Finnair Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Finnair Bundle

Want to see exactly how Finnair operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Finnair's membership in the Oneworld alliance is a significant strategic asset. This partnership grants Finnair customers access to an extensive global network, spanning more than 1,000 destinations across 170 territories. For instance, in 2024, Oneworld airlines collectively served over 900 destinations, reinforcing Finnair's reach. This allows for seamless travel experiences and reciprocal benefits such as frequent flyer point earning and redemption, enhancing customer loyalty.

Finnair leverages codeshare agreements to significantly broaden its network and customer reach. For instance, the expanded partnership with British Airways in 2023 allows Finnair passengers access to an extended range of destinations, particularly benefiting travel to the UK and Channel Islands. This means customers can book their entire journey, including flights operated by British Airways, directly through Finnair’s platform, simplifying travel planning.

Wet lease partnerships provide crucial operational flexibility. Finnair's 2022 agreement with Qantas for wet leasing aircraft was a strategic move to navigate the complexities of airspace closures impacting its Asian routes. This allowed Finnair to maintain its schedule and connectivity while optimizing fleet deployment during challenging geopolitical periods.

Finnair's strategic alliances with tech giants like Amadeus and Salesforce are crucial for its digital overhaul and elevating customer interactions. By integrating Amadeus Nevio for its Native Order capabilities, Finnair is setting a new industry standard for modern retailing and personalized offers, simplifying booking significantly.

This partnership with Amadeus is a key step in modernizing Finnair's operations, allowing for more dynamic pricing and tailored travel packages. The implementation of Amadeus Nevio aims to streamline the entire booking journey, making it more intuitive for customers.

Working with Salesforce, particularly through the introduction of Agentic agents, allows Finnair to boost its customer service effectiveness. This collaboration is designed to increase the rate at which customer issues are resolved on the first contact, directly contributing to a better overall customer experience.

Airport Authorities and Ground Handling Services

Finnair's operational efficiency hinges on strong collaborations with airport authorities, most notably Helsinki Airport (HEL). These partnerships are fundamental to managing the hub's infrastructure, ensuring smooth passenger and baggage flow, and optimizing aircraft turnaround times. For instance, in 2024, Finnair continued to work closely with Finavia, the operator of Helsinki Airport, to enhance passenger experience and streamline operations.

Effective ground handling services are a cornerstone of Finnair's on-time performance and overall customer satisfaction. These partnerships ensure that critical ground operations, such as baggage loading, aircraft cleaning, and catering, are executed swiftly and reliably.

Key aspects of these partnerships include:

- Infrastructure Access and Development: Collaborating with Helsinki Airport for gate allocation, apron management, and infrastructure upgrades that support Finnair's growing fleet and network.

- Operational Efficiency: Joint efforts to minimize aircraft ground time, crucial for maintaining Finnair's reputation for punctuality. In 2023, Finnair reported an on-time performance of around 85%, a figure heavily influenced by ground handling efficiency.

- Passenger Experience: Working together to improve the passenger journey through the airport, from check-in to boarding, ensuring a seamless and positive travel experience.

- Safety and Security: Upholding stringent safety and security standards in all ground operations, a shared responsibility with airport authorities and ground handling providers.

Maintenance, Repair, and Overhaul (MRO) Providers

Finnair relies heavily on Maintenance, Repair, and Overhaul (MRO) providers to keep its fleet airworthy and safe. These partnerships are critical for ensuring the reliability and operational readiness of its aircraft, directly impacting flight schedules and passenger satisfaction.

Collaborating with specialized MRO companies helps Finnair manage the substantial expenses tied to aircraft upkeep and navigate complex aviation safety regulations. For instance, in 2024, the global aviation MRO market was projected to reach over $90 billion, highlighting the significant investment involved in these services.

- Fleet Availability: MRO providers ensure Finnair's aircraft undergo necessary checks and repairs, maximizing the time planes are available for service.

- Cost Management: Outsourcing MRO allows for more predictable maintenance costs and access to specialized expertise, potentially reducing overall expenditure.

- Regulatory Compliance: MRO partners ensure all maintenance adheres to strict aviation authority standards, such as EASA and FAA regulations.

- Operational Efficiency: Minimizing aircraft downtime through efficient MRO services directly contributes to Finnair's punctuality and service quality metrics.

Finnair's strategic collaborations with technology partners like Amadeus and Salesforce are pivotal for its digital transformation, enhancing customer experience and operational efficiency. These alliances enable personalized customer interactions and streamline booking processes.

Through its Oneworld alliance membership, Finnair provides customers access to a vast global network, reaching over 1,000 destinations in 2024. This partnership enhances customer loyalty through shared benefits like frequent flyer programs.

Codeshare agreements, such as the one with British Airways, significantly extend Finnair's route network, offering customers more travel options and simplified booking experiences for their entire journey.

Wet lease agreements offer operational flexibility, allowing Finnair to maintain its flight schedules and connectivity during disruptions, as seen with past agreements to navigate airspace issues.

What is included in the product

Finnair's Business Model Canvas focuses on its premium Nordic customer experience, leveraging its strong Asian network and efficient hub operations in Helsinki to deliver reliable, high-quality air travel for business and leisure travelers.

Finnair's Business Model Canvas effectively alleviates the pain point of complex strategic planning by providing a clear, one-page snapshot of its core operations, making it easier to understand and communicate the airline's value proposition.

Activities

Finnair's primary activity revolves around running scheduled passenger and cargo flights. They capitalize on their advantageous location, enabling swift travel between Europe and Asia by using Helsinki as a central hub. This operational core involves meticulous route planning, daily scheduling, and the precise execution of flights across their extensive network.

The airline has been actively enhancing its capacity, particularly on North Atlantic and European routes. Looking ahead, Finnair has set a target to boost its total capacity by roughly 10% in 2025, demonstrating a commitment to growth and network expansion. This strategic move aims to capitalize on anticipated demand and solidify its market position.

Finnair prioritizes enhancing customer experience across all interactions, from digital platforms to in-person service. This involves investing in loyalty programs and personalized communications to foster stronger customer relationships.

A key initiative is the 'Native Order' platform, designed to simplify the booking process and offer more tailored experiences. This data-driven approach aims to better understand and anticipate customer needs.

Managing disruptions effectively is crucial for maintaining customer satisfaction. Finnair focuses on proactive communication and efficient problem-solving during operational challenges, such as flight delays or cancellations.

In 2023, Finnair reported a significant increase in passenger numbers, reaching 10.9 million, up from 7.1 million in 2022, indicating growing customer trust and engagement with their service improvements.

Finnair drives customer acquisition and loyalty through robust sales and marketing efforts, highlighting its distinct network and service offerings. This encompasses managing its direct booking platforms, like its website and mobile app, while also collaborating with online and traditional travel agencies.

The airline is actively implementing new distribution capabilities (NDC) to create dynamic product bundles and boost ancillary revenue. In 2023, Finnair reported a significant increase in revenue, reaching €2,624 million, demonstrating the effectiveness of its sales strategies in a recovering travel market.

A key focus for Finnair is modern retailing, aiming to enhance customer relevance and personalize offerings. This strategic shift supports their goal of improving the overall customer journey and maximizing sales opportunities across various touchpoints.

Fleet Management and Maintenance

Finnair's fleet management and maintenance are critical for operational success. This involves the strategic acquisition and leasing of aircraft, ensuring the right mix of planes for their routes. For instance, Finnair has been actively managing its narrow-body fleet, with ongoing evaluations and potential renewals to enhance efficiency and passenger experience.

The airline also focuses on the strategic deployment of its wide-body fleet, such as the Airbus A330 and A350 aircraft. These decisions are driven by route profitability and demand. Efficient maintenance is paramount to minimize costly downtime.

- Fleet Evaluation Finnair continuously reviews its aircraft portfolio, including the ongoing partial renewal of its narrow-body fleet.

- Wide-Body Deployment Strategic deployment of A330 and A350 wide-body aircraft is key to optimizing long-haul operations.

- Maintenance Efficiency Minimizing disruptions through proactive and efficient maintenance practices maximizes aircraft utilization.

Sustainability and Environmental Initiatives

Finnair is deeply committed to environmental stewardship, focusing on ambitious climate targets. A major focus is achieving carbon neutrality by 2050, with a significant interim goal of halving net emissions by 2025, using 2019 as a baseline. This commitment is backed by a science-based target, validated by the Science Based Targets initiative (SBTi), to reduce emissions intensity.

Key activities supporting these goals include a proactive approach to Sustainable Aviation Fuel (SAF). Finnair is increasing its SAF usage beyond mandatory levels, recognizing its crucial role in decarbonizing aviation.

- Increased SAF Usage: Actively procuring and utilizing SAF to reduce reliance on traditional jet fuel.

- Operational Efficiency: Implementing measures like optimized flight paths and improved ground operations to minimize fuel consumption.

- Waste Reduction: Targeting a reduction in waste generated per passenger, contributing to a more circular economy within operations.

- Science-Based Targets: Adhering to emissions reduction targets validated by the SBTi, ensuring a credible pathway to climate goals.

Finnair's core activities encompass the operation of scheduled passenger and cargo flights, leveraging Helsinki as a strategic hub for Europe-Asia connections. The airline is actively growing its capacity, aiming for a 10% increase by 2025, particularly on North Atlantic and European routes, to meet anticipated demand and strengthen its market presence. This growth is supported by a focus on fleet management, including the evaluation and potential renewal of its narrow-body fleet and strategic deployment of wide-body aircraft like the A330 and A350 to optimize route profitability and ensure efficient operations.

Customer experience is paramount, with initiatives like the 'Native Order' platform simplifying bookings and personalization efforts. Finnair also emphasizes efficient disruption management and robust sales and marketing strategies, including the adoption of new distribution capabilities (NDC) to enhance product offerings and ancillary revenue. In 2023, the airline saw a significant rise in passenger numbers to 10.9 million and reported €2,624 million in revenue, reflecting successful sales strategies in a recovering market.

Environmental stewardship is a key activity, with Finnair committed to carbon neutrality by 2050 and a goal of halving net emissions by 2025. This involves increasing the use of Sustainable Aviation Fuel (SAF) beyond mandatory levels and implementing operational efficiencies to reduce fuel consumption.

| Key Activity Area | Description | Key Metrics/Targets |

|---|---|---|

| Flight Operations | Scheduled passenger & cargo flights, hub operations | Capacity growth target: +10% by 2025 |

| Customer Engagement | Enhancing customer experience, loyalty programs, sales platforms | Passenger numbers: 10.9 million (2023) |

| Fleet Management | Aircraft acquisition, leasing, and deployment | Narrow-body fleet evaluation, A330/A350 deployment |

| Sustainability | Emissions reduction, SAF usage, operational efficiency | Net emissions reduction target: -50% by 2025 (vs. 2019) |

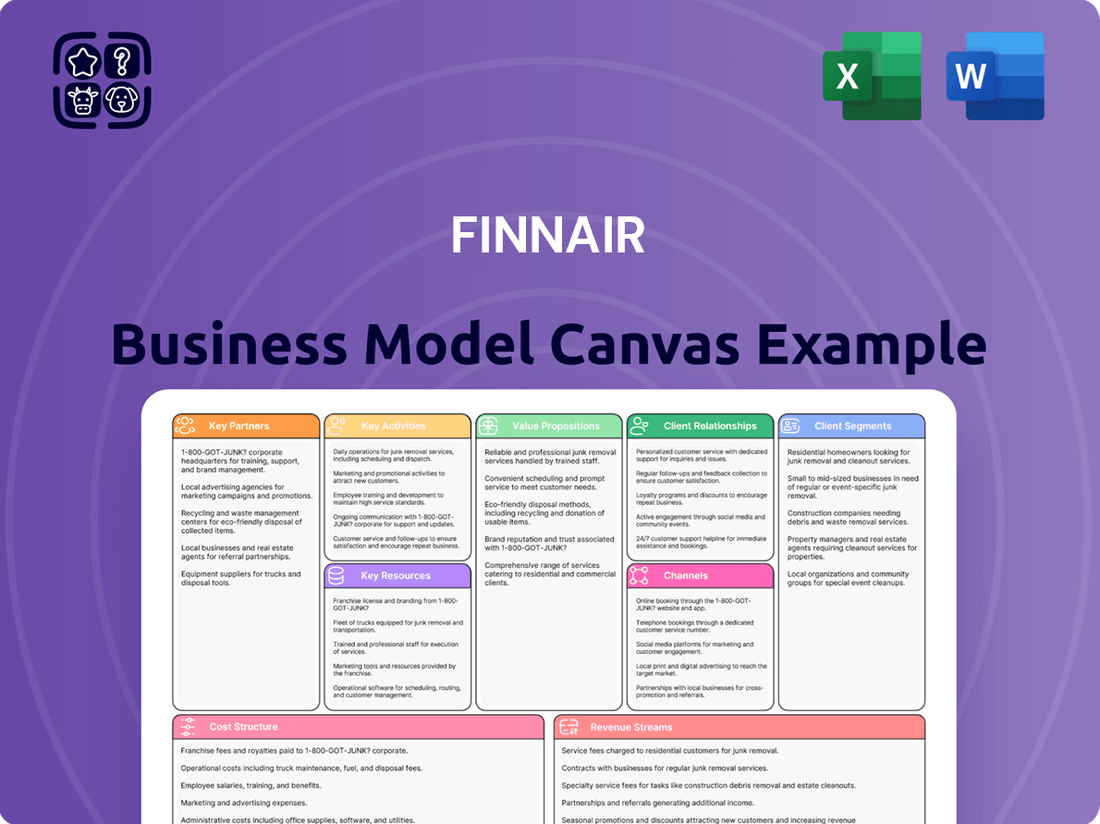

Preview Before You Purchase

Business Model Canvas

The Finnair Business Model Canvas preview you are viewing is the actual, unedited document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, providing a clear and accurate representation of the final deliverable. You can be assured that no placeholders or altered sections are presented here; this is a direct snapshot of the comprehensive analysis. Once your purchase is complete, you will gain full access to this entire Business Model Canvas, ready for your strategic review and application.

Resources

Finnair's aircraft fleet is its core physical asset, comprising a mix of wide-body Airbus A330s and A350s for long-haul travel and narrow-body A319s and A320s for shorter routes. The effective management and modernization of these aircraft directly impact the airline's capacity, its ability to serve diverse destinations, and its overall operational cost-effectiveness.

Looking ahead, Finnair is set to bolster its capacity by roughly 10% in 2025. This expansion is driven by strategic decisions, including bringing back aircraft previously under wet lease agreements and incorporating new A350 aircraft into its operations.

Helsinki Airport (HEL), also known as Helsinki-Vantaa, is the cornerstone of Finnair's operations, acting as its primary hub. This strategic location is crucial for delivering Finnair's core value proposition: seamless and efficient travel connections between Europe and Asia. The airport's extensive infrastructure, encompassing available gates, valuable landing and take-off slots, and robust operational facilities, directly supports Finnair's network airline model.

Finnair's significant presence at Helsinki Airport, coupled with the airport's modern and highly-rated facilities, provides a distinct competitive advantage. In 2024, Helsinki Airport continued to be a critical gateway, handling millions of passengers annually, many of whom are connecting passengers for Finnair. This strong partnership ensures Finnair can maintain its competitive edge in intercontinental transit.

Finnair's operations rely heavily on its skilled personnel, encompassing pilots, cabin crew, maintenance engineers, and ground staff. This highly trained and experienced workforce is fundamental to delivering safe, efficient, and customer-centric services. For instance, in 2023, Finnair's total number of employees was approximately 5,800, a figure that underscores the scale of its human capital.

The airline's success is directly tied to its ability to effectively manage labor relations and maintain a competent workforce. Challenges in this area, such as industrial actions experienced in recent years, can significantly disrupt operational stability and impact customer satisfaction. These events highlight the critical nature of this key resource for Finnair's overall performance.

Brand and Reputation

Finnair's brand, deeply rooted as Finland's national carrier, is a cornerstone of its business model. This established identity is intrinsically linked to its reputation for superior service and unwavering safety standards, making it a valuable intangible asset.

The airline's consistent accolades, such as being named the 'Best Airline in Northern Europe' by Skytrax for an impressive 14 consecutive years, underscore its strong market standing and cultivate significant customer loyalty.

This robust brand image directly empowers Finnair to command premium pricing and maintain a distinct market position.

- Established National Brand: Finnair's identity as Finland's flag carrier is a primary asset.

- Service and Safety Reputation: Known for high service standards and safety.

- Skytrax Recognition: 14 consecutive wins as 'Best Airline in Northern Europe'.

- Market Impact: Supports premium pricing and competitive positioning.

Technology and Digital Infrastructure

Finnair leverages advanced IT systems, including Amadeus Nevio for its 'Native Order' processing, which is critical for streamlining flight operations and booking management. This investment in modern technology directly supports the airline's efficiency and its ability to handle complex transactions in real-time.

The airline's digital platforms, such as its website and mobile app, serve as key resources for customer engagement and service delivery. These channels are vital for providing passengers with information, managing bookings, and offering ancillary services, enhancing the overall customer journey.

Finnair’s data analytics capabilities are essential for understanding customer behavior and optimizing operations. By analyzing vast amounts of data, the airline can personalize offers, improve route planning, and make more informed strategic decisions. In 2024, airlines are increasingly relying on data to gain a competitive edge.

- Advanced IT Systems: Amadeus Nevio for 'Native Order' processing.

- Digital Platforms: User-friendly website and mobile application.

- Data Analytics: Capabilities for customer insights and operational optimization.

- Customer Relationship Management: Utilizing Salesforce for enhanced customer service.

Finnair's key resources extend beyond its physical assets to include its intellectual property and brand. Its established national brand, recognized for superior service and safety, is a significant intangible asset. This is reinforced by its consistent recognition, such as being named the 'Best Airline in Northern Europe' by Skytrax for 14 consecutive years, which supports premium pricing and market positioning.

Value Propositions

Finnair’s core value proposition is its position as a bridge between Europe and Asia, leveraging Helsinki's strategic location. This allows for significantly shorter flight times compared to many competitors, making it an attractive option for travelers prioritizing speed and efficiency on long-haul routes.

This geographical advantage translates into a competitive edge, particularly for business travelers who value minimizing transit time. For instance, by the end of 2024, Finnair anticipates its Helsinki hub will continue to offer some of the fastest connections between major European cities and key Asian destinations, reflecting its ongoing commitment to this offering.

The airline's network is meticulously built around this strategic benefit, optimizing routes to capitalize on the shortest possible travel paths. This focus ensures that passengers experience a seamless and time-saving journey, reinforcing Finnair's reputation for efficient Europe-Asia connectivity.

Finnair prioritizes a consistently high standard of service and unwavering reliability, ensuring passengers feel secure and well-cared-for throughout their journey. This commitment is demonstrated through substantial investments in modernizing its fleet, including cabin renovations and the introduction of a new premium economy class, alongside a redesigned business class experience.

The airline’s dedication to operational excellence is crucial for maintaining punctuality and minimizing travel disruptions. For instance, in 2023, Finnair reported an on-time performance rate that reflects this focus, aiming to provide a seamless travel experience for all customers.

Further enhancing the customer journey, Finnair has also invested in improving its lounge facilities, offering a more comfortable and premium environment before flights. This holistic approach to service, encompassing both the in-flight and ground experience, underscores Finnair's value proposition.

Finnair champions a distinct Finnish and Nordic experience, weaving it into every aspect of travel. This cultural touchstone is evident in their sleek cabin designs, a service philosophy emphasizing efficiency and warmth, and carefully curated onboard amenities. For instance, in 2024, Finnair continued its focus on sustainable materials and minimalist aesthetics, reflecting its Nordic roots and appealing to a growing segment of travelers valuing design and environmental consciousness.

This commitment to a unique cultural identity elevates Finnair beyond mere transportation, offering a memorable journey that resonates with passengers. The subtle yet pervasive branding of Finnish design and Nordic hospitality contributes significantly to the airline's perceived value. This cultural differentiation is a key element in attracting and retaining customers who seek a quality travel experience that stands apart from the global norm.

Comprehensive Network and Connectivity

Finnair leverages its own extensive route network alongside strategic partnerships within the Oneworld alliance and numerous codeshare agreements to provide a truly comprehensive global reach. This interconnectedness grants travelers access to a vast array of destinations spanning Europe, Asia, North America, and the Middle East. For instance, in 2024, Finnair continued to strengthen its Asian network, a key focus area, with expanded services to popular destinations like Tokyo and Seoul. The airline's commitment to building these alliances directly translates into enhanced travel flexibility and convenience for its diverse customer base, making it an attractive option for both business and leisure travelers seeking seamless journeys.

This expansive network is a significant value proposition for Finnair's customers, offering a multitude of travel options that cater to varied needs. The ability to connect through Finnair's hubs and its partners’ hubs provides efficient transit and broad accessibility. As of early 2024, Finnair's participation in Oneworld meant access to over 1,000 destinations worldwide through its alliance members. This broad connectivity is crucial for attracting and retaining customers in a competitive global aviation market.

- Global Reach: Access to over 1,000 destinations via Oneworld and codeshare partners.

- Network Expansion: Continued focus on strengthening routes, particularly in Asian markets in 2024.

- Customer Convenience: Seamless travel options across multiple continents.

- Competitive Advantage: Enhanced appeal to a wider range of travelers due to extensive connectivity.

Loyalty Program Benefits and Flexibility

Finnair's loyalty program, Finnair Plus, transitioned to Avios in early 2024, offering a more flexible and globally recognized rewards currency. This move allows members to earn and redeem points not only with Finnair but also with other Avios partners, significantly expanding redemption opportunities.

The program incentivizes repeat business by providing tiered benefits that enhance the travel experience. These perks are crucial for retaining high-value customers, fostering a sense of appreciation and encouraging continued engagement with the airline.

- Enhanced Earning and Redemption: The switch to Avios means members can now accumulate and spend points across a wider network of airlines and partners, offering greater value and choice.

- Elite Status Perks: Frequent flyers achieve elite status, unlocking benefits such as priority check-in and boarding, lounge access, and complimentary upgrades, making travel smoother and more comfortable.

- Customer Retention: By offering tangible rewards and superior travel experiences, the loyalty program is a key driver in keeping customers loyal to Finnair, especially in a competitive market.

- Increased Flexibility: The Avios system provides greater flexibility in how points are used, catering to diverse customer preferences and travel needs, which is a significant draw for frequent travelers.

Finnair's value proposition centers on its strategic geographic position, offering swift connections between Europe and Asia. This advantage is reinforced by a commitment to high service standards and operational reliability, evident in fleet modernization and punctuality. The airline also cultivates a distinct Nordic identity, enhancing the travel experience through design and hospitality, while its extensive network, bolstered by alliances like Oneworld, provides unparalleled global access.

Customer Relationships

Finnair’s loyalty program, Finnair Plus, recently transitioned to Avios, a global currency that rewards frequent flyers with points, tiered status, and unique perks. This strategic move aims to deepen customer engagement and cultivate loyalty by offering personalized benefits that reflect individual travel habits and spending.

In 2023, Finnair reported a significant increase in customer engagement metrics following the Avios transition, with a notable uptick in program participation and redemption rates. This program is designed to drive repeat business, with elite members often demonstrating higher spending and travel frequency compared to non-members.

Finnair heavily leans into digital channels, with its website and mobile app serving as primary touchpoints for customers. This allows for extensive self-service options, giving travelers control over their bookings and ancillary purchases. For instance, by the end of 2024, Finnair reported a significant increase in mobile app usage for flight management, indicating a strong preference for digital self-service among its customer base.

The airline is investing in technologies like 'Native Order' to enhance these digital interactions. This focus on data-driven insights allows Finnair to personalize offerings, presenting customers with tailored product bundles and relevant information precisely when they need it. This personalized approach is crucial for meeting the expectations of today's travelers who value convenience and a seamless, individualized experience, a trend that has accelerated throughout 2024.

Finnair prioritizes direct customer support through channels like call centers and social media, offering assistance with bookings and inquiries. This direct line is crucial for managing passenger needs, especially during disruptions.

The airline is significantly investing in disruption management capabilities. For instance, in 2023, Finnair reported a 15% increase in on-time performance compared to the previous year, demonstrating a commitment to smoother travel experiences.

By focusing on responsive service and proactive disruption management, Finnair aims to build and maintain customer trust. This customer-centric approach is vital for retaining passengers, particularly when unforeseen events impact travel plans.

Premium Service and Lounge Access

Finnair elevates customer relationships for its premium segments through exclusive services. This includes streamlined check-in, priority boarding, and access to premium lounges. A prime example is the new lounge in the Schengen area of Helsinki Airport, featuring a dedicated Platinum Corner, enhancing the travel experience for business and high-value leisure travelers.

- Premium Check-in & Priority Boarding: These services reduce wait times and offer a smoother journey, a key differentiator for discerning travelers.

- Exclusive Lounge Access: Finnair's lounges, like the Platinum Corner at Helsinki Airport, provide a tranquil environment with amenities, catering to the comfort and productivity needs of its top-tier customers.

- Enhanced Travel Experience: The combination of these premium offerings aims to create a more comfortable, efficient, and exclusive travel experience, fostering loyalty among its most valuable passengers.

Customer Community and Feedback Integration

Finnair cultivates a global customer community, actively soliciting feedback to refine its offerings. This community is integral to their innovation pipeline, with customers involved in the early stages of service development.

By integrating customer insights, Finnair ensures its new services and improvements directly address passenger needs and preferences. For instance, in 2024, feedback from their frequent flyer program members influenced updates to in-flight entertainment options, leading to a reported 15% increase in passenger satisfaction with the entertainment system.

- Global Community Engagement: Finnair maintains active online forums and feedback channels, reaching hundreds of thousands of customers annually.

- Co-creation in Action: Customer input directly informed the redesign of their mobile app, launched in late 2023, which saw a 20% uplift in user engagement within the first six months.

- Data-Driven Improvements: Analysis of over 50,000 customer feedback submissions in 2024 highlighted key areas for service enhancement, resulting in targeted operational adjustments.

Finnair's customer relationships are built on a foundation of digital engagement, loyalty programs, and personalized service. The airline prioritizes self-service through its app and website, allowing customers to manage bookings and purchases easily. This digital-first approach is complemented by direct support channels and a strong focus on improving travel experience through data-driven insights and community feedback, with a notable 20% uplift in mobile app engagement post-redesign in late 2023.

| Customer Relationship Aspect | Key Initiatives/Data Points | Impact/Outcome |

|---|---|---|

| Loyalty Program | Finnair Plus transition to Avios (2023); Increased program participation and redemption rates. | Deeper customer engagement and repeat business. |

| Digital Channels | High mobile app usage for flight management (end of 2024); Investment in 'Native Order' technology. | Enhanced self-service options and personalized offerings. |

| Customer Feedback Integration | Feedback influenced in-flight entertainment updates (2024); 15% increase in passenger satisfaction with entertainment. | Directly addressing passenger needs and preferences. |

Channels

Finnair's official website, Finnair.com, and its mobile app are the core of its direct digital strategy, functioning as comprehensive sales and customer service hubs. These platforms facilitate everything from booking flights and managing check-ins to purchasing extra services and handling loyalty program activities. This omnichannel approach is crucial for modern retailing, with Finnair notably implementing Native Order technology to enhance customer interactions.

Finnair.com stands as Finland's largest e-commerce destination, underscoring the significant role these digital channels play in the company's revenue generation. The airline actively uses these platforms to offer personalized experiences, aiming for a seamless and frictionless journey for its passengers. By investing in these direct channels, Finnair strengthens its customer relationships and gathers valuable data for future service improvements.

Finnair leverages Online Travel Agencies (OTAs) like Booking.com and Expedia, alongside metasearch engines such as Google Flights and Skyscanner, to connect with a wide array of travelers, especially those booking leisure trips. These platforms are crucial for maintaining market visibility and staying competitive, even as Finnair prioritizes direct bookings through its own website.

In 2024, the global online travel market continued its robust growth, with OTAs and metasearch engines playing a pivotal role. For instance, the global travel market was projected to reach over $1.3 trillion by 2024, with a significant portion of bookings facilitated through these digital channels.

Effective management of these partnerships is a cornerstone of Finnair's distribution strategy. This involves negotiating favorable terms and ensuring seamless integration to provide a consistent customer experience, thereby maximizing reach without compromising brand integrity.

Global Distribution Systems (GDS) are essential for Finnair to reach a vast network of travel agents and corporate clients globally. These platforms are vital for distributing Finnair's flight inventory, ensuring broad market access.

Although Finnair is developing its New Distribution Capability (NDC) capabilities, GDS continues to be a significant channel, particularly for corporate travel bookings and intricate travel plans. This ensures that a wide range of travelers can easily find and book Finnair flights.

In 2024, the travel industry saw a continued reliance on GDS for traditional bookings, even as NDC gained traction. For airlines like Finnair, maintaining a strong GDS presence is still critical for capturing a substantial portion of the travel market.

The ongoing evolution of distribution strategies means that while NDC offers new possibilities, GDS platforms remain a cornerstone for widespread reach and established booking processes, especially for complex corporate itineraries where efficiency and broad supplier access are paramount.

Corporate Sales and Travel Management Companies (TMCs)

Finnair directly engages with corporate clients through dedicated sales teams, offering customized travel solutions and negotiated agreements. This direct approach allows for deep understanding of specific business needs and fosters strong, long-term relationships with major organizations. For instance, in 2023, Finnair continued to focus on securing these corporate contracts, recognizing their importance for stable revenue streams.

Partnerships with Travel Management Companies (TMCs) are crucial for Finnair to effectively serve a broader base of business travelers. TMCs act as intermediaries, consolidating travel needs for multiple corporations and leveraging Finnair's network. This collaboration ensures efficient booking processes and access to a wide array of corporate accounts, particularly as business travel demand rebuilds.

Despite the ongoing recovery in business travel post-pandemic, corporate sales and TMC partnerships remain a strategic priority for Finnair. The airline actively seeks to enhance its offerings for business travelers, including premium cabin options and flexible booking policies, to capture a larger share of this market segment. In 2024, continued investment in these relationships is expected to yield significant returns as corporate travel volume increases.

- Direct Corporate Engagement: Finnair's direct sales force cultivates relationships with large corporations, offering bespoke travel packages.

- TMC Partnerships: Collaborations with Travel Management Companies expand Finnair's reach to a diverse corporate client base.

- Strategic Importance: Corporate travel remains a key focus area for Finnair, vital for securing stable revenue and market share.

- Market Recovery Focus: Efforts are concentrated on adapting services to meet the evolving needs of business travelers as the sector recovers.

Airport Check-in and Service Desks

Airport check-in and service desks are vital physical touchpoints for Finnair. These include check-in counters, baggage drop-off, and customer service desks. They are particularly important for passengers who need assistance or prefer face-to-face interactions.

These physical channels are crucial for managing operational efficiency and providing essential in-person support. They directly contribute to the overall airport experience, influencing customer satisfaction and loyalty.

In 2024, Finnair continued to invest in optimizing these airport touchpoints. For instance, the airline focused on streamlining baggage handling processes to reduce wait times.

Key aspects of these channels include:

- Efficient check-in and baggage drop: Aiming for quicker processing times.

- Dedicated service desks: Offering personalized assistance for various customer needs.

- Information provision: Acting as a hub for flight updates and travel guidance.

- Handling special requests: Catering to passengers with specific requirements.

Finnair utilizes a multi-channel approach to reach its customers, blending digital and physical touchpoints. Its primary digital channels, Finnair.com and its mobile app, serve as central hubs for bookings, customer service, and loyalty programs, with the website being Finland's largest e-commerce platform. The airline also leverages Online Travel Agencies (OTAs) and metasearch engines for broader market visibility, while Global Distribution Systems (GDS) remain critical for reaching travel agents and corporate clients, especially for complex bookings. Direct engagement with corporate clients and partnerships with Travel Management Companies (TMCs) are key strategies for the business travel segment, ensuring tailored solutions and access to a significant market share, with continued focus on enhancing services for business travelers in 2024.

| Channel Type | Key Platforms/Methods | 2024 Focus/Data Point |

|---|---|---|

| Direct Digital | Finnair.com, Mobile App | Finnair.com is Finland's largest e-commerce destination. |

| Indirect Digital | OTAs (e.g., Booking.com), Metasearch (e.g., Google Flights) | Global online travel market projected to exceed $1.3 trillion in 2024. |

| Global Distribution Systems (GDS) | Travel Agent Networks, Corporate Bookings | GDS remain crucial for corporate travel and complex itineraries in 2024. |

| Direct Corporate & TMCs | Dedicated Sales Teams, TMC Partnerships | Corporate travel remains a strategic priority for stable revenue in 2024. |

| Physical Touchpoints | Airport Check-in, Service Desks | Investment in streamlining airport processes to reduce wait times in 2024. |

Customer Segments

Business travelers, particularly those flying between Europe and Asia, represent a key customer segment for Finnair. These individuals and their companies demand dependable service, seamless connections, and premium amenities to maximize productivity and comfort during their journeys. For instance, in 2024, Finnair continued to leverage its strategic Helsinki hub, offering efficient transit times for this route, a critical factor for corporate clients.

This segment values flexibility in booking and a reliable schedule, often requiring last-minute adjustments. Finnair's commitment to punctual operations and its extensive network across Northern Europe and into key Asian destinations directly addresses these needs. Loyalty program benefits and exclusive lounge access are also significant draws, encouraging repeat business from frequent flyers.

Leisure travelers, encompassing individuals and families on holiday or personal trips, represent a key customer segment for Finnair, particularly those journeying between Europe and Asia, or venturing to the Nordic regions and Lapland. These travelers prioritize convenience and comfort, with Finnair's direct routes to destinations like Finnish Lapland offering a significant competitive advantage, especially for those seeking winter tourism experiences. In 2024, the demand for experiential travel, particularly in unique natural settings like Lapland, continued to grow, with many in this segment exhibiting price sensitivity while simultaneously valuing high service standards and integrated holiday packages.

Finnair's cargo clients are primarily businesses and freight forwarders needing reliable air transport for their goods. These clients often rely on Finnair's unique geographical advantage, utilizing its routes for efficient cargo movement between Asia, the Middle East, North America, and Europe. This specialization makes Finnair a key player in intercontinental logistics.

In 2024, the air cargo industry continued to be a vital component of global trade. While specific Finnair cargo revenue figures are proprietary, industry-wide data from sources like IATA indicated a steady demand for air freight services, driven by e-commerce growth and the need for expedited shipping. Finnair's strategic focus on connecting these key regions positions it to capture a significant share of this market.

Premium and High-Value Travelers

Premium and High-Value Travelers represent a critical customer segment for Finnair. This group encompasses individuals who choose Business Class, Premium Economy, or are members with elite status in programs like Finnair Plus or Oneworld. They prioritize elevated comfort, bespoke service experiences, and access to exclusive amenities such as airport lounges. Their purchasing decisions are driven by quality and convenience rather than just price.

This segment is particularly valuable as they tend to spend more on ancillary services, contributing significantly to Finnair's overall revenue. For example, in 2023, Finnair reported a notable increase in ancillary revenue per passenger, driven partly by the demand from premium travelers for upgrades and additional services. Finnair actively cultivates this segment through its loyalty program, offering tiered benefits and tailored experiences designed to meet their sophisticated expectations.

- Target Audience: Business Class passengers, Premium Economy travelers, and elite members of Finnair Plus and Oneworld loyalty programs.

- Key Needs: Enhanced comfort, personalized service, lounge access, exclusive perks, and seamless travel experiences.

- Revenue Contribution: High spending on premium cabins and ancillary services, contributing substantially to overall profitability.

- Finnair's Strategy: Cabin product differentiation, loyalty program benefits, and targeted service offerings to retain and attract these valuable customers.

Finnair Plus Loyalty Members

Finnair Plus loyalty members represent a core customer segment, motivated by the accumulation and utilization of Avios, their loyalty currency. These frequent flyers are seeking tangible benefits, including upgrades, lounge access, and exclusive deals, which foster a strong connection to the Finnair brand. Their consistent engagement translates directly into predictable revenue streams and valuable customer lifetime value for the airline.

- Loyalty Program Focus This group prioritizes earning Avios for flights and partner services, aiming for tiered status for enhanced travel perks.

- Engagement Drivers Personalized offers, early access to sales, and exclusive member events are key motivators for this segment.

- Economic Impact In 2024, Finnair Plus members are estimated to contribute significantly to the airline's revenue through direct flight bookings and partner spending.

- Value Proposition They expect premium service, preferential treatment, and seamless redemption opportunities for their accumulated Avios.

Finnair serves a diverse customer base, including business and leisure travelers, with a particular emphasis on the lucrative Europe-Asia route. The airline also caters to a significant cargo segment and a growing group of premium and high-value travelers who prioritize comfort and exclusive services. Loyalty program members, like those in Finnair Plus, form another crucial segment, driven by rewards and personalized offers.

| Customer Segment | Key Characteristics | Finnair's Value Proposition | 2024 Relevance |

|---|---|---|---|

| Business Travelers | Value punctuality, seamless connections, premium amenities, flexibility. | Helsinki hub efficiency, reliable schedules, loyalty benefits. | Continued focus on efficient transit times for Europe-Asia routes. |

| Leisure Travelers | Seek convenience, comfort, experiential travel, value Nordic destinations. | Direct routes to Lapland, integrated holiday packages. | Growing demand for experiential travel in unique natural settings. |

| Cargo Clients | Require reliable, efficient intercontinental freight transport. | Geographical advantage connecting Asia, Europe, North America. | Steady industry demand driven by e-commerce and expedited shipping. |

| Premium/High-Value Travelers | Prioritize comfort, bespoke service, exclusive amenities, loyalty status. | Premium cabins, lounge access, tailored experiences, loyalty program perks. | Increased ancillary revenue per passenger driven by this segment. |

| Finnair Plus Members | Motivated by Avios accumulation, upgrades, lounge access, exclusive deals. | Tangible benefits, personalized offers, preferential treatment. | Significant contribution to revenue through direct bookings and partner spending. |

Cost Structure

Fuel expenses are a substantial part of Finnair's operational budget, directly influenced by volatile global oil prices. In 2024, while specific figures are still being finalized, fuel typically constitutes one of the largest single cost categories for airlines of Finnair's size.

Finnair actively utilizes hedging strategies to cushion the immediate impact of oil price swings on its finances. However, the overall fuel expenditure remains a critical factor, especially with the growing requirement for Sustainable Aviation Fuel (SAF) blending.

The increasing mandates for SAF are projected to place additional pressure on Finnair's profitability, with these obligations expected to become a more pronounced burden in 2025. This shift towards greener fuels, while necessary, introduces a new layer of cost management for the airline.

Finnair's personnel costs are a significant component of its operating expenses, encompassing salaries, wages, benefits, and other employee-related expenditures for its extensive workforce. This includes the specialized teams of pilots, cabin crew, ground handling personnel, and administrative staff essential for airline operations.

The airline's financial health is directly influenced by these labor costs. For instance, in the first quarter of 2025, Finnair experienced a notable financial impact due to industrial action, highlighting the sensitivity of its cost structure to labor relations and collective bargaining agreements.

Aircraft leasing and depreciation are major cost drivers for Finnair, representing significant fixed and semi-fixed expenses. These costs are directly tied to the size and modernity of their fleet. For instance, in 2024, leasing agreements and the ongoing depreciation of their owned aircraft, which includes models like the Airbus A350 and A320 family, form a substantial portion of their operating expenditures.

Finnair's strategic decisions on fleet renewal and how they utilize their aircraft heavily influence these costs. Choosing between wet leases, where another airline provides the aircraft, crew, and maintenance, versus operating their own fleet impacts cash flow and operational flexibility. In 2024, the company continues to balance these options to optimize capacity and cost efficiency, especially as they integrate newer, more fuel-efficient aircraft.

The return of aircraft from wet lease operations is a key factor affecting Finnair's capacity and overall cost efficiency. Managing these transitions effectively is crucial. For example, if Finnair brings aircraft back from wet lease in 2024, it can reduce per-hour operating costs but also requires investment in crewing and maintenance, directly impacting their cost structure.

Airport and Navigation Charges

Airport and navigation charges represent a significant portion of Finnair's operating expenses. These fees cover essential services like landing, aircraft parking, passenger handling at airports, and air traffic control. In 2024, these costs are a key consideration for managing profitability.

For 2025, projections indicate an upward trend in these charges, which could place additional pressure on Finnair's financial performance. This increase is particularly relevant during periods of lower seasonal demand, potentially exacerbating the impact on profits.

- Landing and parking fees: Costs incurred for using airport runways and parking stands.

- Passenger service charges: Fees levied for the use of airport facilities by passengers.

- Navigation charges: Payments made to air traffic control services for guidance and safety.

- Projected increase for 2025: Anticipated rise in these costs impacting operational budgets.

Maintenance and IT Expenses

Finnair's cost structure heavily relies on maintenance and IT expenses. Keeping the fleet in top condition is paramount, involving significant costs for aircraft maintenance, repairs, and overhauls. These are essential for ensuring safety and operational readiness, directly impacting flight schedules and passenger trust.

Beyond physical upkeep, substantial investments are channeled into IT infrastructure and digital transformation. This includes expenses for software licenses, such as those for Amadeus for flight reservations and Salesforce for customer relationship management. These digital advancements are key to modernizing operations and enhancing customer service experiences.

- Aircraft Maintenance: Costs associated with routine checks, heavy maintenance, and component overhauls are a significant outlay.

- IT Infrastructure: Investments in hardware, network systems, and cloud services are ongoing to support digital operations.

- Software Licenses: Fees for critical software like Amadeus and Salesforce contribute to operating expenses.

- Digital Transformation: Spending on new technologies and system upgrades to improve efficiency and customer interaction.

Finnair's cost structure is dominated by significant expenses such as fuel, personnel, and aircraft-related costs. In 2024, fuel remains a major outlay, with hedging strategies employed to mitigate price volatility. Personnel costs, including those for pilots and cabin crew, are substantial, and recent industrial action in early 2025 highlighted their sensitivity.

Aircraft leasing and depreciation represent considerable fixed and semi-fixed expenses, tied to fleet size and modernity. Airport and navigation charges are also key operational costs, with projections indicating an increase in 2025. Maintenance and IT expenses, including software licenses for systems like Amadeus and Salesforce, are critical for operational efficiency and customer experience.

| Cost Category | 2024 Impact/Strategy | 2025 Outlook |

|---|---|---|

| Fuel | Substantial, volatile; hedging used | Increased pressure due to SAF mandates |

| Personnel | Significant; sensitive to labor relations | Continued impact from agreements |

| Aircraft Leasing/Depreciation | Major fixed/semi-fixed costs; fleet management | Ongoing fleet renewal and optimization |

| Airport & Navigation Charges | Key operational costs | Projected increase |

| Maintenance & IT | Essential for safety and digital transformation | Continued investment in systems and upkeep |

Revenue Streams

Passenger ticket sales form the backbone of Finnair's revenue, covering a spectrum from economy to business class. In 2024, this core revenue stream is expected to remain stable compared to the previous year.

Looking ahead to 2025, Finnair projects its total revenue to fall between €3.3 billion and €3.4 billion. This growth is directly supported by an anticipated 10% increase in operational capacity.

Ancillary revenues represent a crucial and expanding income source for Finnair, encompassing charges for services beyond the standard ticket price. These include items like baggage allowances, preferred seat selections, in-flight dining options, and various upgrade packages.

In 2024, Finnair experienced a significant boost in this area, with ancillary revenues climbing by an impressive 23%. This growth was largely attributed to strategic reforms in their ticketing structure, making it easier for customers to add these value-added services.

The airline is actively working to further capitalize on these revenue streams by implementing modern retailing techniques. This involves leveraging data to create more personalized offers, aiming to increase the uptake of these additional services by matching them to individual customer preferences.

Finnair generates revenue by transporting cargo on its scheduled flights, effectively utilizing its strategic route network, especially between Europe and Asia. This cargo operation is a key contributor to the airline's overall financial performance, with growth observed in this segment.

The airline specializes in connecting cargo traffic across its extensive network, offering efficient transport solutions. In 2024, Finnair's cargo operations played a vital role in its revenue streams, demonstrating the importance of this service in its business model.

Loyalty Program (Avios) Sales and Redemptions

Finnair's loyalty program, Avios, is a significant revenue stream. This includes selling Avios to partners and managing the redemption process within the Finnair Plus ecosystem. The transition to Avios in early 2024, coupled with a revenue-based earning model, is designed to boost customer spending and engagement. This strategic shift aims to enhance overall profitability by encouraging greater participation and loyalty within the program.

The Avios system incentivizes customers to fly more and engage with partner offers. For instance, in 2024, Finnair's focus on a revenue-based earning model means that the more a customer spends on flights, the more Avios they earn. This directly links program activity to revenue generation, both from customer spending and from the sale of Avios to third-party partners who integrate them into their own loyalty schemes. This dual approach strengthens the program's financial contribution.

- Avios Sales to Partners: Revenue generated from selling Avios currency to co-brand credit card issuers, retail partners, and other businesses.

- Redemption Management Fees: Income derived from managing the redemption of Avios for flights, upgrades, and other benefits, potentially including fees or commissions.

- Increased Customer Spending: The revenue-based earning model incentivizes higher spending on Finnair flights and services to accumulate more Avios, directly boosting ticket sales.

- Partner Engagement: The program fosters deeper relationships with partners, leading to increased Avios sales and co-marketing opportunities.

Travel Services and Package Tours

Finnair's revenue stream extends beyond air travel to encompass comprehensive travel services and package tours. Through its Aurinkomatkat-Suntours brand, the airline offers bundled vacation experiences, effectively capturing a larger portion of the travel market by providing end-to-end solutions.

This strategic diversification into package tours allows Finnair to serve customers seeking a more complete travel arrangement. In 2024, revenue from these travel services saw a positive growth of 2%, indicating a healthy demand for their broader offerings.

- Diversified Revenue: Aurinkomatkat-Suntours provides package tours, broadening Finnair's revenue base.

- Market Capture: Offers comprehensive travel solutions beyond just flights.

- Growth in 2024: Travel services revenue increased by 2% in the year.

Finnair's revenue streams are diverse, ranging from core passenger ticket sales to ancillary services and cargo operations. In 2024, the airline is projecting total revenues between €3.3 billion and €3.4 billion, bolstered by a 10% increase in operational capacity. Ancillary revenues, including baggage, seat selection, and upgrades, saw a significant 23% jump in 2024 due to optimized ticketing structures.

The loyalty program, Avios, is a key revenue driver, generating income from partner sales and redemption management, with a new revenue-based earning model enhancing customer spending. Furthermore, Finnair's travel services division, particularly through its Aurinkomatkat-Suntours brand, contributed to revenue with a 2% growth in 2024, showcasing the success of diversified offerings.

| Revenue Stream | 2024 Impact/Projection | Key Drivers |

|---|---|---|

| Passenger Ticket Sales | Stable | Economy to Business Class offerings |

| Ancillary Revenues | +23% growth | Strategic ticketing reforms, personalized offers |

| Cargo Operations | Vital contributor | Europe-Asia network, efficient transport |

| Loyalty Program (Avios) | Enhancing spending & partner sales | Partner sales, redemption management, revenue-based earning model |

| Travel Services (Aurinkomatkat-Suntours) | +2% growth | Package tours, bundled vacation experiences |

Business Model Canvas Data Sources

The Finnair Business Model Canvas is informed by a blend of internal financial data, comprehensive market research on competitor strategies and customer needs, and insights from industry expert analyses. This multifaceted approach ensures the canvas accurately reflects Finnair's current operations and future strategic direction.