Ferrellgas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrellgas Bundle

Uncover the strategic positioning of Ferrellgas's diverse product portfolio with our comprehensive BCG Matrix analysis. See which offerings are fueling growth and which require a closer look.

This preview offers a glimpse into Ferrellgas's market standing, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to make informed investment decisions and optimize your product strategy.

Don't miss out on the complete picture; purchase the full BCG Matrix today to gain a clear understanding of Ferrellgas's competitive landscape and unlock your path to strategic success.

Stars

Blue Rhino, a key brand under Ferrellgas, is positioned as a Star in the BCG Matrix. Its organic growth is robust, with January 2025 cylinder deliveries exceeding the summer volumes of the previous three years, signaling strong and consistent demand.

This performance highlights Blue Rhino's significant market share in the propane exchange industry. Operating across more than 68,000 retail locations nationwide, the brand benefits from high consumer adoption for activities like grilling and home backup power, reinforcing its status as a market leader with substantial growth potential.

Ferrellgas's strategic national account wins highlight significant growth potential. Three recent major contracts are anticipated to boost annual volume by over 700,000 gallons, underscoring their success in expanding the commercial customer base.

Furthermore, six additional national accounts are projected to add a substantial 1.6 million gallons over the next three years. These achievements are crucial for increasing overall volume and strengthening Ferrellgas's position within the commercial market.

Ferrellgas is making significant strides in broadening its reach, particularly in the Western and Southeastern United States. This expansion isn't just about planting flags; it's about cultivating new customer bases organically. For instance, in 2024, the company reported a notable increase in customer acquisitions in these new territories, demonstrating a successful strategy to move beyond its historical Midwest strongholds.

This geographical diversification is a smart move, lessening the company's dependence on any single region. By tapping into the growing populations and economic vitality of the West and Southeast, Ferrellgas is strategically positioning itself to benefit from emerging market opportunities. This proactive approach aims to capture a larger share of the increasing demand for their services in these dynamic areas.

Autogas Business Development

Ferrellgas is actively developing its autogas business, focusing on clean energy solutions like fueling school buses. This strategic move positions the company to be less reliant on traditional weather-dependent energy demands, showcasing a forward-thinking approach. The U.S. autogas market is a significant growth driver for the propane sector, with an increasing number of vehicles adopting propane as a fuel source.

This burgeoning autogas segment represents a prime opportunity for Ferrellgas to secure an early market leadership position. By investing in this area, Ferrellgas is tapping into a high-growth market that aligns with broader trends towards cleaner transportation fuels.

- Autogas Growth: The U.S. autogas market is expanding, contributing to overall propane demand.

- School Bus Initiative: Ferrellgas is fueling school buses with clean autogas, demonstrating a commitment to alternative fuels.

- Weather-Agnostic Strategy: This focus helps Ferrellgas diversify its revenue streams beyond weather-sensitive segments.

- Market Position: Ferrellgas is establishing an early presence in this high-growth sector.

Renewable Propane Initiatives

Ferrellgas is making significant strides in renewable propane, a move that aligns perfectly with the increasing global focus on sustainability. This cleaner-burning fuel is produced from recycled sources such as used cooking oil and animal fats, tapping into a market that's experiencing rapid growth.

The U.S. Energy Information Administration (EIA) anticipates a substantial increase in biofuel production, which directly benefits renewable propane. For instance, EIA data from 2023 indicated that biofuels accounted for over 5% of total U.S. primary energy consumption, a figure expected to rise as demand for greener alternatives escalates.

This strategic push places Ferrellgas in a prime position within a high-growth sector. The renewable propane market is projected to see considerable expansion in the coming years, driven by environmental regulations and consumer preference for sustainable energy. This initiative is a key component of Ferrellgas's strategy to adapt to evolving energy landscapes.

- Renewable Propane Production: Derived from waste streams like used cooking oil and animal fats.

- Market Growth: Supported by EIA projections of increased biofuel production.

- Sustainability Focus: Addresses growing demand for environmentally conscious energy solutions.

- Strategic Positioning: Ferrellgas is at the forefront of a rapidly expanding, green energy segment.

Ferrellgas's strategic investments in the autogas sector and renewable propane position these as Stars in its BCG portfolio. The company's expansion into fueling school buses with clean autogas, a market projected for significant growth, highlights its commitment to cleaner transportation fuels. Similarly, its focus on renewable propane, derived from recycled materials, taps into a surging demand for sustainable energy solutions, further solidifying its Star status.

| Business Segment | Market Share | Market Growth | BCG Matrix Position |

|---|---|---|---|

| Autogas (School Buses) | Emerging Leader | High | Star |

| Renewable Propane | Growing | High | Star |

What is included in the product

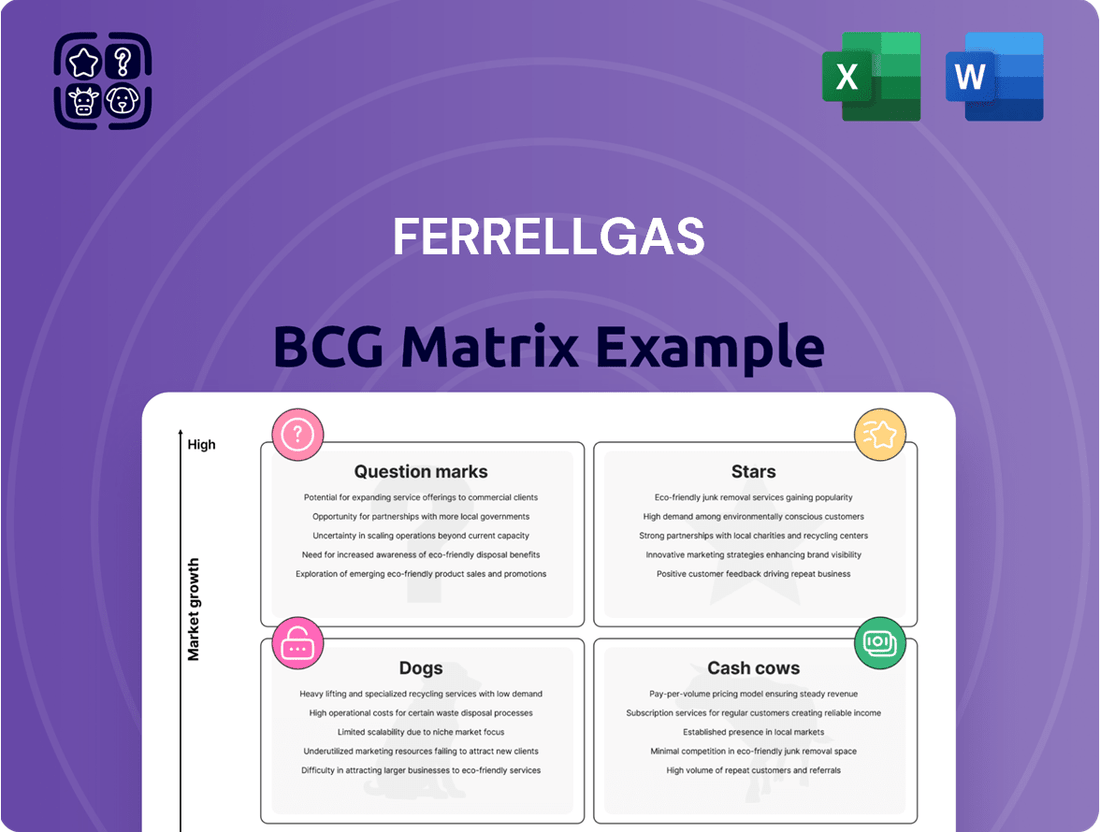

The Ferrellgas BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each unit.

The Ferrellgas BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

Ferrellgas's Nationwide Propane Distribution Network is a classic Cash Cow. Its extensive reach, covering all 50 states, D.C., and Puerto Rico, solidifies a dominant market share in the mature propane distribution sector. This robust infrastructure guarantees predictable and substantial revenue streams.

Ferrellgas's core residential propane delivery services are a classic example of a Cash Cow in the BCG Matrix. This segment serves a large and established residential customer base, meaning it holds a significant market share in a mature industry.

While the residential propane market may not be experiencing explosive growth, its stability ensures consistent demand and predictable, reliable cash flow for Ferrellgas. This steady income stream is crucial for funding other business ventures.

The company's deep-rooted relationships with its residential customers further solidify its strong position in this segment, contributing to its enduring success and consistent revenue generation.

Ferrellgas's commercial and industrial propane supply is a strong Cash Cow. This segment accounts for almost 30% of global propane demand, showcasing its substantial market presence and consistent revenue streams. The company’s integrated service model, encompassing tank installation and upkeep, solidifies its competitive edge and ensures dependable cash flow.

Midstream Services and Supply Logistics

Ferrellgas's midstream services, focusing on propane logistics, are vital for efficient distribution and competitive pricing. This segment, while not always a direct revenue driver, underpins the core business by optimizing supply chain costs, contributing to overall profitability. It's a high-volume, low-growth, yet indispensable part of their operations.

- Logistical Efficiency: Midstream operations ensure reliable propane delivery, minimizing transportation costs and maximizing supply chain throughput.

- Cost Optimization: By managing storage and transportation effectively, Ferrellgas can reduce operational expenses, bolstering margins in its core retail propane business.

- Market Stability: A robust midstream network provides a stable supply, allowing Ferrellgas to maintain consistent product availability and pricing for customers, even in fluctuating market conditions.

- Essential Infrastructure: This segment represents the critical backbone supporting Ferrellgas's extensive retail and wholesale propane distribution network.

Fixed Cost Price Programs

Ferrellgas's fixed-cost price programs for residential customers act as significant cash cows. These programs have been instrumental in driving favorable margin per gallon increases, a key indicator of profitability in the propane industry. In 2024, for instance, such programs helped Ferrellgas maintain stable margins despite volatility in wholesale propane markets, demonstrating their effectiveness in insulating the company from price fluctuations.

These initiatives are crucial for fostering customer loyalty and ensuring predictable revenue streams within a mature market segment. By offering price stability, Ferrellgas secures consistent demand, translating into reliable cash flow. This predictability is vital for a company operating in an industry sensitive to seasonal demand and external economic factors.

The strategic advantage of these fixed-cost programs lies in their ability to lock in customer demand. Even when wholesale prices surge, customers on these plans are shielded, encouraging retention and reducing churn. This consistent demand underpins the cash cow status of these offerings, providing a stable base for the company's operations and investments.

Key benefits include:

- Enhanced Margin Per Gallon: Programs contribute to increased profitability on each gallon sold.

- Customer Loyalty: Price predictability fosters stronger customer relationships and retention.

- Predictable Revenue Streams: Stabilized pricing creates consistent and reliable income.

- Cash Flow Stability: Secures consistent demand and cash flow, even with market price swings.

Ferrellgas's established retail propane distribution, particularly its residential services, functions as a significant cash cow. This segment benefits from a large, stable customer base in a mature market, ensuring consistent revenue. The company's extensive nationwide network, covering all 50 states, D.C., and Puerto Rico, further solidifies its dominant market share and predictable cash flow generation.

The commercial and industrial propane supply also represents a strong cash cow, accounting for a substantial portion of global propane demand. Ferrellgas’s integrated service model, including tank installation and maintenance, reinforces its competitive edge and guarantees dependable cash flow from these sectors.

Ferrellgas's fixed-cost price programs are instrumental cash cows, driving favorable margin per gallon increases. These programs, as evidenced by their performance in 2024, helped maintain stable margins amidst wholesale market volatility, showcasing their effectiveness in generating predictable revenue and customer loyalty.

| Segment | BCG Classification | Key Characteristics | Financial Impact |

|---|---|---|---|

| Residential Propane Distribution | Cash Cow | Large, stable customer base; mature market; extensive nationwide network | Predictable, substantial revenue streams; consistent cash flow |

| Commercial & Industrial Propane Supply | Cash Cow | Significant market share; integrated service model | Dependable cash flow; strong revenue generation |

| Fixed-Cost Price Programs | Cash Cow | Drives margin per gallon increases; fosters customer loyalty; price stability | Predictable revenue; stable cash flow even with market volatility |

What You’re Viewing Is Included

Ferrellgas BCG Matrix

The Ferrellgas BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means you can confidently assess the depth of analysis and strategic insights provided, knowing that no watermarks or placeholder content will obscure the professional presentation of Ferrellgas's business units.

Dogs

Within Ferrellgas's distribution network, some local centers might be struggling due to intense local competition or a shrinking customer base in their specific area. These could be draining resources without generating much profit.

For instance, if a particular region saw a 5% decline in propane demand in 2024, a distribution center located there might become a cash trap. Identifying these specific locations and considering options like selling them or finding ways to make them more efficient is crucial for overall company health.

Certain niche industrial uses for propane, like specific manufacturing processes or older heating systems in specialized facilities, are seeing reduced demand. This is often because industries are switching to electricity or natural gas, or updating their equipment. For example, some metal fabrication shops that historically relied on propane for certain heating steps might now use induction heating, a more energy-efficient alternative.

If Ferrellgas has a small presence in these declining sectors, these would be considered Dogs in the BCG Matrix. These segments are unlikely to grow and may even shrink further, offering little potential for profit and potentially costing more to maintain than they generate. In 2023, the industrial sector's overall propane consumption saw a slight dip compared to previous years, reflecting these ongoing shifts.

Aging or inefficient fleet assets, even with Ferrellgas's telematics investments, represent a significant challenge. These older vehicles, potentially representing a portion of their substantial fleet, likely incur higher maintenance expenses and poorer fuel economy compared to newer models. For instance, a fleet aging without consistent upgrades might see a 10-15% increase in repair costs annually for those specific units.

These underperforming assets contribute minimally to operational efficiency and can actively drain resources. Their lower fuel efficiency, perhaps 5-10% less than modern equivalents, directly impacts profitability. Furthermore, their unreliability can lead to service disruptions, diminishing customer satisfaction and potentially impacting revenue streams.

Highly Competitive, Low-Margin Retail Segments

Certain highly competitive, low-margin retail segments within Ferrellgas's operations may face significant challenges. In these saturated markets, where price wars are common, achieving substantial market share or profitable expansion can be difficult. These areas are often marked by thin profit margins and a tendency for customers to switch providers frequently.

A strategic assessment of these underperforming retail segments is crucial. The goal is to identify and address operations that could potentially drain resources without yielding adequate returns. This proactive approach helps prevent these segments from becoming financial burdens.

- Market Saturation: In 2024, many retail propane markets experienced intense competition, with an average of 3-5 local providers vying for customers in densely populated areas.

- Low Margins: Retail propane margins can sometimes fall below 15% in highly competitive zones, making it challenging to cover operational costs and invest in growth.

- Customer Churn: High customer churn rates, sometimes exceeding 10% annually in price-sensitive markets, further erode profitability and require continuous, costly acquisition efforts.

- Strategic Review: Companies like Ferrellgas must continuously evaluate these segments to determine if they warrant continued investment or if divestment or a change in strategy is more appropriate to avoid becoming cash traps.

Small, Non-Strategic Acquisitions with Poor Integration

Smaller, non-strategic acquisitions that Ferrellgas has made in the past, particularly those that haven't been effectively integrated, might be categorized as Dogs. These might include smaller regional distributors or specialized service providers that didn't align well with the core business or failed to generate anticipated cost savings and revenue growth.

These acquisitions often require significant management oversight without yielding proportional returns, diverting resources from more promising ventures. For instance, if a small acquired propane distributor in a declining rural area failed to achieve economies of scale or cross-selling opportunities with Ferrellgas's larger operations, it could represent a Dog.

- Poor Integration: Acquisitions where synergies were not realized due to operational or cultural mismatches.

- Minimal Market Share Gain: Entities that added little to no significant new customer base or geographic reach.

- Disproportionate Management Attention: Smaller units demanding substantial oversight relative to their financial contribution.

- Low Growth Potential: Businesses operating in stagnant or declining markets, unable to scale effectively.

These are business units or assets that have a low market share in a low-growth industry, offering minimal profit potential and possibly draining resources. For Ferrellgas, this could include certain retail locations in saturated, low-margin markets or smaller, poorly integrated acquisitions. For example, a retail propane outlet in a declining rural area with only a handful of competitors might struggle to achieve profitability, especially if its market share is small.

These "Dogs" require careful management to avoid becoming significant cash drains. In 2024, many such segments faced challenges due to increased operational costs and stagnant demand. Identifying and addressing these underperforming areas is key to optimizing Ferrellgas's overall portfolio and ensuring resources are allocated to more promising ventures.

The strategic decision for these Dog segments often involves either divestment, turnaround efforts, or simply minimizing investment to contain losses. For instance, a retail location with consistently low sales and high operating costs might be a candidate for closure or sale if a turnaround isn't feasible.

Ferrellgas's evaluation of these segments in 2024 likely focused on their ability to contribute to overall profitability or strategic goals. Segments that failed on both counts would be prime candidates for divestment or significant restructuring to prevent them from becoming liabilities.

| Segment Example | Market Growth | Market Share | Profitability | Strategic Action |

|---|---|---|---|---|

| Saturated Retail Market | Low | Low | Low/Negative | Divest/Restructure |

| Declining Industrial Niche | Very Low | Low | Low | Divest/Minimize Investment |

| Poorly Integrated Acquisition | Low | Low | Low/Negative | Divest/Integrate or Divest |

Question Marks

Ferrellgas's emerging renewable energy partnerships, focusing on areas beyond traditional propane, would likely fall into the Question Marks category of the BCG Matrix. These ventures, while potentially high-growth, currently represent a small market share for the company. For instance, exploring partnerships in green hydrogen or advanced biofuels, sectors experiencing rapid expansion, fits this profile.

These initiatives demand substantial investment to develop and scale, aiming to transition them into Stars in the future. The renewable energy sector saw global investment reach an estimated $1.7 trillion in 2023, highlighting the growth potential these partnerships aim to tap into.

Ferrellgas's advanced telematics and logistics optimization services represent a potential question mark in their BCG Matrix. While the company has invested in telematics for internal fleet management and cost reduction, the commercialization of this technology as a standalone service is still in its nascent stages.

This area presents an opportunity to develop a new market for their internal efficiency tools. Currently, Ferrellgas likely holds a low market share in this specialized service sector, but the potential for high growth exists as businesses increasingly seek data-driven logistics solutions. For instance, the global telematics market was valued at approximately $25 billion in 2023 and is projected to grow significantly, indicating a strong demand for such services.

Unproven international market ventures for Ferrellgas would likely be classified as Question Marks in the BCG Matrix. These are markets with high growth potential for propane demand but where Ferrellgas has a low market share, requiring significant investment to compete effectively.

While Ferrellgas's core operations are firmly rooted in the United States, any nascent or experimental ventures into international territories with minimal existing presence would fit this category. For instance, if Ferrellgas were to explore opportunities in emerging economies in Asia or Africa, where propane adoption is growing but competition is also intensifying, these would be considered Question Marks.

These markets, though promising for future growth, demand substantial capital outlay and a carefully crafted strategy to establish a foothold and gain meaningful market share. The success of these ventures hinges on thorough market research and a deep understanding of local regulatory environments and consumer preferences, which can be challenging to navigate.

New, Untested Product or Service Offerings

New, untested product or service offerings for Ferrellgas, such as pilot programs for smart home propane monitoring or bundled energy solutions, would be categorized as Question Marks. These initiatives represent a diversification beyond their core propane business. While they currently hold a small market share, they are positioned in markets with significant growth potential.

The success of these ventures relies heavily on achieving rapid market acceptance and substantial investment to scale. For instance, if Ferrellgas launched a smart home propane monitoring system in late 2023, its initial adoption rate would be a key indicator. By mid-2024, if only a few thousand households adopted the service, it would solidify its Question Mark status, requiring further analysis of customer feedback and competitive landscape to determine future investment.

- Diversification Beyond Propane: Ferrellgas exploring smart home monitoring or integrated energy solutions.

- Low Current Market Share: These new offerings have minimal penetration in the market today.

- High Growth Potential Markets: The target sectors for these new products are expected to expand significantly.

- Strategic Investment Required: Success depends on substantial capital infusion and effective market penetration strategies.

Recent Small-Scale Acquisitions in Growth Markets

Recent small-scale acquisitions like Kilhoffer Propane in October 2024 and Eastern Sierra Propane in January 2024, while bolstering Ferrellgas's presence, initially represent a low market share within the company's broader portfolio. These acquisitions are strategically positioned in growing regional markets, indicating potential for future expansion. The success of these ventures in transitioning from Question Marks to Stars hinges on significant investment in their integration and scaling processes.

These acquisitions, though individually small, contribute to Ferrellgas's overall growth strategy by expanding its footprint in developing areas. For instance, Kilhoffer Propane and Eastern Sierra Propane, while not massive in scale compared to Ferrellgas's existing operations, are situated in markets exhibiting robust demand. This strategic placement is crucial for their potential to capture increasing market share.

- Acquisition Focus: Kilhoffer Propane (Oct 2024), Eastern Sierra Propane (Jan 2024).

- Market Position: Low relative market share within Ferrellgas, but in growing regional markets.

- Growth Potential: These are considered Question Marks, requiring substantial investment to become Stars.

- Strategic Importance: These acquisitions are key to Ferrellgas's organic growth and market penetration in developing regions.

Ferrellgas's ventures into renewable energy, such as green hydrogen or advanced biofuels, are prime examples of Question Marks. These initiatives, while targeting high-growth sectors, currently represent a minimal portion of Ferrellgas's overall business. The global renewable energy sector attracted substantial investment, with an estimated $1.7 trillion poured in during 2023, underscoring the market's potential for these emerging ventures.

Similarly, the commercialization of Ferrellgas's internal telematics and logistics optimization technology falls into the Question Marks category. This is a nascent service offering with low current market penetration but significant potential, mirroring the broader telematics market which was valued at approximately $25 billion in 2023 and is expected to see considerable growth.

Untested international market expansions and new product pilots, like smart home propane monitoring, also fit the Question Mark profile. These require substantial investment and strategic planning to gain traction in markets with high growth expectations but where Ferrellgas currently holds little to no market share.

Recent acquisitions such as Kilhoffer Propane (Oct 2024) and Eastern Sierra Propane (Jan 2024) are also considered Question Marks. While they expand Ferrellgas's footprint in growing regions, their current market share within the company is small, necessitating further investment for integration and scaling to potentially become Stars.

| BCG Category | Ferrellgas Business Unit/Venture | Market Share | Market Growth | Investment Need | Potential Outcome |

| Question Mark | Renewable Energy Partnerships (Green Hydrogen, Biofuels) | Low | High | High | Star or Dog |

| Question Mark | Telematics & Logistics Optimization Services | Low | High | High | Star or Dog |

| Question Mark | Untested International Markets | Low | High | High | Star or Dog |

| Question Mark | New Product Pilots (Smart Home Monitoring) | Low | High | High | Star or Dog |

| Question Mark | Recent Small Acquisitions (Kilhoffer, Eastern Sierra) | Low | High | High | Star or Dog |

BCG Matrix Data Sources

Our Ferrellgas BCG Matrix is constructed using comprehensive data from financial reports, industry-specific market research, and internal operational metrics to provide a clear strategic overview.