Far East Horizon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Far East Horizon Bundle

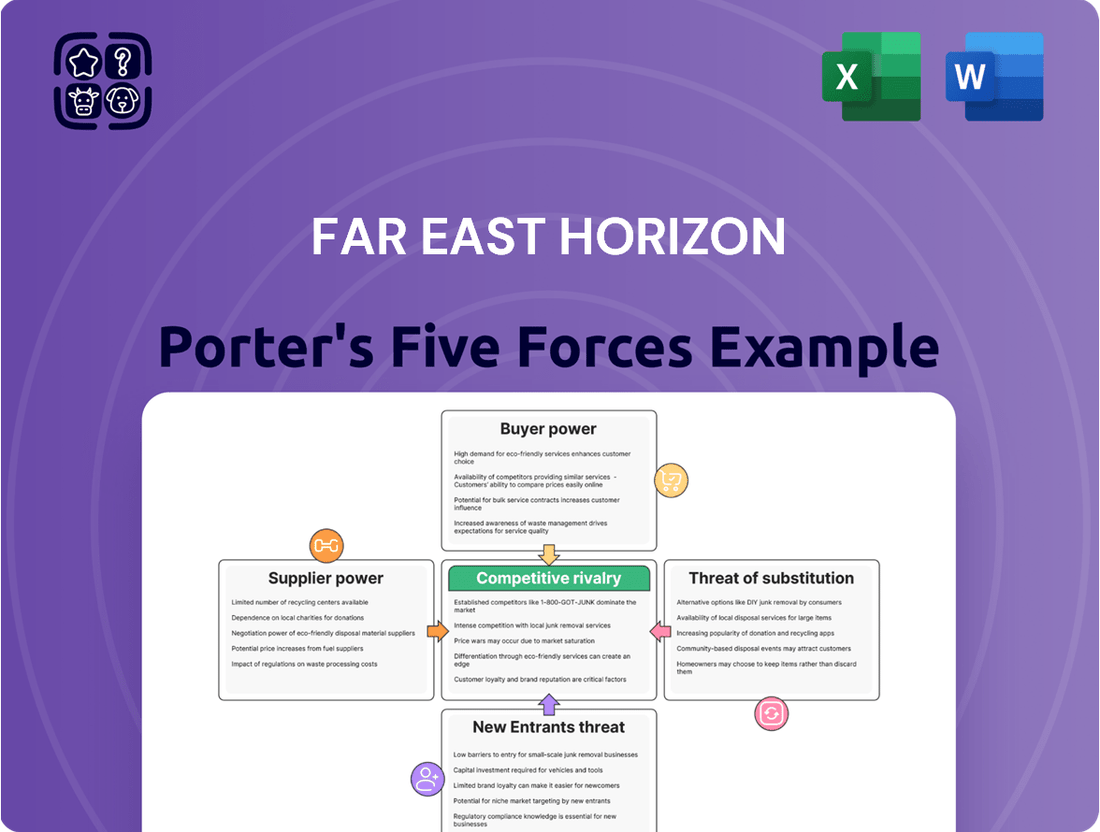

Understanding the competitive landscape for Far East Horizon is crucial for any strategic decision. Our analysis reveals how buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry all shape their market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Far East Horizon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Far East Horizon's reliance on capital markets and banking institutions for funding means these entities act as significant suppliers. The cost and availability of capital are directly tied to their power. For instance, a rise in benchmark interest rates, such as the US Federal Reserve's target rate which saw increases throughout 2022 and 2023, directly impacts the cost of borrowing for Far East Horizon, increasing the bargaining power of its financial suppliers.

Far East Horizon, operating in financial services and industrial sectors, heavily relies on advanced IT systems, data analytics, and specialized software. Suppliers offering proprietary or competitively advantageous financial technology and industry-specific operational tools hold considerable sway. This is particularly true when their solutions are critical for risk management and enhancing operational efficiency, making them indispensable.

Far East Horizon's distinctive 'finance plus industry' approach necessitates a unique blend of financial expertise and profound operational knowledge across varied sectors such as healthcare, education, and construction. This specialized human capital is crucial for their business model.

The scarcity of professionals possessing this integrated skillset, especially within particular industrial niches, can significantly amplify the bargaining power of key employees or specialized recruitment firms. For instance, in 2024, the demand for professionals with cross-functional expertise in fintech and green construction was particularly acute, driving up compensation expectations.

This limited supply of talent means that suppliers of this expertise, whether individual employees or recruitment agencies, can command higher wages and more favorable terms, directly impacting Far East Horizon's operational costs and strategic flexibility.

Regulatory and Compliance Service Providers

The bargaining power of regulatory and compliance service providers for Far East Horizon is significant due to the highly regulated nature of the financial services sector. These suppliers, including legal, auditing, and specialized compliance firms, offer expertise that is non-substitutable for maintaining operational legality and a strong reputation. For instance, in 2024, the global financial services industry saw continued increases in regulatory spending, with firms allocating substantial budgets to compliance and legal advisory services to navigate evolving international standards.

Their specialized knowledge is critical, as failing to adhere to these complex frameworks can result in severe penalties and reputational damage. This reliance means that Far East Horizon must engage with these providers, granting them considerable leverage. The ongoing need for up-to-date legal interpretations and audit certifications solidifies their position.

- Essential Expertise: Regulatory and compliance service providers offer specialized knowledge crucial for Far East Horizon's legal operation.

- Non-Substitutable Services: The unique skills of these firms cannot be easily replicated internally or outsourced to less specialized entities.

- Reputational Risk Mitigation: Adherence to regulations, facilitated by these suppliers, is vital for maintaining Far East Horizon's reputation and trustworthiness.

- Industry Trends: In 2024, the financial services industry's compliance costs continued to rise, underscoring the value and bargaining power of these service providers.

Data and Information Providers

The bargaining power of data and information providers is a key consideration for Far East Horizon. Accurate and comprehensive industry-specific data is crucial for Far East Horizon's risk assessment, market analysis, and strategic decision-making across its various industrial segments. Suppliers of this specialized, high-quality data, particularly for niche sectors, hold considerable power because their information is essential for the company's integrated business model.

In 2024, the demand for granular, real-time data across industries like manufacturing, healthcare, and technology, where Far East Horizon operates, intensified. Companies are increasingly relying on data analytics for competitive advantage. For instance, specialized financial data providers catering to specific industrial financing needs can command higher prices and dictate terms due to the proprietary nature and critical importance of their insights.

- Criticality of Data: Far East Horizon's integrated business model relies heavily on data for credit assessment, market forecasting, and operational efficiency.

- Niche Market Suppliers: Providers of highly specialized or proprietary data for sectors like advanced manufacturing or specialized healthcare financing hold significant sway.

- Concentration of Suppliers: In certain niche data markets, a limited number of suppliers can create concentrated power, allowing them to influence pricing and access.

- Switching Costs: The effort and cost involved in changing data providers, including data integration and retraining personnel, can also contribute to supplier power.

Far East Horizon's reliance on financial institutions for capital means these entities are key suppliers. Their bargaining power is evident in the cost and availability of funding, directly influenced by macroeconomic factors. For example, the sustained higher interest rate environment in 2023 continued to empower banking suppliers by increasing the cost of borrowing, impacting Far East Horizon's financing expenses.

The company's need for specialized IT and data analytics solutions from technology providers also grants these suppliers leverage. When these solutions are critical for risk management or operational efficiency, their power intensifies. The ongoing digital transformation across industries in 2024 means that providers of advanced, integrated tech solutions are in high demand, enabling them to negotiate favorable terms.

Expertise in niche industrial sectors, combined with financial acumen, is a scarce resource for Far East Horizon. Suppliers of this specialized human capital, whether individuals or recruitment firms, can exert significant bargaining power. In 2024, the competition for professionals skilled in areas like renewable energy finance or advanced manufacturing operations led to increased compensation demands, highlighting supplier strength.

| Supplier Type | Key Dependence | 2024 Trend Impact | Bargaining Power Factor |

|---|---|---|---|

| Financial Institutions | Access to Capital | Higher borrowing costs due to sustained interest rates | Strong |

| Technology Providers | Critical IT & Data Solutions | Increased demand for advanced analytics and digital transformation | Moderate to Strong |

| Specialized Human Capital | Cross-functional Expertise | High demand for niche industry and finance skills | Strong |

| Regulatory & Compliance Firms | Legal & Operational Adherence | Rising compliance costs and evolving international standards | Strong |

| Data & Information Providers | Market Analysis & Risk Assessment | Intensified demand for granular, real-time data | Moderate to Strong |

What is included in the product

Analyzes the competitive intensity within Far East Horizon's operating environments, detailing the power of buyers and suppliers, threat of new entrants and substitutes, and rivalry among existing players.

Instantly identify and mitigate competitive threats by visualizing the impact of each Porter's Five Forces on Far East Horizon's strategic position.

Gain a clear, actionable understanding of market dynamics to proactively address potential challenges and capitalize on opportunities.

Customers Bargaining Power

Customers within Far East Horizon's diverse sectors, including healthcare, education, construction, and transportation, frequently exhibit a pronounced sensitivity to the cost of financing. This means they actively compare pricing across different providers.

The landscape for customer financing is competitive, with many alternative avenues available. Traditional bank loans, other financial leasing firms, and the option of direct asset acquisition all present viable choices for customers.

This abundance of alternatives significantly bolsters customer bargaining power. They are empowered to shop around and secure the most advantageous financing terms and conditions available in the market.

For instance, in 2024, the average interest rate for corporate loans from major banks in China, a key market for Far East Horizon, hovered around 3.5% to 4.5%, creating a benchmark for leasing companies to compete against.

While Far East Horizon provides comprehensive solutions, the ease with which customers can switch to alternative financial service providers, particularly for more common leasing products, can be a significant factor. If the process of transferring existing contracts or integrating with a new vendor is straightforward and cost-effective, customers are empowered to seek better terms.

For instance, if a customer can easily move their leasing portfolio to a competitor with minimal disruption or upfront fees, their bargaining power increases substantially. This is particularly relevant in the leasing sector where technological integration with new providers might not be a major hurdle for many businesses, potentially keeping switching costs low.

In 2024, the financial services industry saw a continued trend towards digital onboarding and platform interoperability. This technological advancement generally reduces the friction associated with changing providers, thereby potentially lowering switching costs for a wide range of Far East Horizon's clientele, especially those utilizing more standardized financial products.

Customer concentration in certain industries can significantly amplify the bargaining power of those customers for Far East Horizon. If a substantial portion of their business comes from a few major clients or specific market niches, these key clients can leverage their importance to negotiate more favorable terms, including reduced pricing or enhanced service levels. For instance, if a large percentage of Far East Horizon's revenue in 2024 was tied to a handful of clients in the manufacturing sector, those clients would have considerable sway.

Customer Sophistication and Information Access

Far East Horizon's customer base, primarily large enterprises and institutions operating in capital-intensive industries, exhibits a high degree of sophistication. These clients possess substantial knowledge regarding prevailing market rates for financing and leasing, along with a keen understanding of various alternative financial structures available to them. This informed position directly enhances their bargaining power.

The ability of these sophisticated customers to readily access and interpret market information allows them to negotiate more effectively with Far East Horizon. They can readily compare offerings and terms, putting pressure on pricing and service conditions. For instance, in 2024, the increasing availability of digital platforms offering transparent benchmarking for financial services has further amplified this trend, enabling clients to pinpoint competitive advantages and demand them.

- Sophisticated Clientele: Far East Horizon's customers are typically large corporations and institutions.

- Market Knowledge: They possess deep understanding of financing rates and alternative structures.

- Negotiating Leverage: Access to market data empowers customers to negotiate favorable terms.

- Digital Impact: Increased use of online platforms in 2024 provides even greater price transparency for buyers.

Potential for In-House Financing Solutions

Large industrial customers, especially those with robust financial health or consistent capital expenditure requirements, may explore establishing their own in-house financial leasing or financing operations. This move towards backward integration by customers significantly diminishes their dependence on external financing providers, thereby amplifying their bargaining power.

For instance, a major manufacturing conglomerate with substantial cash reserves might opt to self-finance its equipment acquisitions rather than rely on a lessor like Far East Horizon. This capability inherently strengthens their negotiating position when seeking financing terms.

- Independent Financing Capability: Large customers can leverage their own capital to fund asset acquisition, bypassing external financing.

- Reduced Reliance: Developing in-house solutions decreases dependence on lessors, giving customers more control.

- Negotiating Leverage: The ability to self-finance provides a powerful tool for negotiating better rates and terms.

- Market Trend: In 2024, a growing number of large corporations are exploring captive finance arms to manage costs and gain strategic advantages.

Far East Horizon's customers, particularly large enterprises in capital-intensive sectors, possess significant bargaining power due to their market knowledge and the availability of alternative financing options. Their ability to compare rates, understand complex financial structures, and leverage digital platforms for transparency in 2024 empowers them to negotiate more favorable terms, directly impacting Far East Horizon's pricing and service agreements.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Cost Sensitivity | High | Average corporate loan rates around 3.5%-4.5% in China (key market) created a competitive benchmark. |

| Availability of Alternatives | High | Numerous financing options (banks, other lessors, direct purchase) allow customers to shop for best terms. |

| Switching Costs | Potentially Low | Digitalization and platform interoperability in 2024 reduced friction for changing providers, especially for standard products. |

| Customer Concentration | Can be High | Key clients in specific niches can leverage their importance for better terms. |

| Customer Sophistication | High | Informed clients use market data and digital tools to negotiate effectively. |

| In-house Financing Capability | Potential to Increase | Large, financially strong clients explore captive finance arms for strategic cost management, reducing reliance on external lessors. |

Preview Before You Purchase

Far East Horizon Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details Far East Horizon's competitive landscape through Porter's Five Forces, offering insights into industry rivalry, the threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products. This comprehensive analysis is ready for your immediate use, providing a foundational understanding of the strategic forces shaping Far East Horizon's market position. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

The financial services landscape in China, Far East Horizon's key operational arena, is characterized by intense competition stemming from its fragmented and diverse nature. A multitude of entities, ranging from colossal state-owned banks and dynamic commercial banks to a vast number of agile, independent financial leasing firms, actively vie for market share. This sheer volume and variety of participants inherently amplify competitive pressures, demanding constant innovation and strategic differentiation.

In 2024, China's economic growth experienced a slowdown, impacting various industrial sectors. This deceleration inherently fuels competitive rivalry as companies, including those like Far East Horizon, fight harder for a diminishing market share. A constrained market often translates into more aggressive pricing and promotional activities from competitors.

Economic downturns, a reality in 2024, directly affect traditional financial businesses by potentially reducing lending and investment opportunities. This contraction amplifies the pressure on firms like Far East Horizon, as they face increased competition for fewer profitable transactions, leading to a more intense battle for survival and growth.

Far East Horizon's 'finance + industry' integrated model aims for differentiation, but its effectiveness in curbing rivalry hinges on how truly unique and difficult these offerings are to copy. If competitors can easily replicate the bundled services, it intensifies price-based competition. For instance, in 2024, while financial leasing remained a core, the company expanded its industrial operations, but the market saw increased activity from diversified financial institutions also offering leasing and industry-specific solutions, potentially diluting unique value propositions.

High Fixed Costs and Exit Barriers

Far East Horizon operates within a competitive landscape characterized by high fixed costs and significant exit barriers. The financial leasing sector inherently demands substantial upfront capital for asset acquisition, robust infrastructure, and the development of specialized talent. These considerable investments create a strong disincentive for companies to leave the market, even when facing economic downturns.

Consequently, firms are often compelled to maintain operations and vie for market share, intensifying competitive rivalry. For instance, as of early 2024, the global financial leasing market, valued at over $1 trillion, illustrates the scale of capital deployment required.

- High Capital Investment: Leasing companies must acquire significant assets, like machinery, vehicles, or real estate, which represent substantial fixed costs.

- Specialized Expertise: The industry requires personnel with deep knowledge in finance, asset management, and specific industry sectors, adding to operational expenses.

- Long-Term Commitments: Many leasing contracts span several years, creating long-term asset commitments that are difficult to divest quickly.

- Industry-Specific Investments: Investments in proprietary technology platforms or extensive client networks are not easily transferable, acting as further exit barriers.

Aggressive Pricing and Innovation

The competitive landscape for companies like Far East Horizon is characterized by fierce rivalry, pushing players to adopt aggressive pricing and rapid innovation. This dynamic means companies must continuously develop new products and services, often at lower price points, to gain market share.

For instance, in the competitive leasing sector where Far East Horizon operates, industry-wide net profit margins can be squeezed. In 2023, average net profit margins for the broader financial leasing industry hovered around 5-10%, a figure that can be further pressured by intense competition. This relentless pursuit of differentiation through innovation and cost-effectiveness directly impacts profitability.

- Aggressive Pricing: Competitors frequently engage in price wars to attract customers, which can lead to reduced revenue per unit.

- Innovation Pressure: There's a constant need to invest in research and development to create new offerings or improve existing ones, increasing operational costs.

- Value-Added Services: Companies differentiate not just on price or product but also on customer service and support, adding to expenses.

- Margin Compression: The combined effect of aggressive pricing and innovation investments often results in thinner profit margins for all players.

The competitive rivalry within China's financial services sector, Far East Horizon's primary market, is notably intense due to a large and diverse player base. This includes major state-owned banks, commercial banks, and numerous independent financial leasing firms all vying for market share, a situation amplified in 2024 by China's economic slowdown which forces companies to compete more aggressively for diminishing opportunities.

The high capital requirements and specialized expertise needed in financial leasing act as significant barriers to entry but also lock existing players in, intensifying competition. Even with differentiation strategies like Far East Horizon's integrated model, competitors in 2024 were observed expanding their own industry-specific solutions, potentially eroding unique value propositions and leading to price-based competition.

This intense rivalry pressures profit margins, with the broader financial leasing industry seeing net profit margins around 5-10% in 2023, a figure susceptible to further compression from aggressive pricing and the constant need for innovation. Companies must therefore continuously innovate and control costs to maintain competitiveness.

| Factor | Impact on Rivalry | 2024 Relevance |

|---|---|---|

| Market Fragmentation | High number of players increases competition | Persistent in China's financial services |

| Economic Conditions | Slowdown intensifies fight for market share | Notable in China's 2024 economic landscape |

| Barriers to Exit | High fixed costs and long-term commitments keep firms competing | Significant in capital-intensive leasing sector |

| Pricing Pressure | Aggressive pricing to gain customers squeezes margins | Common tactic when demand is constrained |

SSubstitutes Threaten

Traditional bank loans and credit facilities represent a significant threat of substitution for financial leasing. Many businesses, especially those with strong credit profiles, can secure direct financing from banks for asset acquisition, often at competitive interest rates. For instance, in 2024, corporate loan growth in many developed economies remained robust, indicating a continued reliance on bank financing as a primary funding source. This direct access to capital means companies might bypass leasing arrangements altogether if bank terms are more favorable.

Companies with robust financial health can opt for direct capital expenditure and cash purchases for essential assets, bypassing lease payments and financing intricacies. This strategy serves as a potent substitute for traditional financing methods, allowing businesses to retain full ownership and avoid interest liabilities.

For instance, in 2024, many businesses with substantial retained earnings are prioritizing outright asset acquisition over leasing. This trend is particularly evident in sectors like manufacturing and logistics, where significant capital investment is standard. The ability to fund these purchases internally directly mitigates the need for external capital, thereby reducing reliance on lenders and the associated costs.

This direct investment approach offers a clear advantage by eliminating interest expenses and simplifying financial structures. Businesses can therefore allocate resources more efficiently, free from the ongoing obligations of lease agreements or loan repayments, thereby strengthening their balance sheets and improving cash flow flexibility.

Businesses can raise funds by selling shares rather than taking on debt, offering a significant substitute for traditional financing methods. For instance, in 2024, many companies explored equity markets to fuel growth, bypassing the need for loans or leasing agreements. This equity financing, whether through private placements or initial public offerings (IPOs), provides capital without the obligation of interest payments, directly impacting a company's capital structure and financial flexibility.

Rental Agreements and Pay-Per-Use Models

The availability of rental agreements and pay-per-use models presents a significant threat of substitutes for businesses considering asset acquisition or long-term leasing. These flexible arrangements allow companies to access necessary equipment or services without the substantial upfront investment and long-term commitment typically associated with outright ownership.

For instance, the equipment rental market has seen robust growth. In 2024, the global equipment rental market was estimated to be worth over $100 billion, with projections indicating continued expansion. This demonstrates a clear preference among many businesses for short-term solutions that can scale with demand.

These models offer distinct advantages:

- Reduced Capital Expenditure: Businesses can avoid large upfront costs by renting equipment, freeing up capital for other strategic investments.

- Operational Flexibility: Pay-per-use models allow companies to match costs directly to usage, providing greater agility in fluctuating markets.

- Access to Latest Technology: Renting often provides access to newer, more efficient equipment without the burden of obsolescence.

- Lower Maintenance Overhead: Rental companies typically handle maintenance and repairs, reducing the operational burden on the lessee.

In-house Asset Management and Shared Economy Platforms

Large corporations increasingly explore in-house asset management or equipment pooling to reduce reliance on external financing. This internal optimization can bypass the need for services typically provided by companies like Far East Horizon. For instance, a major manufacturing conglomerate might establish its own fleet management division, negating the demand for specialized equipment leasing.

Shared economy platforms for industrial equipment also present a significant threat. These platforms allow businesses to rent idle machinery from other companies, effectively creating a competitive offering to traditional asset financing. In 2024, the industrial equipment rental market saw robust growth, with many smaller players leveraging these platforms to offer specialized assets at competitive rates, potentially impacting the volume of business for established financiers.

- Internal Optimization: Corporations developing proprietary asset management systems to improve utilization and reduce external financing needs.

- Shared Economy Platforms: The rise of digital marketplaces for renting industrial equipment, offering an alternative to traditional leasing models.

- Cost Efficiency: These substitutes often promise lower operational costs by maximizing asset uptime and reducing overhead associated with external providers.

- Market Disruption: The increasing adoption of these models could lead to a shift in how businesses acquire and manage their industrial assets.

The threat of substitutes for financial leasing is significant, with direct bank loans and outright cash purchases offering compelling alternatives. Many businesses, especially those with strong credit ratings, can secure favorable terms from banks, bypassing leasing altogether. For instance, robust corporate loan growth in 2024 across developed markets highlights the continued preference for traditional bank financing.

Rental agreements and pay-per-use models also pose a substantial threat. These flexible arrangements allow businesses to access equipment without large upfront investments, offering operational agility and access to the latest technology. The global equipment rental market, exceeding $100 billion in 2024, underscores this trend.

Businesses can also raise capital through equity financing, such as IPOs or private placements, which avoids the interest obligations associated with loans or leases. This strategy provides capital while enhancing financial flexibility. Internally managed asset pools and shared economy platforms for industrial equipment further diversify options, allowing companies to optimize asset utilization and reduce reliance on external leasing providers.

| Substitute Option | Key Advantage | 2024 Market Insight |

|---|---|---|

| Direct Bank Loans | Potentially lower interest rates for creditworthy firms | Robust corporate loan growth in developed economies |

| Cash Purchases | Full ownership, no interest expense | Increased prioritization by companies with strong retained earnings |

| Equipment Rental/Pay-per-use | Reduced CapEx, operational flexibility | Global market exceeding $100 billion, with continued expansion |

| Equity Financing | Capital without interest obligations | Increased exploration of equity markets for growth funding |

| Shared Economy Platforms | Cost-effective access to specialized assets | Growth in industrial equipment rental, with smaller players leveraging platforms |

Entrants Threaten

The financial services and leasing sector, where Far East Horizon operates, is inherently capital-intensive. This means new players need deep pockets from the start, requiring substantial initial investments in technology, infrastructure, and regulatory compliance. For instance, in 2024, the average startup capital for a new fintech leasing company could easily run into tens of millions of dollars, a significant hurdle for many aspiring entrants.

Access to consistent and diverse funding is also paramount. Companies need to secure lines of credit, attract equity investment, and potentially tap into debt markets to sustain operations and growth. The difficulty in establishing these funding channels, especially for unproven entities, acts as a formidable barrier. Many startups in 2024 struggled to secure Series A funding rounds exceeding $50 million, highlighting the challenge.

Consequently, the high capital requirements and the intricate process of accessing reliable funding channels significantly deter potential new entrants. This barrier protects established players like Far East Horizon by limiting the influx of new competition. Without robust financial backing, new companies find it exceedingly difficult to scale and compete effectively in this demanding market.

China's financial leasing sector operates under a strict and continually changing regulatory landscape. New rules concerning capital adequacy, leverage limits, and liquidity management are frequently introduced, making it challenging for newcomers to comply. For instance, in 2023, regulatory bodies continued to emphasize risk control, impacting how leasing companies manage their balance sheets.

Acquiring the required licenses and successfully navigating the intricate web of compliance procedures presents a substantial hurdle for potential new entrants. These barriers effectively limit the influx of new competitors, thereby strengthening the position of established firms like Far East Horizon.

Far East Horizon's integrated 'finance + industry' model necessitates profound operational expertise and deeply entrenched relationships across its target industrial sectors. New entrants would face significant hurdles in replicating this specialized knowledge and the trust built over years, a crucial element for success in their business.

Cultivating extensive client networks and demonstrating a genuine understanding of complex industrial operations is a time-consuming and capital-intensive endeavor. This inherent difficulty in acquiring specialized industry knowledge and forging vital relationships acts as a substantial barrier, deterring potential new competitors from entering the market.

Economies of Scale and Cost Advantages

Established players like Far East Horizon leverage significant economies of scale in their funding operations, a crucial advantage in the competitive financial leasing sector. Their substantial asset base and extensive operational history allow them to secure capital at lower costs compared to newcomers.

This cost advantage extends to operational efficiency and risk management, areas where larger entities can spread fixed costs over a greater volume of business. For instance, in 2023, Far East Horizon reported total assets exceeding RMB 600 billion, a scale that enables optimized resource allocation and more sophisticated risk mitigation strategies.

New entrants would find it exceedingly difficult to replicate these cost efficiencies. Without a comparable asset base and track record, they would likely face higher borrowing costs and less favorable terms, making it challenging to compete on price with established firms.

- Economies of Scale in Funding: Far East Horizon's large asset base (over RMB 600 billion in 2023) allows for lower borrowing costs.

- Operational Efficiency: Spreading fixed costs over a larger operational volume reduces per-unit expenses.

- Risk Management: Established players can implement more robust and cost-effective risk management systems.

- Pricing Disadvantage for New Entrants: Higher funding costs and lower operational efficiencies make it hard for new firms to match established pricing.

Brand Reputation and Customer Trust

In the financial services sector, building a strong brand reputation and earning customer trust is a considerable hurdle for new entrants. Clients typically gravitate towards established institutions with a demonstrated history of reliability and successful client relationships. For instance, in 2024, major global banks like JPMorgan Chase, with over 160 years of history, continue to leverage their long-standing reputation to attract and retain a significant market share, making it difficult for newer fintech firms to compete solely on service without a comparable level of trust.

New players must invest heavily in marketing and customer service to even begin to chip away at the ingrained loyalty enjoyed by incumbents. This often translates into higher initial operating costs and a longer path to profitability. Consider the extensive marketing budgets of established asset managers in 2024, which dwarf those of many startups attempting to enter the space, highlighting the significant barrier presented by brand equity.

- Brand Equity: Established firms benefit from decades of accumulated trust, making customers more likely to choose them for significant financial decisions.

- Customer Loyalty: Existing client bases are less likely to switch to unproven entities, especially for critical services like wealth management or lending.

- Credibility Gap: New entrants must overcome a perception of risk and unreliability compared to well-known financial institutions.

- Regulatory Trust: Long-standing firms often have a perceived advantage in navigating complex regulatory environments, further bolstering customer confidence.

The threat of new entrants for Far East Horizon is significantly mitigated by the substantial capital requirements inherent in the financial leasing sector. Establishing a presence requires considerable investment in technology, infrastructure, and regulatory compliance, with new fintech leasing companies in 2024 needing tens of millions of dollars in startup capital. Furthermore, securing consistent and diverse funding, such as lines of credit and equity, is crucial, as evidenced by the struggles of many startups to raise over $50 million in Series A funding in 2024.

Navigating China's stringent and evolving regulatory landscape also poses a major barrier, with frequent updates to capital adequacy and leverage limits making compliance challenging for newcomers. Acquiring necessary licenses and managing intricate compliance procedures are significant hurdles. Far East Horizon's 'finance + industry' model further complicates entry, demanding profound operational expertise and deeply entrenched industry relationships that are difficult and costly for new players to replicate, a process that takes years and significant capital to build.

Established players like Far East Horizon benefit from significant economies of scale in funding and operations, allowing them to secure capital at lower costs and operate more efficiently. With total assets exceeding RMB 600 billion in 2023, their scale enables optimized resource allocation and sophisticated risk management. This cost advantage, coupled with strong brand equity and customer trust built over time, creates a formidable barrier, as new entrants struggle to match established pricing and credibility in a market where reliability is paramount.

| Barrier Type | Description | Example (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High initial investment needed for technology, infrastructure, and compliance. | Fintech leasing startups requiring tens of millions USD in 2024. |

| Regulatory Hurdles | Strict and evolving compliance rules in China's financial leasing sector. | Emphasis on risk control impacting balance sheet management in 2023. |

| Industry Expertise & Relationships | Need for specialized knowledge and entrenched client networks. | Years of experience and trust-building required to replicate Far East Horizon's model. |

| Economies of Scale | Cost advantages from large asset base and operational volume. | Far East Horizon's >RMB 600 billion assets in 2023 leading to lower borrowing costs. |

| Brand Reputation & Trust | Customer preference for established, reliable institutions. | Long-standing banks leveraging decades of trust against newer fintech firms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Far East Horizon is built upon a foundation of robust data, including the company's annual reports, investor presentations, and official regulatory filings. We supplement this with insights from reputable industry research firms and macroeconomic data providers to capture the full competitive landscape.