FibroGen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

Discover the strategic positioning of FibroGen's product portfolio with our insightful BCG Matrix preview. See which products are poised for growth and which require careful management.

This glimpse into FibroGen's market standing is just the start. Unlock the full potential of strategic planning by purchasing the complete BCG Matrix report, offering detailed quadrant analysis and actionable insights.

Gain a competitive edge by understanding FibroGen's market share and growth prospects. Invest in the full BCG Matrix for a comprehensive breakdown and a clear roadmap to optimize your investment decisions.

Stars

Roxadustat has cemented its position as a leading treatment for anemia in patients with chronic kidney disease (CKD) in China. Its strong market performance is evident, as it held the number one brand by value share in the CKD anemia category in 2024. This translates to approximately 46% of the value share within the combined segment of erythropoiesis-stimulating agents (ESAs) and hypoxia-inducible factor-prolyl hydroxylase (HIF-PH) inhibitors.

The broader global renal anemia treatment market is also experiencing robust growth, projected to expand from $6.85 billion in 2024 to $14.15 billion by 2034. This expanding market landscape further underscores Roxadustat's established leadership and the significant opportunity it represents.

FibroGen's strategic decision to sell FibroGen China to AstraZeneca, anticipated to finalize in the third quarter of 2025, will inject substantial capital into FibroGen. This financial influx will bolster its strategic endeavors, while importantly, FibroGen will retain its rights to Roxadustat in key territories outside of China, South Korea, and those covered by Astellas' licenses.

FG-3246 is a promising antibody-drug conjugate (ADC) designed to target CD46, a protein often found on cancer cells, specifically for metastatic castration-resistant prostate cancer (mCRPC). This represents a potential first-in-class therapy in a market segment with substantial unmet medical needs.

FibroGen is strategically positioning FG-3246 for advancement, with plans to commence a Phase 2 monotherapy dose optimization study in mCRPC patients during the third quarter of 2025. This move underscores the company's commitment to exploring the drug's efficacy as a standalone treatment.

Further fueling anticipation, topline results from the Phase 2 portion of an investigator-sponsored trial combining FG-3246 with enzalutamide in mCRPC patients are slated for release in the fourth quarter of 2025. The oncology market, particularly for mCRPC, is a high-growth area, and FG-3246's targeted approach addresses a critical demand for more effective treatments.

FG-3180, a CD46-targeting PET imaging agent, is being co-developed with FG-3246. This dual development aims to assess diagnostic performance and explore the link between CD46 expression and patient response to FG-3246, fostering a precision medicine strategy.

The development of FG-3180 directly supports FG-3246 by providing a diagnostic tool. This synergy is expected to bolster the value proposition within the metastatic castrate-resistant prostate cancer (mCRPC) market.

Roxadustat for LR-MDS Anemia (US)

FibroGen is actively pursuing the US market for roxadustat in lower-risk myelodysplastic syndromes (LR-MDS) anemia. A Type-C meeting request has been submitted to the FDA to outline a potential Phase 3 development program. This strategic move targets a rapidly expanding and underserved patient population.

The myelodysplastic syndrome market is a significant growth area. Projections indicate it will reach $2.85 billion in 2025 and climb to $4.17 billion by 2029. This robust growth underscores the substantial commercial opportunity for effective treatments like roxadustat.

- Market Growth: The LR-MDS anemia market is projected to expand significantly, reaching $2.85 billion in 2025 and $4.17 billion by 2029.

- Unmet Need: This expansion highlights a substantial unmet medical need for improved treatment options in LR-MDS.

- Strategic Focus: FibroGen's engagement with the FDA for a Phase 3 program demonstrates a clear strategy to address this market.

- New Opportunity: Successful US approval for roxadustat in LR-MDS anemia would unlock a valuable new revenue stream for the company.

Immuno-oncology Product Candidates

FibroGen's strategic expansion into immuno-oncology is a significant move within its product candidate portfolio. The company is focusing on novel approaches to combat solid tumors, a challenging area in cancer treatment.

- FG-3165: This galectin-9 targeted monoclonal antibody received FDA Investigational New Drug (IND) clearance in June 2024. A Phase 1 clinical trial is slated to commence enrollment in the latter half of 2024, marking a crucial step in its development.

- FG-3175: This candidate, an anti-CCR8 monoclonal antibody, is on track for an IND filing in 2025. Its development further diversifies FibroGen's immuno-oncology pipeline.

- Market Potential: These early-stage assets are positioned to tap into the high-growth potential of the immuno-oncology market, which continues to see substantial investment and innovation.

FibroGen's product candidates, particularly those in late-stage development or with strong market positioning, can be categorized as Stars in the BCG matrix. Roxadustat's dominance in China's CKD anemia market, holding 46% value share in 2024, firmly places it in this category. FG-3246, targeting mCRPC, also shows Star potential due to its first-in-class approach and planned Phase 2 and 3 trials, addressing a high-growth oncology segment.

The company's strategic focus on expanding roxadustat into the US for LR-MDS anemia further solidifies its Star status, given the market's projected growth to $4.17 billion by 2029. FG-3165, with its IND clearance and upcoming Phase 1 trial in immuno-oncology, represents an emerging Star with significant future potential.

| Product Candidate | Therapeutic Area | Market Position/Potential | Key Development Milestone | Projected Market Size (Relevant Segment) |

|---|---|---|---|---|

| Roxadustat | CKD Anemia, LR-MDS Anemia | #1 brand by value share (China CKD Anemia, 2024) | FDA Type-C meeting for US LR-MDS Phase 3 | CKD Anemia (Global): $6.85B (2024) to $14.15B (2034) LR-MDS Anemia (US): $2.85B (2025) to $4.17B (2029) |

| FG-3246 | Metastatic Castration-Resistant Prostate Cancer (mCRPC) | Potential first-in-class therapy | Phase 2 monotherapy study start Q3 2025; Phase 2 combo topline Q4 2025 | mCRPC Market: High-growth area |

| FG-3165 | Immuno-Oncology (Solid Tumors) | Emerging asset | IND clearance (June 2024); Phase 1 enrollment H2 2024 | Immuno-Oncology Market: Substantial investment and innovation |

What is included in the product

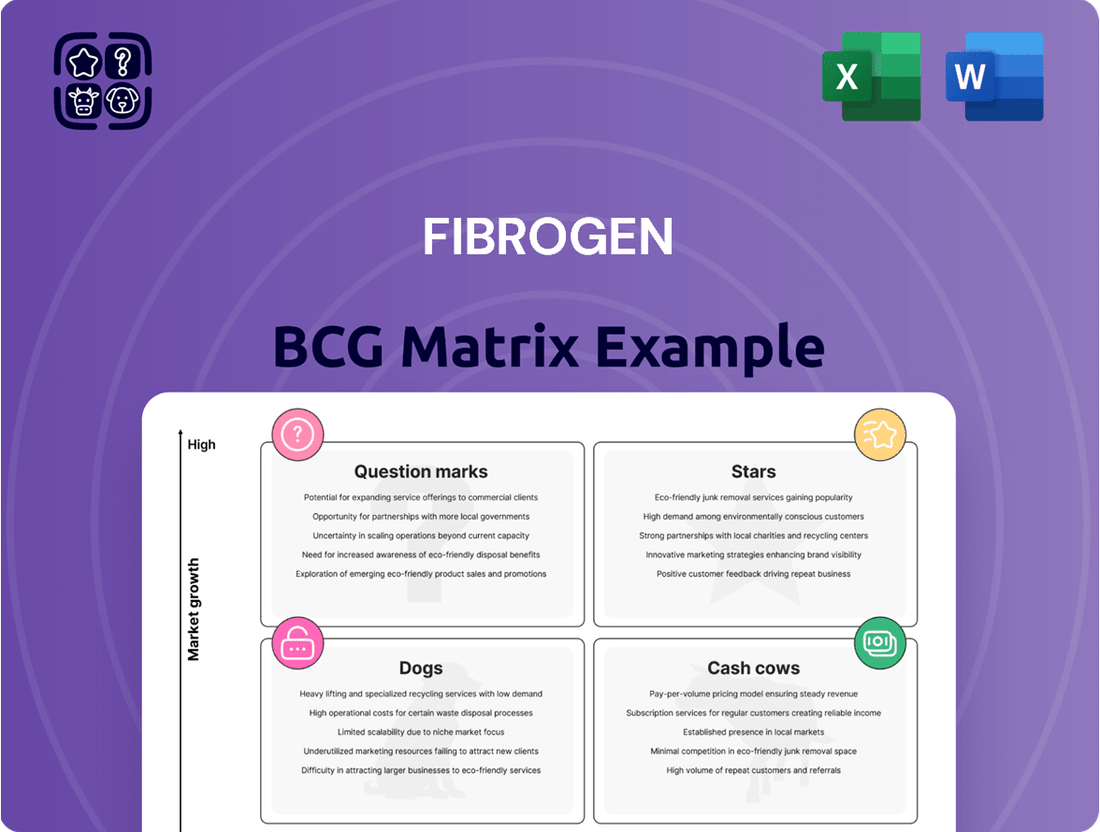

FibroGen's BCG Matrix offers a strategic overview of its product portfolio, categorizing assets into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

FibroGen's BCG Matrix offers a clear, actionable snapshot of its portfolio, easing strategic decision-making.

Cash Cows

Roxadustat has solidified its position as the undisputed market leader for chronic kidney disease anemia in China, consistently holding the top spot by value share. This established dominance in a mature market translates into significant and reliable cash flow for FibroGen.

The drug's strong performance is evident in its financial results, with total roxadustat net sales in China reaching $79.4 million in the first quarter of 2024 and climbing to $92.3 million in the second quarter of 2024. These figures underscore its ongoing success and its role as a key cash cow for the company.

FibroGen’s collaborations with Astellas for roxadustat in the E.U. and Japan, and with AstraZeneca for markets outside China and South Korea, position these ventures as strong Cash Cows. These established markets generate consistent, reliable revenue streams for FibroGen through tiered royalties and milestone payments. For instance, in 2023, Astellas reported significant sales of Evrenzo (roxadustat) in Japan, contributing to FibroGen’s royalty income.

The sale of FibroGen China to AstraZeneca for roughly $185 million, anticipated to finalize in the third quarter of 2025, is a major cash infusion for FibroGen. This deal unlocks significant capital from an asset with a strong market presence in a well-established market.

This transaction will bolster FibroGen's financial health and push its cash runway into the latter half of 2027. The capital will enable strategic reinvestment into other promising pipeline assets.

Existing Intellectual Property Portfolio

FibroGen's robust intellectual property portfolio, particularly concerning roxadustat and its other novel compounds, is a significant asset. This existing intellectual property creates a strong competitive moat, deterring new entrants in markets where roxadustat has already secured approvals.

This IP generates continuous value, not just through direct sales but also via licensing deals and commercialization partnerships. For instance, in 2023, FibroGen reported royalty revenues from its collaborations, underscoring the ongoing financial benefit derived from its intellectual assets.

The company's patent strategy protects its innovations, ensuring a sustained advantage in the therapeutic areas it targets.

- Key Patents: FibroGen holds numerous patents covering the composition of matter, manufacturing processes, and methods of use for roxadustat.

- Competitive Barrier: These patents effectively block competitors from developing or marketing similar drugs in approved indications.

- Licensing Revenue: The IP portfolio fuels licensing agreements, contributing to FibroGen's revenue streams beyond direct product sales.

- Future Potential: Ongoing research and development continue to expand the IP, potentially creating future cash cows from new drug candidates.

Operational Cost Reduction Initiatives

Following the disappointing pamrevlumab trial outcomes, FibroGen initiated a substantial operational cost reduction in the U.S. This included a workforce reduction of roughly 75%, a difficult but necessary step to enhance efficiency and bolster cash flow.

These measures are crucial for improving the company's financial standing and allowing it to reallocate resources more effectively. The aim is to create a more streamlined and agile organization capable of navigating future challenges.

- Workforce Reduction: Approximately 75% of the U.S. workforce was impacted by these cost-saving measures.

- Objective: To significantly lower operating expenses and improve overall cash flow.

- Strategic Rationale: To foster a leaner and more focused organizational structure post-trial setbacks.

Roxadustat's strong performance in China, with sales reaching $92.3 million in Q2 2024, firmly establishes it as a key Cash Cow. This drug's market leadership in a mature market generates consistent and substantial revenue for FibroGen.

The company's licensing agreements for roxadustat in the EU and Japan, as well as with AstraZeneca for other territories, also function as significant Cash Cows. These partnerships provide reliable income streams through royalties and milestone payments, demonstrating the global value of FibroGen's intellectual property.

The anticipated sale of FibroGen China to AstraZeneca for approximately $185 million, expected in Q3 2025, represents a substantial capital infusion. This transaction will bolster FibroGen's financial runway, extending it into late 2027 and enabling strategic reinvestment in its pipeline.

| Product/Asset | Market | Status | Key Financial Indicator | BCG Category |

|---|---|---|---|---|

| Roxadustat | China | Market Leader | Q2 2024 Sales: $92.3 million | Cash Cow |

| Roxadustat Licensing (EU/Japan) | EU/Japan | Commercialized | Royalty Revenue (2023 data available) | Cash Cow |

| FibroGen China Sale | China | Divestment | Expected Proceeds: ~$185 million | Capital Infusion (from Cash Cow) |

What You’re Viewing Is Included

FibroGen BCG Matrix

The FibroGen BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted strategic analysis ready for your immediate use. You can confidently proceed with the knowledge that the detailed insights and visual representations within this matrix will be exactly what you download, enabling you to make informed decisions and develop effective strategies for FibroGen's product portfolio.

Dogs

Pamrevlumab, when viewed through the lens of the BCG matrix for FibroGen, clearly falls into the Dog category. This classification stems from significant setbacks in its clinical development for pancreatic cancer.

Both the Precision PromiseSM study targeting metastatic pancreatic cancer and the LAPIS study for locally advanced, unresectable pancreatic cancer failed to achieve their primary goal of improving overall survival. These disappointing results led FibroGen to cease further investment in pamrevlumab research and development, signaling a strategic shift away from this asset.

The financial implications are substantial, with FibroGen having invested over $3.3 billion in R&D up to December 31, 2024. A significant portion of these expenditures was allocated to pamrevlumab, roxadustat, and FG-3246, highlighting the considerable resources committed to programs that ultimately did not yield the desired commercial success.

Pamrevlumab's journey in treating idiopathic pulmonary fibrosis (IPF) and Duchenne muscular dystrophy (DMD) has been challenging, placing it in the 'question mark' category of the BCG matrix. The drug previously failed to meet key objectives in clinical trials for both conditions.

Specifically, pamrevlumab did not achieve its primary or secondary endpoints in Phase III trials for DMD. This outcome was a significant blow to FibroGen, resulting in a notable decline in the company's stock price, underscoring the drug's limited market potential in this area.

These consistent setbacks across different therapeutic areas for pamrevlumab signal a low market share and dim growth prospects. This positions FibroGen's pamrevlumab as a product requiring careful strategic consideration within its portfolio.

FibroGen's strategy involves managing assets with uncertain futures. Early-stage immuno-oncology candidates lacking compelling pre-clinical or clinical data risk becoming cash drains.

These programs would consume valuable resources without a clear path to market or a distinct competitive edge. In 2024, companies often re-evaluate R&D pipelines, with approximately 30% of early-stage biotech projects being discontinued due to insufficient efficacy or safety data.

Without robust initial results, such FibroGen assets would likely be considered for divestiture or termination to preserve capital for more promising ventures.

Underperforming Roxadustat Territories (excluding China, Astellas, AstraZeneca licensed)

FibroGen retains rights to roxadustat in the U.S., Canada, and Mexico. Despite these rights, roxadustat has not gained significant market traction in these territories, largely due to a previous FDA rejection in the U.S.

The commercialization efforts in these specific regions have yielded low market share. This situation places these territories in the 'dog' quadrant of the BCG matrix, indicating low growth and low market share for roxadustat.

Without new strategic initiatives or partnerships, these regions are unlikely to contribute significantly to FibroGen's revenue from roxadustat.

- U.S. Market Rejection: The FDA's previous rejection of roxadustat in the United States significantly hampered its commercial prospects in a key market.

- Limited Commercial Success: Despite FibroGen's retained rights, roxadustat has failed to capture meaningful market share in the U.S., Canada, and Mexico.

- Low Growth Potential: These territories are characterized by low market growth rates for anemia treatments, further exacerbating roxadustat's underperformance.

- Strategic Re-evaluation Needed: The current status suggests a need for a strategic review of roxadustat's commercialization approach in these specific regions.

Legacy Research Programs with No Active Development

Legacy research programs with no active development represent a significant drag on resources. These could include preclinical assets that have been deprioritized due to strategic realignments or early-stage data that proved unpromising. For instance, if FibroGen had a pipeline of early-stage oncology compounds that failed to show efficacy in initial lab studies, these would fall into this category, tying up capital without a clear path to market.

These "dogs" in the BCG matrix are characterized by low market share and low growth potential, essentially representing a drain on the company's financial health. FibroGen's stated shift in strategic focus suggests a deliberate pruning of such less promising early-stage assets to reallocate capital towards more viable opportunities. This strategic pivot is crucial for optimizing resource allocation and improving overall portfolio efficiency.

- Tied-up Capital: Funds invested in discontinued or stalled research cannot be redeployed to more promising ventures.

- Opportunity Cost: The resources, both financial and human, dedicated to these legacy programs could have been used for active, high-potential projects.

- Strategic Shift Impact: FibroGen's evolving strategy necessitates the identification and divestment or discontinuation of assets that no longer align with its future direction.

FibroGen's pamrevlumab, particularly its failed attempts in pancreatic cancer trials like the Precision PromiseSM and LAPIS studies, firmly places it in the Dog category of the BCG matrix. These failures, which did not improve overall survival, led to the cessation of further investment, indicating a low market share and growth prospects. The substantial R&D investment, exceeding $3.3 billion by the end of 2024, underscores the financial commitment to assets that ultimately did not deliver.

Roxadustat's performance in the U.S., Canada, and Mexico also aligns with the Dog quadrant. Despite FibroGen retaining rights, the drug's limited market traction, largely due to a previous FDA rejection in the U.S., results in low market share and minimal growth in these territories. Without new strategies, these regions are unlikely to become significant revenue drivers for roxadustat.

Legacy research programs that are no longer actively developed, such as early-stage oncology compounds that failed initial efficacy studies, also represent Dogs. These assets consume capital without a clear path to market, highlighting the need for strategic pruning to reallocate resources to more promising ventures.

The discontinuation of assets with low growth and market share is crucial for optimizing FibroGen's portfolio. This strategic pivot aims to prevent tied-up capital and opportunity costs associated with underperforming projects, allowing for a more efficient allocation of financial and human resources.

| Asset | BCG Category | Rationale | Key Financial Impact (as of Dec 31, 2024) |

|---|---|---|---|

| Pamrevlumab (Pancreatic Cancer) | Dog | Failed to meet primary endpoints in clinical trials, leading to cessation of investment. | Significant R&D expenditure allocated, contributing to over $3.3 billion total R&D spend. |

| Roxadustat (US, Canada, Mexico) | Dog | Low market traction due to FDA rejection and limited commercial success. | Low market share and growth in key territories. |

| Deprioritized Early-Stage Assets | Dog | Lack of compelling pre-clinical or clinical data, representing potential cash drains. | Ties up capital and human resources that could be used for more promising projects. |

Question Marks

FibroGen is exploring a U.S. market entry for roxadustat to treat anemia in lower-risk myelodysplastic syndrome (LR-MDS). This strategic move targets a rapidly expanding market, with projections indicating the myelodysplastic syndrome sector will grow from $3.6 billion in 2025 to $6.3 billion by 2035.

Despite the promising market growth, roxadustat's path in the U.S. is complicated by prior regulatory challenges for chronic kidney disease (CKD) anemia. Consequently, its current market share in this new LR-MDS indication remains low and subject to significant uncertainty, positioning it as a potential question mark within FibroGen's portfolio analysis.

FG-3246, an antibody-drug conjugate targeting CD46, is currently being developed for metastatic castration-resistant prostate cancer (mCRPC). Its potential for treating other solid tumors is still in the early stages of investigation, making it a prime candidate for the Question Mark quadrant of the BCG matrix.

Expanding FG-3246's indications into other oncology markets, such as lung or breast cancer, could tap into significant growth opportunities. For instance, the global oncology market was valued at approximately $200 billion in 2023 and is projected to grow substantially. However, in these potential new markets, FG-3246 currently holds a negligible market share.

This position necessitates substantial investment in research, clinical trials, and market penetration strategies to establish a competitive presence. Without this investment, FG-3246 risks remaining a niche product, unable to capitalize on the broader potential within the lucrative oncology landscape.

FG-3165, a monoclonal antibody targeting galectin-9, is FibroGen's new entrant into the immuno-oncology space for solid tumors. Its Phase 1 clinical trial is slated to begin enrollment in the latter half of 2024, marking a significant step for the company.

The global oncology market, particularly for solid tumors, is substantial, projected to reach over $200 billion by 2026, offering a vast potential market. However, FG-3165 is in its nascent stages, meaning its current market share is negligible, and considerable investment is needed to demonstrate its therapeutic value and safety profile.

FG-3175 (Anti-CCR8 mAb) in Solid Tumors

FG-3175, an anti-CCR8 monoclonal antibody, represents FibroGen's foray into immuno-oncology, with an Investigational New Drug (IND) filing slated for 2025. This positions it as a future contender in a market actively seeking novel therapies.

CCR8 is a highly sought-after target in oncology, suggesting FG-3175 could enter a high-growth segment. The global immuno-oncology market was valued at approximately $75 billion in 2023 and is projected to grow significantly, driven by advancements in T-cell therapies and checkpoint inhibitors.

As a preclinical asset, FG-3175 currently holds no market share and necessitates considerable investment for clinical trial progression. The cost of Phase 1 trials alone can range from $10 million to $20 million, with subsequent phases escalating these figures substantially, highlighting the significant capital commitment required.

- Product Candidate: FG-3175 (Anti-CCR8 mAb)

- Therapeutic Area: Immuno-oncology, Solid Tumors

- Development Stage: Preclinical, IND filing anticipated 2025

- Market Opportunity: High, as CCR8 is a popular oncology target

- Investment Requirement: Substantial, for clinical trial progression

Roxadustat for Chemotherapy-Induced Anemia (CIA) in China

Roxadustat's application for chemotherapy-induced anemia (CIA) in China is currently a Question Mark. The China Health Authority accepted the Supplemental New Drug Application (sNDA) for review, with an expected decision in the latter half of 2024. This positions roxadustat for potential growth in a market projected to reach $2,800.2 million by 2035.

While roxadustat has a presence in China for chronic kidney disease (CKD) anemia, its market share in the CIA segment is minimal as it awaits regulatory approval. This low current market penetration, coupled with significant future market potential, defines its Question Mark status within the FibroGen BCG Matrix.

- Roxadustat sNDA for CIA in China: Accepted for review, decision expected H2 2024.

- CIA Market Projection: Estimated to reach $2,800.2 million by 2035.

- Current Market Share in CIA: Low, pending approval, indicating high growth potential.

- BCG Matrix Classification: Question Mark, due to low market share and high market growth.

Question Marks represent products or ventures with low market share in high-growth industries. These require significant investment to increase market share and move towards becoming Stars. Without successful investment, they risk becoming Dogs.

FibroGen's roxadustat for LR-MDS in the U.S. and for CIA in China, along with FG-3246 and FG-3165, all fit this category. They are in growing markets but currently have minimal market penetration.

FG-3175, while targeting a high-growth immuno-oncology market, is still in preclinical stages, making its market share negligible and its future uncertain, thus classifying it as a Question Mark.

| Product Candidate | Market Growth Potential | Current Market Share | BCG Classification | Key Considerations |

|---|---|---|---|---|

| Roxadustat (LR-MDS, U.S.) | High (MDS market $3.6B in 2025 to $6.3B by 2035) | Low (U.S. market entry) | Question Mark | Regulatory hurdles, prior challenges |

| Roxadustat (CIA, China) | High (China CIA market $2,800.2M by 2035) | Low (Pending approval) | Question Mark | Regulatory decision expected H2 2024 |

| FG-3246 (mCRPC) | High (Oncology market ~$200B in 2023) | Negligible (Early development) | Question Mark | Expansion into other solid tumors |

| FG-3165 (Solid Tumors) | High (Solid tumor oncology market >$200B by 2026) | Negligible (Nascent stages, Phase 1 enrollment H2 2024) | Question Mark | Requires significant R&D investment |

| FG-3175 (Immuno-oncology) | High (Immuno-oncology market ~$75B in 2023) | Negligible (Preclinical, IND filing 2025) | Question Mark | High investment for clinical trials |

BCG Matrix Data Sources

Our FibroGen BCG Matrix leverages comprehensive data, including internal financial reports, clinical trial results, and market research on therapeutic areas, to accurately assess product performance and potential.