Fedrus International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedrus International Bundle

Fedrus International's SWOT analysis reveals a compelling blend of robust market opportunities and strategic challenges. While their established brand and global reach present significant strengths, understanding potential threats and weaknesses is crucial for navigating the competitive landscape.

Want the full story behind Fedrus International's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fedrus International boasts a comprehensive product portfolio, a significant strength in the building materials market. Their offerings span bituminous and synthetic membranes, a variety of insulation solutions, and all the necessary accessories. This extensive range allows them to provide complete integrated solutions for building envelopes, serving both residential and commercial construction projects.

This breadth of products is a key differentiator, reducing their reliance on any single product line and enabling them to meet a wide spectrum of customer requirements effectively. For instance, in 2023, their diverse product mix contributed to a stable revenue stream, with their roofing and facade solutions being particularly strong performers across various European markets.

Fedrus International has actively pursued growth through strategic acquisitions, notably its purchase of Plastivan. This move diversifies the company's operations into closely related markets within the building materials sector, strengthening its overall market position.

Further demonstrating a forward-looking approach, Fedrus International acquired a minority stake in Aerobel, a startup specializing in advanced insulation materials such as aerogels. This investment highlights a strategic pivot towards innovative and environmentally friendly product development, aligning with growing market demand for sustainable solutions.

Fedrus International is making sustainability a core part of its operations, weaving environmental, social, and governance (ESG) principles into its business and expansion plans. This proactive approach is designed to meet the increasing consumer and investor preference for eco-friendly building materials.

The company is set to release its first Corporate Sustainability Reporting Directive (CSRD) report for the fiscal year 2025, demonstrating a commitment to transparent sustainability disclosures. Furthermore, Fedrus has transitioned its financing to a Sustainable Linked Loan, directly linking its financial performance to achieving specific ESG targets.

Established Market Presence and Expertise

Fedrus International leverages over two decades of experience, consistently delivering high added value across its business units. This extensive track record has cultivated unique expertise and deep know-how specifically within the building industry. Their ambition to become the premier European one-stop shop for roof and facade materials is supported by individual business units already holding leading market positions in their respective niches.

This established market presence and specialized expertise translate into a significant competitive advantage. For instance, in 2024, the European construction market, particularly for roofing and facade solutions, continued to show resilience, with demand driven by renovation projects and new sustainable building initiatives. Fedrus's strong foothold in these segments positions them well to capitalize on these trends.

- Over 20 years of value creation in the building sector.

- Targeting a leading European one-stop shop position for roof and facade materials.

- Multiple business units are already market leaders in their specific domains.

Integrated Solutions for Building Envelopes

Fedrus International's strength lies in its integrated solutions for building envelopes, a key area in modern construction. This focus directly addresses the increasing demand for both structural integrity and energy efficiency in buildings. For instance, the global building envelope market was valued at approximately $220 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of around 5.5% through 2028, driven by sustainability initiatives and stricter energy codes.

Their comprehensive approach allows them to offer a complete package of products and services for building envelopes, which is a significant advantage. This integrated model simplifies the construction process for clients and ensures better performance of the final building. The company's ability to provide these end-to-end solutions positions them favorably to capture a larger share of this expanding market, especially as clients increasingly seek reliable and efficient building envelope systems.

- Core Competency: Specialization in integrated building envelope solutions.

- Market Demand: Capitalizes on growing need for energy-efficient and structurally sound buildings.

- Competitive Advantage: Offers comprehensive product and service packages, simplifying client procurement.

- Growth Potential: Well-positioned to benefit from the expanding global building envelope market, projected to reach over $300 billion by 2028.

Fedrus International's extensive product portfolio, covering bituminous and synthetic membranes, insulation, and accessories, allows them to offer complete integrated solutions for building envelopes. This broad offering, as seen in their strong 2023 performance in roofing and facade solutions across Europe, reduces reliance on single product lines and meets diverse customer needs.

The company's strategic acquisitions, including Plastivan and a stake in insulation innovator Aerobel, significantly diversify its operations and bolster its market position. These moves underscore a commitment to sustainable and advanced building materials, aligning with increasing market demand for eco-friendly options.

Fedrus International's deep expertise, cultivated over two decades in the building sector, supports its ambition to become Europe's leading one-stop shop for roof and facade materials. Several of their business units already hold dominant positions in their respective niches, providing a substantial competitive edge in the resilient 2024 European construction market.

Their specialization in integrated building envelope solutions directly addresses the growing global demand for energy-efficient and structurally sound buildings. This comprehensive approach simplifies procurement for clients and enhances the performance of the final structures, positioning Fedrus to capture a larger share of the expanding building envelope market, projected to exceed $300 billion by 2028.

What is included in the product

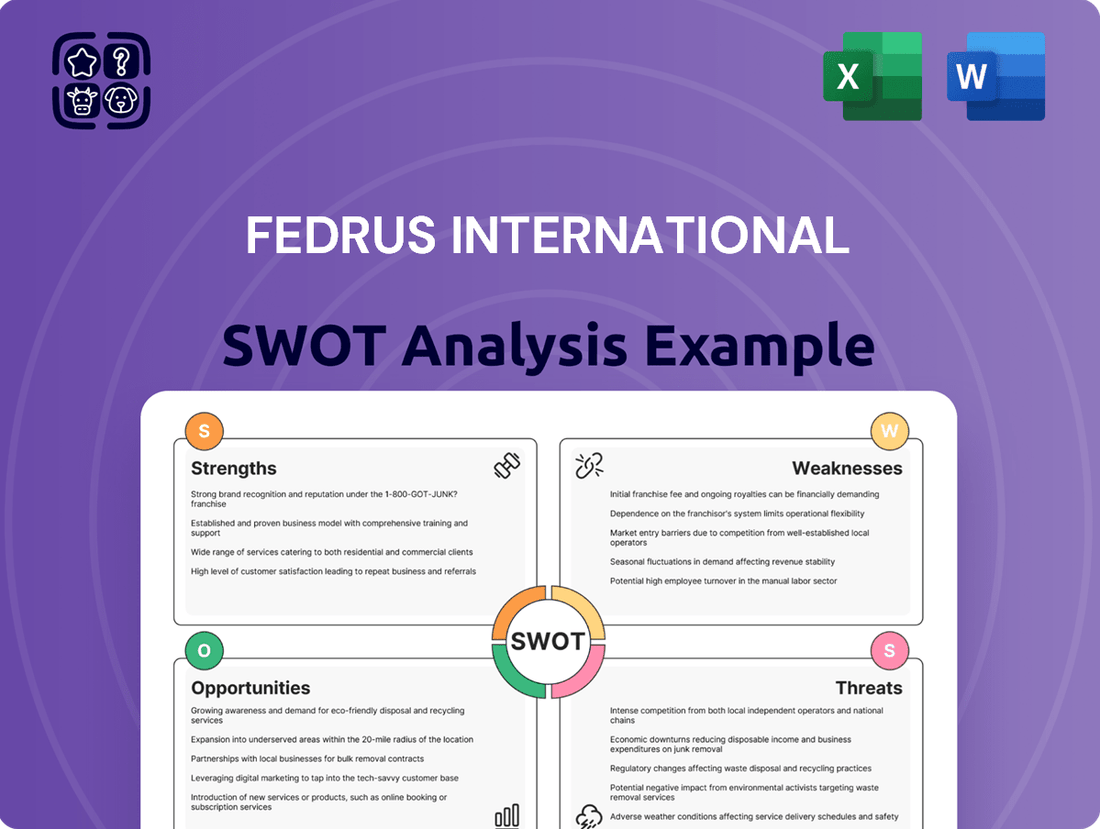

Analyzes Fedrus International’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Fedrus International's SWOT analysis provides a clear, actionable roadmap to identify and address strategic challenges, transforming potential weaknesses into opportunities for growth.

Weaknesses

Despite some stabilization in material prices, the construction industry, a key market for Fedrus International, still grapples with supply chain challenges. Production and transportation delays remain a concern, impacting the timely availability of essential materials.

While Fedrus International likely employs strategies to mitigate these issues, persistent global market disruptions or geopolitical tensions could still hinder their ability to source materials efficiently. This could lead to project delays and increased costs, directly affecting profitability and operational efficiency. For instance, the global shipping industry experienced significant disruptions in 2024, with container spot rates fluctuating wildly due to port congestion and labor shortages, a factor that could still influence Fedrus's logistics.

Fedrus International's reliance on the construction sector makes it susceptible to market downturns. For instance, a projected slowdown in global construction spending in 2024, with some regions experiencing contractions, could directly impact Fedrus's revenue streams.

High interest rates, a persistent concern in 2024, increase borrowing costs for developers and consumers, potentially dampening new construction projects and renovations. This economic headwind directly affects demand for Fedrus's roofing and facade materials.

Regional economic disparities also pose a challenge. While some markets might remain robust, others could face significant slowdowns, creating uneven demand patterns for Fedrus's products across its operating territories.

Fedrus International's reliance on traditional materials presents a notable weakness. While the company is making strides in sustainable solutions, a substantial part of their current product line likely still consists of bituminous and synthetic membranes. This can be a vulnerability if market demand shifts rapidly towards newer, eco-friendlier alternatives.

For instance, if consumer preference or regulatory bodies push for materials with lower environmental impact, Fedrus might face significant challenges. Such a shift could demand considerable investment in research and development to create new product lines and retool manufacturing processes, potentially impacting profitability and market share in the short to medium term.

Limited Public Financial Transparency

Fedrus International's public financial transparency is a notable weakness. Specific, detailed financial performance figures for the entire group covering 2024 and the projected 2025 are not readily accessible in public snippets. While historical group-level sales data from 2020 exists, a lack of more recent comprehensive financial disclosures hinders a deeper assessment of their current profitability and overall financial health.

This limited visibility makes it challenging for stakeholders to conduct thorough due diligence. For instance, without readily available 2024 revenue breakdowns or 2025 earnings per share projections, investors and analysts face hurdles in valuing the company accurately.

- Limited 2024-2025 Financial Data: Comprehensive group-level financial performance figures for the most recent periods are not publicly disclosed.

- Historical Data Gap: While 2020 sales figures are mentioned, more recent and detailed financial reports are absent.

- Hindered Assessment: The lack of transparency impedes in-depth analysis of current profitability and financial stability.

Intense Competition in European Markets

Fedrus International faces significant headwinds in the European roofing and building envelope sectors due to intense competition. The market is crowded with both established global manufacturers and agile local suppliers, all aggressively pursuing market share. This competitive landscape can put considerable pressure on Fedrus's pricing strategies and profit margins.

Key competitors are actively engaging in strategic partnerships, mergers, and acquisitions to bolster their market presence and product portfolios. For instance, in 2024, several European construction material companies announced significant M&A activity aimed at consolidating market share. This trend could further intensify competition, potentially impacting Fedrus International's ability to maintain its current market position without substantial strategic adjustments.

The constant drive for product innovation among rivals also presents a challenge. Companies are investing heavily in developing advanced, sustainable, and cost-effective building envelope solutions. Fedrus International must continually innovate and adapt its offerings to remain competitive against these dynamic market forces.

Specific competitive pressures include:

- Market Saturation: The European market for roofing and building envelopes is mature, with limited organic growth opportunities, leading to aggressive competition for existing business.

- Price Sensitivity: Customers in many European regions are highly price-sensitive, forcing suppliers like Fedrus to manage costs meticulously to remain competitive.

- Regulatory Landscape: Evolving building codes and sustainability regulations across different European countries create a complex environment where competitors with specialized compliant products can gain an advantage.

Fedrus International's reliance on traditional materials like bituminous and synthetic membranes is a weakness, as market demand increasingly favors eco-friendlier alternatives. This could necessitate significant R&D investment and manufacturing adjustments to adapt to evolving consumer preferences and regulations, potentially impacting short-to-medium term profitability.

The company's limited public financial transparency for 2024-2025 hinders thorough stakeholder assessment of its current profitability and financial health. This lack of detailed, recent financial data makes accurate valuation and due diligence more challenging for investors and analysts.

Intense competition in the European roofing and building envelope sectors, characterized by market saturation and price sensitivity, puts pressure on Fedrus International's pricing and profit margins. Competitors' strategic M&A activity and product innovation further intensify this challenge, requiring Fedrus to adapt continuously.

Full Version Awaits

Fedrus International SWOT Analysis

The preview you see is the actual Fedrus International SWOT analysis document you’ll receive upon purchase. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency and quality. The complete version, offering comprehensive insights, becomes available immediately after checkout.

Opportunities

The global building envelope market is projected for robust expansion, with analysts anticipating a compound annual growth rate (CAGR) of approximately 6.5% through 2028, largely fueled by heightened awareness of energy efficiency and stricter environmental regulations. This growing demand for sustainable building solutions presents a significant opportunity for companies like Fedrus International.

Fedrus International's strategic focus on eco-friendly materials, such as their investment in aerogel insulation technology, positions them favorably to capitalize on this trend. Aerogels offer superior thermal performance, contributing to reduced energy consumption in buildings, a key driver for sustainable construction.

The company's alignment with these market dynamics is further supported by the increasing adoption of green building certifications, like LEED and BREEAM, which prioritize materials with low environmental impact and high energy-saving capabilities. This creates a strong market pull for Fedrus's sustainable product offerings.

Europe's aging building stock, with a significant portion requiring modernization, presents a prime opportunity for Fedrus International. The increasing emphasis on energy efficiency in renovations and retrofitting projects directly fuels demand for high-performance roofing and facade materials, a core offering for the company.

This growing market segment is expected to see continued expansion. For instance, the European Commission's Renovation Wave strategy aims to at least double renovation rates by 2030, with a focus on energy performance, directly benefiting suppliers like Fedrus International.

Technological advancements in building envelopes, such as smart materials and green facades, are revolutionizing construction. Fedrus International can capitalize on these innovations to create more efficient and sustainable products, potentially integrating smart building envelope solutions that respond to environmental changes. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating significant growth potential for companies offering advanced envelope technologies.

Urbanization and Infrastructure Development

The global trend of increasing urbanization, especially in Asia-Pacific and Europe, is a significant opportunity. This growth directly translates into a higher demand for advanced building envelope solutions that prioritize energy efficiency, a core offering for Fedrus International. The ongoing surge in infrastructure projects worldwide further amplifies this demand, creating a substantial market expansion potential for the company.

Fedrus International is well-positioned to capitalize on this trend. For instance, the Asia-Pacific region alone is projected to see continued rapid urbanization, with estimates suggesting that by 2025, over 60% of its population will reside in urban areas. This demographic shift necessitates extensive new construction and retrofitting, directly benefiting suppliers of high-performance building materials.

- Growing Urban Populations: Driven by migration and natural increase, urban centers are expanding.

- Infrastructure Investment: Governments and private entities are investing heavily in new construction and upgrades.

- Demand for Efficiency: Modern building codes and environmental concerns push for energy-efficient materials.

- Market Expansion: Opportunities exist to increase sales volumes and market share in these developing regions.

Leveraging Digital Tools for Efficiency

The construction sector is rapidly embracing digital tools, with platforms for inventory management and AI-powered design becoming standard for boosting efficiency. Fedrus International can capitalize on this trend by increasing its investment in digital transformation. This strategic move would allow for smoother operations, more effective procurement, and the delivery of richer insights to its client base.

By integrating advanced digital solutions, Fedrus International can expect tangible benefits. For instance, adopting AI in design processes could reduce planning time by up to 20% in some projects, as observed in industry case studies. Furthermore, enhanced digital inventory management can lead to a reduction in material waste by an estimated 5-10%, directly impacting cost savings and sustainability. These digital upgrades are crucial for maintaining a competitive edge in a market that increasingly values speed and precision.

- Streamlined Operations: Implementing digital platforms for real-time inventory tracking and project management.

- AI-Driven Design: Utilizing artificial intelligence to optimize building designs, potentially reducing material usage and construction timelines.

- Enhanced Customer Insights: Leveraging data analytics from digital tools to provide clients with better project forecasting and performance metrics.

Fedrus International is poised to benefit from the increasing global demand for energy-efficient building solutions, a market projected to grow significantly. Their focus on advanced materials like aerogel insulation aligns perfectly with this trend, offering superior thermal performance that appeals to environmentally conscious construction projects. The company's strategic investments in sustainable technologies position it to capture market share as green building standards continue to gain traction worldwide.

Threats

The construction sector, including companies like Fedrus International, is grappling with persistently high and fluctuating prices for key materials such as steel, concrete, and electrical supplies. This volatility directly impacts project budgets and can squeeze profit margins, even with some recent stabilization observed in commodity markets.

For instance, the Producer Price Index (PPI) for construction materials saw a notable increase in early 2024, with specific components like fabricated structural metal products experiencing double-digit percentage hikes year-over-year. While inflation has shown signs of moderating through mid-2024, the underlying cost pressures remain a significant threat to the profitability and competitiveness of construction firms.

The construction sector continues to grapple with a persistent deficit of skilled workers, a trend that directly impacts project timelines and budgets. This shortage, which has been a growing concern throughout 2024 and is projected to continue into 2025, can lead to significant project delays and increased labor costs.

These labor constraints can indirectly dampen demand for Fedrus International's offerings by slowing overall construction activity. For instance, reports from the Bureau of Labor Statistics in late 2024 indicated that job openings in construction significantly outpaced the number of available workers, highlighting the severity of the issue.

Fedrus International faces increasing pressure from evolving regulations, especially concerning environmental performance and carbon emissions. While some mandates can drive innovation, the speed and complexity of new rules, like those anticipated in the 2024-2025 period, could necessitate substantial investments in research, development, and manufacturing adjustments to ensure compliance.

Economic Uncertainty and Interest Rate Fluctuations

Ongoing economic volatility and fluctuating interest rates present a significant challenge for the construction sector, directly impacting companies like Fedrus International. This uncertainty can lead to project delays or outright cancellations as clients and developers find their budgets squeezed, making long-term planning difficult. For instance, the Federal Reserve's actions in 2024 to manage inflation, potentially involving further rate adjustments, could significantly alter borrowing costs for construction projects, affecting demand for Fedrus's services.

The unpredictability stemming from these economic conditions directly impacts Fedrus International's sales forecasts and overall market stability. For example, if interest rates rise sharply in late 2024 or early 2025, it could dampen new construction starts, a key revenue driver for the company. This makes it harder to accurately project future earnings and manage resources effectively.

- Economic Volatility: Global economic shifts in 2024, including supply chain disruptions and geopolitical tensions, create an unpredictable operating environment for construction firms.

- Interest Rate Sensitivity: Fedrus International's reliance on projects financed through debt makes it vulnerable to interest rate hikes, which increase project costs and can reduce client investment.

- Project Pipeline Impact: Fluctuating economic conditions can lead to a slowdown in new project announcements and approvals, potentially shrinking Fedrus's future order book.

- Forecasting Challenges: The inherent uncertainty makes it difficult for Fedrus to accurately forecast sales and manage inventory or resource allocation, potentially leading to inefficiencies.

Competitive Landscape and Market Share Erosion

The roofing and facade material markets, both globally and specifically within Europe, are intensely competitive arenas. Fedrus International faces a crowded field with many well-established companies vying for market dominance. This intense rivalry means that aggressive pricing tactics and swift product development by competitors pose a significant threat.

If Fedrus International fails to consistently innovate and clearly differentiate its products, there's a real risk of losing valuable market share. For instance, in 2023, the global construction materials market was valued at approximately $1.1 trillion, with roofing and facade segments representing a substantial portion. Companies that can offer superior performance, sustainability, or cost-effectiveness are likely to gain an advantage.

- Intense Competition: Numerous established players operate in the global and European roofing and facade markets.

- Pricing Pressure: Aggressive pricing strategies from rivals can erode profit margins and market share.

- Innovation Race: Rapid product innovation by competitors necessitates continuous investment in R&D for Fedrus International to remain competitive.

- Market Share Erosion: Failure to differentiate offerings could lead to a decline in Fedrus International's market standing.

Fedrus International faces significant threats from economic volatility, including fluctuating interest rates and potential project slowdowns, impacting its sales forecasts and resource management. The construction sector's persistent skilled labor shortage also poses a risk, potentially delaying projects and increasing labor costs, which indirectly affects demand for Fedrus's products.

Intense competition in the roofing and facade markets, characterized by aggressive pricing and rapid innovation from rivals, threatens Fedrus's market share if it cannot effectively differentiate its offerings.

Evolving environmental regulations could necessitate substantial investments in R&D and manufacturing adjustments for compliance, adding to operational costs and complexity.

| Threat Category | Specific Threat | Impact on Fedrus International | Relevant Data/Context (2024-2025 Projection) |

|---|---|---|---|

| Economic Volatility | Interest Rate Hikes | Increased project financing costs, reduced client investment | Federal Reserve's potential rate adjustments in late 2024/early 2025 could raise borrowing costs. |

| Labor Market | Skilled Labor Shortage | Project delays, increased labor costs, dampened demand | Bureau of Labor Statistics data in late 2024 showed construction job openings significantly exceeding available workers. |

| Market Competition | Aggressive Pricing & Innovation | Erosion of profit margins, loss of market share | Global construction materials market valued at ~$1.1 trillion in 2023; competitive advantage hinges on performance and cost-effectiveness. |

| Regulatory Environment | Environmental Mandates | Need for substantial investment in R&D and manufacturing adjustments | Anticipated complex environmental rules in the 2024-2025 period require compliance investments. |

SWOT Analysis Data Sources

This Fedrus International SWOT analysis is built upon a robust foundation of data, including comprehensive financial statements, detailed market research reports, and insights from industry experts. These sources collectively provide a well-rounded and accurate understanding of the company's strategic position.