Ferrellgas SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrellgas Bundle

Ferrellgas navigates a competitive landscape, leveraging its established brand and extensive distribution network as key strengths. However, the company also faces challenges from fluctuating propane prices and the growing adoption of alternative energy sources, presenting significant threats to its market share.

Want the full story behind Ferrellgas's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ferrellgas possesses an extensive national distribution network, a key strength that underpins its market position. This vast infrastructure allows for efficient and widespread service delivery to a diverse customer base across the United States.

With over 68,000 Blue Rhino exchange locations, Ferrellgas has a significant retail footprint, making propane accessible and convenient for millions of consumers. This broad reach is a substantial competitive advantage in capturing market share and serving various geographic regions effectively.

Ferrellgas's strength lies in its remarkably diversified customer base, spanning residential, commercial, agricultural, and industrial sectors. This broad reach means the company isn't overly dependent on any one market segment, which is a significant advantage. For instance, in fiscal year 2023, Ferrellgas reported that its propane segment served over 1.1 million retail customers, showcasing the depth of its residential reach, while its commercial and industrial segments also contributed substantially to its overall revenue stability.

Ferrellgas's Blue Rhino brand enjoys exceptional recognition, a significant strength that resonates with consumers across the United States. This brand is a household name, readily available at over 60,000 retail locations, making propane tank exchanges incredibly convenient for millions of customers.

This widespread accessibility and established brand loyalty are crucial for Ferrellgas's market penetration, particularly within the consumer propane sector. The Blue Rhino name itself often drives purchasing decisions, reducing the need for extensive consumer education and marketing spend on brand awareness.

Strategic Acquisitions and Organic Growth

Ferrellgas demonstrates a robust strategy of both acquiring complementary businesses and fostering internal expansion. Notable acquisitions, like Kilhoffer Propane in October 2024 and Eastern Sierra Propane in January 2024, have effectively broadened its retail footprint and customer reach.

Beyond acquisitions, Ferrellgas is experiencing significant organic growth, particularly within its Blue Rhino tank exchange segment. This growth is driven by consistent new customer acquisition, underscoring the brand's appeal and operational effectiveness.

- Strategic Acquisitions: Expansion through key purchases like Kilhoffer Propane (Oct 2024) and Eastern Sierra Propane (Jan 2024).

- Organic Growth Driver: Blue Rhino tank exchange business is a key area for organic expansion.

- Customer Base Expansion: Both acquisition and organic efforts contribute to a growing customer roster.

Operational Efficiency and Technological Adoption

Ferrellgas is actively enhancing its operational efficiency, notably through the strategic implementation of telematics. This technology is instrumental in optimizing their fleet management, directly contributing to reduced fuel expenditures and more efficient delivery routes. For instance, by analyzing real-time data from their vehicles, they can minimize idle times and optimize truck loading, leading to significant cost savings. This technological adoption not only streamlines logistics but also bolsters their ability to provide superior customer service by ensuring timely and reliable deliveries.

The company's commitment to technological advancement extends to its broader operational framework. By integrating advanced systems, Ferrellgas aims to achieve a more agile and responsive business model. This focus on innovation allows for better resource allocation and predictive maintenance, further reducing operational disruptions and enhancing overall productivity. Their investment in these areas underscores a forward-thinking approach to managing the complexities of energy distribution.

Key aspects of their operational efficiency improvements include:

- Telematics for Fleet Management: Real-time tracking and diagnostics to optimize fuel consumption and route planning.

- Route Optimization Software: Utilizing algorithms to create the most efficient delivery paths, reducing mileage and driver time.

- Data-Driven Decision Making: Leveraging operational data to identify areas for cost reduction and service enhancement.

Ferrellgas boasts a substantial and well-established national distribution network, a critical asset for its widespread service delivery. This extensive infrastructure ensures efficient propane access for millions of customers across the United States.

The Blue Rhino brand is a significant strength, enjoying widespread consumer recognition and availability at over 60,000 retail locations, making propane tank exchanges highly convenient. This brand equity drives customer preference and simplifies market penetration.

Ferrellgas benefits from a diversified customer base, serving residential, commercial, agricultural, and industrial sectors. This broad market reach, evidenced by over 1.1 million retail customers served in fiscal year 2023, provides revenue stability and reduces reliance on any single segment.

The company's strategic approach to growth, combining key acquisitions like Kilhoffer Propane (Oct 2024) and Eastern Sierra Propane (Jan 2024) with strong organic expansion, particularly in the Blue Rhino segment, continuously broadens its market presence and customer base.

| Strength | Description | Supporting Data |

|---|---|---|

| National Distribution Network | Extensive infrastructure for efficient service delivery. | Serves customers across the United States. |

| Blue Rhino Brand Recognition | High consumer awareness and convenience. | Over 60,000 retail exchange locations. |

| Diversified Customer Base | Serves residential, commercial, agricultural, and industrial sectors. | Over 1.1 million retail customers served in FY2023. |

| Strategic Growth Initiatives | Acquisitions and organic expansion. | Acquired Kilhoffer Propane (Oct 2024) and Eastern Sierra Propane (Jan 2024). |

What is included in the product

Offers a full breakdown of Ferrellgas’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear roadmap for addressing Ferrellgas's market vulnerabilities and capitalizing on its operational strengths.

Weaknesses

Ferrellgas's retail propane sales, especially for keeping homes warm, are really sensitive to how the weather behaves. If winters are milder than usual, demand for propane drops, meaning fewer gallons are sold. This directly impacts the company's earnings and overall profitability.

Ferrellgas has grappled with significant financial burdens stemming from accrued liabilities linked to ongoing litigation. A prime example is the $125.0 million accrual recorded in fiscal year 2025 for the Eddystone litigation.

Although a settlement has since been reached, the substantial financial impact of this legal challenge has been a considerable setback for the company, affecting its financial health and potentially its future investment capacity.

Ferrellgas has been grappling with rising operating expenses. This includes significant upticks in plant and other operational costs, alongside increased personnel expenses. For instance, overtime pay and workers' compensation claims have contributed to this upward trend.

These escalating costs, including a notable rise in legal expenses, directly impact the company's profitability. Such pressures on profit margins can make it harder for Ferrellgas to maintain its financial health and invest in future growth initiatives.

Dependence on Propane Market Dynamics

Ferrellgas's significant reliance on the propane market creates a notable weakness. Fluctuations in supply and demand, inventory levels, and global production or export dynamics directly impact their revenue and profitability. This inherent linkage means the company is susceptible to market volatility beyond its direct control.

For instance, in the fiscal year ending September 30, 2023, Ferrellgas reported total revenue of $2.9 billion. A significant portion of this revenue is directly tied to the price and availability of propane, making them vulnerable to external market shocks. The company's performance is therefore heavily influenced by factors such as weather patterns affecting demand and geopolitical events impacting supply chains.

The company's exposure to these market dynamics can be further understood by considering:

- Price Volatility: Propane prices can experience substantial swings, impacting both the cost of goods sold and the revenue generated from sales.

- Supply Chain Disruptions: Issues with production, transportation, or international trade can lead to shortages or increased costs, directly affecting Ferrellgas's operations.

- Demand Sensitivity: Residential and commercial demand for propane is often seasonal and weather-dependent, creating periods of high and low utilization for the company's assets.

Competition from Alternative Fuels

Ferrellgas faces significant competition from alternative energy sources. The increasing prevalence of natural gas infrastructure and the growing adoption of electric heat pumps, especially in residential and commercial heating, directly challenge propane's market share. This trend is amplified by broader electrification initiatives aimed at reducing carbon emissions.

The energy landscape is rapidly evolving, with significant investments being made in renewable electricity generation and grid modernization. For instance, by the end of 2024, the U.S. Energy Information Administration (EIA) projected that renewable energy sources, including solar and wind, would account for approximately 23% of total utility-scale electricity generation, a figure expected to climb further into 2025. This growing reliance on electricity for heating and other applications directly erodes the demand for propane.

Key competitive pressures include:

- Natural Gas Availability: Expanded natural gas pipelines provide a readily available and often cheaper alternative in many regions.

- Electrification Trends: Government incentives and consumer preference for electric vehicles and appliances, including heat pumps, are steadily reducing reliance on fossil fuels like propane for heating.

- Advancements in Renewable Energy: Improved efficiency and decreasing costs of solar and wind power make electricity a more attractive and sustainable energy option.

Ferrellgas's profitability is significantly impacted by rising operating expenses, including higher plant costs and increased personnel expenditures. For example, overtime pay and workers' compensation claims have notably contributed to these escalating costs, directly affecting the company's profit margins and its capacity for future investments.

The company's substantial reliance on the propane market exposes it to considerable volatility. Fluctuations in supply, demand, and global export dynamics directly influence revenue, as seen in fiscal year 2023 where total revenue was $2.9 billion, heavily tied to propane's price and availability.

Ferrellgas faces intense competition from alternative energy sources like natural gas and electric heat pumps. As electrification initiatives gain momentum, with renewables projected to reach approximately 23% of U.S. utility-scale electricity generation by the end of 2024, propane's market share for heating is increasingly challenged.

Same Document Delivered

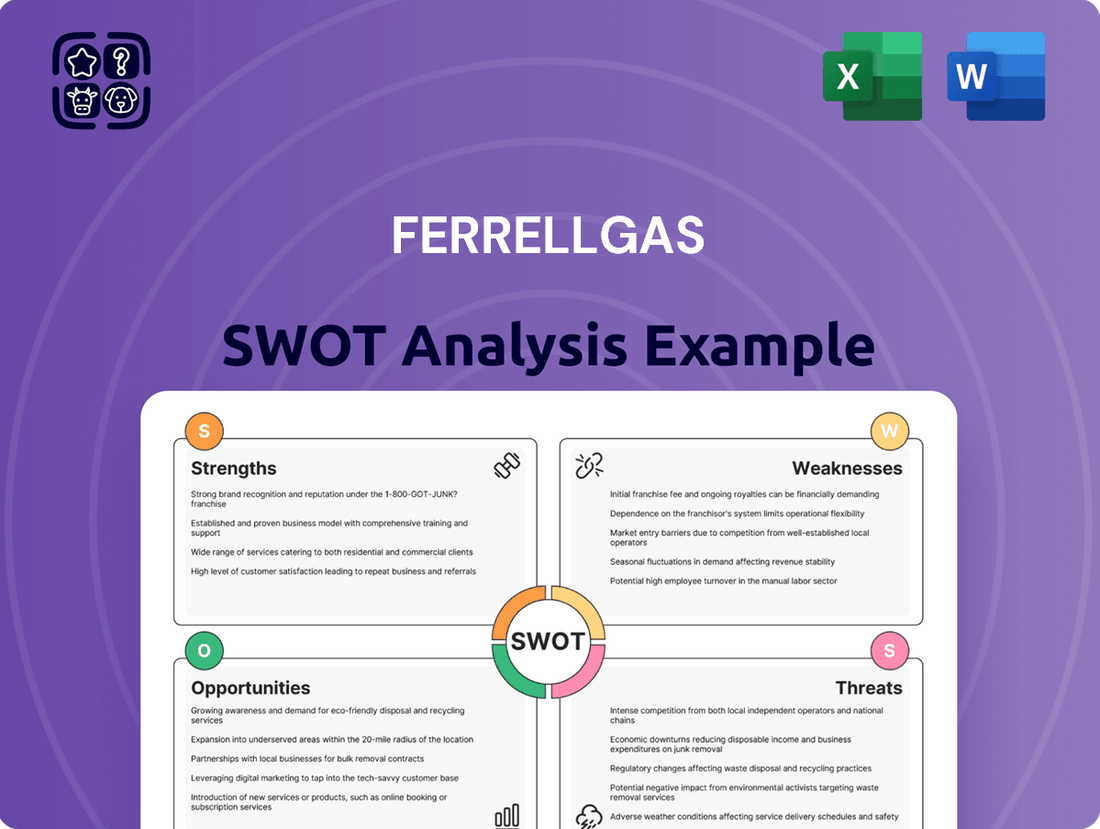

Ferrellgas SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Ferrellgas SWOT analysis, providing a clear overview of its strategic positioning. Purchase unlocks the complete, in-depth report for your comprehensive understanding.

Opportunities

The growing emphasis on clean energy and sustainability is a significant opportunity for Ferrellgas, driven by the increasing production and adoption of renewable propane. This trend directly addresses environmental concerns, potentially positioning propane as a more eco-friendly fuel choice.

For instance, the global renewable propane market is projected to reach approximately $10 billion by 2030, with a compound annual growth rate of around 6.5%, according to market research from the past few years. This expansion offers Ferrellgas a chance to tap into a burgeoning sector.

Ferrellgas is strategically targeting expansion into new geographic markets, with a particular focus on the West and Southeast regions of the United States. This move aims to capture untapped customer bases and diversify its operational footprint.

The company is also prioritizing growth within its 'weather agnostic' customer segments. This includes bolstering its presence in the tank exchange business, expanding its autogas offerings, and deepening penetration in the industrial and commercial sectors, which are less susceptible to seasonal demand fluctuations.

In 2024, Ferrellgas's propane segment demonstrated resilience, and the company continues to see opportunities in these less weather-dependent areas. For example, the autogas market, particularly for fleet vehicles, offers consistent demand throughout the year, aligning with the company's diversification strategy.

Ferrellgas can capitalize on the growing need for propane in commercial settings, particularly for heating and powering essential equipment like generators and restaurant appliances. This trend is expected to contribute to a modest overall increase in retail propane demand.

The industrial sector presents a significant growth avenue, with propane increasingly favored for metal processing and ceramics manufacturing. This shift highlights propane's versatility and efficiency in demanding industrial applications.

Strategic Partnerships and Acquisitions

Ferrellgas's strategy of acquiring smaller propane distributors, a move that has consistently bolstered its market presence, is a key opportunity. For instance, in fiscal year 2023, the company completed several strategic acquisitions, contributing to its revenue growth. This approach not only expands their distribution footprint but also consolidates market share, making them a more formidable competitor.

Forging partnerships that champion propane as an environmentally friendly and efficient energy source offers another significant growth avenue. Such collaborations can enhance public perception and drive demand, particularly as industries and consumers increasingly prioritize sustainability. For example, partnerships with agricultural or industrial sectors looking for cleaner energy alternatives could unlock substantial new markets for Ferrellgas.

- Acquisition Strategy: Continued integration of smaller propane providers to expand market share and distribution network, mirroring successful past transactions.

- Partnership Potential: Collaborations focused on promoting propane's clean and efficient fuel attributes to drive demand across various sectors.

Leveraging Technology for Enhanced Customer Service

Ferrellgas can significantly boost customer satisfaction and operational efficiency by investing further in technology. Advanced tank monitoring systems, for instance, allow for proactive service delivery, reducing the likelihood of run-outs and improving customer peace of mind. This aligns with a growing consumer preference for digitally enabled, reliable services, a trend observed across many utility sectors.

Route optimization software is another key area for technological enhancement. By leveraging data analytics to refine delivery routes, Ferrellgas can lower fuel costs and reduce delivery times, directly translating to better service and potentially a stronger competitive edge. In 2024, many logistics companies reported significant cost savings and improved delivery metrics through the adoption of AI-powered route planning.

The strategic implementation of these technologies presents a clear opportunity to attract new customer segments, particularly those who value convenience and modern service delivery. Companies that demonstrate technological sophistication often appeal to a broader market. For example, a survey of energy consumers in late 2024 indicated that over 60% would consider switching providers based on superior digital service offerings.

- Enhanced Customer Experience: Proactive service through tank monitoring reduces customer anxiety and improves satisfaction.

- Operational Efficiency Gains: Route optimization leads to lower fuel consumption and faster delivery times.

- Market Competitiveness: Attracting tech-savvy customers seeking reliable and modern energy solutions.

- Cost Reduction: Streamlined operations and reduced waste contribute to improved profitability.

Ferrellgas is well-positioned to capitalize on the growing demand for propane in non-weather-dependent sectors like autogas and industrial applications. The company's ongoing acquisition strategy continues to be a significant growth driver, as evidenced by several successful integrations in fiscal year 2023 that bolstered revenue. Furthermore, strategic partnerships focused on promoting propane's environmental benefits offer a pathway to expand market reach and enhance brand perception.

Technological advancements, such as advanced tank monitoring and route optimization software, present a clear opportunity to improve customer satisfaction and operational efficiency. Data from late 2024 suggests over 60% of energy consumers would switch providers for superior digital services, highlighting the market's responsiveness to such innovations.

| Opportunity Area | Description | 2024/2025 Data/Trend |

|---|---|---|

| Clean Energy Adoption | Growth in renewable propane and propane as an eco-friendly alternative. | Global renewable propane market projected to reach ~$10 billion by 2030 (CAGR ~6.5%). |

| Market Expansion | Targeting West and Southeast US, alongside growth in 'weather agnostic' segments. | Continued focus on autogas, industrial, and commercial sectors for consistent demand. |

| Acquisition Strategy | Integrating smaller propane distributors to increase market share. | Fiscal year 2023 saw multiple strategic acquisitions contributing to revenue growth. |

| Technological Integration | Implementing advanced tank monitoring and route optimization. | Logistics companies reported significant savings via AI route planning in 2024. |

Threats

Ferrellgas faces significant rivalry from established giants such as AmeriGas and Suburban Propane. This fierce competition can lead to price wars, impacting margins. For instance, in fiscal year 2023, the propane industry saw fluctuating wholesale prices, with Mont Belvieu propane averaging around $1.00 per gallon, creating a challenging environment for maintaining profitability.

Propane prices can swing quite a bit because of things like how much is in storage, how much is being produced, how much people want, and what's happening in international markets. This volatility directly affects Ferrellgas's costs for buying propane and how much their customers can afford to pay.

For instance, in early 2024, propane prices saw fluctuations influenced by a milder winter in some regions, leading to lower demand than anticipated, which can put downward pressure on prices. Conversely, unexpected supply disruptions or a surge in demand for agricultural or industrial uses can cause sharp price increases, impacting Ferrellgas's operating margins and customer retention.

Evolving environmental regulations present a notable threat to Ferrellgas. For instance, the increasing push for electrification in transportation and heating, often supported by government incentives, could directly reduce demand for propane. New emissions standards, if implemented, might also increase operational costs for distributors.

Economic Downturns and Inflationary Pressures

Economic downturns pose a significant threat to Ferrellgas. As inflation rises, consumer spending power decreases, which can lead to reduced demand for propane, especially among residential customers. This is compounded by the fact that many small businesses, a key customer segment for propane, may be forced to close or scale back operations during economic contractions. For example, the U.S. Bureau of Labor Statistics reported a 3.7% unemployment rate in April 2024, indicating potential headwinds for consumer spending and business activity.

Inflationary pressures directly impact Ferrellgas's cost of doing business, from the acquisition of propane to transportation and operational expenses. These rising costs can squeeze profit margins if they cannot be fully passed on to customers, particularly in a competitive market. The Consumer Price Index (CPI) for all urban consumers rose 3.4% in the 12 months ending April 2024, signaling persistent inflationary trends that could affect Ferrellgas's pricing strategies and profitability.

The combined effects of economic slowdowns and inflation can create a challenging operating environment for Ferrellgas. Key impacts include:

- Reduced Retail Customer Demand: Lower disposable income and business closures directly translate to fewer propane sales.

- Increased Operating Costs: Higher fuel prices and general inflation drive up the cost of delivering propane and maintaining infrastructure.

- Pricing Sensitivity: Customers may become more price-sensitive, making it difficult for Ferrellgas to implement necessary price increases to offset rising costs.

Severe Weather Events and Climate Change

Severe weather events pose a significant threat to Ferrellgas's operations. While colder periods can boost demand for propane, extreme weather like hurricanes can directly interrupt service delivery and negatively affect customer numbers, as seen in the aftermath of major storms impacting regional demand and logistics. For instance, in 2023, the lingering effects of severe weather events in certain regions led to temporary disruptions in supply chains for energy providers.

Looking ahead, the broader trend of climate change presents a more consistent challenge. Projections indicate a potential for milder winters in many of Ferrellgas's key service areas. This gradual warming trend could lead to a sustained decrease in heating demand for propane, impacting overall sales volume and revenue streams over the long term.

- Disruption Risk: Hurricanes and other severe weather can halt deliveries and damage infrastructure, impacting service continuity and customer satisfaction.

- Demand Fluctuation: While cold snaps increase demand, extreme weather events create unpredictable swings in customer usage and operational needs.

- Long-Term Demand Erosion: Climate change-induced milder winters threaten to consistently reduce the need for propane as a primary heating fuel.

- Operational Costs: Responding to and recovering from severe weather events often incurs significant, unplanned operational expenses.

Ferrellgas faces intense competition from major players like AmeriGas and Suburban Propane, potentially leading to price wars that squeeze profit margins. The propane industry's price volatility, influenced by supply, demand, and global markets, directly impacts Ferrellgas's costs and customer affordability, as seen with fluctuating wholesale prices in 2023 and early 2024.

Shifting environmental regulations and the increasing adoption of electrification pose a threat, potentially reducing propane demand for heating and transportation. Economic downturns and persistent inflation also present challenges, decreasing consumer spending power and increasing operational costs, with the CPI rising 3.4% in the year ending April 2024.

Severe weather events can disrupt service and damage infrastructure, while the long-term trend of milder winters due to climate change threatens to reduce overall propane demand for heating.

| Threat Category | Specific Impact | Supporting Data/Example |

|---|---|---|

| Competition | Price wars, margin pressure | Fluctuating wholesale propane prices in FY2023 (avg. ~$1.00/gallon) |

| Price Volatility | Unpredictable costs and customer affordability | Milder winter in early 2024 impacting demand and prices |

| Environmental Regulations & Electrification | Reduced demand, increased operational costs | Government incentives for electric vehicles and heating |

| Economic Downturns & Inflation | Lower demand, higher operating costs | U.S. unemployment at 3.7% (April 2024), CPI up 3.4% (April 2024) |

| Severe Weather & Climate Change | Operational disruptions, long-term demand erosion | Disruptions from storms in 2023, trend of milder winters |

SWOT Analysis Data Sources

This Ferrellgas SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive industry market research, and expert analyst reports. These sources provide a clear understanding of the company's financial health, competitive landscape, and future market projections.