First Financial Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

First Financial Holding navigates a landscape shaped by intense rivalry and the constant threat of new entrants, while buyer power presents a significant consideration. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping First Financial Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

First Financial Holding, like many financial institutions, relies heavily on specialized technology providers for everything from core banking software to advanced cybersecurity solutions. The bargaining power of these suppliers can be substantial, particularly when their offerings are unique or proprietary. For instance, in 2024, the global IT spending by financial services firms was projected to reach over $300 billion, highlighting the significant demand for these specialized services.

The dependence on these vendors becomes a critical factor when switching costs are high. Migrating complex financial systems, retraining staff, and ensuring data integrity during a transition can be incredibly expensive and time-consuming. This makes First Financial Holding vulnerable to price increases or unfavorable contract terms if a technology provider holds a dominant market position or if their solutions are deeply integrated into the holding's operations.

First Financial Holding's reliance on specialized talent in finance, IT, risk, and compliance significantly influences supplier bargaining power. A scarcity of these highly skilled professionals, or competitive offers elsewhere, can empower employees as labor suppliers, potentially inflating operational expenses.

While depositors are crucial, First Financial Holding also relies on broader funding markets like interbank lending and bond markets. These markets, along with institutional investors, act as suppliers of capital. The cost of this funding is directly tied to market liquidity and prevailing interest rates, significantly impacting the company's profitability and its capacity for lending and investment activities.

Regulatory and Compliance Service Providers

Financial institutions, including First Financial Holding, are heavily reliant on specialized regulatory and compliance service providers. These firms, offering legal, auditing, and consulting expertise, are crucial for navigating intricate global and domestic regulatory frameworks. Their specialized knowledge and necessary accreditations can translate into significant bargaining power.

For instance, in Taiwan, where financial regulations are robust, and in international financial hubs, the demand for these services is consistently high. This dependence amplifies the leverage of these service providers. In 2024, the global regulatory compliance market was projected to reach over $100 billion, indicating the substantial investment financial firms make in these essential services.

- High Switching Costs: Financial institutions often face substantial costs and time commitments when switching between compliance service providers due to the need for extensive knowledge transfer and system integration.

- Concentration of Providers: In certain niche areas of financial regulation, the number of highly qualified and accredited service providers may be limited, concentrating bargaining power among a few key players.

- Essential Nature of Services: Non-compliance can result in severe penalties, reputational damage, and operational disruptions, making regulatory and compliance services indispensable and increasing the bargaining power of their providers.

- Information Asymmetry: Service providers possess specialized knowledge of evolving regulations and best practices that clients may lack, allowing them to dictate terms more effectively.

Data and Information Service Vendors

Data and information service vendors, like Bloomberg and Refinitiv, wield considerable bargaining power over financial institutions. Their platforms provide critical real-time market data, credit ratings, economic forecasts, and specialized analytics that are indispensable for daily operations and strategic decision-making.

The high cost and complexity of switching to alternative data sources, or developing proprietary systems, further solidify the suppliers' position. For instance, a comprehensive Bloomberg Terminal subscription can cost upwards of $25,000 per user annually, making it a significant investment but often a necessary one for market participants.

- High Switching Costs: Financial firms face substantial costs and operational disruptions when attempting to migrate from established data providers.

- Critical Nature of Services: Access to accurate and timely financial data is not a luxury but a necessity for trading, risk management, and compliance.

- Limited Substitutes: Few vendors offer the breadth and depth of integrated services that major players like Bloomberg provide, reducing the availability of viable alternatives.

Suppliers of specialized technology, regulatory services, and critical data hold significant bargaining power over First Financial Holding. High switching costs, the essential nature of these services, and limited provider options amplify this influence. For instance, in 2024, financial institutions globally were expected to spend over $300 billion on IT, underscoring the dependence on technology vendors.

The concentration of providers in niche regulatory areas and the information asymmetry between these experts and financial firms further strengthen supplier leverage. The indispensable need for accurate financial data, exemplified by the annual cost of a Bloomberg Terminal exceeding $25,000 per user, solidifies the position of data vendors.

Labor, particularly highly skilled professionals in finance, IT, and compliance, also acts as a supplier. Scarcity in these areas can empower individuals, leading to increased operational expenses for First Financial Holding.

The cost of capital from funding markets and institutional investors is also subject to supplier bargaining power, influenced by liquidity and interest rates.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on First Financial Holding |

| Technology Providers | High switching costs, proprietary solutions, deep integration | Potential for price increases, unfavorable contract terms |

| Regulatory & Compliance Services | Specialized knowledge, limited accredited providers, essential nature of services | Increased costs, dependence on expertise for compliance |

| Data & Information Vendors | High switching costs, critical nature of data, limited substitutes | Significant operational expenses, reliance on vendor platforms |

| Labor (Skilled Professionals) | Scarcity of talent, competitive offers | Higher compensation costs, potential operational disruptions |

| Capital Markets | Market liquidity, prevailing interest rates | Cost of funding, impact on profitability and lending capacity |

What is included in the product

Tailored exclusively for First Financial Holding, analyzing its position within its competitive landscape by examining supplier and buyer power, the threat of new entrants and substitutes, and existing rivalry.

A clear, one-sheet summary of all five forces for First Financial Holding, perfect for quick decision-making and strategic alignment.

Customers Bargaining Power

Customer switching costs are a key factor in how much power customers have over First Financial Holding. If it's hard or expensive for a client to move their money, investments, or insurance elsewhere, they have less leverage to demand better terms. For instance, if a customer has multiple integrated services with First Financial Holding, like a checking account, mortgage, and investment portfolio, the effort to untangle and re-establish these with a new provider can be substantial.

In 2024, the financial services industry continued to see a trend towards digital integration, which can either increase or decrease switching costs. While some digital platforms make it easier to open new accounts, the process of transferring complex financial products, like annuities or managed investment accounts, often involves significant paperwork and potential penalties. This complexity inherently limits a customer's ability to easily switch, thus strengthening First Financial Holding's position by reducing customer bargaining power.

Customers of First Financial Holding have a significant advantage due to the sheer abundance of alternative financial services available. Whether it's traditional banks, innovative online platforms, or agile fintech companies, consumers can easily find comparable options for banking, securities, insurance, and asset management. This widespread availability means customers aren't tied to a single provider and can readily switch if they find better terms or services elsewhere, thereby increasing their bargaining power.

Customers, particularly large corporate clients and savvy individual investors, exhibit significant price sensitivity regarding fees, interest rates, and expected investment returns. This sensitivity directly translates into increased bargaining power, as they actively seek the most favorable terms.

The digital age has dramatically amplified this trend. Enhanced information transparency, readily available through online platforms, allows customers to effortlessly compare financial product pricing across various institutions. For instance, in 2024, many online brokerage platforms provided real-time fee comparisons, enabling investors to identify cost savings. This ease of comparison empowers customers to negotiate better terms or switch providers, forcing financial institutions to offer more competitive pricing to retain business.

Customer Concentration and Size

The bargaining power of customers for First Financial Holding can be significantly influenced by customer concentration. If a substantial portion of their revenue is derived from a small number of large corporate clients or institutional investors, these entities gain considerable leverage. They might negotiate for lower fees, tailored financial products, or special service agreements, directly impacting First Financial Holding's profitability.

For instance, in the financial services sector, a few major institutional clients can represent a significant percentage of a holding company's assets under management or transaction volume. This concentration allows these clients to demand more favorable terms. In 2024, the trend of consolidation among large institutional investors continues, potentially amplifying their bargaining power across the industry.

- Customer Concentration: High reliance on a few large clients increases their bargaining power.

- Negotiating Leverage: Large clients can demand preferential rates and customized services.

- Impact on Profitability: Lower fees and tailored offerings can squeeze profit margins.

- Industry Trends: Continued consolidation in institutional investing may heighten this power.

Access to Diverse Product Offerings

Customers seeking a broad range of financial services, such as banking, investments, and insurance, from a single institution may find their bargaining power diminished if First Financial Holding provides distinctive bundled or integrated offerings. This is particularly true if these combined services are not easily replicated elsewhere.

Conversely, if these financial services are widely available from multiple providers, either separately or through other integrated solutions, the bargaining power of these customers significantly increases. For instance, as of the first quarter of 2024, the Taiwanese banking sector, where First Financial Holding operates, saw a substantial number of competing institutions offering similar product suites, potentially empowering customers.

- Increased Customer Power: When financial services are commoditized and readily available from numerous competitors, customers can easily switch providers, thereby increasing their bargaining leverage.

- Bundling Strategy: First Financial Holding's ability to offer unique, integrated financial packages can reduce customer bargaining power by creating switching costs or perceived value.

- Market Competition: The competitive landscape in Taiwan's financial services sector, with many banks and securities firms offering similar products, generally favors customers by providing ample choices.

- Information Availability: The ease with which customers can compare offerings and prices across different financial institutions further amplifies their bargaining power.

Customers wield significant bargaining power when First Financial Holding's products and services are easily substitutable. The proliferation of financial technology (fintech) and digital banking platforms in 2024 has intensified this, offering consumers a wider array of choices for everything from savings accounts to investment management. This ease of substitution means customers can readily switch to competitors offering better rates or lower fees, forcing First Financial Holding to remain competitive.

The availability of information further bolsters customer power. In 2024, online comparison tools and financial news outlets provided consumers with granular data on pricing, service quality, and customer satisfaction across the industry. For example, readily accessible data on average mortgage rates or credit card APRs allows customers to pinpoint the best deals, directly influencing their negotiations with First Financial Holding.

| Factor | Description | Impact on First Financial Holding |

|---|---|---|

| Availability of Substitutes | Numerous banks, fintechs, and investment platforms offer similar financial products. | Increases customer leverage to seek better terms. |

| Information Transparency | Online tools allow easy comparison of fees, rates, and services. | Empowers customers to negotiate or switch. |

| Digitalization Trend | Easier account opening for some products, but complex transfers remain a barrier. | Can both increase and decrease switching costs, influencing power. |

What You See Is What You Get

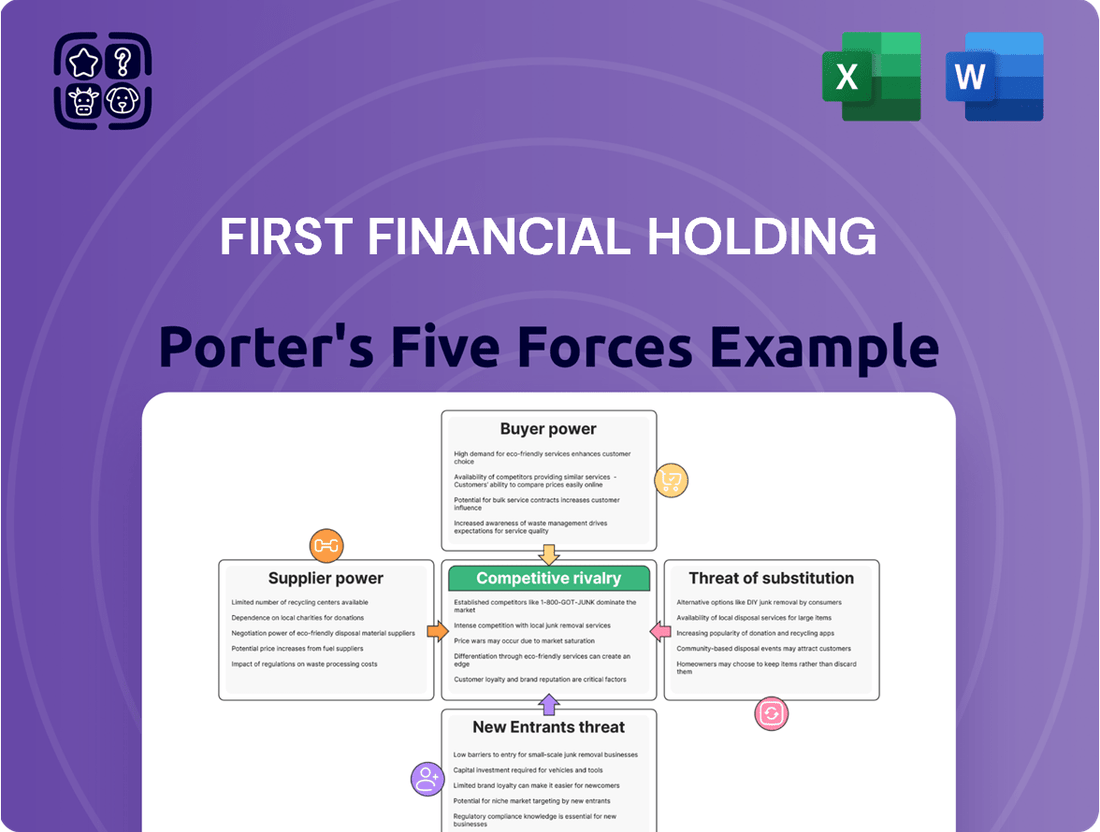

First Financial Holding Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for First Financial Holding, offering a comprehensive examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or missing sections. You're looking at the actual document, ready for your immediate download and use, providing actionable insights into First Financial Holding's strategic landscape.

Rivalry Among Competitors

Taiwan's financial landscape is densely populated, featuring a significant number of domestic and international banks, securities firms, and insurance companies. This maturity means intense competition for market share, as players constantly vie for customer attention and loyalty.

As of early 2024, Taiwan's banking sector alone comprises over 30 domestic banks and several foreign bank branches, alongside a robust network of credit unions and postal savings. This sheer volume of institutions, each possessing distinct capabilities and market penetration, fuels a fierce rivalry, making it challenging for any single entity to achieve overwhelming dominance.

In mature financial markets, like those First Financial Holding operates in, slow growth in traditional offerings means companies battle harder for existing customers. This intensified rivalry often results in price competition and aggressive marketing campaigns as firms strive to capture market share. For instance, the Taiwanese banking sector, a key market for First Financial Holding, saw a net profit after tax of NT$349.6 billion in 2023, indicating a competitive landscape where efficiency and customer acquisition are paramount.

The intensity of competition for First Financial Holding is significantly shaped by its ability to make its products and services stand out. In the financial sector, where many offerings can seem very similar, companies work hard to differentiate themselves. This differentiation often comes through exceptional customer service, embracing new technology, providing specialized advice, or developing unique product features.

However, achieving truly strong differentiation in financial services remains a considerable challenge. For instance, in 2024, while many banks reported increased digital service adoption, the core banking products like savings accounts and loans often presented minimal distinguishing characteristics for the average consumer, making it difficult for any single institution to capture significant market share solely on product uniqueness.

Switching Costs for Customers

For First Financial Holding, lower customer switching costs in the financial services sector mean that competitors can more readily attract clients by offering slightly more attractive rates or enhanced services. This dynamic directly fuels competitive rivalry.

Conversely, if First Financial Holding can establish high switching costs, perhaps through deeply integrated digital banking platforms or specialized investment products that are difficult to replicate or transfer, it can create a significant barrier for customers looking to move elsewhere. This helps to insulate the company from intense competitive pressures.

In 2023, the average customer retention rate across major banks in Taiwan, where First Financial Holding operates, remained robust, indicating that while switching is possible, inertia and integrated services do play a role. For instance, a significant portion of customers utilize multiple products from a single institution, making a complete switch more cumbersome.

- Low switching costs enable competitors to easily attract clients with better offers.

- High switching costs, like integrated ecosystems, lock in customers and reduce rivalry.

- In 2023, customer retention in Taiwan's banking sector was strong, suggesting switching barriers exist.

Exit Barriers and Industry Consolidation

First Financial Holding faces intensified competitive rivalry due to significant exit barriers. High fixed asset investments, like extensive branch networks and IT infrastructure, make it difficult and costly for underperforming financial institutions to exit the market. This can lead to a situation where unprofitable firms continue to operate, contributing to market overcapacity and sustained competitive pressure.

The financial services sector, including banking and insurance, is characterized by substantial regulatory hurdles and long-term contractual obligations with customers. These factors further elevate exit barriers, trapping even struggling companies within the industry. For instance, the need to maintain capital adequacy ratios or fulfill existing loan commitments can prevent a swift and clean departure.

The potential for industry consolidation through mergers and acquisitions (M&A) is a significant factor influencing competitive rivalry. In 2024, the global financial services sector saw continued M&A activity, driven by a desire for scale, efficiency, and diversification. For example, the proposed merger of two regional banks in the US, valued at over $15 billion, illustrates the trend of consolidation aimed at strengthening market position and reducing operational costs, which can reshape the competitive landscape for all players, including First Financial Holding.

- High fixed asset requirements in banking, such as property, plant, and equipment, represent substantial exit barriers.

- Regulatory compliance costs and long-term customer contracts create additional difficulties for firms wishing to exit the financial services industry.

- Industry consolidation, evidenced by significant M&A deals in 2024, is actively reshaping competitive dynamics.

First Financial Holding operates in a highly competitive Taiwanese financial market, characterized by numerous domestic and international players. This dense market structure, with over 30 domestic banks and numerous other financial institutions as of early 2024, forces companies into aggressive competition for market share. The intense rivalry is further fueled by slow growth in traditional financial products, leading to price wars and extensive marketing efforts. For instance, the Taiwanese banking sector's NT$349.6 billion net profit after tax in 2023 underscores the need for efficiency and customer acquisition in this crowded space.

The challenge for First Financial Holding lies in differentiating its offerings in a market where products like savings accounts and loans often appear similar to consumers. While digital adoption increased in 2024, true product uniqueness remained elusive for many, making it hard to capture significant market share based on product innovation alone. This similarity, coupled with low customer switching costs, allows competitors to easily lure clients with slightly better rates or services, intensifying the competitive battle.

Significant exit barriers, such as high fixed asset investments in branch networks and IT infrastructure, keep even struggling firms in the market, contributing to overcapacity and sustained competitive pressure for First Financial Holding. Regulatory requirements and long-term customer contracts further solidify these barriers. The ongoing trend of industry consolidation, exemplified by substantial M&A deals in the global financial sector during 2024, is also actively reshaping the competitive landscape.

| Factor | Description | Impact on First Financial Holding |

| Market Density | Over 30 domestic banks and numerous other financial institutions in Taiwan. | Intense rivalry for market share and customer loyalty. |

| Product Similarity | Core banking products often lack significant differentiation for consumers. | Difficulty in capturing market share based on product uniqueness; reliance on other factors like service. |

| Switching Costs | Generally low customer switching costs in financial services. | Competitors can easily attract clients with better offers, increasing competitive pressure. |

| Exit Barriers | High fixed asset investments, regulatory hurdles, and long-term contracts. | Perpetuates market overcapacity and sustained competitive pressure. |

| Industry Consolidation | Ongoing M&A activity in the financial sector. | Reshapes competitive dynamics and market structure. |

SSubstitutes Threaten

The rise of fintech solutions presents a significant threat of substitution for First Financial Holding. Companies offering innovative digital alternatives, like mobile payment apps and peer-to-peer lending platforms, directly challenge traditional banking services. For instance, the global digital payments market was valued at over $2 trillion in 2023 and is projected to grow substantially, indicating a strong shift towards these substitute channels.

Customers are increasingly bypassing traditional financial intermediaries. Platforms like Robinhood and Charles Schwab's own offerings allow direct investment in stocks and ETFs. This trend is amplified by the rise of real estate crowdfunding platforms, offering alternative avenues for capital deployment.

The rise of decentralized finance (DeFi) and cryptocurrency platforms presents a significant threat of substitutes for traditional financial services offered by First Financial Holding. These platforms enable peer-to-peer transactions, lending, and asset management, bypassing conventional intermediaries. By mid-2024, the total value locked in DeFi protocols surpassed $100 billion, demonstrating substantial user adoption and a growing alternative to established banking models.

Non-Bank Financial Institutions and Specialized Lenders

Beyond traditional banks, a growing number of non-bank entities, including credit unions, specialized lending companies, and online lenders, offer specific financial products. These niche players can act as substitutes for particular services, drawing away customers who only require a limited range of offerings.

For instance, in 2024, the online lending market continued its robust expansion, with platforms facilitating billions in personal and business loans, directly competing with traditional bank offerings for specific customer segments. This trend is amplified by the agility of fintech companies, which can often process applications and disburse funds far more rapidly than established institutions.

- Growth in Online Lending: The global online lending market was projected to reach over $1.5 trillion by 2024, indicating a significant alternative to traditional banking services.

- Specialized Niche Offerings: Many non-bank institutions focus on specific loan types, such as equipment financing or invoice factoring, providing tailored solutions that banks may not prioritize.

- Customer Demand for Convenience: The increasing preference for digital-first financial interactions fuels the adoption of non-bank alternatives, especially among younger demographics.

- Regulatory Arbitrage: In some cases, non-bank lenders may operate under different regulatory frameworks, allowing them to offer more competitive rates or terms on certain products.

Internal Corporate Finance Capabilities

Large corporations increasingly possess the internal expertise and resources to manage sophisticated financial operations. For instance, by 2024, a significant number of Fortune 500 companies have established robust treasury departments capable of handling complex cash management and even direct debt issuance, bypassing traditional investment banking services. This internal capacity acts as a potent substitute for external financial providers.

This trend of 'self-supply' directly impacts the demand for a range of corporate financial services. Instead of engaging external banks for treasury functions or debt underwriting, these corporations leverage their in-house teams. This reduces the reliance on, and therefore the revenue potential for, external financial institutions in these specific areas.

Consider the implications for financial institutions: by 2023, the global market for corporate treasury and cash management services, while substantial, faces pressure from this internal shift. Companies that can efficiently manage their liquidity and funding internally are less likely to outsource these functions, thereby limiting the growth opportunities for external service providers.

The threat of substitutes is amplified as technology further enables internal capabilities. Advanced treasury management systems and direct access to capital markets allow even mid-sized enterprises to develop more self-sufficient financial operations, presenting a growing challenge to traditional financial intermediaries.

The threat of substitutes for First Financial Holding is multifaceted, encompassing digital alternatives, specialized non-bank lenders, and even the internal capabilities of large corporations. Fintech innovations, online lending platforms, and decentralized finance (DeFi) are increasingly offering efficient, often lower-cost, alternatives to traditional banking services. By mid-2024, the total value locked in DeFi protocols exceeded $100 billion, highlighting a significant shift in financial intermediation.

Non-bank entities, focusing on niche financial products like equipment financing or invoice factoring, also present a considerable substitution threat. The global online lending market was projected to surpass $1.5 trillion by 2024, underscoring the growing customer preference for these specialized and convenient options. This trend is further fueled by the demand for digital-first financial interactions, particularly among younger demographics.

Furthermore, large corporations are increasingly developing in-house treasury functions and directly accessing capital markets, reducing their reliance on external financial institutions. By 2023, many Fortune 500 companies had robust treasury departments capable of complex cash management and debt issuance, effectively acting as substitutes for traditional investment banking services. This internal capacity limits the market for external financial providers in key areas.

| Substitute Type | Key Characteristics | Market Size/Growth Indicator (2023-2024 Data) | Impact on First Financial Holding |

| Fintech & Digital Payments | Convenience, speed, lower fees | Global digital payments market > $2 trillion (2023) | Reduced transaction volumes, customer attrition |

| Online Lending Platforms | Specialized products, faster approvals | Global online lending market projected > $1.5 trillion (2024) | Loss of loan market share, particularly in personal and SME segments |

| DeFi & Cryptocurrency | Peer-to-peer, disintermediation | DeFi Total Value Locked > $100 billion (mid-2024) | Potential erosion of traditional banking functions (lending, payments) |

| Non-Bank Niche Lenders | Targeted solutions (e.g., invoice factoring) | Growth in specialized financing sectors | Loss of specific profitable product lines |

| Corporate In-house Treasury | Direct capital market access, self-management | Significant Fortune 500 treasury capabilities (2023) | Reduced demand for corporate banking services (treasury, debt underwriting) |

Entrants Threaten

The financial sector, particularly for entities like First Financial Holding, faces substantial regulatory hurdles. These include stringent capital adequacy ratios, such as the Basel III framework, which mandates higher capital reserves for banks, and extensive licensing requirements across various jurisdictions. For instance, in 2024, many financial institutions were still adapting to evolving capital requirements aimed at bolstering stability, making initial investment for new entrants incredibly steep.

Established financial institutions like First Financial Holding often leverage significant economies of scale. For instance, in 2024, major banks continued to consolidate, with large players benefiting from lower per-unit costs in areas like IT infrastructure and compliance due to their vast customer bases and transaction volumes. This makes it challenging for newcomers to match their operational efficiency and pricing power.

Building a strong brand reputation and earning customer trust in the financial services industry is a monumental task, often taking many years, if not decades. Financial consumers, by nature, tend to be cautious with their money, gravitating towards established and reputable institutions they believe offer security and reliability. For instance, in 2023, major banks like JPMorgan Chase continued to leverage their long-standing presence and brand recognition, which played a significant role in their ability to attract and retain deposits, even amidst evolving market conditions.

Access to Distribution Channels and Customer Base

Established financial institutions, like First Financial Holding, benefit from deeply entrenched distribution channels, including extensive branch networks and sophisticated digital platforms. These incumbents also possess a significant advantage through their existing, loyal customer base, built over years of service.

New entrants face the formidable challenge of replicating this reach. They must make substantial investments to build their own distribution infrastructure and attract customers, a process that is often slow and financially demanding. For instance, in 2024, the cost of acquiring a new retail banking customer can range from hundreds to thousands of dollars, depending on the services offered and marketing efforts.

- Established networks: Incumbents leverage existing branches and digital platforms.

- Customer loyalty: Existing relationships provide a stable revenue stream.

- High entry costs: New entrants need significant capital for distribution and customer acquisition.

- Market penetration: Acquiring a substantial customer base is a lengthy and expensive endeavor.

Technological and Talent Acquisition Challenges

Fintech startups, while digitally native, face significant hurdles in replicating the sophisticated, secure, and scalable IT infrastructure that established institutions like First Financial Holding possess. Building and maintaining such systems demands substantial capital investment and ongoing technical expertise.

Acquiring specialized talent is another major challenge for new entrants. The financial services sector requires professionals skilled in areas like advanced data analytics, robust cybersecurity, and complex financial engineering. For instance, the demand for cybersecurity professionals globally is projected to grow significantly, with estimates suggesting a shortfall of 3.5 million by the end of 2025, making recruitment highly competitive and costly for emerging players.

- High Capital Outlay: Traditional financial services require immense investment in secure, scalable IT infrastructure, a barrier for many startups.

- Talent Scarcity: Securing skilled professionals in data analytics, cybersecurity, and financial engineering is a significant challenge due to high demand.

- Regulatory Compliance Costs: Meeting stringent regulatory requirements necessitates advanced technological solutions and specialized legal/compliance talent, further increasing entry barriers.

- Established Brand Trust: New entrants must overcome the established trust and reputation that incumbents like First Financial Holding have cultivated over years, often requiring significant marketing spend and demonstrable reliability.

The threat of new entrants for First Financial Holding is generally considered moderate to low due to high barriers to entry. Significant capital requirements for technology and regulatory compliance, coupled with the need to build brand trust, deter many potential competitors. For example, the cost to establish a fully compliant digital banking platform in 2024 could easily run into tens of millions of dollars.

| Barrier to Entry | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Regulatory Compliance | High | Licensing and capital adequacy requirements (e.g., Basel III) necessitate substantial upfront investment. |

| Capital Requirements | High | Building robust IT infrastructure and meeting liquidity ratios requires significant funding. |

| Brand Reputation & Trust | High | Customers prefer established institutions, requiring extensive marketing and time to build credibility. |

| Economies of Scale | Moderate | Incumbents benefit from lower per-unit costs, making it hard for new players to compete on price. |

| Distribution Channels | Moderate | Replicating extensive branch and digital networks is costly and time-consuming. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for First Financial Holding leverages a comprehensive data strategy, incorporating annual reports, investor relations disclosures, and regulatory filings to capture internal company dynamics. We supplement this with industry-specific market research reports and economic databases to provide a well-rounded view of the external competitive landscape.