Fertitta Entertainment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fertitta Entertainment Bundle

Fertitta Entertainment boasts significant strengths in its established brands and prime real estate, but faces opportunities in market expansion and emerging entertainment trends. Understanding their potential weaknesses and the competitive landscape is crucial for strategic decision-making.

Want the full story behind Fertitta Entertainment's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fertitta Entertainment boasts a robust portfolio of established brands spanning restaurants like Landry's Seafood House and Bubba Gump Shrimp Co., alongside hotel and casino operations under the Golden Nugget banner. This diversification across dining, lodging, gaming, and entertainment venues significantly reduces reliance on any single market segment, creating a more resilient revenue base.

Fertitta Entertainment benefits immensely from the strong leadership and clear vision of its founder, Tilman Fertitta. His entrepreneurial success is underscored by his personal net worth, estimated to exceed $10 billion by the close of 2024, a testament to his strategic business decisions and successful acquisitions.

Fertitta's strategic approach is characterized by a focus on acquiring high-value, or 'trophy assets,' and actively enhancing their worth. This strategy is evident in his recent significant real estate investments in Houston, such as the development and expansion of the River Oaks District, demonstrating his ability to identify and capitalize on growth opportunities.

Fertitta Entertainment benefits from its ownership of Golden Nugget casinos, which are actively being enhanced through renovations and expansions, like the ongoing work at Golden Nugget Lake Tahoe. This strategic investment positions the company to capitalize on the booming U.S. commercial gaming sector.

The gaming industry is experiencing unprecedented growth, with total revenues anticipated to surpass $67 billion in 2024, fueled by the rapid expansion of sports betting and iGaming. This robust market trend creates a highly advantageous backdrop for Fertitta Entertainment's gaming operations.

Integration of Dining, Lodging, and Entertainment

Fertitta Entertainment's strength lies in its ability to seamlessly blend dining, lodging, and entertainment. This integrated approach creates a compelling customer experience, encouraging longer stays and higher spending. For instance, the synergy between Golden Nugget's gaming floors and its diverse culinary offerings, including well-known restaurant brands, drives significant cross-promotional opportunities.

This strategy fosters customer loyalty by providing a comprehensive entertainment package. By offering a variety of amenities under one roof, Fertitta Entertainment can capture a larger share of a customer's entertainment budget. This integrated model is a key differentiator in the competitive casino and resort market.

The company's properties benefit from this integration, as seen in the performance of its lodging and dining segments complementing its core gaming operations. For example, in Q1 2024, Golden Nugget's net revenue reached $377 million, with its casino operations, supported by its hospitality and dining, showing robust performance.

- Integrated Experience: Combines gaming, dining, lodging, and entertainment for a holistic customer offering.

- Synergistic Revenue Streams: Dining and lodging drive traffic and spend within gaming operations, and vice versa.

- Enhanced Customer Loyalty: A comprehensive entertainment package encourages repeat business and longer customer engagement.

Real Estate Holdings and Development Potential

Fertitta Entertainment's portfolio includes valuable real estate assets like The Post Oak Hotel and Kemah Boardwalk, which are significant draws for millions of visitors annually. These properties represent not just operational income streams but also substantial long-term asset appreciation potential.

While large-scale development projects, such as the previously planned Las Vegas Strip casino, have been put on hold, the underlying ownership of prime real estate remains a core strength. This strategic pause allows for future flexibility and potential repurposing of these valuable land holdings.

- The Post Oak Hotel in Houston, a luxury destination, contributes to the company's real estate value.

- Kemah Boardwalk attracts a substantial number of tourists, underscoring the appeal of its entertainment-focused real estate.

- The company's strategic real estate holdings provide a foundation for future growth and potential development opportunities.

Fertitta Entertainment's diversified brand portfolio, encompassing restaurants, hotels, and casinos, provides a stable and resilient revenue base. This strategic diversification mitigates risks associated with reliance on any single market segment.

The company benefits from the strong leadership and financial acumen of its founder, Tilman Fertitta, whose net worth exceeded $10 billion by the end of 2024. His strategic vision is key to identifying and capitalizing on high-value assets and growth opportunities.

Fertitta Entertainment's ownership of Golden Nugget casinos is a significant strength, especially given the booming U.S. commercial gaming sector. Total industry revenues were projected to surpass $67 billion in 2024, driven by sports betting and iGaming expansion.

The company excels at integrating gaming, dining, and lodging, creating a comprehensive and appealing customer experience. This synergy enhances customer loyalty and encourages higher spending, as demonstrated by Golden Nugget's Q1 2024 net revenue of $377 million.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Diversified Portfolio | Spans restaurants, hotels, and casinos, reducing single-market reliance. | Landry's Seafood House, Bubba Gump Shrimp Co., Golden Nugget casinos. |

| Founder's Leadership | Strong vision and financial expertise from Tilman Fertitta. | Personal net worth exceeding $10 billion by end of 2024. |

| Gaming Operations | Capitalizes on strong growth in the U.S. commercial gaming sector. | Projected industry revenues over $67 billion in 2024. |

| Integrated Experience | Synergy between gaming, dining, and lodging enhances customer value. | Golden Nugget Q1 2024 net revenue of $377 million. |

What is included in the product

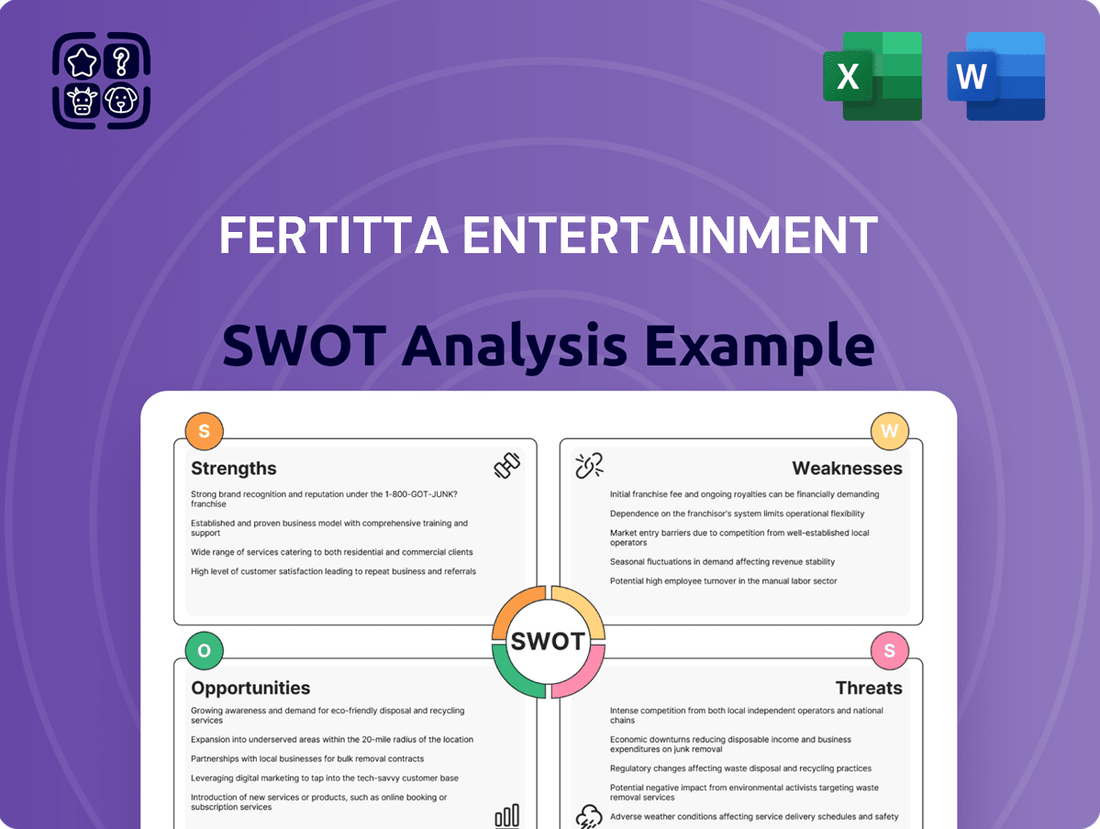

Analyzes Fertitta Entertainment’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear visualization of Fertitta Entertainment's competitive landscape, highlighting key strengths and weaknesses to proactively address potential threats and capitalize on opportunities.

Weaknesses

Fertitta Entertainment's significant reliance on discretionary consumer spending presents a key weakness. This makes the company particularly susceptible to economic fluctuations, such as inflation and shifts in consumer confidence, which directly impact the willingness of individuals to spend on entertainment and dining.

For instance, projections for 2025 suggest a moderation in domestic leisure travel growth, a sector crucial to Fertitta's revenue streams. This slowdown is attributed to persistent inflation concerns and a general dip in consumer sentiment, indicating a potentially tighter spending environment for the company's offerings.

Tilman Fertitta's recent appointment as the U.S. Ambassador to Italy and San Marino presents a notable weakness for Fertitta Entertainment. This new role necessitates him pausing significant projects, including the highly anticipated Las Vegas Strip casino, to navigate potential conflicts of interest stemming from his substantial stake in Wynn Resorts. This pause could delay key growth initiatives.

While Fertitta has committed to resigning from corporate positions to mitigate these conflicts, this transition could still affect the immediate strategic direction and expansion plans of Fertitta Entertainment. The leadership vacuum or the need for new decision-making processes might slow down operational momentum and future development.

Fertitta Entertainment operates in highly saturated markets, facing intense rivalry from both large, diversified corporations and niche specialists across hospitality, dining, and gaming. This constant pressure from established brands and emerging players means pricing flexibility is often limited, and significant investment in innovation is crucial to capture and maintain customer loyalty. For instance, in 2023, the U.S. gaming revenue reached an estimated $267 billion, illustrating the sheer scale of the market and the competitive intensity within it.

Vulnerability to Rising Operating Costs

Fertitta Entertainment, like many in the hospitality and restaurant industries, faces a significant vulnerability to escalating operating expenses. These costs, encompassing everything from the price of ingredients to the wages paid to staff, can eat into profitability. For instance, the U.S. Bureau of Labor Statistics reported that the consumer price index for food away from home increased by 5.1% in the 12 months ending April 2024, a clear indicator of rising food costs.

The labor market presents another substantial challenge. Increases in minimum wages, coupled with high employee turnover rates common in the service sector, create ongoing recruitment and retention difficulties. This forces companies to spend more on training and competitive compensation, directly impacting the bottom line. In 2023, the restaurant industry experienced an average turnover rate of 72.9%, according to the National Restaurant Association, highlighting the persistent nature of this issue.

These combined cost pressures can directly squeeze profit margins across Fertitta Entertainment's diverse portfolio of restaurants and hotels. Managing these expenses effectively is crucial for maintaining financial health and competitiveness in a dynamic market.

- Rising Food Costs: Increased prices for ingredients directly affect the cost of goods sold.

- Labor Expenses: Higher minimum wages and the cost of attracting and retaining staff are significant burdens.

- Supply Chain Disruptions: Volatility in the supply chain can lead to unpredictable price fluctuations and availability issues for key supplies.

- Impact on Profitability: These escalating costs can reduce overall profit margins if not effectively managed through pricing strategies or cost-saving measures.

Uncertainty in Future Development Projects

The indefinite pause of Fertitta Entertainment's planned Las Vegas Strip casino project introduces significant uncertainty regarding its future expansion in this crucial market. This decision impacts a key potential growth driver, leaving a prime real estate asset undeveloped and potentially limiting long-term opportunities.

This pause, reportedly influenced by Tilman Fertitta's other business interests and potential conflicts, means Fertitta Entertainment isn't capitalizing on a prime location. For instance, the company's 2024 first-quarter earnings report highlighted ongoing strategic reviews, but specific timelines for recommencing major Strip development remain unclear, creating a gap in their growth narrative.

- Delayed Expansion: The Las Vegas Strip project's indefinite pause directly impacts Fertitta Entertainment's ability to tap into one of the world's most lucrative gaming and entertainment markets.

- Opportunity Cost: Holding undeveloped prime real estate on the Strip represents a missed opportunity for revenue generation and market share growth.

- Strategic Uncertainty: The reasons behind the pause, potentially related to other ventures or capital allocation, create ambiguity about the company's long-term commitment and strategy for its Las Vegas presence.

Fertitta Entertainment's heavy reliance on discretionary spending makes it vulnerable to economic downturns, such as the projected moderation in domestic leisure travel growth for 2025 due to inflation and decreased consumer confidence. This sensitivity to economic shifts can directly impact revenue streams. Furthermore, the company faces intense competition in highly saturated markets, as evidenced by the estimated $267 billion U.S. gaming revenue in 2023, which limits pricing power and necessitates continuous investment in innovation to maintain market share.

Escalating operating expenses, including a 5.1% increase in food away from home prices in the year ending April 2024, and labor challenges like the 72.9% average restaurant industry turnover rate in 2023, significantly squeeze profit margins. The indefinite pause of the Las Vegas Strip casino project also represents a missed opportunity for growth in a key market, creating strategic uncertainty.

Preview Before You Purchase

Fertitta Entertainment SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fertitta Entertainment's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

The digital gaming and sports betting sectors represent a substantial opportunity for Fertitta Entertainment. The U.S. online gambling market is projected to hit $26.8 billion in gross revenues by the close of 2025, a figure expected to climb even higher, potentially exceeding $41 billion by 2028.

Leveraging its existing iGaming presence through the Golden Nugget brand, Fertitta Entertainment is well-positioned to expand into online sports betting and other digital gaming areas. This strategic move allows the company to tap into a rapidly expanding market and capitalize on evolving consumer preferences for digital entertainment.

The hospitality and restaurant sectors are rapidly integrating technologies like AI and automation to boost efficiency and customer satisfaction. Fertitta Entertainment can strategically deploy these innovations across its brands, from AI-powered guest services in its Golden Nugget casinos to advanced ordering systems in its Landry's restaurants, to sharpen its competitive edge.

By investing in AI for personalized marketing and automation for streamlined operations, Fertitta Entertainment can significantly enhance guest experiences and optimize profitability. For example, the global AI in hospitality market was projected to reach $1.6 billion in 2023 and is expected to grow substantially, offering a clear opportunity for companies like Fertitta Entertainment to gain market share.

Current market conditions, including a potential recalibration of private equity investment strategies and continued industry consolidation, create fertile ground for Fertitta Entertainment to pursue strategic acquisitions. The gaming and hospitality sectors have seen significant M&A activity, with deal volumes fluctuating but underlying interest remaining strong.

Acquiring smaller, complementary businesses or independent properties could allow Fertitta Entertainment to achieve greater economies of scale, streamline operational efficiencies, and broaden its market footprint. For instance, in 2024, the hospitality industry continued to see consolidation, with private equity firms actively seeking opportunities in resilient segments.

Furthermore, forging partnerships, especially with companies adept at digital transformation and online engagement, offers a pathway to accelerate the modernization of traditional business models. Collaborations with tech innovators can be crucial for expanding into the online gaming and digital entertainment spaces, a trend that gained significant momentum in 2024.

Growth in Experiential Entertainment and Luxury Segments

Consumer appetite for unique, hands-on entertainment is surging, with a particular focus on immersive, location-based attractions. This includes theme parks, entertainment districts, and casinos, all seeking to offer more than just passive enjoyment. Fertitta Entertainment, already boasting assets like Kemah Boardwalk and the upscale Post Oak Hotel, is strategically positioned to leverage this shift.

The company can further enhance its integrated luxury and experiential portfolio, tapping into a market segment that values memorable experiences. For instance, the global market for experiential marketing is projected to reach $800 billion by 2028, indicating a significant growth runway. Fertitta Entertainment’s existing infrastructure provides a solid foundation for expanding these offerings.

- Growing Demand: Consumers increasingly seek authentic, immersive, and interactive entertainment.

- Fertitta's Assets: Existing venues like Kemah Boardwalk and The Post Oak Hotel align with this trend.

- Market Potential: The experiential marketing sector shows robust growth, indicating strong revenue opportunities.

- Strategic Advantage: Fertitta Entertainment can leverage its properties to develop integrated luxury and experiential offerings.

International Market Expansion

Fertitta Entertainment can leverage its strong brand recognition to tap into the burgeoning global hospitality and tourism market. Projections indicate a robust recovery and potential surpassing of pre-pandemic international visitor numbers by 2025, presenting a significant opportunity for expansion.

Strategic entry into high-growth international markets, particularly those showing strong demand for luxury hospitality and gaming, could significantly diversify revenue streams. For instance, the Asia-Pacific region is expected to see continued economic growth and an expanding middle class, making it an attractive target for premium entertainment offerings.

- Global tourism recovery: International tourist arrivals are projected to reach or exceed 2019 levels in many regions by 2025, according to the UN World Tourism Organization (UNWTO).

- Asia-Pacific growth: The Asia-Pacific region alone is anticipated to account for a substantial portion of global tourism growth in the coming years.

- Luxury market demand: Increasing disposable incomes in emerging economies fuel demand for high-end travel and entertainment experiences.

The digital gaming and sports betting sectors represent a substantial opportunity for Fertitta Entertainment. The U.S. online gambling market is projected to hit $26.8 billion in gross revenues by the close of 2025, a figure expected to climb even higher, potentially exceeding $41 billion by 2028.

Leveraging its existing iGaming presence through the Golden Nugget brand, Fertitta Entertainment is well-positioned to expand into online sports betting and other digital gaming areas. This strategic move allows the company to tap into a rapidly expanding market and capitalize on evolving consumer preferences for digital entertainment.

The hospitality and restaurant sectors are rapidly integrating technologies like AI and automation to boost efficiency and customer satisfaction. Fertitta Entertainment can strategically deploy these innovations across its brands, from AI-powered guest services in its Golden Nugget casinos to advanced ordering systems in its Landry's restaurants, to sharpen its competitive edge.

By investing in AI for personalized marketing and automation for streamlined operations, Fertitta Entertainment can significantly enhance guest experiences and optimize profitability. For example, the global AI in hospitality market was projected to reach $1.6 billion in 2023 and is expected to grow substantially, offering a clear opportunity for companies like Fertitta Entertainment to gain market share.

Threats

The hospitality and restaurant industries are particularly vulnerable to economic downturns and ongoing inflation. For Fertitta Entertainment, this means a potential dip in consumer spending on discretionary items like dining out and entertainment. As of early 2024, many economies are still grappling with elevated inflation rates, with the US experiencing a Consumer Price Index (CPI) that, while moderating, remained above the Federal Reserve's target for much of 2023 and into 2024.

Persistent inflation directly impacts Fertitta Entertainment's cost structure. Rising food and beverage prices, coupled with ongoing supply chain challenges that began in 2021 and continue to have lingering effects, can significantly erode profit margins. Furthermore, the labor market remains tight, leading to increased wage pressures across its workforce, from front-of-house staff to kitchen personnel, adding another layer of operational expense.

The restaurant and hospitality sectors are still grappling with serious labor issues, including worker scarcity and climbing minimum wages. For Fertitta Entertainment, this translates directly to higher operating expenses and a constant challenge in keeping service standards consistently high. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings for leisure and hospitality workers saw a notable increase, putting pressure on businesses to match these gains to attract and retain staff.

High employee turnover remains a persistent hurdle, forcing continuous investment in recruitment and training. This cycle not only drains financial resources but can also negatively impact the customer experience due to less experienced staff. Industry reports from late 2023 and early 2024 indicated that turnover rates in hospitality remained elevated compared to pre-pandemic levels, underscoring the ongoing nature of this threat.

The gaming sector faces a dynamic regulatory environment, with evolving iGaming laws and a heightened focus on responsible gaming practices presenting potential challenges. For Fertitta Entertainment, shifts in these regulations or increased taxation on gaming income could directly affect the financial performance of its casino businesses. For instance, as of early 2024, several US states are actively debating or implementing new iGaming regulations, with some considering higher tax rates on gross gaming revenue, which could impact margins.

Increased Competition from Online and Digital Platforms

The escalating presence of online gaming and digital entertainment platforms presents a significant competitive challenge. These platforms can attract consumer spending away from traditional venues like Fertitta Entertainment's casinos. For instance, the global online gambling market was valued at over $60 billion in 2023 and is projected to grow substantially, indicating a shift in consumer preferences towards digital engagement.

Failure to embrace and integrate digital strategies could lead to a decline in market share for companies like Fertitta Entertainment. Operators who are agile in adopting new technologies and offering seamless online experiences are better positioned to capture a larger segment of the entertainment market.

- Digital Disruption: Online platforms offer convenience and accessibility, directly competing for entertainment budgets.

- Market Share Erosion: Companies slow to adapt risk losing customers to more digitally integrated competitors.

- Technological Arms Race: Continuous innovation in digital offerings by competitors necessitates ongoing investment and adaptation.

- Changing Consumer Habits: A growing segment of consumers prefers digital interactions, impacting traditional entertainment models.

Geopolitical Uncertainties and Travel Restrictions

Geopolitical tensions and the reintroduction of travel restrictions pose a significant threat to Fertitta Entertainment. These events can directly dampen both international and domestic travel, impacting the core demand for hospitality and entertainment services. For instance, a resurgence of widespread travel advisories in late 2024 or early 2025 could lead to a noticeable drop in bookings at properties like Golden Nugget casinos and Landry's restaurants.

The hospitality sector is particularly sensitive to global instability. Reduced international arrivals, coupled with potential domestic hesitancy to travel, could translate to lower occupancy rates across Fertitta's hotel portfolio and decreased foot traffic at its dining establishments. This directly affects revenue streams, as seen in past periods of heightened global uncertainty where travel spending saw significant contractions.

- Reduced International Tourism: Geopolitical events can deter foreign travelers, a key demographic for many of Fertitta Entertainment's properties.

- Domestic Travel Hesitancy: Uncertainty can also make domestic consumers more cautious about discretionary spending on travel and entertainment.

- Operational Disruptions: Potential for sudden travel bans or restrictions could disrupt supply chains and staffing for venues.

- Impact on Event Bookings: Large-scale events and conventions, crucial revenue drivers, may be canceled or postponed due to geopolitical concerns.

The competitive landscape for Fertitta Entertainment is intensifying, with rivals actively investing in digital transformation and customer experience enhancements. This necessitates continuous innovation and significant capital expenditure to maintain market relevance. For instance, competitors are increasingly leveraging data analytics to personalize offers and improve engagement, a trend that requires substantial investment in technology infrastructure and skilled personnel.

The gaming and hospitality sectors are also subject to fluctuating consumer preferences and evolving entertainment trends. A failure to adapt to these shifts, such as a growing demand for unique experiences or a move towards more casual gaming formats, could lead to a decline in customer engagement and revenue. The rise of experiential entertainment, for example, means that traditional offerings must constantly evolve to remain appealing.

The ongoing integration of online and offline gaming experiences presents both opportunities and threats. Competitors who successfully blend these channels can offer a more seamless and engaging customer journey. Fertitta Entertainment must ensure its digital platforms are robust and integrated with its physical properties to avoid losing customers to more digitally savvy operators.

The increasing prevalence of data privacy regulations and cybersecurity threats also poses a significant risk. Protecting customer data and ensuring the security of online transactions are paramount. A data breach could lead to substantial financial penalties and severe damage to the company's reputation. As of early 2024, regulatory bodies globally are increasing scrutiny on data handling practices, with potential fines for non-compliance reaching millions of dollars.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Fertitta Entertainment's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.