Flowco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowco Bundle

Flowco's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for strategic planning and identifying opportunities for growth.

The complete report reveals the real forces shaping Flowco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Flowco's reliance on specialized artificial lift equipment and digital solutions from a limited number of providers significantly enhances supplier bargaining power. The proprietary nature of some advanced technologies, crucial for well optimization and gas/plunger lift systems, creates a dependency that suppliers can leverage. For instance, in 2024, the global market for oilfield services equipment, including artificial lift systems, saw continued demand driven by upstream activity, with key component manufacturers often holding strong pricing positions due to R&D investments and patent protection.

Flowco's reliance on highly skilled engineers, technicians, and field service personnel for critical operations like equipment installation and ongoing support highlights the significant bargaining power of labor suppliers. A scarcity of specialized talent within the oil and gas industry, a trend observed throughout 2024, directly amplifies the leverage these skilled individuals possess. For instance, reports from the Bureau of Labor Statistics in late 2023 indicated a growing shortage in skilled trades, impacting sectors like energy infrastructure. Flowco's capacity to attract and retain this top-tier talent is therefore a direct determinant of its service quality and operational efficiency, giving skilled labor substantial influence.

Suppliers of essential raw materials like specialized metals and critical components for artificial lift systems possess considerable bargaining power. This is particularly true when these inputs face price volatility or experience disruptions in global supply chains. For instance, the price of nickel, a key component in many alloys used in oilfield equipment, saw significant fluctuations in early 2024, impacting manufacturing costs for companies like Flowco.

Geopolitical events and rising protectionist policies worldwide continue to put pressure on global energy supply chains. This can translate into higher input costs and extended lead times for manufacturers. In 2024, ongoing trade disputes and regional conflicts have exacerbated these supply chain vulnerabilities, making reliable sourcing a significant challenge.

Flowco's investment in and utilization of its internal manufacturing facilities in Houston and Fort Worth serve as a strategic advantage, allowing for greater control over production processes and a degree of insulation from supplier power. By managing a larger portion of its manufacturing in-house, Flowco can mitigate some of the risks associated with external supplier dependence and potential price hikes.

Digital and Automation Software Vendors

The bargaining power of digital and automation software vendors is significant for Flowco, especially as the oil and gas industry increasingly relies on these technologies. Vendors providing advanced AI and IoT solutions for well optimization hold considerable sway because their tools are crucial for boosting efficiency and cutting operational expenses. For instance, the global industrial automation market, which includes software, was projected to reach over $200 billion by 2024, highlighting the critical nature of these solutions.

Flowco's reliance on these specialized software providers for real-time monitoring, predictive maintenance, and control systems means that switching costs can be high. If a vendor offers unique, proprietary digital technologies that are deeply integrated into Flowco's own product offerings, their power increases. This dependence can lead to price increases or stricter contract terms from the software suppliers.

- Criticality of Technology: AI and IoT solutions for well optimization are essential for efficiency gains, giving vendors leverage.

- High Switching Costs: Deep integration of proprietary software makes it costly and complex for Flowco to switch vendors.

- Market Growth: The expanding industrial automation market, expected to exceed $200 billion by 2024, underscores the value and demand for these digital solutions.

- Vendor Differentiation: Suppliers offering unique, advanced capabilities can command higher prices and more favorable terms.

Logistics and Transportation Services

The reliable delivery and deployment of Flowco's artificial lift equipment, often to remote oil and gas fields, heavily depend on robust logistics and transportation services. These providers hold significant sway, particularly when supply chain disruptions occur.

In 2025, reports indicated that global shipping costs saw an average increase of 15% due to factors like fuel price volatility and port congestion, directly impacting the bargaining power of logistics firms. Flowco must therefore cultivate strong relationships with these essential service providers to mitigate potential delays and manage operational expenses effectively, ensuring timely and cost-efficient project execution.

- Dependence on Remote Operations: Flowco's need for specialized transport to remote oil and gas sites amplifies the importance of logistics providers.

- Supply Chain Vulnerabilities: Increased bottlenecks and costs in the broader energy supply chain, observed throughout 2024 and projected into 2025, grant these logistics companies greater leverage.

- Cost Management Imperative: Flowco's ability to maintain competitive pricing and operational efficiency hinges on its success in negotiating and managing these transportation contracts.

Flowco's dependence on a concentrated group of suppliers for critical, proprietary artificial lift technologies and digital solutions grants these providers substantial bargaining power. The specialized nature of these components, coupled with the significant R&D investment by manufacturers, often results in limited alternatives and high switching costs for Flowco. In 2024, the global oilfield services equipment market continued to see strong demand, allowing key component suppliers to maintain pricing leverage due to their technological advancements and patent protections.

The bargaining power of suppliers is amplified by the critical nature of their inputs and the potential for supply chain disruptions. For example, the price of nickel, a vital alloy component for oilfield equipment, experienced significant volatility in early 2024, directly impacting manufacturing costs for Flowco. Geopolitical instability and protectionist policies in 2024 further strained global energy supply chains, leading to higher input costs and extended lead times, thereby increasing supplier leverage.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Flowco | 2024/2025 Relevance |

|---|---|---|---|

| Artificial Lift Technology Providers | Proprietary technology, R&D investment, limited alternatives | Higher component costs, potential for dependency | Continued strong demand in oilfield services market |

| Digital & Automation Software Vendors | AI/IoT integration, high switching costs, market growth | Increased software licensing fees, potential for vendor lock-in | Industrial automation market projected to exceed $200 billion by 2024 |

| Raw Material Suppliers (e.g., Nickel) | Price volatility, supply chain disruptions | Increased manufacturing expenses, potential production delays | Nickel price fluctuations observed in early 2024 |

| Logistics & Transportation Services | Dependence on remote operations, supply chain bottlenecks | Higher shipping costs, potential for project delays | Global shipping costs increased by ~15% in 2025 due to fuel prices and congestion |

What is included in the product

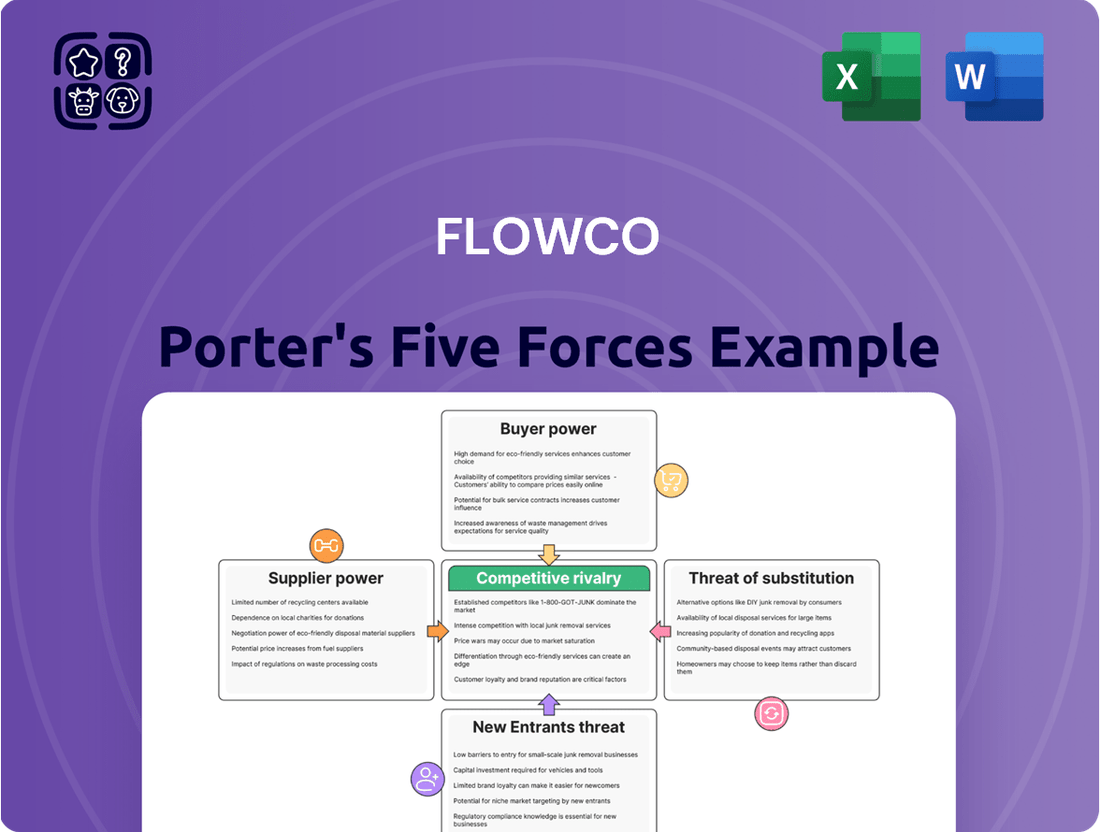

Flowco's Porter's Five Forces Analysis dissects the competitive intensity within its industry, evaluating threats from new entrants, substitutes, buyer and supplier power, and rivalry among existing competitors.

Instantly identify and address competitive threats with a visual breakdown of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Customers Bargaining Power

Flowco's customers are primarily oil and gas companies, a sector that has experienced considerable consolidation. For instance, in 2023, the Permian Basin alone saw several major mergers and acquisitions, creating larger, more powerful entities. These consolidated clients, due to their sheer size and the vast quantities of services they procure, wield significant bargaining power.

This amplified purchasing power allows these major oil and gas operators to negotiate aggressively on pricing, demand highly specialized and tailored service packages, and secure more advantageous contract terms. Their ability to switch suppliers or bring services in-house if terms are not met further strengthens their position.

While customers can choose from various artificial lift providers, the actual cost of switching existing installed systems is substantial. This includes expenses for new equipment, potential operational downtime during the transition, and the need for re-engineering processes. For instance, a typical switch-out of a downhole artificial lift system could incur costs ranging from tens of thousands to hundreds of thousands of dollars, depending on the complexity and depth of the well.

Flowco's strategy of offering integrated solutions, encompassing everything from initial engineering design and installation to continuous operational support, is designed to lock in customers. This holistic approach makes it more challenging for clients to move to a competitor once Flowco's systems are in place, effectively increasing customer stickiness and reducing their bargaining power.

Oil and gas producers are intensely focused on boosting efficiency and cutting costs, particularly in established fields and challenging unconventional plays. This persistent drive for cost-effectiveness means customers wield significant power to negotiate pricing and service agreements.

For instance, in 2024, the average breakeven cost for oil production globally hovered around $60 per barrel, a figure that producers are constantly striving to lower. This economic pressure directly translates to customer leverage.

Flowco's strategy to maximize its own operational efficiency and output directly supports these customer priorities, aligning its goals with the industry's overarching demand for reduced expenditures and enhanced performance.

Access to Multiple Artificial Lift Technologies

Customers benefit from a wide array of artificial lift technologies, encompassing gas lift, plunger lift, and electric submersible pumps (ESPs) from numerous suppliers. This extensive choice enables clients to thoroughly evaluate and select solutions tailored to their unique well parameters and financial goals, significantly enhancing their negotiating leverage.

The competitive landscape for artificial lift technologies is robust, featuring many established and emerging providers. For instance, in 2024, the global artificial lift market was valued at approximately $15 billion, with projections indicating steady growth driven by demand for enhanced oil recovery. This competitive intensity directly translates to greater customer bargaining power.

- Diverse Technology Options: Customers can choose from gas lift, plunger lift, ESPs, and other specialized systems.

- Supplier Competition: A large number of vendors offer these technologies, fostering competitive pricing and service.

- Cost Sensitivity: Well operators are highly attuned to the operational costs and efficiency gains offered by different lift systems.

- Technological Advancements: Continuous innovation in artificial lift provides customers with better performance and potentially lower lifecycle costs.

Customer Demand for Integrated Digital Solutions

Oil and gas firms are increasingly prioritizing integrated digital solutions to improve well performance through real-time monitoring, automation, and predictive maintenance. This trend signifies a growing customer demand for sophisticated, interoperable technologies.

Customers possessing advanced digital capabilities are well-positioned to negotiate for more advanced and seamlessly integrated solutions from providers like Flowco. This capability directly impacts pricing power and the structure of service offerings.

- Digital Transformation Investment: Global spending on digital transformation in the oil and gas sector was projected to reach over $60 billion in 2024, highlighting the strong customer drive for these solutions.

- Interoperability Demand: A 2023 survey indicated that 70% of oil and gas IT decision-makers consider system interoperability a critical factor when selecting new digital solutions.

- Flowco's Strategic Alignment: Flowco's commitment to developing and offering these integrated digital solutions directly addresses this escalating customer requirement, positioning it to meet market needs.

Flowco's customers, primarily large oil and gas corporations, possess significant bargaining power due to industry consolidation and intense cost pressures. For example, the global artificial lift market, valued at around $15 billion in 2024, features numerous suppliers competing for business, which benefits buyers. This allows clients to negotiate favorable pricing and demand tailored service packages, especially as they strive to lower production breakeven costs, which globally averaged around $60 per barrel in 2024.

| Factor | Impact on Flowco | Customer Leverage |

|---|---|---|

| Industry Consolidation | Larger clients negotiate more aggressively. | High |

| Cost Sensitivity | Customers demand lower prices and efficiency. | High |

| Supplier Competition | Customers have many alternatives. | High |

| Switching Costs | Significant expenses for new systems can limit customer flexibility. | Moderate |

| Integrated Digital Solutions | Customers with advanced digital capabilities demand sophisticated offerings. | High |

Same Document Delivered

Flowco Porter's Five Forces Analysis

This preview shows the exact Flowco Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed analysis is professionally formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

The artificial lift market, a crucial segment for oil and gas production, is characterized by a dynamic competitive landscape. While many smaller companies offer specialized solutions, the market is significantly shaped by a few dominant multinational corporations. These giants, including Schlumberger, Halliburton, Baker Hughes, and NOV Inc., command substantial market share due to their broad service offerings and extensive global operational footprints.

Flowco, a new entity formed through a merger in June 2024, is strategically positioned to contend for leadership in this arena, particularly in production optimization and artificial lift technologies. The market's growth trajectory, projected to reach approximately $30 billion by 2028 according to some industry analyses, intensifies the rivalry among these established and emerging players.

The artificial lift system market is booming, with global revenues expected to climb from $10.66 billion in 2024 to $11.57 billion in 2025. This rapid expansion, fueled by increasing energy needs and the development of older oil fields, naturally intensifies rivalry among established companies. They are all eager to secure a larger piece of this growing pie.

Innovation is the name of the game in this dynamic sector. Companies are fiercely competing on advancements like smart monitoring systems, digital twin technology, and automation solutions. These cutting-edge developments are crucial for gaining a competitive edge and meeting the evolving demands of the energy industry.

Competitive rivalry in the oil and gas services sector is significantly fueled by technological innovation. Companies are pouring substantial resources into research and development, aiming to refine their product portfolios and boost operational efficiency. This constant pursuit of technological superiority is a key driver of competition.

Flowco has strategically leveraged its proprietary digital technologies, securing patents for its gas-assisted plunger lift (GAPL) well optimization systems. This patent protection grants Flowco a distinct advantage, setting its offerings apart in a crowded market and reinforcing its competitive position.

Rival firms are also actively developing and implementing advanced smart systems. These systems are designed to enable remote monitoring and adjustments of operations, reflecting a broader industry trend towards digitalization and automation to enhance control and responsiveness.

Price Sensitivity and Cost Reduction Focus

In the current oil market, where prices can swing considerably, customers are keenly focused on keeping costs down. This means artificial lift providers like Flowco must offer competitive prices and clearly show how their solutions deliver a good return on investment. For instance, in 2024, many oil and gas producers reported increased capital discipline, prioritizing projects with shorter payback periods.

Flowco faces significant pressure to cut costs throughout its supply chain. These savings are directly passed on to customers, intensifying price competition. The industry's drive to maximize profits and extend the productive life of oil wells fuels this cost-conscious atmosphere.

- Customer Cost Sensitivity: Oil and gas operators in 2024 are highly attuned to expenditures, demanding clear ROI from artificial lift systems.

- Supply Chain Cost Reduction: Flowco must achieve substantial savings in its supply chain to remain competitive on pricing.

- Profitability and Well Longevity: The industry's focus on maximizing well profitability and extending economic lifespans directly translates into intense price pressure.

Mergers, Acquisitions, and Strategic Partnerships

The competitive rivalry within Flowco's industry is intensifying, marked by a surge in mergers, acquisitions, and strategic partnerships. This activity signals a dynamic market where companies are actively reshaping their positions to gain a competitive edge. Flowco itself is a product of a major merger that occurred in 2024, underscoring this trend.

Competitors are not standing still; they are also pursuing strategic maneuvers. These include launching innovative products and forging collaborations to bolster their market presence and capture greater market share. For instance, in early 2024, rival company AquaTech announced a strategic alliance with a leading technology firm to integrate advanced sensor technology into their water management solutions, aiming to differentiate their offerings.

- Industry Consolidation: Increased divestments and M&A activity are reshaping the competitive landscape.

- Flowco's Formation: The company's own establishment via a significant merger in 2024 highlights this trend.

- Competitor Strategies: Rivals are actively introducing new products and forming partnerships.

- Market Positioning: These actions are driven by the need to enhance market presence and secure strategic advantages.

The competitive rivalry in the artificial lift market is fierce, driven by innovation and customer cost sensitivity. Flowco, formed in a 2024 merger, faces established giants like Schlumberger and Halliburton, all vying for market share in a sector projected to reach $11.57 billion by 2025.

Companies are intensely competing on technological advancements, such as smart monitoring and automation, with Flowco holding patents for its GAPL systems. This innovation race is critical for differentiation and meeting the energy industry's evolving demands, especially as producers prioritize projects with shorter payback periods in 2024.

The intense focus on cost reduction throughout the supply chain is a major factor, directly impacting pricing strategies. Flowco must achieve significant savings to remain competitive, as the industry strives to maximize well profitability and extend operational life, leading to considerable price pressure.

Strategic maneuvers like mergers, acquisitions, and partnerships are reshaping the competitive landscape. Flowco's own formation via a 2024 merger exemplifies this trend, with rivals also actively launching new products and forging collaborations to enhance market presence and secure strategic advantages.

| Key Competitor | 2024 Market Focus | Innovation Area |

|---|---|---|

| Schlumberger | Broad service offerings, global operations | Digital solutions, automation |

| Halliburton | Integrated solutions, technology development | Smart monitoring, AI integration |

| Baker Hughes | Advanced artificial lift systems | Remote operations, predictive maintenance |

| NOV Inc. | Production optimization, efficiency improvements | IoT integration, data analytics |

| Flowco | Proprietary digital technologies, GAPL systems | Patented optimization solutions |

SSubstitutes Threaten

While artificial lift is a primary method for enhanced oil recovery (EOR), several other techniques can act as substitutes or complements. These include chemical injection, water flooding, and advanced drilling methods like refracturing, offering alternative pathways to boost production from mature fields.

As the industry actively seeks to optimize recovery from existing reserves, companies are increasingly assessing a wider spectrum of EOR solutions. For instance, in 2024, global EOR market growth is projected to continue, driven by the need for efficient production, with chemical EOR alone expected to see significant uptake.

Continuous innovation in drilling techniques, such as horizontal drilling and ultra-long lateral wells, directly impacts the demand for artificial lift systems. These advancements can significantly boost initial production rates and extend the natural flow period of wells, thereby reducing the immediate need for artificial lift solutions. For instance, advancements in hydraulic fracturing have allowed for much longer horizontal sections, increasing reservoir contact and initial flow without artificial assistance.

The drive for efficiency in the upstream sector, spurred by new mandates and a focus on optimizing production, further reinforces this trend. Automated drilling systems and improved well placement strategies are designed to maximize output from each well, potentially decreasing the reliance on costly artificial lift equipment. This shift means that companies investing in artificial lift technologies face a threat from these upstream operational improvements that enhance natural well performance.

The global energy landscape is undergoing a significant transformation, with a pronounced shift towards renewable energy sources. This trend directly impacts industries reliant on traditional hydrocarbon production, potentially influencing the long-term demand for artificial lift systems used in oil and gas extraction. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a substantial increase from previous years, signaling a growing momentum away from fossil fuels.

While oil and gas will likely remain crucial components of the global energy mix for the foreseeable future, escalating investments in alternatives like solar, wind, and hydrogen present a viable long-term substitute for energy production. By 2024, the International Energy Agency reported that investments in clean energy technologies were projected to reach $2 trillion globally, underscoring the significant capital flowing into these sectors.

This energy transition necessitates that oil and gas companies adapt by also investing in low-carbon technologies and diversifying their portfolios. This strategic pivot could lead to a gradual reduction in upstream investment for conventional oil and gas, consequently affecting the market for artificial lift solutions that support such operations.

Improved Natural Reservoir Management

Enhanced natural reservoir management presents a significant threat by reducing the reliance on artificial lift technologies, a core offering for many energy service companies. Advanced seismic imaging and the integration of vast datasets through cognitive fields are enabling more precise reservoir understanding and optimization. This leads to extended natural flow periods and delays the need for costly artificial lift installations.

Predictive analytics and AI are revolutionizing reservoir modeling, allowing for more accurate forecasting of production and identification of optimal extraction strategies. This proactive approach aims to maximize the natural lifespan and productivity of wells, thereby diminishing the demand for services that primarily focus on artificial lift solutions. For instance, companies are investing heavily in these technologies, with the global AI in oil and gas market projected to reach USD 5.1 billion by 2026, indicating a strong push towards optimizing natural production.

- Optimized Extraction: Technologies like advanced seismic analysis improve the understanding of subsurface geology, allowing for more efficient natural oil and gas extraction.

- Extended Well Life: Predictive analytics and AI-driven reservoir management can prolong the productive life of wells, delaying the need for artificial lift interventions.

- Reduced Artificial Lift Demand: As natural reservoir performance improves, the necessity for artificial lift systems, a key market for energy service providers, is reduced.

- Cost Savings for Operators: By maximizing natural flow, oil and gas operators can achieve significant cost savings, making them less dependent on external service providers for artificial lift solutions.

Cost-Effective Well Intervention and Optimization without Artificial Lift

The threat of substitutes for traditional artificial lift systems in well intervention is growing, particularly with advancements in cost-effective optimization. Solutions focusing on flow remediation technologies that reduce water production can significantly lower lifting costs, offering an alternative to energy-intensive artificial lift. For instance, some operators are seeing a 10-15% reduction in lifting costs by implementing these advanced intervention techniques.

Continuous innovation in well intervention and optimization methods presents a viable alternative to artificial lift, especially for wells experiencing decline. These methods aim to enhance well productivity and, importantly, reduce associated CO2 emissions. By improving the natural flow of hydrocarbons, these technologies can circumvent the need for artificial lift, thereby cutting operational expenses and environmental impact.

- Alternative Well Intervention: Technologies that remediate flow and reduce water production offer a substitute for artificial lift, potentially lowering lifting costs by 10-15%.

- Production Optimization: Innovations in well intervention can improve productivity and reduce CO2 emissions without relying on traditional artificial lift systems.

- Cost Savings: By enhancing natural flow, these methods can bypass the energy and capital expenditure associated with artificial lift.

The threat of substitutes for artificial lift systems is multifaceted, encompassing both technological advancements in oil and gas extraction and the broader energy transition. Improved natural reservoir management, leveraging AI and advanced analytics, can extend well productivity, reducing the immediate need for artificial lift. For example, the global AI in oil and gas market was projected to reach USD 5.1 billion by 2026, highlighting significant investment in optimizing natural production.

Furthermore, innovations in well intervention techniques, such as flow remediation that reduces water production, offer cost-effective alternatives. These methods can lower lifting costs by an estimated 10-15% and improve well productivity without the energy expenditure of artificial lift. The accelerating global shift towards renewable energy, with record renewable capacity additions reaching 510 gigawatts by the end of 2023, also presents a long-term substitute for fossil fuel-based energy production, indirectly impacting demand for oil and gas extraction technologies.

| Substitute Category | Key Technologies/Trends | Impact on Artificial Lift | Example Data/Projections |

|---|---|---|---|

| Enhanced Natural Reservoir Management | AI, Advanced Seismic Imaging, Predictive Analytics | Delays need for artificial lift, extends natural flow | AI in Oil & Gas Market: USD 5.1 billion by 2026 |

| Alternative Well Intervention | Flow Remediation, Reduced Water Production | Lowers lifting costs, bypasses artificial lift | Lifting Cost Reduction: 10-15% |

| Energy Transition | Renewable Energy Sources (Solar, Wind, Hydrogen) | Indirectly reduces long-term demand for fossil fuel extraction | Global Renewable Capacity Additions (2023): 510 GW |

Entrants Threaten

Entering the artificial lift solutions market demands significant upfront capital. Companies need to invest heavily in specialized manufacturing plants, cutting-edge machinery, and ongoing research and development to create unique technologies. For instance, Flowco's successful IPO in January 2025, which raised substantial funds for expansion and debt management, underscores the immense financial resources required to compete effectively in this sector. This considerable financial hurdle acts as a strong deterrent for many aspiring new players.

The artificial lift industry, particularly for sophisticated systems like high-pressure gas lift and digital optimization, requires a deep well of specialized engineering knowledge and advanced technological capabilities. This significant barrier makes it difficult for new players to enter and compete effectively. Flowco leverages its comprehensive suite of offerings, encompassing equipment, intricate engineering design, installation, and continuous support, to solidify its position.

Established players like Flowco, reinforced by its 2024 merger, leverage deep-seated relationships with major oil and gas operators. These partnerships are built on years of trust and a demonstrated ability to deliver critical production optimization solutions, creating a significant barrier for newcomers.

The oil and gas sector demands a high level of reliability and proven performance. New entrants face the arduous task of not only matching Flowco's technical capabilities but also replicating the extensive time and investment required to build a comparable reputation and secure the confidence of key industry players.

Regulatory and Environmental Hurdles

The oil and gas sector, including companies like Flowco, faces significant regulatory and environmental challenges. Navigating these complex requirements can be a substantial barrier for new entrants. For instance, in 2024, the global energy sector continued to grapple with evolving emissions standards and pressure for sustainable operations, demanding substantial upfront investment in compliance technology and processes.

Flowco's focus on methane abatement solutions is particularly relevant in this context. Methane emissions are a critical environmental concern, and regulatory bodies worldwide are intensifying their focus on reducing them. Companies entering the market must invest in technologies and strategies to meet these stringent environmental mandates, a cost that can deter new competitors.

- Increased compliance costs: New entrants must allocate significant capital to meet stringent environmental regulations, such as those related to carbon capture and storage or methane leak detection and repair.

- Environmental scrutiny: Public and governmental pressure for sustainable practices in the oil and gas industry is growing, requiring new players to demonstrate robust environmental stewardship from the outset.

- Flowco's competitive advantage: Flowco's existing methane abatement solutions position it favorably, as it already addresses a key environmental priority for the industry, potentially lowering the barrier for Flowco itself compared to new, unequipped entrants.

Economies of Scale and Supply Chain Integration

Economies of scale present a significant barrier for new entrants in the energy sector. Major incumbent energy companies, like ExxonMobil and Shell, leverage massive operational volumes to achieve lower per-unit costs in exploration, production, and refining. For instance, in 2024, the average capital expenditure for a new oil and gas project can easily run into billions of dollars, a sum prohibitive for most startups.

Supply chain integration further solidifies the position of established players. These companies control vast networks, from upstream resource extraction to downstream distribution. This integration allows them to mitigate risks associated with volatile energy prices and supply disruptions, a critical advantage in the current global economic climate. In 2023, the global energy supply chain faced significant challenges, with the International Energy Agency reporting extended lead times for critical equipment, making it harder for smaller, less integrated companies to secure necessary resources.

- Economies of Scale: Large energy firms benefit from cost advantages due to high production volumes, making it difficult for new entrants to compete on price.

- Supply Chain Control: Incumbents possess established and resilient supply chains, offering a buffer against market volatility and logistical hurdles.

- Capital Intensity: The substantial upfront investment required for energy infrastructure deters new market participants.

The threat of new entrants for Flowco is moderate, primarily due to the substantial capital requirements and specialized knowledge needed in the artificial lift sector. While Flowco's 2024 merger and 2025 IPO demonstrate significant financial strength, new players must still overcome high barriers to entry.

The industry demands extensive R&D, proprietary technology, and established customer relationships, which take years to build. Regulatory hurdles and the need for proven reliability further complicate market entry. For instance, in 2024, the cost of developing and deploying advanced artificial lift systems often exceeded hundreds of millions of dollars.

While not insurmountable, the combination of financial, technical, and reputational barriers means that the influx of new competitors is likely to be limited. Companies that can demonstrate unique technological advantages and secure strong partnerships can still find a niche, but widespread disruption from new entrants is unlikely in the near term.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of diverse data sources, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive intensity and strategic positioning.