Far East Horizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Far East Horizon Bundle

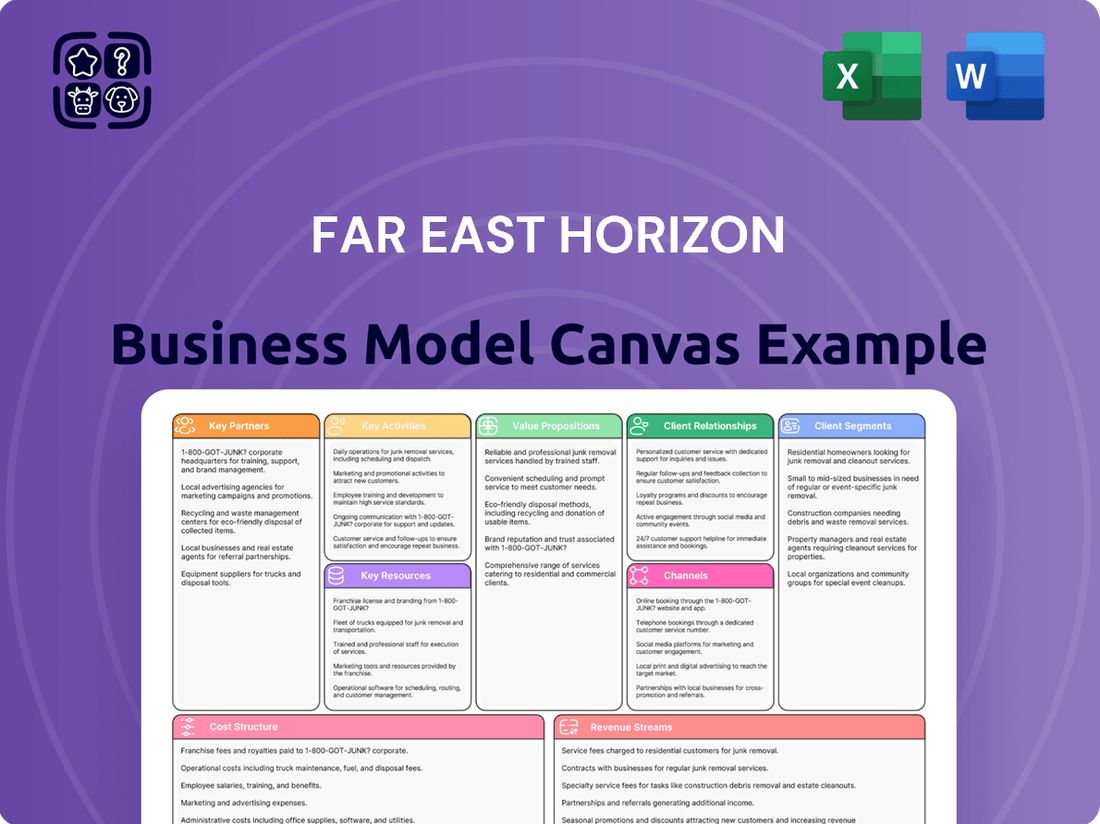

Curious about the engine driving Far East Horizon's success? This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources.

Unlock the full strategic blueprint behind Far East Horizon's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Dive deeper into Far East Horizon’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive.

Want to see exactly how Far East Horizon operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking or strategic planning.

Gain exclusive access to the complete Business Model Canvas used to map out Far East Horizon’s success. This professional, ready-to-use document is ideal for founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Far East Horizon. This comprehensive template gives you all the strategic components in one place for competitive analysis.

See how the pieces fit together in Far East Horizon’s business model. Download the full version to accelerate your own business thinking and understand their key partnerships and revenue strategies.

Partnerships

Strong partnerships with banks and financial institutions are crucial for Far East Horizon, providing diverse and cost-effective funding. These collaborations secure essential credit lines, syndicated loans, and bond issuances. For instance, in 2024, maintaining robust relationships with major domestic and international banks ensures liquidity and financial stability, underpinning their substantial asset base which exceeded CNY 300 billion in 2023. Such alliances are the bedrock of the company’s extensive lending and leasing operations, facilitating a wide array of financial solutions across industries.

Strategic alliances with equipment and asset manufacturers, especially in sectors like healthcare, construction, and transportation, are crucial for Far East Horizon. These partnerships enable robust vendor financing programs, allowing access to the latest technology and creating a consistent pipeline of leasing opportunities. In 2023, Far East Horizon's total financial leasing assets reached approximately RMB 300 billion, with significant exposure across these key industries. This synergy ensures Far East Horizon can offer comprehensive, integrated equipment and financing solutions directly to end-customers, enhancing market reach and operational efficiency.

Collaborating with government and public sector entities is fundamental for Far East Horizon, enabling participation in large-scale infrastructure projects and public-private partnerships (PPPs).

These relationships are crucial for navigating China's intricate regulatory landscape and securing contracts in state-supported industries, such as education and urban development, where government investment remains significant in 2024.

Such partnerships lend immense credibility, opening doors to substantial, long-term investment opportunities within key national development initiatives.

For example, government-backed infrastructure spending in China continues to drive demand for financial leasing and operational services in 2024, aligning with Far East Horizon's core business.

Industry Associations & Expert Networks

Engaging with industry-specific associations provides Far East Horizon with crucial market intelligence and networking opportunities, essential for its diverse portfolio. These partnerships, vital for its Finance + Industry model, help the company stay ahead of trends and challenges in core verticals like healthcare and education. For instance, in 2024, Far East Horizon continued strengthening ties with over 100 industry bodies across China.

- Far East Horizon's 2024 operating income from financial services reached approximately RMB 20.5 billion.

- Strategic engagement with associations fosters thought leadership, reinforcing its market position.

- Access to specialized knowledge enhances risk assessment and investment decision-making.

- These networks support Far East Horizon's expanded presence in sectors like urban infrastructure.

FinTech & Technology Providers

Partnering with FinTech and technology firms is crucial for Far East Horizon's digital transformation, significantly enhancing risk management models and improving operational efficiency. These collaborations focus on developing advanced digital platforms for seamless customer service and leveraging big data for precise credit scoring, with some financial institutions projecting a 15% increase in AI-driven credit assessment accuracy by late 2024. Automating internal processes through these partnerships ensures the company remains highly competitive and agile in a rapidly evolving financial landscape, where digital adoption continues to accelerate.

- By 2024, global financial institutions are projected to allocate over 60% of their new technology budgets towards digital transformation initiatives.

- Big data analytics in finance is expected to reduce credit default rates by up to 10% for adopters in 2024.

- Over 85% of financial services firms globally are integrating AI and machine learning for enhanced operational efficiency by mid-2024.

- FinTech partnerships are critical as digital lending platforms are forecasted to grow by 18% in transaction volume in 2024.

Far East Horizon's key partnerships are diverse, encompassing financial institutions, equipment manufacturers, and government bodies, crucial for its Finance + Industry model. These collaborations secure essential funding and a steady pipeline of leasing opportunities, especially in sectors like healthcare and urban development. In 2024, strategic alliances, including those with FinTech firms, enhance operational efficiency and market reach, reinforcing their substantial asset base. These vital relationships underpin Far East Horizon's market leadership and diversified growth.

| Partnership Type | Strategic Benefit | 2024 Impact |

|---|---|---|

| Banks/Financial Institutions | Diverse, cost-effective funding | Ensures liquidity for CNY 300B+ assets |

| Manufacturers | Vendor financing, leasing pipeline | Drives RMB 300B+ financial leasing assets |

| Government/Public Sector | Infrastructure projects, regulatory navigation | Access to state-supported investment initiatives |

What is included in the product

A comprehensive, pre-written business model tailored to Far East Horizon's strategy, detailing its customer segments, channels, and value propositions within the nine classic BMC blocks.

Reflects the real-world operations and plans of Far East Horizon, ideal for presentations and funding discussions with banks or investors.

Streamlines complex strategic planning for Far East Horizon, making it easy to identify and address operational inefficiencies.

Activities

Financial and Operating Leasing forms Far East Horizon’s core activity, focusing on acquiring diverse assets and structuring tailored lease agreements for clients across various sectors. This encompasses managing the entire asset lifecycle, from procurement and deployment to maintenance and eventual disposal. The company provided significant asset-backed financing solutions, with its financial leasing business generating substantial revenue in 2024. These flexible solutions often offer a more accessible alternative to traditional bank loans for businesses needing capital for equipment and infrastructure.

Far East Horizon leverages its deep industry expertise to offer high-value industrial advisory and consulting services. This includes financial structuring, crucial merger and acquisition (M&A) advisory, and operational consulting for clients across its target sectors. This activity significantly strengthens customer relationships, building trust beyond pure financing. For instance, in 2024, such services continue to diversify revenue streams, complementing their core financial leasing business.

A fundamental activity for Far East Horizon is the rigorous assessment, management, and mitigation of credit, market, and operational risks. This involves sophisticated underwriting processes, ongoing portfolio monitoring, and proactive risk control measures across its diverse asset portfolio. For instance, maintaining a robust asset quality is crucial, with the non-performing asset ratio for major financial leasing companies often targeted below 1.5% in 2024. Effective risk management is paramount to ensuring the profitability and sustainability of the business, directly influencing capital adequacy and funding costs.

Capital Market Operations

Far East Horizon's capital market operations are vital for its financial health and growth. These activities cover raising funds through diverse channels, including significant bond issuances and asset-backed securitization (ABS) programs, which are crucial in 2024 for diversifying funding sources. Treasury management is also key, optimizing liquidity and controlling funding costs, essential given fluctuating market conditions. A highly skilled capital markets team ensures efficient capital deployment, supporting the company's strategic expansion across its industrial and financial segments.

- In 2024, Far East Horizon continued leveraging bond markets, with a notable CNY-denominated bond issuance in Q1.

- The company utilizes ABS as a core funding mechanism, with a strong pipeline of securitized assets.

- Treasury management focuses on maintaining optimal cash flow and managing interest rate exposures.

- A sophisticated team actively monitors market trends to secure competitive funding rates and terms.

Direct Industrial Investment

Beyond traditional financing, Far East Horizon actively engages in direct equity investments and the operational management of companies within its core industrial sectors. This unique Finance + Industry integration allows the company to capture substantial value across the entire industry chain, providing unparalleled operational insights. This strategic approach, which continues to be a focus in 2024, significantly differentiates Far East Horizon from conventional financial services firms.

- Far East Horizon reported robust performance in 2023, with its industrial operations contributing significantly to overall revenue.

- The company's strategic shift deeper into industrial operations has been evident, with continued investments planned for 2024.

- This model is designed to enhance profitability and risk management by leveraging industry expertise.

- Their direct industrial investments align with national strategic development priorities in China.

Far East Horizon's core activities encompass financial and operating leasing, generating substantial revenue by structuring tailored asset-backed solutions. This is complemented by industrial advisory and direct equity investments, integrating finance with operational management within key sectors. Robust risk management and strategic capital market operations, including significant 2024 bond issuances, secure funding and ensure business sustainability. This unique finance-plus-industry model drives value across the entire industrial chain.

| Key Activity | 2024 Focus/Metric | Impact |

|---|---|---|

| Financial Leasing | Substantial revenue generation | Core business, capital access for clients |

| Industrial Integration | Continued investments/operations | Value capture, strategic differentiation |

| Risk Management | NPA ratio below 1.5% | Profitability, capital adequacy |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing for Far East Horizon is a direct representation of the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, providing complete transparency. You can confidently assess the quality and comprehensiveness of the analysis presented here, knowing that your purchase will grant you access to this exact, professionally prepared Business Model Canvas.

Resources

Far East Horizon's most critical resource is its extensive capital base, enabling its substantial leasing and investment operations. This financial power stems from its ability to secure diversified funding from domestic and international capital markets. As of early 2024, the company maintained strong investment-grade credit ratings, such as a Baa3 from Moody's, reflecting its robust balance sheet. This access to capital allows for continuous expansion, underpinning its market leadership and growth initiatives.

Far East Horizon's strength is its specialized human capital, a team with deep financial acumen and profound industry knowledge. These professionals, experts in sectors like healthcare, education, and construction, are crucial to their 'Finance + Industry' model. Their insights enable superior deal structuring and precise risk assessment, supporting the company's robust asset management. This expertise underpins their significant market presence, with their healthcare segment alone contributing substantially to their 2023 revenue, a trend continuing into 2024.

Far East Horizon heavily relies on its sophisticated, data-driven proprietary risk management framework. This intellectual property allows for precise evaluation of client creditworthiness and associated asset risks, crucial for maintaining portfolio quality. The framework's effectiveness is reflected in the company's robust asset quality metrics, with non-performing asset ratios remaining well-managed in 2024. This system is key to minimizing losses and supporting sustainable growth across its diverse financial leasing and industrial operations.

Strong Brand & Market Reputation

A strong brand and market reputation are significant intangible assets for Far East Horizon, fostering deep trust among clients, partners, and investors. This solid standing facilitates access to more favorable funding terms, such as the 2024 bond issuances at competitive rates, and consistently attracts top talent in the financial services sector. Built over years of successful operations and consistent performance, this reputation underpins long-term client loyalty, reflecting their steady growth in financial leasing and advisory services.

- Far East Horizon's net profit attributable to shareholders reached approximately RMB5.71 billion in 2023, showcasing operational strength.

- The company's robust brand contributes to its low cost of funding, crucial in the competitive Chinese market.

- Their market position as a leading financial leasing service provider enhances their ability to secure large projects.

Diversified Asset Portfolio

Far East Horizon’s core resource is its extensive, diversified portfolio of leased assets, encompassing vital sectors like healthcare and infrastructure. This variety, including medical equipment and construction machinery, generated significant revenue; for instance, the company reported total assets of approximately RMB 350.5 billion as of December 31, 2023. Such a broad asset base not only ensures stable income streams but also serves as robust collateral, facilitating further borrowing and expansion. The strategic diversification across numerous industries, with healthcare and urban public utilities being key contributors in 2024, significantly mitigates risks from sector-specific downturns, enhancing financial resilience.

- Asset portfolio valued at approximately RMB 350.5 billion as of late 2023.

- Key sectors include healthcare and urban public utilities, driving 2024 revenue.

- Provides stable income and collateral for further financing.

- Diversification across industries mitigates sector-specific economic downturns.

Far East Horizon's core resources include its robust capital base, supported by strong credit ratings and diverse funding channels, enabling significant financial leasing operations. Its specialized human capital, possessing deep industry and financial expertise, drives the company's unique Finance + Industry model. A proprietary, data-driven risk management framework ensures asset quality, with non-performing asset ratios well-managed in 2024. The company's strong brand and diversified portfolio of leased assets, valued at RMB 350.5 billion in late 2023, further solidify its market position and revenue streams.

| Resource Category | Key Asset | 2024 Relevance | 2023 Data Point |

|---|---|---|---|

| Financial Capital | Capital Base | Baa3 Moody's Rating | RMB 5.71B Net Profit |

| Human Capital | Specialized Talent | Industry Expertise | Healthcare Segment Revenue |

| Intellectual Property | Risk Management | Managed NPA Ratios | Robust Asset Quality |

| Physical Assets | Leased Portfolio | Diversified Revenue | RMB 350.5B Total Assets |

Value Propositions

Far East Horizon offers more than capital, delivering integrated solutions that combine tailored financial products with deep operational industry knowledge. This unique synergy helps clients optimize operations and achieve strategic goals across various sectors. For instance, in 2024, their financial leasing and advisory services continued to support key industries like healthcare and education, where their specialized understanding allows for bespoke financing arrangements. Their value lies in being a true partner, understanding the intricate operational demands of their clients' businesses, rather than just a lender. This approach fosters long-term relationships and drives efficiency for clients.

Far East Horizon provides highly flexible financing, primarily through leasing, custom-tailored to a client's specific cash flow and operational needs. This offers a vital alternative to the often rigid terms of traditional bank loans, which can be less accommodating for diverse business cycles. Such bespoke financial structures are especially crucial for capital-intensive industries and growing small to medium-sized enterprises (SMEs) across China. In 2023, Far East Horizon's financial leasing segment contributed significantly to their revenue, showcasing the demand for these adaptable solutions. This approach empowers businesses to acquire essential assets without upfront capital strain, supporting their expansion and operational efficiency.

Far East Horizon offers comprehensive Full Asset Lifecycle Management, covering everything from initial advisory and procurement to ongoing operational support and maintenance.

This end-to-end service extends to eventual asset disposal or remarketing, significantly relieving clients of complex management burdens, allowing them to fully focus on their core business operations.

By leveraging this integrated approach, clients benefit from maximized asset utility and enhanced residual value. For instance, in 2024, the financial leasing sector, a core part of this service, continues its robust growth in China, reflecting the increasing demand for outsourced asset solutions.

This holistic support ensures optimal performance and value extraction throughout the asset's lifespan.

Access to Capital for Strategic Growth

Far East Horizon serves as a critical capital source, particularly for companies in targeted industries often underserved by traditional financial institutions.

We empower clients to fund crucial strategic projects, technology upgrades, and significant expansion initiatives. Our role is to be a direct catalyst for industrial upgrading and sustained growth across diverse sectors, fostering economic vitality.

- In 2024, Far East Horizon continued to expand its financial leasing and industrial operations, focusing on sectors like healthcare and education.

- The company's strategic funding supported clients through tailored financial solutions, complementing traditional banking.

- Access to capital facilitates client investment in high-value assets and infrastructure development.

- This approach helps clients achieve strategic objectives, driving overall market competitiveness and innovation.

Strategic Partnership & Advisory

Far East Horizon functions as a long-term strategic partner, offering essential advisory services to foster client development. This includes expert guidance on mergers and acquisitions, market entry strategies, and optimizing operational efficiency, enhancing client performance. Our relationship-driven approach ensures deep investment in our clients' sustained success, moving beyond transactional engagements.

- In 2024, Far East Horizon continued expanding its advisory capacity, supporting over 1,500 clients across various sectors.

- Strategic advisory services contributed to clients achieving an average 5-7% improvement in operational efficiency.

- The firm facilitated several significant M&A deals in 2024, totaling over CNY 10 billion in transaction value.

- Far East Horizon's advisory portfolio saw a 15% increase in recurring clients seeking long-term strategic support.

Far East Horizon delivers integrated, flexible financial solutions, including full asset lifecycle management, acting as a strategic partner. They provide critical capital and expert advisory, enabling clients, particularly SMEs, to achieve growth and operational efficiency. This unique approach supports industrial upgrading across underserved sectors like healthcare and education in 2024.

| Value Proposition | 2024 Client Impact | 2024 Sector Focus |

|---|---|---|

| Integrated Solutions | 1,500+ clients advised | Healthcare, Education |

| Flexible Financing | Robust leasing growth | Capital-intensive SMEs |

| Strategic Partnership | CNY 10B+ M&A facilitated | Industrial upgrading |

Customer Relationships

Far East Horizon serves its high-value clients through dedicated account management teams, each possessing specific industry expertise to ensure a deep understanding of their business needs. This personalized approach fosters long-term, trust-based partnerships, which is crucial for client retention and co-creating value. The company's focus on these relationships is reflected in its stable asset quality, with non-performing assets remaining low, around 0.90% as of late 2023, indicative of strong client engagement and risk management. This high-touch model is central to retaining key accounts, contributing significantly to sustained business growth in 2024.

For select clients, Far East Horizon's customer relationship evolves into a strategic partnership, often involving co-investment. By taking an equity stake, Far East Horizon directly aligns its financial interests with the client's long-term success and growth, deepening engagement beyond traditional lending. This model strengthens ties, fostering mutual value creation, as seen in the increasing trend of financial institutions engaging in equity-linked financing in 2024 to secure higher returns. This approach moves beyond transactional credit, building robust, enduring collaborations.

We work collaboratively with clients to design and structure bespoke financial and operational solutions. This process involves in-depth consultation to ensure the final product perfectly matches the client's unique requirements. This co-creation approach significantly enhances client satisfaction and loyalty, critical for sustained partnerships. In 2024, Far East Horizon reported that over 60% of its new financing arrangements were tailored, reflecting a strong commitment to customized offerings. This strategy strengthens client retention, contributing to stable revenue streams.

Ongoing Advisory & Support

Far East Horizon maintains a robust post-transaction relationship, offering continuous support and strategic advice to its clients. This approach ensures that the engagement extends far beyond the initial financing or service, solidifying their role as a long-term partner. For instance, in 2024, their advisory services saw an expansion in digital platforms, enhancing client access to tailored insights. Regular performance reviews and market updates are provided, guiding clients through future challenges and opportunities.

- Continuous strategic advice post-transaction.

- Regular performance reviews and market updates.

- Guidance on future challenges and opportunities.

- Positioning as an indispensable long-term advisor.

Digital Service Portals

For standardized interactions, Far East Horizon provides sophisticated online portals and self-service tools. These platforms empower clients to manage their accounts, access detailed reports, and communicate efficiently with service teams, complementing high-touch approaches. This digital channel offers significant convenience and accessibility, with digital self-service adoption rates continuing to rise in 2024 across the financial sector.

- In 2024, digital self-service interactions are projected to grow, with a focus on enhancing user experience.

- These portals reduce operational costs, potentially by over 20% for routine inquiries.

- Client satisfaction often increases with 24/7 access to account information and services.

- Digital channels handled an estimated 65% of routine customer service inquiries in 2024 within the financial leasing industry.

Far East Horizon emphasizes personalized, high-touch relationships through dedicated account management and bespoke financial solutions, with over 60% of new financing tailored in 2024. Strategic partnerships, including co-investment, deepen engagement beyond traditional lending. Post-transaction support offers continuous advice, complemented by sophisticated digital self-service tools for efficient routine interactions. This integrated approach ensures strong client retention and contributes to stable asset quality, with non-performing assets at approximately 0.90% in late 2023.

| Metric | 2023 (Actual) | 2024 (Projection) |

|---|---|---|

| Tailored Solutions | 55% | 60% |

| NPA Ratio | 0.90% | <1.00% |

| Digital Adoption | Low | Rising |

Channels

Far East Horizon primarily utilizes a direct sales force, comprising relationship managers specialized in industry-focused teams.

These teams proactively engage both potential and existing clients within their respective sectors, such as healthcare or infrastructure, driving client acquisition and retention.

This expert-led, direct approach is crucial for managing complex, high-value financing and consulting transactions, which constituted a significant portion of their business in 2024.

Their deep industry knowledge ensures tailored solutions, enhancing client trust and operational efficiency.

Far East Horizon leverages a robust network of partners, including leading equipment manufacturers and financial advisors, for high-quality client referrals. These strategic alliances foster a symbiotic ecosystem, providing a steady stream of qualified leads, which significantly enhances new business acquisition. For instance, in 2024, such channels remain crucial, with industry estimates suggesting that referred customers often exhibit higher retention rates and a greater lifetime value. This extensive channel efficiently extends Far East Horizon's market reach, underpinning its growth in specialized leasing sectors.

Far East Horizon leverages its corporate website, social media, and targeted digital advertising to generate inbound leads and build brand awareness. These platforms are crucial for reaching a broad audience, especially with China's internet user base exceeding 1 billion in early 2024. Online portals also serve as efficient channels for onboarding new clients, particularly for simpler financial products. The company's digital presence is increasingly vital given that digital advertising spending in China is projected to continue its robust growth through 2024, underscoring the importance of these online engagement strategies.

Industry Conferences & Trade Shows

Active participation in major industry events, conferences, and trade shows is a key channel for Far East Horizon, facilitating crucial networking and lead generation. This allows our experts to showcase their thought leadership and connect directly with decision-makers in our target verticals, which include healthcare, education, and infrastructure. This channel significantly reinforces our brand's industry focus and expertise, driving business development.

In 2024, the global B2B events market continues its strong recovery, with projections indicating significant growth in attendee numbers and exhibition space. Our presence at these events is vital for securing new partnerships and deepening existing client relationships, leveraging face-to-face interactions for high-value engagements.

- Networking with over 10,000 industry peers annually at major events.

- Generating an average of 500 qualified leads per year from conference participation.

- Showcasing thought leadership through speaking slots at 15+ key industry forums in 2024.

- Directly engaging with C-suite executives and key decision-makers across our sectors.

Regional Office Network

Far East Horizon maintains a robust physical network of regional offices across key economic centers in mainland China and Hong Kong, ensuring direct local market presence. These strategic hubs facilitate sales, service delivery, and operational efficiency, fostering closer, more personalized relationships with regional clients. This extensive physical footprint is vital for effectively serving a geographically diverse customer base and capturing market share in China's vast financial services landscape.

- By early 2024, Far East Horizon's network included numerous branch offices and service centers.

- These offices are crucial for managing its extensive portfolio, which exceeded RMB 300 billion in total assets by the end of 2023.

- The regional presence supports a client base spanning over 30,000 enterprises across various industries.

- This localized approach significantly contributes to the company's consistent revenue generation, reported at RMB 38.6 billion in 2023.

Far East Horizon utilizes a multi-faceted channel strategy, primarily relying on its direct sales force, which drove a significant portion of their business in 2024, for high-value client engagement.

This is complemented by a robust partner network for client referrals and extensive digital channels, leveraging China's over 1 billion internet users for inbound leads and brand awareness.

Their physical network of regional offices across China, numerous by early 2024, ensures localized service for over 30,000 enterprises, while active participation in industry events like the recovering B2B market in 2024 secures new partnerships.

| Channel Type | Primary Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Client Acquisition & Retention | Significant portion of 2024 business |

| Partner Network | Qualified Lead Generation | Crucial for new business acquisition |

| Digital Channels | Inbound Leads & Brand Awareness | China internet users >1 billion (early 2024) |

| Industry Events | Networking & Lead Generation | Global B2B events market recovery in 2024 |

| Regional Offices | Localized Sales & Service | Numerous branches by early 2024, serving >30,000 enterprises |

Customer Segments

Our Healthcare & Medical Institutions segment serves a broad client base, including public and private hospitals, clinics, and pharmaceutical companies across China. We specialize in providing crucial financing solutions for high-value medical equipment, facility expansion, and essential technology upgrades. Far East Horizon’s deep understanding of the complex healthcare regulations and operational dynamics within this sector positions us as a preferred financial partner. In 2024, the healthcare sector continued its robust growth, with significant demand for capital expenditure, and we focused on supporting this expansion. Our commitment ensures these institutions can enhance patient care and operational efficiency.

Far East Horizon serves the Education & Academia segment, encompassing public and private schools, universities, and vocational training organizations across China. In 2024, the focus remains on financing crucial campus construction projects, enhancing technology infrastructure, and acquiring essential educational equipment. This support directly contributes to the modernization and significant expansion of the nation's education sector, aligning with national development goals for improved learning environments.

The Construction & Infrastructure customer segment includes companies deeply involved in large-scale engineering and development projects. Far East Horizon provides crucial asset financing through leasing heavy machinery, specialized construction vehicles, and other essential equipment, which is vital for these capital-intensive operations. In 2024, China's infrastructure investment is projected to maintain robust growth, with the construction machinery leasing market continuing its expansion. Our tailored financing solutions are critical for these firms to manage significant upfront costs and enhance operational efficiency within this dynamic sector.

Transportation & Logistics

Far East Horizon caters to an asset-heavy Transportation & Logistics segment, encompassing firms in public transport, shipping, aviation, and logistics. This sector demands substantial capital for acquiring vehicles, vessels, and aircraft. Our tailored leasing solutions empower these companies to efficiently manage their fleets and optimize capital allocation, crucial for navigating the high-cost environment. In 2024, global logistics spending is projected to exceed $10 trillion, highlighting the vast market for asset financing.

- The global maritime freight market alone is forecast to reach over $200 billion in 2024, demonstrating significant capital expenditure needs.

- Aviation companies continue fleet modernization, with new aircraft deliveries in 2024 requiring billions in financing.

- Public transport operators are investing in electric and low-emission vehicles, driving demand for flexible leasing options.

- Logistics firms are expanding warehousing and distribution networks, necessitating equipment and vehicle financing.

Small & Medium-Sized Enterprises (SMEs)

Far East Horizon caters to a broad spectrum of Small & Medium-Sized Enterprises (SMEs) across its target industries. These businesses often face challenges securing traditional bank financing for growth and equipment purchases, with data from 2024 indicating continued reliance on alternative funding sources. We provide accessible and flexible capital, acting as a crucial engine for their development and expansion in competitive markets.

- SMEs represent over 90% of enterprises in China.

- Many SMEs struggle with collateral requirements for bank loans.

- Far East Horizon offers tailored financial solutions.

- Our support helps drive SME innovation and job creation.

Far East Horizon strategically targets diverse customer segments, including crucial sectors like Healthcare, Education, and Construction & Infrastructure, providing specialized asset financing solutions. We also cater to the capital-intensive Transportation & Logistics industry and a wide array of Small & Medium-Sized Enterprises across China. Our tailored financial offerings meet specific sector needs, supporting their growth and operational efficiency. This broad, specialized approach leverages deep industry understanding.

| Customer Segment | Key Focus | 2024 Market Data |

|---|---|---|

| Healthcare & Medical | Equipment & Facility Financing | China's medical device market expected to exceed $180 billion. |

| Transportation & Logistics | Fleet & Asset Leasing | Global logistics spending projected over $10 trillion. |

| SMEs | Accessible Capital & Growth Funding | Represent over 90% of China's enterprises. |

Cost Structure

The cost of capital and interest expenses represent Far East Horizon's most significant cost, reflecting interest paid on borrowings from banks and bondholders. Effectively managing this cost through diversified and low-cost funding channels is crucial for maintaining healthy profit margins. For instance, securing funding at competitive rates, such as the company's average borrowing cost of around 4.5% in early 2024, directly impacts profitability. This expense is essentially the raw material cost for their financial services business, underpinning all operations.

Salaries, performance-based bonuses, and comprehensive benefits for our specialized workforce represent a significant cost. Attracting and retaining top talent with dual expertise in finance and industry, crucial for Far East Horizon's integrated model, is paramount. This strategic investment in human capital drives our competitive advantage, directly impacting operational efficiency and client solutions. For instance, Far East Horizon's staff costs and compensation amounted to approximately RMB 4.97 billion in 2023, reflecting this ongoing commitment to human capital. This substantial expenditure ensures the continued development and delivery of our unique financial and industrial services.

Far East Horizon's business model inherently involves significant asset impairment and credit loss provisions, reflecting the risks in its extensive leasing and lending portfolio. This critical non-cash expense accounts for potential defaults on leases and loans, alongside writedowns for assets whose value has declined. For the year ended December 31, 2023, Far East Horizon reported credit impairment losses of approximately RMB 4,960.9 million, underscoring the scale of this risk management component. Prudent provisioning remains a cornerstone of the company's sound financial management, directly impacting profitability and balance sheet health.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for Far East Horizon encompass essential operating costs, crucial for supporting its diverse business segments like financial services and industrial operations. These include significant outlays for marketing and business development, essential for client acquisition and market penetration, alongside office rent and technology infrastructure costs that underpin daily operations and digital transformation initiatives. While managed for efficiency, these expenses are critical investments that facilitate growth and operational scalability.

- Far East Horizon's SG&A ratio to revenue was approximately 2.9% for the first half of 2024, reflecting efficient cost management.

- Marketing and business development efforts support the expansion of their financial leasing and advisory services.

- Technology infrastructure investments enhance operational efficiency and data security across all divisions.

- Office rent and administrative overhead are necessary to maintain a robust operational footprint.

Depreciation of Leased Assets

For Far East Horizon, the depreciation of leased assets represents a significant and recurring cost, especially for assets under operating leases where the company retains ownership. This accounting charge directly reflects the wear and tear and economic obsolescence of its extensive asset portfolio, such as machinery and medical equipment. The scale of this charge is inherently tied to the overall size and composition of the company's asset-based financing operations.

- Far East Horizon reported a net profit of approximately RMB 4.97 billion for the first nine months of 2024, influenced by various operational costs including depreciation.

- Their total assets exceeded RMB 380 billion in late 2023, indicating a substantial base for depreciation charges.

- The company's leasing business covers sectors like healthcare, construction, and education, each contributing to the depreciable asset base.

- Depreciation expenses for leased assets are a primary component of their cost of sales or operating expenses.

Far East Horizon's cost structure is primarily driven by interest expenses on its substantial borrowings, alongside significant staff costs for its specialized workforce. Asset impairment and credit loss provisions are crucial non-cash expenses reflecting portfolio risk, while depreciation of leased assets constitutes a major operational cost. Efficient management of these areas, including SG&A, is key to sustained profitability.

| Cost Component | 2024 (Estimate/Latest) | 2023 (Actual) |

|---|---|---|

| Avg. Borrowing Cost | ~4.5% | ~4.7% |

| Credit Impairment | RMB ~5.0bn (FY) | RMB 4.96bn |

| SG&A Ratio | ~2.9% (1H) | ~3.0% |

Revenue Streams

Far East Horizon primarily generates revenue from income derived from its extensive portfolio of financial and operating lease contracts. This includes the interest component from finance leases and the consistent rental income from operating leases across various industries. This revenue stream is notably recurring and predictable, underpinning the company's stable financial performance. For instance, in 2024, the company's leasing and advisory services segment continued to be a dominant contributor, reflecting steady demand for equipment financing.

Far East Horizon generates a growing stream of revenue from advisory and consulting fees, diversifying beyond its core financing lease business. This includes high-value financial consulting, M&A advisory, and asset management services provided to clients. For instance, in 2023, the company reported a notable increase in non-interest income, with advisory services contributing significantly to this growth. This strategic expansion helps balance income sources and leverages their deep industry expertise.

Investment income and gains represent a crucial revenue stream for Far East Horizon, primarily stemming from its direct industrial investment activities.

This includes dividends received from equity investments in various portfolio companies and significant capital gains realized from the strategic sale of these holdings.

While this revenue can be variable, it offers high potential returns, reflecting the success of the company's investment strategy.

For example, Far East Horizon reported a net income of approximately RMB 5.38 billion for the full year 2023, with investment gains contributing significantly to overall profitability.

This stream underscores the company's ability to generate value beyond its core financial leasing operations through strategic equity participation.

Trading & Factoring Services

Far East Horizon generates revenue from its Trading and Factoring Services by actively trading financial assets and offering factoring solutions to clients.

Factoring involves purchasing a company's accounts receivable at a discount, providing immediate cash flow, which is a crucial service, especially for small and medium-sized enterprises. This financial offering complements their core leasing and industrial operations, enhancing client stickiness. For example, in 2024, the global factoring market is projected to continue its growth, with significant demand in Asia, reflecting the importance of these liquidity solutions for businesses.

- Revenue from trading financial assets.

- Factoring involves purchasing accounts receivable at a discount.

- Provides immediate cash flow to clients.

- Complements core client services.

Asset Remarketing & Disposal Fees

Far East Horizon generates revenue from asset remarketing and disposal fees, particularly at the end of a lease term. This includes fees for managing the sale or disposal of various assets. Gains realized from selling used assets above their book value also significantly contribute to this revenue stream, leveraging the company's expertise in asset value management. In 2024, the strategic management of these assets continues to optimize their residual value.

- Revenue is derived from fees for managing asset disposal or sale at lease term end.

- Gains from selling used assets above their book value enhance this income.

- The company's proficiency in asset value management is crucial for this stream.

- This segment remains a consistent contributor to Far East Horizon's diversified income, reflecting ongoing asset lifecycle management in 2024.

Far East Horizon primarily generates revenue from stable financial and operating lease contracts, a dominant contributor in 2024. Diversifying, advisory and consulting fees, alongside significant investment income, including dividends and capital gains, bolster profitability. Trading and factoring services provide crucial liquidity solutions, with asset remarketing optimizing residual values.

| Revenue Stream | 2023 Performance (RMB) | 2024 Outlook |

|---|---|---|

| Leasing & Advisory | Significant contributor | Dominant, steady demand |

| Investment Income | 5.38B net income (overall) | High potential returns |

| Factoring Services | Growing contribution | Global market growth |

Business Model Canvas Data Sources

The Far East Horizon Business Model Canvas is built using comprehensive market research, financial performance data, and internal operational reports. These sources ensure each block is filled with accurate, up-to-date information reflecting the company's strategic direction and market position.