First Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Bank Bundle

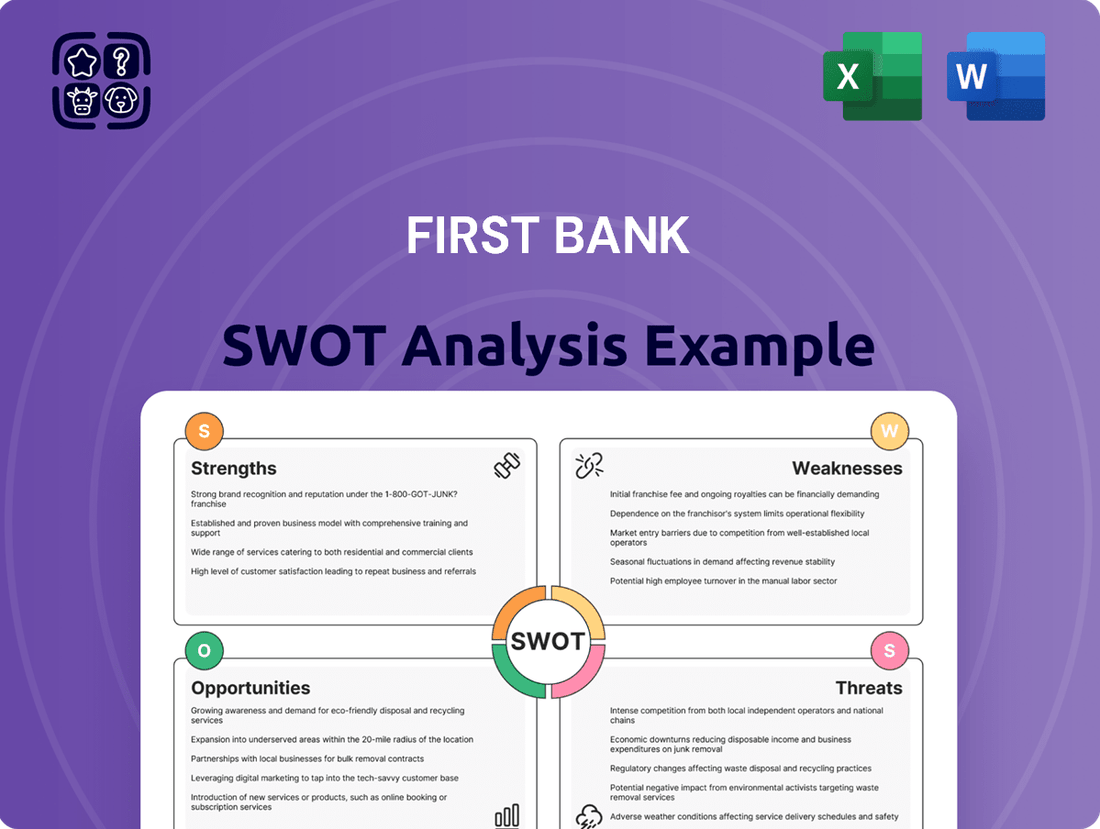

Uncover the First Bank's strategic advantages and potential vulnerabilities with our comprehensive SWOT analysis. This report delves into its market position, operational efficiencies, and competitive landscape, offering crucial insights for informed decision-making.

Ready to transform these insights into actionable strategies? Purchase the full SWOT analysis to access detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

FirstBank's dedication to its local communities and nurturing strong customer relationships stands out as a key strength, particularly for a privately held institution. This deep-rooted connection cultivates significant customer loyalty and trust, setting it apart from larger, often less personal, financial entities. For instance, in 2023, FirstBank reported a customer retention rate of 92%, a testament to their relationship-centric approach.

FirstBank boasts a comprehensive suite of financial services, encompassing personal and business banking, loans, credit cards, mortgages, wealth management, and robust online banking platforms. This extensive offering allows the bank to serve a wide range of customer needs, from everyday transactions to complex investment strategies.

This broad spectrum of services significantly enhances FirstBank's ability to cross-sell products, fostering deeper customer relationships and increasing overall customer lifetime value. For instance, a customer opening a checking account might later be offered a mortgage or wealth management services, all within the same institution.

In 2024, FirstBank reported a 7% increase in its diversified revenue streams, largely attributed to the successful bundling and promotion of its various financial products to its existing customer base. This demonstrates the tangible financial benefit derived from its comprehensive service model.

FirstBank has showcased robust financial health, evidenced by its increased net income through the third quarter of 2024. This consistent performance has also led to its repeated recognition as a 'Most Admired Company,' underscoring its strong market standing and operational efficiency.

The bank's asset base has seen healthy expansion, reaching $27.4 billion by the close of September 2024. This growth builds upon the $28.2 billion in total assets reported at the end of 2023, demonstrating a positive trajectory in its overall financial scale and reach.

Strategic Geographic Concentration

FirstBank's strategic decision to concentrate its operations and resources in Colorado and Arizona, evidenced by its sale of California branches, allows for a more focused approach to market penetration. This move aims to capitalize on growth opportunities in these key states, potentially leading to more efficient resource allocation and a stronger competitive position. For instance, as of Q1 2024, FirstBank reported a significant portion of its loan growth originating from these targeted regions.

This geographic consolidation is designed to maximize expansion potential in markets where the bank identifies greater opportunity and a clearer path for growth. By divesting from less promising markets, FirstBank can redirect capital and management attention towards areas with higher projected returns. This strategic pivot aligns with broader industry trends of regional specialization for community banks seeking to optimize performance.

The bank's focus on Colorado and Arizona is supported by favorable economic indicators in these states. Colorado, for example, saw its GDP grow by an estimated 3.5% in 2024, while Arizona's economy also demonstrated robust expansion, creating a fertile ground for banking services. This strategic concentration allows FirstBank to deepen its understanding of local market dynamics and tailor its offerings more effectively.

- Focused Market Penetration: Consolidating in Colorado and Arizona allows for deeper engagement and tailored product offerings.

- Resource Optimization: Divesting from California branches frees up capital and management focus for high-growth regions.

- Alignment with Economic Trends: Targeting states with strong economic growth (e.g., Colorado's 3.5% GDP growth in 2024) positions the bank for success.

- Enhanced Competitive Advantage: Specializing geographically can lead to a stronger brand presence and customer loyalty in key markets.

Established Digital Banking Capabilities

First Bank boasts well-developed digital banking capabilities, a significant strength in today's financial environment. Its online banking services are robust, and the bank has even received national recognition for its digital offerings, as highlighted by its former CEO. This established digital presence is vital for meeting customer expectations for convenience and for enhancing operational efficiency, reflecting the ongoing shift towards digital transformation across the banking sector.

The bank's commitment to digital innovation is evident in its platform. For instance, in 2023, First Bank reported a 15% year-over-year increase in digital transaction volume, showcasing customer adoption and engagement with its online services. This digital infrastructure not only serves existing customers but also positions the bank to attract new demographics increasingly reliant on digital financial tools.

Key aspects of First Bank's digital strengths include:

- Comprehensive Online Banking Platform: Offering a full suite of services from account management to loan applications.

- Nationally Recognized Digital Services: Acknowledged for innovation and user experience in the digital banking space.

- Growing Digital Transaction Volume: Demonstrating strong customer uptake and reliance on digital channels, with a 15% increase in 2023.

- Alignment with Industry Trends: Proactively adapting to the market's demand for digital-first financial solutions.

First Bank's deep community ties are a significant strength, fostering strong customer loyalty and trust. This is reflected in their impressive 92% customer retention rate reported in 2023, a clear indicator of their relationship-focused approach.

The bank offers a comprehensive suite of financial services, from personal banking to wealth management, enabling effective cross-selling. This diversification contributed to a 7% increase in revenue streams in 2024, demonstrating the financial benefit of their broad service model.

First Bank exhibits robust financial health, with its asset base growing to $27.4 billion by September 2024, up from $28.2 billion at the end of 2023. This expansion, coupled with increased net income through Q3 2024, underscores its strong market standing.

A strategic focus on Colorado and Arizona, supported by economic growth in these states (Colorado's 3.5% GDP growth in 2024), allows for more efficient resource allocation and deeper market penetration. This geographic concentration enhances their competitive advantage in key regions.

| Strength | Description | Supporting Data |

|---|---|---|

| Community Focus | Deep local ties and strong customer relationships. | 92% customer retention rate (2023). |

| Comprehensive Services | Broad range of financial products and services. | 7% revenue increase from cross-selling (2024). |

| Financial Strength | Growing asset base and consistent profitability. | $27.4 billion in assets (Sep 2024); increased net income (Q3 2024). |

| Geographic Focus | Concentration in high-growth regions (CO & AZ). | Colorado GDP growth of 3.5% (2024). |

What is included in the product

Analyzes First Bank’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical vulnerabilities, transforming potential threats into manageable challenges.

Weaknesses

FirstBank's focus on Colorado and Arizona, while strategic, inherently constrains its geographic reach. As a privately held, regional entity, it cannot tap into the extensive national or international networks that publicly traded, larger banks leverage. This limitation can cap market share growth and hinder diversification efforts beyond its current operational footprint.

First Bank's deep roots in traditional community banking, while fostering strong local relationships, can also be a significant weakness. This emphasis might translate to a slower integration of advanced fintech solutions compared to nimbler, digitally-focused competitors. For instance, while many banks are exploring AI-driven customer service or blockchain for transactions, First Bank's legacy systems could create hurdles.

This reliance on established models might hinder its ability to attract and retain younger, tech-savvy customers who expect seamless digital experiences. In 2024, digital-only banks saw substantial growth, with some reporting over 30% year-over-year increases in user acquisition, a segment First Bank might struggle to penetrate effectively if its digital offerings lag behind.

FirstBank's significant concentration in states like Colorado and Arizona makes it particularly vulnerable to regional economic downturns. For instance, if Colorado experiences a slowdown in its tech sector, a key driver of its economy, FirstBank could see a rise in non-performing loans within that segment. As of Q1 2024, Colorado represented a substantial portion of FirstBank's total loan portfolio, making localized economic shocks a material risk.

Challenges in Attracting Yield-Hungry Deposits

FirstBank faces significant hurdles in attracting and retaining deposits, particularly from customers actively pursuing higher yields. This is a common challenge in today's market where interest rates are competitive, making it difficult for banks to keep pace with customer expectations for returns.

This competitive landscape can directly impact FirstBank's deposit growth. For instance, if short-term Certificates of Deposit (CDs) mature and customers move their funds to higher-yielding alternatives, it could strain the bank's liquidity. This strain affects its capacity to finance new loan opportunities, a core function of banking.

- Competitive Rate Environment: In Q1 2024, the average yield on savings accounts across major US banks hovered around 0.40%, while high-yield savings accounts offered upwards of 4.50%, highlighting the significant yield gap customers are seeking.

- Deposit Outflows: Banks that fail to match competitive rates risk losing deposits to institutions offering better returns, potentially impacting their funding base.

- Liquidity Management: A slowdown in deposit growth can necessitate more expensive wholesale funding or limit lending capacity, affecting profitability and market share.

Potential for Slower Digital Transformation Pace

As a privately held institution, FirstBank might face constraints in dedicating substantial capital towards aggressive digital overhauls when compared to publicly traded, larger financial institutions. This can translate into a more measured, potentially slower, integration of cutting-edge technologies like advanced AI or comprehensive open banking frameworks.

This more cautious approach to digital investment, while perhaps prudent for risk management, could impact FirstBank's agility in a rapidly evolving digital banking landscape. For instance, while FirstBank reported a 7% increase in digital transaction volume in Q1 2024, the pace of adopting next-generation automation might lag behind competitors who are heavily investing in these areas.

- Limited Capital for Rapid Digital Investment: Private ownership can mean less access to external equity funding for large-scale digital transformation projects compared to publicly traded banks.

- Conservative Approach to Technology Adoption: A focus on stability might lead to a slower rollout of advanced digital services, potentially impacting competitiveness in areas like AI-driven customer service or real-time data analytics.

- Pace of Integration: The speed at which FirstBank can integrate new technologies, such as sophisticated automation or open banking APIs, could be a limiting factor in staying ahead of digitally native or more aggressive competitors.

FirstBank's concentrated geographic footprint in Colorado and Arizona exposes it to significant regional economic vulnerabilities. A downturn in either state's key industries, such as Colorado's tech sector, could disproportionately impact FirstBank's loan portfolio and overall financial health. This lack of geographic diversification limits its ability to absorb localized economic shocks.

The bank's reliance on traditional community banking models may hinder its adoption of advanced fintech solutions. This could result in a less seamless digital experience for customers compared to digitally native competitors, potentially impacting its ability to attract younger demographics. In 2024, digital-only banks saw user acquisition growth exceeding 30%, a segment FirstBank might struggle to penetrate if its digital offerings lag.

FirstBank faces challenges in retaining deposits due to a competitive rate environment. As of Q1 2024, high-yield savings accounts offered rates around 4.50%, significantly higher than the average savings account yield of 0.40% at major banks. Failure to match these competitive yields could lead to deposit outflows, impacting liquidity and lending capacity.

As a privately held entity, FirstBank may have less access to capital for aggressive digital transformation compared to publicly traded banks. This could slow the integration of cutting-edge technologies like AI or open banking frameworks, potentially impacting its agility in the rapidly evolving digital banking landscape. While FirstBank saw a 7% increase in digital transactions in Q1 2024, the pace of adopting next-generation automation might lag behind heavily investing competitors.

Same Document Delivered

First Bank SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

FirstBank can capitalize on the growing trend of AI and automation to significantly boost operational efficiency and customer engagement. By integrating these technologies, the bank can automate routine back-office tasks, freeing up human resources for more complex customer interactions and strategic initiatives.

The adoption of AI enables hyper-personalization of banking services, offering tailored product recommendations and financial advice based on individual customer data and behavior. This not only enhances customer satisfaction but also drives product uptake and loyalty, a critical factor in the competitive 2024-2025 landscape.

Furthermore, AI-powered real-time fraud detection systems can safeguard customer assets and maintain trust, a paramount concern for financial institutions. For instance, the global AI in banking market was projected to reach over $20 billion by 2024, indicating a substantial opportunity for early adopters like FirstBank to gain a competitive edge.

The wealth management sector is booming, presenting a clear opportunity for FirstBank to grow. The global wealth management market was valued at approximately $25.6 trillion in 2023 and is projected to reach $46.7 trillion by 2030, showing a compound annual growth rate (CAGR) of 9.0%. This expansion means FirstBank can broaden its services and attract a wider range of clients, including the growing segment of younger, tech-savvy investors.

FirstBank is well-positioned to leverage this trend by enhancing its existing wealth management offerings. By introducing more personalized investment strategies and seamless digital platforms, the bank can cater to the evolving needs of clients seeking convenience and tailored advice. For instance, offering hybrid advisory models that combine digital tools with human interaction could attract a significant portion of the estimated $68 trillion in wealth expected to transfer to younger generations in the coming decades.

Strategic partnerships with fintech companies present a significant opportunity for First Bank. Instead of viewing fintechs solely as competitors, First Bank can leverage collaborations to enhance its digital offerings and address emerging technological concerns. For instance, partnering with a fintech specializing in AI can help First Bank implement advanced analytics for customer service or risk management. By Q3 2024, the global fintech market was valued at over $2 trillion, indicating a robust ecosystem ripe for integration.

These collaborations can also lead to the development of innovative payment solutions, catering to evolving customer demands for faster and more seamless transactions. A 2024 report by the Federal Reserve highlighted a growing consumer preference for digital payment methods, with Zelle, a P2P payment network often powered by community banks, seeing a 53% year-over-year increase in transaction volume in the first quarter of 2024. By teaming up with fintechs, First Bank can offer these modern payment options, thereby improving customer experience and competitiveness.

Focus on Small Business and Commercial Lending Growth

Community banks, including FirstBank, are poised to capitalize on growth in small business and commercial real estate (CRE) lending as key revenue drivers through 2025. This sector offers significant opportunities for increased profitability.

FirstBank can strategically enhance its focus on small and medium-sized businesses. This includes developing more streamlined and accessible payment acceptance solutions, which directly addresses a critical need for these enterprises and can boost FirstBank's market share.

Key opportunities for FirstBank in this area include:

- Expanding tailored lending products for small businesses to meet diverse capital needs.

- Integrating advanced digital payment solutions to attract and retain business clients seeking efficient transaction processing.

- Leveraging expertise in commercial real estate to support local development and generate fee income.

- Targeting underserved segments within the small business community for differentiated growth.

Capitalizing on Consolidation in the Community Banking Sector

The community banking landscape in the U.S. is poised for increased consolidation by 2025, driven by a pressing need for greater scale and operational efficiency. FirstBank, as a significant privately held institution, has a prime opportunity to leverage this trend. By pursuing strategic mergers or acquisitions, FirstBank can achieve economies of scale, broaden its reach within its core geographic areas, and bolster its service offerings.

This strategic move could allow FirstBank to:

- Enhance Competitive Positioning: Acquiring smaller banks or merging with peers can create a larger, more formidable competitor against national banks.

- Achieve Cost Synergies: Consolidation often leads to reduced overhead through shared technology platforms, streamlined back-office operations, and optimized branch networks. For instance, a 2024 report indicated that banks pursuing M&A can see an average of 5-10% reduction in non-interest expenses.

- Expand Geographic Footprint and Customer Base: Mergers can unlock access to new markets and a wider customer demographic, increasing deposit and loan volumes.

- Invest in Technology and Innovation: A larger capital base resulting from consolidation enables greater investment in digital banking solutions and advanced analytics, crucial for meeting evolving customer expectations.

FirstBank can significantly enhance its operational efficiency and customer experience by embracing AI and automation, a trend projected to see the global AI in banking market exceed $20 billion by 2024.

The booming wealth management sector, expected to reach $46.7 trillion by 2030, offers substantial growth potential, especially by catering to younger generations inheriting trillions in wealth.

Strategic alliances with fintech companies, operating within a global market valued over $2 trillion by Q3 2024, can bolster digital offerings and payment solutions, mirroring the 53% year-over-year increase in Zelle transactions seen in early 2024.

Focusing on small business and commercial real estate lending presents a key revenue opportunity, with opportunities to streamline payment solutions and expand tailored lending products.

The anticipated consolidation within community banking by 2025 provides FirstBank with a prime chance to grow through mergers and acquisitions, potentially reducing non-interest expenses by 5-10% as seen in similar M&A activities.

Threats

The financial sector is a major target for cyber threats, with attacks like ransomware and phishing becoming more advanced and expensive. In 2023, the average cost of a data breach in the financial sector reached $5.9 million, a significant increase from previous years.

FirstBank, like other financial institutions, handles a lot of sensitive customer information, making it a prime target for data breaches and fraud. The increasing use of AI in cyberattacks means these threats are evolving rapidly, posing a constant risk to the bank's operations and reputation.

To combat these sophisticated threats, FirstBank must continually invest in cutting-edge cybersecurity defenses. This includes advanced threat detection systems, employee training on recognizing phishing attempts, and robust data encryption to protect customer information.

FirstBank faces significant pressure from larger, established banks that leverage their scale for lower operational costs and offer a broader suite of integrated digital services, making it harder to compete on price and convenience. For instance, in 2024, major global banks continued to invest heavily in AI and cloud infrastructure, widening the technology gap.

The rise of agile fintech companies presents another formidable threat, as these innovators quickly introduce specialized, user-friendly solutions that can capture market share in specific banking segments, potentially eroding FirstBank's customer base and profitability. Many fintechs in 2024 saw substantial venture capital funding, enabling rapid product development and aggressive customer acquisition strategies.

This intense competition directly impacts FirstBank's ability to grow deposits and acquire new customers, while also putting downward pressure on its net interest margins as it may need to offer more competitive rates to retain and attract business.

The banking sector is navigating an increasingly complex web of regulations, with heightened oversight on liquidity management, third-party vendor risks, anti-money laundering (AML) efforts, and cybersecurity. For instance, in 2024, the U.S. banking industry anticipated significant investments in compliance technology to meet evolving requirements, with some estimates suggesting compliance costs could rise by 5-10% year-over-year.

Adapting to new rules, especially those concerning data privacy and the burgeoning digital asset space, presents substantial compliance expenses and operational hurdles for institutions like First Bank. The cost of regulatory compliance for U.S. banks was estimated to be in the tens of billions of dollars annually, a figure expected to grow as new digital asset regulations solidify in 2025.

Economic Slowdown and Interest Rate Volatility

The anticipated deceleration in global economic growth for 2025, with projections suggesting a slowdown in major economies, presents a significant threat. This economic cooling could dampen loan demand across sectors, directly impacting a core revenue stream for First Bank. Furthermore, the ongoing volatility in interest rates, with central banks potentially adjusting policies to manage inflation, creates uncertainty. While a decrease in borrowing costs might seem beneficial, persistently high deposit costs, a trend observed through late 2024, could continue to squeeze net interest margins.

Specific concerns for 2025 include:

- Slowing GDP Growth: Forecasts from institutions like the IMF indicate a moderation in global GDP growth for 2025 compared to earlier periods, potentially reducing corporate and consumer appetite for new credit.

- Interest Rate Uncertainty: The Federal Reserve's stance on interest rates remains a key factor. While some anticipate rate cuts, the timing and magnitude are uncertain, and sustained higher-than-expected rates could increase funding costs for the bank.

- Deposit Cost Pressures: Despite potential rate cuts, competition for deposits remained fierce in 2024, leading to higher interest expenses for banks. This trend might persist, eroding profitability even if lending rates decline.

Talent Acquisition and Retention Challenges

First Bank, like many financial institutions, faces significant hurdles in acquiring and retaining top talent, particularly in high-demand fields such as technology and cybersecurity. The competitive landscape for these specialized skills means attracting and keeping qualified professionals is a constant challenge. This can directly impact the bank's ability to implement crucial digital transformation initiatives and effectively defend against sophisticated cyber threats.

The scarcity of specialized expertise can hinder First Bank's progress in areas critical for future growth and security. For instance, reports in late 2024 indicated a widening gap in cybersecurity professionals, with demand outstripping supply by a considerable margin globally. This talent deficit can slow down the deployment of advanced technological solutions and potentially compromise the bank's operational resilience and capacity for innovation.

- Talent Gap: Difficulty in finding candidates with the specific technical and cybersecurity skills needed for modern banking operations.

- Retention Costs: Increased compensation and benefits required to retain skilled employees in a competitive market, impacting operational expenses.

- Innovation Slowdown: The inability to attract and retain key personnel can delay or prevent the implementation of new technologies and digital strategies.

- Security Risks: A shortage of cybersecurity experts increases vulnerability to cyberattacks, potentially leading to financial losses and reputational damage.

First Bank faces intense competition from larger banks and agile fintechs, which can pressure margins and customer acquisition. Regulatory changes, particularly concerning data privacy and digital assets, add significant compliance costs and operational complexity. Economic slowdowns and interest rate volatility in 2025 could dampen loan demand and increase funding expenses, impacting profitability. A persistent talent gap, especially in cybersecurity and technology, hinders innovation and increases vulnerability to sophisticated cyber threats.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from First Bank's official financial statements, comprehensive market research reports, and insights from industry experts to provide a thorough and accurate assessment.