Financial Institutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financial Institutions Bundle

Financial institutions operate within a complex ecosystem shaped by Porter's Five Forces. Understanding the intensity of rivalry among existing players, the bargaining power of both buyers and suppliers, the threat of new entrants, and the potential for substitute products is crucial for navigating this dynamic sector. Each force presents unique challenges and opportunities that directly impact profitability and strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Financial Institutions’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Financial Institutions Inc. (FIIN) and similar banks depend significantly on customer deposits, which act as their primary capital source. Depositors wield considerable bargaining power, especially when interest rates are competitive or during uncertain economic times. They can easily shift their funds to institutions offering more attractive rates or perceived greater safety, influencing FIIN's cost of funds.

Wholesale funding markets also serve as crucial suppliers of capital for financial institutions. The bargaining power within these markets shifts based on overall market liquidity and the perceived risk associated with lending. For instance, during periods of tight credit markets, these wholesale funding providers can demand higher rates, increasing costs for banks like FIIN.

In 2024, the Federal Reserve's monetary policy significantly impacted deposit rates. As the Fed maintained higher interest rates for a considerable part of the year, many banks, including those similar to FIIN, faced pressure to increase deposit yields to retain and attract funds. This directly amplified the bargaining power of depositors.

Furthermore, the stability of wholesale funding markets in 2024 was influenced by global economic sentiment and geopolitical events. Increased uncertainty often leads to reduced liquidity and higher borrowing costs in these markets, thereby strengthening the bargaining power of wholesale funding providers against financial institutions.

Financial institutions are heavily reliant on technology, from core banking software to advanced cybersecurity and data analytics. This dependency means that technology and software providers hold considerable sway.

A few specialized vendors often control crucial software segments, such as core banking platforms. For instance, in 2024, major core banking system providers like Fiserv and FIS continued to be key players, with their market share indicating a concentrated supplier landscape.

The high cost and complexity associated with switching these critical systems significantly bolster supplier bargaining power. Migrating core banking systems can cost tens of millions of dollars and take years, making it a daunting prospect for banks.

The financial services sector's reliance on specialized expertise, from AI engineers to compliance officers, significantly amplifies the bargaining power of human capital. This demand for niche skills means top talent can command higher salaries and more favorable terms, directly impacting a financial institution's operating expenses.

In 2024, the competition for cybersecurity professionals, for instance, reached a fever pitch, with average salaries for senior roles often exceeding $150,000 annually. This scarcity of specialized talent, especially in rapidly evolving fields like artificial intelligence and quantum computing, grants these individuals considerable leverage when negotiating employment packages.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies, such as the Federal Reserve and the Securities and Exchange Commission (SEC), wield significant influence over financial institutions. These agencies impose complex compliance requirements and capital standards that financial firms must meet. For instance, in 2024, the SEC continued to focus on enhancing disclosure requirements for publicly traded companies, impacting how financial institutions report their activities.

The necessity of adhering to these stringent regulations often drives financial institutions to seek specialized services from legal, consulting, and auditing firms. These service providers possess critical expertise in navigating the intricate regulatory landscape. Their specialized knowledge and the high stakes involved in regulatory compliance grant them substantial bargaining power.

- Regulatory Mandates: Agencies like the FDIC set capital requirements, influencing how much capital banks must hold, directly impacting their operations and profitability.

- Compliance Costs: Financial institutions spent billions globally on compliance in 2023, highlighting the significant financial commitment and the leverage held by compliance service providers.

- Expertise Dependence: The complexity of regulations like Basel III, which continued to be refined in 2024, makes specialized consulting firms indispensable for many financial entities.

- Risk Mitigation: Engaging expert auditors and legal counsel is crucial for mitigating regulatory risk, a factor that strengthens the bargaining position of these specialized service providers.

Information and Data Providers

Financial institutions rely heavily on information and data providers for accurate, timely financial data, credit information, and market intelligence. The ability to access this crucial data directly impacts their risk assessment capabilities and strategic decision-making processes. For instance, in 2024, the market for financial data services, including those from credit bureaus and market data aggregators, continued to see significant growth, underscoring the essential nature of these inputs.

These providers often wield substantial bargaining power. This is largely due to the proprietary nature of the data they collect and curate, making it difficult for financial institutions to replicate or substitute. The sheer volume and depth of information available from a single provider can also create a significant switching cost, further strengthening their position.

The essentiality of this data for core functions like underwriting, trading, and compliance means that financial institutions are often willing to pay a premium. This dynamic can lead to increased operational costs for banks and investment firms, directly influencing their profitability and competitive edge.

- Data Proprietary Nature: Information providers often hold unique datasets, making them indispensable.

- Essentiality for Operations: Access to data is critical for risk management and strategic planning.

- High Switching Costs: Integrating new data sources can be complex and expensive.

- Market Concentration: In some data segments, a few dominant players exist, limiting alternatives.

Suppliers of capital, whether depositors or wholesale funding markets, hold significant bargaining power over financial institutions. This power is amplified by factors like interest rate competition, market liquidity, and the perceived risk of lending. In 2024, the Federal Reserve's monetary policy directly influenced deposit rates, forcing banks to offer higher yields to retain customer funds, thereby increasing depositor leverage.

Technology and software providers, particularly for core banking systems, also exert considerable influence due to the specialized nature of their offerings and the immense cost and complexity associated with switching. Similarly, providers of essential financial data and market intelligence possess strong bargaining power due to the proprietary nature of their information and the high switching costs involved.

The demand for specialized human capital, such as cybersecurity and AI professionals, further strengthens the bargaining position of skilled individuals. Regulatory bodies, by imposing stringent compliance requirements, indirectly enhance the bargaining power of the specialized legal, consulting, and auditing firms that help institutions navigate these complex rules. The essentiality of these services means financial institutions often pay premiums, impacting operational costs.

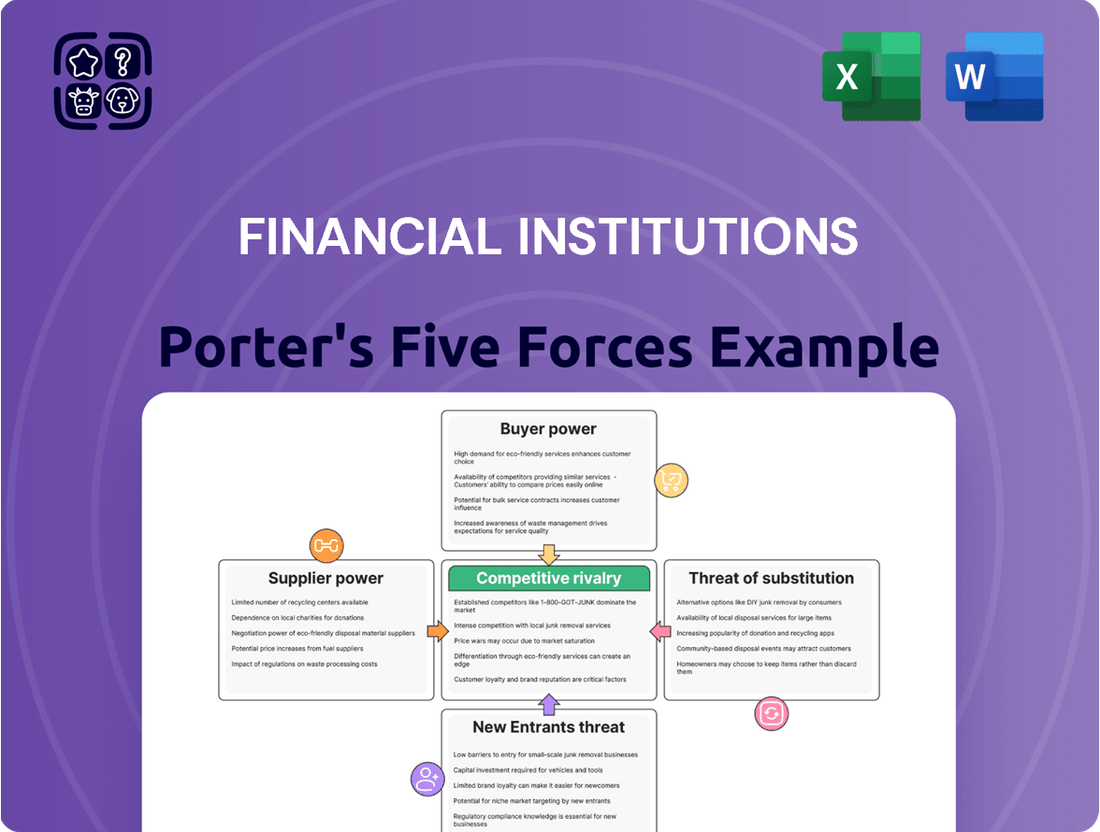

What is included in the product

Analyzes the five competitive forces impacting financial institutions, including new entrants, buyer power, supplier power, substitutes, and rivalry, to understand industry profitability and strategic positioning.

Effortlessly identify competitive threats and opportunities to proactively safeguard profitability.

Customers Bargaining Power

For many common financial products, like checking and savings accounts, moving your money to another institution is pretty straightforward. The actual fees for closing an account or transferring funds are often minimal, sometimes even zero. This low financial barrier means customers can easily switch if they find a better interest rate or a more convenient service elsewhere.

While there are some minor inconveniences, like updating direct deposit information, the digital age has really lowered the hurdles to switching. Online account opening and money transfer services make it simpler than ever. For instance, in 2024, a significant percentage of consumers reported being comfortable switching banks for better rates, highlighting this reduced friction.

Customers today wield significant power due to readily available price comparison tools. Online platforms allow individuals and businesses to effortlessly compare interest rates, fees, and service charges across various banks. This transparency directly fuels price sensitivity, compelling institutions to maintain competitive offerings.

For instance, in 2024, the average savings account interest rate in the US hovered around 0.35%, a stark contrast to the 4.5% or higher offered by some online banks, showcasing the impact of comparison. This readily accessible data empowers customers to seek out the best deals, thereby increasing their bargaining leverage.

The sheer variety of financial products available significantly boosts customer bargaining power. Customers can easily compare offerings for loans, savings accounts, investments, and insurance from a multitude of providers, including traditional banks, credit unions, and increasingly, fintech innovators. For instance, in 2024, the global fintech market was valued at over $1.2 trillion, reflecting this diverse ecosystem and the readily available alternatives for consumers.

Large Commercial and High-Net-Worth Clients

Major commercial clients and high-net-worth individuals wield significant bargaining power in the financial sector. Their substantial business volumes, covering loans, deposits, and investment management, give them leverage. For instance, in 2024, large corporate clients often negotiate lower interest rates on loans or higher yields on deposits due to the sheer scale of their financial transactions.

Financial institutions must often provide customized solutions and more attractive pricing to secure and maintain relationships with these key client segments. This can involve preferential treatment, dedicated relationship managers, and bespoke financial products designed to meet their specific needs, which can impact a bank's profitability margins.

- Substantial Transaction Volumes: High-net-worth individuals and large corporations can move significant amounts of capital, giving them considerable influence over pricing and service terms offered by financial institutions.

- Demand for Tailored Services: These clients often require specialized financial products, wealth management, and corporate banking services that are not standard, allowing them to demand better terms for unique offerings.

- Availability of Alternatives: With numerous financial institutions competing for their business, these clients have a wide array of choices and can easily switch providers if dissatisfied with the current terms or services.

- Impact on Profitability: The ability of these clients to negotiate better rates and fees can directly affect a financial institution's net interest margins and overall profitability.

Digital Empowerment and Self-Service Options

Digital empowerment significantly bolsters customer bargaining power in financial institutions. The proliferation of user-friendly mobile banking apps and online platforms allows customers to effortlessly compare products, switch providers, and manage their accounts with minimal effort. This ease of access means customers are less "sticky" to any single institution, actively seeking better rates and more convenient services. For instance, by mid-2024, over 70% of banking transactions in developed markets were conducted digitally, a testament to this trend.

This digital shift translates into tangible leverage for consumers. They can readily access and analyze information, from interest rates on savings accounts to fees on checking accounts, all from their smartphones. This transparency forces financial institutions to compete more aggressively on price and service quality to retain their customer base. In 2023, the average customer acquisition cost for banks remained a significant expense, further incentivizing retention through superior digital offerings.

- Increased Transparency: Customers can easily compare fees, interest rates, and service quality across multiple financial institutions.

- Convenient Switching: Digital platforms simplify the process of opening new accounts and closing old ones, reducing switching costs for consumers.

- Demand for Self-Service: A growing preference for managing finances independently through apps and online portals puts pressure on banks to enhance their digital capabilities.

- Data-Driven Decisions: Customers are more informed than ever, using readily available data to make choices that best suit their financial needs.

Customers hold considerable sway in the financial sector due to the ease of switching and the abundance of choices. The digital age has significantly lowered barriers, allowing consumers to compare rates and services effortlessly, pushing institutions to offer competitive pricing. This power is amplified by the availability of diverse financial products, from traditional banking to fintech solutions, and is particularly pronounced among large corporate clients and high-net-worth individuals who command significant transaction volumes and often require tailored services.

| Factor | Impact on Financial Institutions | 2024 Data/Trend |

|---|---|---|

| Ease of Switching | Reduces customer loyalty, forces competitive pricing. | Over 70% of banking transactions digital in developed markets. |

| Availability of Alternatives | Increases price sensitivity, necessitates differentiation. | Global fintech market valued over $1.2 trillion. |

| Information Transparency | Empowers price-sensitive customers, drives rate competition. | US savings account rates ~0.35% vs. online banks at 4.5%+. |

| Bargaining Power of Large Clients | Allows negotiation of better terms, impacting margins. | Corporate clients commonly negotiate lower loan rates. |

Preview Before You Purchase

Financial Institutions Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for the financial institutions sector, offering an in-depth examination of competitive forces. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously details the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing firms, and the threat of substitute products or services. This comprehensive report equips you with the strategic insights necessary to understand and navigate the complex landscape of financial services.

Rivalry Among Competitors

Financial Institutions Inc. navigates a crowded marketplace teeming with rivals. The competitive intensity is high, stemming from a broad spectrum of players. These include established national banks, nimble regional and community banks, member-focused credit unions, and increasingly, agile non-bank financial entities that are disrupting traditional models.

This fierce rivalry isn't confined to one area; it permeates all of Financial Institutions Inc.'s core operations. Whether it's in banking services, insurance products, or investment management, the company must constantly contend with competitors vying for market share. For instance, in the U.S. banking sector alone, there were over 4,000 FDIC-insured institutions as of early 2024, showcasing the sheer density of players.

The presence of numerous competitors means that customer loyalty can be fragile, and pricing pressures are a constant factor. Financial Institutions Inc. must differentiate itself through service, innovation, or specialized offerings to stand out. The ongoing digital transformation also introduces new competitive threats from fintech companies, further intensifying the landscape.

Many core financial products, like checking accounts and basic loans, are increasingly seen as commodities. This similarity forces institutions into fierce price competition, often squeezing profitability. For example, in 2024, the average interest rate on a new car loan hovered around 7.2%, a figure heavily influenced by competitive pressures rather than unique product features.

To stand out, banks are channeling resources into enhancing customer service and developing advanced digital platforms. They are also creating niche products, such as specialized business loans or personalized investment advice. However, these investments, while necessary for differentiation, can significantly impact profit margins, as seen in the rising operational costs for digital transformation projects across the banking sector.

Financial institutions are locked in a fierce battle, with competitors constantly rolling out aggressive marketing and promotional campaigns. This often involves enticing offers like sign-up bonuses, appealingly low interest rates, or waived fees, all designed to lure new customers and persuade existing ones to switch. For instance, in 2023, the average sign-up bonus for a new checking account could range from $100 to $300, a significant incentive for consumers. This intense promotional activity means that staying competitive requires continuous innovation and robust marketing efforts to not only attract but also retain market share.

Consolidation and M&A Activity

The banking sector, especially among regional players, continues to experience significant consolidation via mergers and acquisitions. This ongoing trend allows for the creation of larger, more dominant competitors. These consolidated entities benefit from enhanced economies of scale and a wider array of services, thereby escalating the competitive pressure on banks that remain independent.

This intensified rivalry forces remaining institutions to innovate and optimize their operations to remain competitive. For instance, in 2024, the financial industry witnessed several notable M&A deals, with some reports indicating a surge in cross-border banking transactions. This consolidation directly impacts pricing strategies and customer acquisition efforts for smaller, unmerged banks.

- Increased Market Share: Mergers create entities with a larger slice of the market, concentrating customer bases and assets.

- Economies of Scale: Larger banks can often reduce per-unit costs through greater operational efficiency.

- Broader Service Offerings: Consolidated banks can offer a more comprehensive suite of products, from retail banking to investment services.

- Heightened Competitive Pressure: Independent banks must find ways to differentiate or face challenges in competing with larger, more resourced rivals.

Fintech Innovation and Disruption

Fintech innovation is significantly intensifying competitive rivalry within the financial services sector. Companies are rapidly developing new solutions in areas like digital payments, peer-to-peer lending, and robo-advisory services, directly challenging traditional banks. For instance, by the end of 2023, fintech funding reached over $100 billion globally, signaling robust competition.

This surge in fintech activity forces established financial institutions to either adapt or risk losing market share. Many banks are now actively pursuing partnerships with fintech firms to integrate new technologies, while others are investing heavily in their own digital transformation efforts to keep pace. The average cost to acquire a new customer for traditional banks can be upwards of $100, whereas fintechs often achieve this for less than $50.

- Fintech funding in 2023 exceeded $100 billion globally, indicating intense competition.

- Fintechs typically have lower customer acquisition costs than traditional banks.

- Key competitive areas include digital payments, lending, and wealth management.

- Banks are responding through digital transformation and strategic partnerships with fintechs.

Competitive rivalry significantly pressures financial institutions like Financial Institutions Inc. The market is densely populated with thousands of banks, credit unions, and emerging fintech companies, all vying for customers. This intense competition, evident in 2024 with over 4,000 FDIC-insured institutions in the U.S., drives down prices and necessitates constant innovation in services and digital offerings to retain market share.

| Metric | 2023 Data | 2024 Outlook | Impact on Rivalry |

|---|---|---|---|

| Number of U.S. FDIC-Insured Institutions | ~4,200 | ~4,000+ | High density fuels price wars and service differentiation. |

| Average Checking Account Sign-up Bonus | $100 - $300 | Projected to remain competitive | Aggressive customer acquisition tactics. |

| Fintech Funding (Global) | >$100 billion | Continued strong investment | Disruptive innovation challenging traditional models. |

SSubstitutes Threaten

The rise of digital payment platforms like PayPal, Venmo, and Apple Pay presents a significant threat of substitutes for traditional financial institutions. These services offer a convenient and often faster alternative to established bank-based payment methods. For instance, in 2023, global digital payment transaction value was projected to exceed $10 trillion, highlighting their growing dominance and the potential shift away from traditional card and check usage.

Cryptocurrencies further amplify this threat by providing decentralized payment rails that bypass traditional banking infrastructure entirely. This accessibility and innovation can erode customer loyalty to incumbent banks, especially among younger demographics who are more comfortable with digital-native solutions. The increasing ease of use and integration of these digital wallets into everyday commerce means fewer transactions may originate from or pass through traditional bank accounts.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat to traditional financial institutions by offering alternative funding channels for borrowers. These platforms, such as LendingClub and Prosper in the P2P space, and Kickstarter and GoFundMe for crowdfunding, provide access to capital, often with more streamlined processes and potentially better rates for certain borrower profiles.

For borrowers, these platforms act as a direct conduit to a pool of individual investors, bypassing the gatekeepers of conventional banking. This disintermediation can be particularly attractive for small businesses or individuals with non-traditional credit histories who might struggle to secure loans from banks. By the end of 2023, the global P2P lending market was valued at over $100 billion, with projections indicating continued growth.

Crowdfunding, while often associated with charitable donations or project funding, also includes equity and debt-based models that directly compete with bank financing for startups and small enterprises. The ability to raise capital from a broad base of small investors, rather than relying on a single institutional lender, diversifies funding sources and can lower the cost of capital. Global crowdfunding volume reached approximately $20 billion in 2023, demonstrating its increasing relevance.

These alternative finance models challenge established financial institutions by capturing market share in lending and capital raising. They often leverage technology to reduce overhead costs, allowing them to offer competitive terms. This forces traditional banks to innovate and adapt their own lending products and customer service approaches to remain competitive.

Robo-advisors and online investment platforms present a significant threat of substitution for traditional financial institutions like Financial Institutions Inc. These digital solutions offer a more accessible and cost-effective way for individuals to manage their investments, potentially luring customers away from established wealth management arms such as Courier Capital and HNP Capital.

By 2024, the digital investment landscape has matured considerably. For instance, assets under management (AUM) for leading robo-advisors have continued to climb, demonstrating their growing appeal. Many of these platforms boast expense ratios significantly lower than those of traditional advisors, often in the range of 0.25% to 0.50%, compared to the 1% or more commonly seen in full-service wealth management.

This cost advantage, coupled with user-friendly interfaces and broad accessibility, makes them an attractive alternative for a growing segment of the investing public. Investors seeking straightforward portfolio management without the premium fees associated with human advisors are increasingly opting for these digital channels.

Non-Bank Lenders and Specialized Finance Companies

The threat of substitutes for traditional banks is significantly amplified by the rise of non-bank lenders and specialized finance companies. These entities, operating outside the traditional banking regulatory framework, offer a diverse range of financial products, directly competing with banks for customers seeking mortgages, auto loans, and small business financing. Their agility and focus on specific market segments often translate into more streamlined application processes and competitive pricing, making them attractive alternatives.

For instance, in 2023, the alternative lending market saw substantial growth. Online lenders alone originated an estimated $150 billion in loans, a notable increase from previous years, showcasing their growing market share and ability to capture demand that might otherwise go to banks. This trend is projected to continue, with forecasts indicating further expansion in specialized lending areas through 2025.

- Mortgage Market Disruption: Non-bank mortgage originators have captured a significant portion of the U.S. mortgage market, with their share often fluctuating between 40-50% in recent years, directly challenging traditional banks.

- Small Business Lending Expansion: Online small business lenders provided over $100 billion in funding in 2023, offering faster approval times and more flexible terms than many traditional bank loans.

- Auto Loan Competition: Auto finance companies, often backed by manufacturers or specialized lenders, continue to offer competitive rates and leasing options that directly substitute for bank auto financing.

- Fintech Integration: Many of these non-bank lenders leverage technology to offer seamless digital experiences, appealing to younger demographics and those seeking efficient, online-first financial solutions.

Direct-to-Consumer Insurance Providers

Financial Institutions Inc., through its SDN Insurance Agency, faces a significant threat from direct-to-consumer online insurance providers. These digital-first companies often leverage technology to streamline the purchasing process, offering competitive pricing and a user-friendly experience that appeals to a broad customer base.

The rise of these digital insurers means that customers can bypass traditional agency models for many insurance needs. For instance, by mid-2024, the online insurance market was projected to continue its robust growth, capturing an increasing share of new policy sales, especially in auto and home insurance segments.

Furthermore, large national carriers are increasingly offering their policies directly to individuals and businesses. This strategy allows them to control the entire customer journey, from initial quote to policy management, potentially offering greater efficiency and cost savings that can be passed on to consumers, thereby intensifying the substitution threat.

- Digital Convenience: Direct-to-consumer platforms often provide 24/7 access and self-service options, a key draw for customers prioritizing speed and ease.

- Competitive Pricing: Lower overhead costs for online-only insurers can translate into more aggressive pricing, directly challenging traditional agency models.

- Specialized Coverage: Some direct providers focus on niche markets or highly specialized insurance products, attracting customers seeking tailored solutions not readily available through broader offerings.

- Customer Acquisition Costs: While direct-to-consumer models can have higher initial acquisition costs, their scalable digital infrastructure often leads to lower long-term costs per customer compared to traditional agency networks.

The threat of substitutes for traditional financial institutions is multifaceted, encompassing digital payment alternatives, decentralized finance, and non-traditional lending platforms. These substitutes often offer greater convenience, lower costs, or more specialized services, directly challenging established players.

Digital payment systems like PayPal and Apple Pay, along with cryptocurrencies, bypass traditional banking infrastructure, offering faster and sometimes cheaper transactions, with global digital payment transaction value projected to exceed $10 trillion in 2023. Peer-to-peer lending and crowdfunding platforms provide alternative funding channels, with the P2P lending market valued at over $100 billion by the end of 2023, and crowdfunding volume reaching approximately $20 billion. Robo-advisors and online investment platforms offer cost-effective wealth management, with many boasting expense ratios between 0.25% and 0.50% compared to traditional advisors' 1% or more.

Non-bank lenders, particularly in the mortgage and small business sectors, have captured significant market share, with online lenders alone originating an estimated $150 billion in loans in 2023. Direct-to-consumer online insurance providers also pose a threat, leveraging technology for streamlined processes and competitive pricing, with the online insurance market continuing robust growth by mid-2024.

Entrants Threaten

Establishing a full-service financial institution demands immense capital. Think about the costs for licenses, building branches or robust digital platforms, sophisticated technology systems, and meeting stringent regulatory reserve requirements. For instance, in 2024, the average capital required to open a new community bank in the US can easily run into tens of millions of dollars, with larger institutions needing billions.

This substantial upfront investment acts as a formidable barrier, discouraging many potential new entrants who lack the necessary financial muscle. It’s not just about having cash; it’s about demonstrating the financial stability and capacity to operate safely and soundly, which is a hurdle few can easily clear.

The financial services sector faces a significant barrier to entry due to its stringent regulatory environment. Compliance with rules such as those concerning anti-money laundering, data privacy like GDPR, and capital adequacy requirements, exemplified by Basel III standards, demands substantial investment and expertise.

Navigating this complex and constantly changing regulatory landscape is a considerable hurdle for new players. For instance, the cost of compliance for financial institutions can run into millions annually, a significant deterrent for startups lacking established infrastructure and capital.

In 2024, the ongoing focus on cybersecurity and digital asset regulation further layers complexity. Entities looking to enter markets like digital banking or cryptocurrency services must contend with evolving frameworks, increasing the time and resources needed to establish a compliant operation.

This regulatory burden effectively limits the threat of new entrants by making market access expensive and time-consuming, favoring established institutions with existing compliance capabilities and resources.

Established financial institutions possess a significant advantage due to decades of cultivated brand trust and deep-rooted customer loyalty, particularly for core services like savings accounts and mortgages. This trust is not easily replicated by newcomers.

New entrants face a considerable hurdle in rapidly building the credibility necessary to attract and retain a substantial customer base, especially when competing against institutions with long-standing reputations.

For example, in 2024, major banks like JPMorgan Chase continued to leverage their brand recognition, with customer satisfaction scores often cited as a key differentiator, even as fintechs gained traction.

This loyalty acts as a formidable barrier, as consumers often prioritize security and familiarity for their financial needs, making it challenging for new players to disrupt established relationships.

Economies of Scale and Scope

Existing financial institutions, particularly large and regional banks, leverage significant economies of scale. This allows them to spread costs for technology infrastructure, marketing campaigns, and operational processes across a vast customer base. For instance, in 2024, major banks continued to invest billions in digital transformation, a cost new entrants would struggle to match at inception.

These economies of scale translate into competitive pricing and a wider array of services, making it difficult for newcomers to compete on cost alone. A smaller fintech startup, for example, might find it prohibitively expensive to develop the same level of cybersecurity or offer the same breadth of loan products as an established institution with decades of operational experience.

- Economies of Scale: Established banks can amortize high fixed costs (like IT systems) over a larger volume of transactions, reducing per-unit costs.

- Economies of Scope: Large institutions can offer a bundled suite of products (checking, savings, loans, investments) more efficiently than a specialized new entrant.

- Capital Requirements: The sheer scale of capital required to establish a competitive presence acts as a substantial barrier.

- Brand Recognition & Trust: Existing players benefit from long-standing customer relationships and established trust, which new entrants must work hard to build.

Talent Acquisition and Infrastructure Costs

New financial institutions face significant hurdles in acquiring the necessary talent and building robust infrastructure. The investment in secure, cutting-edge digital platforms alone can run into millions, a substantial barrier for nascent players. For instance, establishing a modern, compliant trading system can cost upwards of $5 million, and that’s before accounting for human capital.

Attracting and retaining skilled financial professionals, especially those with expertise in areas like cybersecurity, data analytics, and regulatory compliance, is a fierce competition. In 2024, the average salary for a senior financial analyst in a major financial hub could easily exceed $150,000 annually, plus bonuses and benefits, making personnel costs a major drain on resources for new entrants.

- High Capital Outlay for Technology: Developing and maintaining state-of-the-art, secure digital platforms is a capital-intensive requirement.

- Competitive Talent Market: Financial institutions must compete for top-tier talent, driving up labor costs significantly.

- Ongoing Investment in R&D: Continuous innovation and adaptation to new technologies necessitate ongoing research and development expenditures.

- Regulatory Compliance Infrastructure: Building systems and hiring personnel to meet stringent financial regulations adds considerable expense.

The threat of new entrants in financial institutions is significantly mitigated by the immense capital required for operation. Establishing a full-service bank or even a specialized fintech requires substantial upfront investment for licensing, technology, and regulatory compliance. For example, in 2024, the cost to launch a new digital bank in the US could easily range from $10 million to $50 million, a considerable barrier for most aspiring entities.

Furthermore, the highly regulated nature of the financial industry presents a formidable challenge. New entrants must navigate complex compliance frameworks, including anti-money laundering (AML) and know-your-customer (KYC) regulations, which demand significant resources and expertise. The annual cost of regulatory compliance for financial firms in 2024 averaged around 10% of their operating budget, a figure that can be prohibitive for startups.

The established brand loyalty and trust enjoyed by incumbent institutions also pose a substantial hurdle. Customers often prefer to bank with familiar names due to perceived security and reliability. For instance, in 2024, major banks like Bank of America and Wells Fargo continued to benefit from decades of customer relationships, making it difficult for new players to gain significant market share quickly.

Economies of scale further consolidate the advantage of existing players. Large institutions can spread their fixed costs, such as technology investments and marketing, over a much larger customer base, leading to lower per-unit costs. In 2024, banks investing billions in AI and cloud infrastructure were better positioned to absorb these costs than a new entrant trying to build similar capabilities from scratch.

| Barrier | 2024 Estimated Cost/Impact | Impact on New Entrants |

| Capital Requirements | $10M - $50M+ for digital bank launch | Extremely High |

| Regulatory Compliance | 10% of operating budget annually | High |

| Brand Trust & Loyalty | Decades of cultivated relationships | High |

| Economies of Scale | Billions in technology investment | High |

Porter's Five Forces Analysis Data Sources

Our analysis leverages comprehensive data from regulatory filings, industry-specific reports, and financial databases to dissect the competitive landscape of financial institutions.