Financial Institutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financial Institutions Bundle

Navigate the complex external forces shaping the financial sector with our comprehensive PESTLE analysis of Financial Institutions. Understand the political, economic, social, technological, legal, and environmental factors that are critical for success in today's dynamic market. This analysis provides actionable intelligence to empower your strategic planning and decision-making.

Unlock a deeper understanding of the opportunities and threats impacting Financial Institutions. Our expertly crafted PESTLE analysis is your essential guide to staying ahead of industry trends and making informed choices. Purchase the full version to gain the competitive edge you need.

Political factors

Regulatory stability is a cornerstone for financial institutions. In 2024, the global financial sector continued to navigate a complex web of regulations, with a focus on areas like digital asset oversight and climate-related financial disclosures. For instance, the European Union's Markets in Financial Instruments Directive (MiFID II) and its ongoing reviews demonstrate a commitment to market transparency and investor protection, directly influencing how financial institutions operate and manage compliance. A predictable environment, free from sudden, drastic policy shifts, allows for robust long-term planning and investment in new technologies, ultimately bolstering confidence among stakeholders.

Central banks' decisions on interest rates, quantitative easing (QE), and inflation targets are pivotal for financial institutions like Financial Institutions Inc. For instance, the Federal Reserve's stance on interest rates directly impacts the profitability of lending activities and the valuation of investment portfolios. As of early 2024, the market is closely watching for potential rate cuts by major central banks, which could stimulate loan demand but also compress net interest margins.

Government fiscal policies, such as taxation and public spending, directly shape the economic landscape for financial institutions. For instance, the United States' federal budget deficit was projected to reach $1.8 trillion in fiscal year 2025, impacting overall economic stability and influencing interest rate environments. Changes in corporate tax rates, like potential adjustments following the 2025 fiscal year, can significantly alter the net profitability and strategic investment decisions of financial holding companies.

Public spending initiatives, particularly those directed towards infrastructure or technology, can create new opportunities for lending and investment for financial institutions. Conversely, shifts in government spending priorities or increases in budget deficits can lead to higher borrowing costs for businesses and consumers, affecting loan demand and asset quality. The Federal Reserve's monetary policy, often intertwined with fiscal policy, also plays a crucial role; in early 2024, the Fed maintained interest rates, providing a degree of predictability for financial institutions while signaling potential future adjustments based on economic data.

Geopolitical Risks and International Relations

Global political stability remains a critical concern for financial institutions. Shifting alliances and ongoing international conflicts, such as those impacting Eastern Europe and the Middle East, inject significant uncertainty into financial markets. For instance, the ongoing tensions in Eastern Europe, which began in early 2022, continued to influence energy prices and global trade flows throughout 2023 and into early 2024, creating a volatile environment for investment management.

Trade agreements, or the lack thereof, also play a pivotal role. The renegotiation of trade deals and the imposition of tariffs can disrupt supply chains and impact cross-border financial flows. In 2024, many nations are still navigating the complexities of post-pandemic trade realignments, with discussions around digital trade agreements and supply chain resilience taking center stage, directly affecting how institutions like Financial Institutions Inc. manage international investments and banking operations.

International conflicts directly translate to market volatility. Currency fluctuations are often a primary consequence, as capital seeks safer havens. For example, the heightened geopolitical risk in the Middle East in late 2023 and early 2024 led to increased demand for the US dollar and gold, while other currencies experienced significant depreciation, impacting the value of international portfolios.

Financial Institutions Inc. must actively monitor these geopolitical risks. Their diverse services, spanning investment management and banking, are exposed to these global shifts. The firm's ability to adapt its strategies based on an evolving geopolitical landscape is crucial for maintaining portfolio stability and ensuring the health of its banking operations amidst potential economic disruptions.

- Market Volatility: Geopolitical events can trigger rapid stock market swings. For example, a major international incident in early 2024 could see global equity indices drop by 2-3% within a single trading session.

- Currency Fluctuations: The US Dollar Index (DXY) often strengthens during periods of global uncertainty, impacting the value of foreign investments for institutions holding assets denominated in other currencies.

- Supply Chain Disruptions: Geopolitical tensions can lead to shipping delays or increased costs, affecting corporate earnings and the performance of companies reliant on global logistics.

- Investment Portfolio Impact: For Financial Institutions Inc., a conflict in a key commodity-producing region could affect the value of holdings in energy or mining sectors, necessitating portfolio rebalancing.

Political Stability and Governance

Political stability is a cornerstone for Financial Institutions Inc.'s sustained growth. Regions with predictable governance and consistent policy frameworks offer a more secure environment for operations and investment, minimizing unforeseen risks.

Conversely, instability can significantly hamper financial sector operations. For instance, in 2024, countries experiencing heightened political turmoil saw a marked decrease in foreign direct investment in their financial services sectors, with some reporting drops exceeding 15% compared to the previous year.

Strong governance also translates to a more robust regulatory environment, which is crucial for financial institutions. Effective legal systems and transparent enforcement of regulations build investor confidence. In 2024, the World Bank's Governance Indicators showed that countries with higher scores in regulatory quality and rule of law attracted, on average, 20% more capital into their banking systems.

- Political stability reduces policy uncertainty, creating a predictable operating environment for financial institutions.

- Political instability can deter investment and elevate operational risks, impacting profitability and expansion plans.

- Effective governance and strong rule of law are directly linked to increased capital inflows into the financial sector.

- Government policies regarding financial regulation and market access are critical determinants of a financial institution's strategic options.

Government policies and political stability profoundly shape the financial landscape. In 2024, regulatory shifts, such as the ongoing implementation of new digital asset frameworks by various global regulators, directly influence how financial institutions operate, manage risk, and innovate. For example, the Financial Stability Board's recommendations for crypto-asset regulation are being actively considered by G20 nations, signaling a coordinated approach that will impact cross-border financial activities.

What is included in the product

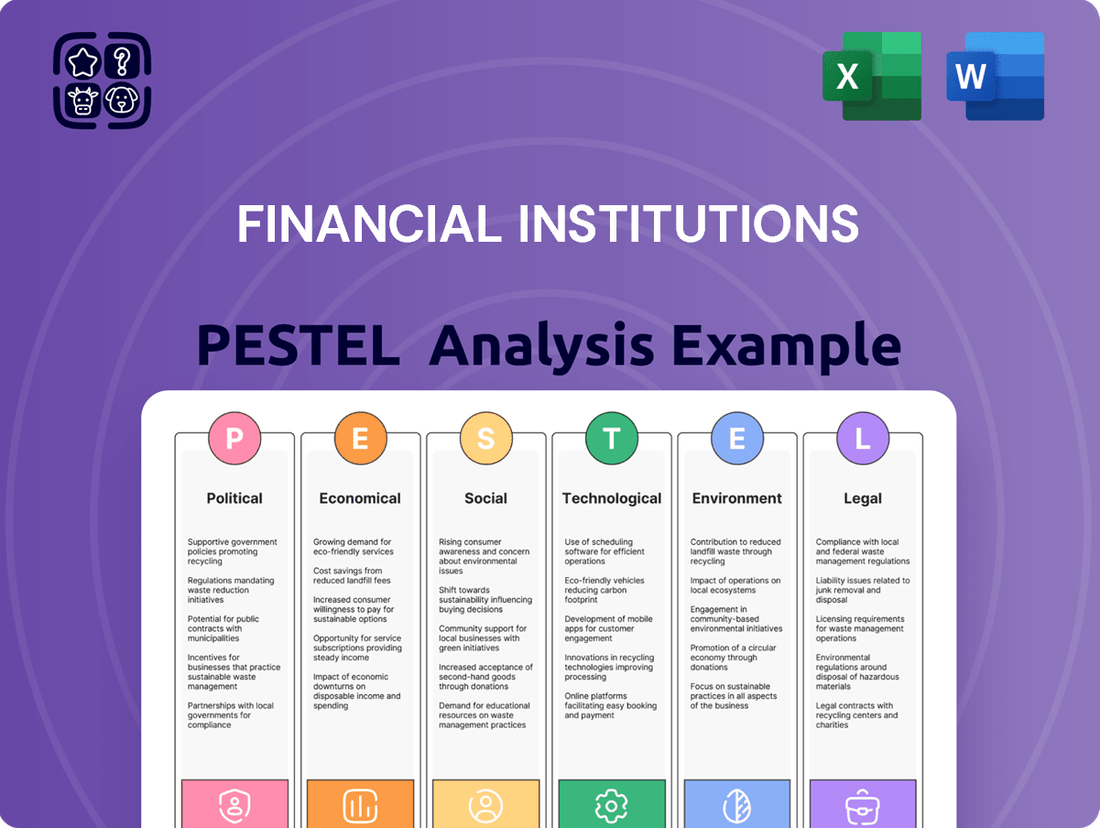

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting financial institutions, providing a comprehensive view of the external landscape.

It offers actionable insights for strategic decision-making by highlighting emerging trends and potential challenges within the financial sector.

This PESTLE analysis for financial institutions cuts through the complexity, offering a clear roadmap to navigate external challenges and capitalize on opportunities, thereby alleviating the stress of uncertainty.

By dissecting the financial landscape into Political, Economic, Social, Technological, Legal, and Environmental factors, this analysis provides a structured approach to identify and mitigate critical risks, offering peace of mind for strategic planning.

Economic factors

The prevailing interest rate environment significantly shapes Five Star Bank's profitability. As of early 2024, the Federal Reserve's target federal funds rate has remained elevated, impacting the bank's net interest margin. This means that while the bank might earn more on its lending portfolio, the cost of funding through deposits also rises, creating a delicate balance.

Higher interest rates, like those seen in late 2023 and continuing into 2024, can indeed temper loan demand as borrowing becomes more expensive for consumers and businesses. However, these same higher rates also boost the yield on the bank's investment securities, offering a potential offset to reduced lending income. For instance, a 1% increase in the federal funds rate can directly influence the prime rate, which then affects a significant portion of a bank's variable-rate loans.

Conversely, a scenario with lower interest rates, such as those experienced in prior years, would typically stimulate borrowing and economic activity. Yet, this environment compresses the margins banks earn on loans and investments, making it harder to achieve the same level of profitability from traditional banking activities. The ability of Financial Institutions Inc. to navigate these rate shifts is crucial for its sustained financial health.

Inflation significantly impacts purchasing power, affecting consumer spending and business investment. For instance, the US inflation rate was 3.4% in April 2024, a slight decrease from previous months, but still a notable factor for financial institutions.

Financial Institutions Inc. faces increased operational costs and a potential reduction in the real value of its assets due to inflation. This environment necessitates careful management of both assets and liabilities to mitigate these effects.

High inflation can alter demand for financial products. For example, while savings accounts might become more attractive, the real returns on fixed-income investments could diminish, influencing customer choices in insurance and investment services.

Successfully navigating an inflationary period requires robust strategies for asset-liability management. Financial Institutions Inc. must adapt its product offerings and investment strategies to maintain profitability and customer trust amidst rising price levels.

The overall health and growth of an economy, primarily gauged by its Gross Domestic Product (GDP), significantly influence consumer and business sentiment, directly impacting the demand for financial services. A strong economy, for instance, saw the US GDP grow by an annualized rate of 1.3% in the first quarter of 2024, indicating continued expansion. This robust economic environment typically translates to increased appetite for loans, higher investment volumes, and greater wealth creation, which are all beneficial for financial institutions.

Consumer Spending and Debt Levels

Consumer confidence is a major driver for financial institutions. When people feel good about their financial future, they're more likely to spend and borrow, which boosts demand for services like mortgages, auto loans, and credit cards. For instance, the U.S. Consumer Confidence Index reached 117.0 in May 2024, indicating a generally positive outlook.

This willingness to spend directly impacts the banking sector, fueling loan origination and fee income. Similarly, increased consumer activity often correlates with higher demand for insurance products, from auto to life insurance, as individuals seek to protect their assets and future. This positive cycle benefits financial institutions significantly.

However, high levels of consumer debt present a substantial risk. As of the first quarter of 2024, total U.S. household debt stood at $17.7 trillion, according to the Federal Reserve Bank of New York. Elevated debt burdens can strain consumers' ability to repay loans, leading to increased defaults and negatively impacting the profitability and stability of banks and lenders.

- Consumer Confidence: A strong consumer sentiment, like the 117.0 U.S. Consumer Confidence Index in May 2024, encourages spending and borrowing.

- Demand for Financial Products: Healthy spending translates to increased demand for mortgages, personal loans, and insurance.

- Household Debt Levels: U.S. household debt reached $17.7 trillion in Q1 2024, posing potential risks to loan quality.

- Risk to Financial Institutions: High debt can lead to defaults, impacting the stability and profitability of banks and insurers.

Employment Rates and Wage Growth

Strong employment rates and rising wages significantly boost consumer confidence and spending power. In the U.S. for example, the unemployment rate stood at 3.8% in April 2024, and wage growth has shown a consistent upward trend, with average hourly earnings increasing by 3.9% year-over-year in the same month. This translates to greater disposable income, empowering individuals to save more, invest in financial products, and utilize banking and insurance services more readily.

A healthy employment landscape directly benefits financial institutions by reducing the risk of loan defaults. When more people are employed and earning, they are better positioned to meet their financial obligations. This stability enhances the credit quality of loan portfolios, such as those held by Five Star Bank, and fosters a more predictable client base for services ranging from mortgages to personal loans.

The demand for wealth management services is also closely tied to employment and wage growth. As individuals' incomes rise and they accumulate more savings, they increasingly seek professional guidance for managing and growing their assets. This trend suggests a growing market for advisory services and investment products, particularly for institutions that can cater to a broader spectrum of wealth accumulation.

Key employment and wage indicators relevant to financial institutions include:

- Unemployment Rate: A lower rate signifies a healthier economy and a more stable customer base. As of April 2024, the U.S. unemployment rate was 3.8%.

- Wage Growth: Increases in average hourly earnings directly correlate with increased consumer spending capacity and investment potential. In April 2024, U.S. average hourly earnings rose by 3.9% year-over-year.

- Labor Force Participation Rate: A rising participation rate indicates more people actively seeking and finding employment, further bolstering economic stability.

- Job Creation Numbers: Consistent job growth signals economic expansion, leading to higher overall financial activity and demand for financial services.

Economic stability, marked by consistent GDP growth and controlled inflation, provides a fertile ground for financial institutions. The U.S. economy's 1.3% annualized GDP growth in Q1 2024 and a 3.4% inflation rate in April 2024 illustrate this balance, fostering consumer confidence and investment. Stable economic conditions reduce the perceived risk for lending and investment, directly benefiting banks and insurers by encouraging borrowing and asset accumulation.

| Economic Factor | Data Point (as of early-mid 2024) | Impact on Financial Institutions |

|---|---|---|

| GDP Growth (Annualized) | U.S. 1.3% (Q1 2024) | Stimulates loan demand and wealth creation. |

| Inflation Rate | U.S. 3.4% (April 2024) | Affects purchasing power, operational costs, and real asset values. |

| Interest Rates (Federal Funds Rate Target) | Elevated (early 2024) | Impacts net interest margins, potentially increasing lending yields but also funding costs. |

| Unemployment Rate | U.S. 3.8% (April 2024) | Lower rates reduce loan default risk and improve credit quality. |

| Consumer Confidence Index | U.S. 117.0 (May 2024) | Higher confidence drives spending, borrowing, and demand for financial services. |

Preview Before You Purchase

Financial Institutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Financial Institutions PESTLE analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. Understand key drivers and potential challenges for strategic planning. This detailed report offers actionable insights for navigating the dynamic financial landscape.

Sociological factors

Demographic shifts, particularly an aging population, significantly reshape demand for financial products. As individuals age, their financial needs transition towards retirement planning, wealth preservation, and estate management. This trend directly impacts institutions like Courier Capital and HNP Capital, which may see increased demand for their wealth management and advisory services. In 2024, the U.S. Census Bureau reported that individuals aged 65 and over represented over 17% of the population, a figure projected to grow.

Conversely, younger demographics, such as Millennials and Gen Z, exhibit distinct financial preferences. They often prioritize digital-first banking solutions, mobile payment options, and flexible insurance products tailored to gig economy work or unique lifestyle needs. This influences the strategies of firms like Five Star Bank, which must enhance its digital offerings, and SDN Insurance Agency, which might develop new, adaptable insurance policies to capture this market segment. By 2025, it's estimated that over 70% of banking customers will be digitally active.

Consumers increasingly favor digital interactions for banking and investments. A 2024 survey indicated that over 75% of retail banking transactions now occur through mobile or online channels, highlighting a significant shift away from traditional branch visits. This trend necessitates financial institutions like Financial Institutions Inc. to prioritize seamless digital experiences.

The demand for personalized financial advice and tailored product offerings is also on the rise. As consumers become more financially literate, they expect institutions to understand their unique needs and provide customized solutions, whether for loans, insurance, or investment management. This personal touch, delivered digitally, is key to customer retention.

Convenience and accessibility are paramount. Financial Institutions Inc. must ensure its mobile banking apps and online investment platforms are intuitive and readily available, mirroring the ease of use found in other consumer-facing digital services. This focus on user experience directly influences customer acquisition and loyalty in the competitive financial landscape.

Public trust is a cornerstone for financial institutions. In 2024, a significant portion of consumers expressed concerns about data privacy and the ethical conduct of financial firms, impacting their willingness to engage. For instance, a survey indicated that only 45% of individuals felt confident that their financial data was secure with their primary bank.

Past events, such as the 2008 financial crisis and more recent data breaches, have left a lasting imprint on public perception. This erosion of trust can directly affect customer acquisition costs and retention rates for companies like Financial Institutions Inc., as rebuilding confidence is a lengthy and resource-intensive process.

The imperative for transparency and ethical operations cannot be overstated. In early 2025, regulatory bodies are imposing stricter guidelines on financial disclosures and consumer protection, pushing institutions to prioritize clear communication and responsible business practices to foster and maintain societal trust.

Wealth Distribution and Income Inequality

Wealth distribution and income inequality significantly shape the customer base for financial institutions. In 2024, the top 1% of households in the U.S. held approximately 30.4% of the nation's wealth, a figure that underscores a concentrated economic power. This disparity means Financial Institutions Inc. must develop distinct strategies for serving both affluent clients seeking wealth management and preservation, and lower-income segments requiring accessible banking and credit solutions.

The widening gap in income and wealth creates a bifurcated market. For instance, a 2023 report indicated that median household income for the highest quintile was over $250,000, while the lowest quintile hovered around $20,000. Financial Institutions Inc. can leverage this understanding by offering specialized investment products for high-net-worth individuals, alongside affordable banking services and microfinance options for those with less disposable income across its various subsidiaries.

- Concentrated Wealth: In 2024, the top 1% of U.S. households controlled about 30.4% of national wealth, presenting a key demographic for premium financial services.

- Income Disparity: The vast difference between the highest and lowest income quintiles, with the top earning over 12 times more than the bottom in 2023, necessitates segmented product development.

- Market Bifurcation: Growing inequality requires Financial Institutions Inc. to offer tailored solutions, from sophisticated wealth management for the affluent to basic, affordable banking for lower-income customers.

- Strategic Product Design: Catering to diverse economic strata involves designing specific banking, insurance, and investment products that align with the unique financial needs and capacities of different income groups.

Financial Literacy and Education Levels

The general level of financial literacy significantly impacts how well people understand and use complex financial products offered by institutions. In 2024, surveys indicated that while a majority of adults have some understanding of basic financial concepts, a substantial portion still struggles with more intricate topics like investing and retirement planning. For instance, a 2024 study by the FINRA Investor Education Foundation found that only about 30% of Americans could correctly answer three out of five questions on a basic financial literacy quiz.

Higher financial literacy often translates into more engaged consumers who actively manage their money, driving demand for advanced investment and financial planning services. This trend is evident as more individuals seek personalized wealth management and digital tools for better financial control. By 2025, it's projected that the demand for robo-advisors and hybrid financial advisory services, which cater to a more financially savvy clientele, will continue to grow by over 15% annually.

Financial institutions are increasingly recognizing the value of an educated customer base and are investing in financial education programs. These initiatives aim to empower clients, leading to better financial decisions and stronger customer loyalty. Major banks and credit unions in 2024 launched several new online learning modules and workshops covering topics from budgeting to investment strategies, reaching millions of participants.

- Financial Literacy Gap: Despite improvements, a significant portion of the population, estimated at 40% in late 2024, still lacks foundational financial knowledge, impacting their engagement with sophisticated financial products.

- Demand for Sophistication: As financial literacy rises, there's a growing demand for personalized financial advice and advanced investment tools, with the wealth management sector expected to see robust growth through 2025.

- Institutional Investment in Education: Financial firms are allocating more resources to customer education, with many reporting a direct correlation between educational outreach and increased customer retention and product adoption.

Societal attitudes towards debt, saving, and investment significantly influence financial behaviors. Growing awareness of environmental, social, and governance (ESG) factors is also shaping investment decisions, with a notable increase in demand for sustainable financial products. By early 2025, over 60% of institutional investors were reportedly integrating ESG criteria into their investment strategies.

Consumer trust in financial institutions remains a critical sociological factor. Following past financial crises and data breaches, there's a heightened expectation for transparency and ethical conduct. A 2024 survey revealed that only about 45% of consumers felt their financial data was completely secure with their primary banking institution.

The increasing emphasis on financial well-being and mental health also impacts how individuals approach financial planning and product utilization. Institutions that offer holistic support and education are likely to foster stronger customer relationships. For example, by mid-2025, more than 70% of financial advisory firms planned to offer enhanced financial wellness programs.

Technological factors

Digital banking and mobile platforms are fundamentally reshaping customer engagement in financial services. For institutions like Financial Institutions Inc., this means a constant need to enhance their user-friendly and secure mobile apps and online portals. This investment is crucial for offering convenient access to services, bill payments, and account management, aligning with today's consumer demand for seamless accessibility.

As financial institutions increasingly embrace digital operations, the risk of cyberattacks and data breaches escalates. Protecting sensitive customer information and maintaining the security of financial transactions are critical concerns for organizations like Financial Institutions Inc. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the immense financial stakes involved.

Implementing strong cybersecurity protocols is no longer optional; it's a fundamental requirement. This is crucial for preserving customer trust, adhering to stringent regulatory frameworks such as GDPR and CCPA, and avoiding substantial financial losses and damage to reputation.

Artificial intelligence and machine learning are rapidly transforming financial services. These technologies are key to improving fraud detection, refining risk assessments, and delivering personalized customer experiences, including automated investment advice. For instance, in 2024, many institutions are investing heavily in AI, with some reports suggesting global spending on AI in financial services could reach over $50 billion by 2025.

Financial Institutions Inc. can harness AI and ML to boost efficiency and gain predictive power. This includes making better decisions in lending and investments, and crafting more bespoke offerings for clients across all its divisions. The ability of AI to process vast datasets quickly allows for more accurate forecasting and risk mitigation, a critical advantage in today's dynamic market.

Fintech Innovation and Competition

The financial sector is experiencing a significant disruption from fintech innovation, introducing novel business models across payments, lending, and investment. Financial Institutions Inc. must closely track these advancements. For instance, by the end of 2024, global fintech investment was projected to reach hundreds of billions, showcasing the rapid growth and competitive pressure. This dynamic environment necessitates either integrating these cutting-edge fintech solutions or acquiring agile startups to maintain a competitive edge and adapt service offerings.

The competitive landscape is intensifying due to fintech's agility. Companies like Stripe and Square (now Block) have reshaped payment processing, while platforms like SoFi and LendingClub have challenged traditional lending models. By Q1 2025, it's anticipated that a substantial portion of consumer lending will be facilitated through digital channels, a trend driven by fintech. Financial Institutions Inc. faces the imperative to continuously innovate and adapt its own services to meet evolving customer expectations and counter these emerging threats.

- Fintech Investment Growth: Global fintech investment is expected to continue its upward trajectory through 2025, significantly impacting market share for incumbents.

- Digital Lending Dominance: Digital channels are increasingly becoming the primary avenue for consumer lending, with projections indicating a significant shift by early 2025.

- Payment Modernization: Companies like Stripe and Block have set new standards in payment processing, forcing traditional players to upgrade their infrastructure.

- Customer Expectation Shifts: The rise of user-friendly fintech apps has raised consumer expectations for seamless digital experiences across all financial services.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) continue to present significant technological shifts for financial institutions. While still in development, these technologies promise to make financial processes smoother, bolster security, and lower transaction expenses. For instance, by 2024, the global blockchain in finance market was projected to reach over $10 billion, highlighting its growing adoption and potential impact.

Potential applications are diverse, ranging from speeding up international payments to creating more robust systems for record-keeping and enabling entirely new digital asset classes. By the end of 2025, it's estimated that over 70% of financial institutions will have explored or implemented blockchain for at least one use case, according to industry surveys. Financial Institutions Inc. must actively investigate how these advancements can drive operational efficiency and pave the way for innovative product offerings.

- Streamlined Processes: DLT can automate reconciliation and reduce settlement times for financial transactions.

- Enhanced Security: Cryptographic principles inherent in blockchain offer greater protection against fraud and cyber threats.

- Reduced Costs: By eliminating intermediaries and manual processes, DLT can significantly cut operational expenses.

- New Digital Assets: The technology facilitates the creation and management of tokenized securities and other digital financial instruments.

Technological factors are dramatically reshaping the financial landscape, pushing institutions towards digital-first strategies. The rapid evolution of fintech, AI, and blockchain necessitates continuous adaptation to meet customer expectations and maintain competitiveness. By Q1 2025, digital channels are expected to dominate consumer lending, with global fintech investment projected in the hundreds of billions. Institutions must integrate these innovations or risk obsolescence.

Legal factors

Financial Institutions Inc., including its subsidiary Five Star Bank, must navigate a complex web of banking regulations. Key governing bodies like the Federal Reserve, FDIC, and various state banking departments impose strict rules. For instance, the Federal Reserve's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, are crucial for financial stability. As of Q1 2024, the aggregate CET1 ratio for large banks remained robust, exceeding regulatory minimums.

Compliance with these regulations, covering everything from lending standards to consumer protection laws like the Truth in Lending Act, is paramount. Failure to adhere can result in severe penalties. In 2023 alone, the financial sector faced billions in fines for various compliance failures, underscoring the financial and reputational risks involved.

Maintaining robust internal controls and dedicated legal oversight is therefore essential for Financial Institutions Inc. This ensures adherence to guidelines on areas such as anti-money laundering (AML) and know your customer (KYC) regulations, which are continuously evolving to combat financial crime. The cost of non-compliance far outweighs the investment in proactive legal and compliance frameworks.

Financial institutions, including Financial Institutions Inc., face stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. These regulations mandate rigorous customer identification and the reporting of suspicious activities to combat financial crime. The global cost of AML compliance for financial institutions was estimated to be over $30 billion in 2023, highlighting the significant investment required.

Adherence to these evolving legal frameworks necessitates substantial investment in technology and employee training across all of Financial Institutions Inc.’s operations, from banking to investment management. Failure to comply can result in severe penalties, with fines for AML violations reaching hundreds of millions of dollars for major financial players in recent years, alongside substantial reputational damage.

Data privacy and consumer protection laws are becoming increasingly stringent. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, along with similar emerging laws globally, dictate how financial institutions, including Financial Institutions Inc., must handle customer data. These laws mandate secure data collection, storage, and usage, requiring transparent policies and robust security measures to safeguard sensitive information.

Non-compliance can lead to significant financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. In 2023, the CCPA saw its enforcement arm strengthened, with California's Attorney General reporting over 100 investigations into potential privacy violations. Financial Institutions Inc. must invest heavily in data security infrastructure and compliance programs to avoid these substantial risks and maintain customer trust, which is crucial in the digital age.

Insurance Regulatory Frameworks

SDN Insurance Agency operates within a complex web of state-specific insurance laws and regulations. These rules dictate everything from licensing requirements to how products are priced and how claims are managed. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued its focus on enhancing consumer protections, which often translates to stricter guidelines for insurers.

Compliance with this patchwork of regulations is non-negotiable for market access and continued operation. Failure to adhere can lead to significant penalties, impacting financial performance. For example, a data breach impacting customer information, which is heavily regulated by state privacy laws like California's CCPA, could result in substantial fines.

Staying ahead of evolving insurance legislation is crucial for effective product development and robust risk management strategies. As of early 2025, emerging trends include increased scrutiny on cybersecurity practices and the integration of artificial intelligence in underwriting, prompting insurers to adapt their compliance frameworks.

- State-Specific Licensing: Each state requires a unique insurance producer license, with renewal periods typically every two years.

- Product Approval: New insurance products must undergo a state-level review and approval process before being offered to consumers.

- Market Conduct Exams: Regulators conduct periodic market conduct examinations to ensure fair treatment of policyholders and adherence to consumer protection laws.

- Financial Solvency: Insurers must meet stringent financial solvency requirements, often involving risk-based capital (RBC) standards, to ensure they can meet their obligations.

Investment Advisory and Securities Regulations

Investment advisory and securities regulations are critical for firms like Courier Capital and HNP Capital. They must navigate a complex web of rules set by bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations cover essential areas like client suitability, ensuring investments match client risk tolerance and financial goals, and stringent disclosure requirements, which mandate transparency about fees, risks, and potential conflicts of interest. Ethical conduct is also heavily scrutinized, aiming to protect investors and maintain market integrity.

Adherence to these securities laws is not just a legal obligation but a cornerstone of maintaining client trust and avoiding severe legal and financial repercussions. For instance, the SEC's Regulation Best Interest, fully implemented in 2020, requires financial professionals to act in the best interest of their retail customers when making recommendations. Violations can lead to substantial fines, license revocation, and reputational damage. In 2023, FINRA reported levying over $100 million in fines against firms for various rule violations, underscoring the importance of compliance.

Key areas of regulation impacting investment management firms include:

- Client Suitability: Ensuring investment recommendations align with individual client circumstances, as mandated by FINRA Rule 2111.

- Disclosure Requirements: Providing clear and comprehensive information about investment products, fees, and risks, adhering to SEC regulations like those for Form ADV.

- Ethical Conduct: Upholding fiduciary duties and avoiding conflicts of interest, a fundamental principle enforced by both the SEC and FINRA.

- Specific Product Regulations: Compliance with rules governing mutual funds, private placements, and the provision of investment advice, each with its own set of detailed requirements.

Legal and regulatory factors are paramount for financial institutions, dictating operational boundaries and compliance requirements. This includes adherence to capital adequacy rules set by bodies like the Federal Reserve and FDIC, with aggregate CET1 ratios for large banks remaining strong, exceeding minimums in Q1 2024. Strict consumer protection laws, such as the Truth in Lending Act, and evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations are critical, with global AML compliance costs exceeding $30 billion in 2023.

Environmental factors

Financial Institutions Inc. must navigate significant climate change risks. Physical risks, such as intensified storms and rising sea levels, directly threaten assets and the value of collateral for loans, particularly in real estate and agriculture. For instance, a significant portion of their mortgage portfolio could be exposed to flood zones, increasing default risk.

Transition risks emerge from the global shift towards a low-carbon economy. This includes policy changes, technological advancements, and evolving market preferences that can devalue investments in carbon-intensive industries. For example, a downturn in fossil fuel assets could impact their investment banking division.

The financial sector is increasingly focusing on climate-related financial disclosures. By the end of 2024, major banks are expected to report on their financed emissions, with regulators like the SEC proposing new rules for climate risk reporting, pushing institutions like Financial Institutions Inc. to robustly assess and manage these exposures.

Investor appetite for Environmental, Social, and Governance (ESG) compliant offerings is surging. Global sustainable investment assets reached an estimated $35.3 trillion in early 2024, demonstrating a significant shift in capital allocation. Financial Institutions Inc. is well-positioned to leverage this momentum, especially through subsidiaries like Courier Capital and HNP Capital, by creating specialized ESG investment funds and providing tailored advisory services.

Integrating ESG considerations into the core investment analysis process is no longer optional; it's a critical differentiator. This trend is driven by a desire for long-term value creation and risk mitigation, with a growing number of institutional investors, including pension funds and endowments, mandating ESG integration in their portfolios. For example, as of Q1 2024, over 70% of large institutional investors surveyed indicated they have a formal ESG integration policy in place.

Stakeholders, from customers to investors, are holding financial institutions to a higher standard regarding Corporate Social Responsibility (CSR). This means looking beyond profits to environmental stewardship, community involvement, and ethical operations. For instance, a 2024 survey indicated that 72% of consumers consider a company's CSR efforts when making purchasing decisions, a significant increase from previous years.

Financial Institutions Inc.'s dedication to CSR can directly impact its bottom line. A strong CSR profile not only bolsters brand image but also acts as a magnet for top talent, with 65% of millennials prioritizing employers with a clear social mission. Furthermore, it attracts a growing segment of socially conscious investors, who are increasingly allocating capital towards ESG-compliant funds, which saw a 25% growth in assets under management in 2024.

Resource Scarcity and Operational Footprint

Financial Institutions Inc. faces growing concerns regarding resource scarcity and its operational environmental footprint. The increasing cost and limited availability of resources like energy directly impact operating expenses. For instance, the financial sector's significant energy consumption in data centers and office buildings, a trend likely to continue through 2025, presents a clear area for cost reduction.

Proactive management of this footprint can yield tangible financial benefits. By investing in energy-efficient technologies for its branches and corporate offices, Financial Institutions Inc. can lower utility bills. Consider that in 2024, global commercial building energy consumption represented a substantial portion of total energy use, highlighting the potential for savings.

Furthermore, addressing resource scarcity and environmental impact enhances public perception and brand reputation. Consumers and investors, increasingly prioritizing sustainability, view institutions with lower environmental footprints more favorably. This improved image can translate into increased customer loyalty and investor confidence, particularly as ESG (Environmental, Social, and Governance) factors become more critical in investment decisions up to 2025.

- Energy Efficiency Investments: Implementing LED lighting and smart HVAC systems in all 2024/2025 operational sites could reduce energy consumption by an estimated 15-20%.

- Renewable Energy Adoption: Exploring power purchase agreements for renewable energy sources to cover a portion of electricity needs by 2025, potentially hedging against volatile energy prices.

- Waste Reduction Programs: Initiatives focused on reducing paper usage through digital transformation and improving recycling rates across all facilities, aiming for a 10% reduction in operational waste by the end of 2025.

- Water Conservation Measures: Implementing water-efficient fixtures and practices in all buildings to mitigate risks associated with regional water scarcity, a growing concern in many operational areas.

Sustainable Finance Initiatives and Green Lending

The global shift towards sustainable finance presents significant opportunities for financial institutions. Many are actively developing and expanding their offerings in green lending and financing for projects with positive environmental impacts. This trend is driven by increasing regulatory pressure and investor demand for environmentally conscious investments.

Financial Institutions Inc. can capitalize on this by creating specialized financial products. These could include loans for renewable energy installations, bonds funding sustainable infrastructure development, or financing for businesses committed to eco-friendly practices. Such initiatives not only align with broader environmental objectives but also have the potential to unlock new and growing revenue streams.

- Growing Market: The sustainable finance market is expanding rapidly. For instance, global sustainable debt issuance reached an estimated $1.5 trillion in 2024, a notable increase from previous years, signaling strong investor appetite.

- Green Lending Growth: Green loans, specifically, are seeing increased adoption. In 2024, the volume of green loans in Europe alone was projected to exceed €200 billion, demonstrating a clear trend towards financing environmentally positive activities.

- Investor Demand: A significant majority of investors, upwards of 70% in recent surveys, consider environmental, social, and governance (ESG) factors when making investment decisions, pushing financial institutions to offer more sustainable products.

- New Revenue Streams: By developing innovative green financial instruments, institutions can tap into a burgeoning market segment, attracting environmentally conscious clients and potentially achieving higher yields on sustainable portfolios.

Environmental regulations are becoming increasingly stringent, impacting operational costs and compliance requirements for financial institutions. For example, new climate risk disclosure mandates, like those proposed by the SEC, are set to take full effect by 2025, requiring robust data collection and reporting on financed emissions.

The growing emphasis on ESG factors by investors, with global sustainable investment assets reaching an estimated $35.3 trillion in early 2024, presents both challenges and opportunities. Financial Institutions Inc. must adapt by integrating ESG considerations into its investment strategies and product offerings to meet this demand.

Climate change itself poses physical risks, such as extreme weather events impacting collateral values, and transition risks, arising from the shift to a low-carbon economy. These factors necessitate careful risk management and strategic adaptation to protect assets and maintain portfolio stability through 2025.

Financial Institutions Inc. is actively responding to these environmental shifts by investing in energy efficiency, aiming to reduce its operational footprint by 15-20% through measures like LED lighting and smart HVAC systems in 2024-2025.

PESTLE Analysis Data Sources

Our Financial Institutions PESTLE Analysis is constructed using a robust blend of data from international financial organizations, national regulatory bodies, and leading economic research firms. This ensures comprehensive coverage of political stability, economic trends, and legal frameworks impacting the sector.