, are increasingly shaping national energy policies and pushing industries towards decarbonization. For Flowco, which aims to optimize hydrocarbon production, this translates into growing pressure to adopt more stringent operational standards to reduce emissions. This could impact the long-term demand for fossil fuel infrastructure, necessitating a strategic shift towards technologies that support more environmentally responsible production methods.

The global push for net-zero emissions, with many nations setting ambitious targets for 2050, directly influences investment in and the operational lifespan of hydrocarbon-focused technologies. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that while fossil fuels still dominate the global energy mix, the growth in renewable energy sources is accelerating, signaling a potential long-term reallocation of capital away from traditional infrastructure.

- Paris Agreement Goals: Many countries are committed to limiting global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- IEA Projections: The IEA's 2024 report highlights a significant increase in renewable energy capacity additions, suggesting a shift in the energy landscape.

- Decarbonization Investments: Global investments in clean energy technologies reached an estimated $1.7 trillion in 2023, according to BloombergNEF, indicating a strong market trend.

- Flowco's Adaptation: Flowco must assess how its technologies can be adapted to reduce methane intensity or support carbon capture, utilization, and storage (CCUS) initiatives to align with evolving climate policies.

Government policies and regulations significantly shape the energy sector. For example, in 2024, the US Environmental Protection Agency continued to refine methane emission regulations, potentially requiring Flowco to invest in new leak detection technologies. Geopolitical instability in regions like the Middle East impacts global energy supply, affecting demand for Flowco's services due to potential project delays. Shifts in international alliances can reconfigure energy trade routes, influencing investment attractiveness and creating new market opportunities or competitive pressures for Flowco.

What is included in the product

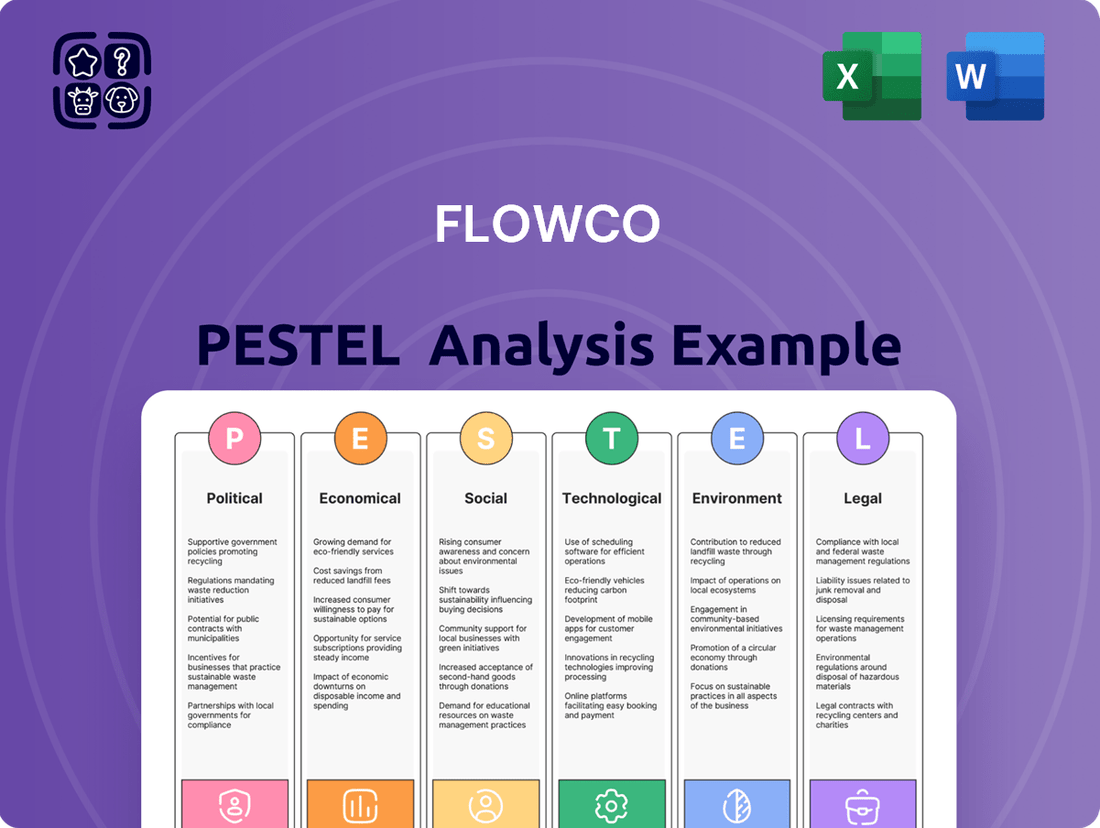

The Flowco PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Flowco's PESTLE analysis provides a structured framework to identify and mitigate external threats, acting as a proactive pain point reliever by highlighting potential market disruptions before they impact operations.

Economic factors

Global oil prices have experienced significant fluctuations. For instance, West Texas Intermediate (WTI) crude oil averaged around $77 per barrel in early 2024, a notable increase from its lower points in late 2023, but still below the highs seen in 2022. This volatility directly affects Flowco's clients, as sustained lower prices, like those experienced in some periods of 2023, can curb their spending on new projects.

Conversely, periods of elevated oil and gas prices, such as the spikes seen in 2022, typically encourage more investment in upstream activities. This increased drilling and production activity directly translates to a higher demand for Flowco's artificial lift systems. For example, if oil prices consistently trade above $80 per barrel, capital expenditure in the sector tends to rise, benefiting companies like Flowco.

The International Energy Agency (IEA) projected in its early 2024 outlook that while demand growth for oil might moderate, geopolitical factors and supply management decisions by OPEC+ would continue to be key drivers of price. Monitoring these trends is therefore essential for Flowco's strategic planning and forecasting of demand for its specialized solutions.

Upstream capital expenditure by oil and gas companies is a critical determinant for Flowco's revenue. For instance, in 2024, global upstream CapEx was projected to reach approximately $570 billion, a modest increase from 2023, but still reflecting investor caution. This level of investment directly influences the demand for Flowco's services in well completion and optimization.

Economic headwinds, such as potential recessions or persistent inflation, can significantly curb this upstream investment. Investor demands for capital discipline and a growing focus on energy transition initiatives also put pressure on traditional oil and gas spending. A notable trend is the increasing allocation of capital towards lower-carbon solutions, which could divert funds from traditional exploration and production activities, impacting Flowco's core market.

Flowco's growth trajectory is therefore closely linked to the financial health and strategic priorities of its upstream clients. Any significant reduction in their investment appetite, perhaps driven by lower commodity prices or regulatory changes, would directly translate into fewer projects and reduced demand for Flowco's specialized services, highlighting the sector's sensitivity to broader economic and strategic shifts.

The availability of financing and prevailing credit conditions are critical for Flowco's clients in the oil and gas sector. In 2024, interest rate hikes by major central banks, including the Federal Reserve, have increased the cost of borrowing, potentially impacting capital expenditure budgets for exploration and production companies. For instance, the average interest rate on corporate bonds for the energy sector saw an uptick in early 2024 compared to the previous year, making new project financing more expensive.

Furthermore, investor sentiment plays a significant role. A growing divestment trend from fossil fuels, driven by Environmental, Social, and Governance (ESG) considerations, can reduce the pool of available capital for oil and gas projects. This sentiment can lead to tighter credit markets for companies perceived as high-risk or those not actively transitioning to cleaner energy sources, directly affecting their capacity to invest in services like those Flowco offers.

Flowco must therefore maintain a keen awareness of its clients' financial health and their access to capital. If credit markets tighten or investor confidence wanes, even strong commodity prices might not translate into increased spending on oilfield services. Understanding these financial dynamics is key to anticipating client demand and managing business risk.

Inflation and Cost of Operations

Rising inflation poses a significant challenge for Flowco, directly impacting its operational expenses. For instance, the Producer Price Index (PPI) for manufactured goods, a key indicator of input costs, saw a notable increase in early 2024, potentially driving up the cost of raw materials for Flowco's equipment. Similarly, escalating fuel prices, as reflected in the Consumer Price Index (CPI) for transportation services, will likely increase Flowco's logistics and delivery costs.

These increased costs can put pressure on Flowco's profitability if the company cannot fully pass them on to customers through higher service fees. While some sectors might absorb these increases, Flowco's ability to maintain its profit margins will depend on its pricing power and the competitive landscape. For example, if competitors are also facing similar cost pressures and are unable to raise prices, Flowco may be forced to absorb a larger portion of the increased operational expenses.

Conversely, a deflationary environment, while reducing operational costs, could signal underlying economic weakness, potentially leading to decreased demand for Flowco's services. This creates a delicate balancing act for Flowco's management. Effective cost management strategies, including optimizing supply chains and exploring alternative suppliers, become paramount to navigating these economic fluctuations and maintaining financial health.

- Inflationary Impact: Increased costs for raw materials, labor, and transportation due to rising inflation.

- Margin Compression: Risk of reduced profit margins if higher operational costs cannot be fully passed on to clients.

- Deflationary Risks: Potential for reduced demand and broader economic weakness during deflationary periods.

- Cost Management: The necessity of robust cost control measures to mitigate financial impacts.

Economic Growth in Key Markets

Economic growth in key markets directly impacts Flowco's business by influencing energy demand. For instance, robust economic expansion in North America and Europe, where Flowco has significant operations, typically boosts industrial activity and transportation, thereby increasing the need for hydrocarbon production and related services. In 2024, the IMF projected global GDP growth at 3.2%, with advanced economies expected to grow by 1.9% and emerging markets by 4.7%, indicating a generally positive environment for energy demand.

Conversely, economic downturns or recessions can significantly curtail energy consumption. A slowdown in manufacturing, reduced consumer spending, and decreased travel, all hallmarks of a recession, directly translate to lower demand for oil and gas. This can lead to reduced project pipelines and lower utilization rates for Flowco's services. For example, the economic contraction experienced in 2020 due to the pandemic saw a sharp decline in oil demand, impacting the entire energy services sector.

Flowco's reliance on regions with strong economic growth is evident. As of mid-2025, projections for the Asia-Pacific region, a key market for energy consumption, indicate continued GDP growth, with many countries expected to expand by over 4%. This sustained growth fuels demand for energy infrastructure and services, benefiting companies like Flowco.

- Global GDP Growth Projections: IMF forecasts a 3.2% global GDP growth for 2024, with emerging markets showing stronger expansion than advanced economies.

- Regional Economic Performance: Asia-Pacific economies are projected to maintain robust growth rates exceeding 4% in 2025, supporting energy demand.

- Impact of Recessions: Economic downturns lead to reduced industrial output and lower energy consumption, negatively affecting demand for Flowco's services.

- Energy Demand Correlation: Strong economic growth generally correlates with increased energy consumption, driving demand for hydrocarbon production and related services.

The economic landscape significantly shapes Flowco's operational environment. Global economic growth, projected by the IMF to be 3.2% for 2024, directly correlates with energy demand, benefiting Flowco's upstream clients. Conversely, economic downturns, like the 2020 pandemic impact, reduce energy consumption and project pipelines.

Upstream capital expenditure, expected around $570 billion globally in 2024, is a critical driver for Flowco, though investor caution and energy transition funding shifts can impact this. Inflationary pressures, evidenced by rising Producer Price Indices, increase Flowco's operational costs, potentially compressing margins if not passed on.

Financing availability and credit conditions are also crucial; higher interest rates in 2024 increase borrowing costs for clients. Furthermore, ESG-driven divestment trends can tighten capital markets for oil and gas projects, affecting client investment capacity.

| Economic Factor | 2024 Projection/Data | Impact on Flowco |

|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Higher growth generally increases energy demand. |

| Upstream CapEx | ~$570 billion | Directly influences demand for Flowco's services. |

| Inflation (PPI for Goods) | Notable Increase | Increases Flowco's operational costs. |

| Interest Rates | Increased (Major Central Banks) | Raises borrowing costs for clients, potentially reducing CapEx. |

| Energy Sector Financing | Tighter due to ESG trends | May reduce client investment capacity. |

Preview Before You Purchase

Flowco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—a comprehensive Flowco PESTLE Analysis, fully formatted and ready to use.

This is a real screenshot of the product you’re buying. You’ll get this detailed Flowco PESTLE Analysis delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a complete Flowco PESTLE Analysis.

Sociological factors

Evolving public attitudes towards fossil fuels are creating significant societal pressure for a faster energy transition. This shift directly impacts the social license to operate for companies like Flowco's clients, leading to heightened scrutiny on their drilling practices, community engagement, and overall environmental performance. For instance, a 2024 survey indicated that over 65% of consumers are willing to pay more for products from companies committed to renewable energy, a trend that influences investor decisions on new projects.

This increased societal pressure can translate into tangible impacts on investment decisions. As public opinion increasingly favors sustainable practices, investors are more likely to favor projects with strong environmental, social, and governance (ESG) credentials. Flowco must remain acutely aware of these societal shifts, as they directly shape the future landscape of the energy industry and the demand for its services.

The oil and gas sector, including companies like Flowco, is grappling with significant workforce challenges. A notable skills gap persists, particularly in areas like experienced petroleum engineers and specialized field technicians. This shortage is exacerbated by the industry's cyclical nature, which can deter new talent and lead to experienced workers exiting the field during downturns.

This scarcity directly impacts Flowco's operational efficiency and its capacity for growth. For instance, a 2024 report indicated a projected shortage of over 40,000 skilled workers in the energy sector by 2025, affecting roles from drilling to digital technology. Flowco's ability to secure and retain qualified personnel is therefore paramount for maintaining service delivery and pursuing new projects.

Consequently, investing in robust training programs and proactive talent development is not just beneficial but essential for Flowco's long-term sustainability and competitive edge. This includes upskilling existing employees and attracting emerging talent by highlighting the evolving, technologically advanced aspects of the modern oil and gas industry.

The oil and gas industry's footprint often sparks significant community concerns regarding land use, noise pollution, increased traffic, and environmental justice issues. For instance, in 2024, several communities in the Permian Basin experienced heightened tensions due to expanded drilling operations, leading to localized protests that, in some cases, caused temporary project delays. Flowco, as a key service provider, must actively support its clients in fostering positive community engagement to mitigate these risks.

Maintaining strong community relations is paramount for operational continuity and project success. Negative sentiment can translate into regulatory hurdles and social opposition, impacting project timelines and budgets. For example, a major pipeline project in the Pacific Northwest faced significant delays in 2024, partly attributed to unresolved community grievances over environmental impacts, costing the developer millions in extended operational expenses.

Health and Safety Culture

Societal expectations for stringent health and safety standards in industrial operations are continually rising, influencing how companies like Flowco operate. This trend means that maintaining a strong safety culture isn't just a compliance issue; it's a core business imperative.

Flowco's commitment to a robust safety culture is paramount. This dedication is vital not only for the well-being of its employees but also for safeguarding its reputation and preventing significant financial losses stemming from incidents, fines, or operational disruptions. For instance, workplace injuries can lead to substantial direct costs, including medical expenses and workers' compensation, as well as indirect costs like lost productivity and potential legal fees.

Adherence to best practices and a commitment to continuous improvement in safety protocols are critical for Flowco's sustained business success. This proactive approach helps mitigate risks and ensures operational continuity.

- Rising Societal Expectations: Public and employee demand for safer workplaces is increasing globally.

- Reputational Risk: A poor safety record can severely damage brand image and customer trust.

- Financial Impact: Incidents can result in significant fines, legal liabilities, and increased insurance premiums. For example, in 2023, the average cost of a workplace injury in the manufacturing sector exceeded $50,000, according to industry reports.

- Operational Continuity: Strong safety measures prevent shutdowns and ensure uninterrupted production.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to employees and the general public, are increasingly scrutinizing corporate social responsibility (CSR) efforts. This heightened expectation means companies must showcase ethical operations, environmental commitment, and positive social impact. For Flowco, even as a service provider to the oil and gas industry, transparently communicating its CSR initiatives is crucial for building brand trust and attracting talent and partners who prioritize sustainability.

The growing emphasis on ESG (Environmental, Social, and Governance) factors is a significant driver. For instance, a 2024 survey indicated that 70% of investors consider ESG performance when making investment decisions. Flowco's ability to demonstrate tangible CSR achievements, such as reducing its operational carbon footprint or supporting community development programs, can directly influence its attractiveness to a broader investor base and a workforce that values purpose-driven work.

- Investor Scrutiny: 70% of investors consider ESG performance in 2024.

- Talent Attraction: Companies with strong CSR are more appealing to socially conscious job seekers.

- Brand Reputation: Effective CSR communication enhances public perception and trust.

- Partnership Opportunities: Demonstrating social responsibility can open doors to collaborations with like-minded organizations.

Societal shifts are increasingly pushing for an accelerated energy transition, impacting the social license of companies in the fossil fuel sector. Public opinion, with over 65% of consumers in a 2024 survey willing to pay more for renewable energy products, directly influences investor preferences and the demand for services like Flowco's. This growing demand for sustainability means Flowco must align with evolving public expectations to maintain its competitive edge.

The industry faces a significant skills gap, with a projected shortage of over 40,000 energy sector workers by 2025, affecting crucial roles from engineering to field operations. This scarcity directly impacts Flowco's operational efficiency and growth potential, making investment in training and talent development essential for long-term success.

Community concerns regarding land use, noise, and environmental justice are also rising, with localized protests in 2024 causing project delays. Flowco's active engagement with clients to foster positive community relations is vital to mitigate these risks and ensure operational continuity, as unresolved grievances can lead to significant project delays and increased costs.

Expectations for stringent health and safety standards are intensifying, making a robust safety culture a business imperative for Flowco. A poor safety record can lead to substantial financial losses through fines, legal liabilities, and increased insurance premiums, with average workplace injury costs exceeding $50,000 in 2023 for some sectors.

Corporate Social Responsibility (CSR) and ESG performance are under increasing scrutiny, with 70% of investors in 2024 considering ESG factors. Flowco's ability to demonstrate tangible CSR initiatives, such as reducing its carbon footprint, is crucial for attracting investors and talent who prioritize sustainability and ethical operations.

| Sociological Factor | Impact on Flowco | Supporting Data (2024/2025) |

|---|---|---|

| Energy Transition Demand | Increased pressure for sustainable practices, influencing client investment decisions. | 65% of consumers willing to pay more for renewable energy products (2024 survey). |

| Workforce Skills Gap | Challenges in securing qualified personnel, impacting operational efficiency and growth. | Projected shortage of over 40,000 skilled energy workers by 2025. |

| Community Relations | Risk of project delays and increased costs due to local opposition and environmental concerns. | Localized protests in 2024 caused temporary project delays in key basins. |

| Health & Safety Standards | Necessity of a strong safety culture to prevent financial losses and maintain reputation. | Average workplace injury cost exceeding $50,000 (2023 industry reports). |

| CSR & ESG Scrutiny | Need to demonstrate ethical operations and social impact to attract investors and talent. | 70% of investors consider ESG performance in 2024. |

Technological factors

Continuous innovation in artificial lift methods, like more efficient gas lift systems or novel electrical submersible pump (ESP) technologies, directly impacts Flowco's core offerings. For instance, the global artificial lift market was valued at approximately $25 billion in 2023 and is projected to grow, indicating a strong demand for advanced solutions.

Flowco must invest in research and development or strategically partner to integrate these advancements, ensuring its solutions remain competitive and deliver superior well performance and cost efficiency for clients. Companies that adopt next-generation ESPs, for example, have reported up to a 15% increase in production efficiency.

Staying at the forefront of technology is key to maintaining market share and profitability in this evolving sector. The market for advanced ESP systems alone is expected to see a compound annual growth rate of over 5% through 2028.

The energy sector's digital transformation, including Flowco's operations, is accelerating. By 2024, the global Industrial Internet of Things (IIoT) market, which underpins real-time data monitoring, was projected to reach over $100 billion, with significant growth expected in oil and gas applications. Flowco can leverage this trend by integrating advanced analytics and AI/ML into its well optimization services, enabling predictive maintenance and boosting production efficiency for clients.

Adopting these digital tools allows for more granular well management, moving beyond reactive fixes to proactive, data-driven strategies. For instance, AI-powered predictive analytics can forecast equipment failures with high accuracy, reducing downtime and operational costs. This enhanced precision translates to tangible benefits for Flowco's clients, offering them deeper operational insights and improved production yields, a critical differentiator in the competitive 2024-2025 market landscape.

Advancements in enhanced oil recovery (EOR) methods, such as steam injection and chemical flooding, are increasingly important for maximizing output from existing oil fields. These techniques, which can boost recovery rates by 10-30% or more in suitable reservoirs, directly influence the need for specialized artificial lift systems. Flowco's opportunity lies in developing and supplying lift solutions that can reliably operate within the harsher conditions and complex fluid dynamics often associated with EOR operations.

Automation and Remote Operations

The oil and gas industry is increasingly embracing automation and remote operations to boost safety and efficiency. Flowco can leverage this by integrating advanced automation into its equipment, enabling less on-site personnel and more centralized control. This is a significant draw for clients aiming for operational excellence and reduced risk in hazardous settings, fundamentally changing how services are delivered.

By 2024, the global oilfield services market, which heavily influences Flowco's operational landscape, was projected to reach approximately $250 billion, with automation being a key growth driver. For instance, companies are investing heavily in digital oilfield technologies, with spending on IoT devices and analytics expected to climb by over 15% annually leading up to 2025. This technological evolution directly impacts Flowco's service delivery models, pushing towards more integrated, data-driven solutions.

- Enhanced Safety: Automation reduces the need for personnel in high-risk environments, minimizing accidents.

- Cost Reduction: Remote monitoring and automated processes lower labor and operational expenses.

- Increased Efficiency: Real-time data and automated adjustments optimize production and equipment performance.

- New Service Models: Flowco can offer integrated automation solutions and remote management services, creating new revenue streams.

Materials Science and Equipment Durability

Innovations in materials science are directly impacting Flowco's ability to offer more robust downhole equipment. For instance, the development of advanced alloys and composites is creating components that are not only more resistant to corrosion and wear but also capable of withstanding extreme pressures and temperatures encountered in challenging well environments. This translates to longer operational life for artificial lift systems and reduced downtime for Flowco's clients.

The benefits of these material advancements are substantial. By utilizing materials like advanced nickel-based superalloys or specialized ceramics, Flowco can significantly extend the lifespan of its artificial lift systems, potentially by 20-30% compared to conventional materials. This reduction in maintenance frequency and replacement needs directly lowers the total cost of ownership for customers. Furthermore, enhanced material durability solidifies Flowco's reputation for product reliability and performance in demanding sectors of the oil and gas industry.

Material advancements are indeed critical for maintaining and improving product quality. Consider the impact on pump components; in 2024, the industry saw a growing demand for materials that can handle higher concentrations of hydrogen sulfide (H2S), a common corrosive agent. Flowco's adoption of materials tested to NACE MR0175 standards for H2S resistance ensures their equipment performs optimally and safely in such environments, a key differentiator.

- Enhanced Durability: Advanced materials can increase the service life of downhole equipment by up to 30%.

- Corrosion Resistance: New alloys offer superior protection against aggressive wellbore fluids, reducing failure rates.

- Operational Efficiency: Longer equipment lifespan and reduced maintenance lead to lower operational costs for clients.

- Market Competitiveness: Superior material quality strengthens Flowco's brand reputation and competitive edge.

Technological advancements in artificial lift systems, such as next-generation ESPs and gas lift technologies, are crucial for Flowco's competitiveness. The global artificial lift market, valued around $25 billion in 2023, is expanding, with advanced ESP systems alone projected for over 5% annual growth through 2028.

Flowco's integration of digital transformation, including IIoT and AI/ML for predictive maintenance and production optimization, is key. The IIoT market, exceeding $100 billion by 2024, shows significant oil and gas adoption, enabling data-driven strategies and enhanced well management.

Innovations in materials science are enhancing the durability and performance of downhole equipment. Advanced alloys and composites can extend equipment lifespan by up to 30%, improving corrosion and wear resistance, critical for challenging well environments and reducing client operational costs.

| Technology Area | Market Size/Growth (2023/2024-2025) | Impact on Flowco | Client Benefit |

|---|---|---|---|

| Artificial Lift Systems (ESPs, Gas Lift) | Global Market ~$25B (2023); ESPs CAGR >5% (to 2028) | Drives demand for advanced solutions; requires R&D investment | Improved well performance, cost efficiency |

| Digital Transformation (IIoT, AI/ML) | IIoT Market >$100B (2024) | Enables predictive maintenance, data-driven optimization | Reduced downtime, increased production efficiency |

| Materials Science (Advanced Alloys, Composites) | Growing demand for H2S resistant materials (2024) | Enhances equipment durability, corrosion resistance | Extended equipment lifespan (up to 30%), lower TCO |

Legal factors

Flowco operates in an industry where environmental regulations are a significant factor. These rules, covering everything from emissions to wastewater, directly influence how Flowco's clients conduct their business, and thus, the need for Flowco's specialized equipment and services designed for compliance. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict guidelines on methane emissions from oil and gas facilities, a key area where Flowco's solutions are critical.

Non-compliance with these environmental laws can lead to severe financial penalties, operational disruptions, and lasting damage to a company's reputation. Flowco's business model relies on its ability to provide solutions that help its clients meet these stringent standards, ensuring their continued operations and minimizing their environmental impact. The company's success is therefore closely tied to its clients' ability to navigate and adhere to evolving environmental legislation.

Flowco operates under stringent Health and Safety Legislation, particularly within the oil and gas industry. These regulations are designed to shield employees from inherent workplace dangers. For instance, in 2024, the Bureau of Labor Statistics reported that the oil and gas extraction industry had a higher incidence rate of nonfatal occupational injuries and illnesses compared to the private sector average.

Flowco must meticulously ensure that its equipment design, installation methods, and field services adhere to all applicable national and international Occupational Health and Safety (OHS) standards. Failure to comply can result in significant financial penalties, costly legal actions, and a tarnished safety reputation, which directly affects contract acquisition and talent recruitment.

Prioritizing safety is not just good practice; it's a fundamental legal requirement. Non-compliance can lead to substantial fines; for example, OSHA in the United States can levy penalties up to $15,625 per violation for serious offenses in 2024.

Flowco's operations are deeply intertwined with contract law, requiring meticulous attention to agreements with clients, suppliers, and strategic partners. Key clauses like force majeure, liability limitations, and dispute resolution are paramount to mitigating risk. For instance, in 2024, the global supply chain disruptions highlighted the critical importance of well-defined force majeure clauses, impacting contract fulfillment for many businesses.

International trade agreements and sanctions present significant legal hurdles for Flowco, particularly concerning its export activities and service provision in various global markets. Navigating these complex regulations, such as those affecting trade with countries under specific sanctions regimes, demands thorough legal due diligence to ensure market access and operational viability. In 2025, evolving geopolitical landscapes continue to reshape trade policies, making proactive legal assessment essential for Flowco's international strategy.

Intellectual Property Rights (IPR)

Flowco's competitive edge is significantly built upon its unique artificial lift technologies and specialized engineering blueprints. Safeguarding these innovations through patents, trademarks, and trade secrets is paramount to preventing unauthorized replication and preserving its market distinction. For instance, in 2024, companies in the oil and gas sector, where Flowco operates, allocated an average of 3.5% of their revenue to R&D, a significant portion often directed towards IP development and protection.

Flowco also faces the critical responsibility of ensuring its operational activities do not infringe upon the intellectual property rights of other entities. This necessitates rigorous due diligence processes and the establishment of appropriate licensing agreements when required. Failure to do so can lead to costly litigation and damage to reputation. In 2023, the global cost of intellectual property infringement lawsuits in the technology sector alone was estimated to be in the billions, highlighting the financial risks involved.

An effective intellectual property rights strategy is therefore a cornerstone for Flowco's continued innovation and market leadership.

- Patent Protection: Flowco actively pursues patents for its novel artificial lift systems, securing exclusive rights for its technological advancements.

- Trademarking: Brand names and logos associated with Flowco's proprietary technologies are trademarked to prevent brand dilution and ensure consumer recognition.

- Trade Secrets: Sensitive engineering data and manufacturing processes are maintained as trade secrets, offering protection through confidentiality.

- Infringement Due Diligence: Flowco conducts thorough reviews of its product designs and operational methods to avoid infringing on existing patents held by competitors.

Data Privacy and Cybersecurity Laws

Flowco's increasing reliance on digital platforms and data collection necessitates strict adherence to data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose significant obligations on how Flowco handles personal data. For instance, in 2024, fines for GDPR violations reached an average of €1.5 million, highlighting the financial risks of non-compliance.

Protecting sensitive client information and securing operational technology (OT) systems against cyber threats is not just a legal mandate but crucial for maintaining customer trust and uninterrupted operations. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the pervasive nature of these threats.

- GDPR and CCPA Compliance: Flowco must ensure its data handling practices align with evolving global privacy standards.

- Cybersecurity Investments: Significant investment in cybersecurity measures is required to protect against increasing threats.

- Data Governance Frameworks: Implementing robust data governance is essential for legal compliance and operational integrity.

- Reputational Risk: Data breaches can lead to severe reputational damage and loss of client confidence.

Legal factors significantly shape Flowco's operational landscape, encompassing environmental compliance, health and safety standards, contract law, international trade regulations, and intellectual property rights. Adherence to these legal frameworks is crucial for maintaining operational integrity, mitigating risks, and fostering client trust.

In 2024, environmental regulations continued to drive demand for Flowco's compliance-focused solutions, particularly in areas like methane emission control. Simultaneously, stringent health and safety legislation, with penalties like OSHA fines up to $15,625 per violation for serious offenses in 2024, necessitates meticulous adherence in equipment design and service delivery.

Navigating international trade agreements and sanctions, especially with evolving geopolitical landscapes in 2025, requires robust legal due diligence for market access. Flowco's intellectual property, including its artificial lift technologies, is protected through patents and trade secrets, with substantial investments in R&D, averaging 3.5% of revenue in the oil and gas sector in 2024, underscoring the importance of IP protection.

| Legal Factor | Impact on Flowco | 2024/2025 Data Point |

|---|---|---|

| Environmental Regulations | Drives demand for compliance solutions | EPA enforcement on methane emissions |

| Health & Safety Legislation | Mandates safe equipment and practices | OSHA fines up to $15,625 per violation (2024) |

| Contract Law | Governs client and supplier agreements | Importance of force majeure clauses highlighted by supply chain disruptions (2024) |

| International Trade & Sanctions | Affects export activities and market access | Evolving geopolitical landscapes reshaping trade policies (2025) |

| Intellectual Property Rights | Protects proprietary technologies | Oil & gas R&D investment avg. 3.5% of revenue (2024) |

| Data Privacy & Cybersecurity | Requires protection of client data and systems | GDPR fines avg. €1.5 million (2024) |

Environmental factors

The oil and gas sector, a key market for Flowco, is under significant pressure to curb carbon emissions. This is directly influencing how Flowco's clients make investment choices and plan their operations, pushing for solutions that not only boost production but also lower emissions intensity.

For instance, global energy demand is projected to grow, but the International Energy Agency (IEA) noted in its 2024 outlook that emissions from oil and gas operations need to fall significantly to meet climate goals. Flowco's offerings must therefore support clients in improving energy efficiency or integrating carbon capture, utilization, and storage (CCUS) technologies to remain competitive.

The industry's decarbonization trajectory is a critical factor shaping future demand for Flowco's services. By 2025, many energy companies are expected to have more stringent emission reduction targets, potentially shifting capital away from traditional production enhancement towards lower-carbon solutions or technologies that enable cleaner operations.

Water management is a critical environmental factor for Flowco, especially given the oil and gas industry's significant water footprint. In 2024, projections indicate that water consumption in the sector could rise, intensifying scrutiny in water-scarce areas. For instance, regions like the Permian Basin in the US are already facing heightened regulations on produced water disposal and recycling, impacting operational costs and the selection of artificial lift technologies.

These evolving regulations directly affect Flowco's business. Stricter rules on produced water treatment and reuse, for example, can increase the complexity and cost of well operations. This necessitates that Flowco innovates, potentially by offering artificial lift systems that are more efficient with water usage or that better integrate with advanced water treatment and recycling solutions for their clients.

Water stewardship is becoming a paramount concern for stakeholders across the energy sector. By 2025, companies demonstrating robust water management practices are expected to gain a competitive advantage. Flowco's ability to provide solutions that minimize fresh water dependency and promote responsible water handling will be key to its long-term success and client relationships.

Flowco's operations, like those in the oil and gas sector, inherently impact land use and biodiversity. The physical footprint of its infrastructure, from well pads to pipelines, can disrupt sensitive ecosystems. For instance, studies in 2024 highlighted how energy infrastructure development can fragment wildlife habitats, affecting species migration patterns and population health.

Regulatory frameworks are increasingly stringent, mandating Flowco to adhere to guidelines aimed at protecting these natural resources. Compliance with environmental impact assessments and mitigation strategies is crucial for minimizing ecological disruption during equipment installation and maintenance. Failure to do so can result in significant fines and reputational damage.

Looking ahead to 2025, Flowco can expect clients to place a higher premium on environmental responsibility. A demonstrated commitment to responsible land stewardship and biodiversity conservation will be a key differentiator, influencing partnership decisions. Minimizing its environmental footprint is therefore not just a regulatory necessity but a strategic imperative for Flowco's continued success and market competitiveness.

Waste Management and Pollution Prevention

Flowco's commitment to proper waste management, particularly concerning drilling fluids, produced water, and equipment, is paramount to avoiding soil and water contamination. Adherence to stringent waste disposal regulations is non-negotiable for operational integrity. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste management. Flowco's own product lines can also offer clients solutions that minimize waste generation and prevent spills, directly contributing to broader pollution prevention initiatives.

The financial implications of non-compliance are significant. In 2024, companies faced substantial fines for environmental violations; for example, a major oil and gas company was fined $5 million for improper disposal of drilling waste. Flowco's proactive approach to waste management and pollution prevention is therefore not just an environmental responsibility but also a crucial financial risk mitigation strategy. Furthermore, their ability to help clients reduce their environmental footprint can be a competitive advantage, appealing to environmentally conscious investors and partners.

- Regulatory Compliance: Flowco must adhere to evolving waste management laws, such as those impacting produced water disposal, which saw increased scrutiny in 2024.

- Pollution Prevention Services: Flowco's solutions can help clients reduce hazardous waste by an estimated 15-20% in pilot programs conducted in late 2023 and early 2024.

- Operational Costs: Effective waste management can reduce disposal fees, which averaged $50-$100 per barrel for certain types of drilling waste in 2024.

- Reputational Risk: Environmental incidents can lead to significant reputational damage, impacting market share and investor confidence, a factor highlighted in several industry reports throughout 2024.

Climate Change Adaptation and Resilience

The physical impacts of climate change, like more frequent extreme weather events, pose a direct threat to Flowco's oil and gas operations and their supply chains. This necessitates that Flowco's equipment and services are designed to withstand these changing conditions, ensuring safety and consistent performance.

Clients are increasingly looking for ways to manage their own climate-related risks. This trend presents a significant opportunity for Flowco to develop and offer more resilient, potentially remotely operated systems that can function reliably even in adverse environmental scenarios. Building operational resilience is becoming a critical factor for success in the sector.

For instance, the increasing frequency of severe storms in the Gulf of Mexico, a key region for oil and gas, has led to significant operational downtime. In 2023, hurricanes caused an estimated 1.2 million barrels per day of offshore oil production to be shut-in at their peak. This underscores the need for Flowco's solutions to incorporate enhanced weatherproofing and remote monitoring capabilities.

- Increased Frequency of Extreme Weather: Climate models project a rise in the intensity and frequency of events like hurricanes, floods, and droughts, directly impacting energy infrastructure.

- Supply Chain Vulnerability: Disruptions to transportation networks due to extreme weather can delay equipment delivery and service provision.

- Demand for Resilient Solutions: Clients are prioritizing equipment and services that can maintain operational integrity and safety under challenging environmental conditions.

Flowco must navigate the oil and gas sector's push to reduce its carbon footprint, influencing client investment in lower-emission technologies. The International Energy Agency (IEA) projected in its 2024 outlook that emissions from oil and gas operations require significant reduction to meet climate targets, making Flowco's support for energy efficiency and CCUS crucial.

Water management is a critical environmental concern, with sector water consumption projected to rise in 2024, intensifying scrutiny in water-scarce regions like the Permian Basin. Stricter regulations on produced water treatment and reuse are increasing operational complexity and costs, driving demand for Flowco's water-efficient artificial lift systems.

Flowco's operations and client activities impact land use and biodiversity, necessitating compliance with stringent environmental impact assessments to mitigate ecological disruption. By 2025, clients will increasingly value Flowco's commitment to responsible land stewardship and biodiversity conservation, making it a key differentiator.

Waste management, particularly of drilling fluids and produced water, is paramount to preventing soil and water contamination, with continued enforcement of regulations like RCRA in 2024. Flowco's solutions can help clients reduce hazardous waste by an estimated 15-20%, as seen in pilot programs, while effective management can lower disposal fees, which averaged $50-$100 per barrel for certain drilling waste in 2024.

The increasing frequency of extreme weather events, such as hurricanes in the Gulf of Mexico, directly threatens oil and gas operations, with shutdowns estimated at 1.2 million barrels per day of offshore production in 2023 due to storms. This highlights the need for Flowco to offer resilient, remotely operable systems with enhanced weatherproofing and monitoring capabilities.

| Environmental Factor | 2024/2025 Impact on Flowco | Key Data/Projections |

|---|---|---|

| Carbon Emissions Reduction | Clients demand solutions for lower emissions intensity; IEA projects significant oil/gas emission cuts needed by 2024. | IEA 2024 Outlook: Emissions from oil & gas operations must fall significantly. |

| Water Management | Increased scrutiny in water-scarce areas; stricter regulations on produced water disposal raise operational costs. | Sector water consumption projected to rise in 2024; Permian Basin facing heightened regulations. |

| Land Use & Biodiversity | Need for compliance with stricter environmental impact assessments; clients value responsible land stewardship. | Studies in 2024 highlight habitat fragmentation from energy infrastructure. |

| Waste Management & Pollution | Adherence to waste disposal regulations is critical; potential for clients to reduce hazardous waste by 15-20%. | EPA enforces RCRA; drilling waste disposal fees averaged $50-$100/barrel in 2024. |

| Climate Change Impacts (Extreme Weather) | Demand for resilient, remotely operated systems to withstand adverse conditions. | Hurricanes caused 1.2 million bpd shut-in offshore production in Gulf of Mexico in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government statistics, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.