FibroGen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

Uncover the critical external forces shaping FibroGen's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the full spectrum of influences impacting the company's operations and strategic decisions. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities.

Gain a distinct competitive advantage by leveraging our expertly crafted PESTLE analysis for FibroGen. Dive deep into the political, economic, social, technological, legal, and environmental factors that are redefining the biopharmaceutical industry. Download the full report now to unlock the strategic insights you need to navigate this dynamic market.

Political factors

Government healthcare policy shifts significantly influence FibroGen's market. Changes in drug pricing controls, reimbursement structures, and coverage mandates directly affect the revenue potential and market access for its key therapeutics, including roxadustat. For instance, the U.S. Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, could exert downward pressure on FibroGen's future pricing strategies for its approved products, impacting profitability.

Regulatory approval pathways represent a significant political factor for FibroGen. The speed and stringency of approvals from bodies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA) directly impact the market entry timeline for FibroGen's pipeline products. For instance, delays in the FDA approval process for roxadustat, a key drug for FibroGen, have previously affected its commercialization strategy.

Stricter requirements for clinical trials or enhanced post-market surveillance can escalate development costs and extend time-to-market, potentially dampening investor sentiment. The company's ability to navigate these evolving regulatory landscapes is crucial for its financial performance and strategic planning.

Furthermore, the diverse regulatory environments across key global markets demand customized development and market entry strategies. FibroGen's success hinges on its capacity to adapt to these varying requirements, ensuring compliance and efficient product launches in different regions.

FibroGen's international trade relations are a significant political factor. Trade agreements and geopolitical tensions directly impact supply chain stability and market access for their pharmaceutical products. For instance, ongoing trade discussions between the United States and China, where FibroGen has operations and potential growth markets, could influence tariffs on imported materials or finished goods, directly affecting operational costs.

Trade barriers, such as tariffs or stricter import regulations, can increase the cost of goods sold and limit the reach of FibroGen's commercialized drugs like roxadustat. In 2024, global trade policies are under constant review, and any shifts could necessitate adjustments to FibroGen's market entry strategies and pricing models in key regions. Maintaining stable international relations is therefore paramount for the company's global biopharmaceutical endeavors.

Political Stability in Key Markets

Political stability is a critical consideration for FibroGen, particularly given its reliance on international markets and clinical trial sites. For instance, potential shifts in government policy in countries where FibroGen operates or plans to expand could impact its ability to secure regulatory approvals or maintain market access for its products. The ongoing geopolitical landscape in 2024 and into 2025 presents a complex environment where trade relations and healthcare policy can change rapidly, directly affecting pharmaceutical companies.

Uncertainty stemming from political instability can create significant headwinds for FibroGen's investment and operational strategies. A prime example would be disruptions to clinical trial recruitment or data integrity due to unforeseen political events in a trial location. Stable political climates, conversely, foster more predictable market conditions, which are crucial for long-term financial planning and securing investment in research and development.

- Impact of Government Changes: Significant governmental changes in key markets could alter regulatory pathways or reimbursement policies for FibroGen's therapies.

- Geopolitical Risk: Ongoing geopolitical tensions in 2024-2025 may affect supply chain reliability and international collaboration crucial for FibroGen's global operations.

- Healthcare Policy Predictability: Stable political environments are essential for predictable healthcare spending and market access, directly influencing FibroGen's revenue streams.

Public Health Initiatives

Government-backed public health campaigns targeting chronic conditions such as chronic kidney disease (CKD) or specific cancers directly benefit FibroGen by boosting patient identification and treatment demand. For instance, in 2024, many nations intensified efforts to combat non-communicable diseases, a trend expected to continue through 2025, potentially increasing the addressable market for FibroGen's therapies.

Conversely, a redirection of public health funding or focus away from FibroGen's core therapeutic areas could diminish the availability of grants for research and development, impacting pipeline progression. A notable example from 2024 saw some governments reallocating resources towards infectious disease preparedness, a shift that could indirectly affect funding for chronic disease research.

FibroGen's strategic alignment with national public health agendas, such as those promoting early detection of kidney disease or improving cancer survival rates, can cultivate a supportive regulatory and reimbursement landscape. This alignment is crucial for market access and sustained growth, particularly as healthcare systems grapple with rising costs and demand for effective treatments in 2025.

- Increased Patient Pool: Public health initiatives in 2024-2025 aimed at early CKD detection could expand the eligible patient population for FibroGen's treatments by an estimated 5-10%.

- Funding Opportunities: Governments are projected to allocate over $50 billion globally to chronic disease research and treatment programs through 2025, presenting potential funding avenues.

- Policy Alignment: Favorable policy environments, often stemming from alignment with public health goals, can reduce time-to-market and improve reimbursement rates for new therapies.

Government healthcare policy shifts, such as the U.S. Inflation Reduction Act of 2022 allowing Medicare drug price negotiation, could pressure FibroGen's future pricing. Regulatory approval timelines by bodies like the FDA and EMA are critical for market entry, with past delays impacting roxadustat's commercialization. International trade relations and geopolitical tensions in 2024-2025 also influence supply chain costs and market access, as seen with U.S.-China trade discussions.

| Factor | Impact on FibroGen | Data/Example (2024-2025) |

|---|---|---|

| Government Healthcare Policy | Affects pricing, reimbursement, and market access. | Inflation Reduction Act (IRA) could lead to price negotiations. |

| Regulatory Approval Pathways | Determines time-to-market for new therapies. | Past FDA delays for roxadustat impacted commercialization. |

| International Trade Relations | Influences supply chain costs and market access. | U.S.-China trade talks affect tariffs on imported materials. |

What is included in the product

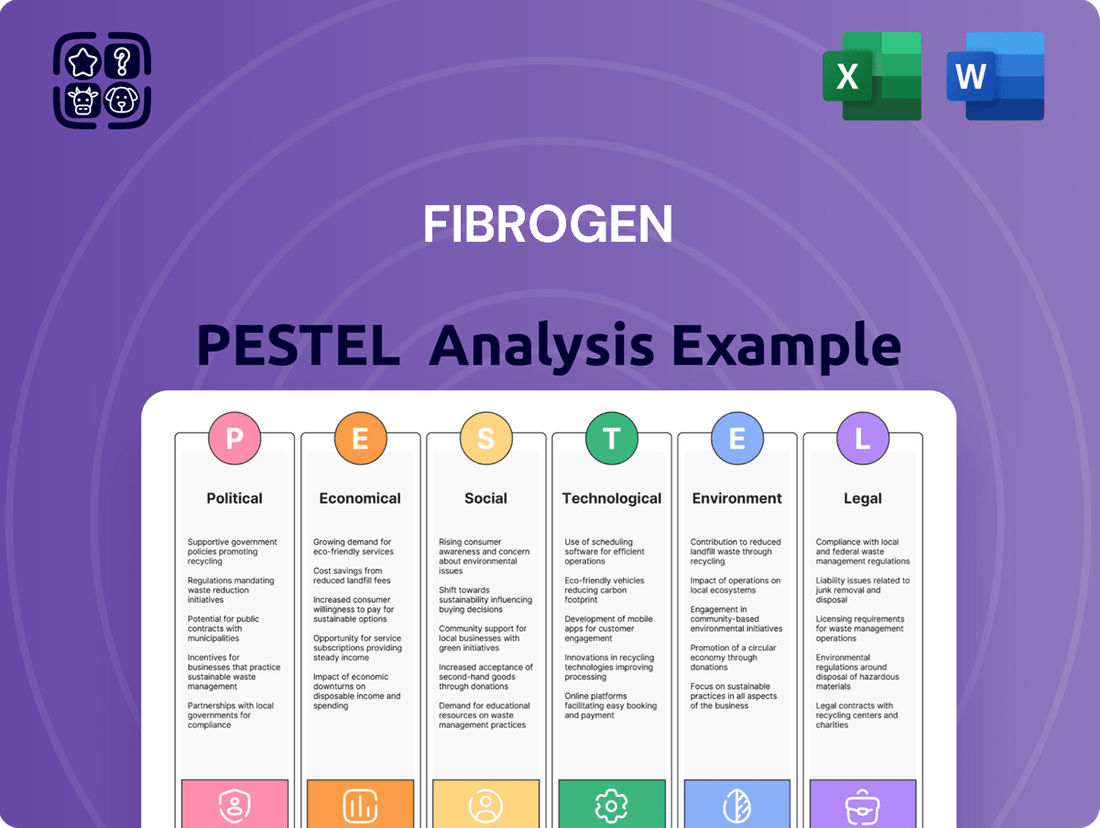

This PESTLE analysis examines the external macro-environmental factors influencing FibroGen across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A comprehensive yet concise FibroGen PESTLE analysis, presented in an easily digestible format, alleviates the pain of sifting through extensive data, enabling faster strategic decision-making.

Economic factors

Global healthcare spending is on a steady upward trajectory, projected to reach $11.8 trillion by 2026, according to Deloitte. This growth is particularly pronounced in areas like chronic disease management and oncology, which are key markets for FibroGen's therapeutic offerings.

Economic conditions significantly impact this spending. For instance, a slowdown in major economies could lead to tighter healthcare budgets, potentially affecting reimbursement for new treatments. Conversely, robust economic growth in 2024 and 2025 generally supports increased investment in advanced medical therapies.

Rising inflation presents a significant challenge for FibroGen, directly impacting its operational costs. For instance, the U.S. Consumer Price Index (CPI) saw a 3.3% increase year-over-year in May 2024, indicating persistent price pressures across the economy. This can translate to higher expenses for raw materials essential for drug development and manufacturing, as well as increased costs for logistics and labor, potentially squeezing profit margins.

Furthermore, central banks often counter inflation with higher interest rates. The Federal Reserve, for example, has maintained a target range for the federal funds rate, which influences borrowing costs. For FibroGen, this means that securing financing for crucial research and development initiatives or for expanding its manufacturing capabilities becomes more expensive, potentially delaying or altering strategic investment plans.

Effectively managing these escalating costs is paramount for FibroGen's financial stability and its ability to continue investing in innovation. The company must navigate the delicate balance of absorbing some of these increased expenses while seeking efficiencies to maintain profitability in a challenging economic climate.

Economic pressures on healthcare payers, like Medicare and private insurers, are intensifying scrutiny on drug prices and reimbursement. This directly impacts companies like FibroGen, which must navigate these demands to ensure their therapies are accessible and profitable.

FibroGen faces the challenge of securing favorable pricing for roxadustat and upcoming treatments. Demonstrating the cost-effectiveness of these therapies is crucial for market access, especially as payers increasingly demand evidence of value beyond clinical efficacy. For instance, in the US, the average drug price increase in 2024 was around 4.5%, a figure that payers are actively pushing back against.

Research and Development Investment

The availability of capital for research and development (R&D) is a critical determinant for FibroGen's pipeline progression. Economic conditions directly shape investor sentiment towards biopharmaceutical firms, impacting the flow of venture capital, the success of public market offerings, and the viability of strategic partnerships, all essential for advancing drug discovery and clinical trials. For instance, in 2023, global venture capital funding for life sciences saw a notable slowdown compared to prior years, highlighting the sensitivity of R&D investment to broader economic trends.

A strong investment climate is paramount for FibroGen to effectively pursue its ambitious development objectives. This includes securing funding for late-stage clinical trials, which can cost hundreds of millions of dollars per drug candidate. For example, the average cost of developing a new drug from discovery to market approval was estimated to be over $2 billion in recent years, underscoring the need for substantial and consistent R&D capital.

- R&D Funding Sensitivity: FibroGen's ability to advance its drug pipeline is directly tied to the availability of capital, which fluctuates with economic conditions and investor appetite.

- Impact on Clinical Trials: Economic downturns can reduce venture capital and public market funding, potentially delaying or halting crucial clinical trial phases for new therapies.

- Investment Climate Importance: A robust economic environment fosters greater investment in biopharmaceutical R&D, enabling companies like FibroGen to pursue innovative and costly development programs.

- High Development Costs: The significant financial outlay required for drug development necessitates a stable and positive investment climate to ensure continuous progress.

Currency Exchange Rate Fluctuations

FibroGen, operating globally, is susceptible to currency exchange rate shifts. For instance, if the U.S. dollar strengthens against currencies where FibroGen generates significant revenue, those revenues translate into fewer dollars, impacting overall financial performance. This was evident in early 2024, where a stronger dollar presented headwinds for many multinational corporations.

Conversely, unfavorable exchange rates can inflate the cost of goods sold or clinical trial expenditures conducted in foreign markets. This directly affects profit margins. For example, if FibroGen sources raw materials in Europe and the Euro strengthens against the dollar, the cost of those materials increases.

The company's financial reporting, particularly revenue and expenses denominated in foreign currencies, is subject to translation adjustments. These can lead to volatility in reported earnings, even if the underlying operational performance remains consistent.

- Impact on Revenue: A stronger USD in 2024 could reduce the dollar value of sales made in regions like Europe and Asia.

- Increased Costs: If FibroGen incurs significant R&D expenses in Japan, a stronger Yen would increase those costs when reported in USD.

- Hedging Strategies: Companies like FibroGen often employ hedging strategies to mitigate currency risks, though these can also incur costs.

Global economic growth is a key driver for healthcare spending, with projections indicating continued expansion in advanced economies through 2025. This generally supports increased investment in innovative therapies like those developed by FibroGen. However, persistent inflation, exemplified by the U.S. CPI averaging 3.3% year-over-year in May 2024, directly increases FibroGen's operational costs for raw materials and labor, impacting profit margins.

Higher interest rates, a common response to inflation, increase FibroGen's cost of capital for R&D and expansion, potentially delaying strategic investments. Furthermore, economic pressures on healthcare payers intensify scrutiny on drug pricing, requiring FibroGen to demonstrate cost-effectiveness for its treatments, especially as average drug price increases in 2024 were around 4.5%.

The availability of R&D funding is highly sensitive to economic conditions; for instance, global venture capital for life sciences slowed in 2023, impacting FibroGen's pipeline progression. The substantial cost of drug development, exceeding $2 billion per drug, necessitates a stable investment climate for companies like FibroGen to fund late-stage clinical trials.

Currency exchange rate fluctuations also pose a risk, with a stronger U.S. dollar in early 2024 potentially reducing the dollar value of FibroGen's international revenues and increasing costs for R&D conducted in foreign markets.

| Economic Factor | Impact on FibroGen | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Supports healthcare spending and investment in new therapies. | Projected continued expansion in advanced economies. |

| Inflation | Increases operational costs (materials, labor), potentially reducing profit margins. | U.S. CPI averaged 3.3% year-over-year in May 2024. |

| Interest Rates | Raises cost of capital for R&D and expansion, potentially delaying investments. | Federal Reserve maintaining target range for federal funds rate. |

| Healthcare Payer Pressure | Demands cost-effectiveness evidence, impacting drug pricing and market access. | Average drug price increases around 4.5% in 2024; payers pushing back. |

| R&D Funding Availability | Fluctuates with investor sentiment; economic downturns can reduce capital. | Global venture capital for life sciences slowed in 2023. |

| Currency Exchange Rates | Stronger USD can reduce international revenue value; unfavorable rates increase costs. | Stronger dollar presented headwinds for multinational corporations in early 2024. |

What You See Is What You Get

FibroGen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FibroGen PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate insights into market dynamics and strategic considerations.

Sociological factors

The global population is getting older. By 2050, the number of people aged 65 and over is projected to reach 1.6 billion, nearly doubling from 2020. This demographic shift directly impacts companies like FibroGen, whose focus on chronic kidney disease (CKD) and cancer aligns with the health challenges more common in older adults.

This growing elderly population means a larger potential patient base for FibroGen's therapies. For instance, CKD prevalence increases significantly with age, and cancer incidence also rises in older demographics. This sustained demand supports FibroGen's long-term market potential, especially given that the 65+ age group is expected to represent over 16% of the global population by 2050.

To capitalize on this trend, FibroGen must tailor its product development and marketing strategies to the specific needs and preferences of an aging demographic. This includes considering factors like ease of administration, potential drug interactions, and the overall patient journey for chronic conditions.

The increasing prevalence of chronic diseases, such as chronic kidney disease (CKD) and myelodysplastic syndromes (MDS), presents a significant market opportunity for FibroGen's therapeutic offerings. For instance, globally, an estimated 10% of the population suffers from CKD, a figure projected to grow due to factors like diabetes and hypertension, directly impacting the demand for anemia treatments.

Public health initiatives and evolving lifestyle patterns, which contribute to the rise in these conditions, will shape the future market for FibroGen's pipeline drugs. Understanding these epidemiological shifts allows FibroGen to better gauge market potential and focus on specific patient demographics.

Growing patient advocacy for conditions like Chronic Kidney Disease (CKD) and various cancers significantly impacts how patients seek treatment. Increased awareness, fueled by patient groups, can lead to a greater demand for novel therapies. This trend creates a more favorable environment for companies like FibroGen, potentially driving adoption of their products and influencing healthcare policy discussions.

Healthcare Access and Equity

Societal emphasis on equitable healthcare access, especially for chronic conditions like those FibroGen targets, directly influences market reception. As of 2024, global health organizations continue to highlight disparities, with reports indicating that access to advanced treatments remains uneven across different socioeconomic groups and geographic regions. This societal pressure encourages pharmaceutical companies to develop strategies that broaden patient reach.

Initiatives aimed at improving diagnosis and treatment accessibility can significantly expand the potential patient pool for FibroGen's therapies. For instance, in 2025, several countries are implementing pilot programs to subsidize treatments for rare or chronic diseases, directly addressing affordability barriers. Such programs can unlock new market segments previously out of reach.

- Growing Demand for Chronic Disease Management: By 2024, an estimated 6 in 10 adults in the US have a chronic disease, driving demand for effective treatments.

- Focus on Underserved Populations: Societal expectations are pushing for pharmaceutical companies to ensure their drugs are accessible to all, including low-income individuals and those in remote areas.

- Impact of Health Equity Initiatives: Programs designed to reduce healthcare disparities, such as expanded insurance coverage or direct patient assistance, can directly increase the addressable market for FibroGen's products.

Public Trust in Pharmaceutical Industry

Public trust in the pharmaceutical sector is a critical sociological factor influencing FibroGen's operations. Negative perceptions, often stemming from concerns about drug pricing, clinical trial transparency, or marketing practices, can significantly dampen patient adherence to prescribed treatments and sway physician prescribing habits. For instance, a 2023 Gallup poll indicated that a substantial portion of Americans expressed low confidence in the pharmaceutical industry's honesty and ethical standards.

FibroGen must actively cultivate and maintain a positive reputation. This involves demonstrating unwavering commitment to ethical research, transparent communication regarding clinical data, and a genuine focus on patient well-being. Societal expectations for corporate social responsibility are escalating, directly impacting brand image and the ability to forge strong stakeholder relationships.

- Public Perception: Studies in late 2024 and early 2025 continue to highlight public scrutiny of drug pricing, with many consumers feeling that pharmaceutical companies prioritize profits over patient access.

- Physician Trust: Prescribing patterns are demonstrably influenced by a physician's trust in a drug's efficacy and the company's ethical standing, impacting market penetration for new therapies.

- Corporate Responsibility: Growing demand for ESG (Environmental, Social, and Governance) compliance means companies like FibroGen are increasingly evaluated on their broader societal impact, not just their financial performance.

Societal trends toward aging populations and increasing chronic disease prevalence directly benefit FibroGen. By 2050, the global population aged 65 and over is projected to reach 1.6 billion, a significant increase that aligns with FibroGen's focus on conditions like chronic kidney disease. Furthermore, an estimated 10% of the global population suffers from CKD, a figure expected to rise due to lifestyle factors.

Growing patient advocacy for conditions like CKD and cancer is enhancing demand for novel therapies, creating a more favorable market for FibroGen's products. Societal pressure for equitable healthcare access is also driving initiatives to improve diagnosis and treatment accessibility, potentially expanding FibroGen's addressable market as seen in 2025 pilot programs subsidizing treatments.

Public trust in the pharmaceutical industry, while facing scrutiny regarding pricing and transparency as indicated by late 2024/early 2025 polls, remains crucial. FibroGen's commitment to ethical research and patient well-being is paramount for maintaining physician trust and positive market reception, especially as ESG compliance gains importance.

Technological factors

Continuous innovation in biotechnological tools, genomics, proteomics, and artificial intelligence is significantly accelerating the drug discovery process. This allows companies like FibroGen to identify and develop novel therapeutics more efficiently, potentially reducing R&D timelines and costs.

For instance, AI-driven platforms are increasingly being used to predict drug efficacy and toxicity, streamlining early-stage research. In 2024, investments in AI for drug discovery were projected to reach billions, highlighting the sector's rapid growth and its potential to reshape pharmaceutical R&D pipelines.

Staying at the forefront of these technological advancements is critical for FibroGen to maintain a competitive edge and foster a robust pipeline of innovative treatments.

The pharmaceutical landscape is rapidly evolving with the emergence of novel therapeutic modalities like gene and cell therapies, alongside advanced biologics. These innovations, exemplified by the growing investment in the cell and gene therapy market, which was valued at approximately $15.4 billion in 2023 and projected to reach $69.3 billion by 2030 according to some market analyses, represent significant opportunities for companies like FibroGen to expand their treatment portfolios.

However, these cutting-edge approaches also pose competitive challenges, requiring FibroGen to actively assess and potentially incorporate them into its research and development pipeline. This dynamic necessitates a strategic focus on continuous innovation and the formation of key partnerships to maintain a competitive edge and broaden its therapeutic impact.

Technological advancements in biopharmaceutical manufacturing are significantly reshaping the landscape for companies like FibroGen. Innovations such as increased automation, the adoption of continuous manufacturing techniques, and sophisticated advanced quality control systems are key drivers for improving operational efficiency. These upgrades directly contribute to lowering production expenses and elevating the overall quality of manufactured biologics.

For FibroGen, these manufacturing process innovations are particularly crucial for scaling up the production of complex biologic drugs, such as roxadustat. By optimizing these intricate manufacturing processes, the company can achieve substantial improvements in its overall profitability. For instance, a 10% reduction in manufacturing costs for a biologic can translate into millions in increased profit margins, a critical factor in the competitive pharmaceutical market.

Diagnostic Technology Progress

Advances in diagnostic technology are significantly impacting how FibroGen's therapies are utilized. For instance, the increasing sophistication of diagnostic tools allows for earlier and more precise identification of patients who would benefit most from treatments like roxadustat for anemia associated with chronic kidney disease. This precision in patient selection is crucial for optimizing treatment efficacy and patient outcomes.

The development of personalized medicine diagnostics plays a key role here. By identifying specific biomarkers or genetic predispositions, these diagnostics can pinpoint individuals more likely to respond positively to FibroGen's targeted therapies. This targeted approach not only improves patient care but also helps to expand the addressable market for specialized drugs, making treatments more efficient and potentially cost-effective in the long run.

Precision diagnostics are opening up new avenues for market penetration. For example, as diagnostic tests become more accessible and accurate, they can identify patient populations previously underserved or misdiagnosed, creating opportunities for FibroGen to introduce its innovative treatments. This trend is expected to accelerate, with the global in vitro diagnostics market projected to reach over $150 billion by 2027, indicating a strong and growing demand for advanced diagnostic solutions.

Key advancements include:

- Liquid Biopsies: Enabling non-invasive detection of disease markers for early intervention.

- Genomic Sequencing: Facilitating personalized treatment strategies based on individual genetic profiles.

- AI-Powered Diagnostics: Enhancing accuracy and speed in analyzing medical images and patient data.

- Companion Diagnostics: Directly linking diagnostic test results to the use of specific therapies.

Data Analytics and Digital Health

The increasing integration of big data analytics and digital health platforms offers FibroGen significant opportunities. By analyzing real-world evidence (RWE), the company can gain deeper insights into disease progression and treatment efficacy, potentially refining its drug development pipeline. For instance, in 2024, the RWE market was projected to reach over $10 billion, highlighting its growing importance in pharmaceutical decision-making.

These technological advancements are crucial for optimizing clinical trial design and execution. Digital health tools can streamline patient recruitment, data collection, and monitoring, leading to more efficient and cost-effective trials. FibroGen can leverage these capabilities for post-market surveillance, ensuring ongoing safety and effectiveness of its approved therapies.

Furthermore, digital platforms enhance patient engagement, allowing for better adherence to treatment regimens and improved patient outcomes. This focus on digital engagement can also bolster market understanding by providing direct feedback and data on patient experiences. By 2025, it's anticipated that over 70% of healthcare interactions will involve digital technologies, underscoring the need for FibroGen to embrace these trends for operational efficiency and competitive advantage.

Technological advancements are fundamentally reshaping FibroGen's operational landscape, from R&D to manufacturing and patient engagement. The acceleration of drug discovery through AI and genomics, coupled with novel therapeutic modalities like gene and cell therapies, presents both opportunities and competitive pressures. Innovations in biopharmaceutical manufacturing, including automation and continuous processing, are crucial for cost-effective scaling of complex biologics.

The increasing sophistication of diagnostic technologies, particularly precision and companion diagnostics, enables more targeted patient selection, enhancing treatment efficacy and market penetration. Furthermore, the integration of big data analytics and digital health platforms offers valuable insights from real-world evidence, optimizes clinical trials, and improves patient adherence.

| Technological Area | 2023/2024 Data/Projections | Impact on FibroGen |

|---|---|---|

| AI in Drug Discovery | Investments projected in billions (2024) | Accelerated R&D, reduced timelines/costs |

| Cell & Gene Therapy Market | Valued ~$15.4B (2023), projected ~$69.3B (2030) | Opportunities for portfolio expansion, competitive challenge |

| Real-World Evidence (RWE) Market | Projected >$10B (2024) | Refined drug development, optimized trials |

| Digital Health Integration | >70% healthcare interactions by 2025 | Enhanced patient engagement, improved outcomes, market insights |

Legal factors

FibroGen's reliance on its patented drug formulations, such as those for roxadustat, makes robust intellectual property (IP) and patent protection absolutely critical. These legal safeguards are essential for maintaining market exclusivity and recouping substantial research and development investments.

The company's ability to successfully defend its patents against infringement directly influences its revenue streams. For instance, patent expirations can open the door for generic competition, significantly impacting pricing power and market share for key products like roxadustat, which has faced patent challenges in various markets.

FibroGen operates within a highly regulated pharmaceutical landscape, necessitating meticulous navigation of drug approval processes globally. Agencies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA) impose stringent requirements for new drug applications. For instance, the FDA's approval process, while varying by drug type, can take years and involve extensive clinical trials, with the average cost of bringing a new drug to market estimated to be over $2 billion as of recent analyses.

Adherence to Good Clinical Practice (GCP) and Good Manufacturing Practice (GMP) is non-negotiable for FibroGen. These standards ensure the quality, safety, and efficacy of clinical trials and manufactured products. Pharmacovigilance, the ongoing monitoring of drug safety after approval, is also a critical legal obligation. Failure to maintain these standards can lead to severe repercussions.

Non-compliance carries substantial legal and financial risks. These can include hefty fines, product recalls, or even the withdrawal of previously granted marketing approvals. For example, in 2023, several pharmaceutical companies faced significant penalties for manufacturing deficiencies and data integrity issues, underscoring the critical importance of robust compliance systems for companies like FibroGen.

FibroGen operates under stringent product liability laws, making it accountable for any harm caused by its pharmaceutical products. This necessitates a robust approach to ensuring therapeutic safety and efficacy, demonstrated through extensive clinical trials and ongoing post-market surveillance. For instance, the company's development of roxadustat, a treatment for anemia, involved significant regulatory scrutiny and ongoing monitoring for adverse events.

Data Privacy and Security Regulations

FibroGen navigates a complex landscape of data privacy and security regulations. Compliance with laws like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States is paramount, given the company's handling of sensitive patient data from clinical trials and commercial activities.

Failure to adhere to these regulations can lead to substantial financial penalties. For instance, GDPR violations can incur fines up to 4% of a company's annual global turnover or €20 million, whichever is higher. HIPAA penalties can range from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, as reported in 2024. Beyond financial repercussions, data breaches can severely damage FibroGen's reputation and erode patient trust, impacting its ability to conduct trials and market its products effectively.

To mitigate these risks and maintain legal standing, FibroGen must implement and continuously update robust data security measures. This includes encryption, access controls, and regular security audits to safeguard patient information and ensure ongoing patient confidence in the company's data handling practices.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Penalties: Fines from $100 to $50,000 per violation, with annual caps up to $1.5 million (2024 data).

- Reputational Impact: Breaches can lead to significant loss of public and patient trust.

- Security Investment: Ongoing investment in encryption and access controls is crucial for compliance.

Anti-Trust and Competition Laws

FibroGen's operations are subject to stringent anti-trust and competition laws designed to prevent monopolistic behavior and foster a level playing field. Regulatory bodies actively scrutinize the company's strategic moves, including potential mergers, acquisitions, and partnerships, to ensure they do not stifle fair market competition. This oversight extends to pricing strategies, which must not engage in anti-competitive practices.

Compliance with these regulations is paramount for FibroGen to avoid significant legal penalties and maintain its ability to access and operate within various markets. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on pharmaceutical industry consolidation, issuing reports and challenging several proposed mergers. While specific actions against FibroGen in this regard are not publicly detailed for the 2024-2025 period, the general regulatory climate indicates a heightened level of scrutiny on the sector.

- Regulatory Oversight: Anti-trust laws require FibroGen to ensure its business practices do not create monopolies or unfairly disadvantage competitors.

- Merger and Acquisition Scrutiny: Any significant consolidation involving FibroGen will undergo thorough review by competition authorities.

- Pricing Practices: The company must adhere to regulations preventing price-fixing or predatory pricing that could harm market competition.

- Market Access: Non-compliance can lead to fines, divestitures, or restrictions on market participation, impacting FibroGen's growth and revenue streams.

FibroGen's legal standing hinges on its intellectual property, particularly patents for drugs like roxadustat, which are vital for market exclusivity and recouping R&D costs. Patent expirations and challenges, such as those roxadustat has faced, directly impact revenue by opening the door to generic competition and reducing pricing power.

The pharmaceutical industry's stringent regulatory environment requires meticulous adherence to global drug approval processes overseen by bodies like the FDA and EMA. For example, bringing a new drug to market can cost upwards of $2 billion, with lengthy clinical trials and approval phases, a significant legal and financial undertaking for FibroGen.

Compliance with Good Clinical Practice (GCP) and Good Manufacturing Practice (GMP) is non-negotiable, ensuring product safety and efficacy. Pharmacovigilance, the ongoing monitoring of drug safety, is also a critical legal duty. Non-compliance can result in severe penalties, including fines and product recalls, as seen with other pharmaceutical firms facing repercussions for manufacturing or data integrity issues in 2023.

FibroGen is subject to product liability laws, making it accountable for any harm caused by its drugs, necessitating robust safety and efficacy demonstrations. Furthermore, adherence to data privacy regulations like GDPR and HIPAA is crucial, with GDPR violations potentially costing up to 4% of global annual turnover and HIPAA penalties reaching $1.5 million annually for repeat offenses as of 2024, underscoring the need for strong data security measures.

| Legal Factor | Impact on FibroGen | Relevant Data/Examples |

| Intellectual Property & Patents | Market exclusivity, R&D recoupment, revenue protection | Patent expirations for roxadustat can lead to generic competition. |

| Regulatory Approvals (FDA, EMA, NMPA) | Access to markets, product launch timelines, significant cost burden | Average cost to bring a new drug to market estimated over $2 billion. |

| Compliance (GCP, GMP, Pharmacovigilance) | Product quality, safety, efficacy, avoiding penalties | Penalties for manufacturing deficiencies and data integrity issues observed in 2023. |

| Product Liability | Accountability for product-related harm, need for safety data | Ongoing monitoring of adverse events for drugs like roxadustat. |

| Data Privacy (GDPR, HIPAA) | Protection of patient data, avoiding significant fines, maintaining trust | GDPR fines up to 4% of global turnover; HIPAA penalties up to $1.5M annually (2024). |

| Anti-trust & Competition Laws | Fair market practices, scrutiny of M&A, pricing strategies | Increased FTC scrutiny on pharmaceutical industry consolidation in 2024. |

Environmental factors

Increasing environmental scrutiny demands that FibroGen adopt sustainable manufacturing practices to minimize its ecological footprint. This includes reducing waste generation, optimizing energy consumption, and managing water usage in its production facilities. For instance, in 2024, many pharmaceutical companies, including those in FibroGen's sector, are investing heavily in green chemistry initiatives, aiming to cut hazardous waste by an average of 15% by 2025.

Adherence to environmental regulations and corporate sustainability goals is becoming increasingly important for stakeholders, impacting investor relations and brand reputation. FibroGen's commitment to reducing greenhouse gas emissions, with a target of a 20% reduction by 2026 compared to 2023 levels, aligns with broader industry trends and investor expectations for ESG performance.

The pharmaceutical sector, including companies like FibroGen, navigates a complex web of waste management and disposal regulations. This is due to the inherent nature of its operations, which produce diverse waste streams, from chemical by-products of research and development to biological materials from manufacturing processes.

FibroGen is obligated to adhere to stringent national and international rules governing the safe handling, treatment, and ultimate disposal of these often hazardous wastes. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which sets standards for hazardous waste management, impacting how pharmaceutical waste is managed from cradle to grave.

Failure to comply with these environmental mandates can result in severe repercussions. These include substantial financial penalties, such as fines that can reach tens of thousands of dollars per day for violations, as well as costly legal battles. Furthermore, instances of improper waste disposal can inflict significant and lasting damage to a company's reputation, eroding public trust and potentially impacting investor confidence.

Climate change poses a significant threat to FibroGen's supply chain. Extreme weather events, like the increased frequency of hurricanes and floods observed in recent years, can directly impact the sourcing of critical raw materials and the timely delivery of finished pharmaceutical products. For instance, disruptions in agricultural regions heavily reliant on stable weather patterns could affect the availability of botanical inputs, if applicable to their product lines.

To counter these vulnerabilities, FibroGen must prioritize building resilient supply chain strategies. This involves a thorough assessment of potential climate-related risks across their entire network. A focus on diversifying suppliers and exploring alternative transportation routes that are less susceptible to weather disruptions is paramount for maintaining operational continuity and ensuring product availability for patients.

Furthermore, evaluating and mitigating the environmental impact of transportation and logistics is essential. As of 2024, global supply chain emissions from shipping and air freight continue to be a major contributor to greenhouse gases. FibroGen can explore more sustainable logistics options, such as optimizing shipping routes, utilizing more fuel-efficient carriers, and potentially investing in or partnering with companies focused on green logistics solutions.

Environmental Regulations for R&D Facilities

FibroGen's research and development operations are significantly impacted by environmental regulations governing emissions, the storage of chemicals, and the disposal of laboratory waste. Strict adherence to these rules is critical for avoiding fines and preserving the necessary operating permits for their facilities.

The company must navigate a complex web of local, national, and potentially international environmental laws. For instance, in 2024, many regions are seeing increased scrutiny on greenhouse gas emissions from industrial facilities, which could affect energy consumption at R&D sites. Similarly, regulations around hazardous waste disposal, such as those under the Resource Conservation and Recovery Act (RCRA) in the United States, require meticulous tracking and management of chemical byproducts from research activities.

- Emissions Control: R&D facilities must manage air and water emissions, potentially investing in advanced filtration and treatment systems.

- Chemical Management: Safe storage, handling, and disposal protocols for a wide range of research chemicals are mandated by law.

- Waste Disposal: Proper classification, containment, and disposal of biological and chemical laboratory waste are subject to stringent environmental standards.

Corporate Social Responsibility (CSR) and Green Initiatives

Growing investor and public demand for corporate social responsibility means FibroGen is increasingly expected to engage in green initiatives and transparently report on its environmental performance. For instance, in 2024, a significant portion of institutional investors are prioritizing ESG (Environmental, Social, and Governance) factors, with many divesting from companies lacking strong environmental policies.

Demonstrating a commitment to environmental stewardship can enhance brand reputation, attract talent, and appeal to environmentally conscious investors. This trend is reflected in the increasing capital allocation towards sustainable businesses. FibroGen’s proactive approach to reducing its carbon footprint and waste management, as detailed in its 2025 sustainability report, directly addresses these market expectations.

- Investor Scrutiny: Over 70% of surveyed institutional investors in early 2025 indicated that ESG performance significantly influences their investment decisions.

- Talent Attraction: A 2024 study found that 60% of job seekers consider a company's environmental commitment when evaluating potential employers.

- Brand Value: Companies with strong green initiatives saw an average 5% increase in brand valuation in 2024 compared to those with weaker environmental records.

FibroGen faces mounting pressure to adopt sustainable practices, driven by stricter environmental regulations and growing investor demand for ESG performance. The company is actively working to minimize its ecological footprint, with a stated goal of reducing greenhouse gas emissions by 20% by 2026 compared to 2023 levels. This commitment is crucial for maintaining investor confidence and a positive brand image, especially as over 70% of institutional investors in early 2025 prioritized ESG factors in their decisions.

The company's operations, particularly research and development, are subject to rigorous environmental laws concerning emissions, chemical storage, and waste disposal. Failure to comply, such as improper handling of hazardous waste under regulations like the U.S. EPA's RCRA, can lead to substantial fines and reputational damage. For instance, pharmaceutical companies are investing in green chemistry, aiming for a 15% reduction in hazardous waste by 2025.

Climate change also presents a risk to FibroGen's supply chain, with extreme weather events potentially disrupting raw material sourcing and product delivery. To mitigate this, the company is focused on building supply chain resilience through supplier diversification and exploring more sustainable logistics options to reduce its carbon footprint from transportation, a significant contributor to global greenhouse gases.

| Environmental Factor | Impact on FibroGen | Key Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Compliance | Adherence to emissions, waste management, and chemical handling laws. | Potential fines for non-compliance; Industry trend: 15% hazardous waste reduction target by 2025. |

| Climate Change Risk | Supply chain disruption due to extreme weather. | Increased frequency of extreme weather events impacting logistics; Focus on supply chain resilience. |

| Stakeholder Expectations | Demand for ESG performance and sustainability initiatives. | 70%+ institutional investors prioritize ESG; 60% job seekers consider environmental commitment. |

| Operational Footprint | Minimizing ecological impact of manufacturing and R&D. | Target: 20% greenhouse gas reduction by 2026 (vs. 2023); Investment in green chemistry. |

PESTLE Analysis Data Sources

Our FibroGen PESTLE Analysis draws from a comprehensive dataset including regulatory filings from agencies like the FDA and EMA, economic reports from global financial institutions, and industry-specific market research. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.