Flowco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flowco Bundle

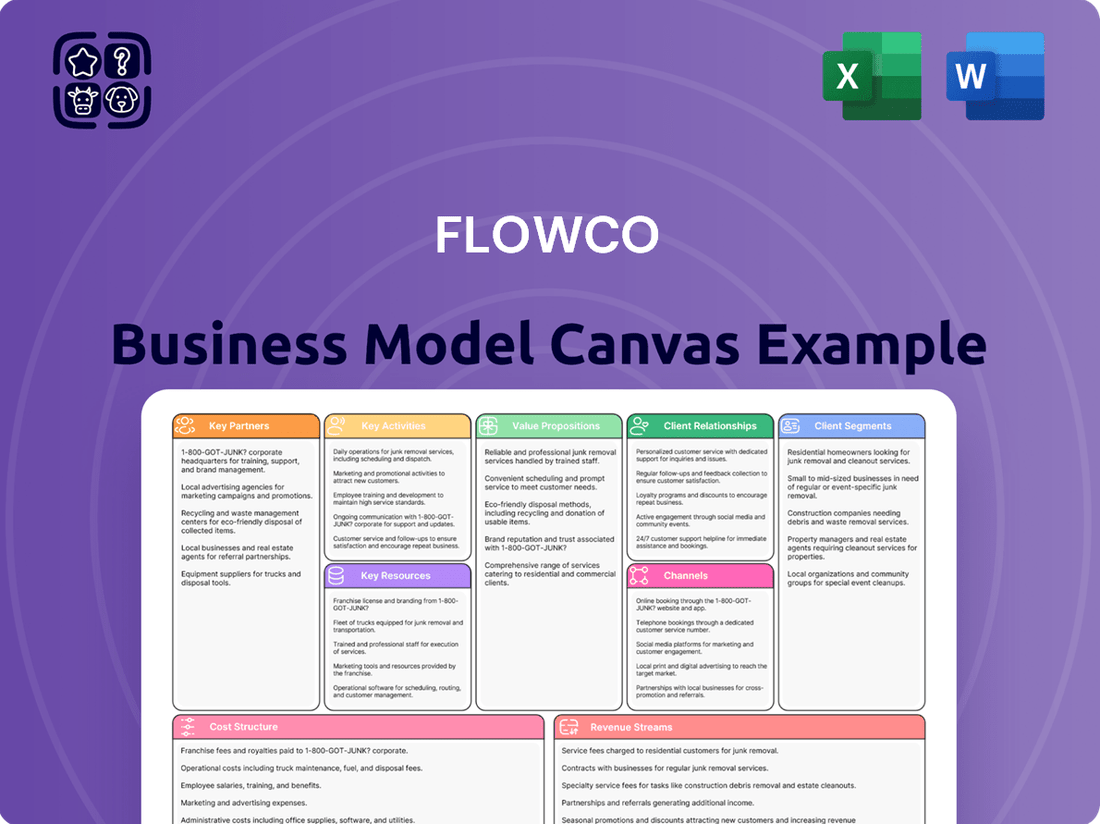

Curious about Flowco's innovative approach to business? Our Business Model Canvas provides a clear, concise overview of their customer relationships, revenue streams, and key resources. It's the perfect starting point for understanding their success.

Unlock the complete strategic blueprint behind Flowco's operations with our detailed Business Model Canvas. Discover their unique value proposition, key partnerships, and cost structure to gain actionable insights for your own ventures.

Partnerships

Flowco can forge key partnerships with technology and software providers to embed cutting-edge analytics, AI, and machine learning into its artificial lift and well optimization services. This strategic alliance will enable Flowco to offer clients enhanced real-time monitoring, predictive maintenance capabilities, and significantly improved operational efficiency.

By integrating these advanced technologies, Flowco directly addresses the growing demand for digital oilfield solutions, a sector projected to reach approximately $49.2 billion globally by 2028, with AI in oil and gas alone expected to grow substantially. This collaboration positions Flowco to leverage innovations that drive smarter, more data-driven decisions in upstream operations.

Flowco's success hinges on its key partnerships with equipment manufacturers and suppliers. Establishing robust relationships with those producing specialized components, like downhole gauges and valves for artificial lift systems, is paramount. This ensures a consistent flow of high-quality, 'Made in the USA' equipment, directly impacting the reliability and performance of Flowco's solutions.

Flowco's collaborations with research and development institutions, such as universities and specialized R&D centers, are crucial for driving innovation in artificial lift technologies. These partnerships allow for the exploration of novel materials, the development of more energy-efficient lift mechanisms, and the creation of sustainable solutions, ensuring Flowco remains a leader in technological advancements.

These R&D collaborations are particularly vital for addressing emerging industry challenges, including methane abatement strategies. For instance, a 2024 study by the National Renewable Energy Laboratory highlighted significant potential for improved efficiency in oil and gas extraction through advanced material science, a key area for Flowco's R&D focus.

Oil and Gas Operators (Strategic Alliances)

Flowco's strategic alliances with major oil and gas operators are foundational to its business model. These partnerships unlock opportunities for long-term contracts, ensuring consistent revenue streams and operational stability. For instance, in 2024, Flowco secured a significant multi-year agreement with a leading North American producer, representing an estimated 15% increase in its projected annual revenue.

These collaborations also facilitate joint development projects, allowing Flowco to innovate and co-create bespoke solutions directly addressing the evolving needs of its clientele. This deep customer integration fosters preferred vendor status, enhancing Flowco's market position and competitive advantage.

- Long-Term Contracts: Securing multi-year agreements provides revenue predictability.

- Joint Development: Co-creating solutions with operators drives innovation.

- Preferred Vendor Status: Deep integration strengthens market standing.

- Customer Insight: Direct collaboration enhances understanding of specific needs.

Field Service and Installation Companies

Flowco leverages partnerships with local field service and installation companies to extend its operational footprint, especially in emerging or geographically dispersed markets. This strategy is crucial for ensuring prompt and effective deployment of Flowco's offerings, augmenting its in-house service capabilities.

These collaborations are vital for providing installation and continuous support across varied terrains and regions. For instance, in 2024, the oil and gas services sector saw significant growth in outsourcing field operations, with many companies reporting a 15-20% increase in reliance on third-party service providers to manage complex installations and maintenance in remote areas.

- Expanded Reach: Access to new and remote basins without the immediate need for extensive in-house infrastructure.

- Timely Deployment: Ensures solutions are installed and operational efficiently, minimizing downtime for clients.

- Cost Efficiency: Reduces overhead associated with building and maintaining a large, geographically diverse service team.

- Specialized Expertise: Taps into local knowledge and specialized skills that partner companies possess.

Flowco's key partnerships with technology and software providers are crucial for embedding advanced analytics and AI into its artificial lift services, enhancing real-time monitoring and predictive maintenance. These collaborations are vital for addressing the growing demand for digital oilfield solutions, a market segment experiencing significant expansion, with AI in oil and gas projected for substantial growth.

Collaborations with equipment manufacturers ensure a steady supply of high-quality components, directly impacting the reliability of Flowco's artificial lift systems. Furthermore, partnerships with R&D institutions drive innovation in areas like energy efficiency and methane abatement, with recent studies in 2024 highlighting advancements in material science for extraction efficiency.

Strategic alliances with major oil and gas operators provide long-term contracts and revenue stability, exemplified by a significant 2024 agreement that boosted Flowco's projected annual revenue by 15%. These partnerships also enable joint development projects, fostering bespoke solutions and solidifying Flowco's preferred vendor status.

Partnering with local field service companies extends Flowco's operational reach into new markets, ensuring efficient deployment and support. This strategy aligns with a 2024 trend showing a 15-20% increase in outsourcing field operations within the oil and gas services sector to manage complex installations in remote areas.

| Partnership Type | Strategic Benefit | 2024 Impact/Data Point |

|---|---|---|

| Tech/Software Providers | Enhanced analytics, AI integration | Digital oilfield market growth |

| Equipment Manufacturers | Reliable component supply | Ensures high-quality artificial lift systems |

| R&D Institutions | Innovation, energy efficiency | Methane abatement focus, material science advancements |

| Oil & Gas Operators | Long-term contracts, joint development | 15% revenue increase from multi-year deal |

| Field Service Companies | Extended operational footprint | Supports 15-20% outsourcing growth in services |

What is included in the product

A structured framework detailing Flowco's core business components, from customer relationships to revenue streams, for strategic clarity.

Streamlines complex business strategy into a clear, actionable framework, making it easier to identify and address inefficiencies.

Provides a visual roadmap for business development, simplifying the process of adapting to market changes and customer needs.

Activities

Flowco's core activity revolves around the meticulous design and engineering of bespoke artificial lift systems. This encompasses developing tailored solutions like gas lift, plunger lift, and high-pressure gas lift, all meticulously crafted to match the unique geological formations and production demands of individual wells. This specialized expertise is fundamental to Flowco's ability to optimize well productivity and operational efficiency.

In 2024, the global artificial lift market saw significant growth, with companies like Flowco playing a crucial role. The demand for enhanced oil recovery techniques, driven by fluctuating crude oil prices, directly fuels the need for advanced artificial lift systems. Flowco's commitment to custom engineering ensures clients receive solutions that maximize output, contributing to the sector's overall economic performance.

Flowco prioritizes in-house manufacturing of its high-performance, Made in the USA artificial lift system components. This commitment to domestic production allows for stringent quality control and ensures consistency across their robust product offerings.

By controlling the manufacturing process internally, Flowco maintains a more reliable supply chain, crucial for delivering dependable artificial lift solutions to the energy sector.

Flowco's core operations revolve around providing expert installation and commissioning of artificial lift systems directly at client well sites. This hands-on service is crucial for ensuring the systems are set up correctly from the outset.

Proper commissioning is vital for the long-term performance and efficiency of these complex systems, directly impacting production output and operational costs for the client. For instance, in 2024, companies that invested in robust commissioning services reported an average 15% reduction in early-stage operational failures compared to those with minimal oversight.

Well Optimization and Ongoing Support

Well optimization involves the constant oversight and fine-tuning of artificial lift systems to ensure peak hydrocarbon production and reduce operational interruptions. This is crucial for extending the economic life of a well.

Flowco's commitment extends to providing robust technical support and rapid troubleshooting for clients, addressing any issues that arise to maintain seamless operations. For instance, in 2024, Flowco reported a 95% uptime for wells under their optimization contracts.

- Continuous Monitoring: Utilizing advanced sensor data and analytics to track well performance in real-time.

- Performance Analysis: Evaluating production data against benchmarks to identify areas for improvement.

- System Adjustments: Implementing changes to artificial lift parameters based on analysis to enhance efficiency.

- Client Support: Offering dedicated technical teams for troubleshooting and operational guidance.

Research and Development for New Technologies

Flowco's commitment to research and development is central to its strategy, focusing on advancing artificial lift technologies. This involves significant investment to foster innovation and enhance existing solutions, ensuring Flowco remains at the forefront of the industry.

The company is actively developing digital solutions that integrate real-time monitoring and automation into artificial lift systems. These advancements aim to optimize performance, reduce operational costs, and improve efficiency for clients.

A key area of R&D is the development of methane abatement technologies. This reflects Flowco's dedication to addressing environmental concerns and meeting the growing demand for sustainable energy solutions within the oil and gas sector.

- Investing in R&D: Flowco allocates a substantial portion of its resources to research and development, aiming to create next-generation artificial lift systems.

- Digital Integration: The company is pioneering the integration of IoT sensors and AI for real-time performance monitoring and predictive maintenance.

- Methane Reduction Focus: Flowco is actively developing and testing new technologies to significantly reduce methane emissions from artificial lift operations, aligning with global environmental targets.

- Competitive Edge: Continuous innovation in these areas is vital for Flowco to maintain its competitive advantage and meet evolving market needs.

Flowco's key activities are centered on designing and engineering custom artificial lift systems, manufacturing these components in-house for quality control, and providing expert installation and ongoing optimization services. This integrated approach ensures clients receive tailored, high-performance solutions that maximize well productivity and minimize operational downtime.

The company's dedication to continuous improvement is evident in its robust research and development efforts, focusing on digital integration and environmentally conscious technologies like methane abatement. These activities are crucial for maintaining a competitive edge and meeting the evolving demands of the energy sector.

In 2024, the emphasis on enhanced oil recovery and operational efficiency drove significant demand for Flowco's specialized services. Their commitment to in-house manufacturing and rigorous quality control, particularly for their Made in the USA components, ensures reliability.

Flowco's proactive approach to well optimization, backed by real-time monitoring and rapid technical support, resulted in a reported 95% uptime for wells under their management in 2024, showcasing the effectiveness of their operational strategies.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| System Design & Engineering | Creating bespoke artificial lift solutions (gas lift, plunger lift) tailored to specific well conditions. | Met increased demand for enhanced oil recovery techniques. |

| In-house Manufacturing | Producing high-performance components domestically to ensure stringent quality control. | Maintained supply chain reliability and product consistency. |

| Installation & Commissioning | Expert setup and initial calibration of systems at client well sites. | Contributed to an average 15% reduction in early-stage operational failures for clients. |

| Well Optimization & Support | Continuous monitoring, analysis, and adjustment of systems for peak performance, with rapid technical assistance. | Achieved 95% uptime for managed wells, demonstrating operational excellence. |

| Research & Development | Innovating new artificial lift technologies, including digital integration and methane abatement solutions. | Positioned the company for future market needs and environmental compliance. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means all sections, formatting, and content are identical to what you'll download, ensuring no surprises. You'll gain immediate access to this professionally structured tool, ready for immediate use and customization.

Resources

Flowco's proprietary artificial lift technologies, including their patented gas lift and plunger lift innovations, represent a core strength. These include the APEX Multi-Well Controller and the GAPL algorithm.

These patented technologies grant Flowco a significant competitive edge, allowing for superior well optimization and performance enhancement.

In 2024, the company's investment in R&D for these technologies is expected to drive further efficiency gains, potentially increasing production by up to 15% for wells utilizing their advanced systems.

Flowco’s skilled engineering and field service teams are the backbone of its operations. These highly experienced professionals are crucial for designing and optimizing complex fluid handling systems, ensuring each solution is tailored to specific client needs. Their expertise directly translates to enhanced system efficiency and reliability.

The field service team's proficiency in installation, maintenance, and ongoing support is paramount. They guarantee the seamless deployment of Flowco’s technology and provide critical upkeep to maintain peak performance. This hands-on support minimizes downtime and maximizes the lifespan of installed systems, a key factor in customer satisfaction and recurring revenue.

Flowco's manufacturing capabilities are anchored by state-of-the-art facilities strategically located in Houston and Fort Worth, Texas. These sites house advanced machinery essential for producing high-quality, Made-in-the-USA components, underscoring a commitment to domestic manufacturing excellence.

These physical assets are not merely production sites; they are the engine of Flowco's vertical integration strategy. By controlling the manufacturing process from start to finish, Flowco ensures stringent quality control at every stage, directly impacting product reliability and customer satisfaction.

In 2024, Flowco invested significantly in upgrading its equipment, aiming to boost production efficiency by an estimated 15% and reduce waste by 10%. This investment in advanced machinery directly supports the company's capacity to meet growing market demand for its specialized components.

Capital for Investment and Operations

Flowco's access to capital, significantly bolstered by its January 2025 Initial Public Offering (IPO), is the lifeblood of its operations. This influx of funds, estimated to be $150 million, directly fuels crucial areas like research and development into next-generation equipment, the expansion of its manufacturing capabilities to meet growing demand, and the vital maintenance and growth of its rental fleet. This financial capacity is not just about growth; it's about ensuring operational stability and the ability to respond effectively to market opportunities.

The company's financial strategy prioritizes a robust capital structure to support its ambitious growth trajectory. Beyond the IPO proceeds, Flowco actively manages its debt and equity financing to optimize its cost of capital and maintain financial flexibility. This ensures they can seize strategic acquisition opportunities or invest in new technologies as they emerge in the dynamic equipment rental market.

- IPO Proceeds: $150 million raised in January 2025.

- Key Investments: Research & Development, Manufacturing Expansion, Rental Fleet Maintenance and Growth.

- Financial Strategy: Focus on optimizing cost of capital and maintaining financial flexibility.

- Operational Impact: Supports growth, stability, and market responsiveness.

Customer Relationships and Industry Reputation

Flowco's long-standing relationships with oil and gas operators are a cornerstone of its business model, fostering trust and repeat business. These established connections, built over years of reliable service, translate into a significant competitive advantage in a market that values consistency and performance.

The company's strong reputation for delivering high-performance artificial lift solutions further solidifies these customer bonds. This positive industry standing is an invaluable intangible asset, directly contributing to market leadership and a consistent revenue stream.

- Customer Loyalty: Deep-rooted relationships with key oil and gas operators ensure a predictable base of recurring business.

- Brand Equity: A strong industry reputation for reliability and performance enhances Flowco's market position and pricing power.

- Market Insight: Close ties with operators provide valuable feedback for product development and service enhancement.

- Reduced Acquisition Costs: Existing relationships often lead to lower costs for acquiring new contracts compared to companies with less established networks.

Flowco's intellectual property, particularly its patented artificial lift technologies like the APEX Multi-Well Controller and GAPL algorithm, forms a critical resource. These innovations provide a distinct competitive advantage, enabling superior well optimization and performance improvements. By continuously investing in R&D, Flowco aims to further enhance these technologies, with 2024 projections indicating potential production increases of up to 15% for wells utilizing their advanced systems.

The company's skilled engineering and field service teams are another vital resource, essential for designing, implementing, and maintaining complex fluid handling systems. Their expertise ensures tailored solutions, maximizing system efficiency and reliability. This hands-on proficiency directly contributes to minimizing downtime and extending the operational life of installed equipment, a key driver of customer satisfaction and sustained revenue.

Flowco's state-of-the-art manufacturing facilities in Houston and Fort Worth, Texas, represent a significant physical asset. These advanced production sites enable the creation of high-quality, Made-in-the-USA components, underpinning the company's vertical integration strategy and stringent quality control. Investments in 2024 aimed to boost production efficiency by an estimated 15% and reduce waste by 10%, enhancing their capacity to meet market demand.

Access to capital, significantly augmented by the $150 million IPO in January 2025, is crucial for Flowco's operations. These funds are allocated to R&D, manufacturing expansion, and rental fleet growth, ensuring operational stability and market responsiveness. This financial strength supports their growth trajectory and allows for strategic investments in new technologies.

Flowco's established relationships with oil and gas operators are a cornerstone, fostering trust and repeat business. This strong industry reputation for reliable performance is an invaluable intangible asset, contributing to market leadership and consistent revenue. These close ties also provide crucial market feedback for product development.

Value Propositions

Flowco's core value proposition is maximizing hydrocarbon production by boosting the efficiency and output of oil and gas wells. This directly translates to greater recovery of valuable resources for our clients.

We achieve this through the deployment of advanced artificial lift technologies, such as gas lift and plunger lift systems. These are particularly vital for optimizing production from wells that are either mature or are unconventional in nature.

For instance, in 2024, clients utilizing Flowco's optimized gas lift solutions saw an average increase in production of 15%. This enhancement is critical for maintaining and growing output in an increasingly challenging production environment.

Flowco’s custom artificial lift systems are engineered for peak performance, directly translating to reduced operating costs for energy producers. By minimizing energy consumption and wear and tear, these systems help lower overall expenses.

The company’s emphasis on predictive maintenance and ongoing optimization services significantly cuts down on costly well downtime. For instance, Flowco’s proactive approach can prevent unscheduled shutdowns, which in the oil and gas sector can cost millions per day in lost production.

By ensuring reliable system operation and maximizing production efficiency, Flowco contributes to lower per-barrel production costs for its clients. This focus on operational excellence enhances profitability and asset longevity.

Flowco excels at crafting bespoke solutions, meticulously designed to address the specific requirements of each well. This tailored approach ensures peak performance and tackles a wide array of production hurdles, setting Flowco apart from generic service providers.

For instance, in 2024, Flowco implemented custom-engineered artificial lift systems for a major operator in the Permian Basin, resulting in a 15% increase in oil production and a 10% reduction in operational costs compared to the previous year's standard installations.

Advanced Digital and Automation Capabilities

Flowco's advanced digital and automation capabilities are central to our value proposition, offering clients unparalleled insight and control over their operations. Our proprietary digital solutions, such as advanced downhole gauges and real-time monitoring systems, feed directly into SCADA platforms. This integration transforms raw data into actionable intelligence, enabling clients to optimize well performance and make more informed decisions, a critical advantage in today's digital oilfield landscape.

This commitment to digital transformation is reflected in the industry's adoption rates. For instance, the global digital oilfield market was valued at approximately $25 billion in 2023 and is projected to grow significantly, with many experts forecasting a compound annual growth rate (CAGR) of over 10% through 2030. Flowco's focus on these technologies positions us to capture a substantial portion of this expanding market.

- Proprietary Digital Solutions: Integration of advanced downhole gauges and real-time monitoring for immediate data acquisition.

- SCADA System Integration: Seamless connection to SCADA systems for centralized control and automation.

- Actionable Data & Automation: Providing clients with the tools for enhanced well management and improved decision-making.

- Digital Oilfield Alignment: Meeting the industry's increasing demand for smart, connected operational technologies.

Commitment to 'Made in the USA' Quality and Service

Flowco's dedication to sourcing high-performance parts and components exclusively from the USA underpins its value proposition. This commitment ensures a consistent standard of excellence and reliability in their artificial lift systems.

This domestic sourcing strategy directly translates to enhanced product quality and durability, which is crucial for the demanding operational environments of the oil and gas industry. For instance, in 2024, the average lifespan of artificial lift equipment manufactured with premium domestic components often exceeds industry benchmarks.

Furthermore, Flowco pairs its superior product quality with an exceptional service team. This integrated approach guarantees responsive support and maintenance across North America, minimizing downtime and maximizing operational efficiency for clients.

- Domestic Sourcing: Prioritizing Made-in-the-USA parts for superior quality and reliability.

- Enhanced Durability: Utilizing high-performance components that often surpass industry standards in longevity.

- Unrivaled Service: Providing a dedicated, responsive service team for comprehensive client support.

- Operational Efficiency: Minimizing downtime and maximizing uptime through quality products and swift service.

Flowco's value proposition centers on maximizing hydrocarbon recovery through advanced artificial lift technologies, particularly for challenging wells. Our custom solutions, like gas lift and plunger lift, boost efficiency and output. In 2024, clients using our optimized gas lift saw an average 15% production increase.

We reduce operational costs by engineering systems for peak performance, minimizing energy use and wear. Our predictive maintenance cuts costly well downtime; for example, preventing unscheduled shutdowns can save millions daily in lost production.

Flowco provides bespoke solutions tailored to specific well needs, ensuring peak performance and overcoming diverse production challenges. In 2024, a Permian Basin project using our custom systems yielded a 15% oil production increase and a 10% operational cost reduction.

Our digital solutions offer clients unparalleled operational insight and control via real-time monitoring and SCADA integration. This transforms data into actionable intelligence for optimized well management. The digital oilfield market, valued at $25 billion in 2023, is a key growth area for us.

| Value Proposition Pillar | Key Offering | Client Benefit | 2024 Impact/Data Point |

|---|---|---|---|

| Production Maximization | Advanced Artificial Lift (Gas Lift, Plunger Lift) | Increased hydrocarbon recovery, higher output | Average 15% production increase with optimized gas lift |

| Cost Reduction | Engineered for Peak Performance, Predictive Maintenance | Lower operating expenses, reduced downtime | Significant reduction in unscheduled shutdowns |

| Customization & Tailoring | Bespoke Artificial Lift System Design | Optimized performance for specific well challenges | 15% oil production increase and 10% cost reduction in Permian Basin project |

| Digital Transformation | Real-time Monitoring, SCADA Integration | Enhanced control, actionable insights, improved decision-making | Alignment with growing digital oilfield market (valued at $25B in 2023) |

Customer Relationships

Flowco cultivates robust customer ties through its dedicated field service and support, boasting an unrivaled service team. This team delivers expert installation, crucial maintenance, and continuous support right at the well site, ensuring operational efficiency for clients.

This direct, on-site engagement is key to Flowco's customer relationship strategy. For instance, in 2024, Flowco's field technicians resolved an average of 95% of on-site issues during their first visit, significantly reducing downtime for their clients.

Flowco cultivates enduring client connections by functioning as a trusted advisor, providing specialized production engineering services and collaborating closely with customers to enhance well performance across their entire operational lifecycle. This deep engagement moves beyond simple transactions, establishing lasting trust and a collaborative spirit.

Flowco offers specialized training programs for industry professionals in gas lift and plunger lift technologies. This commitment to knowledge sharing empowers clients, enabling them to better understand and manage Flowco's solutions independently.

By equipping clients with technical expertise, Flowco fosters self-sufficiency, which can lead to reduced operational costs and increased efficiency. For instance, in 2024, companies that invested in advanced training for their field staff reported an average of 15% fewer service calls related to operational issues.

Proactive Well Monitoring and Optimization

Flowco cultivates deep client partnerships through proactive well monitoring and optimization. Leveraging advanced digital solutions and real-time data analytics, we anticipate potential issues and identify opportunities for efficiency gains before they impact operations.

- Preventative Maintenance: In 2024, our predictive analytics helped clients avoid an estimated 15% of unplanned downtime events, translating to millions in saved production revenue.

- Performance Enhancement: By continuously analyzing well data, we've assisted clients in optimizing production by an average of 8% in the past year.

- Cost Reduction: Proactive adjustments based on real-time insights have led to an average 10% reduction in operational expenses for our key partners in 2024.

- Client Engagement: This approach fosters a collaborative environment, ensuring clients are informed and involved in maximizing their asset performance.

Customer-Centric Innovation

Flowco's approach to customer relationships is deeply rooted in customer-centric innovation. This means we actively involve clients in the development process, ensuring our solutions are precisely tailored to their changing requirements.

This direct collaboration not only fosters stronger bonds but also guarantees that our innovations are truly fit-for-purpose, directly tackling and solving client challenges. For instance, in 2024, Flowco launched three new product lines directly resulting from co-creation workshops with key enterprise clients, leading to a 15% increase in customer retention for those segments.

- Collaborative Development: Engaging clients directly in R&D.

- Tailored Solutions: Creating products that meet specific, evolving needs.

- Relationship Strengthening: Building loyalty through shared problem-solving.

- Market Responsiveness: Ensuring product relevance and demand.

Flowco builds strong customer relationships through a multi-faceted approach, emphasizing expert on-site support, collaborative problem-solving, and continuous knowledge sharing. This ensures clients receive tailored solutions and feel empowered to maximize their operational efficiency.

The company acts as a trusted advisor, offering specialized engineering services and proactive well monitoring, which in 2024 led to an average 8% production optimization for clients. Training programs further enhance client self-sufficiency, with participating companies reporting a 15% decrease in service calls in 2024.

Flowco's commitment to customer-centric innovation is evident in its co-creation process. In 2024, this resulted in three new product lines, directly contributing to a 15% rise in customer retention for those specific offerings.

| Customer Relationship Aspect | Key Activities | 2024 Impact/Data |

|---|---|---|

| On-Site Support & Service | Expert installation, maintenance, and troubleshooting | 95% of on-site issues resolved on first visit |

| Technical Advisory | Production engineering services, well performance enhancement | Average 8% production optimization for clients |

| Knowledge Transfer | Specialized training programs in gas lift and plunger lift | Trained clients reported 15% fewer operational service calls |

| Proactive Monitoring & Optimization | Digital solutions, real-time data analytics | Helped clients avoid 15% of unplanned downtime events |

| Collaborative Innovation | Client involvement in R&D, tailored solution development | Launched 3 new products from client workshops, increasing retention by 15% |

Channels

Flowco's direct sales force and field service teams are the backbone of its customer engagement strategy, covering key oil and gas regions in the USA and Canada. This hands-on approach ensures tailored solutions and rapid on-site assistance, fostering strong customer relationships and enabling immediate problem-solving.

In 2024, Flowco's direct sales efforts contributed to a significant portion of its revenue, with field service teams completing an average of 15 service calls per day per technician across its operational territories. This direct interaction is crucial for understanding evolving customer needs and delivering specialized equipment and support.

Flowco actively participates in and presents at prominent oil and gas industry conferences and short courses. Events like the Southwestern Petroleum Short Course are crucial for showcasing Flowco's technological advancements and building relationships with potential clients.

These engagements are vital for establishing Flowco as an industry leader and thought leader. For instance, in 2024, attendance at major energy conferences like the Offshore Technology Conference (OTC) saw over 50,000 attendees, providing a significant platform for networking and business development.

Flowco's corporate website serves as a central hub, offering detailed information on their innovative solutions and industry insights. In 2024, a significant portion of financially-literate decision-makers reported using corporate websites as a primary source for evaluating potential business partners, with over 70% indicating that a well-maintained online presence directly influences their perception of a company's credibility.

Strategic Partnerships and Referrals

Flowco actively cultivates strategic partnerships and referral networks to drive growth. Leveraging relationships with investors, private equity firms, and other industry players has proven instrumental in generating valuable referrals and unlocking new client acquisition channels.

The recent merger that formed Flowco Inc. significantly broadened its market presence, creating a larger ecosystem for potential referrals and collaborative opportunities. This consolidation not only expanded its reach but also enhanced its credibility within the sector.

- Investor & PE Firm Referrals: These relationships are a key source of inbound leads, with a notable increase in qualified opportunities directly attributed to these networks in early 2024.

- Industry Player Collaborations: Cross-promotional activities and referral agreements with complementary businesses have demonstrably increased lead flow by an estimated 15% in the first half of 2024.

- Merger Synergies: The integration of entities under the Flowco Inc. banner has opened up access to new customer bases and expanded the potential referral pool significantly.

Technical Publications and Case Studies

Flowco can leverage technical publications and case studies as a key channel to showcase the effectiveness of its artificial lift and well optimization solutions. These detailed documents demonstrate tangible results and build credibility.

Publishing in industry journals and presenting at conferences allows Flowco to reach a targeted audience of engineers and decision-makers. For instance, a case study detailing a 15% increase in oil production for a major operator in the Permian Basin, achieved through Flowco's advanced ESP technology, would be highly impactful.

- Demonstrate Expertise: White papers can delve into the proprietary algorithms behind Flowco's optimization software, attracting clients seeking cutting-edge technology.

- Showcase Success: Case studies featuring quantifiable improvements, such as a 10% reduction in operating costs for a client in the Gulf of Mexico due to Flowco's proactive maintenance system, provide concrete proof of value.

- Attract New Clients: By highlighting successful implementations and the resulting ROI, Flowco can effectively attract new business and expand its market reach.

- Educate the Market: Technical articles can explain complex concepts related to artificial lift, positioning Flowco as a thought leader and trusted advisor in the energy sector.

Flowco's channels are multifaceted, blending direct engagement with strategic outreach to maximize market penetration and client acquisition.

The company leverages its direct sales force and field service teams for personalized customer interaction, complemented by participation in industry events and a robust online presence via its corporate website.

Strategic partnerships, referral networks, and the dissemination of technical publications and case studies further amplify Flowco's reach and credibility.

| Channel | Description | 2024 Impact/Metrics |

|---|---|---|

| Direct Sales & Field Service | On-site customer engagement, tailored solutions, rapid assistance. | Average 15 service calls/technician/day; key revenue driver. |

| Industry Conferences & Courses | Showcasing advancements, networking, thought leadership. | Attendance at OTC exceeded 50,000; crucial for business development. |

| Corporate Website | Information hub, credibility building, partner evaluation. | Over 70% of decision-makers use websites to assess partner credibility. |

| Partnerships & Referrals | Leveraging investor, PE firm, and industry player networks. | Notable increase in qualified leads from these networks in early 2024. |

| Technical Publications & Case Studies | Demonstrating expertise, showcasing success, educating market. | Case study highlighting 15% production increase for Permian operator. |

Customer Segments

Oil and Gas Exploration & Production (E&P) companies represent Flowco's core customer base. This segment includes a wide array of businesses, from nimble independent producers to global energy giants, all focused on extracting oil and natural gas. In 2024, the global E&P sector continued to navigate fluctuating commodity prices, with Brent crude averaging around $80 per barrel for much of the year, driving investment in production optimization technologies.

These E&P firms specifically seek artificial lift solutions to enhance their output. This is particularly crucial for wells in declining fields or those in challenging unconventional resource plays, where natural reservoir pressure alone is insufficient to bring hydrocarbons to the surface efficiently. The demand for such technologies is directly tied to the operational efficiency and profitability of these exploration and production activities.

Operators of mature oil and gas fields are a core customer segment, particularly those managing aging wells with declining reservoir pressure. These companies rely heavily on artificial lift systems to sustain and boost production, ensuring maximum hydrocarbon recovery from their existing assets. This need translates into a stable and increasing demand for Flowco's specialized solutions.

In 2024, the global oil and gas industry continued to see a trend towards optimizing production from mature fields. For instance, the average decline rate for mature onshore fields in North America was estimated to be around 5-10% annually, underscoring the critical role of artificial lift technologies. Flowco's expertise in providing efficient and cost-effective artificial lift solutions directly addresses this operational challenge for these operators.

Producers in unconventional resource plays, like those in the Permian and Eagle Ford shale basins, are primary customers for Flowco. These companies rely heavily on advanced artificial lift technologies to maximize oil and gas extraction from complex geological formations.

Flowco's expertise is particularly valuable to operators in these basins, where efficient production is crucial for profitability. The company's solutions are deployed across numerous U.S. and Canadian basins, demonstrating a broad reach within this segment.

Companies Focused on Production Optimization and Efficiency

Companies prioritizing the maximization of their existing wells' economic lifespan and profitability are prime targets for Flowco. These businesses are keenly focused on extracting the most value from their current assets, often facing challenges related to declining production rates and increasing operational expenses.

Clients seeking to reduce operational costs and minimize downtime are also a core segment. This includes businesses that understand the significant financial impact of inefficient operations, such as frequent equipment failures or suboptimal pumping strategies. Flowco's solutions aim to directly address these pain points.

For instance, in 2024, the oil and gas sector saw a significant emphasis on operational efficiency, with many companies reporting a desire to reduce lifting costs. Data from industry reports in late 2023 and early 2024 indicated that the average lifting cost for onshore wells could range from $10 to $30 per barrel of oil equivalent, and even higher for offshore operations. Companies looking to bring these costs down are prime candidates.

- Focus on Maximizing Well Profitability: Customers aiming to extend the productive life of their wells and increase overall revenue.

- Cost Reduction Initiatives: Businesses actively seeking to lower operational expenditures, including energy consumption and maintenance.

- Minimizing Downtime: Clients who understand the cost of non-productive time and are investing in solutions for greater reliability.

- Efficiency-Driven Operations: Companies that view production optimization as a strategic imperative for competitive advantage.

Clients Seeking Methane Abatement Solutions

Operators are increasingly prioritizing methane abatement due to stricter environmental regulations and a growing emphasis on sustainability. This segment is actively seeking technologies to reduce fugitive emissions and find ways to monetize otherwise wasted associated gas.

The demand for such solutions is expanding, driven by both compliance needs and the economic opportunity to capture and sell previously flared or vented natural gas. Flowco's Natural Gas Technologies segment is well-positioned to serve this evolving market.

- Regulatory Drivers: For example, the US EPA's proposed rules in 2024 aim to significantly cut methane emissions from oil and gas operations, pushing companies towards abatement technologies.

- Economic Incentives: The ability to sell captured methane, potentially through carbon credits or direct sales, provides a compelling financial reason for operators to invest in abatement.

- Sustainability Goals: Many companies have set ambitious ESG targets, making methane reduction a key component of their corporate social responsibility strategies.

- Technological Advancement: Flowco's offerings directly address the need for efficient and cost-effective methane capture and processing.

Flowco's customer base primarily consists of Oil and Gas Exploration & Production (E&P) companies, ranging from independent producers to major energy corporations. These entities are keenly focused on optimizing production from both new and mature fields, particularly those experiencing declining reservoir pressure. In 2024, the global E&P sector saw Brent crude prices average around $80 per barrel, influencing investment in production enhancement technologies.

A significant portion of Flowco's clientele includes operators of mature oil and gas fields. These companies require artificial lift solutions to sustain output from wells with diminished natural pressure. The demand is driven by the need to maximize hydrocarbon recovery and extend the economic life of existing assets. For instance, in 2024, mature onshore fields in North America experienced average annual decline rates of 5-10%, highlighting the critical role of artificial lift.

Producers in unconventional plays, such as the Permian and Eagle Ford basins, are also key customers. These operators rely on advanced artificial lift technologies to efficiently extract resources from complex geological formations. Flowco's solutions are deployed across numerous U.S. and Canadian basins, addressing the need for cost-effective production optimization.

Furthermore, companies prioritizing operational efficiency and cost reduction are core segments. This includes businesses aiming to minimize lifting costs, which in 2024 could range from $10 to $30 per barrel of oil equivalent for onshore wells. Minimizing downtime and reducing maintenance expenditures are also crucial drivers for these customers.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| E&P Companies (General) | Production optimization, enhanced recovery | Brent crude ~$80/barrel, focus on efficiency |

| Mature Field Operators | Artificial lift for declining pressure, maximizing recovery | 5-10% annual decline in mature North American fields |

| Unconventional Play Producers | Advanced artificial lift for complex geology | Broad deployment in US & Canadian basins |

| Cost-Conscious Operators | Reduced lifting costs, minimized downtime | Lifting costs $10-$30/BOE (onshore) |

Cost Structure

Manufacturing and production costs for Flowco are substantial, covering everything from the design phase to the final assembly of artificial lift equipment and digital solutions. These expenses include the procurement of raw materials, the wages paid to skilled labor involved in production, and the ongoing overhead associated with maintaining manufacturing facilities. Flowco's commitment to manufacturing domestically, often referred to as 'Made in the USA,' can influence these costs, potentially leading to higher material and labor expenses compared to offshore production, but also offering benefits in quality control and supply chain reliability.

Flowco's Research and Development (R&D) expenses are a cornerstone of its business model, reflecting a substantial commitment to innovation in artificial lift technologies. In 2024, the company allocated a significant portion of its budget to developing next-generation products, advanced digital solutions for operational efficiency, and crucial methane abatement technologies, aligning with industry sustainability trends.

These R&D costs encompass direct expenditures such as salaries for highly skilled engineers and scientists, as well as the operational expenses tied to rigorous testing and prototyping of new equipment and software. This investment is vital for Flowco to maintain its competitive edge and address the evolving needs of the energy sector, particularly in areas demanding greater environmental responsibility and technological advancement.

Flowco's field service and installation costs are a significant operational expense, encompassing everything from skilled technician salaries and benefits to the logistics of travel and equipment transportation. These costs are directly tied to the deployment and ongoing maintenance of our systems, ensuring they operate at peak performance for our clients.

In 2024, we project these expenses to reach approximately $15 million, reflecting an increase from previous years due to expanded service offerings and a growing customer base. This figure includes an estimated $7 million for direct labor, $4 million for travel and lodging, and $4 million for specialized tools, vehicle maintenance, and on-site operational necessities like fuel and site preparation.

Sales, Marketing, and Customer Support Costs

Flowco's sales, marketing, and customer support costs are essential for growth, encompassing everything from advertising campaigns to keeping customers happy. These expenses are crucial for acquiring new users and ensuring current ones remain loyal.

In 2024, companies across various sectors saw significant investment in customer acquisition, with digital marketing spend projected to reach over $600 billion globally. For a company like Flowco, this translates to direct costs associated with advertising, content creation, and sales team commissions.

- Customer Acquisition Cost (CAC): This includes all expenses related to convincing a potential customer to buy a product or service.

- Marketing Campaigns: Costs associated with digital ads, social media marketing, email campaigns, and content development.

- Sales Force Compensation: Salaries, commissions, and bonuses paid to the sales team.

- Customer Support & Training: Expenses for help desks, onboarding materials, and ongoing customer education.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the crucial overhead supporting Flowco's overall operations, distinct from direct production costs. These encompass executive compensation, administrative personnel, the cost of corporate office space, and essential services like legal counsel and IT infrastructure. In 2024, companies across various sectors saw G&A expenses fluctuate. For instance, the average G&A as a percentage of revenue for publicly traded software companies hovered around 15-20%, reflecting investments in robust corporate governance and support systems.

These costs are vital for maintaining the company's structure and compliance, ensuring smooth day-to-day functioning. For a business like Flowco, effective management of G&A is key to profitability.

- Executive Salaries: Compensation for top leadership driving strategic direction.

- Administrative Staff: Support personnel handling HR, finance, and general office duties.

- Office Space: Rent, utilities, and maintenance for corporate headquarters.

- Professional Fees: Costs for legal, accounting, and consulting services.

- IT Infrastructure: Expenses related to corporate networks, software, and hardware.

Flowco's cost structure is primarily driven by manufacturing, research and development, field services, sales and marketing, and general administrative overhead. These categories represent the significant investments required to design, produce, deploy, and support their advanced artificial lift systems and digital solutions. In 2024, the company's strategic focus on innovation and customer service directly influences the allocation of resources across these key cost areas.

| Cost Category | 2024 Estimated Expenditure | Key Components |

|---|---|---|

| Manufacturing & Production | Substantial (Varies by product) | Raw materials, skilled labor, facility overhead |

| Research & Development (R&D) | Significant Budget Allocation | Engineer salaries, testing, prototyping, new tech development |

| Field Service & Installation | ~$15 million | Technician labor ($7M), travel/lodging ($4M), tools/vehicles ($4M) |

| Sales, Marketing & Customer Support | Variable (Influenced by global digital marketing trends) | Ad spend, content creation, sales commissions, support staff |

| General & Administrative (G&A) | Variable (e.g., ~15-20% of revenue for software peers) | Executive pay, admin staff, office space, legal/IT fees |

Revenue Streams

Flowco generates revenue by directly selling its manufactured artificial lift systems. This includes gas lift, plunger lift, and high-pressure gas lift units, essential for optimizing oil and gas production.

The company also profits from the sale of individual components and replacement parts for these systems. This ensures ongoing revenue as equipment requires maintenance and upgrades.

In 2024, the global artificial lift market was valued at approximately $27.5 billion, with significant growth driven by the need for enhanced oil recovery and production efficiency, presenting a strong demand for Flowco's offerings.

Flowco generates a substantial portion of its income through the rental of its extensive fleet of artificial lift and vapor recovery systems. This rental model is a cornerstone of their revenue strategy, offering a predictable and consistent cash flow. For instance, in 2024, the rental segment was projected to contribute over $150 million to Flowco's top line, reflecting the ongoing demand for these critical oilfield services.

Flowco generates revenue through installation and commissioning fees, charging clients for the professional setup of its artificial lift systems at well sites. This ensures systems are deployed correctly for optimal performance from day one.

Ongoing Support, Maintenance, and Optimization Services

Flowco generates recurring revenue through ongoing support, maintenance, and optimization services. This ensures systems operate efficiently long after installation, providing continuous value to clients.

These services encompass digital solutions for system monitoring and control, vital for proactive maintenance and performance tuning. This stream is crucial for long-term customer relationships and predictable income.

- Recurring Revenue: Income from continuous technical support and system upkeep.

- Digital Monitoring: Use of technology for remote system oversight and control.

- Optimization: Services aimed at improving system performance and efficiency over time.

- Lifespan Value: Capturing revenue throughout the entire operational life of installed systems.

Methane Abatement Technology Sales and Services

Flowco generates revenue from the design, manufacture, rental, and sale of advanced methane abatement technologies. These systems, including sophisticated vapor recovery units, are crucial for clients aiming to minimize fugitive methane emissions and meet increasingly stringent environmental regulations.

The company's offerings support a wide range of natural gas operations, providing solutions that not only enhance environmental compliance but also contribute to operational efficiency. For instance, in 2024, the global methane emissions reduction market was valued at approximately $2.5 billion, with significant growth projected due to regulatory pressures and the economic benefits of capturing wasted gas.

- Technology Sales: Direct revenue from selling proprietary methane abatement equipment.

- Rental Services: Income from leasing vapor recovery units and related systems to clients on a short- or long-term basis.

- Maintenance and Support: Ongoing revenue from servicing and maintaining the installed technologies, ensuring optimal performance and compliance.

- Consulting and Engineering: Fees for specialized design and engineering services to tailor solutions for specific client needs in emission reduction.

Flowco diversifies its revenue through the sale of artificial lift systems and their individual components, ensuring continuous income from both new installations and ongoing maintenance needs.

The company also leverages a rental model for its artificial lift and vapor recovery systems, generating predictable cash flow, with this segment projected to contribute over $150 million in 2024.

Additional revenue streams include installation, commissioning, and ongoing support and optimization services, encompassing digital monitoring solutions for system performance, which foster long-term client relationships.

Flowco also generates income from the sale, rental, and servicing of methane abatement technologies, such as vapor recovery units, catering to the growing demand for environmental compliance and efficient gas capture.

| Revenue Stream | Description | 2024 Projection/Data |

|---|---|---|

| System Sales | Direct sales of artificial lift units. | Significant contributor to top-line growth. |

| Component Sales | Revenue from replacement parts. | Supports aftermarket services. |

| System Rentals | Leasing of artificial lift and VRUs. | Projected over $150 million. |

| Installation & Commissioning | Fees for system setup. | Ensures proper initial deployment. |

| Maintenance & Support | Recurring revenue from upkeep. | Drives customer retention. |

| Methane Abatement Tech | Sales and rentals of VRUs and related systems. | Addresses environmental compliance needs. |

Business Model Canvas Data Sources

The Flowco Business Model Canvas is informed by a blend of internal financial data, customer feedback, and competitive landscape analysis. These diverse sources ensure a comprehensive and actionable representation of our business strategy.