First Financial Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

Unlock the critical external factors shaping First Financial Holding's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with this essential intelligence to refine your investment strategy and gain a significant market advantage.

Political factors

Taiwan's political landscape, especially cross-strait relations, directly impacts its financial sector. First Financial Holding's strategic planning must account for shifts in government stability and its policy direction. For 2025, key government priorities include bolstering anti-financial fraud measures and improving corporate governance, which are vital for financial institutions.

The Financial Supervisory Commission (FSC) in Taiwan is actively refining the financial regulatory landscape, directly influencing First Financial Holding's operations. Recent amendments to the Money Laundering Control Act in July 2024, which include stricter rules for virtual asset service providers, highlight the evolving compliance demands.

These ongoing updates to banking laws and anti-money laundering (AML) frameworks necessitate continuous adaptation in First Financial Holding's strategies to ensure adherence and manage risks effectively.

First Financial Holding's exposure to international markets means its performance is directly linked to global trade policies and geopolitical stability. For instance, ongoing trade tensions, like those between the US and China, can ripple through Taiwan's export-reliant economy, impacting the demand for financial services. Taiwan's Ministry of Economic Affairs reported a 1.1% increase in exports in April 2024 compared to the previous year, highlighting the sensitivity of the economy to global trade dynamics.

Furthermore, shifts in international relations can influence investment flows. While geopolitical risks exist, Taiwan's government actively seeks to attract foreign capital, introducing incentives aimed at bolstering economic growth. These efforts are crucial for companies like First Financial Holding, which benefit from a robust and expanding investment landscape, as evidenced by the continued inflow of foreign direct investment into Taiwan's technology sector throughout 2024.

Government Support for Financial Innovation

Taiwan's government is a significant driver of fintech advancement, actively fostering innovation through programs such as the financial regulatory sandbox. This initiative allows companies like First Financial Holding to test new digital financial products and services in a controlled environment. The establishment of the Financial Market Development and Innovation Unit further underscores this commitment, aiming to streamline the adoption of cutting-edge technologies within the financial ecosystem.

This proactive stance creates a fertile ground for First Financial Holding to explore and implement novel solutions. For instance, the government's push for digital transformation in banking, evidenced by increasing digital transaction volumes, presents opportunities for enhanced customer engagement and operational efficiency. In 2023, digital transactions in Taiwan saw a notable surge, with mobile payments and online banking becoming increasingly prevalent, a trend expected to continue and accelerate through 2025.

- Regulatory Sandbox: Provides a testing ground for new fintech products, reducing time-to-market and regulatory hurdles.

- Financial Inclusion Initiatives: Government support aims to expand access to financial services for underserved populations, creating new customer segments.

- Digital Transformation Push: Encourages the adoption of digital technologies, leading to improved customer experiences and operational efficiencies.

- Investment in Innovation: Government funding and policy support for R&D in financial technology can spur the development of advanced solutions.

National Security and Geopolitical Risks

Geopolitical tensions, especially concerning cross-strait relations, present a significant risk to Taiwan's economic stability and investor confidence. These tensions can impact capital flows and market sentiment, affecting financial institutions. For instance, in 2024, Taiwan's defense budget increased by 5.1% to NT$606.8 billion (approximately US$19.6 billion), reflecting a heightened focus on national security amidst regional uncertainties.

The government is actively working to bolster cybersecurity for financial entities, including banks and insurance companies. This focus is critical given the increasing sophistication of cyber threats. Taiwanese financial institutions reported a 20% increase in cyberattack attempts in the first half of 2024 compared to the same period in 2023, underscoring the need for robust defense mechanisms.

- Cross-Strait Tensions: Ongoing geopolitical risks can directly influence foreign investment and market volatility.

- Cybersecurity Focus: Enhanced cybersecurity measures are crucial for protecting financial data and maintaining operational integrity.

- Defense Spending: Increased defense expenditure, such as the 5.1% rise in Taiwan's 2024 budget, signals a commitment to national security.

- Investor Confidence: Perceived stability is vital for attracting and retaining both domestic and international capital.

Taiwan's political stability and government policies are paramount for First Financial Holding. The government's commitment to enhancing anti-financial fraud measures and corporate governance, as prioritized for 2025, directly impacts the operational environment for financial institutions. Furthermore, the ongoing refinement of banking laws and anti-money laundering frameworks by the Financial Supervisory Commission, including stricter rules for virtual asset providers implemented in July 2024, necessitates continuous adaptation.

| Policy Area | 2024/2025 Focus | Impact on First Financial Holding |

|---|---|---|

| Anti-Fraud & Governance | Strengthening measures, improving corporate governance | Enhances trust, reduces operational risk |

| Regulatory Updates | Stricter AML, virtual asset provider rules (July 2024) | Requires enhanced compliance and risk management |

| Fintech & Digitalization | Regulatory sandbox, digital transformation push | Opportunities for innovation and efficiency gains |

| Geopolitical Stability | Increased defense budget (5.1% in 2024), cybersecurity focus | Mitigates market volatility, protects data assets |

What is included in the product

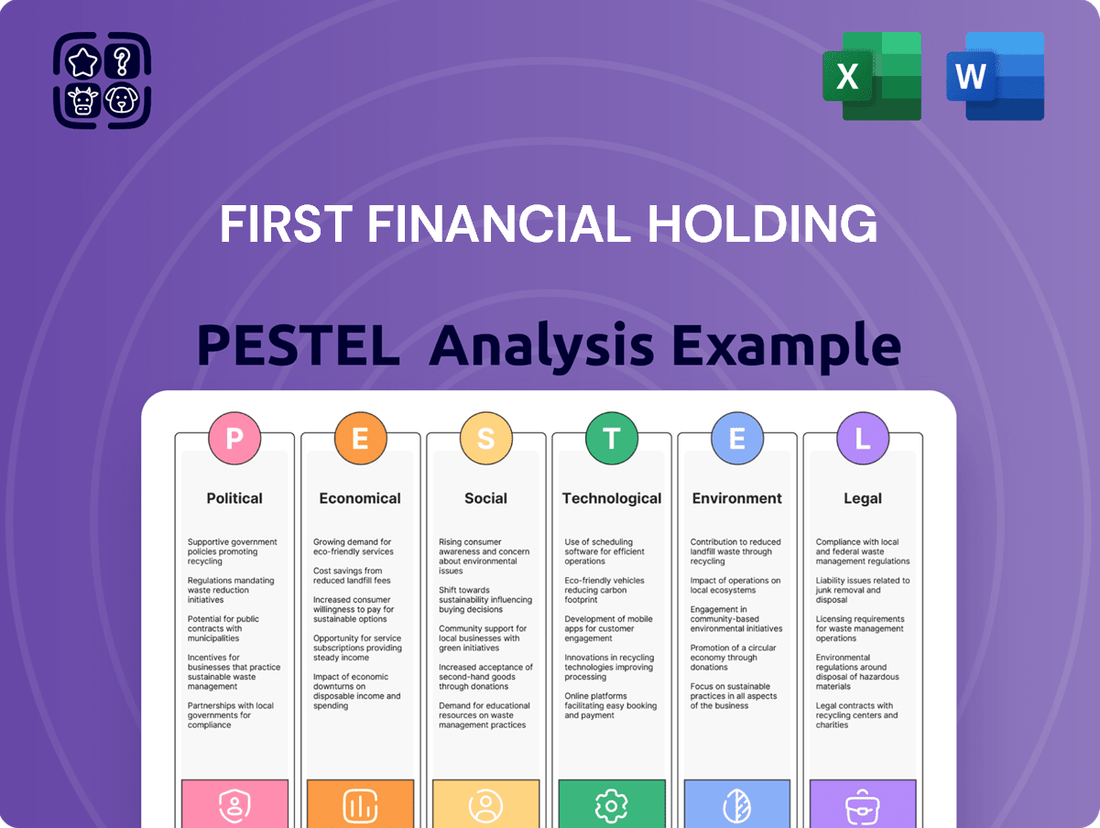

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting First Financial Holding, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A concise PESTLE analysis for First Financial Holding provides a clear overview of external factors, acting as a pain point reliever by enabling proactive strategy adjustments and mitigating unforeseen risks.

Economic factors

The Central Bank of the Republic of China (Taiwan) plays a crucial role in shaping the financial landscape for First Financial Holding. By setting the benchmark interest rate, it directly impacts the company's net interest margins, a key driver of profitability.

For 2024 and extending into 2025, the central bank has maintained its key interest rate at a steady 2%. This stability provides a predictable operating environment for financial institutions like First Financial Holding.

Despite the steady benchmark rate, recent macroprudential tightening measures aimed at cooling the housing market could indirectly influence First Financial Holding by potentially affecting mortgage volumes and overall loan growth.

Taiwan's economic expansion is a crucial driver for First Financial Holding, influencing the demand across its banking, securities, insurance, and asset management divisions. A robust economy typically translates to increased consumer spending, business investment, and a greater need for financial services.

The outlook for Taiwan's Gross Domestic Product (GDP) remains positive, with projections for steady growth in both 2024 and 2025. This growth is largely underpinned by the nation's strong export performance, especially in high-demand sectors like artificial intelligence (AI) hardware and components, alongside a gradual recovery in domestic consumption.

For instance, Taiwan's GDP growth was estimated at 3.4% for 2023 and is forecast to continue around 3.1% in 2024, according to various economic reports. This sustained growth trajectory is expected to bolster the financial sector, creating a favorable environment for First Financial Holding's service offerings.

Inflation rates directly impact how much consumers can buy and how much it costs businesses to operate. While overall inflation, or headline inflation, has seen some upward movement, the underlying inflation, known as core inflation, is showing signs of easing. For instance, in the United States, the Consumer Price Index (CPI) for all items increased by 3.3% in May 2024 compared to the previous year, a slight moderation from earlier peaks, and core CPI rose 3.4% year-over-year, also indicating a cooling trend.

Consumer spending remains a significant driver of economic expansion. In the first quarter of 2024, U.S. real personal consumption expenditures increased at an annual rate of 3.1%, demonstrating robust demand, particularly in areas like services and financial transactions, which indirectly benefits entities like First Financial Holding.

Global Economic Trends and Trade

Taiwan's financial sector is closely tied to global economic performance and trade dynamics, given its export-driven nature. A healthy global economy, characterized by easing inflation and renewed consumer spending, generally benefits Taiwan's export volumes. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 3.0% in 2023, signaling a supportive environment for trade.

However, risks remain. The potential for renewed trade tensions or disruptions within global supply chains, exacerbated by geopolitical events, could negatively impact Taiwan's trade-dependent economy. For example, ongoing discussions around tariffs and trade barriers between major economic blocs continue to create uncertainty for international commerce.

Key factors influencing Taiwan's financial sector through global trends include:

- Global GDP Growth: A higher global GDP growth rate generally translates to increased demand for Taiwanese exports, boosting corporate revenues and financial sector activity.

- Inflation Rates: Moderating inflation globally can lead to more stable consumer spending and investment, reducing economic uncertainty.

- Trade Policies: The implementation or reversal of protectionist trade policies can significantly alter trade flows and impact export-oriented economies like Taiwan.

- Supply Chain Resilience: Efforts to build more resilient global supply chains, following recent disruptions, could reshape trade patterns and affect Taiwanese businesses.

Financial Market Liquidity and Capital Flows

Financial market liquidity is a critical driver for First Financial Holding, directly impacting its capacity for investment and lending. In 2024, global financial markets experienced fluctuating liquidity levels influenced by central bank policies and geopolitical events. For instance, the US Federal Reserve's balance sheet adjustments and interest rate decisions continued to shape the availability of capital worldwide.

Government initiatives are actively working to bolster financial markets and attract capital, which directly benefits companies like First Financial Holding. Taiwan's Asian Asset Management Center Initiative, launched with the goal of becoming a regional hub for asset management, aims to improve market depth and provide greater investment opportunities. This initiative is designed to attract both domestic and international capital, thereby enhancing overall market liquidity.

Patterns of capital flows are also paramount. In 2024, emerging markets, including parts of Asia, saw renewed interest from foreign investors seeking higher yields, though this was often tempered by global economic uncertainty. First Financial Holding's strategic positioning within these markets allows it to capitalize on these flows, but also exposes it to the risks associated with capital repatriation or sudden shifts in investor sentiment.

- Global Liquidity Trends: In early 2024, quantitative tightening measures by major central banks led to a gradual reduction in overall market liquidity compared to the preceding years.

- Capital Inflows to Asia: Despite global headwinds, certain Asian economies, particularly those with strong growth prospects and stable political environments, continued to attract significant foreign direct investment (FDI) and portfolio investment throughout 2024. For example, Vietnam reported a substantial increase in FDI in key sectors.

- Taiwan's Initiative Impact: The Asian Asset Management Center Initiative is projected to increase the assets under management in Taiwan by a significant margin, potentially adding billions of dollars in new capital to the local financial ecosystem by the end of 2025.

- Interest Rate Sensitivity: The sensitivity of capital flows to interest rate differentials remained high in 2024, meaning that changes in monetary policy by major economies could rapidly alter the direction and volume of capital moving across borders.

Taiwan's economic growth is a significant tailwind for First Financial Holding, driving demand across its diverse financial services. The nation's GDP growth, projected at a solid 3.1% for 2024, is fueled by robust exports in high-tech sectors like AI hardware, alongside a recovering domestic market.

Inflationary pressures, while present, show signs of moderation. For instance, US core CPI rose 3.4% year-over-year in May 2024, indicating a cooling trend that can support consumer spending and financial transactions.

Global economic health directly impacts Taiwan's export-oriented economy. The IMF forecasts global growth to reach 3.2% in 2024, a positive sign for Taiwanese trade, though geopolitical risks and trade tensions remain potential headwinds.

The Central Bank of the Republic of China (Taiwan) has maintained its benchmark interest rate at 2% through 2024 and into 2025, offering stability for net interest margins. However, macroprudential measures targeting the housing market could indirectly affect loan growth.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Forecast) | 2025 (Forecast) |

|---|---|---|---|

| Taiwan GDP Growth | 3.4% | 3.1% | ~3.0% |

| Global GDP Growth | 3.0% | 3.2% | ~3.1% |

| Taiwan Benchmark Interest Rate | 2.00% | 2.00% | 2.00% |

Preview the Actual Deliverable

First Financial Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of First Financial Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to actionable insights for strategic planning.

Sociological factors

Taiwan's demographic landscape is rapidly evolving, with a notable aging population. By the end of 2024, it's projected that over 20% of Taiwan's population will be aged 65 and over, a significant milestone. This profound shift directly influences the financial services sector, creating a growing need for specialized products and services tailored to seniors.

This demographic trend presents substantial opportunities for First Financial Holding. Demand is escalating for retirement planning solutions, comprehensive wealth management services to preserve and grow assets, and long-term care insurance to cover future healthcare needs. These evolving consumer requirements signal a fertile ground for financial institutions that can adapt and innovate to meet the demands of an aging demographic.

Taiwanese consumers are increasingly embracing digital transactions, with mobile payment usage expected to grow significantly. By the end of 2024, it's projected that over 70% of the population will utilize mobile payment services, a substantial jump from previous years. This shift necessitates that First Financial Holding enhances its digital platforms and mobile banking capabilities to meet the demand for seamless, convenient, and personalized financial services.

The growing preference for online and mobile channels means traditional branch services may see reduced footfall. First Financial Holding must strategically invest in its digital infrastructure and customer relationship management systems to offer tailored financial advice and product recommendations through these evolving channels, ensuring it remains competitive in a digitally-native market.

Taiwan's government is actively promoting financial literacy and inclusion, recognizing their importance for economic stability and individual well-being. A significant policy goal is to ensure that all citizens, regardless of background, have access to essential financial services. This focus creates opportunities for institutions like First Financial Holding to engage with and support these national objectives.

First Financial Holding can play a crucial role in this landscape by supporting financial education programs. For instance, by partnering with educational institutions or NGOs, they can help improve the financial knowledge of young people and vulnerable groups. Expanding access to banking services for underserved populations, such as rural communities or low-income households, also aligns with this policy direction and can unlock new customer segments.

In 2023, Taiwan's Financial Supervisory Commission (FSC) continued its efforts to boost financial inclusion. While specific data on First Financial Holding's direct impact on inclusion metrics for 2024/2025 is still emerging, broader trends indicate a growing demand for accessible digital banking solutions. The FSC has been encouraging banks to develop user-friendly platforms and offer simplified account opening procedures to reach more people.

Social Responsibility and ESG Expectations

Societal pressure for financial institutions to embrace environmental, social, and governance (ESG) principles is intensifying. Investors are increasingly scrutinizing companies like First Financial Holding, demanding transparency and tangible action on ESG metrics. This shift reflects a broader societal expectation for businesses to contribute positively to the environment and communities.

First Financial Holding is therefore compelled to embed ESG considerations across its operations, from lending practices to investment strategies. Meeting these stakeholder expectations is crucial not only for maintaining a positive public image but also for securing its social license to operate. Failing to adapt could lead to reputational damage and reduced investor confidence.

- Growing Investor Demand: In 2024, global ESG assets under management were projected to reach $50 trillion, indicating a significant shift in investment priorities.

- Regulatory Influence: Many jurisdictions are implementing or strengthening ESG disclosure requirements, pushing financial institutions towards greater accountability.

- Consumer Preference: Surveys consistently show that a growing segment of consumers prefer to bank with institutions demonstrating strong ethical and sustainable practices.

- Risk Management: Proactive ESG integration helps mitigate risks associated with climate change, social inequality, and governance failures, which can impact financial performance.

Talent Pool and Workforce Dynamics

The availability of skilled talent, particularly in rapidly evolving fields like fintech, artificial intelligence, and cybersecurity, is paramount for the sustained growth and competitiveness of financial institutions like First Financial Holding. As of late 2024, the global demand for AI specialists saw an estimated 35% year-over-year increase, highlighting a critical talent gap.

Shifting workforce dynamics, encompassing strategies for attracting and retaining high-caliber professionals, directly impact First Financial Holding's capacity for innovation and market leadership. For instance, a 2025 survey indicated that 60% of finance professionals prioritize opportunities for upskilling and working with cutting-edge technology when considering new roles.

- Fintech Talent Demand: The financial sector's increasing reliance on digital solutions fuels a significant demand for professionals with expertise in blockchain, data analytics, and digital banking platforms.

- AI Integration: The adoption of AI for fraud detection, customer service, and algorithmic trading necessitates a workforce proficient in machine learning and AI development.

- Cybersecurity Imperative: With escalating cyber threats, a robust cybersecurity talent pool is essential to safeguard sensitive financial data and maintain operational integrity.

- Workforce Retention: Offering competitive compensation, flexible work arrangements, and continuous learning opportunities are key to retaining top talent in a highly competitive market.

Taiwan's aging population, projected to exceed 20% over 65 by the end of 2024, drives demand for retirement planning and long-term care insurance. Simultaneously, a strong digital adoption trend, with over 70% mobile payment usage anticipated by year-end 2024, necessitates enhanced digital platforms from institutions like First Financial Holding. The government's push for financial literacy also presents opportunities for expanded access to financial services for underserved communities.

Societal expectations for ESG integration are growing, with global ESG assets projected to reach $50 trillion in 2024. This pressure requires First Financial Holding to embed sustainability into its operations to maintain investor confidence and its social license to operate. The demand for skilled talent in fintech and AI is also critical, with AI specialist demand increasing by an estimated 35% year-over-year in late 2024, impacting innovation and market leadership.

Technological factors

Taiwan's financial sector is actively pursuing digital transformation, with many institutions adopting integrated digital strategies. First Financial Holding needs to keep investing in and utilizing digital tools to boost efficiency, improve customer interactions, and stay competitive in this evolving landscape.

By embracing innovation, First Financial Holding can streamline operations and offer more personalized services. For instance, the adoption of AI-powered chatbots and advanced data analytics can significantly enhance customer engagement and operational effectiveness within the financial services industry.

The financial technology, or fintech, sector is experiencing rapid growth, with virtual banks, embedded finance, and blockchain applications fundamentally altering how financial services are delivered. For instance, the global fintech market size was valued at approximately $2.4 trillion in 2023 and is projected to reach over $9 trillion by 2030, indicating a significant shift.

First Financial Holding must actively monitor these technological advancements and consider integrating fintech innovations into its existing service offerings. This could involve strategic partnerships with emerging fintech firms to leverage their agile solutions and expand market reach, ensuring the company stays competitive in this evolving landscape.

Artificial Intelligence and big data analytics are transforming financial services, enhancing customer interactions through intelligent chatbots and powering robo-advisors. These technologies are also crucial for strengthening risk management frameworks and bolstering fraud prevention measures, critical for institutions like First Financial Holding.

The Financial Supervisory Commission (FSC) has proactively released guidelines for AI adoption within the financial sector, signaling a deliberate and structured approach. This regulatory clarity encourages innovation while ensuring responsible deployment, a key factor for First Financial Holding's strategic technology investments in 2024 and 2025.

Cybersecurity and Data Security

The increasing digitization of financial services elevates cybersecurity and data security risks for First Financial Holding. Protecting sensitive customer information and financial transactions from sophisticated and evolving threats is paramount. Regulators are placing significant emphasis on these areas, with heightened scrutiny expected in 2025.

First Financial Holding must proactively invest in and continuously enhance its cybersecurity infrastructure. This includes implementing advanced threat detection, robust data encryption, and comprehensive employee training programs. The company's ability to maintain customer trust hinges on its demonstrated commitment to data security.

- Increased Sophistication of Cyber Threats: Financial institutions globally are experiencing a rise in complex cyberattacks, including ransomware and phishing schemes targeting customer data.

- Regulatory Compliance Demands: By 2025, expect stricter data protection regulations and increased penalties for non-compliance, impacting how financial firms manage and secure data.

- Customer Data as a Target: Personal and financial data remains a prime target for cybercriminals, making robust security measures essential for maintaining customer confidence and preventing data breaches.

Cloud Computing and Infrastructure

Cloud computing presents significant opportunities for First Financial Holding to enhance its operations. The ability to scale resources up or down as needed, coupled with increased flexibility and potential cost savings, makes cloud adoption a strategic imperative. For instance, many financial firms are migrating core banking systems to the cloud to improve agility and reduce infrastructure overhead.

Investing in secure and advanced digital infrastructure, particularly cloud-based solutions, is crucial for First Financial Holding to power its digital transformation. This includes handling the ever-growing volumes of data generated by customer interactions and market activities. By 2025, the global public cloud market is projected to reach over $1 trillion, underscoring the widespread industry shift.

- Scalability and Flexibility: Cloud platforms allow financial institutions to adjust computing resources dynamically, meeting fluctuating demands.

- Cost Efficiencies: Shifting from on-premise hardware to cloud services can reduce capital expenditure and operational costs.

- Data Management: Robust cloud infrastructure is vital for securely storing, processing, and analyzing vast amounts of financial data.

- Digital Initiatives: Cloud adoption underpins the development and deployment of new digital products and services, enhancing customer experience.

Technological advancements are reshaping the financial landscape, driving digital transformation and the rise of fintech. First Financial Holding must strategically integrate AI, big data, and cloud computing to enhance efficiency, customer experience, and risk management. The global fintech market's projected growth to over $9 trillion by 2030 highlights the imperative for adaptation.

Cybersecurity remains a critical concern, with increasingly sophisticated threats targeting sensitive financial data. First Financial Holding needs to bolster its defenses through advanced threat detection and robust data encryption, especially with stricter regulatory compliance expected by 2025.

Cloud computing offers significant opportunities for scalability, cost efficiencies, and improved data management. By 2025, the global public cloud market is projected to exceed $1 trillion, underscoring its strategic importance for financial institutions like First Financial Holding to support digital initiatives.

| Key Technology Trend | Impact on First Financial Holding | 2024/2025 Outlook |

| Fintech Innovation | Disruption of traditional services, new customer engagement models | Continued rapid growth, focus on embedded finance and virtual banking |

| Artificial Intelligence & Big Data | Enhanced customer service (chatbots), improved risk management, personalized offerings | Increased adoption for fraud detection and predictive analytics; regulatory guidance evolving |

| Cybersecurity | Heightened risk of data breaches, need for robust protection | Escalating threat sophistication, increased regulatory scrutiny on data protection |

| Cloud Computing | Scalability, cost savings, agility for digital services | Widespread adoption for core banking and data analytics; market projected over $1 trillion |

Legal factors

First Financial Holding navigates a complex web of financial regulations, a critical factor impacting its operations and strategic planning. Adherence to capital adequacy requirements, heavily influenced by Basel III standards, is paramount. For instance, as of Q1 2024, many global financial institutions are maintaining CET1 ratios well above the minimum regulatory thresholds to ensure resilience.

The company must also maintain robust internal audit and control systems to comply with stringent legal frameworks. Ongoing compliance with regulations specifically targeting financial holding companies and banking entities is non-negotiable, ensuring operational integrity and market trust. Failure to meet these legal obligations can result in significant penalties and reputational damage.

Taiwan's commitment to combating financial crime intensified with amendments to the Money Laundering Control Act in July 2024, significantly bolstering its Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) framework. These updated regulations mandate enhanced vigilance for financial institutions like First Financial Holding.

To navigate these stricter legal requirements, First Financial Holding must prioritize robust Know Your Customer (KYC) protocols, implement comprehensive suspicious transaction reporting systems, and maintain stringent internal control mechanisms. Failure to comply with these strengthened AML/CTF laws can result in substantial penalties, impacting the company's financial stability and reputation.

As digital services expand, data privacy and consumer protection laws become paramount for First Financial Holding. Compliance with regulations on data handling is essential. For instance, in 2024, global spending on cybersecurity solutions to manage data protection is projected to reach over $200 billion, highlighting the significant investment required.

First Financial Holding must ensure it adheres to stringent rules regarding the collection, storage, and utilization of customer information. This includes safeguarding sensitive financial data against breaches and unauthorized access, a growing concern as cyber threats evolve.

Protecting the rights and interests of financial consumers is also a key legal imperative. This involves transparency in financial product offerings and fair treatment, especially as regulatory bodies worldwide, like the CFPB in the US, continue to strengthen consumer protection frameworks.

ESG Disclosure and Reporting Requirements

Taiwan is tightening its grip on environmental, social, and governance (ESG) disclosures. This means companies like First Financial Holding will face more scrutiny and need to be transparent about their sustainability efforts.

The timeline is clear: by 2025, all listed companies must have their 2024 sustainability reports ready. Then, by 2026, larger companies will be required to align with the International Sustainability Standards Board (ISSB) S1 and S2 standards. This shift is a significant move towards global ESG reporting alignment.

- Mandatory Sustainability Reports: All listed companies must submit sustainability reports for the 2024 fiscal year by 2025.

- ISSB Standards Adoption: Companies with substantial capital will need to adopt ISSB's S1 and S2 standards by 2026.

- Increased Transparency: These regulations aim to enhance transparency and comparability in ESG reporting across Taiwan's market.

Competition Law and Mergers & Acquisitions

Competition laws and regulations significantly shape First Financial Holding's ability to pursue mergers and acquisitions (M&A) for strategic growth and market consolidation. These legal frameworks aim to prevent anti-competitive practices, ensuring a fair market environment. For instance, in 2023, Taiwan's Fair Trade Commission (FTC) reviewed numerous M&A proposals, with a focus on potential market dominance.

The Financial Supervisory Commission (FSC) in Taiwan plays a crucial role by adjusting measures pertaining to M&A activities within the financial sector. These adjustments can impact the ease or difficulty of acquisitions, influencing First Financial Holding's expansion strategies. Recent FSC directives in late 2024 are expected to streamline certain M&A processes for financial institutions, potentially encouraging consolidation.

- Regulatory Scrutiny: M&A deals involving First Financial Holding are subject to review by competition authorities like the FTC to assess potential impacts on market competition.

- FSC Policy Adjustments: Changes in FSC regulations, particularly those concerning capital requirements and approval processes for mergers, directly affect the feasibility of strategic acquisitions.

- Market Consolidation Trends: The evolving landscape of competition law can either facilitate or hinder First Financial Holding's pursuit of market consolidation, depending on the specific regulatory environment and the nature of proposed transactions.

First Financial Holding operates under a stringent legal framework, with Taiwan's Financial Supervisory Commission (FSC) imposing capital adequacy rules, such as those aligned with Basel III, requiring institutions to maintain robust capital ratios. For instance, in Q1 2024, the global financial sector saw average CET1 ratios exceeding 13%, demonstrating a proactive approach to regulatory compliance.

The company must also adhere to updated Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, like Taiwan's July 2024 amendments, necessitating enhanced Know Your Customer (KYC) procedures and suspicious transaction reporting. Furthermore, evolving data privacy laws, with global cybersecurity spending projected to surpass $200 billion in 2024, demand stringent data handling and consumer protection measures.

Mandatory sustainability reporting for all listed companies for fiscal year 2024 is due by 2025, with larger entities adopting ISSB standards by 2026, increasing ESG transparency requirements. Additionally, competition laws, as evidenced by the Fair Trade Commission's reviews in 2023, and FSC policy adjustments in late 2024, influence First Financial Holding's M&A strategies by regulating market consolidation and ensuring fair competition.

| Regulatory Area | Key Requirement/Impact | Relevant Period/Data |

| Capital Adequacy | Adherence to Basel III standards, maintaining strong CET1 ratios. | Q1 2024: Global average CET1 ratios > 13%. |

| AML/CTF | Enhanced KYC, suspicious transaction reporting. | Taiwan's AML Act amended July 2024. |

| Data Privacy | Strict data handling, consumer protection. | 2024 Global Cybersecurity Spend: > $200 billion. |

| ESG Reporting | Mandatory sustainability reports for FY2024 due 2025; ISSB adoption by 2026. | Taiwan's listed companies, large entities. |

| Competition Law/M&A | FTC review of M&A, FSC policy adjustments. | FTC reviewed numerous M&A in 2023; FSC directives late 2024. |

Environmental factors

Taiwan, situated in a typhoon-prone region, faces significant physical risks from extreme weather events. These events, like the typhoons experienced in 2023, can disrupt business operations, damage infrastructure, and impact economic activity, directly affecting First Financial Holding's loan portfolios and asset values.

First Financial Holding must proactively assess and manage these climate-related physical risks. This involves understanding how potential damage to businesses or property, from rising sea levels or intensified storms, could lead to increased loan defaults or a decrease in collateral value, impacting the company's financial stability.

Taiwan's government is pushing for green finance, with the Green Finance Action Plan 3.0 aiming to steer financial institutions towards sustainable development and climate action. This plan encourages institutions like First Financial Holding to prioritize environmentally friendly investments and practices.

First Financial Holding is anticipated to enhance its transparency by disclosing its carbon emissions data, a key requirement under these evolving regulations. The company is also integrating guidelines for recognizing sustainable economic activities directly into its core business strategies, aligning its operations with national green finance objectives.

Taiwan's commitment to achieving net-zero emissions by 2050, coupled with the introduction of carbon fees for major emitters, directly impacts the operational landscape for companies First Financial Holding (FFH) finances. These regulations are likely to increase operating expenses for carbon-intensive industries, potentially affecting their profitability and FFH's loan portfolios.

The implementation of carbon pricing mechanisms, such as the proposed carbon fee in Taiwan, could necessitate significant investment in cleaner technologies and operational adjustments for businesses. This shift will influence FFH's lending strategies, encouraging financing for green projects and potentially leading to a re-evaluation of investments in high-emission sectors.

For FFH itself, direct emissions from its operations will also face scrutiny. While primarily a financial services firm, the company will need to consider its own carbon footprint and potential future regulations impacting its administrative and operational activities, aligning with Taiwan's broader environmental objectives.

Resource Scarcity and Environmental Stewardship

Growing concerns about resource scarcity and environmental degradation are increasingly shaping business practices and consumer preferences. For First Financial Holding, this translates into pressure to champion environmentally friendly projects and integrate sustainable practices across its operations and lending portfolios. This trend is underscored by the global push for net-zero emissions, with many nations setting ambitious targets. For instance, by 2024, many financial institutions are expected to increase their green bond issuances and sustainable finance offerings to meet evolving market demands and regulatory expectations.

First Financial Holding may face increased scrutiny regarding its environmental footprint and its role in financing industries. This could manifest as a demand for greater transparency in its lending practices and a push to divest from high-carbon sectors. The financial sector's commitment to sustainability is becoming a key differentiator, with investors and customers alike favoring institutions demonstrating strong environmental stewardship. In 2024, reports indicate a significant rise in ESG (Environmental, Social, and Governance) investing, with assets under management in sustainable funds projected to reach trillions globally.

- Increased demand for green financing: Businesses are seeking capital for renewable energy, energy efficiency, and pollution control projects.

- Regulatory pressures: Governments are implementing stricter environmental regulations, impacting lending criteria and operational compliance.

- Investor expectations: A growing number of investors prioritize companies with robust environmental policies and sustainable business models.

- Consumer awareness: Consumers are increasingly making purchasing decisions based on a company's environmental impact and ethical practices.

Reputational Risk from Environmental Non-Compliance

Failure to meet environmental regulations or show commitment to sustainability can significantly harm a company's image. For First Financial Holding, this means that any perceived misstep in environmental management, whether directly or through its client portfolio, could erode public trust and brand value. This is a growing concern in 2024, with increasing public scrutiny on corporate environmental performance.

To counter this, First Financial Holding needs to actively manage its own environmental footprint and, crucially, support its clients in their shift towards greener operations. This proactive approach is essential for mitigating reputational damage and maintaining stakeholder confidence. For instance, a 2024 report indicated that 65% of consumers consider a company's environmental impact when making purchasing decisions.

- Reputational Damage: Non-compliance with environmental laws, such as those related to carbon emissions or waste management, can result in fines and negative media attention, impacting brand perception.

- Stakeholder Trust: Demonstrating strong environmental stewardship, including supporting clients in their sustainability transitions, is vital for maintaining trust with investors, customers, and the wider community.

- Market Expectations: By 2025, financial institutions are increasingly expected to integrate Environmental, Social, and Governance (ESG) factors into their business strategies, making environmental performance a key differentiator.

- Client Transition Support: Assisting clients in adopting sustainable practices can create new business opportunities and reinforce First Financial Holding's commitment to a low-carbon economy, a trend gaining momentum throughout 2024.

Taiwan's vulnerability to typhoons, as seen in 2023, poses direct physical risks to First Financial Holding's assets and loan portfolios through potential infrastructure damage and economic disruption.

The government's Green Finance Action Plan 3.0 is actively encouraging financial institutions like First Financial Holding to prioritize sustainable investments and climate action, influencing lending strategies and operational practices.

With Taiwan aiming for net-zero emissions by 2050 and implementing carbon fees, companies financed by FFH face increased operational costs, potentially impacting their financial health and the bank's loan book.

Growing environmental awareness is driving demand for green financing and pressuring institutions like First Financial Holding to demonstrate strong environmental stewardship, with ESG investing assets projected to reach trillions globally by 2024.

| Environmental Factor | Impact on First Financial Holding | Supporting Data (2023-2025 Projections) |

| Climate Change & Extreme Weather | Increased risk of loan defaults and asset devaluation due to physical damage. | Taiwan experienced significant typhoon activity in 2023; projections indicate continued frequency and intensity of extreme weather events. |

| Green Finance Initiatives | Opportunity to finance green projects; pressure to align lending with sustainability goals. | Taiwan's Green Finance Action Plan 3.0 aims to mobilize significant capital for sustainable development; a 2024 report showed a 20% increase in green bond issuances in Asia. |

| Carbon Pricing & Emissions Regulations | Potential for increased credit risk in carbon-intensive sectors; need for FFH to manage its own footprint. | Taiwan's proposed carbon fee aims to incentivize emissions reduction; major emitters could see operational costs rise by 5-10% by 2025. |

| Environmental Awareness & ESG Demand | Reputational risk for non-compliance; opportunity to attract ESG-focused investors and customers. | Global ESG assets under management were projected to exceed $50 trillion by 2025; 65% of consumers consider environmental impact in purchasing decisions (2024 data). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for First Financial Holding is constructed using a blend of official government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.