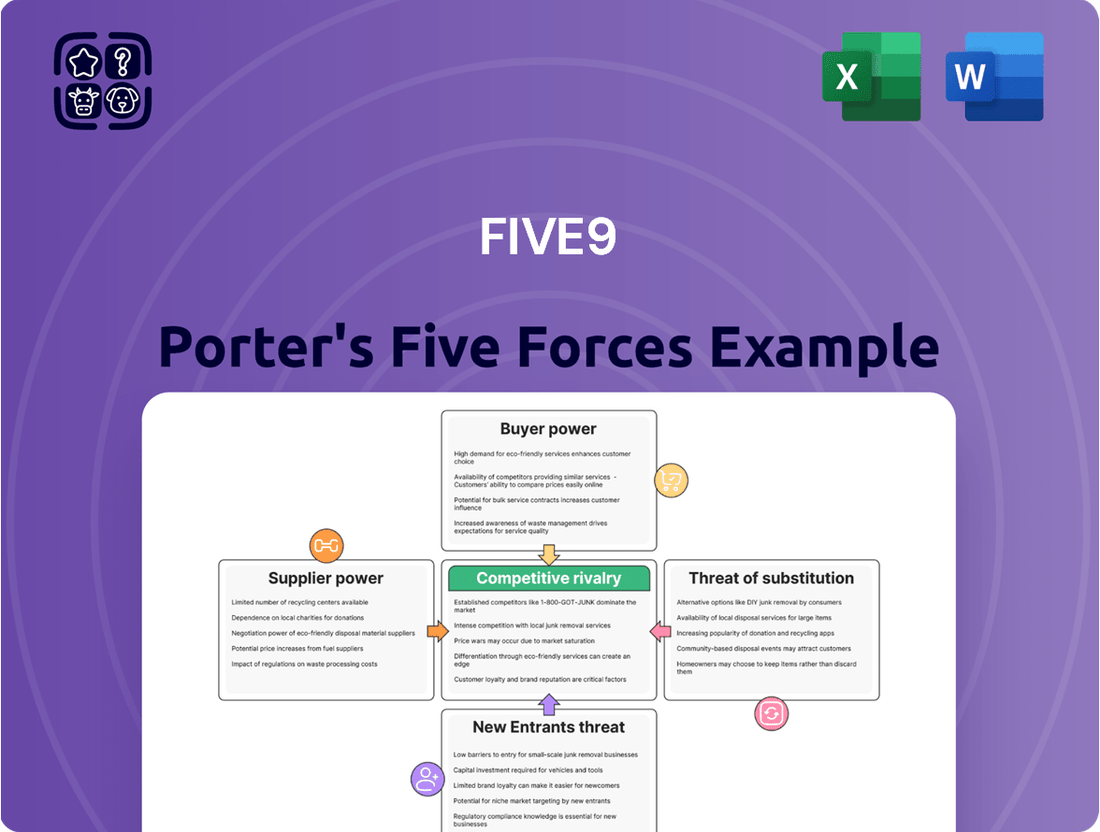

Five9 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five9 Bundle

Five9 operates within a dynamic cloud contact center market, facing intense competition and evolving customer expectations. Understanding the forces of rivalry, buyer power, supplier power, threat of new entrants, and substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping Five9’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Five9's reliance on cloud infrastructure, a market dominated by major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, presents a nuanced situation regarding supplier concentration. While these providers are substantial, the competitive landscape and Five9's potential for multi-cloud strategies or leveraging specific niche providers help dilute the bargaining power of any single entity. For instance, AWS held an estimated 31% of the global cloud infrastructure market share in the first quarter of 2024, while Azure and Google Cloud followed with 25% and 11% respectively. This distribution suggests that while these are large suppliers, Five9 isn't entirely beholden to one, allowing for negotiation and flexibility.

The increasing standardization of core technologies like cloud computing, storage, and networking significantly weakens supplier bargaining power for Five9. As these inputs become commoditized, Five9 can easily switch between providers, limiting the ability of any single supplier to dictate terms. For instance, the global cloud infrastructure market, a key input for Five9's SaaS offerings, saw significant growth in 2024, with major players like AWS, Azure, and Google Cloud competing aggressively on price and service, offering Five9 ample choice.

While it's highly improbable for major cloud infrastructure providers to integrate forward into offering full contact center as a service (CCaaS) solutions like Five9, some niche technology suppliers might consider it. However, the intricate nature of a comprehensive CCaaS platform, encompassing elements like intelligent routing, workforce optimization, and advanced analytics, presents a significant hurdle for most component suppliers to overcome. This complexity inherently limits the immediate threat of suppliers becoming direct competitors to Five9.

Importance of AI and Telecom Providers

The growing reliance on Artificial Intelligence (AI) within contact center solutions significantly influences the bargaining power of AI providers. As companies like Five9 increasingly embed AI for tasks such as intelligent routing, sentiment analysis, and automated customer service, specialized AI developers and platform providers could command greater leverage due to the unique capabilities they offer. For instance, advancements in generative AI, which saw substantial development and investment throughout 2024, could lead to higher demand for specialized models, potentially increasing supplier power.

Telecom providers, the backbone of voice connectivity for contact centers, also represent a critical supplier group. Their pricing structures, service level agreements (SLAs), and network reliability directly affect Five9's operational costs and the quality of service delivered to its clients. While telecom costs can fluctuate, Five9's strategic approach of maintaining relationships with multiple telecom partners helps to mitigate the concentrated bargaining power of any single provider, fostering a more balanced negotiation environment.

- AI Integration: The increasing sophistication of AI in contact centers, including advancements in natural language processing and machine learning, gives specialized AI providers more leverage.

- Telecom Dependence: Reliable and cost-effective voice connectivity from telecom providers is essential, making their pricing and service quality a key factor.

- Supplier Diversification: Five9's strategy of partnering with multiple telecom providers helps to distribute risk and negotiate better terms, thereby reducing the bargaining power of individual suppliers.

- Market Dynamics: The competitive landscape for both AI and telecom services in 2024 and beyond will continue to shape the bargaining power dynamics for Five9.

Switching Costs for Five9

Switching core cloud infrastructure providers or deeply integrated technology partners can incur significant costs and operational disruptions for Five9. This creates some stickiness with existing suppliers, giving them a degree of bargaining power.

For instance, if Five9 relies heavily on a specific cloud provider for its contact center as a service (CCaaS) platform, migrating data, reconfiguring services, and retraining staff could represent substantial expenses and potential downtime. While Five9's platform design likely aims for modularity to minimize these costs where possible, the inherent complexity of deeply integrated systems means some level of switching cost will always exist.

- High Switching Costs: Migrating critical cloud infrastructure or deeply integrated software can involve significant financial outlays and operational interruptions for Five9.

- Supplier Stickiness: These costs create a degree of dependency on existing suppliers, enhancing their bargaining leverage.

- Modularity as a Mitigator: Five9's strategic platform architecture likely incorporates modularity to reduce these switching costs, thereby lessening supplier power.

The bargaining power of suppliers for Five9 is influenced by the concentration of providers and the availability of substitutes. For critical inputs like cloud infrastructure, a few dominant players exist, but Five9's ability to diversify across these providers, coupled with market competition, mitigates individual supplier leverage. For example, in Q1 2024, AWS, Azure, and Google Cloud held significant market shares, but their competition offers Five9 negotiation opportunities.

The commoditization of core technologies, such as cloud computing, reduces supplier power as Five9 can more easily switch providers. The competitive pricing and service offerings in the growing global cloud infrastructure market in 2024 further enhance Five9's ability to negotiate favorable terms. This dynamic allows Five9 to leverage market competition to its advantage.

The increasing reliance on specialized AI solutions for contact centers, however, can empower certain AI providers. As Five9 integrates advanced AI capabilities, the unique expertise of specialized AI developers can lead to increased supplier leverage, particularly with advancements in generative AI seen throughout 2024. This trend necessitates careful supplier selection and relationship management.

Telecom providers are essential for Five9's voice connectivity. While these providers can exert influence through pricing and service levels, Five9's strategy of engaging multiple telecom partners helps to diffuse this power, ensuring more balanced negotiations and reliable service delivery.

| Supplier Type | Key Providers | Market Share (Q1 2024 Est.) | Impact on Five9 Bargaining Power | Mitigation Strategies |

|---|---|---|---|---|

| Cloud Infrastructure | AWS, Microsoft Azure, Google Cloud | AWS: 31%, Azure: 25%, Google Cloud: 11% | Moderate to High (due to concentration) | Multi-cloud strategy, competitive market |

| AI Solutions | Specialized AI Developers | N/A (Fragmented Market) | Potentially High (due to unique capabilities) | Strategic partnerships, in-house development |

| Telecom Services | Major Telecom Carriers | N/A (Varies by Region) | Moderate (essential service) | Multiple provider relationships |

What is included in the product

This analysis examines the competitive forces impacting Five9, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the cloud contact center market.

Effortlessly visualize the competitive landscape with Five9's Porter's Five Forces analysis, transforming complex market dynamics into actionable insights for strategic advantage.

Customers Bargaining Power

Five9's core clientele consists of medium to large enterprises, and for these businesses, the integration of a cloud contact center solution represents a significant undertaking. Once a company has committed to Five9, the process of migrating data, retraining agents on a new platform, and re-establishing connections with existing CRM and other vital business systems can be complex and time-consuming.

These substantial integration efforts translate into high switching costs for Five9's customers. The financial and operational investment required to move to a competitor's platform is considerable, making it less likely for customers to seek out alternatives frequently. This reality directly impacts the bargaining power of individual customers, as the immediate threat of churn is diminished.

For instance, in 2023, the average enterprise contact center migration project can cost anywhere from $50,000 to over $1 million, depending on the scale and complexity. This substantial financial barrier significantly limits a single customer's ability to negotiate aggressively on pricing or terms with a provider like Five9, as the cost of switching outweighs the potential short-term gains.

Contact center operations are crucial for a business's customer experience and brand image, making the software providers strategically important. This importance, however, translates into powerful customer leverage, as clients expect top-tier performance, unwavering reliability, and continuous innovation from their contact center solutions. For instance, in 2024, businesses continued to prioritize customer experience, with studies indicating that over 80% of consumers will switch brands after just one poor service interaction.

Customers are therefore prepared to invest heavily in contact center technologies that promise to elevate their customer service. This willingness to spend empowers them to negotiate favorable terms and demand cutting-edge features. The significant investment required for robust contact center software, often running into hundreds of thousands or even millions of dollars annually for large enterprises, further amplifies their bargaining power.

Customers, even with high switching costs, remain keenly aware of pricing and increasingly scrutinize the return on investment (ROI) from their technology. For instance, in 2024, many businesses reported that a significant driver for cloud-based software adoption was not just functionality but also a clear path to cost savings and demonstrable ROI within 12-18 months.

Five9 needs to consistently showcase the tangible value, efficiency improvements, and enhanced customer satisfaction its solutions provide to validate its pricing. This is particularly crucial given the competitive landscape where alternatives are readily available.

A major push from customers in 2024 has been the desire to leverage AI and automation to drive down operational costs, making this a critical factor in their purchasing decisions and a key area Five9 must address to meet these evolving demands.

Customer Sophistication and Customization Needs

Five9's enterprise clients often possess a high degree of sophistication, leading to complex and specific demands for their contact center technology. These customers frequently require extensive customization options, seamless integration with existing systems, and cutting-edge features such as AI-driven automation and advanced analytics.

This elevated level of client expertise and their need for tailored solutions grants them significant bargaining power. They can leverage these requirements to negotiate for customized service packages, preferential pricing, and enhanced support levels, directly impacting Five9's pricing strategies and service delivery models.

- Sophisticated Demands: Enterprise clients seek highly specific functionalities, including AI-powered chatbots and advanced analytics, which are not standard offerings.

- Customization Leverage: The need for integration with CRM, ERP, and other business systems empowers customers to demand tailored solutions.

- Negotiating Power: Complex requirements allow large clients to negotiate for better terms, potentially impacting Five9's profit margins.

- Industry Benchmarks: In 2024, the average enterprise contact center solution cost can range significantly based on customization, with some deals involving multi-million dollar annual contracts for highly tailored platforms.

Availability of Multiple Vendors

The cloud contact center market, where Five9 operates, is quite crowded. This means customers have many choices, which naturally gives them more leverage. For instance, major competitors like Genesys and NICE CXone, along with cloud giants such as Amazon Connect and Salesforce, all offer robust solutions.

This abundance of alternatives significantly strengthens the bargaining power of customers. They can compare features, pricing, and service levels across multiple vendors, especially when making initial purchasing decisions or during contract renegotiations. In 2024, the competitive landscape continues to intensify, with ongoing innovation and market entry from new players, further tilting the scales in favor of the buyer.

- Numerous Competitors: The cloud contact center market features many established and emerging players, providing customers with ample choices.

- Customer Leverage: A wide array of vendors increases customer bargaining power during vendor selection and contract renewals.

- Market Dynamics: The competitive nature of the market, driven by innovation and new entrants, empowers customers with more options and negotiating strength as of 2024.

Even with high switching costs, customers in 2024 are keenly focused on demonstrating clear return on investment (ROI) and cost savings, often expecting these within 12-18 months. This financial scrutiny means Five9 must continuously prove its value proposition. Furthermore, the increasing demand for AI and automation to reduce operational expenses in 2024 gives customers significant leverage to negotiate for more cost-effective solutions.

The sophisticated demands of Five9's enterprise clients, including complex integrations and advanced AI features, empower them to negotiate for tailored packages and preferential pricing. For example, in 2024, multi-million dollar annual contracts for highly customized platforms reflect this customer power. This necessitates that Five9 demonstrate tangible benefits like efficiency gains and improved customer satisfaction to justify its pricing.

The competitive cloud contact center market in 2024, featuring numerous strong players like Genesys and NICE CXone, significantly enhances customer bargaining power. This abundance of choice allows clients to compare offerings and negotiate favorable terms, especially during renewals, as innovation and new market entrants continue to tip the scales in favor of buyers.

| Factor | Impact on Five9 | Customer Leverage Driver | 2024 Data Point |

|---|---|---|---|

| Switching Costs | Reduces individual customer power | High integration and migration expenses | Enterprise migration projects can cost $50k-$1M+ |

| Customer Sophistication | Increases customer power | Demand for customization and advanced features (AI, analytics) | Need for tailored solutions impacts pricing strategies |

| Competitive Landscape | Increases customer power | Abundance of alternative vendors (Genesys, NICE CXone, Amazon Connect) | Intensifying competition favors buyers in 2024 |

| Focus on ROI/Cost Savings | Increases customer power | Demand for demonstrable cost reduction and efficiency gains | 80%+ consumers switch brands after one poor service interaction (2024) |

Preview the Actual Deliverable

Five9 Porter's Five Forces Analysis

This preview showcases the complete Five9 Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the cloud contact center market. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability. This comprehensive report delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The global cloud-based contact center market is booming, with projections indicating it will reach a massive USD 222.91 billion by 2034, growing at an impressive compound annual growth rate of 21.73% from 2025 to 2034. This rapid expansion acts like a magnet, drawing in numerous companies, both seasoned players and fresh faces. Consequently, the competition is fierce.

Five9 finds itself in this highly dynamic and competitive arena. The sheer volume of participants, all vying for a piece of this expanding market, means that differentiation and innovation are absolutely critical for survival and success. Staying ahead requires constant adaptation and a keen understanding of evolving customer needs.

Five9 contends with formidable rivals like Amazon Connect, Microsoft, Google, and Salesforce, all of which are expanding their cloud contact center (CCaaS) solutions. These giants possess vast financial resources and established client relationships, enabling them to invest heavily in R&D and aggressive market penetration strategies.

The presence of these large, diversified competitors presents a significant challenge. For instance, Amazon Web Services (AWS), powering Amazon Connect, reported over $25 billion in revenue for Q4 2023, showcasing its immense capacity to fund product development and customer acquisition efforts in the CCaaS space.

The cloud contact center landscape is defined by fierce competition, with differentiation increasingly stemming from artificial intelligence and innovative solutions. Companies are vying to offer more sophisticated AI-powered tools to enhance customer interactions and operational efficiency.

Five9 has been actively bolstering its AI capabilities, evidenced by substantial growth in its enterprise AI revenue, highlighting a strategic commitment to this domain. This focus allows them to offer advanced features that set them apart in a crowded market.

However, rivals are also pouring resources into AI development, making relentless innovation a necessity. For instance, in 2024, many competitors announced significant AI feature rollouts, aiming to capture market share through technological advancements.

High Stakes and Strategic Importance for Businesses

The contact center software market is highly competitive, as this technology is crucial for customer service, making vendor selection a significant decision for businesses. Vendors are locked in a fierce battle, not just over product features, but also over reliability, scalability, and the demonstrable impact on business results and customer satisfaction.

This intense rivalry means companies like Five9 face pressure to innovate constantly and offer compelling value propositions. For instance, in 2024, the global contact center as a service (CCaaS) market was projected to reach over $20 billion, underscoring the massive opportunity and the intense competition to capture market share.

- High Switching Costs: Businesses often invest heavily in integrating contact center software with existing CRM and other business systems, creating significant switching costs that lock them into current vendors.

- Product Differentiation Challenges: While features evolve, core functionalities can become commoditized, forcing vendors to compete on less tangible aspects like support, integration ease, and thought leadership.

- Customer Experience as a Differentiator: Vendors are increasingly judged on their ability to help clients deliver superior customer experiences, a key driver of loyalty and revenue growth.

- Market Consolidation and M&A: The pursuit of scale and expanded offerings leads to mergers and acquisitions, further intensifying rivalry as larger players emerge and smaller ones are acquired or struggle to compete.

Acquisition and Consolidation Activity

The cloud contact center market is experiencing significant consolidation. Larger companies are actively acquiring smaller rivals to enhance their technological capabilities or expand their market reach. This trend is evident across the industry as firms seek to scale and gain competitive advantages.

While a notable proposed acquisition of Five9 by Zoom in 2021 did not proceed, the persistent rumors surrounding potential sales or workforce reductions within Five9 highlight the intense pressure for industry consolidation. This ongoing M&A activity means the competitive landscape is in constant flux, with players continually reshaping through strategic transactions.

- Market Consolidation: The cloud contact center sector has seen a rise in acquisition activity, with larger entities absorbing smaller competitors.

- Strategic Acquisitions: These deals are driven by the desire to acquire new technologies or increase market share.

- Industry Pressures: Persistent rumors of potential sales or layoffs within companies like Five9 underscore the ongoing consolidation pressures in the market.

- Evolving Competition: The competitive environment is dynamic, with mergers and acquisitions constantly altering the positioning of key players.

Competitive rivalry in the cloud contact center market is intense, driven by rapid growth and a large number of players. Five9 faces significant competition from tech giants like Amazon, Microsoft, Google, and Salesforce, who leverage their substantial financial resources and existing customer bases to expand their CCaaS offerings. This makes differentiation through innovation, particularly in AI, crucial for survival.

The market is characterized by high switching costs for businesses due to system integrations, and vendors often compete on factors beyond core features, such as customer support and ease of integration. This dynamic environment also sees ongoing market consolidation through mergers and acquisitions, further intensifying the competitive pressures on companies like Five9.

In 2024, the global CCaaS market was valued at over $20 billion, highlighting the substantial opportunity and the fierce competition to capture market share. Companies are investing heavily in AI to enhance customer interactions and operational efficiency, with many announcing new AI features throughout the year.

| Competitor | Key CCaaS Offering | Reported Revenue/Scale Indicator (Approximate) | AI Focus |

|---|---|---|---|

| Amazon (AWS) | Amazon Connect | AWS Q4 2023 Revenue: Over $25 billion | AI-powered contact center analytics, chatbots |

| Microsoft | Microsoft Dynamics 365 Customer Service | Significant investment in AI across Azure and Dynamics | Copilot integration for agent assistance, AI-driven insights |

| Google Cloud Contact Center AI (CCAI) | Google Cloud Q4 2023 Revenue: $8.1 billion | Virtual agents, sentiment analysis, AI-powered routing | |

| Salesforce | Salesforce Service Cloud | Salesforce FY24 Revenue: $34.9 billion | Einstein AI for customer service automation and insights |

SSubstitutes Threaten

Traditional on-premise contact center systems serve as a substitute threat, though the market is increasingly shifting towards cloud-based solutions. This migration is driven by advantages such as enhanced scalability, reduced operational costs, and the enablement of remote workforces, which were particularly highlighted during the 2020-2022 period as businesses adapted to new operational models.

While a segment of large enterprises still maintains on-premise infrastructure, the overwhelming industry trend favors cloud platforms like Five9. The global cloud contact center market was valued at approximately $12.6 billion in 2023 and is projected to grow significantly, indicating a clear preference for the flexibility and cost-efficiency offered by cloud solutions over the upfront capital expenditure and ongoing maintenance of on-premise systems.

For businesses with minimal customer interaction, basic communication tools like standard phone systems, email, or social media messaging can act as substitutes for dedicated contact center solutions. These options are often sufficient for very small operations or those with infrequent customer contact needs, representing a low-cost alternative.

Larger enterprises might explore developing in-house communication platforms. However, such endeavors typically demand significant investment in technology and personnel, often proving more costly and less adaptable than leveraging specialized Contact Center as a Service (CCaaS) offerings. For instance, while custom solutions can be tailored, the ongoing maintenance and upgrade costs can be substantial compared to subscription-based CCaaS models.

Manual processes, like using spreadsheets and basic email for customer service, represent a significant threat. Many smaller businesses or those with very low customer interaction volumes might find this sufficient, avoiding the need for dedicated contact center software. For example, a 2024 survey indicated that 15% of small businesses still primarily rely on email and phone calls without specialized CRM or contact center platforms.

Outsourcing to Business Process Outsourcing (BPO) providers also poses a threat. These firms can offer comprehensive customer service solutions, potentially at a lower cost than investing in and managing an in-house platform like Five9. The global BPO market was valued at over $270 billion in 2023 and is projected to grow, indicating a strong demand for outsourced services.

While BPOs offer a complete service, Five9's value proposition is often in enhancing internal capabilities and providing greater control and integration. Therefore, the threat of substitutes is more about businesses choosing entirely different operational models rather than finding a direct software competitor that performs the exact same function.

Emerging AI-Only Solutions

The rapid evolution of artificial intelligence, especially generative AI and AI-driven automation, presents a significant threat of substitutes for traditional contact center solutions. These advancements could enable entirely AI-powered systems to handle a substantial portion of customer interactions, potentially reducing the reliance on human agents. For instance, in 2024, many companies are exploring AI chatbots and virtual assistants capable of resolving complex queries, which could bypass the need for a full Contact Center as a Service (CCaaS) platform focused on agent assistance.

While Five9 leverages AI to enhance agent capabilities and automate routine tasks, the emergence of standalone, highly autonomous AI solutions poses a long-term risk. These pure AI offerings might fulfill customer needs without requiring the human agent component that current CCaaS models emphasize. This shift could redefine the value proposition of CCaaS providers, pushing them to differentiate through advanced AI integration or specialized human-centric services.

The threat is amplified as AI technology matures, allowing for more sophisticated natural language processing and sentiment analysis. This could lead to AI systems that not only understand but also empathetically respond to customer inquiries, blurring the lines between human and AI interaction. By 2025, it's projected that AI will handle an increasing percentage of customer service inquiries, potentially impacting the market share of CCaaS providers that do not adapt their strategies.

- AI-Powered Automation: Generative AI and automation can handle a growing volume of customer service tasks.

- Reduced Need for Human Agents: Advanced AI solutions may significantly decrease the necessity for human interaction in customer service.

- Pure AI Solutions as Substitutes: Standalone AI platforms could emerge as direct alternatives to CCaaS models reliant on agent productivity.

- Market Disruption: The increasing capability of AI threatens to redefine the CCaaS market by offering alternative, potentially lower-cost, interaction resolution methods.

Other Enterprise Communication Platforms

Other enterprise communication platforms, particularly those in the Unified Communications as a Service (UCaaS) space, present a moderate threat of substitutes for Five9. These platforms often bundle basic customer engagement features alongside their core communication tools, such as instant messaging, video conferencing, and voice calling. While they may not offer the deep, specialized contact center functionalities that Five9 provides, businesses with simpler customer interaction requirements might find these integrated solutions sufficient.

For instance, a company primarily needing to route inbound calls and manage a small volume of customer queries might opt for a UCaaS provider that includes a rudimentary contact center module. This approach can be appealing due to potential cost savings and the convenience of a single vendor for all communication needs. The market for UCaaS is robust, with major players continually enhancing their feature sets. In 2024, the global UCaaS market was projected to reach over $50 billion, indicating a significant competitive landscape where integrated solutions can serve as viable alternatives for certain customer segments.

- UCaaS providers offer integrated communication suites, potentially including basic contact center features.

- These platforms can be a substitute for businesses with less demanding customer engagement needs.

- The UCaaS market's substantial size, exceeding $50 billion in 2024 projections, highlights the availability of alternative solutions.

- Businesses may choose UCaaS for cost efficiency and vendor consolidation, even if it means sacrificing specialized contact center capabilities.

The threat of substitutes for Five9 primarily stems from alternative communication and customer service models that can fulfill similar needs, often at a lower cost or with greater integration into existing business processes. Traditional on-premise systems, while declining, still represent a substitute for a segment of large enterprises. However, the clear industry shift towards cloud-based solutions, with the global cloud contact center market valued at approximately $12.6 billion in 2023, underscores the preference for scalability and cost-efficiency.

For smaller operations, basic tools like email and standard phone systems serve as low-cost substitutes, with a 2024 survey indicating 15% of small businesses still relying on these methods. Outsourcing to Business Process Outsourcing (BPO) providers, a market exceeding $270 billion in 2023, also poses a threat by offering comprehensive customer service solutions.

The most significant emerging threat comes from AI-powered automation. Advanced AI and generative AI can handle a substantial portion of customer interactions, potentially reducing the need for human agents and entire CCaaS platforms. By 2025, AI is projected to handle an increasing percentage of customer service inquiries, challenging the traditional CCaaS model.

Unified Communications as a Service (UCaaS) platforms also present a moderate threat, offering integrated communication suites with basic contact center features. With the UCaaS market projected to exceed $50 billion in 2024, these bundled solutions can be sufficient for businesses with simpler customer engagement needs, offering cost savings and vendor consolidation.

| Substitute Type | Description | Key Advantage | Market Context (2023/2024 Projections) |

|---|---|---|---|

| On-Premise Systems | Traditional, self-hosted contact center software. | Perceived control for some large enterprises. | Declining market share as cloud adoption accelerates. |

| Basic Communication Tools | Standard phone systems, email, social media messaging. | Low cost, simplicity for low-volume interactions. | Used by 15% of small businesses (2024 survey). |

| BPO Providers | Third-party firms offering outsourced customer service. | Comprehensive service, potential cost savings. | Global market valued over $270 billion (2023). |

| AI-Powered Automation | Standalone AI chatbots and virtual assistants. | High automation potential, reduced human agent need. | Rapidly growing, projected to handle increasing customer inquiries by 2025. |

| UCaaS Platforms | Integrated communication suites with basic contact center features. | Cost efficiency, vendor consolidation, convenience. | Global market projected over $50 billion (2024). |

Entrants Threaten

Developing a sophisticated cloud contact center platform, akin to Five9's, demands substantial capital for robust technology infrastructure, advanced software engineering, and continuous research and development, especially in cutting-edge AI. These significant upfront expenditures create a formidable barrier to entry for aspiring competitors.

The threat of new entrants into the contact center as a service (CCaaS) market, particularly concerning technological complexity and AI expertise, is moderately low. The intricate nature of intelligent routing, workforce optimization, advanced analytics, and AI-powered automation demands significant technological depth and a commitment to ongoing innovation. For instance, developing robust AI models for predictive analytics in customer service can take years and substantial investment, a barrier for many newcomers. Companies like Five9, which have invested heavily in their AI platforms, have a distinct advantage. The global CCaaS market, valued at approximately $20 billion in 2023, is expected to grow, but this growth is driven by sophisticated solutions that require considerable R&D.

Five9 benefits from deeply entrenched customer relationships, particularly within the enterprise segment. These long-standing partnerships translate into significant customer loyalty, making it difficult for new entrants to penetrate the market. For instance, in 2024, Five9 reported a customer retention rate of over 90%, highlighting the stickiness of its platform and services.

The high switching costs associated with cloud-based contact center solutions further solidify Five9's position. Migrating from one platform to another involves substantial investment in data transfer, integration, and employee retraining. This barrier discourages potential customers from exploring newer, unproven alternatives, thereby reducing the threat of new entrants.

Regulatory Compliance and Security Needs

The contact center software market, particularly for companies like Five9, faces a significant threat from new entrants due to stringent regulatory compliance and security demands. Handling sensitive customer data means new players must immediately invest in robust security infrastructure and navigate complex data privacy laws, such as GDPR and CCPA, right from their inception. This creates a substantial barrier, as compliance isn't an afterthought but a foundational requirement, demanding significant upfront capital and expertise.

New entrants must also contend with the high cost of building and maintaining secure, compliant platforms. For instance, achieving certifications like SOC 2 or ISO 27001, crucial for enterprise clients, requires substantial financial investment and ongoing auditing. In 2024, the cybersecurity spending for businesses is projected to reach over $200 billion globally, underscoring the scale of investment required for even basic security, let alone the specialized needs of contact center solutions handling personally identifiable information (PII).

- High Upfront Investment: New entrants must allocate significant capital towards building secure infrastructure and obtaining necessary compliance certifications.

- Complex Regulatory Landscape: Navigating global data privacy laws like GDPR and CCPA adds layers of complexity and legal overhead.

- Reputational Risk: A single security breach can severely damage a new entrant's reputation, making trust a critical, yet hard-to-earn, asset.

- Ongoing Compliance Costs: Maintaining compliance involves continuous monitoring, updates, and audits, adding to operational expenses.

Sales and Marketing Challenges

New entrants face considerable hurdles in establishing the necessary sales and marketing infrastructure to connect with and secure large enterprise clients. This is a critical barrier to entry in the contact center as a service (CCaaS) market.

Established companies, such as Five9, benefit from deeply entrenched sales forces, robust channel partner networks, and significant brand equity. These advantages make it exceptionally difficult for newcomers to gain meaningful market traction and compete effectively for enterprise business.

For instance, in 2024, the average enterprise sales cycle for CCaaS solutions can extend over six months, requiring substantial investment in skilled sales professionals and extensive marketing campaigns. New entrants must overcome this inertia and demonstrate immediate value to displace incumbents.

- High Customer Acquisition Costs: New entrants often face significantly higher customer acquisition costs compared to established players due to the need to build brand awareness and trust from scratch.

- Long Sales Cycles: Enterprise sales in the CCaaS sector are complex and lengthy, demanding a sophisticated sales approach and sustained marketing efforts that new entrants may struggle to fund.

- Brand Loyalty and Reputation: Established vendors like Five9 have cultivated strong customer loyalty and a reputation for reliability, making it challenging for new companies to attract customers away from trusted providers.

- Channel Partner Competition: Existing vendors have well-established relationships with channel partners who are often reluctant to invest resources in promoting new, unproven solutions.

The threat of new entrants in the sophisticated cloud contact center market is kept at bay by the immense capital required for advanced technology, AI development, and ongoing R&D. These high initial investments, coupled with the need for specialized expertise in areas like intelligent routing and predictive analytics, present significant barriers for newcomers. For example, developing robust AI models can take years and substantial funding, a challenge for many aspiring companies in a market valued at approximately $20 billion in 2023.

Porter's Five Forces Analysis Data Sources

Our Five9 Porter's Five Forces analysis leverages a comprehensive suite of data, including Five9's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific market research reports and analyst insights to provide a well-rounded view of the competitive landscape.