Fertitta Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fertitta Entertainment Bundle

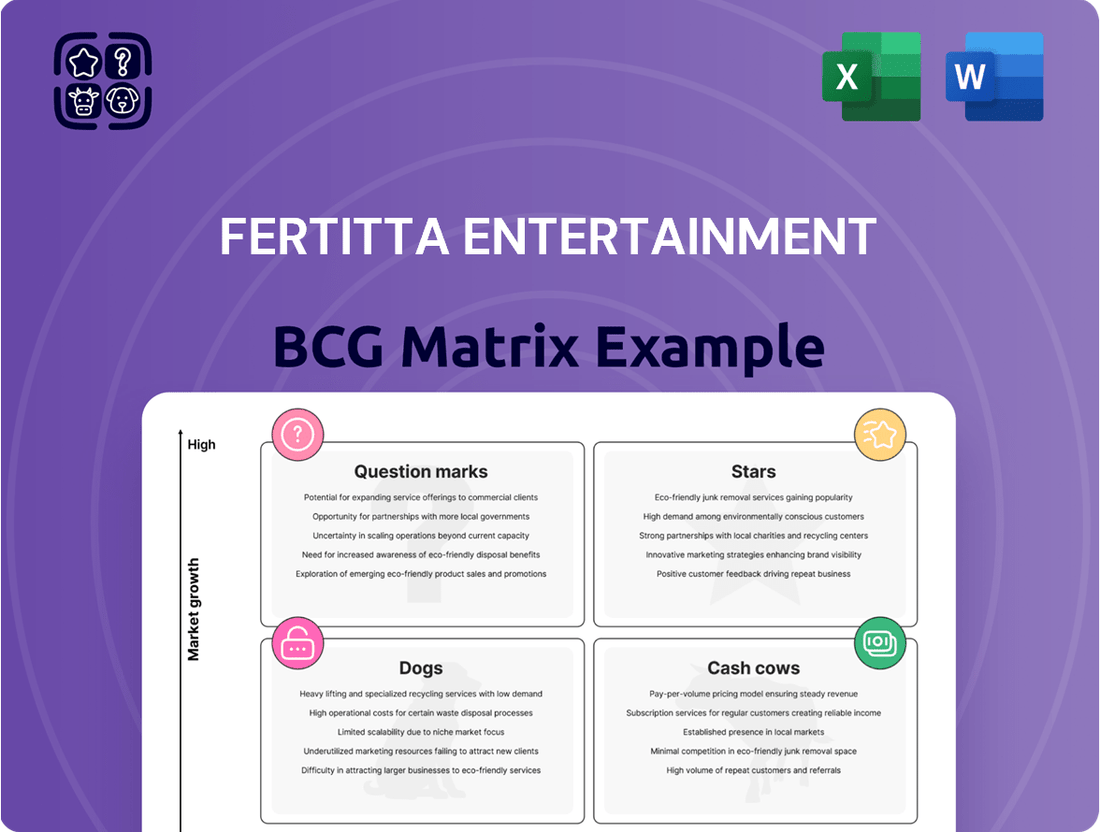

Curious about Fertitta Entertainment's strategic positioning? Our BCG Matrix preview offers a glimpse into their portfolio's potential—identifying promising Stars, reliable Cash Cows, underperforming Dogs, and intriguing Question Marks.

Unlock the full strategic advantage by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each business unit's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

This isn't just data; it's a roadmap to optimizing Fertitta Entertainment's success. Purchase the full report now and transform your strategic planning with actionable insights.

Stars

The Post Oak Hotel in Houston stands out as a premier luxury destination, consistently earning accolades such as Forbes Travel Guide Five-Star status. Its impressive rankings, including U.S. News & World Report's #2 in Texas and #45 nationally for 2025, highlight a significant market share within the thriving luxury hospitality segment.

This strong performance positions The Post Oak Hotel as a Star in the Fertitta Entertainment BCG Matrix. The global luxury hospitality market is experiencing robust growth, with projections indicating it will reach $166.41 billion in 2025 and is expected to expand to $218 billion by 2029.

The Golden Nugget Lake Tahoe renovation, slated for completion in 2025, represents a significant strategic move by Fertitta Entertainment. This extensive upgrade aims to capture a larger slice of the recovering South Lake Tahoe gaming market. The investment is designed to position the property as a leader within its regional segment, which is considered mature.

The addition of premium dining options, such as Mastro's Steak House, is a key component of this strategy. These high-end amenities are expected to significantly boost the Golden Nugget's appeal and competitive standing. This capital infusion underscores a commitment to enhancing the customer experience and driving market share growth.

The Houston Rockets, as a prominent NBA franchise, represent a significant player in the thriving professional sports entertainment market. This sector's growth is fueled by increasing media rights deals and expanding global fan engagement, with the NBA's revenue projected to reach $13 billion in the 2023-2024 season. The Rockets are a high-value asset for Fertitta Entertainment, contributing substantial revenue streams and considerable brand equity.

River Oaks District Luxury Retail

Fertitta Entertainment's acquisition and planned expansion of the River Oaks District in Houston positions it as a significant player in the luxury retail sector. This premier development is a magnet for high-end brands and affluent consumers, reinforcing its status in a lucrative market. The strategy centers on attracting more luxury tenants and elevating the customer experience, aiming for sustained market leadership.

The River Oaks District is a prime example of a "Star" in the BCG matrix for Fertitta Entertainment, given its high market share and high growth potential within the luxury retail segment. This district is a significant asset, attracting considerable investment and attention from top luxury brands. Its prime location and established reputation contribute to its strong performance and future growth prospects.

- High Market Share: The River Oaks District is a dominant force in Houston's luxury retail landscape, attracting a significant portion of high-net-worth shoppers.

- High Growth Potential: Planned expansions and ongoing tenant recruitment signal a strong outlook for continued revenue growth and market expansion.

- Brand Magnetism: It consistently attracts and retains prestigious luxury brands, a testament to its market appeal and economic viability.

- Strategic Investment: Fertitta Entertainment's commitment through acquisition and expansion underscores its belief in the district's capacity to generate substantial returns.

High-End Dining Integration

Fertitta Entertainment's strategy of integrating high-end dining, exemplified by Mastro's Steak House, within its luxury hotel and casino portfolio targets a discerning clientele seeking an all-encompassing premium entertainment experience. This integration capitalizes on the established market presence of its luxury hospitality assets and taps into the expanding market for experiential dining. In 2024, the company continued to focus on enhancing these synergies, aiming to elevate the overall guest value proposition and attract a more affluent customer base, thereby strengthening its position in the high-end entertainment sector.

This approach allows Fertitta Entertainment to leverage its existing infrastructure and brand recognition to introduce and grow premium dining concepts. For instance, the success of Mastro's Steak House, a key component of this strategy, contributes significantly to the ancillary revenue streams of its integrated resorts. By offering a seamless blend of gaming, lodging, and sophisticated dining, the company aims to capture a larger share of wallet from its target demographic.

- Mastro's Steak House: A prime example of a high-end dining integration, contributing to the premium experience.

- Synergistic Revenue Streams: High-end dining enhances overall property revenue and guest spending.

- Affluent Clientele Focus: The strategy directly appeals to and attracts high-net-worth individuals.

- Experiential Dining Growth: Capitalizes on the increasing consumer demand for memorable dining experiences.

The Post Oak Hotel and the River Oaks District are prime examples of Fertitta Entertainment's "Stars" within the BCG matrix. These assets command high market share in their respective luxury segments, hospitality and retail, and benefit from strong growth potential. Their ability to attract premium brands and affluent clientele, coupled with strategic investments and expansions, solidifies their position as key revenue drivers and valuable growth engines for the company.

| Asset | Market Share | Growth Potential | Key Strengths |

|---|---|---|---|

| The Post Oak Hotel | High (Luxury Hospitality) | High (Global market projected to reach $218B by 2029) | Forbes Five-Star, #2 in Texas (2025), attracts affluent guests. |

| River Oaks District | High (Luxury Retail) | High (Planned expansions, strong tenant retention) | Premier luxury destination, magnet for high-end brands. |

What is included in the product

This Fertitta Entertainment BCG Matrix analysis highlights which business units to invest in, hold, or divest based on their market share and growth.

The Fertitta Entertainment BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of complex portfolio analysis.

Cash Cows

Landry's Seafood House stands as a cornerstone within Fertitta Entertainment's vast restaurant empire, a testament to its enduring appeal in the casual dining sector. This established brand likely commands a significant and stable market share, consistently delivering predictable cash flows that are vital to the company's overall financial health.

Given its mature market position and widespread recognition, Landry's Seafood House generates reliable profits with minimal need for substantial growth investments. For instance, in 2024, the casual dining segment, which Landry's Seafood House firmly occupies, continued to show resilience, with many established players reporting steady revenue streams, often reinvesting profits into operational efficiencies rather than aggressive expansion.

Bubba Gump Shrimp Co., a staple within Fertitta Entertainment's portfolio, functions as a Cash Cow. This established casual dining brand commands a significant market share, especially in high-traffic tourist destinations.

While the casual dining sector may not be experiencing explosive growth, Bubba Gump's robust brand recognition and efficient operations consistently generate substantial cash flow. In 2024, the company continued to leverage its unique theme and strong customer loyalty to maintain its position.

The strategic approach for Bubba Gump Shrimp Co. centers on preserving its competitive edge and maximizing returns from its proven success. This involves careful management of costs and continued investment in maintaining the brand's appeal to its core customer base.

McCormick & Schmick's, an upscale seafood restaurant chain, is positioned as a cash cow within Fertitta Entertainment's portfolio. Its mature market segment and established, loyal customer base generate consistent revenue streams.

The brand's enduring reputation for quality seafood and dining experience underpins its sustained market share and profitability. In 2023, the casual dining sector, which includes upscale seafood establishments, saw continued demand, with many chains reporting steady sales growth compared to pre-pandemic levels.

Golden Nugget Las Vegas (Downtown)

The Golden Nugget Las Vegas, situated in downtown, represents a classic cash cow for Fertitta Entertainment. It holds a significant market share within the downtown Las Vegas gaming sector, a mature but consistently profitable market.

This established property, with its loyal customer base, generates substantial and predictable cash flow. Its mature status means it requires minimal reinvestment for growth, allowing it to be a strong contributor to the company's overall financial health. In 2024, downtown Las Vegas casinos, including the Golden Nugget, continued to benefit from a resurgence in tourism, with overall gaming revenue for the area showing steady performance.

- Established Market Position: Commands a strong presence in the downtown Las Vegas gaming market.

- Consistent Cash Flow Generation: Reliably produces significant profits due to its mature operations.

- Low Investment Needs: Requires minimal capital for growth, maximizing its cash-generating potential.

- Mature Segment Contribution: Acts as a stable income source within Fertitta Entertainment's portfolio.

Existing Real Estate Portfolio

Fertitta Entertainment's existing real estate portfolio functions as a classic Cash Cow within the BCG Matrix. These properties, while perhaps not in rapidly expanding markets, are crucial for generating consistent and predictable cash flow. They represent established assets that contribute significantly to the company's financial stability.

The company's real estate holdings, separate from its primary hospitality and gaming ventures, are characterized by their maturity and reliable income generation. This stability is a key attribute of a Cash Cow, providing a steady stream of earnings that can be reinvested in other areas of the business or used to support debt obligations.

For instance, as of the end of 2024, Fertitta Entertainment's real estate segment continued to be a bedrock of its financial performance, contributing a notable portion to its overall revenue through rental income and property value appreciation. This segment exemplifies mature assets with low growth potential but high market share, fitting the definition of a Cash Cow perfectly.

- Stable Rental Income: The portfolio generates consistent rental income, providing a predictable revenue stream.

- Asset Value Appreciation: While growth may be slow, these properties maintain or slowly appreciate in asset value.

- Mature Investments: They represent established, low-risk assets that require minimal new investment.

- Cash Flow Generation: The primary role is to produce substantial, reliable cash flow for the company.

The Golden Nugget Lake Charles, while a newer addition than its Las Vegas counterpart, is also positioning itself as a strong Cash Cow for Fertitta Entertainment. It has secured a significant market share in the regional gaming and hospitality market.

This property benefits from a mature market segment that, while not experiencing rapid expansion, offers consistent demand and profitability. In 2024, the Louisiana gaming market showed resilience, with established properties like the Golden Nugget Lake Charles continuing to draw consistent visitor numbers and revenue.

The strategy here involves optimizing operations and leveraging its established customer base to maximize cash generation with limited need for aggressive growth capital. This allows the property to be a reliable contributor to the company's financial stability.

| Asset | Market Share | Cash Flow Generation | Investment Needs |

|---|---|---|---|

| Golden Nugget Lake Charles | Significant in regional market | Consistent and predictable | Low for growth |

Delivered as Shown

Fertitta Entertainment BCG Matrix

The Fertitta Entertainment BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a polished, professional document ready for immediate application. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file that will be yours to edit, present, or integrate into your business planning. This is the actual BCG Matrix document, meticulously crafted and available for instant download, empowering you with actionable insights into Fertitta Entertainment's portfolio.

Dogs

Within Landry's extensive portfolio, certain casual dining establishments might be classified as Dogs. These locations likely face a combination of low market share and low growth, possibly due to intense local competition, shifts in consumer tastes, or localized economic downturns. For instance, if a specific market sees a surge in new, trendy eateries, established casual dining spots could see their customer base shrink.

Tilman Fertitta himself has acknowledged a deceleration in the pace of restaurant expansion, citing escalating operational costs. This suggests that some of Landry's casual dining units could be underperforming, perhaps only managing to break even or generate minimal profits. Such underperformers can tie up valuable capital that could be reinvested in more promising ventures within the Fertitta Entertainment umbrella.

Older entertainment venues within Fertitta Entertainment's portfolio that haven't seen recent upgrades could be classified as Dogs. These facilities might be losing ground in attracting contemporary audiences due to a lack of modern amenities or technological integration, leading to a diminished market share in a competitive landscape.

Such venues often face stagnant or declining growth prospects. For instance, if a venue's revenue has been flat or decreasing year-over-year, and the broader entertainment market is expanding, it signals a weak competitive position.

The potential for revitalization might require substantial capital investment, which may not yield a justifiable return, making them candidates for divestment or significant strategic review rather than growth initiatives.

Fertitta Entertainment's portfolio might contain older, smaller retail spaces, perhaps not situated in prime luxury areas like River Oaks. These could be in areas where retail isn't thriving or in less attractive spots, leading to minimal customer visits and slow growth. For instance, properties in secondary markets might see occupancy rates dip below the national average for retail, which stood around 93% in early 2024, indicating a tougher environment.

These assets often exhibit low market share and stagnant growth, making them candidates for sale if they consistently fail to meet performance expectations. Their contribution to overall revenue might be minimal, potentially dragging down the company's average performance metrics. Many such legacy properties struggle to adapt to changing consumer habits, unlike newer, more adaptable retail formats.

Less Competitive Regional Gaming Outlets

Within Fertitta Entertainment's portfolio, certain regional gaming outlets may find themselves in a less competitive position. These might be smaller operations or those situated in markets with a high concentration of dominant integrated resorts or newly developed, state-of-the-art facilities. Such outlets could be characterized by a low market share and limited growth potential.

These less competitive regional gaming outlets, despite potentially being strong brands in their own right, might struggle to carve out a distinct niche. The intense competition can make differentiation difficult, impacting their profitability and dimming their future growth prospects. For instance, a smaller casino in a market saturated with mega-resorts might see its revenue growth stagnate.

- Low Market Share: These outlets often hold a smaller percentage of the total regional gaming revenue compared to their larger competitors.

- Limited Growth Prospects: The intense competitive landscape can stifle revenue and profit growth.

- Struggles with Differentiation: Difficulty in standing out against larger, more amenity-rich competitors.

- Minimal Profitability: Lower margins due to competitive pressures and potentially higher operating costs relative to revenue.

Ancillary Businesses with Limited Synergy

Ancillary businesses with limited synergy within Fertitta Entertainment's portfolio likely represent smaller ventures operating in low-growth, niche markets with minimal market share. These may include operations that don't directly support the core hospitality and entertainment focus, potentially offering little strategic advantage.

These types of businesses, if they exist, would typically be classified as Dogs in the BCG Matrix. For instance, if Fertitta Entertainment owned a small, regional catering service with declining demand and little overlap with its casino or restaurant operations, it would fit this description. Such entities often present opportunities for divestment to streamline operations and focus resources on more promising areas.

- Low Market Share: These businesses typically hold a small percentage of their respective niche markets.

- Low Market Growth: The industries these ancillary businesses operate in are characterized by slow or stagnant growth.

- Limited Strategic Alignment: They often lack strong connections to Fertitta Entertainment's core hospitality and gaming strategies.

- Potential Divestment Candidates: Their minimal contribution and lack of synergy make them prime candidates for sale or closure.

Certain underperforming casual dining units within Landry's, part of Fertitta Entertainment, could be classified as Dogs. These are businesses with low market share and low growth, often struggling against local competition or shifting consumer preferences. For example, older restaurant locations that haven't been updated might see declining customer traffic, tying up capital that could be better used elsewhere in the portfolio.

Older entertainment venues lacking modern amenities or technological integration also fall into this category. These facilities might experience stagnant or declining revenue, especially if the broader entertainment market is growing. Such assets may require significant investment for revitalization, making them candidates for divestment.

Additionally, smaller, legacy retail spaces in less prime locations could be considered Dogs. These properties often have minimal customer visits and slow growth, potentially impacting overall company performance metrics. For instance, retail spaces in secondary markets might face lower occupancy rates compared to national averages, around 93% in early 2024.

Regional gaming outlets in highly competitive markets, especially those facing newer, larger integrated resorts, can also be classified as Dogs. These smaller operations may struggle with differentiation and face stagnant revenue growth due to intense competition.

| Category | Characteristics | Example within Fertitta Entertainment |

|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Older, non-renovated casual dining restaurants; Entertainment venues lacking modern amenities; Underperforming regional gaming outlets; Legacy retail spaces in secondary markets. |

Question Marks

The planned luxury casino resort on the Las Vegas Strip, a high-growth potential venture, is currently paused. This strategic move stems from potential conflicts of interest due to Tilman Fertitta's significant stake in Wynn Resorts and his appointment as U.S. Ambassador to Italy.

This project, while promising in a competitive market, is a capital drain without current returns. Its uncertain future positions it as a classic question mark within the BCG Matrix, demanding careful re-evaluation.

Golden Nugget Online Gaming (GNOG) is positioned in a booming U.S. online gaming and sports betting sector, anticipated to hit $20-$25 billion by 2025. This high-growth potential suggests GNOG could be a future star, but its current market share in states like Michigan and Pennsylvania is still nascent.

To transition from a question mark to a star, GNOG needs substantial investment to build brand recognition and customer acquisition. For instance, in Q1 2024, GNOG reported a net revenue of $98.6 million, a 7% increase year-over-year, indicating growth but also the scale of investment needed to outpace competitors.

Fertitta Entertainment is strategically venturing into new niche restaurant concepts, exemplified by 'The Corner Store.' These emerging concepts are positioned to tap into high-growth markets, catering to evolving consumer tastes and specialized demographics.

While these ventures promise significant future growth, they currently represent a smaller portion of Fertitta's overall market share. Significant investment in marketing and operational refinement is necessary to build brand recognition and achieve profitability in these nascent markets.

Future Luxury Real Estate Acquisitions

Tilman Fertitta's ambition to acquire more 'trophy assets' in 2025 signals a strategic move into high-growth luxury real estate markets. These potential acquisitions, while initially possessing low market share within Fertitta Entertainment's current portfolio, represent significant capital investments aimed at future expansion. The focus is on markets with strong appreciation potential, requiring substantial development to transform them into high-performing assets.

- Acquisition Strategy: Targeting prime luxury real estate in 2025, emphasizing 'trophy assets'.

- Market Position: Initial low market share in these new luxury segments, indicating a growth opportunity.

- Capital Requirements: Significant upfront investment needed for acquisition and strategic development.

- Growth Potential: These assets are expected to become 'stars' with strategic capital allocation and development.

Investment in Emerging Hospitality Technologies

Fertitta Entertainment, in its strategic pursuit of growth, likely channels investment into emerging hospitality technologies, positioning these as potential future Stars or Question Marks within its BCG Matrix. These investments, though not always publicly detailed, focus on areas like AI-driven personalization for enhanced guest journeys or cutting-edge digital platforms designed to streamline operations and customer engagement.

These nascent technologies represent high-growth potential but currently exhibit low market share, necessitating significant research and development. For instance, the global hospitality technology market was projected to reach approximately $30 billion by 2024, with AI and IoT segments showing particularly rapid expansion, indicating a fertile ground for strategic, albeit early-stage, investment.

- AI for Personalized Guest Experiences: Enhancing loyalty through tailored offers and service.

- Innovative Digital Platforms: Improving booking efficiency and on-site guest interaction.

- Data Analytics for Operational Efficiency: Optimizing resource allocation and service delivery.

- Emerging Payment Technologies: Streamlining transactions and guest convenience.

The paused luxury casino resort and emerging niche restaurants are classic question marks. They require significant investment to prove their potential and gain market traction. Golden Nugget Online Gaming, while in a high-growth sector, also needs further capital to solidify its market position and transition from a question mark to a star.

Fertitta Entertainment's strategic investments in luxury real estate and hospitality technologies also fall into this category. These ventures have high growth potential but currently low market share, necessitating careful management and substantial capital to achieve future success.

| Business Unit | Market Growth | Relative Market Share | BCG Category |

| Luxury Casino Resort (Paused) | High | Low | Question Mark |

| Niche Restaurant Concepts | High | Low | Question Mark |

| Golden Nugget Online Gaming | High | Low to Medium | Question Mark |

| Luxury Real Estate Acquisitions | High | Low | Question Mark |

| Hospitality Technologies (AI, Digital Platforms) | High | Low | Question Mark |

BCG Matrix Data Sources

Our Fertitta Entertainment BCG Matrix is constructed using comprehensive financial filings, detailed market research reports, and industry growth forecasts to provide an accurate strategic overview.