Fertitta Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fertitta Entertainment Bundle

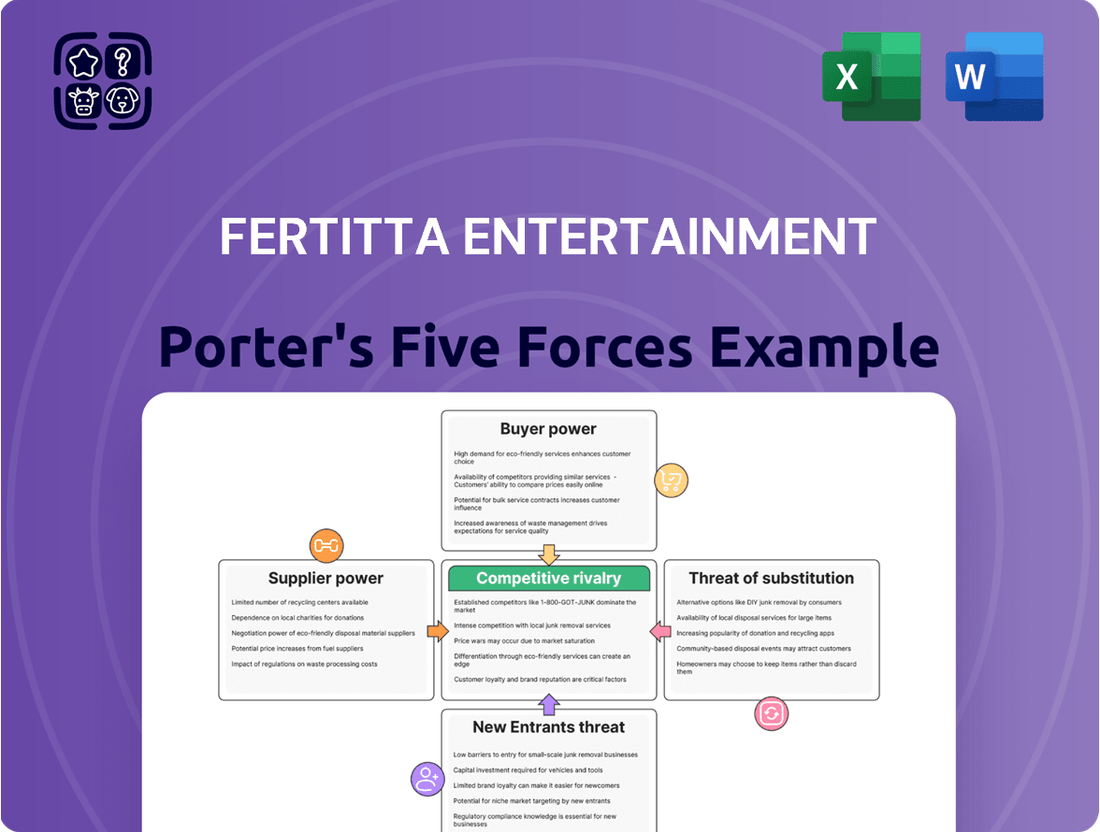

Fertitta Entertainment navigates a landscape shaped by intense competition and the ever-present threat of new entrants. Understanding the power of buyers and the availability of substitutes is crucial for its success. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fertitta Entertainment’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fertitta Entertainment's broad operational scope, encompassing restaurants, hotels, casinos, and entertainment, necessitates sourcing from a vast and fragmented supplier base. This includes everything from food and beverage distributors to gaming equipment providers and construction firms.

The sheer number of potential suppliers across these diverse categories typically dilutes the bargaining power of any single entity. Fertitta Entertainment can often leverage this fragmentation to negotiate favorable terms, as switching suppliers for many goods and services is a relatively straightforward process.

For instance, in the food and beverage sector, which is highly competitive, Fertitta Entertainment likely benefits from numerous suppliers offering similar products. This competitive landscape for suppliers directly translates into reduced individual supplier power.

Fertitta Entertainment's reliance on specialized ingredients for its iconic restaurant brands, such as premium seafood and aged meats, can significantly bolster the bargaining power of its suppliers. For instance, a unique, high-quality beef supplier for a signature steakhouse could command higher prices if alternatives are scarce or of lesser quality. This dependence limits Fertitta Entertainment's flexibility in sourcing, giving these specialized suppliers more leverage in negotiations.

The hospitality and gaming sectors are inherently labor-intensive, making the workforce a critical factor. Shortages of skilled talent, especially in areas like specialized culinary arts or intricate casino operations, can significantly bolster the bargaining power of employees. This dynamic may necessitate Fertitta Entertainment offering more attractive compensation and benefits packages to secure and retain essential staff.

Labor costs remain a substantial hurdle for restaurants, with projections indicating continued upward pressure in 2025. For instance, the U.S. Bureau of Labor Statistics reported a median hourly wage of $15.20 for food preparation and serving workers in May 2023, a figure likely to see further increases due to inflation and demand.

Impact of Supply Chain Disruptions

Global and regional supply chain disruptions, like those impacting food prices and raw materials, can significantly bolster supplier power. This happens when limited availability forces buyers to accept higher costs, as seen in the restaurant industry's recent struggles.

The restaurant sector, including companies like Fertitta Entertainment, has navigated considerable supply chain turbulence. This includes volatile food prices and persistent labor shortages, both of which give suppliers more leverage.

- Food Price Volatility: For instance, the U.S. Producer Price Index for food away from the home increased by 5.7% year-over-year as of April 2024, indicating rising input costs for restaurants.

- Labor Shortages: The U.S. Bureau of Labor Statistics reported a significant number of job openings in the leisure and hospitality sector throughout 2023 and into early 2024, contributing to operational challenges and potentially increasing reliance on suppliers who can guarantee consistent service.

- Increased Supplier Bargaining Power: These factors collectively empower suppliers by creating a situation where demand for their products or services outstrips supply, giving them greater latitude in setting terms and prices.

Long-Term Supplier Relationships

Fertitta Entertainment may cultivate long-term contracts and robust relationships with critical suppliers. This interdependence offers stability but can also empower suppliers if switching costs are high, as seen in the gaming and hospitality sector where specialized equipment or unique sourcing arrangements can be difficult to replicate. For instance, securing exclusive rights to certain casino game suppliers or unique food and beverage purveyors creates a reliance that shifts bargaining power.

Building a resilient supply chain is paramount. This involves identifying and vetting reliable carriers, as delays or disruptions in transporting goods, especially perishable items or time-sensitive components for entertainment venues, can be costly. Fertitta Entertainment's focus on operational efficiency means mitigating risks associated with transportation partners is a continuous effort.

- Supplier Dependence: For critical inputs, Fertitta Entertainment might enter into long-term agreements, fostering interdependence.

- Switching Costs: The complexity and expense of changing suppliers for specialized services or goods can grant existing suppliers leverage.

- Supply Chain Resilience: Proactive risk assessments and partnerships with dependable logistics providers are key to managing supplier power.

- Strategic Sourcing: Securing exclusive or preferential access to unique resources, like specific entertainment technology or premium F&B, enhances supplier relationships and can mitigate their overt power.

While Fertitta Entertainment benefits from a fragmented supplier base in many areas, certain critical inputs and market conditions can significantly amplify supplier bargaining power. This is particularly true for specialized goods, labor, and in periods of supply chain disruption, forcing the company to adapt its sourcing strategies.

| Factor | Impact on Supplier Bargaining Power | Supporting Data (as of mid-2024) |

|---|---|---|

| Specialized Inputs | High | Limited availability of unique F&B ingredients or exclusive gaming technology can lead to price premiums. |

| Labor Market Conditions | Moderate to High | U.S. hospitality sector job openings remained elevated through early 2024, with wage growth continuing. For example, the average hourly earnings for leisure and hospitality workers saw a notable increase. |

| Supply Chain Disruptions | High | Food away from home producer prices increased by approximately 5.7% year-over-year as of April 2024, reflecting ongoing cost pressures that suppliers pass on. |

| Supplier Dependence/Switching Costs | Moderate to High | Long-term contracts for specialized equipment or unique sourcing arrangements can create interdependence, making supplier switching costly and time-consuming. |

What is included in the product

Tailored exclusively for Fertitta Entertainment, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its gaming and hospitality operations.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, enabling Fertitta Entertainment to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Fertitta Entertainment caters to a wide array of customers, from everyday diners enjoying casual meals to affluent individuals frequenting their casinos and luxury hotels. This broad customer base includes leisure travelers and those seeking high-end entertainment experiences.

While any single customer possesses limited bargaining power, the collective preferences and spending patterns of this diverse group can exert considerable influence on Fertitta Entertainment's operational and strategic decisions. For instance, shifts in consumer demand for specific types of entertainment or dining can necessitate adjustments to offerings or pricing.

Looking ahead to 2025, projections indicate a continued rise in consumer spending on entertainment and leisure activities. This trend suggests that while individual customer power remains fragmented, the aggregate purchasing power of a growing consumer market will be a significant factor for Fertitta Entertainment to consider.

In the casual dining and standard hotel sectors, customers often exhibit higher price sensitivity. This means they have a greater ability to switch to competitors if prices become too steep, thereby exerting some bargaining power. For instance, with ongoing inflation, consumers are becoming more discerning about where they spend their discretionary income, often prioritizing perceived value when choosing to dine out or book accommodations.

Customers in the gaming and luxury hospitality sectors often seek unique experiences, which can lessen their price sensitivity and therefore their bargaining power. For example, a 2024 report indicated that over 70% of consumers consider experiences more valuable than possessions, a trend particularly strong among younger demographics. This focus on memorable events rather than just cost means companies like Fertitta Entertainment can command premium pricing.

Availability of Information and Online Reviews

The widespread availability of information and online reviews significantly amplifies customer bargaining power for companies like Fertitta Entertainment. Platforms such as TripAdvisor, Yelp, and Google Reviews allow potential customers to easily compare pricing, amenities, and service quality across various entertainment venues and restaurants. This transparency means customers can readily identify the best value, putting pressure on Fertitta Entertainment to remain competitive.

For instance, a 2024 report indicated that over 85% of consumers read online reviews before making a purchasing decision, especially in the hospitality and entertainment sectors. This reliance on peer feedback empowers customers to negotiate or seek better deals, as they are well-informed about alternatives. Fertitta Entertainment must therefore focus on delivering exceptional experiences and transparent pricing to retain customer loyalty in this environment.

- Informed Decisions: Customers can easily access competitor pricing and service details, enabling them to make more informed choices.

- Price Sensitivity: Transparency leads to increased price sensitivity, compelling Fertitta Entertainment to offer competitive rates.

- Service Quality Pressure: Online reviews directly impact reputation, pushing the company to maintain high service standards.

- 2024 Consumer Behavior: Over 85% of consumers consult online reviews before purchasing, highlighting the impact of readily available information.

Loyalty Programs and Brand Stickiness

Fertitta Entertainment, through brands like Golden Nugget, leverages loyalty programs to foster customer retention. These programs aim to make continued patronage within the Fertitta ecosystem more appealing, thereby diminishing the bargaining power of individual customers.

The effectiveness of these loyalty initiatives is crucial. For instance, a well-structured program can incentivize repeat visits and spending, making customers less likely to seek out competitors based on price alone.

- Brand Stickiness: Loyalty programs are designed to create "stickiness," making it harder for customers to switch to rival offerings.

- Reduced Price Sensitivity: By offering rewards and exclusive benefits, Fertitta Entertainment can lessen the impact of price-based negotiations from customers.

- Authenticity and Experience: A key trend in casino marketing, as observed in 2024, is building brand loyalty through authentic experiences and memorable customer interactions, which further strengthens a brand's position against customer bargaining power.

The bargaining power of customers for Fertitta Entertainment is moderate, influenced by a blend of price sensitivity in casual segments and a focus on experience in luxury areas. While individual customers have limited sway, their collective purchasing power and informed decision-making, amplified by online transparency, exert pressure on the company. Fertitta Entertainment mitigates this by fostering loyalty through programs and emphasizing unique experiences.

| Customer Segment | Bargaining Power Factors | Impact on Fertitta Entertainment | 2024 Data Point |

|---|---|---|---|

| Casual Dining/Standard Hotels | High Price Sensitivity, Ease of Switching | Pressure for competitive pricing and value offerings | Consumers increasingly prioritize value due to inflation. |

| Gaming/Luxury Hospitality | Lower Price Sensitivity, Focus on Experience | Ability to command premium pricing, less susceptible to price wars | Over 70% of consumers value experiences over possessions. |

| All Segments (Information Access) | Widespread Online Reviews, Price Comparison | Need for transparency, high service standards, and competitive rates | Over 85% of consumers read reviews before purchasing. |

Full Version Awaits

Fertitta Entertainment Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Fertitta Entertainment, offering an in-depth examination of competitive rivalry, buyer power, supplier power, the threat of new entrants, and the threat of substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain a comprehensive understanding of the strategic landscape impacting Fertitta Entertainment's operations and profitability.

Rivalry Among Competitors

Fertitta Entertainment operates in highly fragmented sectors like hospitality, restaurants, and gaming, facing a multitude of local, regional, and national competitors. This means they're up against not just other large, diversified companies, but also numerous standalone restaurants, independent hotels, and individual gaming venues, all vying for customer attention.

The global hospitality market is expected to see continued growth, with projections indicating a significant expansion in the coming years. For instance, the global travel and tourism market was valued at approximately $7.6 trillion in 2023 and is anticipated to reach over $13 trillion by 2030, demonstrating robust growth potential. However, this growth landscape is characterized by intense competition across all segments.

Fertitta Entertainment benefits from a strong brand portfolio, including recognizable names like Landry's Seafood House and Golden Nugget, which aids in differentiating itself from rivals. However, the company still contends with significant competitive rivalry from both established players and newer entrants in the hospitality and gaming sectors.

Tilman Fertitta's stated strategy of acquiring 'trophy assets' indicates an aggressive approach to portfolio expansion, aiming to bolster market position and potentially reduce competitive intensity through consolidation or market leadership. For instance, in 2024, the company continued to explore strategic acquisitions, though specific details of major deals impacting competitive dynamics remained under wraps as of mid-year.

Competitive rivalry for Fertitta Entertainment is particularly fierce in concentrated markets like the Las Vegas Strip, where it holds an investment in Wynn Resorts. This highly saturated gaming environment means companies constantly vie for customer attention and spending.

In 2024, the Las Vegas Strip continued to be a battleground for market share, with operators investing heavily in renovations and new attractions. Wynn Resorts, a key player where Fertitta Entertainment has a stake, faces direct competition from numerous other major casino resorts, all seeking to capture a significant portion of the estimated $8.3 billion in gaming revenue generated by the Strip in 2023.

Innovation and Customer Experience Focus

Competitive rivalry in the entertainment sector is fierce, driven by a constant push for innovation in dining, lodging, and gaming. Companies like Fertitta Entertainment must continually invest in upgrading their offerings to keep pace. For instance, as of early 2025, major casino resorts are rolling out advanced loyalty programs and incorporating AI-driven personalized recommendations to enhance guest engagement.

The focus on customer experience is paramount, with competitors differentiating themselves through unique amenities and seamless technology integration. This means Fertitta Entertainment needs to prioritize not just new attractions but also the overall guest journey. By mid-2025, the trend towards immersive, technology-enhanced entertainment, including augmented reality features in gaming and interactive dining experiences, is expected to solidify its importance.

- Competitors are actively innovating in culinary, hotel, and gaming technology.

- Fertitta Entertainment must invest in enhancing its overall entertainment experiences.

- Key 2025 trends include technology, personalization, and immersive experiences.

Economic Sensitivity and Pricing Pressure

The discretionary nature of spending in the hospitality and entertainment sectors significantly amplifies competitive rivalry during economic slowdowns. As consumer budgets tighten, companies like Fertitta Entertainment face increased pressure to attract and retain customers, often leading to price wars. This dynamic was evident in 2023, where persistent inflation impacted consumer confidence and spending habits across the industry.

Rising operational costs, particularly for food and labor, are a major driver of pricing pressure within the restaurant industry. For instance, the U.S. Bureau of Labor Statistics reported that food away from home prices increased by 5.5% in 2023. This forces businesses to either absorb these costs, impacting profit margins, or pass them on to consumers, risking a loss of price-sensitive customers.

- Heightened Rivalry: Economic downturns intensify competition as businesses fight for a shrinking pool of discretionary spending.

- Inflationary Impact: Rising costs for essential inputs like food and labor directly translate to pricing pressure on services offered by companies such as Fertitta Entertainment.

- Consumer Behavior Shift: Consumers become more price-conscious during economic uncertainty, seeking value and potentially trading down to less expensive options.

- Margin Squeeze: The combination of increased operational costs and customer sensitivity to price increases can significantly squeeze profit margins for entertainment and hospitality firms.

Fertitta Entertainment faces intense competition across its diverse portfolio, from restaurants to gaming. The company must constantly innovate to stand out against a wide array of rivals, including both established giants and nimble newcomers. This rivalry is particularly acute in prime locations like the Las Vegas Strip, where significant investments in new attractions and enhanced guest experiences are the norm.

The drive for customer loyalty is a key battleground, with companies increasingly leveraging technology for personalized offerings. For example, by mid-2025, the integration of AI for tailored recommendations and advanced loyalty programs is expected to be a critical differentiator. This focus on customer experience is essential for retaining market share in a highly dynamic industry.

Economic conditions significantly amplify this competitive pressure. During periods of economic slowdown, discretionary spending decreases, forcing companies to compete more aggressively on price and value. This is exacerbated by rising operational costs, such as a 5.5% increase in food away from home prices reported in 2023, which squeezes profit margins and necessitates careful pricing strategies.

| Competitive Factor | Description | Impact on Fertitta Entertainment |

| Number of Competitors | High, spanning local, regional, and national players in hospitality, restaurants, and gaming. | Requires constant effort to maintain brand visibility and market share. |

| Industry Growth Rate | Projected strong growth globally, with the travel market reaching over $13 trillion by 2030. | Offers opportunities but also attracts more competitors, intensifying rivalry. |

| Product Differentiation | Brands like Landry's and Golden Nugget offer some differentiation. | Ongoing investment in unique offerings and customer experience is crucial to combat commoditization. |

| Switching Costs | Generally low for consumers in many segments. | Increases the importance of customer loyalty programs and superior service to retain customers. |

| Price Sensitivity | High, especially during economic downturns and due to rising operational costs. | Creates pressure to manage pricing strategies effectively to balance profitability and customer retention. |

SSubstitutes Threaten

The most significant threat of substitutes for Fertitta Entertainment stems from the sheer volume of alternative leisure and entertainment options available. Consumers can opt for home-based activities like cooking instead of dining out, or choose digital engagement over physical experiences.

The rise of online gaming and sports betting presents a direct substitute for land-based casino experiences. For instance, the global online gambling market was valued at over $64 billion in 2023 and is projected to grow significantly, offering a convenient and accessible alternative to traditional casinos.

The increasing sophistication of home entertainment, fueled by high-definition displays and immersive audio, coupled with the proliferation of streaming services, presents a significant threat. Consumers are spending more on these at-home options, with global spending on subscription video-on-demand services projected to reach over $140 billion in 2024. This trend directly competes with traditional entertainment venues.

Furthermore, the convenience and perceived value of gourmet meal kit deliveries and high-quality home cooking offer a compelling alternative to dining out. The meal kit delivery market alone saw substantial growth, with revenue in the US reaching billions in 2023, indicating a clear shift in consumer preference towards home-based experiences.

The threat of substitutes for Fertitta Entertainment's hotel segment is considerable, with vacation rentals like Airbnb offering a flexible and often more affordable alternative. Boutique hotels and even staying with friends or family also present viable substitutes, each catering to different traveler needs and preferences.

These alternatives can provide unique experiences or different price points, directly competing with traditional hotel offerings. For instance, the vacation rental market saw significant growth, with Airbnb reporting over 1.5 billion guest arrivals globally by early 2024.

Furthermore, the rise of wellness tourism and bleisure travel (combining business and leisure) creates new demands that traditional hotels must address, or risk losing customers to more specialized or flexible lodging options.

Non-Gaming Leisure Activities

Consumers have a wide array of non-gaming leisure activities to choose from, potentially diverting spending away from casinos. These include attending concerts, live sporting events, visiting theme parks, or engaging with cultural attractions. For instance, the global live music industry, a significant competitor, saw revenues rebound strongly post-pandemic, with major tours in 2024 generating hundreds of millions of dollars, demonstrating a robust demand for such experiences.

Fertitta Entertainment's strategy of offering integrated entertainment, combining gaming with dining, shows, and other amenities, aims to keep customers within its ecosystem. However, each individual component of this offering still faces direct competition from standalone substitutes. For example, a customer might choose a high-end restaurant experience at a non-casino establishment or attend a concert venue not affiliated with a resort.

The broader trend of slow or stagnant growth in traditional brick-and-mortar gaming properties underscores the challenge posed by these substitutes. Many established casinos are struggling to attract new demographics or retain existing ones who are increasingly exploring diverse entertainment options. This shift in consumer preference means that while gaming remains a core offering, its appeal as the sole reason for a leisure outing is diminishing.

- Concert Ticket Sales: Major artists in 2024 reported tour revenues exceeding $500 million, showcasing significant consumer spending on live music events.

- Theme Park Attendance: Leading theme park operators reported attendance figures in 2023 that were often above pre-pandemic levels, indicating strong demand for family-oriented entertainment.

- Sports Betting vs. Other Leisure: While sports betting is growing, overall consumer spending on leisure activities is diversified, with significant portions allocated to dining out, travel, and entertainment events outside of gambling.

Shifting Consumer Preferences and Lifestyle Choices

Evolving consumer preferences present a significant threat of substitutes for Fertitta Entertainment. A growing emphasis on health and wellness, for instance, might steer individuals away from traditional casino and dining experiences towards more health-conscious activities or at-home entertainment. Similarly, a desire for sustainable travel options could lead consumers to choose alternatives that offer a lower environmental impact.

Companies are actively adapting to these shifting preferences. The surge in demand for takeout and delivery services in the food sector, a trend accelerated by recent global events, demonstrates how readily consumers will adopt substitutes that offer convenience and align with changing lifestyles. This adaptability in the broader hospitality and entertainment industry means Fertitta Entertainment faces competition not just from direct rivals but also from entirely different ways consumers choose to spend their leisure time and disposable income.

- Health and Wellness Focus: Consumers increasingly prioritize well-being, potentially favoring fitness-oriented entertainment over traditional leisure activities.

- Sustainability Concerns: A growing segment of travelers and consumers are seeking environmentally responsible options, which could divert business from businesses perceived as less sustainable.

- Digital Entertainment Growth: The proliferation of high-quality streaming services, online gaming, and virtual reality experiences offers compelling substitutes for in-person entertainment. In 2024, the global video game market was projected to reach over $200 billion, highlighting the scale of this substitute market.

- Convenience and At-Home Options: The continued strength of food delivery services and the increasing sophistication of home entertainment systems provide convenient alternatives to dining out and visiting entertainment venues.

The threat of substitutes for Fertitta Entertainment is substantial, encompassing a wide array of leisure and entertainment choices. Consumers can opt for home-based activities, digital engagement, or specialized experiences that bypass traditional offerings.

Digital substitutes, such as online gaming and streaming services, are particularly potent. The global online gambling market exceeded $64 billion in 2023, while spending on video-on-demand services was projected to surpass $140 billion in 2024. These digital alternatives offer convenience and accessibility, directly challenging land-based casinos and entertainment venues.

Furthermore, the hospitality sector faces substitutes like vacation rentals, which provide flexibility and often lower costs compared to traditional hotels. The growing emphasis on health, wellness, and sustainability also steers consumers toward alternative leisure pursuits.

| Substitute Category | Example | 2023/2024 Data Point |

|---|---|---|

| Digital Entertainment | Online Gambling | Market valued over $64 billion (2023) |

| Digital Entertainment | Video-on-Demand | Projected spending over $140 billion (2024) |

| Hospitality Alternatives | Vacation Rentals | Airbnb reported over 1.5 billion guest arrivals globally by early 2024 |

| Live Events | Concert Ticket Sales | Major tours in 2024 generated hundreds of millions of dollars |

Entrants Threaten

The integrated hospitality, casino, and entertainment sector demands immense capital. For instance, development costs for new hotels can be roughly 50% higher than simply acquiring existing properties per key, presenting a formidable financial hurdle. This high upfront investment for land acquisition, construction, and establishing a strong brand significantly deters potential new competitors, especially in the casino and luxury hotel segments.

The gaming and hospitality industries are notoriously difficult for newcomers to enter due to stringent regulations and licensing demands. These compliance costs create a significant barrier, making it challenging for new players to establish themselves. For instance, Sri Lanka recently implemented higher licensing fees for casinos, underscoring the financial commitment required.

Fertitta Entertainment enjoys a significant advantage due to its deeply ingrained brand recognition and the strong loyalty it has cultivated across its various entertainment ventures, especially within the casino sector. This established presence makes it challenging for newcomers to gain a foothold. For instance, the Golden Nugget brand, a key part of Fertitta Entertainment, has a long history of customer engagement, a critical factor in the competitive casino landscape where repeat business is paramount.

New entrants face the daunting task of not only matching Fertitta Entertainment's existing brand appeal but also overcoming the substantial marketing and advertising investments required to build comparable brand loyalty from scratch. This barrier is particularly high in the gaming industry, where trust and familiarity are key drivers of customer choice. The cost to build a recognized and trusted brand in this space can easily run into tens or hundreds of millions of dollars annually.

Access to Distribution Channels and Supply Chains

New companies entering the hospitality and restaurant sectors, like those Fertitta Entertainment operates in, often struggle to secure prime real estate and build robust supply chains that can handle a wide range of products. Gaining entry into established distribution networks is also a significant hurdle.

For instance, in 2024, the cost of prime retail space in major tourist destinations saw an average increase of 7% year-over-year, making initial location acquisition more expensive for newcomers. Furthermore, building efficient supply chains requires significant upfront investment in logistics and technology.

- Securing prime locations: New entrants face higher real estate costs, with prime hospitality spots seeing significant price hikes in 2024.

- Establishing efficient supply chains: Building reliable and cost-effective supply chains for diverse food and beverage offerings demands substantial capital and operational expertise.

- Accessing distribution networks: Established players often control key distribution channels, making it difficult for new businesses to negotiate favorable terms or gain widespread reach.

- Overcoming disruptions: Strategies like diversifying suppliers and investing in supply chain visibility tools are crucial for new entrants to mitigate risks and maintain operational continuity in 2024 and beyond.

Experience and Operational Complexity

Operating a diversified hospitality giant like Fertitta Entertainment involves immense operational complexity. This includes juggling numerous business units, managing a vast and varied workforce, and navigating intricate supply chains, all of which require years of honed expertise.

Newcomers often struggle to match the accumulated experience and economies of scale that established players have built over time. For instance, in 2024, the restaurant sector continued to grapple with persistent challenges, including rising food costs, which saw a notable increase in the producer price index for food away from home, and ongoing labor shortages, impacting operational efficiency for all players.

- Operational Complexity: Managing diverse hospitality segments requires deep industry knowledge and established infrastructure.

- Experience Gap: New entrants lack the seasoned operational expertise and established supplier relationships that incumbents possess.

- Economies of Scale: Established firms benefit from cost advantages in purchasing, marketing, and overhead allocation.

- Industry Headwinds: In 2024, rising costs and labor availability remained significant hurdles for new entrants in the hospitality space.

The threat of new entrants for Fertitta Entertainment is significantly mitigated by the substantial capital requirements and complex regulatory landscape inherent in the hospitality and casino sectors. High upfront investments for property acquisition and development, coupled with rigorous licensing processes, create formidable barriers. For example, in 2024, the average cost of acquiring prime real estate in major tourist hubs increased by 7%, further escalating entry costs for potential competitors.

Furthermore, established brand loyalty and the immense marketing investment needed to replicate it pose a significant challenge. Fertitta Entertainment's brands, like Golden Nugget, benefit from years of customer engagement, a critical advantage in an industry where trust is paramount. New entrants must not only match this appeal but also overcome the substantial annual marketing expenditures, often in the tens or hundreds of millions of dollars, required to build comparable brand recognition.

| Barrier Type | Description | 2024 Impact Example |

| Capital Requirements | High costs for land, construction, and brand building. | 7% year-over-year increase in prime hospitality real estate costs. |

| Regulatory Hurdles | Stringent licensing and compliance demands. | Increased licensing fees in various jurisdictions, e.g., Sri Lanka. |

| Brand Loyalty & Marketing | Need for significant investment to build customer trust and recognition. | Annual marketing budgets can reach tens to hundreds of millions of dollars. |

| Operational Expertise | Complexity in managing diverse operations and supply chains. | Persistent challenges with rising food costs and labor shortages impacting efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fertitta Entertainment leverages data from company annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista. This blend ensures a comprehensive understanding of competitive dynamics, buyer and supplier power, and potential threats.