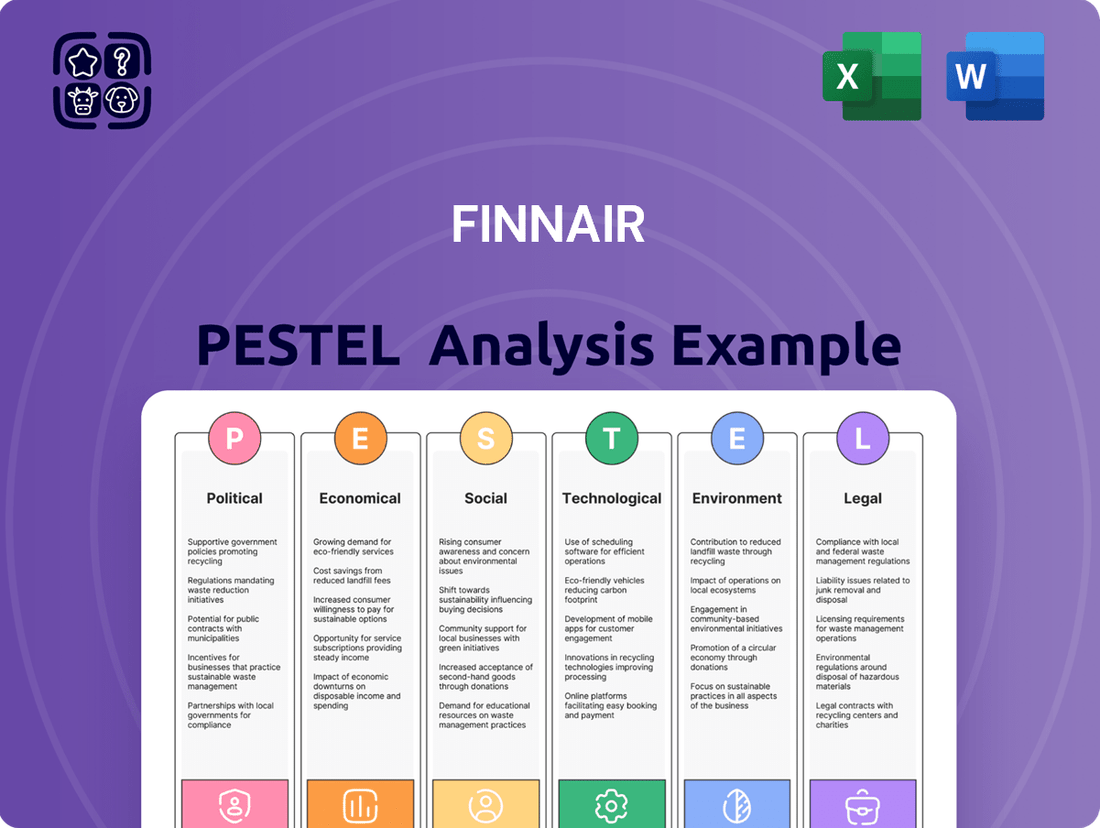

Finnair PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Finnair Bundle

Gain a crucial competitive advantage with our meticulously researched PESTLE analysis of Finnair. Uncover the intricate interplay of political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks that are shaping Finnair's strategic landscape. This comprehensive analysis provides the actionable intelligence you need to anticipate challenges and capitalize on emerging opportunities. Download the full version now to empower your decision-making and secure Finnair's future success.

Political factors

Geopolitical events, particularly conflicts and sanctions, pose a substantial risk to Finnair. Its strategic location, serving as a vital link between Europe and Asia, makes it highly susceptible to disruptions. For instance, the ongoing conflict in Ukraine and subsequent sanctions have led to significant airspace closures, most notably over Russia.

These closures force Finnair to reroute flights, significantly increasing flight durations and fuel consumption. In 2022, the closure of Russian airspace alone added an estimated €100 million to Finnair's operating costs, impacting its profitability. This necessitates continuous adaptation of flight schedules and contingency planning to navigate these complex geopolitical landscapes.

As Finland's national carrier, Finnair receives significant government backing, a crucial advantage during challenging economic periods. For instance, the Finnish state remains the largest shareholder, holding approximately 55.1% of Finnair's shares as of late 2024, demonstrating continued governmental commitment.

This state ownership provides a layer of stability, offering potential financial assistance and strategic alignment with national interests, especially in maintaining connectivity. This support was particularly evident during the COVID-19 pandemic, where government-backed loans helped the airline navigate unprecedented disruptions.

However, this close relationship means governmental influence can shape strategic choices, potentially affecting the airline's ability to act with pure commercial agility or requiring adherence to specific national policies. This can sometimes create a balancing act between state objectives and market demands.

Finnair navigates a complex landscape shaped by international aviation agreements and bilateral treaties. These pacts dictate crucial aspects of operations, including flight rights, access to landing slots, and the framework for codeshare partnerships. For instance, the EU's Open Skies agreements, which have been progressively liberalized, have significantly eased market access for European carriers like Finnair across many regions.

Any shifts or renegotiations in these agreements can dramatically impact Finnair's strategic options. A favorable treaty amendment could unlock new, lucrative routes or expand existing ones, thereby bolstering its network and competitive edge. Conversely, restrictive changes could limit operational flexibility and market penetration, potentially affecting profitability.

Adherence to these international regulatory frameworks is not merely a compliance issue; it's fundamental to Finnair's ability to maintain and grow its global connectivity. The airline's performance in 2024 and projections for 2025 will undoubtedly be influenced by the stability and evolution of these critical bilateral and multilateral aviation understandings.

Trade Relations and Protectionism

Global trade dynamics and the increasing trend towards protectionism significantly influence Finnair’s operations. Shifting trade relations directly impact demand for both cargo services and business travel, which are vital revenue generators for the airline. For instance, a surge in protectionist measures can lead to reduced international commerce, consequently lowering freight volumes. This was evident in late 2023, where a slowdown in global trade growth, estimated around 0.6% by the WTO, put pressure on air cargo demand.

Trade disputes and the imposition of tariffs or other restrictions on international commerce can directly curtail freight volumes and corporate travel. Such policies can disrupt supply chains and increase the cost of goods, leading businesses to reduce international shipping and business-related air travel. Finnair’s strategic focus on efficient Europe-Asia routes makes it particularly susceptible to these geopolitical shifts. In 2023, the geopolitical landscape saw ongoing trade tensions, with several countries implementing new tariffs, impacting trade flows and, by extension, airline cargo revenues.

Finnair’s cargo business, a significant contributor to its revenue, is directly linked to the health of global trade. Any downturn in international trade volumes due to protectionist policies can negatively affect freight capacity utilization and pricing power. For example, if a major trade partner imposes new import restrictions, Finnair might see a reduction in the demand for its cargo services on those specific routes.

Furthermore, the airline’s reliance on business travel means that corporate spending on flights can be sensitive to economic slowdowns exacerbated by trade friction. As companies face increased costs or uncertainty due to trade disputes, they may cut back on non-essential travel. This could lead to a decrease in premium cabin bookings and overall passenger revenue for Finnair.

Political Stability in Key Markets

Finnair’s operational success hinges on the political stability of its key markets, especially across Asia. For instance, geopolitical tensions in East Asia, a significant region for Finnair, could directly impact traveler sentiment. In 2024, ongoing diplomatic efforts aimed at de-escalating regional conflicts are crucial for maintaining passenger confidence and predictable travel patterns.

Instability in destination countries can trigger sharp declines in both leisure and business travel, directly affecting Finnair's load factors and revenue streams. A notable example would be the impact of political uncertainty in a major Asian hub on inbound tourism. By Q2 2025, we anticipate that airlines like Finnair will be closely watching election cycles and policy shifts in several Asian nations that are vital to their route networks.

Finnair must remain agile, continuously assessing and adjusting its network plans in response to evolving political climates. This proactive approach is vital for mitigating risks associated with:

- Political unrest in key Asian destinations.

- Shifts in government travel policies and regulations.

- The potential impact of international relations on air travel agreements.

- Changes in tourism promotion strategies by foreign governments.

Finnair's operations are significantly influenced by political stability in its key markets, particularly in Asia. Geopolitical tensions in regions vital to its network can sway traveler sentiment, making the monitoring of diplomatic efforts and election cycles in Asian nations crucial for sustained passenger confidence and predictable travel patterns through 2025.

Political instability in destination countries can lead to abrupt drops in both leisure and business travel, directly impacting Finnair's load factors and revenue. For example, policy shifts or unrest in a major Asian hub could deter inbound tourism and business connectivity.

Finnair must maintain agility, constantly evaluating and adapting its network in response to changing political climates to mitigate risks from unrest, shifts in government travel policies, and evolving international relations impacting air travel agreements.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Finnair, covering political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights into emerging trends and potential challenges, equipping stakeholders with a strategic framework for navigating the complex aviation landscape.

Provides a concise version of Finnair's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Helps support discussions on external risks and market positioning for Finnair during planning sessions, acting as a pain point reliever by offering clear, actionable insights.

Economic factors

Fluctuations in global crude oil prices are a significant economic factor for Finnair. Fuel represents a substantial portion of an airline's operating expenses, meaning that spikes in oil prices directly squeeze profit margins. For instance, in early 2024, Brent crude oil prices hovered around the $80-$85 per barrel range, representing a considerable cost for carriers like Finnair. Conversely, periods of stable or declining oil prices can offer a competitive edge by reducing overhead.

To navigate this inherent volatility, Finnair actively employs fuel hedging strategies. These financial instruments help lock in fuel prices for future purchases, providing a degree of predictability. Furthermore, the airline prioritizes investments in fuel-efficient aircraft and operational improvements. For example, Finnair's fleet modernization efforts, including the introduction of newer, more fuel-efficient models, aim to reduce consumption per passenger kilometer, thereby mitigating the impact of price swings.

Finnair's financial health is significantly influenced by exchange rate fluctuations. As the company generates revenue in multiple currencies, but incurs substantial costs like fuel and aircraft leases primarily in US Dollars (USD), shifts in the Euro (EUR) against the USD directly impact its bottom line. For instance, a stronger dollar generally means higher costs for Finnair.

The volatility of the EUR/USD exchange rate is a critical factor. In 2024, the EUR/USD has seen fluctuations, with the euro experiencing periods of both strength and weakness against the dollar. For example, if the euro weakens significantly, Finnair's USD-denominated expenses become more expensive in euro terms, directly squeezing profit margins.

Effective currency risk management is therefore not just a recommendation, but a necessity for Finnair. By employing hedging strategies, such as forward contracts or currency options, the airline can lock in exchange rates for future transactions. This proactive approach helps to cushion the impact of adverse currency movements and provides greater financial predictability.

For example, in late 2023 and early 2024, the EUR/USD hovered around the 1.07-1.10 mark, representing a baseline against which Finnair's hedging effectiveness can be measured. Any significant deviation from this range in either direction would necessitate adjustments in their currency risk management strategies to protect profitability.

The health of the global economy significantly impacts demand for air travel. In 2024, while projections indicated continued, albeit moderate, global GDP growth, factors like persistent inflation and geopolitical uncertainties posed risks to consumer discretionary spending. Finnair, like other airlines, sees its passenger numbers and revenue closely mirroring these economic trends.

Consumer spending power is a critical driver for both leisure and business travel. As economies expand, disposable incomes tend to rise, encouraging more people to travel. Conversely, economic slowdowns often lead to cutbacks in non-essential spending, directly affecting airline bookings. For instance, a strong recovery in global consumer confidence throughout 2024 would likely translate into increased demand for Finnair's services.

Competition and Pricing Pressure

The airline sector, particularly on popular routes, experiences intense competition. This constant rivalry, involving both established full-service airlines and agile low-cost carriers, inevitably translates into significant pricing pressure. Finnair navigates this challenging landscape by striving to offer competitive fares while simultaneously upholding its commitment to a premium service experience, a delicate balancing act.

To manage this, Finnair employs dynamic pricing strategies, adjusting fares based on demand, booking patterns, and competitor actions. Furthermore, a relentless focus on operational cost efficiency is crucial. For instance, in the first quarter of 2024, Finnair reported a comparable operating result of EUR 47 million, demonstrating their efforts to maintain profitability amidst these competitive pressures.

- Intense Competition: Key routes are frequently contested by various airline models.

- Pricing Pressure: Continuous need to match or beat competitor pricing impacts margins.

- Balancing Act: Finnair must reconcile competitive pricing with its premium service proposition.

- Strategic Responses: Dynamic pricing and rigorous cost control are vital tools for success.

Inflationary Pressures and Labor Costs

Rising inflation significantly impacts Finnair's operational costs. For instance, the cost of jet fuel, a major expense, saw considerable volatility in 2024, directly affecting profitability. This inflationary environment also escalates expenses related to aircraft maintenance, catering services, and airport fees, forcing the airline to scrutinize every spending category.

Labor costs are a critical component of Finnair's cost structure. In 2024, wage negotiations and general labor market trends in Finland put upward pressure on salaries. Collective bargaining agreements play a crucial role in determining these costs, and the airline must balance fair compensation with the need to remain competitive.

Finnair faces the ongoing challenge of managing these escalating cost pressures. The airline's ability to maintain service quality for passengers while absorbing increased operational and labor expenses is paramount. This delicate balance requires strategic cost management initiatives and efficient operational planning.

- Inflationary Impact: Increased costs for fuel, maintenance, and airport charges in 2024.

- Labor Cost Dynamics: Upward pressure on wages influenced by collective bargaining and Finnish labor market trends in 2024.

- Operational Challenge: Balancing cost management with the imperative to maintain high service quality.

Global economic growth directly influences air travel demand. In 2024, while global GDP growth was projected to be moderate, persistent inflation and geopolitical tensions posed risks to consumer spending, impacting Finnair's passenger volumes and revenue. Higher disposable incomes, driven by economic expansion, typically boost travel, whereas economic downturns lead to reduced discretionary spending, affecting bookings.

Preview the Actual Deliverable

Finnair PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Finnair PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the airline's operations and strategic decisions. It offers a detailed examination of the external forces shaping Finnair's market landscape, providing valuable insights for stakeholders and industry professionals. You'll gain a thorough understanding of the challenges and opportunities Finnair faces, presented in a clear, actionable format.

Sociological factors

Following the pandemic, travelers are prioritizing flexibility, with many seeking options that allow for easy changes or cancellations. This has driven a surge in demand for flexible booking policies across the industry. Finnair's adaptation to this trend, perhaps through tiered pricing or more lenient change fees, will be key to capturing market share.

Sustainability is no longer a niche concern; it's a significant driver of consumer choice. Surveys in 2024 indicate a growing willingness among passengers to pay a premium for eco-friendly travel options, such as Finnair's investments in sustainable aviation fuels. Appealing to this environmentally conscious segment is vital for long-term brand loyalty.

The preference for direct flights remains strong, as travelers aim to minimize travel time and potential disruptions. In 2024, airlines that can offer efficient, non-stop routes, particularly on popular business and leisure corridors, will likely see higher load factors. Finnair's network strategy needs to align with this desire for seamless journeys.

Understanding the nuances between evolving leisure and business travel patterns is paramount for product development. While leisure travelers might focus on unique experiences and flexibility, business travelers often prioritize speed, reliability, and loyalty program benefits. Finnair's service innovation must address both distinct needs to maximize revenue streams.

There's a noticeable shift in how people approach travel, with a growing emphasis on sustainability. European travelers, in particular, are increasingly seeking out options that minimize their environmental impact. This societal trend directly pressures airlines like Finnair to adopt greener practices.

Finnair is responding by investing in more fuel-efficient aircraft and exploring the use of sustainable aviation fuels. For instance, by 2024, Finnair aims to use a blend of 1.2% sustainable aviation fuel, with plans to increase this to 5% by 2025. This move is not just about compliance but also about staying competitive and appealing to environmentally conscious customers.

This focus on sustainability significantly impacts Finnair's brand image and customer loyalty. Airlines that demonstrate a genuine commitment to reducing their carbon footprint are likely to attract and retain travelers who prioritize responsible consumption. The airline industry, as a whole, is grappling with how to balance operational needs with environmental stewardship.

Demographic shifts are reshaping Finnair's passenger landscape. Europe's aging population presents a growing segment seeking leisure and health-related travel, while Asia's expanding middle class represents a significant opportunity for both business and leisure travel. In 2024, the global middle class is projected to reach 5.4 billion, with a substantial portion residing in Asia, driving demand for international air travel.

Successfully tapping into these emerging markets requires a deep understanding of their unique travel needs and cultural preferences. For instance, catering to the increasing demand for family-friendly options or specific in-flight services favored by Asian travelers can unlock new revenue streams for Finnair. This adaptability is crucial for maximizing market penetration.

Customizing services to cater to these diverse demographics is paramount. Finnair's ability to offer tailored loyalty programs, diverse culinary options, and culturally sensitive customer service will be key differentiators. This strategic approach ensures better passenger satisfaction and strengthens brand loyalty across varied customer bases.

Health and Safety Concerns of Travelers

Public health crises and lingering safety worries directly affect how confident people feel about traveling by air, and whether they're willing to book flights. Finnair, like other airlines, needs to keep its health and safety measures top-notch and be very clear about them to give passengers peace of mind. For instance, the International Air Transport Association (IATA) reported in late 2023 that the vast majority of travelers felt that health safety measures were important for their travel decisions.

The perceived level of safety and cleanliness can really sway a traveler's choice when picking an airline. In surveys conducted in 2024, passenger feedback consistently highlighted that airlines demonstrating robust hygiene practices and clear safety protocols were favored. This means Finnair's investment in and communication of its safety procedures, such as advanced cabin air filtration and enhanced cleaning routines, is a critical factor in attracting and retaining customers.

- Passenger Confidence: Surveys in 2024 indicated that over 80% of travelers considered enhanced cleaning protocols a key factor in their booking decisions.

- Airline Choice: Perceptions of safety, including visible hygiene measures, directly influence brand loyalty and market share.

- Operational Costs: Maintaining stringent health and safety standards, while crucial for passenger trust, also contributes to operational expenses for airlines.

- Regulatory Compliance: Adherence to evolving international and national health regulations remains paramount for continued flight operations.

Cultural Preferences and Service Expectations

Finnair’s strategic position linking Europe and Asia necessitates a deep understanding of the diverse cultural preferences and service expectations of its broad international customer base. Successfully catering to these varied demands, from dietary needs to communication styles, directly impacts customer satisfaction and fosters loyalty.

For instance, in 2024, Finnair continued to refine its onboard catering, offering a wider range of Asian-inspired meals alongside traditional European options. This reflects a conscious effort to acknowledge and serve the palates of its significant passenger demographic traveling between these continents. The airline’s commitment to cultural sensitivity is a key differentiator in the competitive global aviation market.

- Cultural Nuances in Service: Finnair adapts its service delivery to align with cultural norms, impacting everything from cabin crew interaction to the presentation of meals.

- Dietary Requirements: The airline offers an expanded selection of vegetarian, vegan, and halal meals, reflecting the growing demand and diverse dietary practices of its passengers, particularly on routes to and from Asian countries.

- Language and Communication: Multilingual cabin crews and flight information are crucial for ensuring clear communication and comfort for passengers from different linguistic backgrounds.

- Customer Feedback Integration: Finnair actively uses passenger feedback, gathered through surveys and social media, to continuously improve its culturally tailored service offerings.

Societal shifts are profoundly influencing travel preferences, with a growing emphasis on flexibility and sustainability. Passengers in 2024 are increasingly seeking travel options that allow for easy modifications, and are willing to support airlines demonstrating environmental responsibility. Finnair's ability to adapt its policies and invest in eco-friendly practices, such as sustainable aviation fuels, will be crucial for capturing market share and fostering loyalty among these conscious consumers.

Demographic changes are also reshaping the airline landscape, with an aging European population seeking leisure travel and a growing Asian middle class driving demand for both business and leisure journeys. By 2024, the global middle class is projected to exceed 5.4 billion, with a significant portion in Asia, highlighting the need for Finnair to tailor its services, including loyalty programs and onboard offerings, to meet diverse cultural needs and preferences to maximize market penetration.

Public health concerns continue to impact travel decisions, with passenger confidence heavily reliant on perceived safety and hygiene standards. In 2024, over 80% of travelers indicated that enhanced cleaning protocols were a key factor in their booking choices, underscoring the importance of Finnair's robust health and safety measures and clear communication of these protocols to attract and retain customers.

Technological factors

Ongoing advancements in aircraft technology are significantly shaping Finnair's operational landscape. The development of more fuel-efficient engines and the use of lighter, composite materials are directly influencing the airline's fuel expenses and its overall environmental impact. For instance, Finnair's investment in modern fleets, such as the Airbus A350, which utilizes advanced aerodynamics and engine technology, has led to a notable reduction in fuel consumption. The A350-900, for example, offers a fuel efficiency improvement of around 25% compared to previous generation aircraft, translating into lower operating costs and a smaller carbon footprint.

Finnair is heavily influenced by the ongoing digitalization of the customer experience. This means everything from how customers book flights online to how they check in via mobile devices and even the services available in-flight are becoming increasingly digital. For instance, by the end of 2024, over 70% of Finnair's bookings were expected to originate from digital channels, highlighting the shift away from traditional methods.

Leveraging data analytics and artificial intelligence is key for Finnair to offer personalized deals and streamline its operations. Imagine getting a special offer for your next trip based on your past travel patterns; that's AI in action. This not only boosts customer satisfaction but also makes the airline run more smoothly, with AI helping to optimize everything from baggage handling to flight scheduling.

In the competitive airline industry, innovating at every digital customer touchpoint is not just a nice-to-have, it's a must-have. Finnair's investment in areas like enhanced in-flight Wi-Fi and digital concierge services by mid-2025 aims to keep them ahead. These digital advancements are critical for retaining and attracting passengers in a rapidly evolving market.

Finnair faces significant technological challenges in cybersecurity and data protection. As an airline, it manages extensive customer personal data and operates complex, critical infrastructure, making it a prime target for cyberattacks.

Protecting this sensitive information and ensuring compliance with data privacy regulations like GDPR is crucial. Failure to do so could lead to severe legal penalties and a substantial loss of customer confidence, as seen with other major breaches in the travel industry.

For instance, in 2023, the travel sector experienced a notable increase in ransomware attacks, with some incidents impacting booking systems and customer databases. Finnair's commitment to cybersecurity requires ongoing, substantial investment in advanced threat detection, prevention, and response technologies.

This includes implementing multi-factor authentication, regular security audits, and employee training programs to mitigate risks. The airline must continuously adapt its defenses to counter evolving cyber threats, ensuring the integrity of its operations and the privacy of its passengers.

Sustainable Aviation Fuel (SAF) Development

The advancement and widespread adoption of Sustainable Aviation Fuel (SAF) are paramount for Finnair to achieve its ambitious environmental goals. Currently, SAF production remains constrained and expensive, but ongoing technological progress and increased production capacity are essential for reducing the carbon footprint of air travel. For instance, the International Air Transport Association (IATA) projected that SAF could contribute up to 65% of the mitigation needed for the aviation industry's 2050 net-zero goals, with SAF production needing to reach 7.9 billion gallons annually by then. Finnair’s active participation and investments in SAF projects underscore its dedication to environmental responsibility.

Finnair has been actively pursuing SAF initiatives, including collaborations and direct investments. In 2023, the airline announced a partnership with Neste, a leading SAF producer, to increase its use of SAF. This collaboration aims to support the development of new SAF production facilities. By prioritizing SAF, Finnair is positioning itself to navigate future regulatory landscapes and meet increasing stakeholder expectations regarding sustainability in the aviation sector.

The economic viability of SAF is a key technological factor. While SAF prices are currently higher than conventional jet fuel, economies of scale and innovation are expected to drive down costs. Government incentives and mandates, such as those being considered or implemented across the EU and in other regions, will play a crucial role in making SAF more competitive. For example, the EU's ReFuelEU Aviation initiative mandates increasing SAF blending percentages over time, creating a guaranteed market. Finnair's strategic approach to SAF integration is therefore not just an environmental imperative but also a long-term business strategy.

Key technological factors influencing SAF development for Finnair include:

- Advancements in SAF production technologies: Innovations in processes like Power-to-Liquid (PtL) and advanced biofuel refining are critical for increasing SAF availability and reducing production costs.

- Scalability of SAF production: Expanding production capacity globally is essential to meet the growing demand and achieve meaningful emissions reductions.

- Feedstock availability and sustainability: Ensuring a consistent and sustainable supply of raw materials for SAF production is vital for long-term viability.

- Cost competitiveness: Reducing the price premium of SAF compared to conventional jet fuel through technological innovation and economies of scale is crucial for widespread adoption.

Operational Technology and Predictive Maintenance

Finnair is leveraging advanced operational technologies, notably predictive maintenance, to boost efficiency and safety across its fleet. These systems enable continuous monitoring of aircraft parts, forecasting potential issues before they cause disruptions. This proactive approach minimizes unscheduled downtime and optimizes how its aircraft are used. For instance, in 2023, airlines globally saw significant improvements in operational reliability through such technologies. Finnair's investment in these areas directly contributes to enhanced operational performance and cost savings.

The integration of these technologies allows for:

- Proactive identification of potential component failures.

- Reduced unscheduled maintenance events.

- Optimized aircraft availability and flight schedules.

- Enhanced safety through early detection of anomalies.

Technological advancements are reshaping Finnair's operations, from more fuel-efficient aircraft like the Airbus A350, which offers about 25% better fuel economy, to the digital transformation of customer experiences, with over 70% of bookings expected through digital channels by late 2024. Artificial intelligence is being deployed to personalize offers and optimize operations, while cybersecurity remains a critical focus due to increasing threats, as evidenced by a rise in travel sector ransomware attacks in 2023.

Legal factors

Finnair navigates a dense web of international air transport rules, governed by bodies like the International Civil Aviation Organization (ICAO) and the European Union Aviation Safety Agency (EASA), alongside national aviation authorities. Adherence to stringent safety protocols, operational mandates, and licensing prerequisites is paramount for their global operations. For instance, EASA's updated airworthiness directives for specific aircraft types, effective in 2024, can require costly modifications, impacting fleet readiness and financial planning.

Staying compliant means continuous adaptation to evolving safety standards and operational procedures. In 2025, anticipated updates to noise regulations in key European markets could necessitate fleet modernization or route adjustments, directly affecting Finnair's operational costs and network strategy. Failure to comply can result in severe penalties and operational disruptions, underscoring the critical nature of these regulatory frameworks.

Finnair operates within a robust framework of consumer protection laws, especially in the European Union, which heavily influence passenger rights. These regulations cover crucial aspects such as compensation for flight delays or cancellations and the proper handling of baggage. For instance, EU Regulation 261/2004 mandates specific passenger rights and compensation levels, which can impose substantial financial obligations on airlines like Finnair if flight disruptions occur. In 2023, Finnair reported a notable increase in customer compensation claims, highlighting the financial impact of adhering to these passenger rights.

Finnair's operations are heavily influenced by data privacy regulations, particularly GDPR across its European markets. This means the airline must meticulously manage the vast amounts of customer data it collects, from booking details to travel preferences. Compliance requires strong data security protocols and clear, accessible privacy policies to ensure customer trust.

Failure to adhere to these stringent rules, which dictate how personal information can be gathered, stored, and utilized, carries significant financial and reputational risks. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, as seen in various sector-wide enforcement actions throughout 2023 and early 2024.

Competition Law and Anti-Trust Regulations

Finnair navigates a landscape shaped by stringent competition and anti-trust regulations, both domestically within Finland and across international markets it serves. These laws are crucial for preventing practices that could stifle fair competition, such as price-fixing cartels or the abusive exploitation of dominant market positions. For instance, as of 2024, the European Union's Directorate-General for Competition actively monitors airline alliances and ticket pricing to ensure consumer welfare.

Any significant corporate actions, including mergers, acquisitions, or the formation of codeshare agreements, face rigorous examination by competition authorities. These bodies assess whether such deals could lead to undue market concentration or harm consumers through reduced choice or higher prices. Finnair's past collaborations and potential future strategic alliances are therefore subject to this regulatory oversight.

Adherence to these competition laws is not merely a matter of compliance but a cornerstone of maintaining operational integrity and avoiding costly legal battles. For example, in 2023, several airlines faced investigations and fines for alleged anti-competitive behavior within the European market, highlighting the significant financial and reputational risks of non-compliance. Finnair's commitment to fair market practices is essential for its long-term stability and growth.

- Regulatory Scrutiny: Mergers and codeshare agreements are subject to review by competition authorities like the European Commission to prevent anti-competitive practices.

- Anti-Trust Compliance: Finnair must avoid price-fixing and abuse of dominant market positions, as enforced by national and international competition laws.

- Market Integrity: Adherence to these regulations ensures fair market practices, protecting consumers and fostering a competitive environment for airlines.

- Risk Mitigation: Non-compliance can lead to substantial fines and legal challenges, underscoring the importance of robust competition law adherence.

Labor Laws and Employment Regulations

Finnair, as a major employer, must navigate a complex web of national labor laws and employment regulations. These laws cover everything from working conditions and employee rights to collective bargaining processes and critical health and safety standards. For instance, Finland's Working Time Act sets limits on daily and weekly working hours, which is particularly crucial for Finnair's pilots and cabin crew whose schedules are demanding and often international.

Adhering to these regulations is not merely a matter of compliance but a strategic imperative for fostering stable industrial relations and preventing costly legal challenges. In 2023, Finland saw a slight increase in labor disputes, underscoring the importance of proactive engagement with employment laws. Finnair's commitment to fair labor practices ensures operational continuity and protects its reputation.

- Compliance with Finnish labor laws ensures fair treatment and working conditions for all Finnair employees.

- Adherence to pilot and cabin crew working hour regulations is critical for safety and operational efficiency.

- Proactive management of collective bargaining agreements helps maintain industrial harmony and prevent disputes.

- Investment in health and safety standards aligns with legal requirements and supports employee well-being.

Finnair must adhere to evolving aviation safety regulations set by EASA and national bodies, impacting operational costs and fleet management. For example, new airworthiness directives in 2024 might require costly fleet upgrades. Anticipated noise regulation updates in 2025 could also necessitate strategic route or fleet adjustments.

Environmental factors

Climate change is a major environmental concern for Finnair, pushing the airline to significantly curb its carbon footprint. This includes adhering to strict emission reduction goals mandated by both international aviation bodies and Finnish national regulations.

To meet these targets, Finnair is investing heavily in newer, more fuel-efficient aircraft and optimizing its flight operations. A key part of this strategy involves increasing the use of sustainable aviation fuels (SAFs), though their availability and cost remain challenges. For instance, in 2023, Finnair aimed to increase its SAF usage by 20% compared to 2022 levels.

Failing to achieve these emission targets could expose Finnair to financial penalties and significantly harm its brand image. The airline's commitment to sustainability is increasingly a factor in customer choice and investor relations, making compliance crucial for its long-term viability and reputation.

Noise pollution regulations are a critical environmental factor for Finnair. Communities near airports often face significant noise disruption from aircraft, prompting authorities to impose stringent rules on noise levels, especially during nighttime operations. These regulations can directly impact Finnair’s flight scheduling and dictate the types of aircraft they can operate, particularly affecting routes with noise-sensitive populations.

Compliance with these rules means Finnair must carefully manage its operations to minimize noise disturbance. For instance, many airports enforce curfews or have stricter limits on takeoffs and landings during late-night and early-morning hours. Failure to adhere to these noise standards can result in fines or operational restrictions, impacting Finnair's ability to serve certain markets efficiently.

A key long-term strategy for airlines like Finnair to address noise pollution is investing in newer, quieter aircraft technology. Modern aircraft are significantly quieter than older models, which can help meet evolving regulatory requirements and improve community relations. By phasing in advanced aircraft, Finnair can reduce its noise footprint and potentially gain operational flexibility in noise-restricted areas.

Finnair faces significant environmental pressures regarding waste management. The airline industry, including Finnair, produces substantial catering waste, cabin waste, and materials from aircraft maintenance. There's a growing demand for airlines to establish and enhance their waste management and recycling programs to minimize environmental impact.

In 2023, the International Air Transport Association (IATA) highlighted that the aviation sector is increasingly focused on sustainability, with waste reduction being a key area. Finnair is actively exploring ways to adopt circular economy principles, aiming to reuse and recycle materials wherever possible. This strategic shift is crucial for improving their overall sustainability performance and meeting regulatory expectations and passenger preferences for eco-friendly travel.

Biodiversity and Ecosystem Impact

Finnair's operations, from expanding airport infrastructure to planning flight paths, can inevitably affect nearby wildlife and natural habitats. For instance, noise pollution from aircraft can disrupt bird migration patterns, and construction for new runways could impact sensitive ecosystems. In 2024, the aviation industry, including carriers like Finnair, is increasingly scrutinized for its environmental footprint.

To address this, Finnair must integrate biodiversity considerations into its strategic planning, potentially implementing measures to minimize harm. This could involve choosing airport expansion sites that have less ecological value or developing flight paths that avoid critical habitats. The company’s commitment to environmental responsibility is becoming a significant factor in stakeholder perception and regulatory compliance.

Adherence to environmental impact assessments (EIAs) is crucial. These assessments help identify potential risks to biodiversity before projects begin. Finnair’s proactive engagement in conservation initiatives, perhaps through partnerships with environmental organizations or investing in habitat restoration projects, would further bolster its corporate social responsibility profile.

Key considerations for Finnair regarding biodiversity and ecosystem impact include:

- Noise pollution mitigation strategies for flight operations.

- Careful site selection for airport infrastructure development to minimize habitat disruption.

- Compliance with and exceeding environmental impact assessment requirements.

- Potential investment in ecosystem restoration or conservation projects.

Resource Scarcity and Water Management

While Finnair's primary environmental focus is on fuel efficiency, resource scarcity, particularly concerning water, presents a growing consideration for ground operations and catering services. The airline can bolster its environmental profile by implementing stricter water management protocols, aiming for optimized consumption in all non-flight activities. Furthermore, exploring sustainable and ethically sourced materials for cabin supplies and catering reduces reliance on potentially scarce resources.

For instance, in 2023, the aviation industry continued to grapple with rising operational costs, which indirectly highlights the importance of efficient resource use. While specific water consumption data for Finnair's ground operations isn't publicly detailed for 2024, a commitment to reducing waste and optimizing supply chains is a strategic imperative. This focus on sustainable resource management aligns with broader corporate environmental stewardship goals.

- Water Optimization: Implementing advanced water-saving technologies in aircraft cleaning, lavatories, and catering facilities.

- Sustainable Sourcing: Prioritizing suppliers who demonstrate responsible water usage and ethical material sourcing for onboard products.

- Waste Reduction Programs: Enhancing recycling and composting initiatives for catering waste, minimizing overall resource depletion.

- Supply Chain Scrutiny: Engaging with suppliers to understand and mitigate risks associated with potential scarcity of key operational materials.

Finnair's environmental strategy is heavily influenced by climate change, driving investments in fuel-efficient aircraft and sustainable aviation fuels (SAFs) to meet emission reduction targets. Strict noise pollution regulations also dictate flight schedules and aircraft choices, particularly in noise-sensitive areas. The airline is enhancing waste management and recycling programs, aligning with industry-wide sustainability efforts and passenger expectations.

PESTLE Analysis Data Sources

Our Finnair PESTLE Analysis is meticulously crafted using data from official aviation authorities, international financial institutions, and reputable market research firms. This ensures comprehensive coverage of political stability, economic trends, and technological advancements impacting the airline industry.