Finnair Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Finnair Bundle

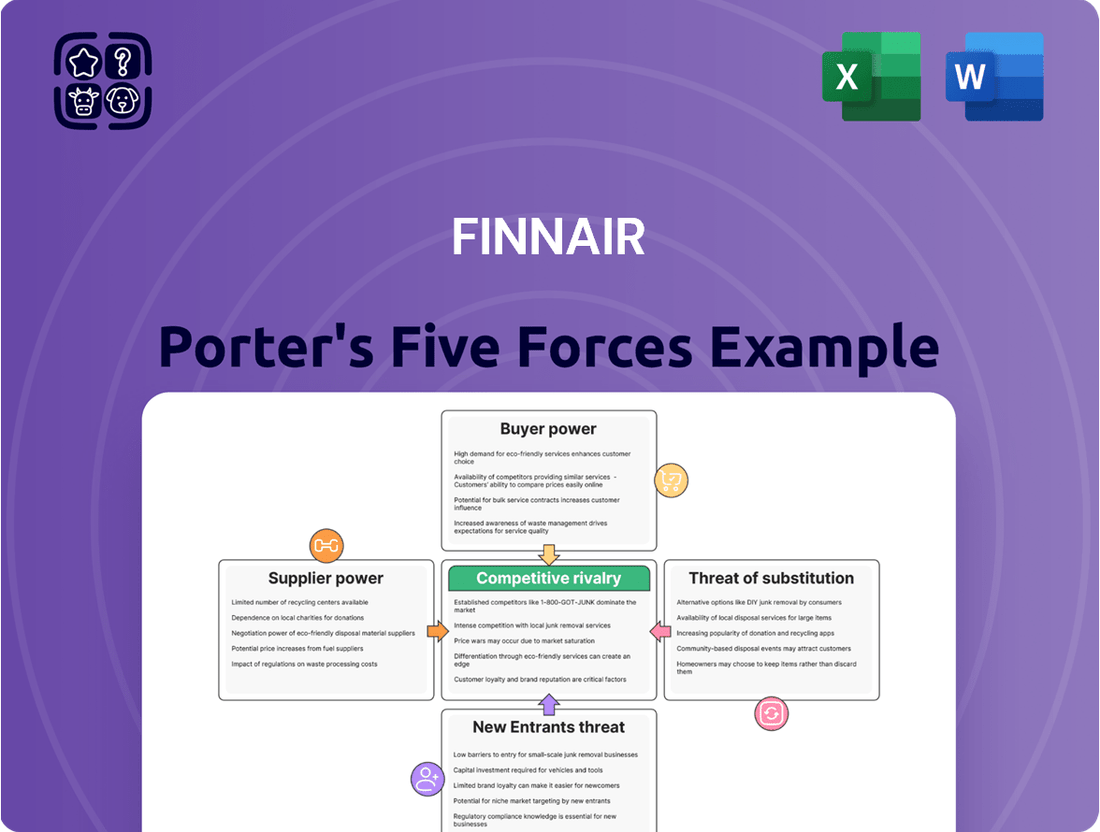

Finnair navigates a competitive aviation landscape, facing intense rivalry from established carriers and low-cost airlines alike. Understanding the bargaining power of its suppliers, from aircraft manufacturers to fuel providers, is crucial for cost management. The threat of new entrants, though high in capital requirements, remains a persistent consideration in the global aviation market.

The allure of substitute services, like high-speed rail or virtual conferencing, also presents a challenge to Finnair's core business. Furthermore, the collective bargaining power of Finnair's customers, influenced by price sensitivity and loyalty programs, significantly impacts pricing strategies and service offerings.

This snapshot offers a glimpse into the forces shaping Finnair's strategic environment. Unlock the full Porter's Five Forces Analysis to explore Finnair’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of engine suppliers for aircraft manufacturers like Finnair is substantial, primarily due to the highly concentrated nature of the global engine market. Major players such as General Electric (GE), Rolls-Royce, and Pratt & Whitney dominate this sector, creating an oligopoly where airlines have limited alternative options. This concentration grants these suppliers significant leverage in negotiations, impacting the overall cost structure for airlines.

For instance, the development and production of advanced aircraft engines require immense capital investment and specialized technological expertise, creating very high barriers to entry. This means that airlines like Finnair are often locked into long-term relationships with a few established engine manufacturers. The cost and complexity of switching engine suppliers, especially for a fleet, are prohibitive, further solidifying the suppliers' strong bargaining position and influencing fleet acquisition strategies.

Fuel suppliers wield significant bargaining power over Finnair due to the critical nature of jet fuel. This commodity represents a substantial portion of an airline's operating expenses, often fluctuating with global oil market dynamics. In 2024, jet fuel prices continued to be influenced by geopolitical tensions and supply chain constraints, directly impacting Finnair's cost structure.

Finnair has limited leverage to negotiate prices with its fuel suppliers, making it highly vulnerable to external economic shifts and political events. While sophisticated hedging strategies can offer some protection against price volatility, the airline’s fundamental reliance on these external providers for a core input remains a key determinant of its profitability.

Airports, particularly major hubs like Helsinki, wield significant bargaining power. This stems from their near-monopoly on essential services such as landing slots, ground handling, and vital infrastructure. For Finnair, whose strategy heavily relies on Helsinki as a crucial hub for its Europe-Asia routes, this dependency translates into considerable influence for airport authorities.

Finnair's dependence on Helsinki Airport for critical operations, including air traffic control and maintenance, amplifies the airport's supplier power. The limited availability of alternative hubs for such extensive operations means Finnair has few options to negotiate terms, making it susceptible to airport-imposed fees and regulations.

In 2023, Helsinki Airport reported handling approximately 16.4 million passengers, underscoring its importance as a gateway. While specific figures for Finnair's operational costs related to airport services are not publicly disclosed, the airline's reliance on this single hub for a substantial portion of its network inherently grants the airport a strong negotiating position.

MRO (Maintenance, Repair, and Overhaul) Providers

Specialized MRO services for aircraft and engines demand rigorous certifications, deep expertise, and specialized equipment. This often leaves airlines reliant on a select group of approved providers or directly on aircraft manufacturers, significantly increasing supplier bargaining power. For instance, the global aviation MRO market was valued at approximately $85 billion in 2023 and is projected to grow, highlighting the critical nature of these services.

The inherent complexity and safety-critical aspect of aircraft maintenance mean that quality and regulatory compliance are non-negotiable. This gives MRO suppliers considerable leverage when negotiating pricing and service level agreements. Airlines cannot easily switch providers without incurring substantial costs and potential operational disruptions, further solidifying the suppliers' position.

- High switching costs: Airlines face significant costs and delays when changing MRO providers due to requalification processes and specialized tooling.

- Limited supplier base: For specific aircraft models or complex engine types, the number of certified and capable MRO providers can be very small.

- Criticality of service: Aircraft safety and operational continuity depend heavily on the quality and reliability of MRO services, reducing an airline's ability to negotiate on price alone.

- Manufacturer dominance: Original Equipment Manufacturers (OEMs) often control proprietary parts and technical data, giving them a strong hand in MRO pricing and terms.

IT and Technology Providers

IT and technology providers hold considerable sway over airlines like Finnair. Airlines depend on intricate IT systems for everything from booking flights to managing operations and keeping customers happy. Companies offering these specialized software and tech infrastructure, like global distribution systems (GDS), often wield significant bargaining power. This is because their solutions are deeply integrated and often proprietary, making it incredibly difficult and expensive for an airline to switch to a different provider. For instance, Amadeus, a leading GDS provider, processed transactions worth billions in 2023, highlighting the scale of these essential services.

The high cost and complexity of switching these core IT systems mean airlines face substantial switching costs. This entrenches the position of existing IT suppliers. Finnair, like many carriers, invests heavily in its IT infrastructure, making the prospect of a complete overhaul daunting. The integration of new systems can take years and millions of dollars, further solidifying the bargaining power of current technology partners.

- High Integration Costs: Implementing new IT systems involves significant expenses in terms of software, hardware, customization, and training, creating a barrier to switching.

- Proprietary Nature of Solutions: Many critical airline IT solutions are developed with unique architecture, making them difficult to replace with off-the-shelf alternatives.

- Switching Disruption: A change in IT providers can disrupt flight operations, ticketing, and customer service, posing a direct threat to an airline's revenue and reputation.

- Limited Number of Specialized Providers: The market for highly specialized airline IT solutions is often dominated by a few key players, reducing competition and increasing supplier leverage.

The bargaining power of suppliers for Finnair is generally high across several critical areas. This strength stems from the concentrated nature of key markets, high switching costs for airlines, and the essential nature of the goods and services provided. For instance, the global aircraft engine market is dominated by a few major players like GE and Rolls-Royce, creating an oligopoly that grants them significant pricing power.

Fuel suppliers also exert considerable influence, as jet fuel constitutes a major operating expense for airlines, and its price is subject to volatile global oil markets. Furthermore, airports, particularly major hubs like Helsinki, hold substantial leverage due to their control over vital infrastructure and landing slots, with Finnair’s strategy heavily reliant on its Helsinki hub.

The need for specialized and certified maintenance, repair, and overhaul (MRO) services, along with complex IT systems, further entrenches supplier power. These sectors often have a limited number of qualified providers, and the cost and operational disruption associated with switching are prohibitive, leaving airlines like Finnair with less room for negotiation.

| Supplier Category | Key Suppliers (Examples) | Factors Contributing to Bargaining Power | Impact on Finnair |

|---|---|---|---|

| Aircraft Engines | General Electric (GE), Rolls-Royce, Pratt & Whitney | Highly concentrated market (oligopoly), high R&D costs, high switching costs for airlines | Significant influence on aircraft acquisition costs and operational expenses. |

| Jet Fuel | Major oil companies and distributors | Commodity with volatile pricing, critical input for operations, limited substitution | Direct impact on operating costs and profitability; vulnerability to geopolitical events. |

| Airport Services | Helsinki Airport, other major hub operators | Near-monopoly on essential services (slots, ground handling), critical infrastructure | Finnair’s reliance on Helsinki as a hub gives airports significant leverage on fees and regulations. |

| MRO Services | OEMs, specialized MRO providers | High technical expertise required, strict certification, high switching costs, proprietary data | Limited negotiation power on pricing and terms for critical maintenance. |

| IT & Technology | Amadeus, Sabre (GDS providers), IT infrastructure firms | Proprietary solutions, high integration costs, risk of operational disruption from switching | Entrenched relationships due to complexity and cost of IT system changes. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Finnair's operational context and strategic positioning.

Understand how Finnair's Porter's Five Forces analysis instantly highlights competitive pressures, allowing for proactive strategy adjustments.

Customers Bargaining Power

Leisure travelers are highly attuned to price, often choosing the most affordable option regardless of brand or specific flight details, especially for non-urgent trips. This price sensitivity significantly amplifies their bargaining power.

The widespread availability of online travel agencies and fare comparison tools empowers leisure travelers to easily pinpoint the lowest prices, intensifying competition among airlines like Finnair.

In 2024, the average airfare for leisure travel saw fluctuations, with some routes experiencing price drops of up to 15% due to increased competition and traveler demand for value.

Finnair needs to maintain a competitive pricing strategy for routes heavily frequented by leisure travelers to capture market share and avoid losing customers to lower-cost alternatives.

Customers now have extensive access to flight details, live pricing, and rival deals via numerous online channels. This heightened transparency allows consumers to swiftly compare choices, thereby bolstering their leverage to negotiate for competitive fares and superior service. For instance, in 2024, comparison sites like Skyscanner and Google Flights processed billions of searches, making it easier than ever for travelers to find the best value.

This ease of comparison directly translates into increased bargaining power for customers. They can readily identify price disparities and service differences between Finnair and its competitors, forcing Finnair to remain highly competitive on both fronts. Airlines that fail to monitor and respond to market pricing, such as offering fewer flexible booking options or higher baggage fees compared to peers, risk losing market share to more transparently priced carriers.

Customers often have numerous choices for flights, whether it's full-service carriers, budget airlines, or even different travel paths. This wide selection, especially on popular European and some longer journeys, really strengthens the customer's hand. For instance, in 2024, the European short-haul market saw numerous carriers like Ryanair and EasyJet offering competitive pricing, directly impacting traditional airlines' pricing power.

Impact of Loyalty Programs and Service Differentiation

While customers in the airline industry typically wield significant bargaining power, Finnair employs strategies to mitigate this. Its loyalty program, Finnair Plus, incentivizes repeat business, encouraging frequent flyers to accumulate points and enjoy exclusive benefits, which can make them less sensitive to price differences with competitors. This focus on rewarding loyalty aims to create stickiness, even when cheaper alternatives are available.

Furthermore, Finnair's commitment to differentiating its service offering plays a crucial role. By emphasizing a high standard of customer service, including aspects like onboard experience and digital offerings, the airline seeks to build brand loyalty that transcends mere price competition. This service differentiation is designed to cultivate a customer base that values the overall travel experience, thereby reducing their inclination to switch based solely on cost.

- Loyalty Program Impact: In 2023, Finnair reported a continued strong engagement with its Finnair Plus loyalty program, with a notable percentage of its passenger base being active members, indicating a solid foundation for customer retention.

- Service Differentiation Efforts: Finnair has been investing in enhancing its digital customer journey and onboard product, aiming to deliver a premium experience that stands out in a competitive market.

- Customer Retention Focus: By fostering loyalty through programs and service quality, Finnair aims to reduce the direct price sensitivity of its customer base, a key factor in managing customer bargaining power.

Business Traveler Demands

Business travelers, a key demographic for airlines like Finnair, exert significant bargaining power due to their specific needs and expectations. While less sensitive to minor price fluctuations than leisure travelers, they demand unwavering reliability and premium services, making them a discerning customer base. For instance, in 2024, corporate travel budgets often prioritize efficiency and connectivity, meaning airlines that falter in these areas risk losing substantial business. Finnair's strategy to cater to this segment necessitates a constant focus on service excellence, ensuring seamless connections and comfortable travel experiences to maintain loyalty among these high-value clients.

Corporate travel policies and negotiated agreements with preferred airlines further concentrate bargaining power. These arrangements can dictate which airlines receive the bulk of a company's travel spending, giving large corporate clients considerable leverage. This means that even individual business travelers, while seeking personal comfort, are often bound by their employer's procurement decisions. Finnair must therefore not only satisfy the individual traveler but also secure favorable corporate partnerships to solidify its position in this lucrative market segment.

- High Demand for Flexibility: Business travelers often require last-minute booking capabilities and the ability to change flights without penalty.

- Reliability is Paramount: On-time performance and minimal disruptions are critical, as delays directly impact productivity and client meetings.

- Premium Service Expectations: This includes access to business lounges, comfortable seating, in-flight Wi-Fi, and efficient boarding processes.

- Corporate Travel Policies: Many companies have preferred airline agreements, consolidating purchasing power and influencing airline choices.

Customers in the airline industry, particularly leisure travelers, possess substantial bargaining power due to price sensitivity and easy access to comparative information. This allows them to readily switch to competitors offering lower fares, forcing airlines like Finnair to maintain competitive pricing. For example, in 2024, the proliferation of online travel agencies and fare comparison tools intensified competition, with some routes seeing price drops of up to 15% as airlines vied for value-conscious passengers.

Business travelers also wield significant influence, driven by demands for reliability, flexibility, and premium services, alongside corporate travel policies that consolidate purchasing power. While less price-sensitive than leisure flyers, their need for seamless travel and connectivity means airlines must consistently deliver on service expectations to retain their business. In 2024, corporate travel budgets prioritized efficiency, making airlines that ensured punctuality and offered robust digital connectivity more attractive.

| Customer Segment | Bargaining Power Drivers | Finnair's Mitigation Strategies | 2024 Data/Trend |

|---|---|---|---|

| Leisure Travelers | High price sensitivity, abundant comparison tools, numerous carrier options | Competitive pricing, loyalty program (Finnair Plus), service differentiation | Up to 15% price drops on some routes due to competition; billions of searches on comparison sites |

| Business Travelers | Demand for reliability, flexibility, premium services; corporate travel policies | Focus on service excellence, seamless connections, catering to corporate partnerships | Prioritization of efficiency and connectivity in corporate travel budgets |

Full Version Awaits

Finnair Porter's Five Forces Analysis

This preview showcases the complete Finnair Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the airline industry. You are looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, detailing threats from new entrants, bargaining power of buyers and suppliers, and the intensity of existing rivalry. This comprehensive report is professionally formatted and ready for immediate use, providing valuable strategic insights for understanding Finnair's competitive landscape.

Rivalry Among Competitors

The airline sector is notoriously competitive on price, particularly for high-demand routes. This constant pressure on ticket prices directly impacts airlines' ability to generate strong yields and maintain healthy profit margins. Finnair is no exception, feeling the heat from both established full-service carriers and aggressive low-cost airlines vying for market share.

High fixed operating costs, such as aircraft maintenance and labor, compel airlines to fill as many seats as possible. This urgency, combined with the fact that an unsold seat on a flight is lost revenue forever, fuels aggressive pricing strategies. For instance, in 2024, the average fare for a round-trip flight between Helsinki and London, a key Finnair route, saw significant fluctuations driven by competitor pricing, often falling below €100 during off-peak periods.

Finnair faces intense competition from major global carriers such as Lufthansa, SAS, Turkish Airlines, Qatar Airways, and Emirates, especially on its crucial Europe-Asia routes. These established players often boast larger fleets, more extensive route networks, and significantly larger marketing war chests, creating a formidable competitive landscape.

For instance, Lufthansa, a key competitor, reported a revenue of €36.57 billion for 2023, highlighting its substantial scale. Similarly, Emirates, a major force in long-haul travel, operates a massive fleet of wide-body aircraft, enabling it to connect a vast number of global destinations efficiently.

Finnair's strategy to counter this involves capitalizing on its strategic Helsinki hub, offering a shorter and more convenient transit point between Europe and Asia. The airline also focuses on delivering high-quality service and a distinct Nordic travel experience as key differentiators.

The European aviation landscape has seen a dramatic rise in low-cost carriers (LCCs) like Ryanair and EasyJet, intensifying competition, particularly on shorter flight paths. These LCCs often provide a more basic, budget-friendly option for travelers.

While Finnair is known for its long-haul services, it relies on numerous European short-haul routes to feed passengers into its hub. These routes are directly challenged by the no-frills offerings of LCCs.

For instance, in 2024, LCCs continued to capture a significant share of the European short-haul market, with Ryanair alone operating over 2,300 routes. This competitive pressure compels Finnair to carefully manage its pricing and service levels on these crucial feeder segments.

The presence of LCCs forces Finnair to differentiate its short-haul product, balancing cost competitiveness with its full-service brand promise to retain passengers.

High Fixed Costs and Capacity Management

Airlines, including Finnair, shoulder immense fixed costs for aircraft, maintenance, and staffing. These significant overheads create a powerful pressure to fill every available seat, driving intense competition.

This constant need to maximize load factors often leads to periods of overcapacity within the industry. Consequently, airlines resort to aggressive pricing tactics, further fueling the rivalry and impacting profitability for all players.

Efficiently managing capacity is therefore not just a strategic advantage but a critical determinant of Finnair's financial success in this highly competitive environment.

- High Fixed Costs: Aircraft acquisition and maintenance represent substantial capital outlays for airlines.

- Incentive to Fill Seats: High fixed costs incentivize airlines to operate at high load factors to spread costs.

- Capacity Management: Finnair's profitability hinges on its ability to effectively manage its fleet capacity.

- Aggressive Pricing: Overcapacity often triggers price wars, intensifying competition.

Strategic Alliances and Network Competition

Airlines frequently forge strategic alliances, such as Oneworld, Star Alliance, and SkyTeam, to broaden their reach and provide customers with integrated travel experiences. Finnair, by being part of Oneworld, gains advantages but simultaneously faces competition from the consolidated networks and services of rival alliances. This competition transcends individual flight paths, encompassing entire global networks and the collective strength of alliance members.

The intense rivalry among these global airline alliances means Finnair must continuously innovate and optimize its offerings to remain competitive. For instance, as of early 2024, Oneworld, Finnair's alliance, serves over 1,000 destinations across 170 territories. This broad network directly competes with Star Alliance, which boasts around 1,300 airports in 190 countries, and SkyTeam, connecting passengers to over 1,000 destinations. The strategic advantages derived from these alliances, like code-sharing agreements and reciprocal loyalty program benefits, amplify the competitive pressures on individual carriers.

- Network Strength: Finnair's Oneworld membership allows it to tap into a vast global network, offering passengers more travel options through partner airlines.

- Alliance Competition: The primary competitive threat comes from the combined strength and reach of other major airline alliances like Star Alliance and SkyTeam.

- Customer Loyalty: Competition extends to customer loyalty, with airlines and alliances vying for passengers through frequent flyer programs and service consistency.

- Global Reach: Finnair competes not just on specific routes but against the aggregated global network capabilities of its rivals' alliances.

The competitive rivalry within the airline industry is exceptionally fierce, driven by high fixed costs and the perishable nature of airline seats, forcing airlines to aggressively price their offerings. Finnair faces pressure from legacy carriers like Lufthansa and Turkish Airlines, which boast larger networks and resources, as well as disruptive low-cost carriers such as Ryanair on short-haul routes. Furthermore, competition extends to strategic alliances, where Finnair's Oneworld membership competes against the broader reach of Star Alliance and SkyTeam, impacting customer loyalty and global connectivity.

| Competitor Type | Key Players | Impact on Finnair | Example Data (2024/2023) |

|---|---|---|---|

| Legacy Carriers | Lufthansa, SAS, Turkish Airlines | Direct competition on price and network for long-haul routes. | Lufthansa Revenue (2023): €36.57 billion. |

| Low-Cost Carriers (LCCs) | Ryanair, EasyJet | Pressure on short-haul routes, impacting feeder traffic. | Ryanair operates >2,300 routes (2024). |

| Airline Alliances | Star Alliance, SkyTeam | Competition for global reach, customer loyalty via frequent flyer programs. | Oneworld serves >1,000 destinations (early 2024). |

SSubstitutes Threaten

High-speed rail presents a significant threat to Finnair's short-haul European routes. For journeys under 500 kilometers, rail often matches or beats flight times when city-center to city-center travel is considered, especially factoring in airport transit and security. In 2023, European high-speed rail networks saw a notable increase in passenger numbers, with some routes experiencing double-digit growth, directly impacting short-haul airline demand.

The environmental appeal of rail is a growing factor for travelers. Many passengers are actively seeking lower-carbon travel options, and high-speed rail typically boasts a considerably smaller carbon footprint per passenger kilometer compared to air travel. This trend is likely to accelerate as sustainability becomes an even more critical decision-making criterion for both corporate and leisure travelers in 2024 and beyond.

Furthermore, the convenience of direct city-center access offered by high-speed rail eliminates the need for often time-consuming and costly transfers to and from airports located on city outskirts. This seamless experience enhances the value proposition of rail, making it a more attractive alternative for many travelers on competitive intra-European corridors.

The increasing sophistication of virtual communication tools and the widespread adoption of remote work models directly challenge the traditional need for business travel. Companies are increasingly substituting in-person meetings with virtual alternatives like Zoom or Microsoft Teams. For example, a 2024 survey indicated that 75% of businesses now regularly use video conferencing for internal meetings, and a significant portion also use it for client interactions.

This shift directly impacts airlines like Finnair, particularly their high-yield business class segments, as fewer trips are deemed essential. The normalization of remote collaboration means that face-to-face interactions, once a primary driver of air travel demand, are being replaced by digital solutions. This trend is expected to persist, representing a substantial long-term threat to revenue streams dependent on business travel.

For shorter regional trips, particularly within Finland or to nearby countries, cars and buses present a compelling alternative to air travel. These ground transportation options are frequently more budget-friendly and can offer greater convenience for door-to-door journeys, potentially drawing passengers away from Finnair's shorter routes.

While not a direct threat to Finnair's long-haul operations, the appeal of car and bus travel can still impact demand for domestic and very short international flights. In 2023, the European automotive sector saw continued recovery, with car sales increasing by 10% compared to 2022, indicating a robust market for personal and shared vehicle use for regional travel.

The cost savings associated with driving or taking a bus, especially for solo travelers or small groups, can be significant. Factors like fuel prices and parking availability at airports further influence this decision, making ground transport an attractive substitute for certain segments of Finnair's customer base.

Cruise Ships for Leisure Travel (Specific Routes)

For specific leisure travel segments, particularly those focused on scenic routes or destinations like the Baltic or Nordic regions, cruise ships present a viable substitute for air travel. While not a direct competitor for typical point-to-point flights, cruises offer an alternative vacation experience that can draw potential passengers away from airlines. This represents a niche, yet tangible, threat for certain leisure travel markets.

The appeal of a cruise lies in its all-inclusive nature and the opportunity to visit multiple destinations without the hassle of repeated packing and unpacking, which can be particularly attractive for certain demographics. For instance, the European cruise market saw a significant rebound post-pandemic, with over 30 million passenger journeys recorded in 2023, indicating a strong consumer appetite for this mode of travel.

- Alternative Experience: Cruises offer a distinct vacation experience, combining travel with accommodation and entertainment, which can appeal to travelers seeking relaxation and a varied itinerary over faster, point-to-point flights.

- Destination Overlap: For popular tourist regions like the Baltic Sea or the Norwegian fjords, cruise itineraries often mirror or complement popular flight-accessible destinations, creating direct substitution possibilities.

- Market Segment: This threat is most pronounced in the leisure travel segment, especially for longer vacation periods where the perceived value of a cruise's comprehensive offering outweighs the time savings of air travel.

- Niche but Present: While not a broad threat across all air travel, for Finnair's specific routes and customer base interested in these types of destinations, cruise ships are a relevant alternative that warrants consideration in strategic planning.

Environmental Concerns and 'Flight Shaming'

Growing environmental awareness, particularly the concept of 'flight shaming,' presents a significant threat of substitutes for airlines like Finnair. This trend, more pronounced in regions like Europe, is influencing consumer choices, pushing travelers towards lower-emission alternatives. For instance, by 2024, the European Environment Agency reported that rail transport often emits significantly less CO2 per passenger-kilometer compared to air travel, making it an increasingly attractive substitute for shorter to medium-haul journeys.

These evolving consumer preferences necessitate that Finnair actively address sustainability. The airline's commitment to reducing its environmental impact, through investments in more fuel-efficient aircraft and exploring sustainable aviation fuels, is crucial to mitigating this threat. Indeed, Finnair's 2024 sustainability report highlighted their progress in optimizing flight routes and reducing fuel burn, a key strategy to counter the appeal of rail and other substitutes.

- Growing Environmental Scrutiny: Increasing public and regulatory pressure on the aviation industry's carbon footprint.

- Rise of Sustainable Alternatives: Enhanced viability and appeal of high-speed rail and other lower-emission transport modes.

- Consumer Behavior Shift: A notable segment of travelers, especially in Europe, actively seeking eco-friendly travel options.

- Finnair's Mitigation Strategy: Investment in fleet modernization, sustainable aviation fuels, and operational efficiencies to retain market share.

The threat of substitutes for Finnair is multifaceted, primarily stemming from ground transportation and evolving travel preferences. High-speed rail offers a compelling alternative for short to medium-haul European routes, often matching flight times when city-center to city-center travel is considered. In 2023, European rail networks saw a significant uptick in passenger numbers, with some routes experiencing double-digit growth, directly impacting short-haul airline demand.

Furthermore, the growing environmental consciousness among travelers is a key driver. Many consumers are actively seeking lower-carbon travel options, and high-speed rail typically boasts a considerably smaller carbon footprint per passenger kilometer compared to air travel. This trend is expected to accelerate, making rail increasingly attractive for both business and leisure trips within Europe. For instance, by 2024, the European Environment Agency reported that rail transport often emits significantly less CO2 per passenger-kilometer compared to air travel.

Virtual communication tools and the normalization of remote work models also present a threat, particularly to business travel. Companies are increasingly substituting in-person meetings with virtual alternatives, reducing the necessity for air travel. A 2024 survey indicated that 75% of businesses regularly use video conferencing for internal meetings, and a significant portion also use it for client interactions, impacting Finnair's high-yield business class segments.

Cars and buses serve as viable substitutes for shorter regional trips, offering budget-friendly and convenient door-to-door travel. The European automotive sector’s recovery, with car sales increasing by 10% in 2023 compared to 2022, highlights the robust market for personal and shared vehicle use for regional travel. Cruise ships also represent a niche but relevant threat for specific leisure travel segments, offering a distinct vacation experience in popular tourist regions.

| Substitute | Affected Routes | Key Advantages | 2023/2024 Data Point |

|---|---|---|---|

| High-Speed Rail | Short to Medium-haul European | City-center access, lower carbon footprint | Double-digit growth in passenger numbers on some routes |

| Virtual Communication | Business Travel | Cost savings, reduced travel necessity | 75% of businesses regularly use video conferencing |

| Cars & Buses | Domestic & Short Regional | Cost-effectiveness, door-to-door convenience | 10% increase in European car sales (2023) |

| Cruise Ships | Leisure Travel (specific regions) | All-inclusive experience, multi-destination appeal | Over 30 million passenger journeys in European cruise market (2023) |

Entrants Threaten

Establishing an airline, particularly a full-service international carrier like Finnair, demands a colossal amount of capital. Think about the sheer cost of acquiring a fleet of modern aircraft, building and maintaining extensive maintenance facilities, and setting up the complex operational infrastructure needed to run global routes. These immense financial hurdles act as a powerful deterrent for any new player looking to enter the market.

The financial barrier to entry is truly staggering. Just to give you an idea, a single new wide-body aircraft can cost upwards of $300 million, and airlines need dozens, if not hundreds, of these. Add to that the ongoing expenses for fuel, staffing, airport fees, and regulatory compliance, and the initial investment required to even get off the ground is astronomical.

For instance, in 2024, the global aviation industry continued to see significant investment in fleet renewal and expansion. Major airlines are committing billions to new aircraft orders, underscoring the immense capital requirements. This means potential new entrants must have access to substantial funding just to compete on a basic level, making it incredibly difficult to break into the established airline landscape.

The airline industry presents formidable barriers to entry, particularly due to stringent regulatory hurdles and rigorous safety standards. National and international authorities impose complex licensing requirements, air traffic control regulations, and demanding safety protocols that new entrants must meticulously navigate. For instance, obtaining an Air Operator Certificate (AOC) is a lengthy and costly undertaking, often taking years and significant investment. In 2024, the European Union Aviation Safety Agency (EASA) continues to enforce some of the world's most comprehensive safety oversight systems, meaning any new airline seeking to operate within its airspace faces extensive scrutiny and compliance demands, adding substantial upfront costs and time delays.

Limited access to airport slots and infrastructure presents a significant threat to new entrants in the airline industry, particularly for carriers like Finnair Porter. Major airports, especially crucial hubs like Helsinki, frequently have constrained availability of landing and take-off slots. These slots are absolutely essential for any airline aiming to build a functional and competitive flight schedule.

Established airlines often possess preferential rights or have secured long-term leases on these valuable slots and gate facilities. This makes it exceedingly challenging for newcomers to obtain prime operating times or even basic ground support. For instance, in 2024, Helsinki Airport (HEL) continued to experience high demand for slots, with a significant portion already allocated to incumbent carriers, reinforcing this barrier.

Strong Brand Loyalty and Established Networks

Finnair, like many established carriers, benefits from deeply entrenched brand loyalty and extensive customer networks. This means travelers often stick with airlines they know and trust, especially for frequent flyer programs that offer tangible rewards. For instance, as of early 2024, Finnair’s Plus program boasts millions of members, showcasing a significant existing customer base that new airlines would struggle to attract quickly.

The sheer investment and time required to build a comparable global distribution system and brand reputation present a formidable barrier. New entrants face the hurdle of establishing partnerships with travel agents, online booking platforms, and other airlines for codeshare agreements, a process that can take years. This established infrastructure and recognized brand equity makes it difficult for newcomers to gain immediate traction and compete on a level playing field.

- Brand Recognition: Finnair’s long history and consistent service have cultivated strong brand recognition, leading to customer preference.

- Loyalty Programs: Extensive membership in loyalty programs like Finnair Plus creates significant switching costs for customers.

- Distribution Networks: Established relationships with travel agencies and online platforms are crucial for reaching customers, a network new entrants must painstakingly build.

- Time and Investment: Replicating Finnair’s brand and network requires substantial capital and years of operational experience.

Economies of Scale and Experience Curve Effects

Existing airlines, like Finnair, leverage significant economies of scale. This allows them to negotiate better prices for fuel, maintenance, and even marketing campaigns. For instance, a larger fleet means bulk purchasing power, driving down per-unit costs.

The experience curve effect also plays a crucial role. Over years of operation, airlines refine their processes, optimize routes, and improve aircraft utilization. This accumulated knowledge translates into greater efficiency and lower operating expenses compared to newcomers.

New entrants face a substantial hurdle in matching these efficiencies. They start with higher per-unit costs and must navigate a steep learning curve to optimize operations. This initial disadvantage makes achieving profitability quickly a significant challenge.

- Economies of Scale: Lower per-unit costs for fuel, maintenance, and marketing due to larger operational volume.

- Experience Curve: Accumulated knowledge leading to optimized routes, improved aircraft utilization, and greater overall efficiency.

- New Entrant Disadvantage: Higher initial operating costs and a steeper learning curve, hindering rapid profitability.

- Competitive Barrier: These factors create a strong barrier to entry, making it difficult for new airlines to compete effectively with established players.

The threat of new entrants for Finnair is significantly mitigated by the industry's high capital requirements, stringent regulatory landscape, and established brand loyalty. These factors create substantial barriers, making it exceptionally difficult for newcomers to challenge established players like Finnair. The sheer investment in aircraft, operational infrastructure, and navigating complex regulations, coupled with the need to build customer trust and loyalty programs, presents a formidable challenge.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | Immense cost of aircraft, facilities, and operations. | Deters entry due to prohibitive upfront investment. | New wide-body aircraft can exceed $300 million; fleet renewal investments by major airlines in billions. |

| Regulatory Hurdles | Complex licensing, safety standards, and compliance. | Time-consuming and costly to meet requirements. | Obtaining an Air Operator Certificate (AOC) takes years; EASA's comprehensive safety oversight. |

| Brand Loyalty & Networks | Established customer base and loyalty programs. | Difficult to attract customers away from trusted brands. | Finnair Plus membership in the millions; need to build distribution networks over years. |

| Economies of Scale & Experience | Lower costs due to volume and operational efficiency. | New entrants start with higher costs and a learning curve. | Established carriers benefit from bulk purchasing power and optimized operations. |

Porter's Five Forces Analysis Data Sources

Our Finnair Porter's Five Forces analysis leverages data from Finnair's annual reports and investor relations website, alongside industry publications like FlightGlobal and CAPA. We also incorporate regulatory filings and economic data from sources like Eurostat to provide a comprehensive view of the competitive landscape.