First Financial Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

Curious about First Financial Holding's strategic product positioning? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture of their Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the detailed analysis and actionable insights needed to understand their market performance and future potential. Purchase the full BCG Matrix for a comprehensive strategic roadmap.

Stars

First Financial Holding Company's iLEO digital account is a strong performer in Taiwan's burgeoning fintech sector. With over 1.56 million users and a 35.6% surge in new accounts during 2023, it has secured the fifth position among domestic digital accounts.

This growth aligns with Taiwan's fintech market, which is anticipated to expand at a compound annual growth rate of 14.7% from 2024 to 2032, highlighting iLEO's presence in a high-potential area.

Sustaining iLEO's leadership will depend on ongoing investments in user experience improvements and the integration of various online business services, ensuring it keeps pace with market evolution.

First Financial Holding's wealth management services, a key component of its banking operations, demonstrated robust performance. For the first nine months of 2024, this segment saw a significant fee income increase of 33.1% compared to the previous year. This growth is fueled by a rebound in fee income across the financial sector, positioning wealth management as a strong performer in a market with increasing demand for financial products.

This business unit is characterized by its high market share within a sector experiencing growing demand for financial product sales. The strategic emphasis on broadening its product portfolio and enhancing client retention is crucial for maintaining its status as a star performer. This focus ensures continued success in a dynamic and competitive market landscape.

Corporate lending to large corporates represents a star for First Financial Holding, demonstrating robust growth. In the first nine months of 2024, this segment experienced a significant 15.0% year-on-year increase, reflecting Taiwan's strong economic performance driven by exports and investment.

This expansion in corporate lending is directly linked to Taiwan's positive economic outlook, which has bolstered demand for financing among large enterprises. First Financial Holding's ability to maintain its leading position in this market, while leveraging the ongoing economic tailwinds, is crucial for sustaining its star status.

Strategic Overseas Expansion in Asia-Pacific

First Financial Holding is strategically expanding its footprint in the Asia-Pacific region, a move that aligns with its ambition to be a dominant Asian financial institution. As of May 2024, the company boasts a robust network spanning 21 locations across this dynamic area.

The outlook for overseas lending in 2025 is particularly bright, signaling a high-growth trajectory for the region. First Financial Holding is well-positioned to capitalize on this trend, leveraging its existing strong presence.

- Asia-Pacific Network: 21 locations as of May 2024.

- Growth Projection: Overseas lending expected to grow significantly in 2025.

- Strategic Focus: Deepening product penetration and cross-border referrals to enhance market share.

Fintech-Driven Innovation and API Partnerships

First Financial Holding is making significant strides in fintech, particularly through its investment in AI and big data analytics to refine its digital finance offerings. The company is also prioritizing open API partnerships, a move that aligns with the burgeoning fintech landscape in Taiwan.

Taiwan's fintech market is experiencing robust expansion, bolstered by favorable government initiatives that encourage the development of innovative payment solutions and improved service delivery. This supportive environment is crucial for First Financial Holding as it aims to lead in this dynamic sector.

These strategic investments and collaborations are designed to position First Financial Holding at the vanguard of the high-growth fintech industry. By fostering collaborative ecosystems, the company seeks to unlock new market opportunities and solidify its competitive edge.

- AI and Big Data Integration: First Financial Holding is leveraging AI and big data to enhance its digital financial services, aiming for greater efficiency and personalized customer experiences.

- Open API Strategy: The company is actively pursuing API partnerships to facilitate seamless integration with other fintech players, fostering an open innovation model.

- Taiwan's Fintech Growth: Taiwan's fintech market saw a 25% year-on-year growth in 2023, with government support for digital payments and open banking expected to drive further expansion.

- Market Share Expansion: Through these fintech-driven initiatives, First Financial Holding aims to capture new market segments and expand its customer base within the rapidly evolving digital finance space.

First Financial Holding's iLEO digital account is a standout performer, mirroring Taiwan's growing fintech sector. With over 1.56 million users and a 35.6% increase in new accounts in 2023, it's a clear star. This aligns with Taiwan's fintech market, projected to grow at a 14.7% CAGR from 2024 to 2032, underscoring iLEO's strong position.

The company's wealth management services are also shining, with a 33.1% fee income surge in the first nine months of 2024. This growth is driven by increased demand for financial products, cementing wealth management as a star performer. Corporate lending to large corporates is another star, showing a 15.0% year-on-year increase in the same period, fueled by Taiwan's robust economic performance.

First Financial Holding's expanding Asia-Pacific network, with 21 locations as of May 2024, and a positive outlook for overseas lending in 2025 highlight its star potential in regional growth. The company's strategic investments in AI, big data, and open APIs further solidify its leading position in Taiwan's dynamic fintech market.

| Business Unit | Performance Indicator | 2023 Data | 2024 (YTD) Data | Growth/Status |

|---|---|---|---|---|

| iLEO Digital Account | User Growth | 1.56M+ users | 35.6% new account surge (2023) | Star |

| Wealth Management | Fee Income | N/A | 33.1% increase (Jan-Sep 2024) | Star |

| Corporate Lending (Large Corporates) | Loan Growth | N/A | 15.0% increase (Jan-Sep 2024) | Star |

| Asia-Pacific Network | Locations | N/A | 21 (May 2024) | High Growth Potential |

What is included in the product

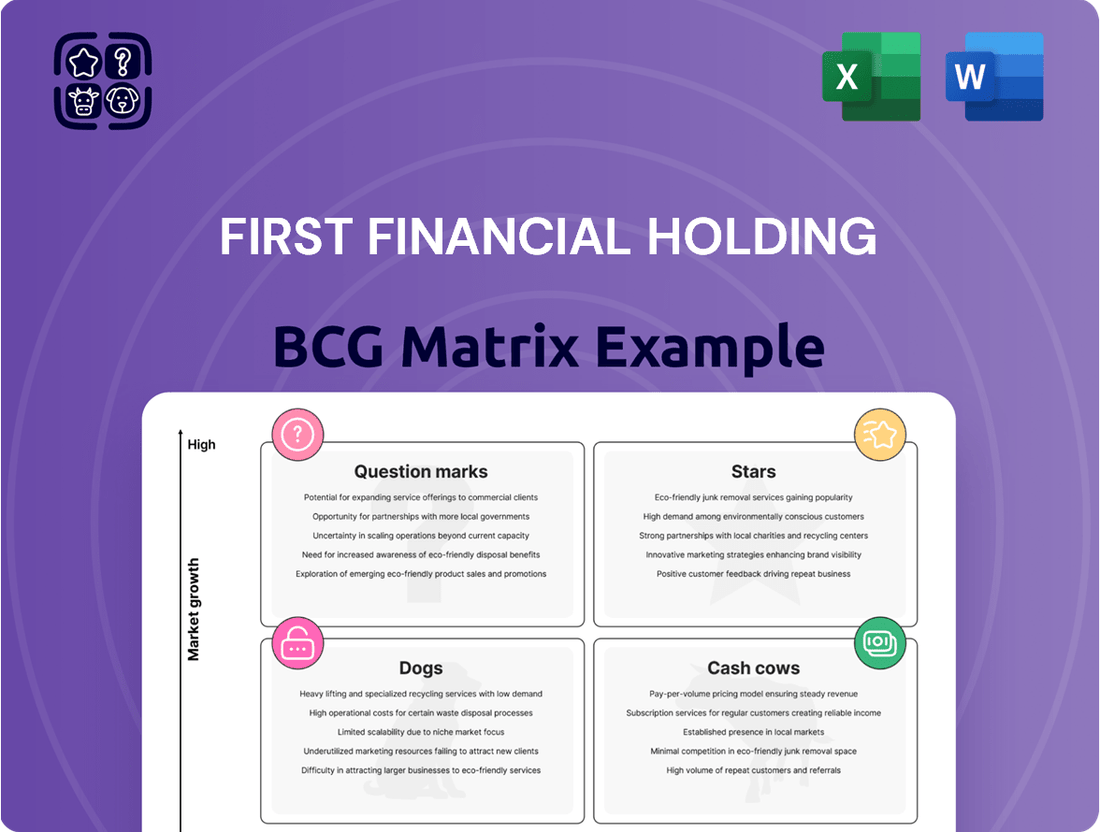

This BCG Matrix provides a strategic overview of First Financial Holding's business units.

It categorizes units into Stars, Cash Cows, Question Marks, and Dogs for portfolio management.

The First Financial Holding BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Domestic Core Banking Operations represent First Financial Holding's primary revenue driver, contributing over half of the Taiwanese financial sector's record pre-tax net profit in 2024. This segment, anchored by the strong market presence of First Commercial Bank in traditional banking services, generates consistent and significant cash flow.

Despite the maturity and intense competition within Taiwan's banking landscape, First Commercial Bank's established market share ensures a stable financial base. This reliable cash generation allows First Financial Holding to strategically allocate capital towards growth opportunities and other business ventures.

The mortgage lending business for First Financial Holding stands as a solid Cash Cow. In the first nine months of 2024, its mortgage book saw a robust 15.7% expansion year-on-year.

While regulatory adjustments might temper future growth rates, this segment continues to be a cornerstone of the company's financial performance. The substantial existing mortgage portfolio ensures a reliable and steady flow of interest income, underpinning its Cash Cow status.

First Financial Holding's securities brokerage and underwriting business is a prime example of a Cash Cow within its BCG Matrix. In 2024, this sector achieved a record pre-tax profit, underscoring its robust performance. The segment benefited from significant upticks in brokerage, underwriting, and proprietary trading revenues, signaling strong market engagement and successful deal execution.

Despite operating in a mature market, this business unit commands a high market share. This dominance allows it to consistently generate substantial fee income, a hallmark of a Cash Cow. Its established infrastructure and deep client relationships contribute to this sustained revenue generation, making it a dependable cash generator for the broader First Financial Holding entity.

Life Insurance Business

First Financial Holding's life insurance business stands out as a cash cow, a testament to its strategic maturity and consistent profitability. In 2024, this segment experienced a remarkable profit surge, multiplying its earnings by 2.91 times, significantly bolstering the group's financial performance.

Since acquiring full ownership of its life insurance subsidiary in 2018, First Financial Holding has effectively leveraged this established market. The business is a reliable generator of substantial cash flow, playing a crucial role in diversifying the holding company's revenue streams and providing a stable financial foundation.

- 2024 Profit Growth: A 2.91-fold increase in profits highlights the segment's strong performance.

- Market Position: Full ownership since 2018 solidifies its standing in a mature life insurance market.

- Cash Generation: The business consistently produces significant cash, supporting overall group operations.

- Income Diversification: It contributes to a more robust and varied income portfolio for the holding company.

Retail Deposit Base

First Financial Holding benefits significantly from its substantial retail deposit base, acting as a cornerstone for its banking operations. This provides a stable and cost-effective funding stream, crucial for maintaining healthy net interest margins. As of the first quarter of 2024, First Financial Holding reported total deposits of NT$2.4 trillion, with a significant portion attributed to retail customers, highlighting the resilience of this funding source.

This strong retail deposit foundation directly supports First Financial Holding's lending activities, enabling sustained growth and profitability in a competitive market. The deep-rooted customer relationships fostered by this deposit base represent a significant competitive advantage, particularly in the mature Taiwanese banking landscape.

- Resilient Funding: A large retail deposit base offers stability, especially during economic downturns.

- Cost-Effectiveness: Retail deposits are typically cheaper than wholesale funding, boosting net interest margins.

- Customer Loyalty: Established relationships with retail depositors translate into cross-selling opportunities and reduced churn.

- Market Position: In 2023, First Financial Holding maintained a strong market share in retail banking, underscoring the importance of its deposit base.

First Financial Holding's robust retail deposit base is a significant Cash Cow, providing a stable and cost-effective funding source. As of Q1 2024, total deposits reached NT$2.4 trillion, with a substantial portion from retail customers, underscoring its resilience.

This strong foundation fuels lending activities and offers a competitive edge through deep customer relationships. The retail deposit segment consistently generates substantial cash flow, reinforcing its position as a dependable generator for the group.

The maturity and stability of this segment, coupled with First Financial Holding's strong market share in retail banking in 2023, solidify its Cash Cow status.

| Segment | Status | Key Metric | Data Point |

| Retail Deposits | Cash Cow | Total Deposits (Q1 2024) | NT$2.4 trillion |

| Retail Deposits | Cash Cow | Funding Stability | High, due to customer loyalty |

| Retail Deposits | Cash Cow | Cost-Effectiveness | Lower than wholesale funding |

Full Transparency, Always

First Financial Holding BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you can confidently assess the quality and content, knowing that no watermarks or placeholder text will be present in the final version. The strategic insights and analysis presented here are exactly what you'll be able to leverage for your business planning. Rest assured, this is the polished, ready-to-use report that will be yours to download and implement without any further modifications.

Dogs

In today's digital-first banking environment, First Financial Holding's traditional branch networks are showing signs of underperformance. Many of these physical locations, despite a strong domestic footprint, are experiencing declining customer traffic and face stiff local competition, leading to returns that don't justify their operating expenses. For instance, as of late 2024, reports indicated that a significant percentage of the bank's physical branches were operating below optimal capacity, contributing to higher overhead costs per transaction compared to digital channels.

Within First Financial Holding's investment trust offerings, some niche products may be experiencing stagnation. Despite overall sector growth, these specific trusts could be facing challenges in attracting new investors, leading to a low market share and minimal fee generation.

These underperforming products might consume management resources without demonstrating significant growth potential, making them candidates for divestment or strategic restructuring. For instance, if a particular niche trust saw its assets under management (AUM) decline by 15% in 2024 while the broader market grew by 8%, it would highlight a significant underperformance.

Legacy IT systems within the financial sector, including for institutions like First Financial Holding, represent a significant challenge. In 2024, the cost of maintaining these aging infrastructures continues to be a substantial drain, with many firms allocating upwards of 70% of their IT budgets simply to keep existing systems running rather than investing in new capabilities.

These outdated platforms often lead to higher operational expenses and slower response times, directly impacting customer service and the ability to innovate. If First Financial Holding still relies heavily on these systems, it could be a cash trap, diverting funds that could otherwise fuel growth initiatives or strengthen competitive positioning in a rapidly digitizing market.

Certain Conventional Loan Portfolios with Low Yields

Certain conventional loan portfolios, especially those characterized by long-term, low-yield interest rates or operating in highly competitive, slow-growth market segments, can be categorized as dogs within a BCG Matrix framework. These portfolios often provide a predictable, albeit modest, income stream that may not align with the growth trajectory of other business units or the potential returns from higher-margin offerings. It is crucial to regularly assess these assets to prevent capital from being tied up ineffectively.

For instance, in 2024, the average yield on a 30-year fixed-rate mortgage in the US hovered around 6.5% to 7.5%, a figure that, while stable, offers limited upside compared to other financial products. Similarly, portfolios focused on mature industries with declining demand might exhibit similar characteristics.

Key considerations for these portfolios include:

- Low Market Share & Low Growth: These portfolios typically operate in saturated markets with little room for expansion.

- Stable but Low Returns: While they may not incur significant losses, their profitability is often capped.

- Capital Inefficiency: The capital allocated to these portfolios could potentially yield higher returns if reinvested in growth areas.

- Strategic Review: Regular analysis is necessary to determine if divesting or restructuring these assets is a more beneficial strategy.

Non-Strategic or Underperforming Small-Scale International Ventures

First Financial Holding's international expansion includes some smaller ventures that aren't performing as well as hoped. These might be minor foreign branches or less strategic overseas operations. They often have a small slice of their market and don't add much to the company's bottom line, sometimes even costing more to run than they bring in.

For instance, in 2024, a review of First Financial Holding's global footprint might highlight specific subsidiaries in emerging markets with less than a 2% market share, struggling against established local competitors. These operations could be experiencing higher regulatory compliance costs, particularly in areas like data privacy or financial reporting, which eat into their already low profitability.

- Underperforming Ventures: Identify specific international branches or small-scale projects with consistently low revenue growth and profitability.

- Market Share Analysis: Evaluate the market share of these ventures against key competitors, noting any significant gaps. For example, a venture holding less than 3% market share in its primary operating region might warrant scrutiny.

- Cost-Benefit Review: Analyze operational and compliance costs relative to the revenue generated by these smaller international entities. High overheads for minimal returns are a red flag.

- Strategic Repositioning or Divestment: Consider options such as selling off non-core or underperforming international assets or attempting to revitalize them through strategic changes if a clear path to improvement exists.

Certain conventional loan portfolios, particularly those with long-term, low-yield interest rates or operating in slow-growth market segments, can be classified as dogs in a BCG Matrix. These portfolios offer stable but modest income streams that may not align with the growth aspirations of other business units. For instance, in 2024, the average yield on a 30-year fixed-rate mortgage in the US was around 6.5% to 7.5%, providing limited upside compared to other financial products.

These "dog" assets often possess low market share and low growth potential, operating in saturated markets with limited expansion opportunities. While they might not incur significant losses, their profitability is typically capped, leading to capital inefficiency. The capital allocated to these portfolios could potentially yield higher returns if reinvested in more promising growth areas, necessitating regular strategic reviews to determine if divestment or restructuring is more beneficial.

First Financial Holding's legacy IT systems also represent a significant challenge. In 2024, maintaining these aging infrastructures consumed a substantial portion of IT budgets, with many firms allocating upwards of 70% to upkeep rather than innovation. These outdated platforms lead to higher operational expenses and slower response times, directly impacting customer service and hindering the ability to innovate, potentially acting as a cash trap diverting funds from growth initiatives.

Similarly, some niche investment trust offerings within First Financial Holding may be experiencing stagnation. Despite overall sector growth, these specific trusts might struggle to attract new investors, resulting in a low market share and minimal fee generation. For example, a niche trust experiencing a 15% decline in assets under management (AUM) in 2024, while the broader market grew by 8%, would clearly indicate underperformance and a potential "dog" status.

| Business Unit/Product | Market Share | Market Growth | Return on Investment (ROI) | BCG Classification |

|---|---|---|---|---|

| Legacy Branch Network | Low (Declining Traffic) | Low (Saturated Market) | Negative (High Overhead) | Dog |

| Niche Investment Trusts | Low (Stagnant Investor Base) | Low (Specific Segment Challenges) | Low (Minimal Fee Generation) | Dog |

| Conventional Loan Portfolios (Low Yield) | Moderate (Stable Market) | Low (Mature Industry) | Low (Predictable, Modest Income) | Dog |

| Underperforming International Ventures | Low (Less than 3% Market Share) | Low (Emerging Market Competition) | Low (Higher Compliance Costs) | Dog |

| Legacy IT Systems | N/A | N/A | Negative (High Maintenance Costs) | Dog |

Question Marks

First Financial Holding is actively exploring and integrating cutting-edge technologies like Artificial Intelligence and blockchain into its service offerings. This aligns with broader government efforts to foster fintech growth in Taiwan, a market projected to expand at a Compound Annual Growth Rate (CAGR) of 14.7%.

Currently, these emerging solutions represent a small fraction of the market due to their early adoption stage. Despite their immense potential, significant investment is crucial for development and marketing to achieve widespread adoption and transition into future market leaders.

First Financial Holding's B2B embedded finance offerings, particularly in Taiwan's burgeoning market, are positioned as a potential star in its BCG matrix. The market is anticipated to see substantial growth, driven by solutions like automated invoice payments and embedded lending for small and medium-sized enterprises (SMEs). This segment taps into a clear demand for streamlined financial processes among businesses.

The integration of AI and Big Data by First Financial Holding to create personalized B2B financial products signifies a strategic move towards innovation and capturing future market share. This technological focus is crucial for differentiating its embedded finance solutions and meeting the evolving needs of business clients in a competitive landscape.

Despite the high growth potential, these B2B embedded finance offerings are currently in their nascent stages, characterized by low market penetration. Consequently, significant investment will be necessary to cultivate market awareness and drive adoption among business clients, a factor that might initially place them in the question mark category before they mature.

First Financial Holding is actively embracing green finance and ESG-linked products, aligning with Taiwan's 2050 net-zero emissions target. The company has put in place decarbonization mechanisms and sustainable credit and investment policies to support this transition.

While the global sustainable finance market is experiencing robust growth, the domestic market for new green bonds, sustainability-linked loans, and ESG investment funds is still developing. First Financial Holding's strategic marketing and product development efforts are key to capitalizing on this burgeoning sector and driving broader market adoption.

New Digital Payment Ecosystem Integrations

First Financial Holding's expansion into new digital payment ecosystem integrations positions it within a high-growth sector, driven by Taiwan's target of 90% mobile payment penetration by 2025. This strategic move taps into a rapidly expanding market, though it likely involves entering competitive arenas where current market share may be modest.

Significant investment in forging new partnerships and acquiring users will be crucial for First Financial Holding to solidify its position and capture a more substantial share of this burgeoning digital payment landscape. The company is investing heavily to keep pace with the evolving digital payment trends.

- Market Growth: Taiwan's digital payment market is experiencing robust expansion, with mobile payment penetration aiming for 90% by 2025.

- Strategic Investments: New integrations and cross-industry alliances are key, requiring substantial capital for partnerships and user acquisition.

- Competitive Landscape: While high-growth, these new digital payment ecosystems are highly competitive, demanding strategic differentiation.

Targeted Expansion into Specific Niche International Markets

Targeted expansion into specific niche international markets, while part of First Financial Holding's broader overseas growth strategy, might initially show a low market share. These ventures, such as tapping into high-growth but competitive Southeast Asian economies or offering specialized financial services in select European markets, represent significant growth potential.

Such strategic moves necessitate considerable investment and careful navigation of local regulatory landscapes and competitive pressures. Success in these areas hinges on adapting business models to suit unique market demands and building a strong local presence.

- Southeast Asia's Fintech Growth: The fintech market in Southeast Asia is projected to reach $60 billion by 2025, presenting a substantial opportunity for niche players.

- European Specialized Finance: Certain European markets show increasing demand for specialized financial services, with areas like green finance and wealth management experiencing double-digit annual growth.

- Investment for Market Entry: Initial market share may be low, but strategic investments in 2024, estimated to be in the tens of millions for targeted regions, are crucial for establishing a foothold.

- Regulatory Adaptation: Compliance with diverse financial regulations across these niche markets is a key factor, requiring dedicated resources and local expertise.

Question Marks in First Financial Holding's BCG matrix represent business units with low relative market share in high-growth industries. These are often new ventures or emerging technologies requiring significant investment to gain traction. Their future success is uncertain, as they could either develop into Stars or decline into Dogs.

For instance, First Financial Holding's nascent B2B embedded finance offerings and its expansion into niche international markets likely fall into this category. While these sectors offer substantial growth potential, their current market penetration is low, necessitating considerable capital outlay for development, marketing, and user acquisition. The company is investing in these areas with the aim of capturing future market leadership.

The success of these Question Marks hinges on strategic execution and market receptiveness. For example, while Southeast Asia's fintech market is projected to reach $60 billion by 2025, First Financial Holding's initial share in these competitive landscapes will be low, demanding substantial investment in 2024 to establish a presence.

BCG Matrix Data Sources

Our First Financial Holding BCG Matrix is built on comprehensive financial disclosures, market share data, and industry growth forecasts to provide strategic clarity.