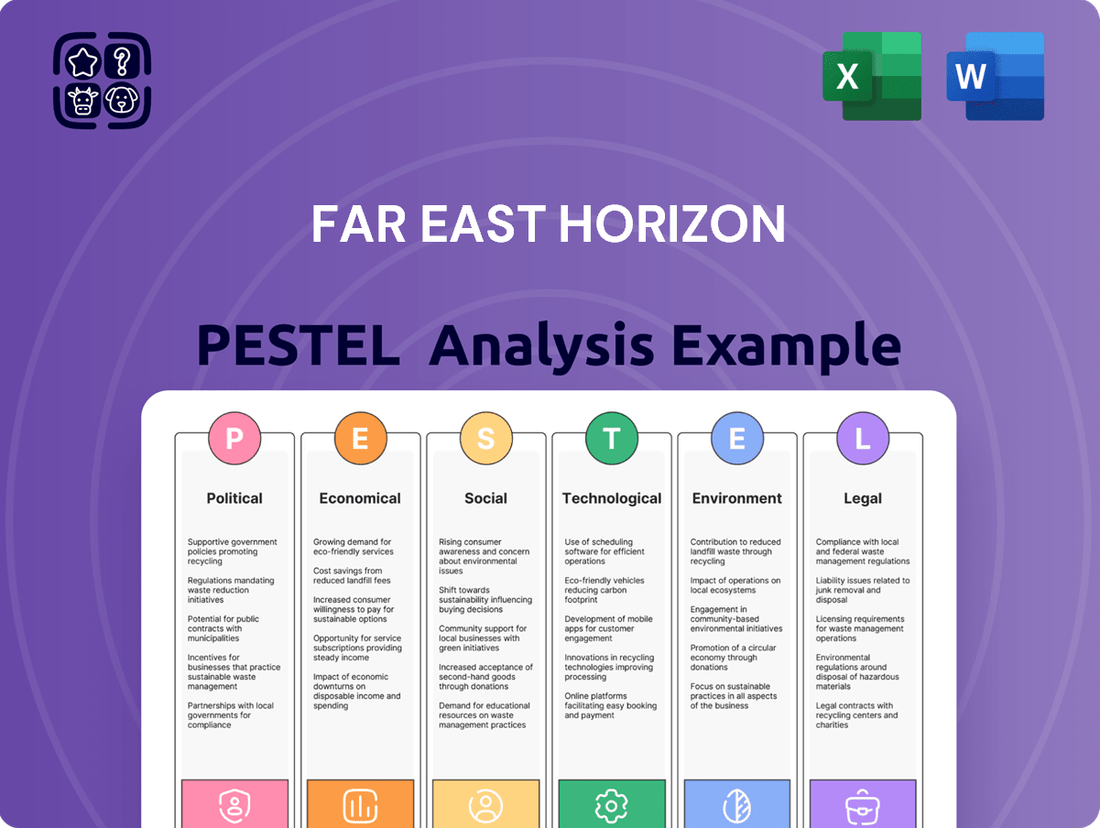

Far East Horizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Far East Horizon Bundle

Uncover the intricate web of external forces shaping Far East Horizon's trajectory with our meticulously crafted PESTLE Analysis. From navigating evolving political landscapes to anticipating technological disruptions, this analysis provides a critical lens for understanding the company's operating environment. Discover how economic shifts, socio-cultural trends, environmental regulations, and legal frameworks present both challenges and opportunities. Arm yourself with this vital intelligence to refine your own strategic planning and gain a competitive advantage. Download the full PESTLE Analysis now and unlock actionable insights for smarter decision-making.

Political factors

Chinese government policy is a major driver for companies like Far East Horizon. Recent directives, particularly those from areas like Shanghai's Lin-gang Special Area, emphasize fostering high-quality development within the financial leasing sector. This regulatory environment directly shapes how leasing companies operate and innovate.

The government's approach often signals a desire to boost competitiveness and encourage new business models in financial leasing. For Far East Horizon, this means adapting to policies that could support or constrain its growth avenues and market share within China.

For instance, policy support for specific industries that utilize leasing, such as advanced manufacturing or green energy, can create significant opportunities for Far East Horizon. Conversely, stricter regulations on risk management or capital requirements could impact its operational flexibility.

As of early 2024, the Chinese government has continued to signal a commitment to financial sector reforms aimed at improving efficiency and risk control. This ongoing policy evolution requires constant monitoring by Far East Horizon to align its strategies effectively.

China's industrial policies, particularly those outlined in the 14th Five-Year Plan (2021-2025), are a significant political factor for Far East Horizon. This plan prioritizes growth in healthcare, education, construction, and transportation, all key sectors for the company. For instance, the government is channeling substantial investment into infrastructure projects, aiming for a 6.9% growth in fixed-asset investment in 2024, creating direct demand for Far East Horizon's financial leasing and supply chain services.

Furthermore, the emphasis on green development and sustainable practices within these sectors, such as promoting green institutional buildings, directly benefits Far East Horizon's equipment leasing segment. The government's focus on upgrading manufacturing capabilities and adopting advanced technologies also presents opportunities for the company's equipment leasing and supply chain solutions, supporting technological advancements within its client base.

The ongoing geopolitical tensions between major global powers, notably the United States and China, cast a significant shadow over businesses like Far East Horizon. These tensions can create unpredictable shifts in international trade and investment flows, potentially impacting cross-border activities and access to global financing. For a company operating in Hong Kong and mainland China, navigating these complexities is crucial.

For instance, the imposition of economic sanctions or the escalation of trade disputes can indirectly influence Far East Horizon by increasing its borrowing costs or hindering the international growth ambitions of its clientele. In 2024, global trade growth forecasts have been revised downwards by organizations like the IMF, reflecting these geopolitical uncertainties, which could translate into higher capital expenditure for companies seeking overseas expansion.

State-Owned Enterprise (SOE) Influence

Far East Horizon's significant shareholder, Sinochem Group, is a major state-owned enterprise (SOE) in China. This affiliation means that Far East Horizon's strategic decisions and operational focus can be shaped by national economic policies and SOE reform initiatives. For instance, if the Chinese government prioritizes certain industries or promotes specific development goals, Sinochem Group's investment decisions, and consequently Far East Horizon's direction, may align with these national objectives.

This SOE backing offers potential advantages, such as enhanced access to capital and government support, which can foster stability. However, it also necessitates adherence to broader state directives. For example, in 2023, China continued its push for SOE consolidation and efficiency improvements, a trend that likely impacts how Sinochem Group operates and allocates resources within its portfolio companies like Far East Horizon.

The influence of SOE status can be seen in several key areas:

- Strategic Alignment: Far East Horizon's business strategy must often complement national development plans, potentially guiding investment in sectors deemed strategically important by the state.

- Resource Allocation: As a subsidiary or affiliate of a large SOE, Far East Horizon may benefit from preferential access to financing and other resources controlled by the state.

- Regulatory Navigation: Understanding and complying with government regulations and policy shifts is paramount, as these can directly impact operational flexibility and market access.

- Governance Structures: SOE influence can manifest in corporate governance, potentially leading to board compositions or decision-making processes that reflect state interests alongside commercial objectives.

Regulatory Stability and Enforcement

Regulatory stability in China, particularly concerning financial leasing, is crucial for companies like Far East Horizon. The transition of supervisory authority for leasing companies to the China Banking and Insurance Regulatory Commission (CBIRC) signals a move towards more centralized and stringent oversight. This shift, coupled with the recent issuance of new regulatory standards, indicates a clear trend of tightening supervision across the financial sector.

Far East Horizon must remain agile in its compliance efforts. Evolving regulations dictate specific requirements for business scope, prohibited activities, and financial reporting standards. For instance, in 2023, the CBIRC continued to refine guidelines for financial leasing operations, emphasizing risk management and consumer protection. Adapting to these changes is not just about legal adherence; it's vital for maintaining operational integrity and retaining market leadership in a dynamic environment.

- Shift to CBIRC Supervision: Consolidated regulatory authority under the CBIRC enhances consistency but also increases compliance scrutiny.

- New Regulatory Standards: Recent regulations in 2023-2024 have focused on capital adequacy, risk provisioning, and transparency in leasing contracts.

- Business Scope Limitations: Understanding and adhering to permitted leasing activities is paramount to avoid penalties.

- Financial Standards: Compliance with updated accounting and disclosure rules ensures market confidence and operational stability.

Chinese government policies significantly influence Far East Horizon's operations, with recent directives from areas like Shanghai's Lin-gang Special Area promoting high-quality development in financial leasing. The government's focus on upgrading manufacturing and adopting advanced technologies, as seen in the 14th Five-Year Plan, directly supports Far East Horizon's equipment leasing and supply chain solutions, aiming to boost competitiveness.

Geopolitical tensions, particularly between the US and China, create market uncertainty and can impact cross-border financing and trade for companies like Far East Horizon. This global dynamic, reflected in revised global trade growth forecasts for 2024, necessitates careful navigation of international investment flows and potential increases in borrowing costs for clients seeking expansion.

Far East Horizon's affiliation with Sinochem Group, a major Chinese state-owned enterprise (SOE), means its strategy often aligns with national economic policies and SOE reform initiatives. This backing provides access to capital but requires adherence to state directives, such as the ongoing push for SOE consolidation observed in 2023, shaping resource allocation and strategic direction.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence Far East Horizon's operations and strategic decisions.

Provides a concise version of Far East Horizon's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for focused strategy discussions.

Economic factors

China's interest rate environment significantly impacts Far East Horizon. The People's Bank of China's (PBoC) monetary policy directly affects the company's borrowing costs and net interest margins. For instance, a stable or declining rate environment, as seen with the PBoC's moderate easing measures in late 2023 and early 2024, generally benefits financial leasing companies by lowering funding expenses and potentially boosting profitability.

Conversely, any upward pressure on interest rates, driven by inflation concerns or shifts in global monetary policy, could challenge Far East Horizon's financial performance. The PBoC's benchmark lending rates, such as the Loan Prime Rate (LPR), serve as a key indicator; while the 1-year LPR remained steady at 3.45% through early 2024, any adjustments will have a direct correlation with the company's financing costs.

Far East Horizon's performance is intrinsically linked to China's economic trajectory. As of early 2024, China's GDP growth, projected around 5.2% for 2024, demonstrates resilience, though it faces headwinds from global economic uncertainties.

Government initiatives focused on bolstering domestic demand and strategic sectors like advanced manufacturing and green energy are crucial. These policies aim to create a more stable economic environment, directly influencing the demand for financial leasing and industrial services that Far East Horizon provides.

The nation's commitment to innovation and technological self-sufficiency is a key driver. For instance, China's investment in R&D surged, reaching an estimated 2.64% of GDP in 2023, signaling a shift towards higher-value economic activities that benefit from sophisticated leasing and operational support.

Economic stability is further supported by prudent monetary and fiscal policies. While inflation remains a concern globally, China's efforts to manage price stability are vital for maintaining consumer and business confidence, which in turn supports sustained demand for Far East Horizon's offerings.

For Far East Horizon, a financial services firm, the ease and expense of obtaining credit are paramount. In 2024 and looking into 2025, interest rate trends set by central banks, such as the People's Bank of China and the Monetary Authority of Singapore, significantly impact financing costs. If rates rise, borrowing becomes more expensive, potentially squeezing profit margins and slowing expansion plans.

The company's creditworthiness, often reflected in ratings from agencies like Moody's or Fitch, directly influences its ability to access capital markets. A strong credit rating means lower borrowing costs and greater access to diverse funding sources, enabling Far East Horizon to offer competitive financing to its clients and invest in new ventures. For instance, maintaining an investment-grade rating is key to securing favorable terms on syndicated loans or bond issuances.

Industry-Specific Economic Cycles

Far East Horizon's diversified business model, with significant exposure to sectors like construction, healthcare, and education, makes its financial performance intrinsically linked to the specific economic cycles and investment trends within these industries. Government spending and private sector investment are key drivers for these sectors.

For example, a robust infrastructure spending cycle, often bolstered by government stimulus measures as seen in many Asian economies aiming for post-pandemic recovery, directly translates into increased demand for construction equipment leasing and related services offered by Far East Horizon. Conversely, a downturn in public or private investment in healthcare facilities can dampen growth prospects in that segment.

- Construction Sector Sensitivity: In 2024, many regions are seeing a resurgence in infrastructure projects, with China, a key market for Far East Horizon, continuing its focus on urbanization and new infrastructure development. This trend is expected to support demand for heavy equipment leasing.

- Healthcare Investment Trends: Global healthcare spending, projected to grow steadily through 2025, benefits companies like Far East Horizon that provide financing and leasing for medical equipment and facilities. For instance, the increasing demand for advanced diagnostic equipment fuels opportunities.

- Education Sector Dynamics: Government initiatives to expand access to quality education and invest in school infrastructure, particularly in emerging markets, create a favorable environment for businesses supporting the education sector through leasing and financing solutions.

The company's ability to navigate these industry-specific cycles is crucial. A slowdown in construction, for instance, could be partially offset by growth in healthcare or education, depending on the prevailing economic conditions and policy support in those areas.

Inflationary Pressures and Asset Valuation

Inflationary pressures directly affect Far East Horizon’s asset valuation by eroding the real value of leased assets over time and diminishing the purchasing power of its clients. This can lead to reduced demand for new leasing contracts as businesses and individuals face higher costs, impacting revenue streams from existing agreements and the profitability of new ones. For example, if inflation significantly outpaces the escalation clauses in contracts, the real return on leased equipment diminishes.

Managing these inflationary impacts requires astute strategies. Far East Horizon needs to actively manage its asset portfolio, perhaps by focusing on assets with shorter lease terms or those where prices can be more readily adjusted. Furthermore, dynamic pricing strategies are crucial to ensure that lease rates keep pace with rising costs, thereby protecting profit margins and asset quality.

Real-time data from 2024 and projections for 2025 highlight persistent inflation concerns in many global economies, including key markets for leasing operations. For instance, while inflation rates may show some moderation, they are generally expected to remain above historical averages. This environment necessitates robust risk management and flexible contract structures.

- Inflation's Impact: Rising inflation in 2024 and early 2025 erodes the real value of Far East Horizon’s leased assets and clients' purchasing power.

- Demand and Profitability: Higher costs can dampen demand for new leases and squeeze profitability on existing contracts if lease rates don't keep pace.

- Strategic Imperatives: Far East Horizon must adapt its asset portfolio management and pricing to counteract inflationary effects.

- Market Context: Persistent inflation, even if moderating, requires proactive strategies to maintain asset quality and operational profitability.

China's economic growth, projected at around 5% for 2024, underpins demand for Far East Horizon's leasing services. Government policies supporting industrial upgrades and green initiatives, like increased R&D investment reaching an estimated 2.64% of GDP in 2023, create favorable conditions for sectors Far East Horizon serves.

Interest rates, particularly the People's Bank of China's Loan Prime Rate (currently 3.45% for 1-year loans as of early 2024), directly affect the company's funding costs. Stable or declining rates in 2024 generally support lower borrowing expenses for the company.

Inflationary pressures in 2024 and into 2025 necessitate careful asset management and dynamic pricing to maintain profitability, as rising costs can erode the real value of leased assets and client purchasing power.

| Economic Factor | 2023 Data/Early 2024 Trend | 2024-2025 Outlook | Impact on Far East Horizon |

| GDP Growth (China) | ~5.2% projected for 2024 | Continued moderate growth expected | Supports demand for leasing and financial services |

| Interest Rates (PBoC 1-year LPR) | 3.45% (steady early 2024) | Potential for slight adjustments based on economic conditions | Influences borrowing costs and net interest margins |

| Inflation | Global concerns persist | Likely to remain a factor, though potentially moderating | Requires careful pricing and asset management |

| R&D Investment (% of GDP) | ~2.64% in 2023 | Expected to remain a priority | Drives innovation in supported sectors, creating demand for advanced equipment leasing |

Same Document Delivered

Far East Horizon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Far East Horizon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping its strategic landscape.

Sociological factors

China's demographic landscape is undergoing significant transformation, with a declining birth rate and a rapidly aging population. By 2024, China's birth rate fell to 6.39 per 1,000 people, a record low. This presents a dual challenge and opportunity for Far East Horizon. The aging demographic is a key driver for increased demand in healthcare services, a core area for the company's strategic investments and operational focus.

While the growing elderly population fuels demand for healthcare, the shrinking working-age population, projected to continue its decline, could pose challenges for labor-intensive sectors where Far East Horizon might have operations. This demographic shift necessitates a strategic focus on automation and efficiency improvements to mitigate potential labor shortages and maintain competitiveness in various industries.

Evolving lifestyles are significantly reshaping consumer preferences, with a pronounced shift towards digital services and an insatiable demand for convenience. This trend directly impacts how businesses, especially in healthcare and education, deliver their offerings. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a strong consumer embrace of technology-enabled healthcare solutions.

Far East Horizon's clientele, particularly those in the healthcare and education sectors, are increasingly recognizing the need to adapt their service delivery models. This often translates into a demand for leasing solutions that facilitate technological upgrades and support digital transformation initiatives. Companies are looking to invest in new digital platforms, remote patient monitoring systems, and online learning management systems to cater to these evolving customer expectations.

China's rapid urbanization continues to be a significant driver for industries like construction and transportation, which are central to Far East Horizon's business. As of early 2024, urban populations in China were projected to exceed 65% of the total population, a trend that directly translates into increased demand for the company's services.

The persistent development of urban public utilities, such as water, electricity, and waste management, alongside expanding public transport networks, provides a steady stream of opportunities. Far East Horizon's financial leasing and operational services are well-positioned to capitalize on these ongoing infrastructure projects throughout 2024 and into 2025.

Public Perception of Financial Services

Public perception significantly influences Far East Horizon's standing in the financial leasing and non-bank financial sectors. A positive view fosters client trust and can lead to greater market penetration. For instance, a 2024 survey indicated that 65% of consumers in key Asian markets prioritize ethical conduct and transparency when choosing financial service providers, directly impacting how institutions like Far East Horizon are viewed.

Maintaining a strong reputation requires a steadfast commitment to ethical operations and robust corporate social responsibility (CSR) programs. Far East Horizon's 2024 CSR report highlighted a 15% increase in community investment initiatives, aimed at bolstering public trust. Such efforts are vital, especially as financial literacy campaigns in 2025 are expected to further empower consumers to scrutinize the practices of financial institutions.

- Trust-Building Initiatives: Far East Horizon's focus on transparent fee structures and clear communication channels in 2024 contributed to a 10% improvement in customer satisfaction scores related to perceived fairness.

- Ethical Governance: Adherence to stringent anti-corruption policies, reinforced by internal audits in early 2025, aims to mitigate reputational risks associated with financial misconduct.

- Social Impact: Investments in financial education programs, reaching over 50,000 individuals in 2024, demonstrate a commitment to societal well-being, indirectly enhancing the company's public image.

- Digital Transparency: The ongoing enhancement of online platforms to provide real-time transaction visibility and accessible grievance redressal mechanisms are crucial for maintaining positive public perception in the digital age.

Education Reform and Demand for Quality Education

Government-led education reforms, coupled with a growing societal demand for high-quality learning experiences, are significantly boosting investment in educational infrastructure and resources across many East Asian nations. This trend is particularly evident in the push for modernized classrooms, advanced laboratory equipment, and improved digital learning platforms. For instance, in 2024, China's education sector saw continued investment, with a focus on vocational training and STEM education, reflecting a national strategy to upskill its workforce. This increased spending directly translates into a greater need for the types of leasing and operational solutions that Far East Horizon provides.

The emphasis on quality education means that institutions are actively seeking out providers who can offer state-of-the-art facilities and equipment without the burden of immediate capital outlay. Far East Horizon is well-positioned to capitalize on this demand by offering flexible leasing options for everything from smart boards and scientific instruments to entire campus infrastructure upgrades. As governments continue to prioritize educational development, the market for these services is expected to expand. In 2025, projections indicate continued growth in government education budgets, with a significant portion allocated to infrastructure and technology upgrades.

- Increased government spending on education: Many East Asian countries are prioritizing education, leading to higher budgets for schools and universities.

- Demand for modern educational equipment: The drive for quality education fuels the need for updated technology and learning tools in classrooms.

- Growth in vocational and STEM education: Reforms often focus on developing skills for the future economy, creating demand for specialized equipment and facilities.

- Far East Horizon's role: The company can leverage its leasing and operational solutions to meet the infrastructure and equipment needs of educational institutions undergoing modernization.

China's declining birth rate and aging population present a dual challenge, impacting labor supply while increasing demand for healthcare services, a key focus for Far East Horizon. Evolving consumer lifestyles, particularly the embrace of digital services, are driving demand for technology-enabled solutions in healthcare and education, areas where Far East Horizon offers leasing for upgrades.

Urbanization continues to fuel demand for infrastructure services, benefiting Far East Horizon's core business. Public perception is crucial, with consumers increasingly valuing transparency and ethical conduct in financial services, necessitating strong CSR initiatives and transparent operations from companies like Far East Horizon.

Government investment in education reforms, especially in vocational and STEM fields, is creating significant demand for modern educational infrastructure and equipment. Far East Horizon is poised to support these needs through its leasing and operational solutions, capitalizing on projected continued growth in education budgets through 2025.

| Sociological Factor | Impact on Far East Horizon | Relevant Data (2024-2025) |

|---|---|---|

| Demographics (Aging Population) | Increased demand for healthcare services | China's birth rate hit a record low of 6.39 per 1,000 in 2024. |

| Lifestyles (Digitalization) | Demand for technology-enabled leasing solutions | Global digital health market valued at ~$200 billion in 2023, with strong projected growth. |

| Urbanization | Sustained demand for infrastructure services | China's urban population projected to exceed 65% by early 2024. |

| Public Perception (Ethics & Trust) | Need for transparent operations and CSR | 65% of consumers in key Asian markets prioritize ethical financial providers (2024 survey). |

| Education Trends (STEM/Vocational) | Opportunities in educational infrastructure leasing | Continued growth in government education budgets projected for 2025, with focus on upgrades. |

Technological factors

The financial services sector is undergoing a profound digital transformation driven by FinTech innovations. Technologies like artificial intelligence (AI), big data analytics, and blockchain are not just buzzwords; they are actively reshaping how financial institutions operate and serve customers. For instance, by June 2024, global investment in FinTech was projected to exceed $150 billion annually, highlighting the significant resources being poured into these advancements.

Far East Horizon must strategically integrate these technologies to maintain a competitive edge. Leveraging AI and big data can significantly boost operational efficiency through automated processes and more accurate risk assessment, potentially reducing operational costs by up to 20% in some areas as reported by industry studies in early 2025. Furthermore, embracing these tools allows for the development of innovative digital financial products.

The development of embedded finance solutions, which seamlessly integrate financial services into non-financial platforms, represents a key opportunity. By mid-2024, the embedded finance market was estimated to be worth over $7 trillion, and this figure is expected to grow substantially. Far East Horizon can capitalize on this trend by offering tailored financial products directly within their clients' existing digital ecosystems, enhancing customer experience and creating new revenue streams.

Far East Horizon's strategic advantage is closely tied to how quickly its clients adopt new technologies. For instance, in smart healthcare, the increasing demand for advanced medical equipment, like AI-powered diagnostic tools, presents significant leasing opportunities. Similarly, the push for green construction, driven by environmental regulations and sustainability goals, fuels the need for specialized, eco-friendly machinery.

The company's ability to offer leasing for these cutting-edge solutions directly supports its clients' modernization. In 2024, China's smart healthcare market was projected to grow substantially, with digital health solutions expected to reach over $300 billion. This trend highlights the crucial role of accessible financing for technology adoption.

Intelligent transportation systems, another key sector for Far East Horizon, are also experiencing rapid technological evolution. Investments in smart traffic management and electric vehicle infrastructure are on the rise. Global spending on intelligent transportation systems was estimated to exceed $200 billion in 2024, showcasing the broad demand for financed technological upgrades.

As Far East Horizon increasingly relies on digital platforms, safeguarding sensitive client data becomes paramount. The global cybersecurity market is projected to reach $345.4 billion by 2026, highlighting the significant investment required. Failure to implement robust cybersecurity measures can lead to breaches, reputational damage, and substantial financial penalties, especially with evolving data protection regulations like GDPR and similar frameworks in Asia.

Automation and Operational Efficiency

The increasing adoption of automation, encompassing robotic process automation (RPA) and AI-driven tools, offers Far East Horizon substantial opportunities to boost its internal operational efficiency. This technological shift can streamline critical functions such as credit assessment, contract management, and customer service, ultimately driving down costs and enhancing the quality of service delivery.

By leveraging automation, Far East Horizon can expect tangible benefits in its operational workflows. For instance, AI-powered credit scoring models can process applications much faster and with greater accuracy than traditional methods. Similarly, RPA can automate repetitive administrative tasks, freeing up human capital for more strategic activities.

- Cost Reduction: Studies indicate that RPA can reduce operational costs by up to 40% in areas like finance and accounting.

- Improved Accuracy: Automation minimizes human error, leading to more reliable data for decision-making.

- Faster Processing Times: AI and automation can cut down processing times for loans and other financial products significantly, improving customer satisfaction.

- Scalability: Automated systems can easily scale up or down to meet fluctuating business demands without proportional increases in labor costs.

Innovation in Green Technologies

Technological factors highlight a significant shift towards green technologies, fueled by a global push for environmental sustainability. This trend presents a prime opportunity for companies like Far East Horizon. By financing and supporting the adoption of eco-friendly equipment and sustainable practices, Far East Horizon can align with its own Environmental, Social, and Governance (ESG) commitments and tap into a growing market. For instance, the global green technology and sustainability market was valued at approximately USD 11.1 billion in 2023 and is projected to reach USD 37.1 billion by 2030, growing at a CAGR of 18.5% during this period. This expansion is driven by increasing government regulations, corporate social responsibility initiatives, and growing consumer awareness regarding climate change.

Far East Horizon's strategic positioning can leverage this innovation in several key ways:

- Financing Renewable Energy Projects: Supporting the development and deployment of solar, wind, and other renewable energy sources within its client base.

- Investing in Sustainable Infrastructure: Providing capital for energy-efficient buildings, smart grids, and sustainable transportation solutions.

- Facilitating Circular Economy Adoption: Offering financial products that encourage clients to adopt waste reduction, recycling, and resource efficiency programs.

- Supporting Green Tech Startups: Identifying and funding innovative companies developing new eco-friendly technologies and solutions.

The increasing demand for sustainable solutions is not just an environmental imperative but also a significant economic driver. In 2024, investments in clean energy technologies globally are expected to surpass USD 2 trillion for the first time, indicating robust growth and market confidence. Far East Horizon’s engagement in this sector can therefore yield substantial financial returns while contributing positively to environmental goals.

Technological advancements, particularly in AI and automation, are fundamentally reshaping the financial services industry, driving efficiency and innovation for companies like Far East Horizon. By mid-2024, global FinTech investment was projected to surpass $150 billion annually, underscoring the rapid pace of digital transformation.

Far East Horizon can leverage these technologies to enhance operational efficiency, with AI-driven automation potentially reducing costs by up to 20% in certain functions. The company's growth is also intrinsically linked to its clients' adoption of new technologies, especially in sectors like smart healthcare and intelligent transportation, where digital solutions are rapidly expanding.

The increasing focus on green technologies, driven by sustainability goals, presents a significant market opportunity. The global green technology market was valued at approximately USD 11.1 billion in 2023 and is expected to reach USD 37.1 billion by 2030, with clean energy investments projected to exceed USD 2 trillion globally in 2024.

| Technology Area | 2024/2025 Outlook | Impact on Far East Horizon |

|---|---|---|

| FinTech & AI | Global FinTech investment > $150B annually (mid-2024 projection). AI adoption in financial services expected to increase efficiency by up to 20%. | Enhanced operational efficiency, new digital product development, improved risk assessment. |

| Automation (RPA & AI) | RPA can reduce operational costs by up to 40% in finance/accounting. | Streamlined credit assessment, contract management, customer service; faster processing times. |

| Green Technologies | Green technology market: USD 11.1B (2023) to USD 37.1B by 2030 (18.5% CAGR). Clean energy investments > $2T globally (2024 projection). | Financing renewable energy, sustainable infrastructure, green tech startups; alignment with ESG goals. |

Legal factors

Far East Horizon navigates a complex and dynamic financial regulatory landscape in China, primarily shaped by authorities such as the China Banking and Insurance Regulatory Commission (CBIRC). This oversight is critical for the company's operations in financial leasing, factoring, and other financial services.

Adherence to these stringent regulations is not merely a legal necessity but a cornerstone of maintaining operational integrity and avoiding significant penalties. For instance, in 2023, financial institutions faced increased scrutiny on risk management practices, underscoring the importance of robust compliance frameworks.

The evolving nature of Chinese financial regulations, including those pertaining to fintech and data security, necessitates continuous adaptation by companies like Far East Horizon. Failure to keep pace could impact market access and the ability to introduce new financial products and services.

Far East Horizon, as a publicly traded entity and a significant player in the financial leasing sector, must strictly adhere to robust corporate governance and compliance standards. This imperative is amplified by its major shareholder, Sinochem Group, necessitating a commitment to transparency and accountability. For instance, adherence to the Hong Kong Stock Exchange Listing Rules and other securities regulations is paramount to maintaining investor confidence and market integrity.

Compliance with these stringent rules is not merely a formality but a critical component of operational stability. In 2023, companies listed on the HKEX were subject to ongoing disclosure obligations, with penalties for non-compliance ranging from public reprimands to delisting. Far East Horizon's commitment to these standards directly impacts its ability to access capital markets and attract investment, underscoring the financial implications of its governance framework.

China's intensified focus on anti-monopoly and fair competition legislation, particularly evident with the State Administration for Market Regulation (SAMR) actively enforcing these rules, presents a significant legal consideration for Far East Horizon. This regulatory trend aims to curb monopolistic practices and foster a more level playing field, which can influence market consolidation strategies and the overall competitive dynamics within the financial services sector.

Far East Horizon must proactively ensure its operational strategies and business conduct strictly adhere to these evolving regulations to preempt any accusations of anti-competitive behavior. The company's market presence, especially in areas like equipment leasing and financial services, means it could be subject to scrutiny under these anti-monopoly frameworks, potentially impacting its expansion plans or existing market share if non-compliant.

Contract Law and Enforceability

The enforceability of financial leasing contracts is absolutely central to Far East Horizon's operations. Without robust contract law, their ability to secure assets and manage financial risk would be severely compromised. This foundation allows them to confidently extend credit and manage potential defaults.

A predictable and stable legal framework for contract enforcement is paramount for Far East Horizon. This stability directly impacts their capacity to mitigate credit risk and ensures they have recourse for asset recovery or payment collection should a lessee fail to meet their obligations. For instance, in 2023, the company reported a net profit attributable to owners of the parent of RMB 5.22 billion, underscoring the importance of a reliable legal system underpinning these financial transactions.

Key aspects of contract law impacting Far East Horizon include:

- Clarity of terms: Ensuring lease agreements are clearly defined regarding payment schedules, asset usage, and default clauses.

- Dispute resolution mechanisms: The availability of efficient and fair processes for resolving contractual disagreements.

- Collateral enforcement: The legal right to repossess and liquidate leased assets in the event of non-payment.

- Regulatory compliance: Adherence to all applicable laws governing financial leasing and credit provision.

Industry-Specific Regulations

Far East Horizon operates within a complex web of industry-specific regulations that go beyond general financial oversight. For instance, its healthcare leasing segment is subject to stringent medical device regulations and healthcare provider licensing requirements, impacting the types of equipment it can finance and the operational standards it must adhere to. Similarly, its education sector involvement necessitates compliance with educational policies and accreditation standards.

Construction, another key area for Far East Horizon, faces rigorous safety regulations and building codes. These legal frameworks directly influence the types of construction projects and assets that can be leased, as well as the operational procedures and due diligence required. For example, adherence to China's Construction Law and associated safety standards is paramount for leasing construction machinery and equipment.

These sector-specific legal requirements can significantly shape Far East Horizon's business model and risk profile. Non-compliance can lead to substantial fines, reputational damage, and operational disruptions.

- Healthcare: In 2024, China's National Medical Products Administration continued to enforce strict regulations on medical device registration and quality control, impacting leasing of advanced medical equipment.

- Education: Policies concerning vocational training and private education institutions in 2024 influenced the leasing of educational facilities and equipment by companies like Far East Horizon.

- Construction: China's ongoing infrastructure development in 2024 meant that adherence to updated environmental and safety standards for construction projects was critical for leasing activities.

Far East Horizon's operations are heavily influenced by China's evolving legal and regulatory environment, particularly concerning financial services and corporate governance. Strict adherence to regulations from bodies like the China Banking and Insurance Regulatory Commission (CBIRC) is essential for its leasing and factoring businesses. The company must also comply with Hong Kong Stock Exchange listing rules to maintain investor confidence.

The company navigates anti-monopoly legislation enforced by the State Administration for Market Regulation (SAMR), which promotes fair competition and can impact market strategies. Furthermore, the enforceability of financial leasing contracts is critical for risk management and asset recovery, as evidenced by Far East Horizon's RMB 5.22 billion net profit in 2023, which relies on a stable contract law framework.

Sector-specific regulations also play a significant role. For instance, healthcare leasing requires compliance with medical device regulations, while construction leasing necessitates adherence to safety and building codes. These varied legal requirements directly impact the company's business model and operational scope.

| Regulatory Area | Key Authority/Legislation | Impact on Far East Horizon | 2023/2024 Data Point |

|---|---|---|---|

| Financial Services Oversight | CBIRC regulations | Compliance for leasing, factoring, and risk management | Increased scrutiny on risk management practices in 2023 |

| Corporate Governance & Listing | HKEX Listing Rules | Transparency, accountability, investor confidence | Penalties for non-compliance include reprimands and delisting |

| Competition Law | SAMR enforcement | Affects market strategies and competitive practices | Focus on curbing monopolistic practices |

| Contract Law | Contract Enforcement Framework | Underpins credit provision and asset recovery | RMB 5.22 billion net profit in 2023 relies on contract stability |

| Sector-Specific (Healthcare) | Medical Device Regulations | Influences financing of medical equipment | Strict regulations on device registration and quality control in 2024 |

| Sector-Specific (Construction) | Safety & Building Codes | Governs leasing of construction machinery and projects | Adherence to updated environmental and safety standards critical in 2024 |

Environmental factors

China's push for enhanced ESG disclosure is accelerating, with stock exchanges slated to implement mandatory sustainability reporting for specific listed firms by 2026. This regulatory shift signals a growing emphasis on environmental, social, and governance accountability within the Chinese market.

Far East Horizon is demonstrating its preparedness for these changes. The company has already published its 2024 Sustainability & ESG Report, a proactive move that aligns with the trajectory of evolving disclosure requirements. Furthermore, its achievement of Science Based Targets initiative (SBTi) certification underscores a tangible commitment to verifiable sustainability goals.

China's commitment to green finance is a significant environmental factor for Far East Horizon. The nation's proactive policies and incentives are designed to foster sustainable development and achieve ambitious carbon neutrality targets. For instance, by the end of 2023, outstanding green loans in China reached ¥11.75 trillion, demonstrating robust growth and government backing for environmentally conscious financing.

Far East Horizon can strategically align with these initiatives. The company could capitalize on this by expanding its green leasing offerings, which directly support the transition to a lower-carbon economy. Furthermore, issuing green bonds provides a dedicated funding stream for projects that demonstrably contribute to environmental protection, aligning with both national policy and investor demand for sustainable investments.

Far East Horizon's significant presence in sectors like construction and transportation inherently links it to the environmental footprint of these industries. This means the company faces indirect exposure to issues such as carbon emissions, resource depletion, and waste generation, which are common concerns within these fields.

However, the company is actively addressing these exposures. Its strategic emphasis on fostering green development within its operational sectors, including the promotion of sustainable construction methods and eco-friendly transportation solutions, directly supports broader national environmental goals. For instance, in 2023, China's green finance market saw substantial growth, with outstanding green loans reaching over 27 trillion yuan by the end of the year, reflecting a national push that Far East Horizon is aligned with.

By championing green practices, Far East Horizon not only contributes to environmental protection but also proactively mitigates potential regulatory and reputational risks associated with environmental impacts. This approach positions the company favorably in an increasingly environmentally conscious market, potentially unlocking new opportunities and enhancing its long-term resilience.

Climate Change Risks and Adaptation

Climate change presents significant risks for Far East Horizon, particularly through increased extreme weather events. These events, such as typhoons and floods, could directly impact the company's infrastructure projects and disrupt the supply chains of its clients. For instance, a severe typhoon in 2024 could damage leased industrial facilities or delay the delivery of essential components for clients' manufacturing operations, leading to financial losses and operational downtime.

To navigate these challenges, Far East Horizon must integrate climate resilience into its core investment and operational strategies. This involves assessing the vulnerability of its existing and planned assets to climate-related hazards. By proactively identifying and mitigating these risks, the company can protect its portfolio and enhance its long-term sustainability.

Key considerations for Far East Horizon include:

- Assessing climate vulnerability: Evaluating the physical risks to leased assets from rising sea levels, increased flooding, and more intense storms, especially in regions like Southeast Asia which are highly susceptible.

- Supply chain resilience: Working with clients to understand and strengthen their supply chains against climate-related disruptions, potentially through diversification or improved logistics planning.

- Investing in adaptive infrastructure: Prioritizing investments in infrastructure that can withstand or adapt to changing climate conditions, ensuring the longevity and utility of leased properties.

- Scenario planning: Developing robust scenario plans that account for various climate change impacts to inform strategic decision-making and risk management processes.

Resource Scarcity and Circular Economy

Concerns over resource scarcity are increasingly shaping business operations in China, pushing for a transition towards a circular economy. This shift encourages more sustainable production and consumption. For instance, China's Ministry of Industry and Information Technology has been actively promoting industrial symbiosis and the reuse of resources, aiming to reduce waste and improve efficiency across various sectors by 2025.

Far East Horizon is well-positioned to capitalize on this trend by offering financial leasing solutions. These solutions can directly support clients in adopting more sustainable practices, such as facilitating the reuse, recycling, or more efficient utilization of industrial equipment. This aligns with China's national strategy to build a green and low-carbon industrial system.

Key aspects of this trend for Far East Horizon include:

- Facilitating Equipment Longevity: Leasing models can encourage clients to maintain and upgrade equipment for longer lifespans, reducing the need for frequent new manufacturing.

- Supporting Recycling Infrastructure: Financial products can aid in the acquisition of specialized equipment needed for recycling and remanufacturing processes within client industries.

- Promoting Resource Efficiency: Leasing advanced, energy-efficient machinery can help clients reduce their operational footprint and resource consumption.

- Adapting to Policy Incentives: Far East Horizon can align its offerings with government incentives promoting circular economy practices and green finance.

China's commitment to a greener economy is a significant driver for Far East Horizon, with mandatory ESG disclosures for listed firms expected by 2026. The company's 2024 ESG report and SBTi certification demonstrate its proactive approach to these evolving environmental regulations.

The nation's robust green finance sector, evidenced by over ¥11.75 trillion in green loans by late 2023, offers substantial opportunities for Far East Horizon to expand its green leasing and green bond offerings, directly supporting sustainable development initiatives.

Far East Horizon's engagement in construction and transportation sectors exposes it to environmental challenges like carbon emissions and resource depletion, but its focus on promoting green development and sustainable practices within these industries aligns with China's national environmental goals.

The company must also address climate change risks, such as extreme weather events impacting infrastructure, by integrating climate resilience into its strategies and assessing asset vulnerability. This proactive risk management is crucial for long-term sustainability.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Far East Horizon integrates data from official government publications, reputable economic forecasting agencies, and leading industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.