Fedrus International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fedrus International Bundle

Fedrus International navigates a complex landscape shaped by buyer power, supplier leverage, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder. This brief overview only scratches the surface of the intricate competitive dynamics at play.

The complete report reveals the real forces shaping Fedrus International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Fedrus International's bargaining power. If the market for crucial inputs, such as the specialized polymers used in their synthetic membranes or particular grades of bitumen for road construction, is dominated by a small number of providers, these suppliers gain considerable leverage. For instance, if a particular polymer formulation essential for Fedrus's high-performance membranes is only produced by two or three companies globally, those companies can dictate terms and pricing more forcefully.

This limited supplier base means Fedrus International has fewer alternative sources for these critical materials. Consequently, they may face increased input costs and less favorable payment or delivery terms, directly affecting their profitability and operational flexibility. In 2023, the global market for advanced polymer additives, a category relevant to synthetic membrane production, saw price increases averaging 8-12% due to supply chain disruptions and rising raw material costs for the producers themselves, illustrating the direct impact of supplier concentration.

Suppliers gain significant bargaining power when their inputs are unique or specialized, lacking close substitutes. For example, if Fedrus International relies on a specific, patented chemical compound for its high-performance membranes that no other supplier can replicate, that supplier would have considerable leverage. This uniqueness makes it difficult and costly for Fedrus to switch to an alternative source, increasing the supplier's ability to dictate terms.

The costs Fedrus incurs when switching suppliers significantly influence supplier bargaining power. If changing to a new supplier requires substantial investment in retooling manufacturing lines or obtaining new product certifications, Fedrus faces a higher hurdle. For instance, if Fedrus's primary material supplier demands a shift to a new chemical compound, the associated research, testing, and regulatory approval processes could easily run into hundreds of thousands of dollars, making a switch economically unviable in the short to medium term.

These high switching costs can effectively lock Fedrus into existing supplier relationships, granting those suppliers greater leverage. Consider a scenario where a key supplier's proprietary manufacturing process for a critical component means Fedrus's machinery is specifically calibrated for it. Replacing this component might necessitate a complete overhaul of their production equipment, a capital expenditure that could approach several million dollars, thereby strengthening the incumbent supplier's position.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a key factor in assessing their bargaining power. If suppliers to Fedrus International, particularly those providing critical roofing and facade materials, possess the capability and motivation to move into manufacturing or distribution themselves, they could become direct competitors. This scenario would directly impact Fedrus's market share and potentially lead to increased input costs as suppliers capture more of the value chain.

While forward integration is less frequently observed among raw material providers, its potential strategic implications for Fedrus cannot be ignored. For instance, a specialized chemical supplier for advanced facade coatings might consider establishing its own finishing operations. This would shift the competitive landscape, transforming a partner into a rival.

Consider the implications for a company like Fedrus International, which relies on a steady supply of specialized materials. If a key supplier, for example, a producer of high-performance insulation panels, were to begin offering pre-fabricated wall systems directly to builders, they would bypass Fedrus. This could significantly disrupt Fedrus's existing business model and supply chain relationships.

The financial health and strategic direction of Fedrus's suppliers are crucial indicators. If suppliers are experiencing strong growth and see opportunities to capture greater profit margins by controlling the end-product, the risk of forward integration increases. For example, if a supplier's revenue growth in 2024 significantly outpaced the overall market for building materials, it might signal an intent to expand its own market reach.

- Supplier Capability: Suppliers must have the financial resources and technical expertise to establish manufacturing or distribution capabilities.

- Supplier Incentive: The potential for higher profit margins by controlling the entire value chain drives the incentive for forward integration.

- Market Dynamics: A fragmented customer base for Fedrus could make it easier for a supplier to target specific segments directly.

- Competitive Landscape: If Fedrus's competitors are also facing similar integration threats, it can alter the overall industry power balance.

Importance of Fedrus to Suppliers

Fedrus International's substantial purchasing volumes, stemming from its broad customer base and comprehensive product range, significantly diminish the bargaining power of its suppliers. When Fedrus represents a large chunk of a supplier's revenue, that supplier is incentivized to offer better pricing, flexible terms, and tailored solutions to maintain the relationship. This dynamic is crucial for Fedrus's cost management and competitive pricing strategies.

For instance, in 2023, Fedrus International reported total revenues of $210.5 million. This scale suggests that individual suppliers are likely reliant on Fedrus for a notable portion of their sales, thereby tipping the scales in Fedrus's favor regarding negotiation power.

- Reduced Supplier Leverage: Fedrus's significant order sizes mean suppliers are less able to dictate terms.

- Favorable Pricing: The company can often secure lower prices due to its volume commitments.

- Supplier Dependence: Suppliers are more inclined to accommodate Fedrus's needs to secure consistent business.

Fedrus International's substantial purchasing volume significantly reduces supplier bargaining power. When Fedrus represents a large portion of a supplier's revenue, the supplier is motivated to offer better terms and pricing to retain the business. This is critical for Fedrus's cost control and competitive pricing.

In 2023, Fedrus International achieved revenues of $210.5 million, indicating that many suppliers likely depend on Fedrus for a considerable percentage of their sales, thus strengthening Fedrus's negotiating position.

This scale allows Fedrus to secure more favorable pricing and flexible terms, as suppliers are keen to maintain consistent business from such a large client. The company's buying power effectively limits the leverage suppliers can exert.

| Factor | Impact on Fedrus's Bargaining Power | Supplier Leverage |

| Purchasing Volume | High | Low |

| Supplier Dependence | High | Low |

| Pricing Negotiations | Favorable | Limited |

What is included in the product

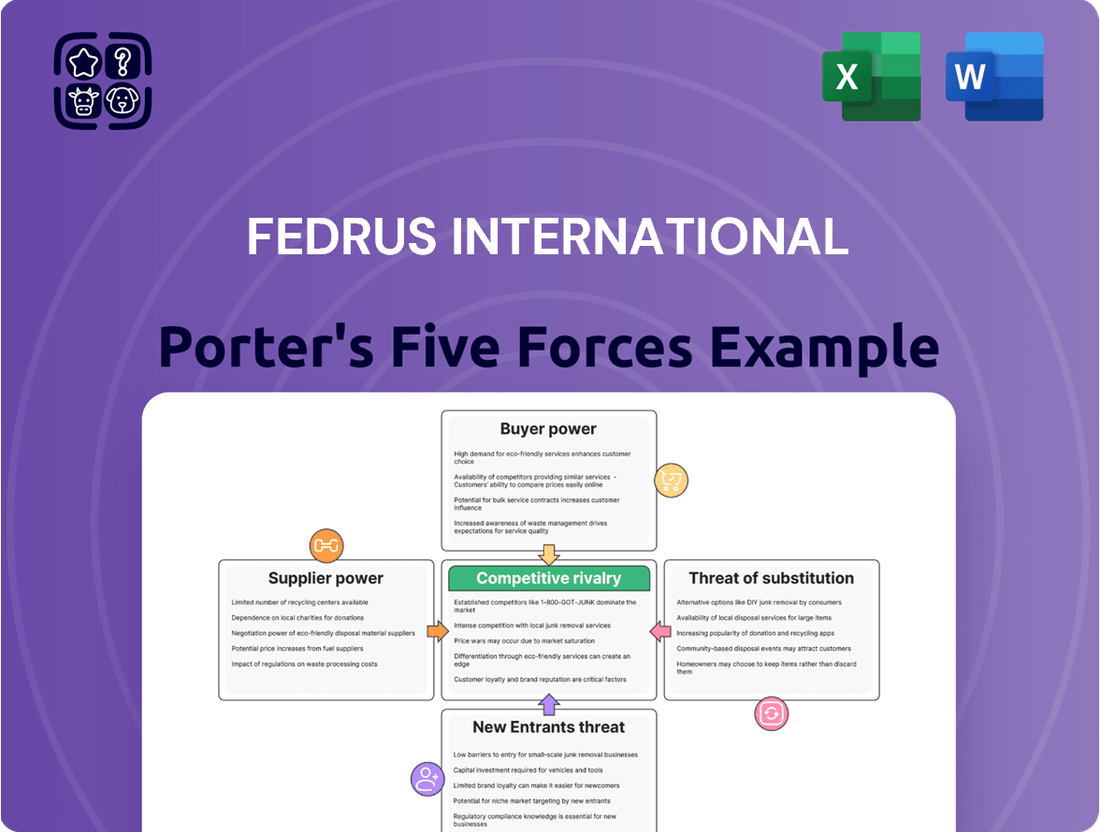

Fedrus International's Porter's Five Forces analysis details the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within its operating environment.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces dashboard.

Customers Bargaining Power

Fedrus International's customer bargaining power is influenced by customer concentration. If a few large clients, like major construction companies or developers, account for a substantial portion of Fedrus's sales volume, these customers gain leverage. They can negotiate for reduced prices or more favorable contract terms, directly impacting Fedrus's profitability.

The company's diverse customer base across residential and commercial markets suggests a varied bargaining power. While smaller customers may have limited influence, significant players within either sector could exert considerable pressure. For instance, a large national homebuilder could demand volume discounts or specific product customizations.

Customer price sensitivity significantly impacts Fedrus International's bargaining power of customers. When customers are highly sensitive to price, they have more leverage, especially if switching to competitors is easy and cost-effective. For instance, in the construction industry, where material costs represent a substantial portion of overall project expenses, buyers actively seek the most competitive pricing. This means Fedrus needs to carefully calibrate its pricing strategy, ensuring it aligns with the perceived value and the benefits of its integrated solutions, rather than just the base cost of materials.

The ease with which customers can find alternative suppliers for roofing and facade materials significantly impacts their bargaining power. If the market is fragmented with numerous manufacturers and distributors, customers have more choices, allowing them to negotiate better prices and terms. For instance, in 2024, the global construction materials market, including roofing and facade, exhibited a degree of fragmentation, with many regional players alongside larger international corporations.

Fedrus International's strategy to counter this by offering integrated solutions is crucial. By providing more than just raw materials, such as design, installation support, and warranties, Fedrus aims to build customer loyalty and create switching costs, thereby reducing the customers' inclination to seek alternatives based solely on price.

Customer Switching Costs

Customer switching costs are a key factor in assessing the bargaining power of customers. When it's easy and inexpensive for customers to switch from one supplier to another, they have more leverage. This is particularly true if adopting materials from a new supplier doesn't require significant redesign, new training for staff, or deal with compatibility problems.

For Fedrus International, the ease with which customers can switch suppliers can directly impact pricing and profitability. If switching is straightforward, customers can more readily compare bids from Fedrus and its competitors, pushing for lower prices. For instance, in 2024, the construction materials sector saw many companies offering modular components, which inherently reduce installation complexity and thus, customer switching costs.

- Low Switching Costs: Customers can easily switch to competitors if Fedrus's pricing or offerings become less attractive.

- Competitive Bidding: The ability to leverage competitive bids is enhanced when switching costs are minimal.

- Fedrus's Solutions: While Fedrus offers integrated solutions, the actual switching costs can differ significantly depending on the specific product line and its integration into the customer's existing processes.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge for Fedrus International. If customers, particularly large developers or construction groups, were to start manufacturing their own roofing and facade materials, it would directly diminish Fedrus's market share and revenue. This capability for customers to produce their own inputs grants them considerable leverage, potentially leading to intensified price negotiations and demands for customized services.

While less common for typical general contractors, the sheer scale of some developers means backward integration is a plausible strategic consideration. For instance, a major real estate development firm undertaking multiple large-scale projects simultaneously might find it economically viable to invest in in-house production of certain standardized materials. This strategic option for customers directly impacts Fedrus's pricing power and its ability to maintain healthy profit margins.

The potential for customers to integrate backward serves as a constant pressure point on Fedrus. This threat necessitates that Fedrus continually innovate, offer competitive pricing, and provide superior value-added services to retain its customer base. Without such efforts, customers might be incentivized to explore self-sufficiency, especially if Fedrus's offerings become commoditized or less cost-effective.

- Customer Leverage: Customers gain bargaining power if they can produce Fedrus's products themselves.

- Developer Potential: Large developers, due to volume, are more likely to consider backward integration.

- Pricing Pressure: This threat can force Fedrus to lower prices to remain competitive.

Fedrus International faces significant bargaining power from its customers, primarily driven by price sensitivity and the availability of alternatives. In 2024, the construction materials market saw intense competition, with many suppliers offering comparable products, allowing buyers to readily compare pricing. This environment empowers customers to negotiate for better terms, directly impacting Fedrus's profit margins.

The ease of switching suppliers further amplifies customer leverage. With many modular and easily integrated components available in 2024, customers could transition between providers with minimal disruption or cost. Fedrus counters this by emphasizing its integrated solutions, aiming to increase switching costs and build loyalty beyond mere price considerations.

The threat of backward integration by large developers also exerts pressure. If major clients, such as large construction conglomerates, found it economically feasible to produce certain materials in-house, they could reduce their reliance on suppliers like Fedrus. This strategic option for customers forces Fedrus to maintain competitive pricing and demonstrate superior value to retain its market share.

| Factor | Impact on Fedrus | 2024 Market Context |

|---|---|---|

| Customer Concentration | High concentration of large buyers increases their negotiation power. | Fedrus serves a mix of large and small clients, with significant players in key sectors. |

| Price Sensitivity | High sensitivity compels Fedrus to offer competitive pricing. | Construction material costs are a major project expense, driving price-conscious purchasing. |

| Ease of Switching | Low switching costs empower customers to seek better deals elsewhere. | Availability of modular components in 2024 reduced installation complexity and switching barriers. |

| Backward Integration Threat | Potential for customers to produce materials in-house reduces Fedrus's market share. | Large developers may consider in-house production for large-scale projects to control costs. |

What You See Is What You Get

Fedrus International Porter's Five Forces Analysis

This preview showcases the complete Fedrus International Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and no hidden surprises.

You're looking at the final, ready-to-use Porter's Five Forces Analysis for Fedrus International. Once your purchase is complete, you’ll gain instant access to this precise document, allowing you to leverage its strategic insights without delay.

Rivalry Among Competitors

The competitive landscape for roofing and facade materials is quite crowded, with a significant number of players vying for market share. This includes both large, established manufacturers and smaller, regional distributors, creating a diverse competitive environment. Fedrus International, with its broad offering of products, finds itself competing against various specialized companies across different material categories.

In 2024, the global roofing market alone was valued at approximately $150 billion, and this growth is fueled by new construction and the essential need for repairs and replacements. This substantial market size naturally attracts a wide array of competitors, from global giants to niche providers, all seeking to capture a piece of this demand.

The construction sector's growth rate significantly influences the competitive rivalry for roofing and facade material providers like Fedrus International. In periods of slow or declining industry growth, competition often intensifies as companies battle more fiercely for a shrinking market share, potentially leading to aggressive pricing strategies.

For instance, if the overall construction market experiences a slowdown, companies may resort to price cuts to secure sales, impacting profit margins across the board. Conversely, stable or moderate growth in construction can foster a less cutthroat environment, allowing for more predictable demand and potentially less aggressive price wars.

Competitive rivalry within Fedrus International's market is influenced by product differentiation and customer switching costs. When products are highly distinct and customers find it difficult or costly to switch to a competitor, rivalry tends to be less intense. Fedrus strives to offer integrated solutions, which aim to set its products apart from simple raw materials.

However, a significant portion of the roofing and facade materials market consists of commodities. This commodity nature often leads to competition primarily based on price. For instance, in 2024, the global construction materials market experienced price fluctuations, with some basic roofing materials seeing price increases of up to 7% due to supply chain pressures, intensifying the need for Fedrus to emphasize its differentiated offerings.

Exit Barriers

Fedrus International likely faces significant competitive rivalry due to high exit barriers. These barriers, often stemming from specialized manufacturing assets and long-term customer commitments, make it financially challenging for companies to leave the market, even when profitability declines. This persistence fuels ongoing competition as firms are compelled to stay and fight for market share.

The capital-intensive nature of Fedrus International's operations, particularly in manufacturing, is a key contributor to these high exit barriers. For instance, specialized machinery and production facilities represent substantial sunk costs that are difficult to recover upon exiting. In 2024, the global manufacturing sector continued to see investments in advanced automation and specialized equipment, further entrenching these exit barriers for companies like Fedrus.

- High Capital Investment: The cost of specialized manufacturing equipment can run into millions of dollars, making it impractical to sell or repurpose quickly.

- Long-Term Contracts: Existing supply agreements with customers can lock Fedrus International into operations, even if market conditions become unfavorable.

- Employee and Community Costs: Shutting down operations can incur significant severance packages and potential environmental remediation costs, acting as further deterrents to exit.

- Market Saturation: If the market Fedrus operates in is already saturated, the inability of less efficient firms to exit exacerbates competitive pressures.

Competitive Strategies Employed

Fedrus International operates in a market where competitors' strategic choices heavily influence the intensity of rivalry. If rivals primarily engage in price wars, the competitive landscape becomes exceptionally fierce, potentially eroding profit margins for all involved.

However, Fedrus's strategic emphasis on providing integrated solutions, rather than competing solely on price, suggests a move towards differentiation. This approach aims to build customer loyalty and command premium pricing by offering unique value propositions.

For instance, in the 2024 market, companies focusing on sustainable material sourcing and advanced product development, like Fedrus, often experience less destructive competition than those locked in pure price battles. This is because innovation and service quality create barriers to entry and reduce the likelihood of direct, commoditized price comparisons.

- Fedrus's integrated solutions strategy aims to differentiate itself from competitors focused on price wars.

- Competition based on innovation and service quality can lead to less intense rivalry compared to price-based competition.

- Companies like Fedrus investing in sustainability and advanced product development are likely to face a more differentiated competitive environment.

Competitive rivalry for Fedrus International is intense due to a crowded market with numerous players, from global giants to niche providers, all vying for market share in the substantial global roofing market, valued at approximately $150 billion in 2024. This rivalry is further amplified by high exit barriers, such as significant capital investments in specialized manufacturing and long-term customer contracts, which prevent less profitable firms from leaving the market. Fedrus's strategy of offering integrated solutions aims to differentiate from price-focused competitors, as innovation and service quality can mitigate the impact of commoditized pricing, especially when basic materials saw price increases of up to 7% in 2024 due to supply chain issues.

| Factor | Impact on Rivalry | Fedrus's Position |

|---|---|---|

| Market Crowdedness | High | Competes with many specialized and large players. |

| Industry Growth Rate | Moderate to High (influences intensity) | Growth in construction supports demand, but competition remains. |

| Product Differentiation & Switching Costs | Moderate (commodity elements exist) | Focuses on integrated solutions to differentiate from price competition. |

| Exit Barriers | High | Specialized assets and contracts make exiting difficult, sustaining rivalry. |

SSubstitutes Threaten

The threat of substitutes for Fedrus International's roofing and facade products is significant. If other materials or construction methods can effectively perform the same functions, demand for Fedrus's offerings could decline. For instance, the rise of green roofs or advanced building envelope systems presents alternatives that might reduce reliance on traditional roofing materials.

Emerging technologies in construction, such as innovative wall claddings or prefabricated facade panels, also pose a threat. Fedrus needs to stay attuned to these technological advancements to maintain its competitive edge. In 2024, the global construction market saw continued innovation in sustainable building materials, with a growing adoption of solutions that offer enhanced energy efficiency and lower environmental impact, directly impacting traditional material demand.

The threat of substitutes is amplified when alternatives offer a better price-performance ratio. If a new material emerges that provides superior insulation, enhanced durability, or more appealing aesthetics at a similar or lower price point, customers will naturally migrate. Fedrus International must continuously benchmark its offerings against these evolving alternatives, ensuring its products deliver compelling value and performance to retain market share.

The threat of substitutes for Fedrus International's products, particularly in the building materials sector, is significantly influenced by customer switching costs. If builders can easily shift to alternative roofing or cladding systems without incurring substantial expenses in redesign, retraining their workforce, or acquiring new equipment, the pressure from substitutes intensifies. For example, a switch from a specialized metal roofing system to a more common asphalt shingle might involve minimal upfront investment for a contractor.

Customer Propensity to Substitute

Fedrus International's threat of substitutes is influenced by customer willingness to adopt new materials and construction methods. If clients are hesitant to deviate from traditional approaches, the threat remains subdued. However, evolving market dynamics can accelerate this. For instance, a growing emphasis on sustainable building practices, driven by increasing environmental awareness and regulatory shifts, could encourage greater adoption of alternative materials.

Several factors can increase customer propensity to substitute away from Fedrus International's offerings. These include:

- Cost-effectiveness of alternatives: If substitute materials offer a lower price point without significant performance compromise, customers may switch.

- Performance improvements in substitutes: Advances in material science can lead to substitutes that outperform current offerings.

- Regulatory mandates for green building: Stricter environmental regulations could favor materials with a lower carbon footprint or improved recyclability.

- Shifting design preferences: New architectural trends might necessitate or favor materials different from those Fedrus International currently provides.

Innovation in Substitute Industries

Continuous innovation in industries offering substitute products can significantly amplify their threat to Fedrus International. For instance, rapid advancements in integrated solar roofing tiles, bio-based insulation panels, or sophisticated modular facade systems, which are not traditionally within Fedrus's core offerings, could swiftly emerge as compelling alternatives for building envelope solutions.

Fedrus must proactively address this evolving landscape. A critical strategy involves substantial investment in research and development (R&D) to stay ahead of emerging technologies or forging strategic partnerships with innovators in these adjacent sectors. This approach is essential to neutralize the growing competitive pressure from these increasingly sophisticated substitutes.

- Innovation in Solar Roofing: Companies like Tesla’s Solar Roof tiles, which integrate solar energy generation with traditional roofing aesthetics, represent a direct substitute for conventional roofing materials and systems.

- Advancements in Insulation: The development of high-performance, eco-friendly insulation materials such as aerogels or advanced vacuum insulated panels offers superior thermal performance, potentially displacing traditional insulation methods.

- Modular Construction: The rise of pre-fabricated and modular building components, including facade systems, allows for faster construction and potentially lower costs, presenting an alternative to site-built structures.

- Material Science Breakthroughs: Ongoing research into novel building materials with enhanced durability, sustainability, or functional properties could create entirely new categories of substitutes for existing products.

The threat of substitutes for Fedrus International's products is a dynamic challenge, particularly as construction materials evolve. In 2024, the global market for sustainable building materials continued its upward trajectory, with an estimated growth rate of 10-12%, driven by regulatory pressures and consumer demand for eco-friendly solutions. This expansion directly impacts traditional roofing and facade materials by offering alternatives with potentially lower environmental footprints and enhanced performance characteristics.

Key substitute areas include advanced insulation technologies, such as aerogels and vacuum insulated panels, which offer superior thermal efficiency compared to conventional options. Additionally, integrated solar roofing solutions, like those pioneered by companies such as Tesla, provide a dual function of protection and energy generation, directly competing with traditional roofing systems. The increasing adoption of modular construction and prefabricated facade systems also presents a substitute by offering faster installation and potentially lower labor costs.

| Substitute Category | 2024 Market Trend | Potential Impact on Fedrus |

|---|---|---|

| Sustainable Building Materials | 10-12% Growth | Increased competition from eco-friendly alternatives |

| Advanced Insulation (Aerogels, VIPs) | Growing adoption for energy efficiency | Threat to traditional insulation products |

| Integrated Solar Roofing | Rising consumer interest and technological advancements | Direct substitute for conventional roofing |

| Modular & Prefabricated Facades | Increased demand for faster construction | Alternative to site-built facade systems |

Entrants Threaten

The capital needed to even start manufacturing and distributing roofing and facade materials presents a considerable hurdle. Think about the cost of building factories, setting up widespread delivery systems, and stocking up on materials – it all adds up to a massive financial commitment.

For instance, a new player might need hundreds of millions of dollars just to establish a competitive manufacturing presence. This high entry cost naturally discourages many aspiring companies from even attempting to enter the market, keeping the field relatively clear for established players like Fedrus International.

Fedrus International, like many established players in its sectors, likely leverages significant economies of scale. This means that as their production volume increases, their per-unit costs decrease due to bulk purchasing of raw materials and optimized manufacturing processes. For instance, in 2023, Fedrus International reported a net sales of $206.9 million, indicating a substantial operational footprint that new entrants would find challenging to replicate immediately.

New companies entering the market would face a considerable hurdle in matching Fedrus International's cost efficiencies. Without the same purchasing power or production volume, their initial per-unit costs would be higher, making it difficult to compete on price against established, scaled operations. This cost disadvantage is a critical barrier to entry, requiring substantial upfront investment and time to overcome.

Access to distribution channels presents a significant barrier for new entrants in the industrial coatings sector where Fedrus International operates. Building and securing these vital links with contractors, distributors, and retailers requires substantial time, capital, and the cultivation of trust. For instance, in 2024, the coatings industry saw continued consolidation, with larger players leveraging their established distribution networks to maintain market share, making it harder for newcomers to secure shelf space or reliable sales partnerships.

Brand Loyalty and Product Differentiation

Strong brand recognition and deep customer loyalty within the roofing and facade sectors present a formidable barrier to new entrants. Established players, like Fedrus International, benefit from years of building trust and consistent quality perception. For instance, in 2024, the global construction market, a key driver for Fedrus, saw continued demand, highlighting the established nature of the industry.

Newcomers would need to invest heavily in marketing and research and development to effectively challenge Fedrus's established reputation. If Fedrus's product offerings are perceived as superior or provide unique, integrated solutions, a new entrant's challenge is amplified. This differentiation is crucial for capturing market share.

- Brand Loyalty: Customers often stick with brands they trust for critical building components like roofing and facades.

- Product Differentiation: Fedrus's ability to offer unique integrated solutions or superior quality can deter new entrants.

- R&D Investment: New companies must invest significantly in innovation to match or surpass existing product capabilities.

- Time and Trust: Building a reputable brand in this sector requires substantial time and consistent performance.

Regulatory and Legal Barriers

The construction materials sector faces significant hurdles for newcomers due to rigorous building codes, essential certifications, and evolving environmental regulations that new products must satisfy. Navigating these intricate requirements demands considerable time and financial investment, effectively acting as a substantial barrier to entry.

Compliance and ongoing testing represent persistent costs for all industry participants, but these challenges are particularly pronounced for emerging companies. For instance, in 2024, the average cost for obtaining necessary product certifications in construction materials can range from $5,000 to $50,000 or more, depending on the product's complexity and the jurisdictions involved.

- Stringent Building Codes: New entrants must ensure their materials meet national and local building standards, which can vary significantly.

- Certification Processes: Obtaining certifications like LEED, ENERGY STAR, or specific material approvals often involves lengthy and costly testing phases.

- Environmental Regulations: Compliance with regulations concerning sustainability, waste management, and material sourcing adds another layer of complexity and expense.

- Testing and Validation: New materials require extensive testing to prove their safety, durability, and performance, a process that can take months and cost tens of thousands of dollars.

The threat of new entrants for Fedrus International is moderate, primarily due to substantial capital requirements and established distribution networks. Significant upfront investment is needed for manufacturing and securing market access, making it difficult for smaller players to compete effectively.

New companies face a steep climb in matching Fedrus's economies of scale and brand loyalty, which are built over years of operation. For example, Fedrus's net sales of $206.9 million in 2023 highlight its established market presence. Furthermore, navigating complex building codes and certification processes in 2024 adds considerable time and expense for any newcomer.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for manufacturing, distribution, and inventory. | Significant hurdle, requiring hundreds of millions in investment. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher initial costs, impacting price competitiveness. |

| Distribution Channels | Established relationships with contractors and distributors. | Difficult for new players to secure reliable sales partnerships. |

| Brand Loyalty & Reputation | Customer trust built through consistent quality and time. | Requires substantial marketing and R&D investment to overcome. |

| Regulatory Compliance | Meeting stringent building codes and certifications. | Adds significant time and financial investment for new products. |

Porter's Five Forces Analysis Data Sources

Our Fedrus International Porter's Five Forces analysis is built upon a foundation of robust data, including the company's annual reports, investor presentations, and industry-specific market research from reputable firms like IBISWorld and Statista.