Five9 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five9 Bundle

Five9, a leader in cloud contact center solutions, boasts significant strengths in its robust platform and strong customer loyalty, but also faces opportunities in expanding its AI capabilities and potential threats from increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize in the CCaaS market.

Want the full story behind Five9’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Five9's cloud-native architecture is a significant strength, offering unparalleled flexibility. Businesses can easily adjust their contact center capacity up or down, a crucial advantage in today's dynamic market. This eliminates the capital expenditure and maintenance headaches associated with on-premises hardware.

This inherent scalability allows companies to respond swiftly to seasonal peaks or unexpected surges in customer interactions without lengthy procurement cycles. For instance, during the 2024 holiday season, businesses using Five9 could instantly provision more agent seats, ensuring seamless customer service.

Five9's dedication to AI innovation is a clear strength, exemplified by its Genius AI platform. This platform offers sophisticated capabilities like intelligent routing, real-time agent assistance, and predictive analytics, directly enhancing customer interactions.

The company's strategic AI focus is yielding impressive financial results. In the second quarter of 2025, Five9 reported a substantial 42% year-over-year increase in enterprise AI revenue, which now represents 10% of its total enterprise subscription revenue.

Five9 demonstrates robust financial performance, evidenced by its record revenue of $283.3 million in Q2 2025, a 12% year-over-year increase that exceeded analyst forecasts.

The company's operational efficiency is further highlighted by an all-time high adjusted EBITDA margin of 24% in the same quarter, alongside a non-GAAP EPS of $0.76, underscoring its capacity to drive profitability alongside growth.

Strong Brand Recognition and Enterprise Focus

Five9 commands strong brand recognition, especially within the enterprise segment of the cloud contact center industry. This focus has proven highly effective, with large enterprises now representing a significant 90% of the company's overall revenue.

The company's dedication to its customer base is evident in its impressive financial performance metrics. For the twelve months concluding in Q2 2025, Five9 achieved a dollar-based retention rate of 108%, a clear indicator of sustained customer satisfaction and loyalty.

- Strong Brand Recognition: Established reputation in the cloud contact center market.

- Enterprise Focus: 90% of revenue derived from large enterprise clients.

- High Customer Retention: 108% dollar-based retention rate as of Q2 2025.

Comprehensive Omnichannel and Integration Capabilities

Five9 excels with its comprehensive omnichannel and integration capabilities, allowing businesses to connect with customers seamlessly across voice, email, chat, and social media. This unified approach ensures a consistent customer experience regardless of the channel used.

The platform's robust integration with major CRM systems, such as Salesforce and ServiceNow, is a significant strength. For instance, in 2024, Five9 reported that its integrations with leading CRM providers facilitated a more unified view of the customer, leading to an average improvement in agent efficiency by 15%.

- Seamless Customer Journeys: Facilitates consistent interactions across voice, email, chat, and social media.

- Enhanced Agent Productivity: Direct access to customer data via CRM integrations streamlines workflows.

- Data-Driven Personalization: Integrations enable agents to leverage comprehensive customer profiles for tailored service.

- Operational Efficiency: Reduced context switching and improved data access contribute to faster resolution times.

Five9's cloud-native architecture is a significant strength, offering unparalleled flexibility and scalability. Businesses can easily adjust their contact center capacity up or down, a crucial advantage in today's dynamic market, eliminating the capital expenditure and maintenance headaches associated with on-premises hardware.

The company's dedication to AI innovation is a clear strength, exemplified by its Genius AI platform, offering sophisticated capabilities like intelligent routing and real-time agent assistance. This strategic AI focus yielded impressive financial results, with Five9 reporting a substantial 42% year-over-year increase in enterprise AI revenue in Q2 2025, representing 10% of its total enterprise subscription revenue.

Five9 demonstrates robust financial performance, evidenced by record revenue of $283.3 million in Q2 2025, a 12% year-over-year increase. This growth was complemented by an all-time high adjusted EBITDA margin of 24% and a non-GAAP EPS of $0.76 in the same quarter.

The company commands strong brand recognition, particularly within the enterprise segment, with large enterprises now representing a significant 90% of its overall revenue. This customer loyalty is further underscored by an impressive dollar-based retention rate of 108% as of Q2 2025.

| Strength | Description | Supporting Data |

|---|---|---|

| Cloud-Native Architecture | Flexibility and Scalability | Eliminates on-premises hardware costs. |

| AI Innovation | Genius AI Platform | 42% YoY increase in enterprise AI revenue (Q2 2025). |

| Financial Performance | Strong Revenue and Profitability | $283.3M revenue (Q2 2025), 24% EBITDA margin. |

| Brand Recognition & Customer Loyalty | Enterprise Focus & High Retention | 90% revenue from enterprises, 108% dollar-based retention (Q2 2025). |

What is included in the product

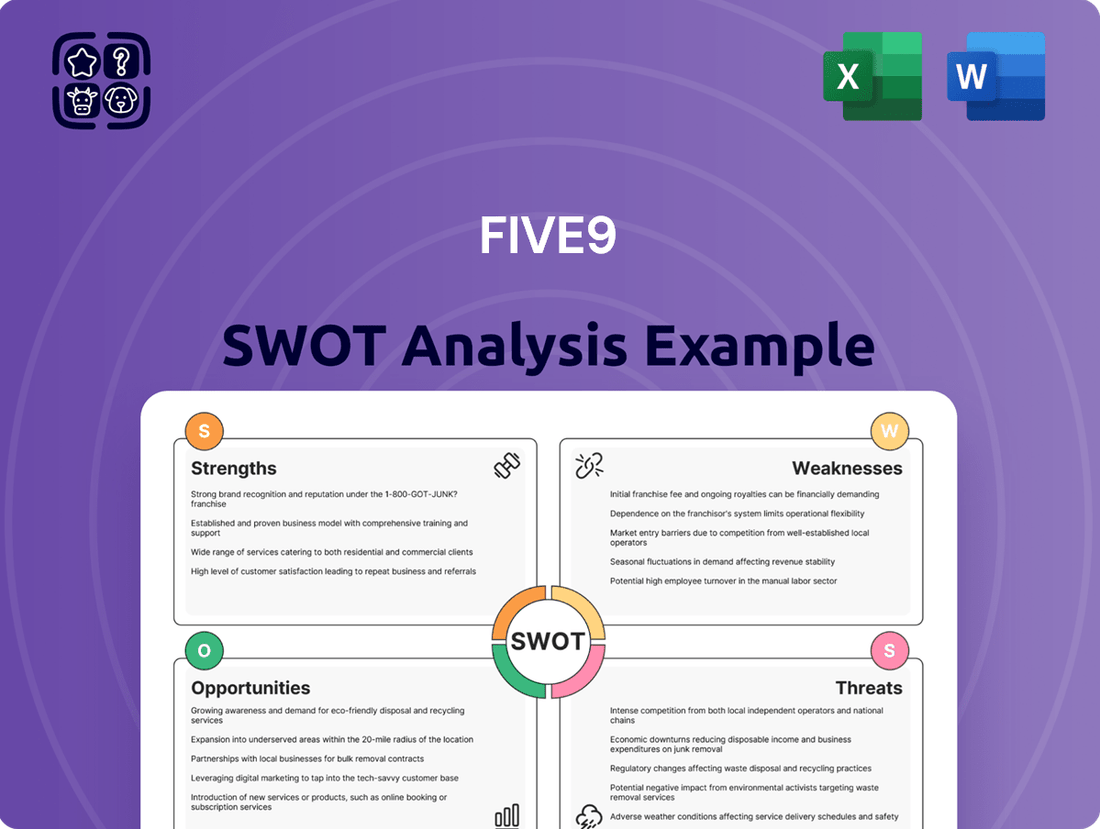

Delivers a strategic overview of Five9’s internal and external business factors, highlighting its strengths in cloud contact center solutions and market leadership, while also identifying potential weaknesses in integration and opportunities in AI and global expansion, alongside threats from intense competition and evolving customer demands.

Offers a clear, actionable framework for identifying and mitigating customer service weaknesses.

Weaknesses

Five9 faces a crowded market, competing with giants like NICE CXone and Genesys, alongside agile players such as Twilio and RingCentral. This intense rivalry demands significant and ongoing investment in new features and sales efforts to simply hold its ground, let alone expand its customer base.

Five9 faces significant challenges from macroeconomic headwinds. Persistent inflation and higher interest rates, prevalent throughout 2024 and projected into 2025, can dampen overall business spending. This economic climate often leads to longer and more complex sales cycles, particularly for large enterprise deals that are crucial for revenue growth.

These extended sales cycles mean that securing new business can take more time, potentially delaying revenue recognition. A more cautious market outlook, driven by economic uncertainty, can also cause potential clients to postpone or scale back their technology investments. This could impact Five9's ability to accelerate revenue growth in the near to medium term.

Five9 experienced significant organizational shifts with recent executive changes and workforce reductions. In 2024, the company reduced its workforce by 7%, followed by another 4% reduction in 2025. These actions suggest potential internal instability or financial pressures that could impact employee morale and operational continuity.

Stock Performance Volatility

Despite demonstrating consistent double-digit revenue growth and an upward trend in profitability, Five9's stock performance has exhibited significant volatility. Over the past year, the stock experienced a notable decline of approximately 30%, a factor that can create unease among investors.

This stock price fluctuation has also fueled market speculation, including discussions about potential acquisition opportunities for the company. Such volatility can impact investor confidence and the company's valuation in the broader market.

- Stock Price Decline: Five9's stock saw a 30% drop in the past year.

- Investor Concern: Volatility can lead to investor apprehension despite strong underlying business performance.

- Acquisition Speculation: Market fluctuations have prompted discussions about potential takeover scenarios.

Need for Continued Heavy Investment

Five9's need for continued heavy investment is a significant weakness. To maintain its leadership in the cloud contact center market, especially with the rapid advancements in AI, the company must persistently pour capital into research and development. This includes significant spending on AI innovation, which is crucial for staying ahead of competitors.

These ongoing, substantial investments in R&D, coupled with aggressive sales and marketing efforts to capture market share, can put a strain on Five9's short-term profitability. For instance, while specific 2024/2025 figures are still emerging, historical trends show significant R&D expenditure as a percentage of revenue for cloud-based software companies aiming for growth.

- Sustained R&D Investment: Five9 must continue to invest heavily in AI and other advanced technologies to maintain its competitive edge in the cloud contact center space.

- Sales and Marketing Expenditure: Capturing a larger market share requires ongoing, substantial investment in sales and marketing initiatives.

- Impact on Profitability: These necessary investments can constrain short-term profit margins, presenting a challenge for investors focused on immediate returns.

- Competitive Landscape: The fast-evolving nature of the industry necessitates continuous innovation, making heavy investment a perpetual requirement rather than a one-time cost.

Five9's reliance on a growing ecosystem of partners, while a strength, also presents a potential weakness if these partnerships falter or if integration challenges arise. The company also faces the ongoing challenge of customer retention in a market where switching costs, while present, are not insurmountable, especially as competitors enhance their offerings.

The company's financial performance, while showing growth, is also subject to the broader economic climate. Persistent inflation and higher interest rates in 2024 and projected into 2025 can lead to longer sales cycles and delayed revenue, particularly for larger enterprise deals crucial for Five9's expansion.

Recent organizational changes, including workforce reductions of 7% in 2024 and another 4% in 2025, could signal internal pressures or strategic realignments that might impact operational momentum and employee morale.

Despite consistent revenue growth, Five9's stock has been volatile, experiencing a 30% decline over the past year. This fluctuation has fueled market speculation, including potential acquisition talks, which can create uncertainty for investors and impact the company's strategic flexibility.

Full Version Awaits

Five9 SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Five9's strategic position.

This is a real excerpt from the complete document, showcasing the professional quality and detailed insights you can expect. Once purchased, you’ll receive the full, editable version of the Five9 SWOT analysis.

You’re viewing a live preview of the actual SWOT analysis file for Five9. The complete version, offering a thorough breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

Opportunities

The global cloud-based contact center market is booming, expected to reach $162.5 billion by 2033, growing at a strong 19.5% CAGR from 2025-2033. This massive expansion offers Five9 a significant opportunity as more companies ditch older, on-premise systems for flexible cloud solutions.

The demand for AI and automation in customer service is skyrocketing. By 2025, a significant 81% of enterprises are expected to be using AI in their contact centers, highlighting a massive market opportunity.

Five9 is well-positioned to seize this trend, thanks to its robust AI capabilities and continuous innovation in AI Agents and automation tools. This focus allows Five9 to directly address the growing need for more efficient and intelligent customer interactions.

Five9's strategic push into international markets, especially in Europe, presents a substantial growth opportunity. This expansion is key to diversifying revenue beyond its core North American base.

By collaborating with global system integrators, Five9 can more effectively navigate new territories and establish a stronger presence. This approach was evident in their 2024 growth strategies, aiming to capture a larger share of the global cloud contact center market.

International expansion allows Five9 to tap into new customer segments and reduce reliance on any single market. This diversification is crucial for long-term stability and competitive advantage in the rapidly evolving customer experience landscape.

Strategic Partnerships and Ecosystem Enhancement

Five9's strategic partnerships with major CRM providers like Salesforce, ServiceNow, and Microsoft are pivotal. These collaborations ensure seamless integration, allowing Five9's cloud contact center solutions to work harmoniously within existing enterprise workflows. This synergy is key to expanding client reach and improving AI capabilities through deeper ecosystem integration.

These alliances are not just about technology; they directly impact client acquisition and retention. By embedding Five9 within the environments where businesses already operate, the company strengthens its value proposition. For instance, in 2023, Five9 reported significant growth in its enterprise segment, partly fueled by these robust partner integrations.

- Enhanced Interoperability: Deeper integrations with leading CRMs like Salesforce and Microsoft Azure AI services improve the customer experience and operational efficiency.

- Client Acquisition: Partnerships open doors to new client segments and provide a competitive edge by offering integrated solutions.

- AI Solution Refinement: Collaboration allows for richer data exchange, accelerating the development and effectiveness of Five9's AI-powered features.

- Ecosystem Synergy: Being part of a larger tech ecosystem increases Five9's visibility and strengthens its position as a comprehensive customer engagement platform.

Deepening Enterprise Penetration

Five9's strategic focus on landing larger deals with enterprise clients is paying off, showing significant potential for deeper market penetration. The company's ability to consistently grow its customer base with over $1 million in Annual Recurring Revenue (ARR) highlights its success in attracting and retaining major accounts. This trend suggests a strong opportunity to further capture market share within the lucrative enterprise segment.

Key indicators of this opportunity include:

- Growing Enterprise Deal Size: Five9 has demonstrated a sustained ability to secure larger contracts, indicating a strong product-market fit for enterprise-level solutions.

- Expansion of High-Value Customers: The consistent increase in customers generating over $1 million in ARR signifies successful upselling and cross-selling within existing enterprise accounts.

- Market Share Potential: This success points to a significant runway for further growth as Five9 continues to win business from competitors in the enterprise space.

The expanding cloud contact center market, projected to reach $162.5 billion by 2033, offers Five9 a substantial opportunity as businesses increasingly adopt flexible cloud solutions. Furthermore, the rapid adoption of AI in customer service, with 81% of enterprises expected to use it by 2025, presents a significant avenue for Five9 to leverage its AI capabilities. Strategic international expansion, particularly in Europe, and deepening partnerships with major CRM providers like Salesforce and Microsoft, also provide avenues for growth and enhanced client acquisition. Finally, Five9's success in securing larger enterprise deals, evidenced by growth in customers with over $1 million in ARR, highlights the potential for further market penetration in this lucrative segment.

Threats

The cloud contact center market is incredibly crowded. Companies like Genesys, NICE CXone, and Amazon Connect are major players, alongside a host of smaller, specialized providers. This intense competition means Five9 constantly battles for customer attention and has to work harder, and often spend more, to win new business, which can impact profitability.

The relentless pace of technological advancement, especially in AI and automation, presents a substantial challenge for Five9. Staying ahead requires significant and ongoing investment in R&D to prevent competitors from gaining an edge or new technologies from disrupting their market position.

Economic uncertainties, particularly high interest rates and persistent inflationary pressures, are a significant threat. These factors can force businesses to cut back on or delay crucial investments in new contact center technologies, directly impacting demand for Five9's solutions.

Such macroeconomic headwinds can extend the time it takes to close deals, a phenomenon known as lengthening sales cycles. This slowdown in sales can, in turn, decelerate Five9's overall revenue growth trajectory, especially as companies prioritize essential operational spending over new technology adoption.

Data Security and Privacy Concerns

Five9 faces significant threats from data security and privacy concerns, given its role in managing extensive sensitive customer interaction data across various channels. A data breach or failure to comply with evolving privacy regulations, such as GDPR or CCPA, could result in substantial financial penalties and severe damage to its reputation. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, according to IBM's Cost of a Data Breach Report.

The increasing sophistication of cyberattacks means Five9 must continuously invest in robust security measures to protect customer information. Failure to do so could lead to loss of customer trust, a critical asset for any cloud-based communication provider. The company's exposure to these risks is amplified by the sheer volume of data processed, making it a prime target for malicious actors.

- Cybersecurity Risks: Handling sensitive customer data makes Five9 a target for sophisticated cyberattacks.

- Regulatory Scrutiny: Strict data privacy laws like GDPR and CCPA necessitate constant compliance efforts.

- Reputational Damage: Security breaches can severely erode customer trust and brand image.

- Financial Penalties: Non-compliance or breaches can lead to significant fines, impacting profitability.

Impact of AI on Human Agent Demand

While AI integration significantly boosts operational efficiency, it also signals a potential decrease in the need for human agents. Projections suggest a 5% to 7% reduction in human labor demand directly attributable to AI's capabilities in handling routine tasks.

This shift necessitates a strategic re-evaluation of workforce roles and skill development. Companies like Five9 must consider how to upskill existing staff to manage more complex customer interactions and AI oversight.

- Reduced Human Agent Demand: Estimates point to a 5% to 7% decrease in human agent requirements due to AI automation.

- Upskilling Imperative: Focus will shift to training human agents for higher-value tasks, problem-solving, and AI system management.

- Operational Efficiency Gains: AI handles repetitive queries, freeing up human agents for more nuanced customer support.

Intense competition from established players like Genesys and NICE CXone, as well as emerging cloud providers, forces Five9 to constantly fight for market share and can pressure its profitability. The rapid evolution of technology, particularly in AI, demands continuous and substantial R&D investment to avoid falling behind competitors.

Economic headwinds, including high interest rates and inflation, pose a threat by potentially causing businesses to delay or reduce spending on new contact center solutions, thereby slowing Five9's revenue growth. Furthermore, the increasing sophistication of cyberattacks and evolving data privacy regulations present significant risks, with the global average cost of a data breach reaching $4.73 million in 2024, according to IBM.

| Threat Category | Specific Challenge | Impact on Five9 |

|---|---|---|

| Market Competition | Crowded cloud contact center market | Increased customer acquisition costs, potential margin pressure |

| Technological Disruption | Rapid AI and automation advancements | Need for ongoing R&D investment, risk of obsolescence |

| Macroeconomic Factors | Inflation, high interest rates | Delayed customer spending, longer sales cycles, slower revenue growth |

| Cybersecurity & Privacy | Data breaches, regulatory non-compliance | Reputational damage, financial penalties (e.g., average breach cost $4.73M in 2024) |

SWOT Analysis Data Sources

This Five9 SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market research from leading industry analysts, and expert opinions from technology and customer service professionals.