Five9 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five9 Bundle

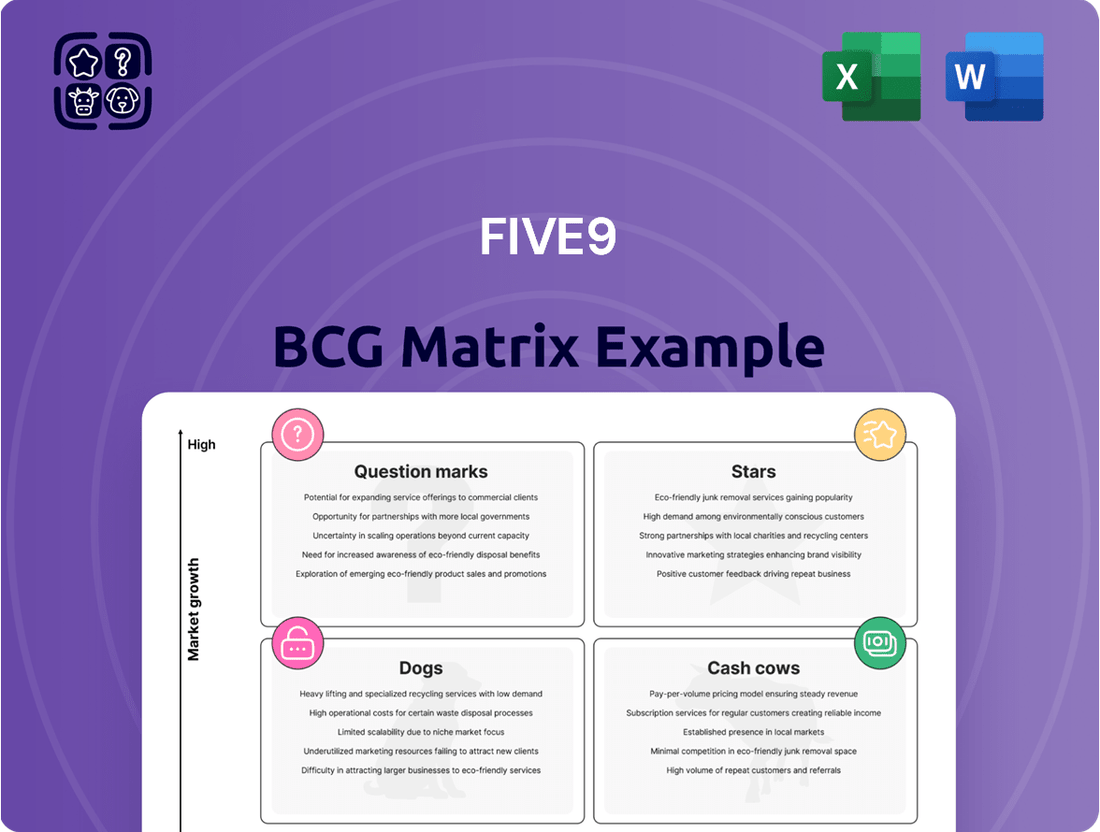

Curious about Five9's strategic product positioning? This glimpse into their BCG Matrix highlights key areas of growth and potential challenges. To truly understand where Five9 shines as a Star, sustains as a Cash Cow, or needs careful consideration as a Question Mark or Dog, dive into the full report.

Unlock the complete Five9 BCG Matrix and gain a clear, actionable view of their product portfolio's performance. This comprehensive analysis provides the data-driven insights you need to make informed strategic decisions and capitalize on market opportunities. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Five9's AI-powered solutions, including the Genius AI Suite, AI Agents, and GenAI Studio, are positioned as stars in the BCG matrix, reflecting their high growth and market share in the dynamic CCaaS sector.

The company's enterprise AI revenue saw a substantial 42% year-over-year increase in Q2 2025, with AI now making up 10% of its total enterprise subscription revenue.

This strong performance is further underscored by the fact that nearly all new deals surpassing $1 million in Annual Recurring Revenue (ARR) now incorporate AI components, highlighting robust market demand and Five9's leading role in AI-driven customer engagement.

Five9's Enterprise Cloud Contact Center Platform is a shining star, dominating its market. This core offering, specifically targeting large enterprises, now accounts for a massive 90% of Five9's total revenue, a testament to its success since its IPO. The company's ability to attract and retain significant clients is evident, with 211 customers generating over $1 million in Annual Recurring Revenue (ARR) by the end of Q4 2024.

The platform's stellar performance is further solidified by its impressive financial metrics. Five9 has demonstrated consistent revenue growth, and a robust dollar-based retention rate of 108% for the twelve months ending Q2 2025 highlights exceptional customer loyalty and expansion within existing accounts. This strong market position and ongoing expansion in a high-growth sector clearly define this product as a star in the Five9 portfolio.

Five9's omnichannel integration capabilities are a significant strength, allowing seamless customer interactions across voice, chat, email, and social media. This is crucial as 90% of customers expect consistent experiences across all touchpoints. The platform's design directly addresses this growing demand, boosting customer satisfaction and driving platform adoption.

Workforce Optimization and Analytics Tools

Five9's workforce optimization and analytics tools are pivotal for contact centers aiming for peak efficiency and agent performance. These solutions empower businesses to make smarter, data-backed decisions, a key differentiator in the expanding customer experience (CX) market. Their ongoing development signifies a commitment to high-growth potential and sustained market relevance.

These tools are essential for driving operational excellence and improving agent productivity, directly contributing to Five9's value proposition. By leveraging advanced analytics, businesses can identify areas for improvement, streamline workflows, and ultimately enhance customer satisfaction.

- Enhanced Agent Performance: Five9's analytics provide insights into agent behavior, allowing for targeted coaching and training to boost productivity.

- Data-Driven Decision Making: Real-time data and reporting enable managers to make informed decisions regarding staffing, scheduling, and performance management.

- Operational Efficiency: Workforce optimization features help automate scheduling and forecasting, reducing manual effort and improving resource allocation.

- CX Market Growth: The increasing demand for superior customer experiences fuels the need for sophisticated tools like those offered by Five9, with the global contact center market projected to reach over $50 billion by 2027.

Global Expansion Initiatives

Five9's strategic global expansion is a key driver of its growth. The company has been actively establishing new data centers, including recent ones in India, to better serve international markets. This infrastructure investment supports their aim to broaden their global reach and cater to a growing international customer base.

Evidence of this global push is clear in their customer engagement. For instance, at their 2024 CX Summit, a significant majority, over 80%, of attendees hailed from international locations. This statistic underscores Five9's success in attracting and engaging clients outside its traditional strongholds, indicating a robust expansion into new and emerging geographical markets.

- New Data Centers: Five9 has strategically opened new data centers, notably in India, to enhance its global service capabilities.

- International Partnerships: The company is actively cultivating and expanding its international partnerships, a critical component of its global strategy.

- Global Customer Base Growth: Five9 is experiencing a notable increase in its international customer base, reflecting successful market penetration.

- 2024 CX Summit Attendance: Over 80% of attendees at the 2024 Five9 CX Summit were from outside the US, highlighting the company's expanding global footprint and engagement.

Five9's AI-powered solutions, including Genius AI Suite and AI Agents, are positioned as stars due to their high growth and market share in the CCaaS sector. Enterprise AI revenue surged 42% year-over-year in Q2 2025, now representing 10% of total enterprise subscription revenue. This strong performance is further validated by nearly all new deals exceeding $1 million in ARR incorporating AI, demonstrating substantial market demand and Five9's leadership in AI-driven customer engagement.

| Product/Service | BCG Category | Key Metrics/Facts |

|---|---|---|

| Enterprise Cloud Contact Center Platform | Star | Accounts for 90% of Five9's total revenue; 211 customers with >$1M ARR (Q4 2024); 108% dollar-based retention rate (ending Q2 2025). |

| AI-Powered Solutions (Genius AI Suite, AI Agents) | Star | 42% YoY increase in enterprise AI revenue (Q2 2025); AI is 10% of enterprise subscription revenue; Nearly all new >$1M ARR deals include AI. |

| Omnichannel Integration | Star | Addresses 90% customer expectation for consistent cross-touchpoint experiences; Drives platform adoption and customer satisfaction. |

| Workforce Optimization & Analytics | Star | Essential for operational excellence and agent productivity; Global contact center market projected over $50B by 2027. |

| Global Expansion | Star | New data centers in India; Over 80% of attendees at 2024 CX Summit were international. |

What is included in the product

The Five9 BCG Matrix provides a strategic overview of its product portfolio, categorizing offerings as Stars, Cash Cows, Question Marks, or Dogs.

Five9's BCG Matrix provides a clear, visual roadmap for resource allocation, alleviating the pain of inefficient investment decisions.

Cash Cows

Five9's core voice and IVR solutions, though not experiencing rapid expansion, are likely the bedrock of its financial stability, generating substantial and consistent cash flow. These mature offerings, fundamental to contact center operations, continue to provide a reliable, high-margin revenue stream, estimated to contribute significantly to the company's overall financial health.

The company's impressive adjusted gross margins, consistently hovering around 62-63%, underscore the profitability of these established services. This financial strength allows Five9 to effectively 'milk' these cash cows, channeling the generated funds into investments for growth in other strategic areas.

Five9's established enterprise customer base is a significant cash cow. This loyal group generates a stable stream of recurring revenue, with many long-term clients increasing their service usage.

The company boasts a strong dollar-based retention rate of 108%, indicating that existing enterprise customers are not only staying but also spending more over time. This high retention translates to predictable and substantial cash flow, requiring less investment in new customer acquisition compared to other business segments.

The unified cloud-native platform, the backbone of Five9's offerings, is a prime example of a cash cow. This robust infrastructure, which underpins all of Five9's solutions, achieved a significant milestone by surpassing one billion dollars in revenue during 2024.

Its established, scalable nature means that it generates consistent, high-margin revenue with minimal incremental investment for its existing services. This platform's ability to efficiently support and deliver all other product lines solidifies its position as a reliable revenue generator for Five9.

Professional Services and Support

Five9's Professional Services and Support segment acts as a reliable cash cow, generating consistent and high-margin revenue. As clients deploy and expand their cloud contact center solutions, they depend on Five9 for essential assistance, training, and tailored configurations. This ongoing support not only fosters customer loyalty but also secures predictable, recurring income for the company.

These services are crucial for customer success and retention. For instance, in 2023, Five9 reported that approximately 18% of its total revenue came from professional services and other revenue, which includes support. This segment is characterized by its ability to command premium pricing due to the specialized expertise and critical nature of the assistance provided.

- Stable Revenue Generation: Professional services and ongoing support provide a predictable and substantial revenue stream for Five9.

- High Profitability: These offerings are typically high-margin due to the specialized knowledge and value delivered to customers.

- Customer Retention: Essential support ensures customer satisfaction and encourages long-term relationships, leading to recurring revenue.

- Scalability: As Five9's customer base grows, the demand for these critical services naturally increases, further solidifying their cash cow status.

Long-Term Contracts and Recurring Revenue Model

Five9's foundation as a cash cow is built upon its robust recurring revenue model, primarily driven by long-term contracts. This structure offers significant predictability in financial performance, a key characteristic of established, high-performing businesses.

The company's subscription-based approach ensures a steady and consistent influx of cash. This stability allows Five9 to confidently allocate resources towards research and development for future growth initiatives, all while capitalizing on the profitability generated from its existing client base.

- Recurring Revenue Dominance: Subscription revenue constituted 80-81% of Five9's total revenue in the first half of 2025.

- Consistent Growth: Subscription revenue saw a healthy 14% year-over-year increase in Q1 2025 and a 16% increase in Q2 2025.

- Contractual Stability: Long-term contracts underpin this recurring revenue, providing a predictable cash flow stream.

- Investment Capacity: The consistent cash flow supports strategic investments in innovation and market expansion.

Five9's core cloud-native platform, a critical infrastructure supporting all its solutions, surpassed one billion dollars in revenue during 2024. This mature offering generates consistent, high-margin revenue with minimal incremental investment, solidifying its role as a reliable revenue generator.

The company's strong dollar-based retention rate of 108% highlights the loyalty and increasing spend of its enterprise customers. This metric directly translates to predictable and substantial cash flow, reducing the need for extensive new customer acquisition efforts.

Subscription revenue, making up 80-81% of Five9's total revenue in the first half of 2025, underscores the company's robust recurring revenue model. This stability, driven by long-term contracts, empowers Five9 to invest strategically in innovation and growth.

| Key Cash Cow Metrics | Value | Period |

|---|---|---|

| Cloud-Native Platform Revenue | Over $1 billion | 2024 |

| Dollar-Based Retention Rate | 108% | H1 2025 |

| Subscription Revenue % of Total | 80-81% | H1 2025 |

| Subscription Revenue Growth (Q1 2025) | 14% YoY | Q1 2025 |

| Subscription Revenue Growth (Q2 2025) | 16% YoY | Q2 2025 |

Full Transparency, Always

Five9 BCG Matrix

The Five9 BCG Matrix preview you're examining is the identical, fully-polished document you'll receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – you're seeing the complete, professionally formatted strategic analysis ready for your direct application.

Dogs

Legacy on-premise integrations represent a potential 'dog' in Five9's BCG Matrix. While the company champions cloud solutions, a small customer segment may still rely on older, on-premise systems. Supporting these legacy integrations can demand significant resources for maintenance and customization, with minimal prospects for substantial growth or new customer acquisition.

Underperforming niche integrations within Five9's product suite, such as specialized industry-specific connectors that haven't achieved widespread adoption or market penetration, would fall into the 'Dogs' category of the BCG Matrix. These offerings might require significant ongoing investment in development and maintenance but yield minimal returns, failing to contribute meaningfully to overall revenue growth or market share. For instance, a hypothetical integration with a niche ERP system that only a handful of clients utilize, despite substantial R&D expenditure, exemplifies such a scenario.

Highly customized, one-off solutions, while potentially lucrative for a specific client, often fall into the dog category within a BCG matrix framework. These are not easily scalable and can consume significant resources without the potential for broad market replication. For example, if Five9 spent a substantial portion of its R&D budget in 2024 developing a unique integration for a single enterprise client, and this solution couldn't be easily adapted for other customers, it would represent a drain on resources with limited future growth prospects.

Outdated Feature Sets Not Aligned with AI-First Strategy

Features within Five9's platform that aren't being actively updated with AI, or don't fit with their AI-first approach to customer experience, could become dogs. This means they might not get much attention or become less useful over time.

The customer experience market is moving fast towards AI. If certain parts of the system stay the same or need a lot of manual work, they could lose popularity and importance. Five9 is concentrating on embedding AI throughout its entire offering.

For example, if a specific reporting module within Five9 relies heavily on manual data compilation rather than AI-powered insights, it might fall into the dog category. This is especially true as competitors increasingly offer automated, AI-driven analytics. In 2023, Gartner reported that 70% of customer interactions would involve AI by 2025, highlighting the urgency for platforms to integrate these capabilities.

- Features lacking AI integration: Modules that do not incorporate AI for automation or enhanced insights.

- Manual intervention requirements: Components demanding significant human effort instead of AI-driven processes.

- Market shift towards AI: The growing industry demand for AI-powered customer experience solutions.

- Declining relevance: Static platform elements risk losing usage and importance as AI adoption accelerates.

Non-Strategic, Low-Adoption Features

Non-strategic, low-adoption features within Five9's platform, if identified, would likely fall into the 'dog' category of the BCG Matrix. These are functionalities that, despite being part of the broader offering, see minimal customer engagement and do not significantly drive revenue or enhance the user experience. For instance, a niche integration that few customers utilize or an underperforming reporting module could fit this description.

Such features represent potential candidates for deprecation or a reduction in maintenance efforts. This strategic pruning allows Five9 to reallocate valuable engineering and support resources towards areas with higher growth potential and greater customer impact. The company's ongoing product portfolio reviews are designed to identify and address these underperforming elements.

- Low Adoption Metrics: Features with less than 5% active usage among the customer base might be flagged.

- Minimal Revenue Contribution: Functionalities that generate negligible direct or indirect revenue are prime candidates.

- Resource Drain: Features requiring disproportionate support or development resources relative to their utilization.

- Strategic Alignment: Components not aligned with Five9's core strategic objectives or future product roadmap.

Legacy on-premise integrations represent a potential 'dog' in Five9's BCG Matrix. While the company champions cloud solutions, a small customer segment may still rely on older, on-premise systems. Supporting these legacy integrations can demand significant resources for maintenance and customization, with minimal prospects for substantial growth or new customer acquisition.

Underperforming niche integrations within Five9's product suite, such as specialized industry-specific connectors that haven't achieved widespread adoption or market penetration, would fall into the 'Dogs' category of the BCG Matrix. These offerings might require significant ongoing investment in development and maintenance but yield minimal returns, failing to contribute meaningfully to overall revenue growth or market share.

Features within Five9's platform that aren't being actively updated with AI, or don't fit with their AI-first approach to customer experience, could become dogs. This means they might not get much attention or become less useful over time as the market shifts. For example, a reporting module relying on manual data compilation rather than AI-driven insights risks losing relevance as competitors offer automated analytics.

Non-strategic, low-adoption features within Five9's platform, if identified, would likely fall into the 'dog' category of the BCG Matrix. These are functionalities that see minimal customer engagement and do not significantly drive revenue or enhance the user experience, potentially requiring deprecation or reduced maintenance.

| Category | Description | Potential Five9 Example | Market Trend Impact | Resource Allocation Consideration |

|---|---|---|---|---|

| Dogs | Low market share, low growth potential. Require significant resources for minimal return. | Legacy on-premise integrations, underperforming niche connectors, features lacking AI integration. | AI adoption in CX is projected to reach 70% of interactions by 2025 (Gartner). | Reallocation of resources to high-growth areas is crucial. |

| Dogs | Features with low adoption metrics (<5% active usage) and minimal revenue contribution. | A specific reporting module not aligned with AI-first strategy. | Competitors increasingly offer automated, AI-driven analytics. | Consider deprecation or reduced maintenance to free up R&D budget. |

Question Marks

Five9's strategic push into emerging international markets, like India with its new data centers and DOT licensing, places it squarely in the question mark category of the BCG matrix. These regions present a tantalizing growth opportunity, but Five9's current market share is minimal, demanding substantial investment to build presence and compete effectively. For instance, the Indian cloud communications market was projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% leading up to 2025.

Five9's new AI Agentic CX capabilities, like their AI Agents and GenAI Studio, represent a significant leap forward, allowing agents to reason, decide, and act autonomously. These are positioned as Stars within the BCG matrix due to their high growth potential and innovative nature. While customer adoption is still in its nascent stages, with many exploring these advanced features, the underlying technology promises to revolutionize customer interactions.

Deeper integrations with specific CRM applications, such as the Five9 Fusion integration with Salesforce, are considered question marks within the Five9 BCG Matrix. These advanced connections are designed to broaden Five9's market appeal and streamline customer workflows by embedding its contact center capabilities directly into popular business platforms.

The success of these integrations hinges on customer adoption within those specific CRM ecosystems. While Five9 reported a 15% increase in its cloud contact center market share in 2024, the actual impact of these deeper integrations on its overall revenue and market position is still developing, requiring continued investment and strategic alliances to fully leverage their potential.

AI Trust & Governance Solutions

Five9's commitment to AI Trust & Governance solutions is a forward-thinking strategy, essential for building confidence in AI adoption. These offerings directly tackle the growing demand for ethical, transparent, and compliant AI systems. As of early 2024, the market for AI governance is rapidly expanding, with projections indicating significant growth as more enterprises integrate AI responsibly.

While this segment is a high-growth area, its market share is still in its nascent stages. Businesses are increasingly recognizing the importance of ethical AI, driving the need for robust governance frameworks. This necessitates ongoing market education and development to fully realize the potential of these solutions.

- Market Growth: The AI governance market is expected to experience a compound annual growth rate (CAGR) of over 30% in the coming years, reaching tens of billions of dollars by 2028.

- Key Concerns: Solutions address AI ethics, bias mitigation, data privacy, and regulatory compliance, which are paramount for enterprise-level AI deployment.

- Adoption Drivers: Increasing regulatory scrutiny and public demand for trustworthy AI are key factors accelerating the adoption of these governance solutions.

- Five9's Position: Five9's focus here positions them to capture a significant share of this emerging market by providing foundational trust for their AI-powered contact center solutions.

Specialized Industry-Specific AI Solutions

Developing highly specialized AI solutions for specific industries, like healthcare or financial services, presents a potential question mark for Five9. While these tailored offerings can tap into high-growth vertical markets, they demand significant investment in understanding unique industry needs and building customized features. Success hinges on effectively penetrating each niche market.

This strategy requires substantial upfront investment in research and development to ensure the AI accurately addresses sector-specific challenges. For example, in healthcare, this might involve HIPAA compliance features and patient interaction protocols, while financial services could require robust fraud detection and regulatory adherence capabilities. The market share achieved will directly correlate with how well Five9 can deliver on these specialized requirements.

- Industry Nuance Investment: Five9 must invest in deep understanding of sector-specific workflows and compliance needs.

- Customization Costs: Building tailored AI solutions for each vertical incurs significant R&D and implementation expenses.

- Market Penetration Risk: Success in niche markets depends on Five9's ability to gain traction against specialized competitors.

- Potential for High Returns: If successful, these specialized solutions can command premium pricing and capture significant market share in underserved segments.

Five9's strategic expansion into emerging international markets and the development of deeper CRM integrations are prime examples of question marks within the BCG matrix. These initiatives require significant investment to build market share and establish a strong presence. For instance, the global cloud contact center market was projected to see continued growth, with analysts anticipating a substantial increase in adoption across various regions by 2025.

These ventures hold high growth potential but currently have a low market share, necessitating substantial capital to compete effectively. The success of these question mark strategies hinges on effective execution and market reception, with continued R&D and strategic partnerships being crucial for Five9 to convert these opportunities into stars.

BCG Matrix Data Sources

Our Five9 BCG Matrix draws from Five9's financial reports, industry analyst assessments, and market growth projections to accurately position their offerings.