Fedrus International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedrus International Bundle

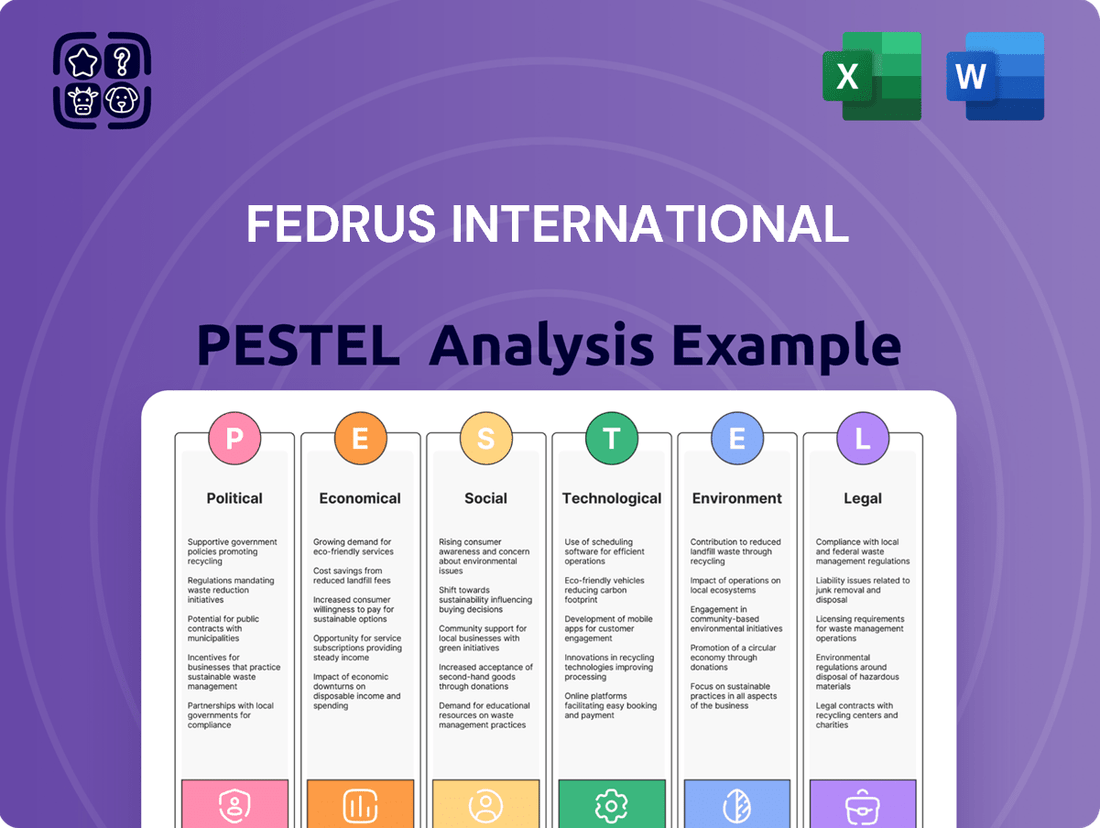

Navigate the complex external forces impacting Fedrus International with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its trajectory. Equip yourself with actionable intelligence to refine your market strategy and anticipate future challenges. Download the full version now for a strategic advantage.

Political factors

European governments are tightening building codes, especially for energy efficiency and material safety, impacting companies like Fedrus International.

The EU Construction Products Regulation (EU) 2024/3110, starting January 7, 2025, mandates sustainability and digitalization, including environmental performance on CE marking and Digital Product Passports.

These changes necessitate Fedrus International adapting its product development and manufacturing to meet new durability, fire safety, and environmental standards for continued market access.

Government investment in infrastructure, particularly through initiatives like the NextGenerationEU program, is a key political factor influencing the construction sector. These programs are designed to stimulate economic recovery and promote modernization across Europe.

For Fedrus International, this translates into opportunities as public procurement for large-scale projects, such as transportation upgrades and renewable energy installations, continues to be robust. In 2024, EU funding is expected to underpin significant infrastructure development, offering a stable demand for construction materials.

The focus on sustainable construction practices within these public works aligns well with Fedrus International's product offerings, potentially creating a competitive advantage. This sustained public spending provides a counterbalance to potential slowdowns in other construction segments.

The European Green Deal and its Circular Economy Action Plan are significantly reshaping the construction industry, a sector known for its substantial resource use and waste output. These policies champion material efficiency and circularity, aiming to lower the carbon footprint of buildings by encouraging recycled or bio-based materials and designing for easier reuse of components.

Fedrus International's strategic direction, including its focus on ecological insulation raw materials and investments like Aerobel, aligns well with these sustainability mandates. The company's recent sustainable linked loan further underscores its commitment to circular economy principles, positioning it advantageously in an evolving market that increasingly values environmentally conscious practices.

Trade Policies and Tariffs

Changes in trade policies and the imposition of tariffs, like the European Union's Carbon Border Adjustment Mechanism (CBAM), directly affect the cost of raw materials and finished goods for international companies such as Fedrus International. The CBAM, which began a transitional phase in October 2023 and will be fully implemented by January 2026, places a carbon levy on specific imported products, potentially altering sourcing and manufacturing strategies. For a global entity like Fedrus, staying abreast of these evolving trade landscapes is crucial for maintaining competitive pricing and ensuring supply chain resilience.

The CBAM's impact is substantial, as it aims to level the playing field for EU industries facing carbon pricing. For instance, the initial reporting obligations under CBAM for importers of goods like iron, steel, and cement began in October 2023, with financial obligations starting in 2026. Fedrus International, depending on its product mix and sourcing locations, may face increased import costs if its suppliers do not meet EU carbon emission standards. This necessitates careful evaluation of supply chain partners and potential investments in cleaner production methods to mitigate these new trade-related expenses.

- CBAM Transitional Period: Began October 2023, with financial implications starting January 2026.

- Affected Sectors: Initial focus includes goods like iron, steel, cement, fertilizers, electricity, and hydrogen.

- Impact on Costs: Tariffs could increase the price of imported materials, affecting Fedrus International's cost of goods sold.

- Supply Chain Adaptation: Companies may need to diversify suppliers or invest in decarbonization to remain competitive.

Political Stability and Geopolitical Events

Political stability within the European Union and ongoing geopolitical events, like the war in Ukraine, significantly impact investor confidence and operational costs in the construction sector. These factors directly influence energy prices and disrupt supply chains, creating a challenging environment. For instance, the European construction sector experienced a contraction in output in early 2024, with some regions seeing year-on-year declines of over 5% in construction activity due to these pressures.

Despite these headwinds, a gradual improvement in the overall European construction market is anticipated for 2025. Projections suggest a modest growth of around 1.5% to 2.5% for the sector across the EU by the end of 2025, driven by recovery in certain segments and potential infrastructure spending.

Fedrus International, with its extensive operations across Europe, must maintain agility to navigate these fluctuating external factors. The company's ability to adapt to changes in market demand and manage increased operational costs stemming from political and geopolitical instability will be crucial for its performance in 2024 and 2025.

- European construction output declined by an average of 2.1% in the first quarter of 2024 compared to the previous quarter.

- Energy prices, heavily influenced by geopolitical events, saw volatility in 2024, with natural gas prices fluctuating by as much as 30% within single months.

- Supply chain disruptions in 2024 led to an average increase of 8-12% in material costs for construction projects in several key European markets.

- Forecasts for the European construction market in 2025 indicate a potential rebound, with an estimated growth rate of 1.8% across the region.

Government regulations are increasingly shaping the construction industry, with new EU mandates like the Construction Products Regulation (EU) 2024/3110, effective January 2025, emphasizing sustainability and digitalization. These evolving standards, including stricter building codes for energy efficiency and material safety, directly impact Fedrus International's product development and compliance strategies.

Public investment in infrastructure, driven by programs like NextGenerationEU, offers significant opportunities for Fedrus International, with EU funding projected to support substantial development in 2024 and beyond. The company's alignment with sustainable construction practices, a key focus of these public works, provides a competitive edge.

Trade policies, particularly the EU's Carbon Border Adjustment Mechanism (CBAM) which begins full implementation in 2026, will affect the cost of imported materials, requiring Fedrus International to adapt its sourcing and manufacturing. Political instability and geopolitical events, such as the war in Ukraine, have also contributed to market volatility, with European construction output seeing a 2.1% decline in Q1 2024, though a modest sector-wide growth of 1.8% is forecast for 2025.

| Political Factor | Impact on Fedrus International | Relevant Data/Timeline |

|---|---|---|

| Regulatory Changes (e.g., EU Construction Products Regulation) | Requires adaptation in product development, manufacturing, and compliance for market access. | EU 2024/3110 effective January 7, 2025. |

| Government Infrastructure Spending (e.g., NextGenerationEU) | Creates demand for construction materials, especially for sustainable projects. | Robust public procurement expected through 2024 and 2025. |

| Trade Policies (e.g., CBAM) | Potentially increases import costs, necessitating supply chain adjustments. | Transitional phase began Oct 2023, full implementation Jan 2026. |

| Geopolitical Instability | Affects investor confidence, energy prices, and supply chains, impacting operational costs and market demand. | European construction output declined 2.1% in Q1 2024; sector growth forecast at 1.8% for 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fedrus International, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Fedrus International's operating landscape.

Fedrus International's PESTLE analysis offers a concise, easily digestible summary, relieving the pain of sifting through lengthy reports for quick understanding during critical meetings.

Economic factors

Interest rate shifts are a major driver for construction investment, especially for Fedrus International, given how much debt finances homes and development. The sharp rate increases seen from mid-2022 led to a noticeable slump in European residential construction investment throughout 2023.

However, the landscape is changing. Early interest rate cuts in 2024 are signaling a potential turnaround, with projections indicating stabilization and a return to growth by 2025 as credit becomes more accessible again. This rebound is vital for Fedrus, as it directly impacts the demand for their roofing and facade products in upcoming construction projects.

The European construction sector is poised for a rebound, with projections indicating a rise to USD 2.28 trillion by 2025, following a dip in 2024. This moderate recovery offers a positive outlook for companies operating within the industry.

While new housing starts encountered headwinds, the renovation segment, especially for energy-saving improvements, is set for sustained expansion. This growth is fueled by stringent government mandates and elevated energy costs, creating a favorable environment for specialized materials.

Fedrus International is well-positioned to leverage these market dynamics. Its diverse product portfolio can cater to the needs of both new construction projects and the increasing demand for sustainable renovation solutions, particularly those focused on enhancing energy efficiency.

Rising material costs have significantly impacted the construction industry, with inflation expected to moderate in 2025. However, persistent labor shortages, exacerbated by an aging workforce and declining interest from younger generations, continue to drive up project expenses and cause delays.

Fedrus International faces the challenge of effectively managing these escalating input costs. Strategies to mitigate the effects of labor scarcity, such as investing in automation or upskilling programs, will be crucial for maintaining operational efficiency and profitability in the coming years.

Inflation and Purchasing Power

Inflation significantly impacts purchasing power, potentially dampening demand for new construction and renovation projects for both residential and commercial clients. As of early 2024, inflation rates, while showing some moderation from previous peaks, continue to influence consumer and business confidence regarding large capital expenditures like building projects.

The general economic climate, shaped by inflationary pressures, affects the willingness of customers to invest in Fedrus International's offerings. This necessitates careful consideration of pricing strategies and product development to align with evolving affordability.

- Inflationary pressures can reduce the real value of savings and disposable income, making clients more hesitant to commit to new construction or renovation projects.

- Businesses may delay or scale back expansion plans if the cost of financing and materials, driven by inflation, becomes prohibitive.

- Fedrus International must monitor inflation trends to adjust its pricing and ensure its products remain competitive and accessible to its target markets.

Economic Stability of Key European Markets

The economic stability of key European markets significantly influences Fedrus International's performance. While some major economies like Germany saw a contraction in construction output by an estimated 1.5% in 2024 according to Euroconstruct, others like Poland experienced a more robust year. Projections for 2025 indicate a broad-based recovery, with the European construction sector expected to grow by approximately 2.3%.

Fedrus International's diversified European footprint means its success is directly linked to navigating these varied economic landscapes. For instance, the company's operations in markets with stronger GDP growth, such as Spain which is forecast to grow by 2.0% in 2025, can offset slower growth in other regions. This necessitates a strategic approach to market allocation and investment.

- Germany's construction sector output declined by an estimated 1.5% in 2024.

- Poland demonstrated resilience with positive construction growth in 2024.

- A European-wide construction sector rebound is anticipated in 2025, with an estimated growth of 2.3%.

- Spain's GDP growth is projected at 2.0% for 2025, supporting its construction market.

Interest rate adjustments significantly impact construction investment, with early 2024 cuts signaling a potential rebound for Fedrus International. The European construction sector is projected to reach USD 2.28 trillion by 2025, recovering from a 2024 dip.

Inflationary pressures continue to affect purchasing power, potentially slowing demand, though moderation is expected by 2025. Persistent labor shortages, however, are driving up project costs and causing delays, necessitating strategic cost management for Fedrus.

Economic stability varies across Europe; Germany's construction output saw an estimated 1.5% decline in 2024, while Poland showed resilience. A broader European construction sector growth of 2.3% is anticipated for 2025, with countries like Spain projected to grow by 2.0%.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Fedrus International |

|---|---|---|---|

| European Construction Market Size | Slight dip | USD 2.28 trillion | Recovery in demand for roofing and facade products |

| Interest Rates | Decreasing | Stabilizing/Lower | Improved access to credit, potentially boosting new construction |

| Inflation | Moderating but persistent | Expected moderation | Affects purchasing power and material costs; necessitates pricing adjustments |

| Labor Shortages | Persistent | Persistent | Increases project costs and delays; requires operational efficiency focus |

| GDP Growth (Selected Markets) | Germany: -1.5% (construction) | Spain: 2.0% | Diversified market performance influences overall revenue |

Same Document Delivered

Fedrus International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Fedrus International.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fedrus International.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Fedrus International.

Sociological factors

The European construction industry is grappling with substantial labor shortages, a trend exacerbated by an aging workforce and declining interest from younger demographics. This demographic shift means a considerable number of experienced workers are set to retire in the near future, potentially causing project delays and escalating costs.

This situation directly impacts Fedrus International's clientele, affecting their operational capacity and efficiency. For instance, in 2023, the EU construction sector reported a shortage of around 1.5 million skilled workers, a figure projected to grow. Fedrus International might need to adapt by offering solutions that lessen on-site labor demands, such as promoting prefabricated components or digital construction tools.

Societal shifts are driving a significant demand for buildings that prioritize energy efficiency alongside occupant health and well-being. This is evident in the surge of certifications like WELL and LEED, which are becoming benchmarks for healthy and sustainable construction. For instance, the global green building market was valued at over $1 trillion in 2023 and is projected to reach $3.4 trillion by 2030, indicating a strong market pull for these attributes.

Fedrus International is strategically aligned with this trend, offering integrated solutions for building envelopes and investing in ecological insulation. Their commitment to sustainable materials and healthy building practices positions them to capitalize on this growing preference for environmentally conscious and occupant-centric developments. The increasing consumer and commercial awareness of the impact of buildings on health and the environment fuels this demand.

Urbanization remains a significant driver for Fedrus International, fueling demand for construction materials in growing metropolitan areas. Globally, an estimated 68% of the world's population is projected to live in urban areas by 2050, presenting a continuous need for housing and commercial spaces. This trend directly impacts Fedrus's markets, as cities expand and require more infrastructure and buildings.

Despite this demand, the construction industry grapples with affordability issues. Rising material costs, a persistent labor shortage, and complex regulations contribute to increased building expenses. For instance, in the US, construction input prices saw a notable increase in late 2023 and early 2024, impacting project feasibility and potentially slowing down the pace of new developments, which Fedrus must navigate.

Fedrus International's broad product range, serving both residential and commercial construction, positions it well to capitalize on urbanization. However, the company must remain attuned to the affordability constraints that can limit overall construction volumes. Successfully addressing these challenges will be key to maintaining growth in this dynamic sector.

Shifting Consumer Preferences for Aesthetics and Customization

Homeowners and commercial clients are increasingly seeking building materials that offer more than just protection; they want personalized aesthetics and integrated technology. This means customized roofing and facade options are becoming the norm, with choices extending to specific colors, intricate designs, and the seamless incorporation of features like solar shingles. For instance, a 2024 survey indicated that over 60% of new home buyers consider exterior appearance a top priority, directly influencing their purchasing decisions.

Fedrus International's capacity to provide a diverse palette of materials and innovative solutions that align with these evolving demands for customization and visual appeal can serve as a significant competitive advantage. The market for customizable building components is projected to grow by 7% annually through 2027, driven by this consumer desire for unique and visually striking properties.

- Increased demand for personalized exterior finishes.

- Integration of technology like solar panels into building aesthetics is a growing trend.

- Consumer preference for unique color and design options in roofing and facades.

- The market for customizable building solutions is expanding rapidly.

Public Awareness and Education on Green Building

Growing public concern over climate change is significantly boosting interest in green building, influencing demand for sustainable materials. Surveys from 2024 indicate that over 60% of consumers are more likely to choose eco-friendly options when available, a trend that directly impacts purchasing decisions in the construction sector.

While regulations are crucial, a noticeable shift towards intrinsic motivation is emerging. For instance, a 2025 report by the Green Building Council found that 45% of developers cited occupant health and well-being as a primary driver for adopting green practices, alongside environmental benefits.

Fedrus International can capitalize on this by developing targeted campaigns. Highlighting the long-term cost savings and enhanced performance of their sustainable products, such as their recycled content insulation which can reduce energy bills by up to 15% annually, will resonate with architects, builders, and end-users alike.

- Rising Consumer Demand: Over 60% of consumers in 2024 showed increased preference for eco-friendly building options.

- Intrinsic Motivations: A 2025 study revealed 45% of developers prioritize occupant health and well-being in green building choices.

- Performance Benefits: Fedrus International's sustainable insulation can lower energy costs by approximately 15% each year.

- Targeted Marketing: Educational initiatives emphasizing environmental and performance advantages can influence key stakeholders.

Societal expectations are increasingly focused on health, well-being, and sustainability within the built environment. This is driving demand for materials and construction methods that promote healthier indoor air quality and reduce environmental impact, with green building certifications like LEED and WELL becoming standard expectations. For example, the global green building market was valued at over $1 trillion in 2023 and is projected to reach $3.4 trillion by 2030.

Fedrus International's investment in ecological insulation and integrated building envelope solutions aligns perfectly with these evolving societal values. The growing consumer and commercial awareness of how buildings affect health and the environment creates a strong market pull for the company's offerings.

Additionally, there's a rising desire for personalized aesthetics and integrated technology in construction, influencing preferences for customizable exterior finishes. A 2024 survey found that over 60% of new home buyers prioritize exterior appearance, impacting their purchasing decisions and driving demand for unique color and design options in roofing and facades.

Fedrus International's diverse product range and capacity for innovation in customizable building components position it to meet these demands, with the market for such solutions projected to grow by 7% annually through 2027.

Technological factors

Technological progress is spurring the creation of novel, high-performance building materials. Innovations like graphene-coated shingles offer increased durability and resistance to the elements, while self-healing roof membranes promise extended lifespan and reduced upkeep expenses. Furthermore, advancements in cool roofing technology enhance solar reflectivity and heat absorption.

Fedrus International, operating as a manufacturer and distributor, is well-positioned to incorporate these advanced materials into its offerings. By integrating cutting-edge solutions, the company can provide enhanced roofing and facade products to the market, potentially capturing a larger share of the construction materials sector.

Digitalization is fundamentally reshaping the European construction sector, with a strong move towards integrated digital systems for everything from project communication and scheduling to compliance and record-keeping. This digital transformation is crucial for enhancing operational efficiency and transparency across the industry.

Building Information Modeling (BIM) stands out as a key digital innovation, significantly boosting project efficiency, improving coordination among stakeholders, and facilitating better long-term management of infrastructure assets. The adoption of BIM is expected to continue its upward trajectory, with many European countries mandating its use for public projects.

Fedrus International is well-positioned to capitalize on and contribute to this digital wave. By ensuring its product offerings are compatible with BIM platforms and by actively utilizing digital tools in its own operations and customer engagement strategies, the company can enhance its market relevance and operational effectiveness. For instance, the European construction market is projected to see continued growth in digital adoption, with BIM software market size in Europe estimated to reach over $3 billion by 2025, indicating a strong demand for digitally integrated solutions.

The increasing adoption of smart building technologies and IoT integration is a significant technological trend. These advancements are transforming how buildings operate, with a strong focus on energy efficiency and overall performance. For example, smart roofs equipped with IoT monitoring and thermal sensors can offer real-time data on temperature and moisture, crucial for maintenance and operational insights.

Fedrus International can leverage this trend by developing or partnering on products that seamlessly integrate with these smart building ecosystems. This integration offers an opportunity to provide enhanced functionality and added value, potentially increasing customer demand for their offerings in the evolving construction and building management sectors.

Prefabrication and Modular Construction

Prefabrication and modular construction are increasingly becoming vital in addressing construction industry labor shortages and accelerating project timelines. These methods involve manufacturing building components off-site, allowing for faster assembly and reduced on-site disruption. For instance, the global modular construction market was valued at approximately $80 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $150 billion by 2030, driven by demand for efficiency and sustainability.

Fedrus International can strategically position its product portfolio to align with these evolving construction methodologies. By developing or adapting its offerings to suit prefabrication and modular building, such as providing pre-assembled facade elements or optimized roofing sections, the company can streamline the on-site construction process for its clients. This adaptation could lead to increased market share in a rapidly expanding segment of the construction industry.

- Market Growth: The modular construction market is experiencing robust growth, with projections indicating a substantial increase in value over the next decade.

- Efficiency Gains: Prefabrication and modular building offer significant reductions in construction time and labor requirements, appealing to developers facing shortages.

- Product Adaptation: Fedrus International can enhance its competitiveness by tailoring products like facade systems or roofing components for off-site manufacturing and rapid on-site installation.

- Industry Trend: This shift towards off-site construction is a major technological trend reshaping the building sector, presenting opportunities for innovative suppliers.

3D Printing in Construction

Advancements in 3D printing are revolutionizing construction, allowing for intricate facade designs and the use of materials like concrete and bioplastics. This innovation promises to significantly cut down material waste and boost structural efficiency.

Specifically, the development of 3D-printed geopolymer concrete, a more environmentally friendly option than traditional cement, is gaining traction in Europe. For instance, projects in the Netherlands have showcased the potential of this technology, with some companies aiming for widespread adoption by 2025.

While still in its early stages, 3D printing presents long-term opportunities for Fedrus International in custom manufacturing and the adoption of sustainable materials. The global 3D printing construction market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, reaching an estimated $10 billion by 2030, according to various market research reports from 2024.

- Material Innovation: Potential to utilize low-carbon geopolymer concrete, reducing environmental impact.

- Design Flexibility: Enables complex and custom facade geometries previously unachievable.

- Efficiency Gains: Expected reduction in material waste and improved structural performance.

- Market Growth: The 3D printing construction sector is experiencing rapid expansion, offering future business avenues.

Technological advancements are driving innovation in building materials, with new products offering enhanced durability and sustainability. Digitalization is transforming the construction sector, making integrated digital systems and Building Information Modeling (BIM) essential for efficiency. Smart building technologies and IoT integration are improving building operations and energy performance, while prefabrication and modular construction are becoming key to faster project delivery and addressing labor shortages. 3D printing is also emerging as a revolutionary technology, enabling complex designs and the use of sustainable materials, with the global market projected for significant growth.

| Technology Trend | Impact on Construction | Fedrus International Opportunity | Market Data (2023/2025 Projections) |

|---|---|---|---|

| Advanced Materials | Increased durability, reduced maintenance | Incorporate into product lines for competitive edge | Graphene shingles, self-healing membranes |

| Digitalization & BIM | Enhanced project efficiency, coordination, and management | Ensure product compatibility, leverage digital tools | BIM software market in Europe projected >$3 billion by 2025 |

| Smart Building/IoT | Improved energy efficiency, real-time operational data | Develop or partner on integrated smart products | Smart roofs with IoT monitoring |

| Prefabrication/Modular | Faster construction, reduced labor needs | Adapt products for off-site manufacturing | Global modular market ~$80 billion (2023), projected growth |

| 3D Printing | Custom designs, material efficiency, sustainability | Explore custom manufacturing, sustainable materials | 3D printing construction market ~$1.5 billion (2023), projected to ~$10 billion by 2030 |

Legal factors

The revised Construction Products Regulation (EU) 2024/3110, effective January 7, 2025, mandates enhanced sustainability and digitalization for construction products. This includes expanding CE marking to cover environmental performance and requiring Digital Product Passports, which will provide detailed product information.

Fedrus International must adapt its roofing and facade materials to meet these new EU-wide requirements for marketing and performance. Non-compliance could impact market access and product acceptance within the European Union.

The EU Green Deal, along with directives like the Energy Performance of Buildings Directive (EPBD), sets a robust legal framework for environmental performance. These regulations demand higher energy efficiency and sustainability in buildings, directly impacting Fedrus International's market.

Stricter rules on carbon emissions and the mandatory use of sustainable materials, driven by circular economy principles, are key components. For instance, the EPBD aims to significantly reduce the building sector's carbon footprint, a major contributor to overall emissions.

Fedrus International needs to ensure its product development and operations comply with these evolving legal requirements. Failure to adapt could lead to competitive disadvantages and potential penalties, underscoring the importance of aligning with the Green Deal's objectives.

Legal frameworks, such as the EU's Waste Framework Directive, place a significant emphasis on construction and demolition waste, which accounts for a substantial portion of total waste. This directive mandates higher recycling and reuse targets for construction materials, creating a legal imperative for companies like Fedrus International to adapt.

Fedrus International must ensure its products are designed for recyclability and circularity, aligning with these evolving legal requirements. For instance, by 2025, the EU aims for a minimum of 70% of non-hazardous construction and demolition waste to be prepared for reuse, recycling, and recovery.

Health and Safety Regulations

Fedrus International operates within a construction sector heavily influenced by rigorous health and safety regulations. These standards are critical for safeguarding both construction site personnel and the end-users of buildings. Key areas of focus include the toxicity of building materials, adherence to stringent fire safety codes, and the implementation of secure installation methodologies.

For instance, in the European Union, regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directly impact the chemical composition of construction products, with compliance costs for manufacturers potentially running into millions of euros depending on the complexity of their product portfolio. Fedrus International must proactively ensure its product lines not only meet these evolving standards but also provide comprehensive guidance on safe handling and application, especially as innovative materials and installation techniques gain traction in the market.

The company's commitment to these regulations is not just a matter of compliance but a strategic imperative.

- Compliance with REACH and similar chemical safety regulations across its operating regions.

- Ensuring all products meet or exceed fire safety standards, such as EN 13501-1 in Europe.

- Providing detailed safety data sheets (SDS) and training for installers on new product applications.

- Monitoring and adapting to updated building codes and health standards in key markets like North America and Europe.

Competition Law and Market Surveillance

Competition laws and market surveillance are crucial for ensuring a level playing field in the construction product sector across EU Member States. These regulations aim to prevent anti-competitive practices, such as price-fixing or market allocation, which could harm consumers and stifle innovation. Fedrus International, operating within this framework, must ensure its business practices align with these stringent requirements.

The revised Construction Products Regulation (CPR) specifically targets inconsistencies in how market surveillance is applied across different countries. This means Fedrus International needs to be vigilant about varying enforcement standards and ensure its products meet all applicable national and EU-wide regulations. For instance, in 2023, the European Commission continued its efforts to harmonize market surveillance, with a particular focus on product safety and conformity in construction materials.

Fedrus International's adherence to competition law and preparedness for market surveillance are vital for maintaining its market standing and avoiding potential penalties. Robust internal compliance mechanisms are essential to navigate these legal landscapes effectively.

- Fair Competition: EU competition law prohibits cartels and abuses of dominant market positions within the construction product sector.

- Market Surveillance: National authorities actively monitor construction products to ensure they meet safety and performance standards, as reinforced by the revised CPR.

- Compliance Costs: Fedrus International incurs costs related to legal counsel, internal audits, and product testing to ensure ongoing compliance.

- Reputational Risk: Non-compliance can lead to significant fines and damage Fedrus International's reputation among customers and regulatory bodies.

Fedrus International must navigate evolving EU regulations like the Construction Products Regulation (EU) 2024/3110, effective January 7, 2025, which mandates enhanced sustainability and digitalization, including expanded CE marking for environmental performance and Digital Product Passports. The EU Green Deal and directives such as the Energy Performance of Buildings Directive (EPBD) also impose stricter rules on carbon emissions and the mandatory use of sustainable materials, aiming to reduce the building sector's carbon footprint by a significant margin.

Compliance with chemical safety regulations like REACH remains critical, with potential costs for manufacturers reaching millions of euros. Furthermore, adherence to fire safety codes, such as EN 13501-1 in Europe, and robust health and safety standards are paramount. The company must also ensure its products are designed for recyclability, aligning with the EU's Waste Framework Directive's targets, which aim for a minimum of 70% of non-hazardous construction and demolition waste to be prepared for reuse or recycling by 2025.

Fedrus International faces stringent competition laws and market surveillance across EU Member States, requiring vigilance regarding varying enforcement standards and ensuring product conformity. Failure to comply can result in substantial fines and reputational damage, highlighting the need for strong internal compliance mechanisms and ongoing adaptation to updated building codes and health standards in key markets.

Environmental factors

The escalating frequency and intensity of extreme weather events, directly linked to climate change, are driving a significant demand for more robust building materials and construction methods. This trend is particularly relevant for roofing and facade products, which must now be engineered to endure severe challenges such as hailstorms, hurricanes, and wildfires. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, underscoring the urgency for resilient infrastructure.

Fedrus International is positioned to capitalize on this evolving market by innovating and offering products designed for enhanced climate resilience. Developing and marketing impact-resistant shingles or fireproof tiles presents a clear opportunity to meet a growing consumer and commercial need for durable, long-lasting solutions that can better withstand the impacts of a changing climate.

The construction industry is a significant source of greenhouse gases, driving a global push for decarbonization. Europe, for instance, aims for carbon neutrality by 2050, demanding reductions in both operational and embodied carbon within buildings. This regulatory environment directly impacts Fedrus International's market, highlighting the importance of sustainable building practices.

Fedrus International's product range, featuring energy-efficient insulation and materials designed to lower embodied carbon, positions the company as a key enabler for its clients. These products are essential for customers striving to meet increasingly strict emission reduction goals. For example, the embodied carbon of concrete, a widely used construction material, can account for a substantial portion of a building's lifecycle emissions, making low-carbon alternatives vital.

The construction sector's heavy reliance on virgin resources and substantial waste generation presents a significant challenge. In 2023, the global construction market consumed an estimated 40% of all raw materials, highlighting the urgency for more sustainable practices.

The European Union's ambitious circular economy agenda, targeting a 30% reduction in primary raw material use by 2030, directly impacts this industry. Fedrus International can align with this by increasing the recycled content in its products, such as its range of recycled plastic lumber, and by designing components for easier deconstruction and reuse.

Exploring novel materials, like those derived from agricultural waste or reclaimed industrial byproducts, offers further avenues for Fedrus International to reduce its environmental footprint and capitalize on the growing demand for sustainable building solutions.

Energy Efficiency in Buildings

Buildings are significant energy consumers in Europe, contributing substantially to overall emissions. For instance, the building sector accounted for approximately 40% of the EU's total energy consumption and 36% of its greenhouse gas emissions in 2022, according to the European Environment Agency. This underscores the critical role of energy efficiency improvements.

There's a persistent push to enhance building energy performance, driven by increasingly stringent regulations and widespread renovation programs across the continent. Many countries are setting ambitious targets for reducing energy use in their building stock to meet climate goals.

Fedrus International's product portfolio, featuring insulation solutions and advanced roofing and facade materials, directly addresses this environmental trend. By improving thermal performance, these offerings help reduce the energy needed for heating and cooling buildings. For example, the EU's Renovation Wave strategy aims to at least double the annual rate of energy-efficient building renovations by 2030, creating a robust market for such solutions.

- Building Sector Energy Consumption: Approximately 40% of the EU's total energy consumption in 2022.

- Building Sector Emissions: Responsible for 36% of EU greenhouse gas emissions in 2022.

- EU Renovation Wave Target: Aims to double annual energy-efficient building renovations by 2030.

- Fedrus International's Alignment: Products directly support energy efficiency mandates through improved thermal performance.

Biodiversity and Land Use Impact

Construction's footprint on biodiversity and land use is significant, stemming from raw material extraction, site preparation, and waste management. These activities can disrupt ecosystems and alter natural landscapes. For instance, the global demand for construction materials, like aggregates, continues to rise, with projections indicating further growth in the coming years, placing pressure on land resources.

Fedrus International can actively contribute to mitigating these impacts. By championing green building solutions, such as advanced systems for green roofs, the company can foster urban biodiversity and enhance environmental quality. These initiatives align with a growing global trend; in 2024, the green building market was valued at over $1.2 trillion, with substantial growth anticipated through 2030.

Furthermore, promoting biophilic design, which seamlessly integrates natural elements into built environments, offers a pathway to improved ecological balance. Fedrus International's product portfolio can be strategically aligned to support these trends. This includes offering materials with demonstrably lower lifecycle ecological footprints, catering to an increasing demand for sustainable construction practices.

- Material Extraction Impact: Global demand for construction aggregates is projected to reach over 50 billion metric tons annually by 2030, highlighting significant land use implications.

- Green Building Growth: The global green building market is expected to exceed $3.5 trillion by 2030, indicating a strong market pull for sustainable construction solutions.

- Biophilic Design Adoption: Studies show biophilic design can reduce employee stress by up to 35% and improve productivity by 15%, driving its adoption in commercial spaces.

- Lifecycle Assessment Demand: Over 60% of construction firms now consider lifecycle assessment (LCA) in material selection, favoring products with lower environmental impact.

The increasing frequency of extreme weather events, like the 28 billion-dollar weather disasters in the U.S. in 2023, drives demand for resilient building materials. Fedrus International can meet this need by innovating impact-resistant and fireproof products. Simultaneously, the global push for decarbonization, with Europe aiming for carbon neutrality by 2050, necessitates sustainable building practices, a trend Fedrus International supports with its energy-efficient and low-embodied carbon materials.

The construction sector's substantial raw material consumption, estimated at 40% globally in 2023, and waste generation are being addressed by initiatives like the EU's circular economy agenda, targeting a 30% reduction in primary raw material use by 2030. Fedrus International can align with this by increasing recycled content in products like its recycled plastic lumber. Furthermore, buildings are major energy consumers, accounting for 40% of the EU's energy use and 36% of its emissions in 2022, making energy efficiency improvements critical, a market Fedrus International's insulation and advanced materials directly serve, supported by the EU's Renovation Wave strategy to double renovations by 2030.

Construction's impact on biodiversity, driven by material extraction and land use, is significant, with global demand for aggregates projected to exceed 50 billion metric tons annually by 2030. Fedrus International can mitigate this by promoting green building solutions, like green roofs, which align with the growing green building market valued over $1.2 trillion in 2024 and projected to exceed $3.5 trillion by 2030. Integrating biophilic design principles and offering materials with lower lifecycle ecological footprints further supports this trend, as over 60% of construction firms now consider lifecycle assessments in material selection.

| Environmental Factor | Key Data Point (2023-2025) | Implication for Fedrus International | Opportunity/Challenge |

| Extreme Weather Events | 28 billion-dollar weather disasters in U.S. (2023) | Increased demand for resilient building materials | Opportunity to innovate impact-resistant and fireproof products |

| Decarbonization Efforts | EU Carbon Neutrality by 2050 | Demand for sustainable building practices and reduced embodied carbon | Opportunity to market energy-efficient and low-carbon materials |

| Circular Economy | EU target: 30% reduction in primary raw material use by 2030 | Emphasis on recycled content and material reuse | Opportunity to increase recycled content in products |

| Energy Efficiency in Buildings | 40% of EU energy consumption, 36% of EU emissions (2022) | Need for improved building thermal performance | Opportunity to provide insulation and advanced facade solutions |

| Biodiversity & Land Use | Global aggregate demand > 50 billion metric tons/year by 2030 | Pressure on land resources and ecosystems | Opportunity to offer green building solutions and biophilic design support |

PESTLE Analysis Data Sources

Our Fedrus International PESTLE Analysis is meticulously crafted using data from reputable international organizations like the IMF and World Bank, alongside government publications and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.