First Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Bank Bundle

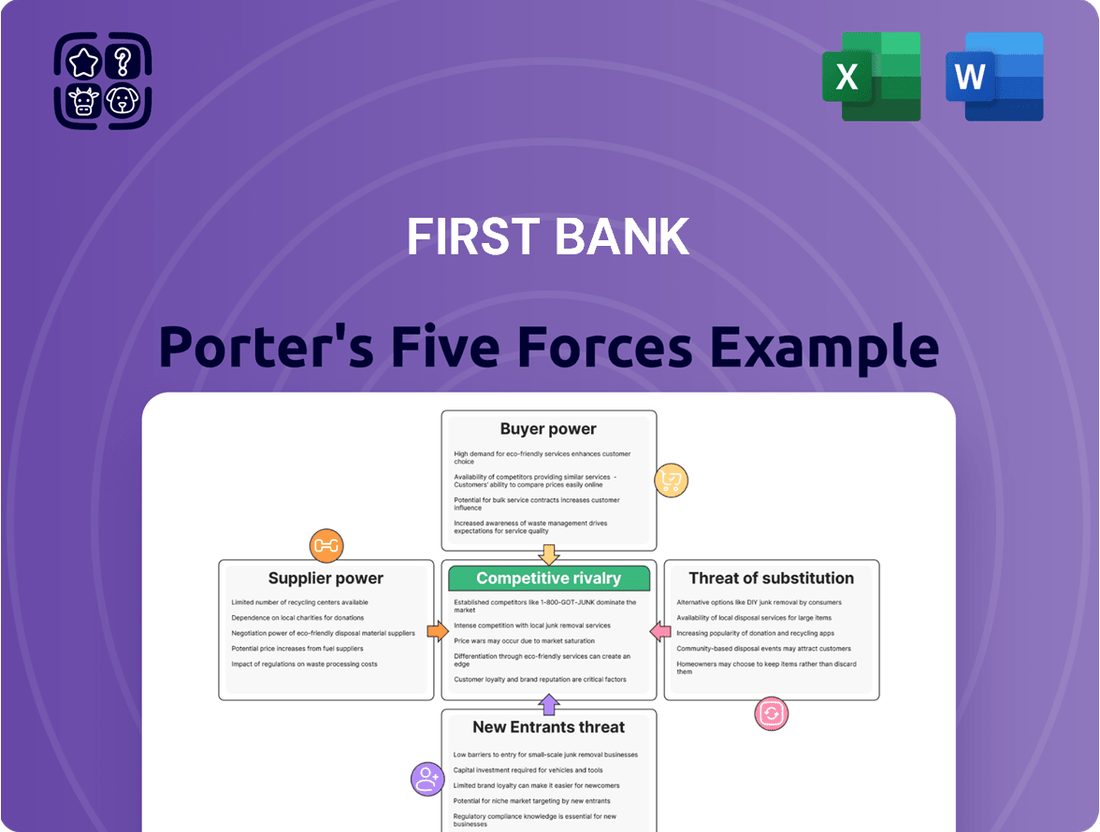

First Bank navigates a competitive landscape shaped by the bargaining power of its customers and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore First Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

First Bank's reliance on technology providers for critical systems like online banking and cybersecurity presents a moderate to high supplier bargaining power. This is particularly true for specialized or advanced solutions, such as AI for fraud detection, where few vendors may possess the necessary expertise.

The financial services software market is substantial, projected to hit $42.9 billion in 2024. While this indicates a competitive landscape with major players like Microsoft, FIS Global, SAP, and Oracle, the specialized nature of some banking software can still give these suppliers significant leverage.

Financial Data and Analytics Providers hold moderate bargaining power over FirstBank. Access to accurate and timely data, market insights, and analytical tools is essential for FirstBank's wealth management and strategic planning. For instance, Bloomberg Terminal, a leading provider, charges significant subscription fees, reflecting the value and often proprietary nature of its data and analytical capabilities, which are critical for informed decision-making in a competitive market.

First Bank's reliance on major payment networks like Visa and Mastercard for credit card and payment processing significantly influences its bargaining power with these entities. These networks wield considerable leverage due to their extensive global reach, robust technological infrastructure, and the fundamental role they play in enabling virtually all card-based transactions.

The widespread acceptance of these networks means First Bank must adhere to their terms and conditions to remain competitive and offer essential services to its customers. For instance, in 2024, Mastercard implemented a mandate for enhanced fraud prevention measures, underscoring the networks' ability to dictate operational requirements and costs for financial institutions.

Human Capital and Talent

The availability of skilled financial professionals, particularly in high-demand areas like wealth management, cybersecurity, and AI, significantly impacts FirstBank's ability to operate and innovate. A competitive labor market for these specialized skills can amplify the bargaining power of employees, leading to increased recruitment and retention expenses for the bank.

Banks are actively investing in employee training programs to equip their workforce with the necessary skills to navigate evolving industry threats and technological advancements. For instance, in 2024, the demand for financial analysts with expertise in data analytics and AI continued to surge, with salary offers reflecting this scarcity.

- Talent Scarcity: Specialized skills in cybersecurity and AI are in high demand, increasing employee leverage.

- Increased Costs: A tight labor market for these roles can drive up recruitment and retention expenses.

- Investment in Training: FirstBank, like its peers, is investing in upskilling its workforce to meet new challenges.

Infrastructure and Utility Providers

Infrastructure and utility providers, while often not the first suppliers that come to mind for a bank like First Bank, hold a foundational role. Reliable internet, consistent power, and even physical branch locations are critical for seamless operations. In 2024, the cost of business internet services can vary significantly, but the availability of multiple providers in most urban and suburban areas generally keeps their bargaining power in check. For instance, major telecommunication companies often compete on speed and price for business-grade internet, limiting individual supplier leverage.

The bargaining power of these infrastructure and utility suppliers is typically low for First Bank. This is largely because many of these services, like electricity and basic internet, are considered commoditized. There are usually several providers available, fostering competition that benefits the bank. However, in certain remote or less developed areas, a local utility provider might hold a near-monopoly, which could slightly increase their bargaining power in those specific locations.

First Bank's strategic shift towards digital banking and embracing virtual work models further mitigates the bargaining power of traditional infrastructure suppliers. By reducing the need for extensive physical branch networks, the bank lessens its dependence on real estate providers and the associated utilities. This digital focus means that while core utilities remain essential, the overall reliance on a broad spectrum of physical infrastructure suppliers is diminishing, thereby weakening their collective bargaining position.

- Commoditized Services: Internet and power are typically offered by multiple competing firms, reducing individual supplier leverage.

- Local Monopolies: Potential for increased supplier power in specific geographic areas with limited utility options.

- Digital Transformation Impact: First Bank's digital strategy reduces reliance on physical infrastructure, weakening supplier bargaining power.

First Bank faces significant supplier bargaining power from technology providers, especially for specialized solutions like AI in fraud detection, where vendor options are limited. The financial software market, projected at $42.9 billion in 2024, features major players like Microsoft and SAP, but the specialized nature of some banking software still grants them leverage.

Payment networks such as Visa and Mastercard exert considerable power due to their global reach and essential role in transactions. First Bank must comply with their mandates, like enhanced fraud prevention measures implemented in 2024. Similarly, financial data providers like Bloomberg Terminal command high fees for their critical market insights and analytical tools.

The scarcity of skilled financial professionals, particularly in cybersecurity and AI, grants employees increased bargaining power, driving up recruitment costs. First Bank, like its peers, is investing in upskilling its workforce, recognizing the surge in demand for data analytics and AI expertise in 2024.

| Supplier Category | Bargaining Power Assessment | Key Drivers | 2024 Data/Trends |

|---|---|---|---|

| Technology Providers (Software, AI) | Moderate to High | Specialized solutions, limited vendors, critical infrastructure | Financial software market: $42.9 billion; High demand for AI talent |

| Payment Networks (Visa, Mastercard) | High | Global reach, essential transaction role, network mandates | Mandatory fraud prevention updates; Dominant market share |

| Financial Data & Analytics Providers | Moderate | Proprietary data, critical insights, high subscription costs | Bloomberg Terminal fees reflect value; Essential for strategic planning |

| Skilled Labor (Cybersecurity, AI) | High | Talent scarcity, high demand, specialized skills | Surging demand for financial analysts with AI/data expertise; Increased recruitment costs |

| Infrastructure & Utilities | Low to Moderate | Commoditized services, multiple providers, digital reliance | Competitive business internet pricing; Reduced reliance on physical infrastructure |

What is included in the product

Uncovers the competitive intensity within the banking sector, assessing the power of buyers and suppliers, the threat of new entrants and substitutes, and the bargaining power of First Bank's customers.

Instantly identify and address competitive threats with a dynamic, visual representation of each force, making strategic adjustments effortless.

Customers Bargaining Power

Individual retail customers at First Bank typically wield low to moderate bargaining power. This is largely because many banking products are standardized, and the cost or effort to switch accounts remains relatively low, especially with the increasing ease of digital banking. However, this dynamic is evolving.

The collective influence of these customers is growing. They now expect more personalized interactions, seamless digital access, and instant service, which can put pressure on banks to adapt. For instance, in 2024, customer satisfaction scores related to digital banking experiences became a key performance indicator for many financial institutions.

First Bank actively works to counter this by focusing on building strong customer relationships and engaging in community initiatives. This approach aims to foster loyalty and reduce the likelihood of customers switching to competitors, thereby mitigating their individual bargaining power.

Business customers, particularly small to medium-sized enterprises (SMEs), often wield moderate bargaining power. This is especially true when they need intricate financial solutions, substantial loan amounts, or specialized cash management services. For instance, in 2024, the SME sector continued to be a significant driver of economic activity, with many businesses seeking tailored banking partnerships to support their growth and operational needs.

FirstBank's strategic focus on business banking, including its array of solutions and dedication to supporting local enterprises, aims to cultivate robust client relationships. This approach is designed to enhance customer loyalty and mitigate the risk of clients switching to competitors, thereby managing their bargaining power.

Wealth management clients, especially high-net-worth individuals (HNWIs), wield considerable bargaining power. Their substantial assets mean they can easily move their business if they aren't satisfied, forcing firms to compete on service and fees. For instance, the global wealth management market was valued at over $100 trillion in assets under management (AUM) in 2023, indicating the sheer scale of capital these clients control.

These clients demand highly tailored, comprehensive financial strategies that go beyond simple investment management. They seek advisors who understand their unique goals, risk tolerance, and even personal values. The increasing demand for personalized digital platforms and ESG (Environmental, Social, and Governance) investing options further amplifies their influence, pushing firms to innovate and adapt their offerings to meet these evolving expectations.

Digital-First Customers

Digital-first customers, especially Gen Z and Millennials, wield considerable influence. They demand intuitive digital platforms, mobile convenience, and cutting-edge features like AI-driven financial advice and instant support. This preference pushes banks to innovate rapidly.

FirstBank must cater to these expectations to retain this growing demographic. For instance, by mid-2024, over 70% of banking interactions are projected to occur digitally, highlighting the critical need for robust online and mobile services.

- Digital Natives' Expectations: Gen Z and Millennials, representing a significant portion of the banking population, expect seamless, personalized digital experiences.

- Switching Behavior: A substantial percentage of these customers are willing to switch banks for superior digital offerings, putting pressure on incumbents.

- Investment in Technology: Banks like FirstBank are compelled to invest billions in digital transformation to meet these evolving demands, impacting operational costs and competitive positioning.

Community and ESG-Focused Customers

FirstBank's dedication to local communities and ESG principles attracts customers who value ethical banking. This segment, while not directly negotiating rates, can shift their deposits based on a bank's social impact, offering indirect bargaining power through loyalty and deposit stability.

FirstBank's commitment is highlighted by its recognition in sustainability indices. For instance, in 2024, the bank was noted for its increased investment in renewable energy projects, which directly appeals to environmentally conscious customers.

- Community Focus: FirstBank's investment in local initiatives, such as supporting small businesses and affordable housing projects, builds strong community ties.

- ESG Recognition: The bank's consistent efforts in ESG have led to positive ratings from independent agencies, reinforcing its appeal to socially responsible investors and depositors.

- Customer Loyalty: Customers who align with FirstBank's values are more likely to remain loyal, reducing churn and providing a stable deposit base, which is a significant, albeit indirect, form of customer power.

Individual retail customers at First Bank generally possess low to moderate bargaining power due to standardized products and ease of switching, though this is evolving with digital banking advancements. By mid-2024, over 70% of banking interactions are projected to be digital, emphasizing the need for robust online services.

Business customers, especially SMEs, have moderate power when requiring specialized financial solutions or significant loan amounts, as the SME sector continued its role as a key economic driver in 2024. Wealth management clients, however, wield considerable power due to their substantial assets, valued in the trillions globally, demanding highly tailored services.

Digital-native customers exert significant influence, expecting intuitive platforms and instant support, pushing banks to invest heavily in technology. Customers valuing ESG principles also exert indirect power through loyalty, with banks like FirstBank increasing investments in renewable energy projects in 2024.

| Customer Segment | Bargaining Power Level | Key Influencing Factors (2024 Relevance) |

|---|---|---|

| Individual Retail Customers | Low to Moderate | Standardized products, ease of switching, growing digital expectations. |

| Small to Medium Enterprises (SMEs) | Moderate | Need for specialized solutions, significant loan requirements, economic contribution. |

| High-Net-Worth Individuals (HNWIs) | Considerable | Substantial assets, demand for personalized strategies, global wealth market scale. |

| Digital Natives (Gen Z/Millennials) | Considerable | Expectations for seamless digital experience, willingness to switch for better tech. |

| ESG-Conscious Customers | Indirect (Loyalty/Deposits) | Alignment with ethical banking, social impact preferences, community initiatives. |

Same Document Delivered

First Bank Porter's Five Forces Analysis

This preview showcases the complete First Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the institution. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

First Bank faces intense competition from a vast number of traditional banks, encompassing both large regional institutions and smaller community banks. This rivalry is primarily fought on the battlegrounds of competitive interest rates, transparent fee structures, the convenience of branch networks, and the quality of customer service provided.

The landscape of community banking in the U.S. is currently experiencing a significant trend towards consolidation. This is largely fueled by the escalating need for greater scale and operational efficiency, particularly to support crucial investments in technology and digital capabilities.

While FirstBank operates with a focus on local markets in Colorado and Arizona, it faces indirect competition from large national and international banks. These behemoths leverage their vast resources, offering a wider array of financial products and services, supported by extensive branch networks and significant marketing power. For instance, in 2024, major banks like JPMorgan Chase and Bank of America continued to invest heavily in digital transformation, enhancing their online and mobile banking platforms to attract and retain customers nationwide.

These larger institutions often compete on established brand recognition and the sheer breadth of their product offerings, from complex investment banking services to everyday retail banking. Their substantial marketing budgets allow them to reach a broader audience and build stronger brand loyalty. In 2023, for example, the top five U.S. banks collectively spent billions on advertising and promotional activities, creating a significant awareness advantage.

FirstBank’s strategy of concentrating on Colorado and Arizona allows it to cultivate deep local relationships and offer more personalized service. However, the competitive pressure from these national players remains, particularly as digital banking capabilities become increasingly crucial for customer acquisition and retention across all market segments.

Credit unions pose a significant competitive threat to First Bank, especially in the retail and small business banking sectors. Their member-owned, non-profit structure often enables them to offer more competitive interest rates on loans and savings accounts, appealing to cost-conscious consumers and those valuing community focus. For instance, in 2023, credit unions collectively held over $2.3 trillion in assets, demonstrating their substantial market presence and ability to attract a significant customer base.

Fintech Companies and Digital-Only Banks

The competitive landscape for traditional banks like First Bank is increasingly shaped by the rise of fintech companies and digital-only banks, often called neobanks. These new players are agile and leverage technology to offer streamlined digital experiences and personalized services, often at a lower cost due to their reduced overhead. For instance, by mid-2024, neobanks continued to gain traction, with some reporting significant user growth and expanding their product offerings beyond basic banking services.

These fintech disruptors are particularly strong in areas like payment processing, personal finance management tools, and lending, directly challenging established revenue streams for incumbent banks. While they may not fully replace traditional banking models, their innovation forces established institutions to adapt and enhance their digital capabilities to remain competitive. The ongoing investment in digital transformation by traditional banks reflects this pressure, with many allocating substantial resources to improve their online and mobile platforms.

- Fintechs Offer Niche Services: Many fintechs focus on specific financial needs, such as international money transfers or peer-to-peer lending, attracting customer segments that may be underserved by traditional banks.

- Digital Experience is Key: Neobanks prioritize user-friendly mobile apps and seamless online onboarding, setting a high bar for customer experience that traditional banks must match.

- Lower Cost Structure: Without the extensive branch networks of traditional banks, fintechs can often operate with lower overheads, allowing them to offer more competitive pricing on services.

- Innovation Pace: The rapid pace of technological advancement means fintechs can quickly introduce new features and products, forcing established banks to accelerate their own innovation cycles.

Specialized Financial Service Providers

FirstBank also contends with specialized financial service providers who target specific market segments. Mortgage lenders, for example, can offer highly competitive rates and tailored products, potentially capturing a significant portion of FirstBank's mortgage business. In 2024, the mortgage origination market saw continued innovation in digital platforms, with some non-bank lenders achieving market shares exceeding 30% in certain product categories.

Wealth management firms represent another competitive front. These entities often provide deep expertise in areas like estate planning, investment advisory, and alternative investments. The wealth management sector is increasingly characterized by a move towards holistic and personalized client strategies, with a growing emphasis on ESG (Environmental, Social, and Governance) investing, which can attract younger, socially conscious investors away from traditional banking models.

Online loan providers, including fintech companies, further intensify rivalry by offering streamlined application processes and rapid funding. These digital-first lenders often leverage advanced data analytics to assess creditworthiness, allowing them to serve customers who may find traditional bank processes cumbersome. By mid-2024, fintech lenders had captured an estimated 20% of the unsecured personal loan market in the United States alone.

- Niche Competition: Specialized firms in mortgages, wealth management, and online lending chip away at FirstBank's customer base.

- Expertise and Pricing: These niche players often compete on focused expertise and aggressive pricing strategies.

- Wealth Management Trends: The industry is shifting towards personalized, holistic strategies, including a greater focus on ESG investing.

- Digital Disruption: Online lenders offer faster, more convenient alternatives, capturing significant market share in specific loan categories.

First Bank faces robust competitive rivalry from a diverse set of players, including large national banks, community banks, credit unions, fintech companies, and specialized financial service providers. This intense competition centers on interest rates, fees, digital offerings, and customer service quality.

Large national banks like JPMorgan Chase and Bank of America, with their substantial marketing budgets and extensive product lines, exert significant pressure. For instance, in 2023, the top five U.S. banks collectively invested billions in advertising, enhancing their brand recognition and reach. Meanwhile, fintechs and neobanks are rapidly gaining market share by offering streamlined digital experiences and competitive pricing, capturing an estimated 20% of the unsecured personal loan market by mid-2024.

Credit unions, operating as non-profits, often provide more attractive rates, holding over $2.3 trillion in assets collectively as of 2023. Specialized providers in areas like mortgages and wealth management also fragment the market, with non-bank mortgage lenders achieving over 30% market share in certain categories in 2024.

| Competitor Type | Key Competitive Factors | Notable 2023-2024 Trends/Data |

|---|---|---|

| Large National Banks | Brand Recognition, Product Breadth, Marketing Power | Billions spent on advertising (2023); Heavy investment in digital transformation. |

| Community Banks | Local Relationships, Personalized Service, Scale Needs | Consolidation trend driven by technology investment needs. |

| Credit Unions | Competitive Rates, Member Focus | Over $2.3 trillion in assets (2023); Attract cost-conscious consumers. |

| Fintechs/Neobanks | Digital Experience, Lower Costs, Niche Services | Gaining user growth (mid-2024); Capturing ~20% of unsecured personal loans (mid-2024). |

| Specialized Providers | Niche Expertise, Aggressive Pricing | Non-bank mortgage lenders >30% market share in some categories (2024); ESG focus in wealth management. |

SSubstitutes Threaten

The rise of digital payment platforms like PayPal and mobile wallets such as Apple Pay presents a significant threat of substitutes for traditional banking services. These alternatives offer consumers greater convenience and speed for everyday transactions, effectively bypassing traditional bank transfers.

This shift is particularly pronounced among younger demographics who readily adopt these new technologies. By 2025, projections indicate that digital wallets will account for the majority of total transaction value in US e-commerce, highlighting their growing dominance.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat of substitutes to traditional banking services like First Bank. These platforms directly connect borrowers with individual or institutional lenders, bypassing banks altogether. For instance, by mid-2024, the global P2P lending market was projected to exceed $200 billion, showcasing its growing appeal as an alternative to bank loans, often offering faster approvals and potentially lower interest rates.

Crowdfunding also offers a viable substitute, particularly for small businesses and startups seeking capital. Platforms like Kickstarter and Indiegogo have facilitated billions in funding for projects, demonstrating a clear shift away from traditional venture capital or bank financing. This growing accessibility to alternative funding models diminishes the necessity for businesses to rely solely on conventional banking institutions for their capital needs.

Robo-advisors and automated investment platforms present a significant threat of substitutes for traditional wealth management services. These digital solutions offer cost-effective, algorithm-driven investment management, attracting a growing segment of digitally native investors, particularly younger demographics. For instance, by mid-2024, estimates suggest that assets under management for robo-advisors in the US alone could surpass $3 trillion, demonstrating their increasing market penetration.

Cryptocurrencies and Decentralized Finance (DeFi)

Cryptocurrencies and Decentralized Finance (DeFi) platforms present a growing threat of substitution by offering alternative avenues for transactions, investments, and savings, effectively bypassing traditional banking systems. While mainstream adoption is still developing, the potential for these technologies to disintermediate financial services represents a significant long-term risk to incumbent banks. For instance, the total value locked (TVL) in DeFi protocols reached over $100 billion in early 2024, indicating substantial capital flow outside traditional finance.

The ongoing evolution and diversification of DeFi offerings are poised to attract a wider user base, further intensifying this competitive pressure. As of mid-2024, the global cryptocurrency market capitalization hovers around $2.5 trillion, demonstrating a considerable alternative financial ecosystem.

- Alternative Transaction Methods: Cryptocurrencies enable peer-to-peer digital transactions, reducing reliance on bank-operated payment networks.

- Investment Diversification: DeFi platforms offer yield farming, lending, and staking opportunities that compete with traditional savings and investment products.

- Disintermediation Potential: The inherent design of DeFi aims to remove intermediaries, directly impacting banks' core business models.

- Market Growth: The increasing market capitalization and user adoption of cryptocurrencies signal a growing alternative financial landscape.

In-house Corporate Finance and Treasury Functions

The threat of substitutes for First Bank's services from in-house corporate finance and treasury functions is growing, particularly for larger enterprises. Companies are increasingly capable of managing their own treasury operations, investments, and even internal credit facilities, diminishing their need for traditional banking partnerships.

This trend is amplified by advancements in financial technology (FinTech). For instance, by the end of 2024, global FinTech investment reached over $150 billion, with a significant portion directed towards solutions that enable businesses to automate and optimize financial processes. These tools allow companies to bypass external banking services for tasks like cash management, payments, and foreign exchange, effectively acting as substitutes.

- Increased FinTech Adoption: Businesses are leveraging platforms for automated treasury management, reducing reliance on banks for liquidity and risk management.

- Internal Capital Markets: Larger corporations can establish internal lending or investment pools, substituting external financing and investment advisory services.

- Digital Payment Solutions: Companies are increasingly using direct peer-to-peer or blockchain-based payment systems, bypassing traditional bank transfer mechanisms.

- Data Analytics for Financial Planning: Sophisticated internal analytics tools allow firms to conduct their own financial forecasting and risk assessment, substituting some advisory roles of banks.

The threat of substitutes for First Bank is multifaceted, encompassing digital payment platforms, peer-to-peer lending, crowdfunding, robo-advisors, cryptocurrencies, DeFi, and in-house corporate finance solutions. These alternatives offer enhanced convenience, lower costs, and greater accessibility, directly challenging traditional banking models.

For example, the global P2P lending market was projected to exceed $200 billion by mid-2024, while assets under management for US robo-advisors could surpass $3 trillion by the same period. Furthermore, the total value locked in DeFi protocols reached over $100 billion in early 2024, and the global cryptocurrency market capitalization hovered around $2.5 trillion as of mid-2024, illustrating the significant capital shifting away from conventional banking.

| Substitute Category | Key Features | Impact on Banks | Market Indicator (Mid-2024/2025 Projections) |

|---|---|---|---|

| Digital Payments & Wallets | Convenience, Speed, E-commerce Integration | Reduced transaction fees, customer disintermediation | US e-commerce transaction value dominated by digital wallets |

| P2P Lending & Crowdfunding | Direct access to capital, potentially lower rates | Loss of loan origination and interest income | Global P2P lending market > $200 billion |

| Robo-Advisors | Cost-effective, automated investment management | Competition for wealth management AUM | US robo-advisor AUM > $3 trillion |

| Cryptocurrencies & DeFi | Decentralized transactions, alternative investments | Disintermediation of core banking functions | DeFi TVL > $100 billion; Crypto market cap ~$2.5 trillion |

| In-house Corporate Finance | Internal treasury, payments, and credit facilities | Reduced demand for corporate banking services | Global FinTech investment > $150 billion (2024) |

Entrants Threaten

Fintech startups pose a substantial threat to established banks like First Bank. Their inherent agility allows them to quickly innovate and adapt, often focusing on specific customer pain points or underserved market segments. For instance, by mid-2024, the global fintech market was projected to reach over $32 trillion, highlighting the immense potential and rapid growth these new entrants can tap into.

These nimble companies can leverage advanced technologies such as artificial intelligence and blockchain to create streamlined, user-friendly financial solutions. Unlike traditional banks burdened by legacy systems, fintechs can build from the ground up, offering competitive advantages in speed and cost-effectiveness. This technological edge enables them to attract customers seeking modern, efficient banking experiences.

Neobanks and digital-only banks pose a significant threat due to their lean operating models. By eschewing physical branches, these fintech challengers dramatically reduce overhead, allowing them to offer more competitive interest rates and superior digital interfaces. The global neobank user base is expected to exceed 45 million by the close of 2025, demonstrating a clear shift in consumer preference towards these agile, tech-driven banking solutions.

Big Tech companies like Apple and Google are increasingly making inroads into financial services, posing a significant threat. For instance, Apple Pay processed over $6 trillion in transactions globally by early 2024, showcasing their massive reach in payments. Their established customer loyalty and advanced technological capabilities allow them to offer seamless, integrated financial products that can quickly gain traction, potentially siphoning off market share from traditional banks.

Embedded Finance Providers

The increasing prevalence of embedded finance presents a significant threat of new entrants for traditional banks like First Bank. Non-financial companies are now able to seamlessly integrate financial services, such as lending or payments, directly into their customer journeys. This disintermediation means consumers can access financial products without ever engaging with a bank, thereby reducing customer touchpoints and loyalty.

This trend is rapidly gaining traction. For instance, by the end of 2023, it was estimated that the global embedded finance market could reach $7 trillion by 2030, showcasing the massive potential for non-traditional players. Companies like Shopify, with its extensive merchant network, or ride-sharing platforms are prime examples of entities that can leverage their existing user bases and data to offer financial solutions, effectively becoming new competitors in the financial services landscape.

- Embedded finance allows non-financial companies to offer financial services directly within their platforms.

- This integration bypasses traditional banking channels, reducing customer interaction with banks.

- The global embedded finance market is projected for substantial growth, indicating a strong threat from new entrants.

- Companies with large customer bases and data are well-positioned to enter the financial services space through embedded offerings.

Regulatory Changes and Open Banking Initiatives

Evolving regulatory landscapes, especially those pushing for open banking, significantly reduce entry barriers for new financial service providers. These regulations often mandate data sharing, allowing new entrants to access customer information with consent, thereby streamlining integration with existing financial systems. For instance, the UK's Open Banking initiative, implemented in 2018, has spurred the development of numerous fintech companies by providing standardized APIs for accessing customer account data, leading to a more competitive market.

This regulatory shift fosters innovation by enabling new players to offer specialized or more user-friendly services, directly challenging incumbents. By leveraging shared data and APIs, these new entrants can bypass the need for extensive legacy infrastructure and customer acquisition costs. In 2024, the continued expansion of open banking frameworks globally, including in regions like Asia and South America, is expected to further democratize access to financial services and intensify competition.

The ease of accessing customer data and integrating with payment systems means that companies with strong technological capabilities but no prior banking license can now enter the market. This has led to the rise of embedded finance, where financial services are integrated into non-financial platforms.

Key impacts of these regulatory changes include:

- Lowered barriers to entry: Reduced need for extensive infrastructure and capital investment.

- Increased competition: Fintechs and tech giants can offer specialized or integrated financial solutions.

- Enhanced customer choice: Consumers benefit from a wider array of innovative and often cheaper financial products.

- Data-driven innovation: New entrants leverage access to customer data to personalize services and create unique value propositions.

The threat of new entrants for First Bank is amplified by the increasing ease of market entry due to technological advancements and regulatory shifts. Fintech startups, neobanks, and even Big Tech companies are leveraging agile models and digital capabilities to offer competitive financial services, often at lower costs.

Embedded finance further lowers barriers, allowing non-financial companies to integrate financial products directly into their platforms, thereby disintermediating traditional banks. Open banking regulations, by mandating data sharing, empower these new players to access customer data and build innovative solutions without the need for extensive legacy infrastructure.

| New Entrant Type | Key Advantage | Example Impact |

|---|---|---|

| Fintech Startups | Agility, specialized solutions | Disrupting specific niches like payments or lending |

| Neobanks | Lean operating model, digital-first | Attracting customers with lower fees and better UX |

| Big Tech | Massive customer base, brand loyalty | Integrating financial services into existing ecosystems (e.g., Apple Pay) |

| Embedded Finance Providers | Seamless integration into non-financial platforms | Bypassing traditional banking channels for transactions |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for First Bank is built upon a foundation of publicly available financial statements, regulatory filings from agencies like the SEC, and industry-specific reports from reputable sources such as S&P Global Market Intelligence and the American Bankers Association.