First Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Bank Bundle

Navigate the complex external forces shaping First Bank's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends create both opportunities and challenges for the institution. Gain the strategic foresight needed to make informed decisions and secure a competitive advantage. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The US banking sector in 2025 is navigating a shifting regulatory environment, shaped by a new presidential administration and evolving supervisory focus. A potential move towards deregulation could influence bank M&A activity, capital requirements, and how climate-related risks are managed.

Despite potential deregulation, banks will likely continue to address existing supervisory findings and maintain robust governance, risk management, and compliance frameworks. For instance, the Federal Reserve's stress tests, a key regulatory tool, will continue to be a critical benchmark for capital adequacy, with results from 2024 informing 2025 strategies.

Geopolitical instability, particularly ongoing conflicts and evolving trade relationships, significantly impacts trade policies and sanctions, creating a challenging landscape for financial institutions like First Bank. The global financial system saw an estimated $1.8 trillion in cross-border trade affected by sanctions in 2023, highlighting the scale of this challenge.

Financial institutions are increasingly tasked with navigating and implementing rapidly changing regional and national sanctions frameworks. For instance, the number of entities and individuals subject to sanctions by major economies has grown by over 20% in the past two years, demanding constant adaptation.

This necessitates robust compliance mechanisms to avoid severe regulatory actions and substantial penalties. Failure to comply with sanctions can result in fines reaching billions of dollars, as seen in several high-profile cases in recent years, directly impacting profitability and reputation.

Government policies designed to boost economic growth are set to shape the banking industry through 2025. As inflation shows signs of easing, central banks are anticipated to fine-tune monetary strategies, potentially including reductions in interest rates. For instance, the Federal Reserve's federal funds rate, which stood at 5.25%-5.50% as of early 2024, might see adjustments that influence borrowing costs.

These policy shifts directly affect banks by altering loan demand and influencing net interest margins, which are crucial for overall profitability. A lower interest rate environment, for example, could make borrowing more attractive, potentially increasing loan volumes but also compressing the spread banks earn on loans.

Political Scrutiny of Bank Mergers

Political scrutiny of bank mergers is intensifying, with federal antitrust regulators actively examining consolidation trends within the financial sector. This heightened oversight could influence the pace and feasibility of future mergers, including those involving community banks seeking to achieve greater scale.

While a deregulatory environment might theoretically reduce some merger hurdles, the actual impact on M&A activity remains contingent on broader economic conditions and the specific roadmaps laid out by regulatory bodies. For instance, the U.S. Department of Justice and the Federal Reserve have signaled a more cautious approach to large bank mergers, potentially slowing down consolidation efforts.

- Increased Antitrust Scrutiny: Federal regulators are closely reviewing bank mergers to prevent undue market concentration.

- Conditional Deregulation: While deregulation might ease some burdens, its actual impact on M&A depends on economic factors and regulatory guidance.

- Community Bank Opportunities: Mergers could offer community banks a path to scale, provided favorable economic and regulatory conditions align.

- 2024/2025 Outlook: Analysts anticipate continued regulatory focus on merger impacts on competition and financial stability in the coming years.

Focus on Financial Stability

Despite potential shifts towards deregulation, a persistent emphasis on financial stability remains a key political factor influencing banking. Regulators are keenly focused on consumer protection and combating financial crimes like fraud and money laundering. This sustained attention means banks, including First Bank, must continue to prioritize robust risk management and maintain strong financial health. For instance, as of late 2024, global regulatory bodies continue to reinforce capital adequacy ratios, with many jurisdictions maintaining or even increasing requirements to ensure banks can withstand economic shocks. This focus translates to a need for banks to demonstrate solid funding, capital, and liquidity positions.

This commitment to stability means that regulatory scrutiny over banks' balance sheets is unlikely to wane. Banks are expected to operate with strong capital buffers and ample liquidity to absorb potential losses and meet their obligations. For example, in the US, the Federal Reserve's stress tests, conducted annually, continue to assess the resilience of major banks under adverse economic scenarios, ensuring they hold sufficient capital. In Europe, the European Banking Authority's (EBA) ongoing work on the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD) reinforces these prudential standards for 2024 and beyond. These efforts underscore the political imperative to safeguard the financial system.

The ongoing focus on financial stability translates into specific operational requirements for institutions like First Bank:

- Enhanced Capital Adequacy: Maintaining capital ratios well above minimum regulatory requirements to absorb unexpected losses.

- Robust Liquidity Management: Ensuring sufficient liquid assets to meet short-term obligations and depositor withdrawals, even in stressed market conditions.

- Stringent Risk Management Frameworks: Implementing comprehensive systems to identify, measure, monitor, and control all forms of risk, including credit, market, operational, and liquidity risk.

- Anti-Financial Crime Measures: Investing in technology and processes to prevent and detect fraud, money laundering, and terrorist financing, aligning with evolving global standards.

Political factors significantly shape the banking landscape for 2024-2025, with a heightened focus on regulatory stability despite potential deregulation. Increased antitrust scrutiny is impacting bank mergers, with regulators like the Department of Justice and Federal Reserve signaling a more cautious approach to consolidation. This means that while community banks might see opportunities for scaling, favorable economic and regulatory conditions must align.

Geopolitical tensions and evolving trade policies continue to present challenges, as evidenced by the substantial impact of sanctions on global trade, estimated at $1.8 trillion in 2023. Financial institutions must navigate increasingly complex sanctions frameworks, with the number of sanctioned entities growing by over 20% in the past two years, demanding robust compliance to avoid significant penalties.

Government policies aimed at economic growth, coupled with potential adjustments in monetary strategies by central banks like the Federal Reserve (whose federal funds rate was 5.25%-5.50% in early 2024), directly influence borrowing costs and net interest margins for banks. This creates a dynamic environment where loan demand and bank profitability are closely tied to macroeconomic policy decisions.

What is included in the product

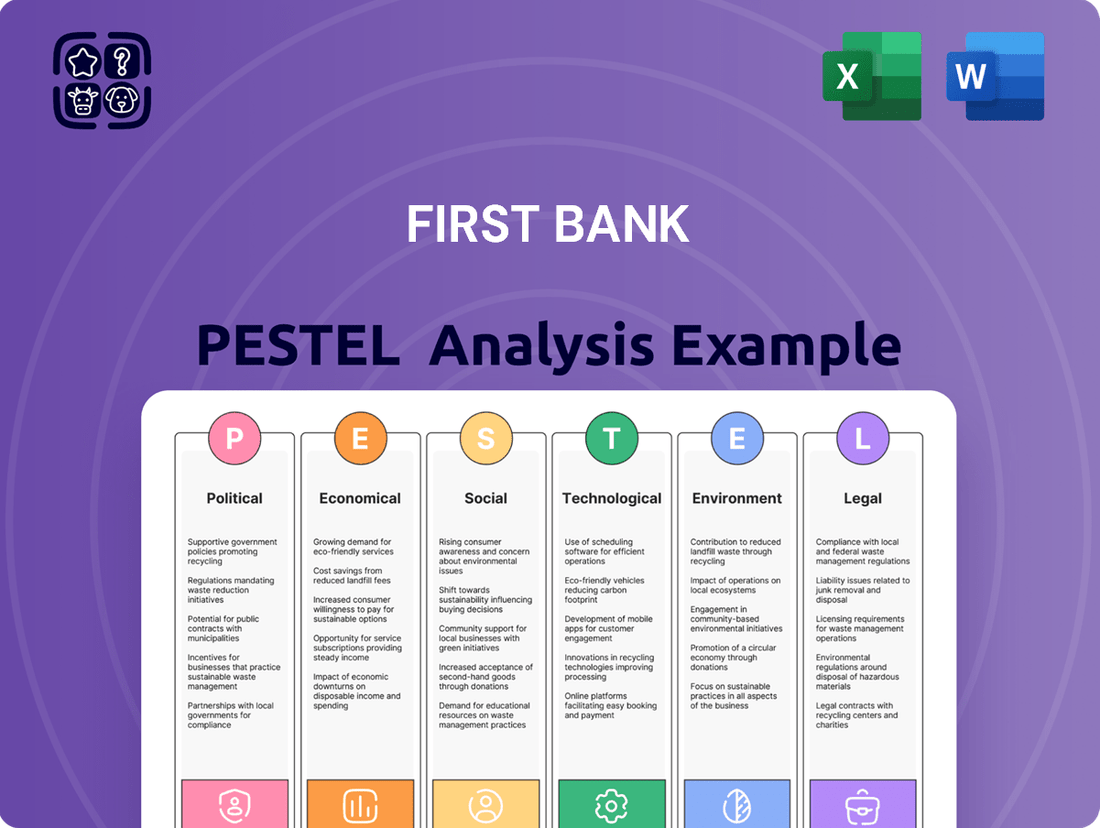

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting First Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within the banking sector.

A PESTLE analysis for the First Bank offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during strategy meetings.

Economic factors

The Federal Reserve is anticipated to continue its path of gradual interest rate reductions throughout 2025. However, the precise timing and magnitude of these cuts will be heavily influenced by incoming economic indicators and the persistence of inflation.

While a lower interest rate environment could stimulate demand for housing loans, it also presents a challenge for banks by potentially compressing their net interest income, especially if the cost of deposits remains high. This economic backdrop requires institutions like First Bank to proactively reassess and adapt their strategies for generating interest income.

Economic growth is projected to slow down in 2025. This deceleration is anticipated due to moderating consumer spending, a potential uptick in unemployment, and subdued business investment, all of which could collectively temper overall economic expansion.

Consumer spending, a key driver of economic activity, faces headwinds. Total consumer debt has reached an unprecedented high, which could strain household finances. This situation may particularly affect loan growth in sectors like credit cards and auto loans.

Financial institutions, including First Bank, should anticipate a normalization in credit quality. This means preparing for modest increases in loan delinquencies as consumers navigate these economic pressures.

Loan demand is anticipated to strengthen, particularly in the mortgage sector, as interest rates trend downward. This shift is a positive indicator for banks looking to expand their lending portfolios.

However, the growth trajectory for credit card debt and auto loans may face headwinds. Consumer financial pressures, stemming from inflation and other economic uncertainties, could lead to more cautious borrowing in these areas.

For community banks, lending activities continue to be the cornerstone of profitability. While non-lending services offer diversification, their contribution to overall earnings remains comparatively modest, underscoring the continued importance of traditional loan origination and servicing.

Net Interest Income Pressure

Net interest income for the U.S. banking sector is anticipated to face downward pressure in 2025. This is largely due to persistently elevated deposit costs, even as interest rates are expected to trend lower. Banks will likely need to focus on enhancing non-interest income sources to build more resilient revenue streams.

Midsize and regional banks, in particular, are feeling this pinch. They often encounter more significant challenges when adjusting deposit rates in response to market shifts, intensifying competition for customer deposits.

- Deposit Costs Remain Sticky: Even with projected rate cuts, deposit costs are expected to stay elevated through 2025, impacting banks' net interest margins.

- Revenue Diversification Imperative: The need to boost non-interest income, such as fee-based services, becomes critical for offsetting declining net interest income.

- Regional Bank Vulnerability: Smaller and regional banks may struggle more with deposit repricing dynamics compared to larger institutions, potentially widening the competitive gap.

Inflationary Pressures and Trade Policies

While inflation has cooled from its peaks, the possibility of it resurging before reaching the Federal Reserve's 2% target remains a concern. This is particularly true if trade policies, such as tariff adjustments, are implemented, potentially increasing import costs and reigniting price pressures. For instance, if new tariffs were imposed on key goods in late 2024 or early 2025, it could add to existing inflationary concerns.

These inflationary uncertainties directly influence the Federal Reserve's approach to monetary policy. Decisions regarding interest rate adjustments will be heavily weighed against the evolving inflation outlook, impacting borrowing costs and overall economic activity. For banks, this means a dynamic environment where strategic planning must account for potential shifts in Fed policy.

Key considerations for banks include:

- Monitoring Inflation Data: Closely tracking core inflation rates, producer price indices, and consumer sentiment surveys for early signs of renewed price pressures.

- Assessing Trade Policy Impact: Analyzing the potential effects of proposed or enacted tariffs on import costs, supply chains, and consumer spending.

- Adapting Monetary Policy Expectations: Adjusting financial models and strategies based on anticipated Federal Reserve actions in response to inflation and trade developments.

- Scenario Planning: Developing contingency plans for various inflation and interest rate scenarios to ensure resilience and capitalize on emerging opportunities.

The U.S. economy is expected to see a slowdown in growth during 2025, influenced by moderating consumer spending and a potential rise in unemployment, impacting loan demand, particularly for credit cards and auto loans.

Despite anticipated interest rate cuts by the Federal Reserve in 2025, deposit costs are likely to remain elevated, squeezing net interest margins for banks like First Bank and highlighting the need for revenue diversification through non-interest income sources.

Inflationary pressures, potentially exacerbated by trade policy changes, will continue to shape the Federal Reserve's monetary policy decisions, creating a dynamic environment for banks that requires careful monitoring of economic indicators and strategic adaptation.

| Economic Factor | Projected Trend (2025) | Impact on Banks | Key Data Point/Consideration |

|---|---|---|---|

| Economic Growth | Slowing | Tempered loan demand, potential increase in delinquencies | Consumer spending moderation, subdued business investment |

| Interest Rates | Gradual Reduction | Compressed net interest income, but potential for mortgage loan growth | Deposit costs remain sticky, impacting net interest margins |

| Inflation | Persistent concern, potential resurgence | Influences Fed policy, creates uncertainty in borrowing costs | Risk of trade policy impacting import costs and reigniting price pressures |

| Consumer Debt | High, potential strain | Headwinds for credit card and auto loan growth | Total consumer debt at an unprecedented high |

Preview Before You Purchase

First Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the First Bank offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and make informed decisions with this complete report.

Sociological factors

Customers today expect banking to be as intuitive and convenient as their favorite apps, with mobile platforms now the main way they interact with their finances. Surveys from 2024 indicate that a substantial majority of online adults want to handle all their banking needs directly through their smartphones.

This shift means banks like First Bank must invest heavily in digital transformation, upgrading mobile apps and online services to provide seamless, user-friendly experiences. Failing to meet these evolving expectations can lead to customer attrition, as users seek out competitors offering superior digital engagement.

Customers increasingly expect hyper-personalized banking experiences, driven by advancements in AI and data analytics. A significant majority, over 50%, of banking clients are willing to switch institutions if their personalization expectations aren't met, highlighting the competitive pressure on financial institutions to adapt.

Customers, especially millennials and Gen Z, are prioritizing banks that demonstrate strong social responsibility and adhere to Environmental, Social, and Governance (ESG) principles. This shift is evident as a significant portion of consumers now consider a company's ethical practices when making financial decisions. For instance, a 2024 survey indicated that over 60% of consumers are more likely to bank with institutions that actively promote sustainability.

This growing consciousness compels financial institutions like First Bank to offer more sustainable financial products, such as green loans and impact investing options. Banks are also facing pressure to be transparent about their environmental impact and social contributions. In 2025, regulatory bodies are expected to further mandate ESG reporting, pushing for clearer disclosures on carbon emissions and social equity initiatives within the banking sector.

Shift Towards Digital-Only and Branchless Banking

The banking sector is witnessing a significant shift away from physical branches towards digital-only models. This trend is driven by evolving customer preferences for convenience and speed, particularly among younger demographics.

Neobanks, often referred to as challenger banks, are at the forefront of this digital transformation. They utilize advanced technology to offer streamlined operations and enhanced customer experiences, thereby attracting a growing segment of tech-savvy consumers. For instance, by mid-2024, neobanks globally reported an average of 25% year-over-year growth in customer acquisition, primarily through mobile channels.

Traditional institutions like First Bank must adapt to remain competitive. This involves prioritizing swift account opening processes via mobile applications and ensuring robust security for all digital transactions. By the end of 2024, it's projected that over 70% of new bank accounts will be opened digitally, highlighting the urgency for traditional banks to bolster their online offerings.

- Digital Adoption: Customers increasingly prefer digital channels for banking, leading to a decline in branch usage.

- Neobank Growth: Fintech-driven neobanks are capturing market share with innovative digital solutions.

- Customer Experience: Seamless mobile onboarding and secure digital transactions are crucial for retaining and attracting customers.

- Industry Trend: By 2025, digital-only banking is expected to represent a substantial portion of the retail banking market.

Community Banking Relevance and Adaptation

Community banks are navigating a landscape reshaped by swift technological advancements and evolving customer expectations, yet their significance to local economic vitality persists. A key challenge for them is maintaining relevance against agile fintech firms and larger financial institutions.

To thrive, community banks are increasingly adopting technologies like artificial intelligence (AI) to streamline operations and pinpoint underserved market segments. For instance, by mid-2024, many community banks reported investing in AI-powered fraud detection systems, aiming to reduce losses and improve customer trust.

- Technological Adaptation: Community banks are investing in digital platforms and AI to compete with fintechs.

- Customer Relationships: Their deep ties to local communities and personalized service remain a strong competitive advantage.

- Economic Impact: These institutions continue to be crucial for small business lending and local economic development, with community banks in the US providing approximately 60% of small business loans in 2023.

Societal shifts are profoundly influencing banking, with customers demanding intuitive digital experiences and personalized services. A significant trend shows a growing preference for mobile banking, with a majority of users wanting to manage all their finances via smartphones, as indicated by 2024 data. Furthermore, there's an increasing emphasis on a bank's social responsibility, with many consumers, over 60% in a 2024 survey, favoring institutions that champion sustainability and ethical practices.

| Sociological Factor | 2024/2025 Trend | Impact on First Bank |

|---|---|---|

| Digital-First Expectations | Majority of online adults prefer smartphone banking. | Requires enhanced mobile app functionality and digital onboarding. |

| Personalization Demand | Over 50% willing to switch banks for better personalization. | Need for AI-driven insights to tailor product offerings. |

| ESG Consciousness | Over 60% favor sustainable banking practices. | Opportunity to develop green financial products and transparent ESG reporting. |

Technological factors

Artificial intelligence and machine learning are reshaping banking, with AI adoption in financial services projected to reach $25.6 billion globally by 2026, according to Statista. This technology is crucial for First Bank in areas like fraud detection, credit risk assessment, and anticipating customer demands for tailored product offerings.

AI-driven chatbots and virtual assistants are now essential for providing continuous customer support and resolving intricate issues. By 2025, it's estimated that 75% of customer interactions in banking will be handled by AI, significantly improving First Bank's service delivery efficiency.

Furthermore, First Bank is utilizing AI to automate routine back-office functions, a trend seen across the industry to boost operational efficiency and lower costs. For instance, AI can process loan applications significantly faster than manual methods, reducing turnaround times and freeing up human resources for more strategic tasks.

Cybersecurity is a paramount concern for First Bank, especially with cyber threats like ransomware and phishing becoming more sophisticated. In 2024, the financial sector saw a significant increase in cyberattack attempts, with reports indicating a 30% rise compared to the previous year. Banks are therefore heavily investing in advanced defense mechanisms.

First Bank is implementing cutting-edge technologies such as AI-powered threat detection systems and advanced data encryption to safeguard sensitive customer information. These investments are crucial, as a data breach can severely damage customer trust and incur substantial financial penalties, with the average cost of a data breach in the financial sector exceeding $5 million in 2024.

The banking sector is undergoing a significant digital transformation, with a strong emphasis on mobile-first experiences. Customers now expect to manage all their banking needs, from transactions to account inquiries, directly through mobile applications. This shift is driven by the desire for convenience and instant service, making mobile platforms the primary channel for customer interaction.

In response, banks like First Bank are prioritizing digital engagement and investing heavily in modernizing their operations. This includes streamlining processes and migrating legacy systems to more agile, cloud-based solutions. For instance, by mid-2024, over 70% of customer interactions for many leading banks occurred via digital channels, highlighting the critical need for robust mobile capabilities to remain competitive.

Growth of Open Banking and Embedded Finance

Open banking, a system allowing secure data sharing between financial institutions and third-party providers through APIs, is expanding rapidly, enhancing financial transparency and competition. This growth is driven by regulatory mandates and consumer demand for integrated financial services. For instance, by the end of 2024, the UK's Open Banking Implementation Entity (OBIE) reported over 10 million active users, showcasing significant adoption.

Embedded finance, the integration of financial services into non-financial platforms, is also a major technological driver. This allows businesses like e-commerce sites or ride-sharing apps to offer payments, loans, or insurance directly at the point of need. By 2025, the global embedded finance market is projected to reach $7.2 trillion, according to Statista, highlighting its transformative potential.

These trends foster innovation, creating new revenue streams and encouraging partnerships within the financial ecosystem. For First Bank, this presents opportunities to leverage APIs for new product development and to integrate its services into partner platforms, thereby expanding its customer reach and offering more convenient financial solutions.

- Open Banking Growth: Over 10 million active users in the UK by late 2024, demonstrating increasing consumer engagement with data-sharing capabilities.

- Embedded Finance Expansion: Projected to reach $7.2 trillion globally by 2025, signifying a massive shift towards integrated financial services.

- API-Driven Innovation: Facilitates secure data exchange, enabling the creation of novel financial products and services.

- New Revenue Streams: Opportunities for banks to offer services through third-party platforms and to monetize data access responsibly.

Blockchain and Central Bank Digital Currencies (CBDCs)

Blockchain technology is fundamentally reshaping how banks operate, offering significant improvements in transaction security and transparency. While cryptocurrencies continue to experience notable volatility, the underlying blockchain infrastructure is seen as a game-changer for financial services. For instance, by mid-2024, over 100 countries were exploring or piloting Central Bank Digital Currencies (CBDCs), aiming to modernize payment systems and improve financial inclusion.

The development of CBDCs by central banks, such as China's digital yuan which has seen widespread testing and adoption in various pilot programs, signifies a move towards digital fiat currency. These initiatives are driven by the potential to create more efficient, secure, and traceable payment rails. The Bank for International Settlements (BIS) reported in early 2024 that a significant portion of central banks are actively engaged in CBDC research or development, highlighting a global trend towards exploring these digital currencies.

These technological advancements, particularly CBDCs, hold the promise of revolutionizing cross-border transactions, making them faster and cheaper. Furthermore, they could unlock new avenues for providing banking services to underbanked populations. For example, pilot programs in countries like Nigeria with the eNaira have demonstrated the potential for increased financial access and reduced transaction costs for citizens.

- Blockchain's impact: Enhanced security and transparency in banking transactions.

- CBDC exploration: Over 100 countries actively researching or piloting CBDCs by mid-2024.

- Global adoption: Significant central bank engagement in CBDC development, as per BIS reports in early 2024.

- Future potential: Streamlined cross-border payments and improved financial inclusion.

Artificial intelligence continues to be a transformative force in banking, with AI in financial services expected to grow significantly. By 2025, it's projected that 75% of customer interactions in banking will be managed by AI, enhancing efficiency and customer experience for institutions like First Bank.

Cybersecurity remains a critical technological factor, as sophisticated threats persist. The financial sector saw a notable increase in cyberattack attempts in 2024, with banks investing heavily in advanced defense mechanisms to protect sensitive data, as the average cost of a data breach exceeded $5 million in 2024.

Digital transformation is paramount, with mobile-first experiences becoming the norm. By mid-2024, over 70% of customer interactions for many leading banks occurred via digital channels, underscoring the need for robust mobile capabilities.

Open banking and embedded finance are expanding, fostering innovation and new revenue streams. The UK's Open Banking initiative reported over 10 million active users by late 2024, while the embedded finance market is projected to reach $7.2 trillion globally by 2025.

| Technology Area | Key Trend | Impact on First Bank | Data Point/Projection |

|---|---|---|---|

| Artificial Intelligence | AI-powered customer service & automation | Improved efficiency, personalized offerings, fraud detection | 75% of customer interactions by AI by 2025 |

| Cybersecurity | Advanced threat detection & data protection | Safeguarding customer data, maintaining trust | Average data breach cost >$5 million in 2024 |

| Digital Transformation | Mobile-first banking & cloud migration | Enhanced customer engagement, operational agility | >70% of interactions via digital channels by mid-2024 |

| Open & Embedded Finance | API integration & service embedding | New revenue streams, expanded customer reach | Embedded finance market to reach $7.2 trillion by 2025 |

Legal factors

Regulatory bodies are actively refining capital frameworks for major banks. For instance, the Basel III endgame reforms, expected to be fully implemented by 2025, will significantly alter capital requirements across credit, market, and operational risks. These changes, impacting everything from loan loss provisions to trading book valuations, necessitate proactive adjustments by institutions like First Bank to maintain financial strength and manage potential increases in capital costs.

Regulatory bodies are intensifying their oversight of cybersecurity, compelling financial institutions like First Bank to meet rigorous standards and reporting obligations. This heightened scrutiny means banks must actively demonstrate robust data protection measures.

New regulations, such as the EU's Digital Operational Resilience Act (DORA) and the U.S. Securities and Exchange Commission's (SEC) new rules on cybersecurity risk management, strategy, incident disclosure, and data protection, are now in effect or being implemented, demanding constant vigilance and transparent reporting from financial firms.

To comply, First Bank must bolster its internal cybersecurity defenses and ensure that all its third-party vendors and partners adhere to equally stringent security protocols, a critical step given the interconnected nature of modern financial operations.

First Bank must navigate evolving Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations, with proposed updates to Bank Secrecy Act (BSA) requirements on the horizon. These changes, which will incorporate AML/CFT Priorities for the first time, necessitate a thorough review and potential overhaul of existing compliance frameworks.

Key areas of adaptation include strengthening beneficial ownership identification processes and generally enhancing overall compliance efforts to meet new standards. For instance, the Financial Crimes Enforcement Network (FinCEN) has been actively soliciting feedback on proposed rules, indicating a significant shift in regulatory expectations for financial institutions in 2024 and beyond.

Consumer Protection and Fair Lending Regulations

Regulatory bodies are intensifying their focus on safeguarding consumers, particularly concerning fair lending practices and the elimination of what are often termed 'junk fees.' For instance, the Consumer Financial Protection Bureau (CFPB) continues to scrutinize overdraft fees, late fees, and other charges that can disproportionately impact vulnerable customers. This heightened scrutiny means banks must proactively review and adjust their fee structures to ensure fairness and transparency.

New regulations are being proposed and implemented to enhance consumer protection. Examples include proposed rules aimed at improving the mortgage servicing process and addressing the reporting of medical debt on credit reports. These initiatives reflect a broader trend towards simplifying financial processes for consumers and preventing unfair reporting practices. First Bank, like its peers, must adapt its operations to align with these evolving standards.

Compliance with these dynamic legal frameworks is paramount. Failure to adhere to consumer protection and fair lending mandates can result in significant financial penalties, reputational damage, and a loss of customer confidence. For example, in 2023, financial institutions paid billions in fines for various compliance violations, underscoring the financial risks associated with non-compliance. Therefore, robust internal controls and ongoing training are essential for First Bank to navigate this complex legal landscape effectively.

Key areas of regulatory focus for banks include:

- Fair Lending: Ensuring equal access to credit and preventing discriminatory lending practices.

- Fee Transparency: Clearly disclosing all fees and eliminating excessive or unjustified charges.

- Data Privacy: Protecting sensitive customer financial information in line with regulations like GDPR and CCPA.

- Debt Collection Practices: Adhering to strict guidelines for collecting debts to prevent abusive or deceptive tactics.

ESG Reporting and Greenwashing Regulations

The financial sector is navigating a complex web of evolving ESG reporting rules. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to shape how financial products are marketed, with ongoing discussions in 2024 and 2025 about further refinements to prevent misleading environmental claims. In the US, the Securities and Exchange Commission (SEC) has also been active, proposing rules for climate-related disclosures that could impact how banks report their environmental risks and opportunities.

These regulatory shifts are a direct response to the growing concern over greenwashing, aiming to ensure that ESG claims are substantiated and investors have clear, reliable information. By mid-2024, several major financial regulators globally had issued guidance or warnings regarding unsubstantiated ESG marketing, signaling a tougher stance. This push for transparency means that financial institutions must be prepared to back up their sustainability commitments with robust data and verifiable metrics.

To adapt, banks are increasingly investing in sophisticated data management and reporting systems. For example, many are exploring AI-driven solutions to track and verify ESG data across their portfolios, a trend expected to accelerate through 2025. This investment is crucial not only for regulatory compliance but also to build trust with a growing segment of eco-conscious investors who demand accountability in their financial choices.

- Stricter Fund Naming: Regulations are tightening rules around how ESG-focused funds can be named to prevent misleading investors.

- Expanded Disclosure: Corporate sustainability reporting requirements are broadening, demanding more detailed and verifiable ESG data.

- Greenwashing Crackdown: A significant regulatory focus is on combating greenwashing, ensuring that ESG claims are accurate and transparent.

- Investment in Technology: Financial institutions are boosting investment in advanced reporting technologies to meet new compliance demands and attract sustainable investment.

First Bank must navigate a landscape of evolving capital requirements, with Basel III endgame reforms set for full implementation by 2025, impacting risk-weighted assets and capital adequacy ratios. Simultaneously, intensified cybersecurity regulations, including the EU's DORA and new SEC rules, mandate robust data protection and transparent incident reporting, requiring significant investment in compliance and defense mechanisms.

The bank also faces stricter Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations, with upcoming Bank Secrecy Act (BSA) updates emphasizing beneficial ownership and requiring enhanced due diligence. Furthermore, a heightened focus on consumer protection, particularly around fair lending and the elimination of 'junk fees' by bodies like the CFPB, necessitates a review of fee structures and lending practices to avoid substantial penalties, which saw the financial sector pay billions in fines in 2023.

The growing emphasis on ESG reporting, driven by regulations like the EU's SFDR and proposed SEC climate disclosures, requires First Bank to substantiate its sustainability claims with verifiable data, a trend underscored by global regulators' crackdown on greenwashing in 2024. This necessitates investment in advanced data management and reporting technologies to ensure transparency and meet investor expectations.

Environmental factors

Environmental factors are increasingly central to financial services, with ESG criteria becoming a fundamental business driver. This shift means banks must embed sustainability into their core strategies, risk management, and capital allocation processes. For instance, by the end of 2024, global sustainable debt issuance reached an estimated $1.5 trillion, highlighting the significant capital flowing towards ESG-aligned businesses.

Sustainability is now a critical lens for assessing stakeholder value and allocating capital, moving beyond superficial compliance. This necessitates robust ESG strategies that permeate every level of banking operations. In 2025, regulatory bodies worldwide are proposing stricter disclosure requirements for climate-related financial risks, further compelling financial institutions to adopt comprehensive ESG frameworks.

Customers and investors are increasingly seeking out financial products that align with environmental and ethical values. This trend is driving significant growth in areas like renewable energy investments and Environmental, Social, and Governance (ESG) focused funds. For instance, the global sustainable bond market saw issuance reach approximately $1.5 trillion in 2023, with projections indicating continued expansion through 2024 and beyond.

In response, banks like First Bank are actively developing and offering a wider array of environmentally conscious financial solutions. This includes specialized offerings such as green loans, which provide financing for projects with positive environmental impacts, and ESG-integrated investment portfolios designed to capture both financial returns and sustainability goals.

Investors and regulators now view climate change as a critical financial factor, embedding climate risk into investment reviews and evaluations. This shift is evident in the growing adoption of tools like climate Value-at-Risk (VaR) and scenario modeling, which are becoming standard practice for assessing potential financial impacts.

Financial institutions are under heightened scrutiny regarding their environmental, social, and governance (ESG) due diligence, especially concerning the negative environmental consequences of their investment portfolios. For instance, by the end of 2024, many major banks were expected to have enhanced their climate risk reporting frameworks, driven by regulatory pressures and investor demand for transparency.

Increased Pressure for ESG Transparency and Disclosure

The financial sector is facing heightened demands for Environmental, Social, and Governance (ESG) transparency. New regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) are now requiring financial institutions to disclose detailed ESG information, including the environmental impact of their financed activities. For instance, banks are increasingly expected to report on metrics such as the carbon emissions associated with their lending portfolios, a significant shift from previous disclosure norms.

This push for transparency means banks like First Bank must invest in sophisticated data infrastructure. They need to accurately collect and analyze vast amounts of data, from energy consumption within their own operations to the carbon footprints of their clients' businesses. Advanced analytics, often powered by artificial intelligence, are becoming crucial for meeting these stringent reporting requirements and providing reliable ESG metrics to stakeholders.

The implications for banks are substantial:

- Regulatory Compliance: Adherence to evolving ESG disclosure mandates, such as the CSRD, is no longer optional but a legal requirement for many financial institutions operating in or with the EU.

- Data Management: Implementing robust systems for collecting, verifying, and reporting ESG data is essential, requiring significant investment in technology and expertise.

- Stakeholder Expectations: Investors, customers, and regulators are demanding greater clarity on a bank's ESG performance, influencing capital allocation and brand reputation.

- Risk Mitigation: Proactive ESG reporting can help identify and manage climate-related and other sustainability risks within lending and investment portfolios.

Operational Footprint and Green Banking Initiatives

First Bank is actively integrating 'green banking' principles to minimize its environmental impact. This includes a strong push towards digital platforms, encouraging paperless transactions via online banking and electronic statements, thereby reducing paper waste.

The bank is also focusing on operational efficiencies, such as lowering energy consumption in its branches and offices. This commitment aligns with broader sustainability goals and can resonate with environmentally aware customers and investors, potentially boosting brand reputation and market appeal.

For instance, by the end of 2024, First Bank aims to have 85% of its customer transactions conducted digitally, a significant increase from 70% in 2023. This initiative is projected to save an estimated 500,000 reams of paper annually.

Key environmental initiatives include:

- Digital Transformation: Promoting online and mobile banking to reduce paper usage and physical branch visits.

- Energy Efficiency: Implementing energy-saving technologies in all operational facilities.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental credentials for operational needs.

- Carbon Footprint Reduction: Setting targets to decrease carbon emissions from business travel and operations by 15% by 2025.

Environmental factors are increasingly shaping the financial landscape, with a significant emphasis on ESG criteria. This means banks must embed sustainability into their core strategies and risk management. For example, global sustainable debt issuance was projected to reach $1.5 trillion by the end of 2024, demonstrating substantial capital flow towards ESG-aligned ventures.

Customers and investors are actively seeking environmentally conscious financial products, driving growth in areas like green finance. By 2025, stricter regulations on climate-related financial risk disclosures are expected, compelling institutions to adopt comprehensive ESG frameworks.

First Bank is responding by developing green loans and ESG-integrated investment portfolios. The bank also aims for 85% of customer transactions to be digital by the end of 2024, projecting a saving of 500,000 reams of paper annually.

Banks face enhanced scrutiny on ESG due diligence, with many major institutions expected to improve climate risk reporting by the end of 2024. This transparency push requires significant investment in data infrastructure and analytics to meet stringent reporting requirements.

| Initiative | Target/Metric | Impact | Year |

|---|---|---|---|

| Digital Transactions | 85% of customer transactions | Estimated 500,000 reams of paper saved annually | End of 2024 |

| Carbon Footprint Reduction | 15% decrease from operations and travel | Reduced environmental impact | By 2025 |

| Sustainable Debt Issuance (Global) | ~$1.5 trillion | Capital flow to ESG-aligned businesses | End of 2024 (Estimate) |

PESTLE Analysis Data Sources

Our First Bank PESTLE analysis is meticulously constructed using data from reputable financial institutions like the Federal Reserve and IMF, alongside insights from leading market research firms and industry-specific publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.